You’ll frequently hear that you should “do your due diligence” before investing in any stocks. It’s another way of saying to do your research.

That’s true! You should do your research! But before you can do that, you have to know where to go.

There are endless websites that provide stock advice, but not all are trustworthy or created by experts. The websites listed below are all reputable and are some of the best stock advisor websites available.

Best Stock Advisor Websites & Services—Top Picks

|

4.7

|

4.8

|

4.7

|

4.3

|

|

$99 for 1st year; $199 renewal

|

Premium: 7-day free trial, then $239/yr. ($60 discount)* Pro: $1,920/yr. ($480 discount)**

|

$299 for 1st year; $499 renewal

|

$399/yr. ($100 discount)*

|

What Is a Stock Advice Website?

Stock advice websites help you choose which stocks to invest in, while still letting you make your own final investment decisions. Top stock advice websites offer detailed screener criteria, characteristics for what they believe makes a great stock pick, exemplary performance compared to a relevant benchmark, and ownership of losing picks with detailed breakdowns of where they went wrong with that choice.

Motley Fool, and other top services, provide researched, vetted stock recommendations that go through extensive due diligence before reaching users.

What Is the Best Stock Advice Subscription?

If I was forced to recommend just one stock advice website, I would choose Motley Fool Stock Advisor. Motley Fool has been around for more than three decades and earned reputation and respect for their continued outperformance.

For reasons further laid out below, I think this stock advice subscription service should get you all the long-term stock performance you need for your portfolio. Their long track record has earned them the top spot on this list.

Who Has the Best Stock Picking Record?

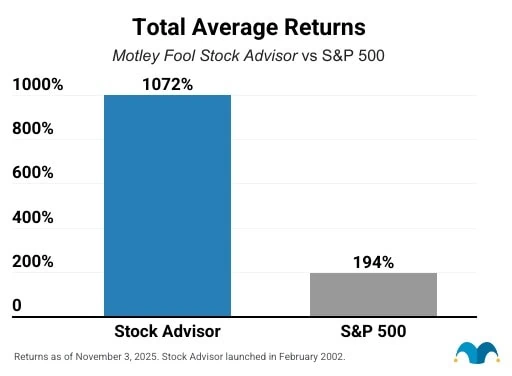

It shouldn’t come as much of a surprise given my recommendation made above, but Motley Fool’s Stock Advisor has the best stock-picking record among the buy-and-hold services mentioned in this article.

Motley Fool cites a “time-weighted return.” That’s the same type of performance reporting you get out of mutual funds and other investment funds. It basically backs out inflows and outflows of cash to the portfolio, providing a more accurate representation of how the investments themselves performed.

As you can see in the chart, Motley Fool Stock Advisor has delivered a time-weighted return well more than five times the S&P 500.

1. Motley Fool Stock Advisor (Best Stock Advisor Service)

- Available: Sign up here

- Price: Discounted price for the first year (shown below)

Motley Fool Stock Advisor is an investment service dedicated to buy-and-hold investors. analysts provide recommendations for both “steady Eddies” and potential high-flying stocks with sound fundamentals—an ideal combination of holdings if you want to generate strong performance without risking extremely high volatility.

Importantly, Stock Advisor doesn’t just give you a list of tickers and call it a day—it also provides investment rationales and research for each pick to help educate you before you buy.

The service targets stocks across a variety of industries, such as energy, industrials, transportation, financial services, technology, and health care.

What do Stock Advisor subscribers get?

Motley Fool Stock Advisor service provides a lot of worthwhile resources to members:

- “Foundational Stocks”: 10 stocks that can serve as the foundation of your portfolio, whether you’re a new investor or experienced

- Two new stock picks each month

- Monthly analyst rankings of the service’s top 10 stocks based on their potential to beat the market over a five-year span

- A list of all the service’s active picks, “hold” recommendations, and closed positions

- Recommendations for stock and fixed-income exchange-traded funds (ETFs) you can use to build a diversified portfolio core

- Access to the GamePlan financial planning hub

- Access to Fool IQ, which provides essential financial data and news summaries about all U.S.-listed publicly traded stocks

- Access to a community of investors engaged in outperforming the market and talking shop

Sign up via our exclusive link to receive a discount on your first year’s subscription, or read more in our Motley Fool Stock Advisor review.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!

- Discounted introductory price

- Strong outperformance above S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

2. Motley Fool Epic (Stock Picks for Any Investor)

- Available: Sign up here

- Price: Discounted price for the first year (shown below)

Motley Fool Epic isn’t itself a stock-picking service—instead, it’s a bundled selection of four popular Motley Fool stock recommendation products, three of which you can only enjoy by becoming an Epic member:

- Stock Advisor: Buy-and-hold stock picks designed to deliver consistent performance with less volatility. Stock Advisor is the only one of these services you can subscribe to individually.

- Rule Breakers: Stocks that have massive growth potential, whether they’re at the forefront of emerging industries or disrupting the status quo in long-established businesses.

- Hidden Gems: Stocks of medium-to-large businesses, selected by Fool CEO and co-founder Tom Gardner for their “all-in, visionary leadership teams.” More so than the other services, Hidden Gems is mindful of macroeconomic and market environments—and how they might dictate how aggressively you should invest.

- Dividend Investor: This recommendation service revolves around producing equity income from the best dividend stocks. Fool analysts target companies that deliver above-average yields and dividend growth, with the hope of producing both competitive total returns and an income stream that should carry you through retirement.

Epic members will get five new picks per month across the various services, can access all active recommendations, and also view Cautious, Moderate, and Aggressive strategies including specific stock allocations.

But Epic is more than just a pile of recommendation services. Among other features, an Epic membership also unlocks access to …

- Fool IQ+: Fool IQ, which comes with Stock Advisor, provides essential financial data and news summaries about all U.S.-listed publicly traded stocks. With Epic, you get Fool IQ+, which includes all the features in Fool IQ, as well as a much wider variety of financial analysis data (earnings coverage, insider trading data, analyst opinions, and more) and advanced charting options.

- GamePlan+: GamePlan, which comes with Stock Advisor, is a hub of financial planning content and tools. GamePlan+, which you get through Epic, delivers a wider array of articles and tools, as well as more in-depth coverage.

- Epic Opportunities: A members-only podcast.

Sign up via our exclusive link to receive a discount on your first year’s subscription, or read more in our Motley Fool Epic review.

Related: Best Brokerage Account Sign-Up Bonuses, Promotions and Deals

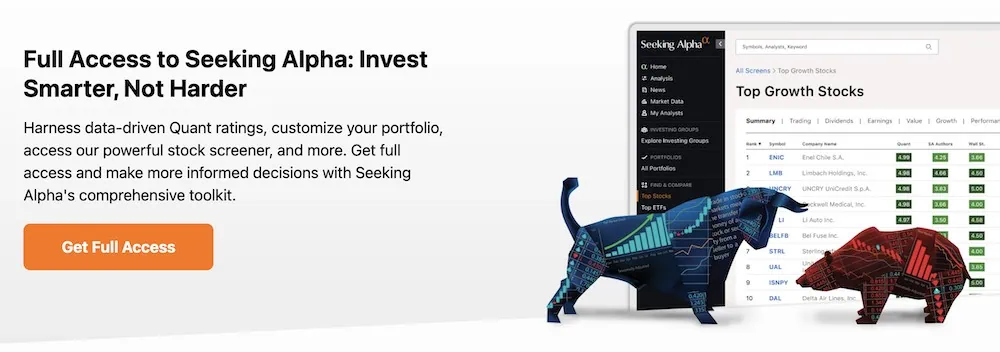

3. Seeking Alpha Premium and Pro (Best for Investment Research + Stock Recommendations)

- Available: Sign up for Premium | Sign up for Pro

- Price: Premium: 7-day free trial, then $239/yr. ($60 off)* Pro: $1,920/yr. ($480 off)**

Seeking Alpha Premium and Seeking Alpha Pro are all-in-one investing research and recommendation services that offer insightful analysis of financial and business news, stocks, and more—all designed to help you make better investing decisions.

Premium best caters to the needs of beginner and intermediate investors looking for an affordable but all-inclusive one-stop research-and-picks stop.

Seeking Alpha Premium gives you unlimited access to thousands of active authors who deliver stock analysis, which is vetted by in-house editors before they’re read and discussed by millions of users. Seeking Alpha also provides you with stock research tools, real-time news updates, crowdsourced debates, and market data. Users can create their own portfolio of favorite stocks, see how they perform, and receive email alerts or push notifications about their investments.

Pro, meanwhile, is an even more powerful stock subscription service that includes everything in Premium, as well as numerous other sources of stock ideas and investor tools.

What do I get from Seeking Alpha Premium?

A Seeking Alpha Premium subscription can help you manage your portfolio with a large investing community so you can better understand the stock market and manage your financial life.

Whether you’re looking to invest on the go or dedicate time for more in-depth research and analysis, Seeking Alpha Premium provides a wealth of features that meet your needs:

- Unlimited access to expert investor content

- Seeking Alpha Quant Ratings (including S&P 500-beating “Strong Buy”-rated stocks)

- ETF and stock screeners

- A portfolio “health check”

- Earnings calls transcripts

- 10 years’ worth of financial statements

- The ability to compare stocks side-by-side with peers

- Access to dividend and earnings forecasts

- And much, much more

In addition to being able to read anything published on Seeking Alpha, you’ll also see authors’ ratings. That lets you know when you’re reading a piece written by someone with top marks or a poor track record.

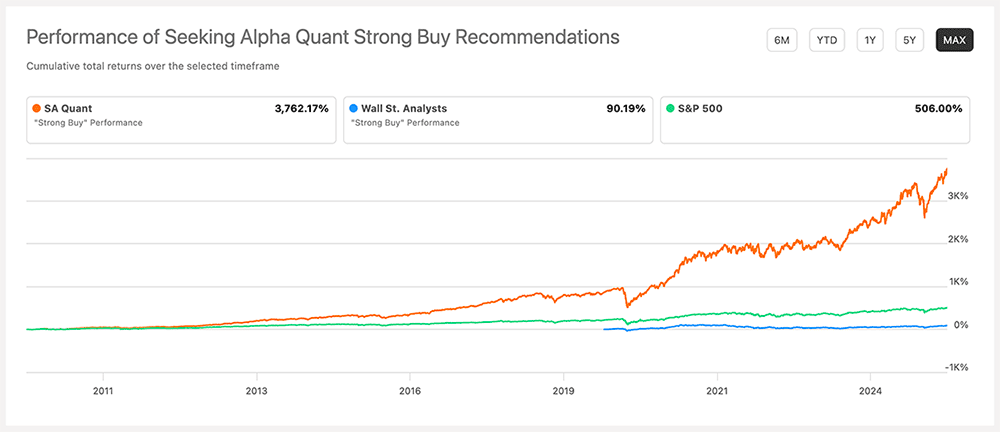

How has Seeking Alpha Premium performed?

Among other things, a Seeking Alpha Premium subscription provides access to the service’s Stock Quant Ratings. The Quant Ratings involve an evaluation of each stock based on data such as financial statements, price performance, and analysts’ estimates of future profits and sales. All told, SA looks at 100 metrics for each stock, uses those metrics to compare it to all other stocks in the sector, then assigns ratings and associated scores. It also provides letter grades for five factors (value, growth, profitability, momentum, and earnings-per-share revisions).

Have a look at the dramatic market outperformance seen by Seeking Alpha’s Quant “Strong Buy” recommendations compared to the S&P 500, as well as to stocks that enjoy “Strong Buy” ratings from Wall Street analysts:

What is Seeking Alpha Pro?

A Seeking Alpha Pro subscription comes with all the features of Seeking Alpha Premium, as well as additional features including:

- Instant access to investment ideas from Seeking Alpha’s top 15 analysts

- The PRO Quant Portfolio for active traders (delivers new high-conviction ideas weekly)

- Exclusive coverage of stocks that have no Wall Street analyst coverage

- Short-selling ideas from SA analysts

- Easy, real-time access to the day’s upgrades and downgrades

The Pro Plan, as the features indicate, targets more advanced and professional investors. Premium is a better fit for most investors (and it’s much less expensive, too).

Why subscribe to Seeking Alpha?

You can read more in our Seeking Alpha review, but in short: Seeking Alpha distills down the relevant financial information for you, so you don’t have to—making it easy for anyone interested in self-directed investments to have a chance at outperforming the market.

Want to try it out? If you use our exclusive links, you can enjoy a free seven-day trial and a discount on your first year’s subscription when you sign up for Premium, or a discount on your first year’s subscription when you sign up for Pro.

- Seeking Alpha Premium and Pro help you find profitable investing ideas, improve your portfolio, research stocks better and faster, track the news to find investing opportunities, and connects you to the world's largest investing community.

- A Premium subscription provides access to Seeking Alpha's stock and ETF ratings, including Seeking Alpha Quant Strong Buy recommendations, which have greatly outperformed the stock market over time.

- Premium also gives you access to Seeking Alpha's portfolio health check, which will analyze your portfolio's quality, risk level, and performance.

- Advanced and professional investors can sign up for Pro, where they'll get everything from Premium, as well as instant access to ideas from SA's top 15 analysts, the PRO Quant Portfolio (for active traders), short-selling ideas, and more.

- Black Friday deal on Premium: New subscribers through our link receive a $60 discount off the price of Seeking Alpha Premium in their first year.*

- Black Friday deal on Pro: New subscribers through our link receive a $480 discount off the price of Seeking Alpha Pro in their first year.**

- Active community of engaged investors and analysts

- Stock screeners, quantitative tools for stock analysis

- Strong track record of market outperformance on stock ratings

- Minimal mutual fund coverage

Related: Best Seeking Alpha Alternatives [Competitors’ Sites to Use]

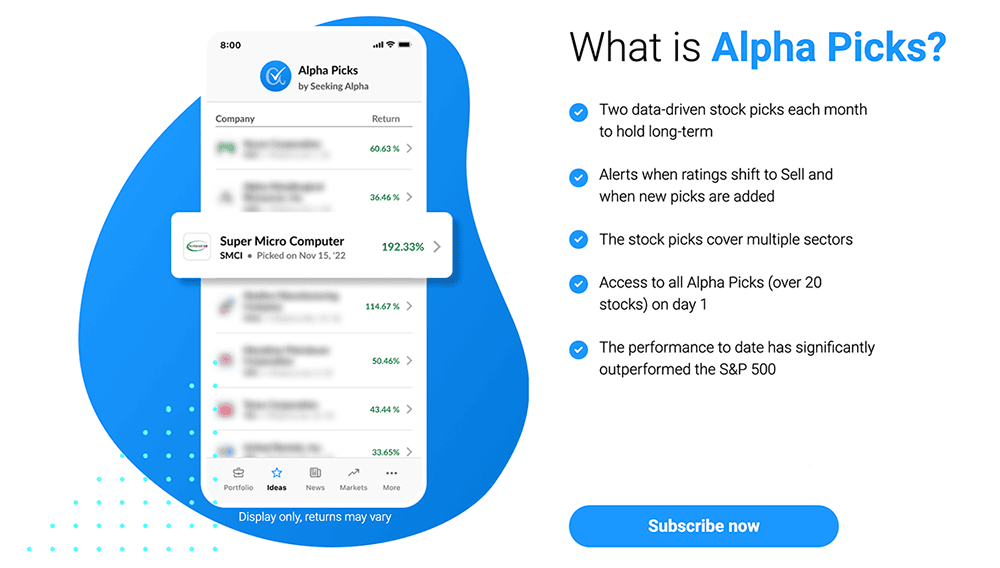

4. Seeking Alpha’s Alpha Picks (Best Data-Driven Stock Recommendation Service)

- Available: Sign up here

- Price: $399/yr. ($100 off)*

Are you looking for a way to beat the market consistently? Seeking Alpha’s Alpha Picks might be a great option to consider.

Alpha Picks is a stock selection service that provides you with two of the best stock picks each month that SA determines have the greatest chance for price upside. They base their selections on fundamentals such as valuation, growth, profitability, and momentum—not hype.

The stock selection process relies on Seeking Alpha’s proprietary, data-driven computer Seeking Alpha Quant scoring system (available to Premium and Pro users) to screen and recommend stocks for more conservative “buy-and-hold” investors, but with a bit of modification. Namely, all recommendations must meet the following criteria:

- Hold a Strong Buy Quant rating for a minimum of 75 days

- Market cap greater than $500 million

- Stock price greater than $10

- Is a publicly traded common stock (no American Depository Receipts [ADRs])

- Be the highest-rated stock at the time of selection that has not been previously recommended within the past year (Alpha Picks releases one pick at the start of the month, another in the middle).

So far, so good: Since the service’s launch on July 1, 2022, Alpha Picks has outperformed the S&P 500 by 170 percentage points.

If you sign up for the service, you can expect the following:

- Access to all Alpha Picks on Day 1

- Two new long-term stock picks to buy and hold delivered every month

- Detailed explanations from Seeking Alpha behind why they rate each stock pick so highly

- Notifications when new picks are added, and when a recommendation changes to Sell

- Regular updates on current Buy recommendations

This service is designed for busy professionals interested in building a portfolio that outpaces the market but without the time to commit to finding these opportunities. If you’re interested, you can use our exclusive link to sign up for a discounted first-year price.

- Seeking Alpha's Alpha Picks is a stock picking service designed for busy professionals who might not have the time needed to select stocks for their own portfolio.

- Using a proprietary computer-scoring model, Alpha Picks makes "buy-and-hold" picks that last at least two years.

- Since its launch in 2022, Alpha Picks has delivered market-beating performance, with a remarkable 180% increase compared to the S&P 500's 61%.

- Rigorous backtesting also has shown Alpha Picks' methodology would have strongly outperformed the S&P 500 index between 2010 and 2022 (+470% vs. +290%).

- Special offer: Receive $100 off the first year's subscription price by signing up via our link.*

- Data-driven, computer-generated stock selection process

- Avoids human bias

- Strong backtest performance vs. S&P 500 index

- Competitive price point

- Not enough actual performance data

- No frills, just stock picks and info about them

5. Morningstar (Best for Fundamentals-Driven Investors)

- Available: Sign up here

- Price: Free 7-day trial. Then $34.95/mo., or $199/yr. (53% savings vs. monthly) when you sign up through our link.*

Morningstar Investor is a rich platform of investment research tools designed for the buy-and-hold crowd, and it plugs investors into one of the world’s foremost sources for mutual fund and ETF data and analysis.

Morningstar’s ratings are among the service’s most revered features. The original Star Rating—which measures a fund’s risk-adjusted past returns—has been around since 1985 and helped steer countless investors toward cheaper, better-constructed mutual funds and ETFs. But Morningstar doesn’t just look to the past. Its forward-looking Medalist Ratings use traits such as a fund’s parent organization, the managers responsible for making decisions, and fund strategies to determine a fund’s ability to outperform over the long term. You must be a Morningstar Investor subscriber to access Medalist Ratings.

Morningstar also provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

Stock owners shouldn’t feel left out—Morningstar also provides everything you need for stock research, including equity data, corporate financials, analysis, and even Star Ratings of publicly traded companies.

With Morningstar Investor, you can also:

- Seamlessly and securely link your external accounts to get a holistic view of your assets from one simple dashboard

- Use Morningstar Portfolio X-Ray®, which evaluates what you hold from numerous angles—asset allocation, stock sector, valuation, fees, and more—and can identify any overlaps between accounts that might impact just how diversified you are (or aren’t!)

- Set up stock and fund watchlists

- Enjoy stock news and commentary that’s tailored to your holdings

- Screen for securities that match your investing goals using a variety of performance and valuation metrics

- Follow Morningstar authors so you can check out their latest articles, videos, and podcasts as soon as they’re posted

Not sure if Morningstar Investor is right for you? Try it out with a free seven-day trial. You can check out the current deal, as well as discounted rates for students and teachers, in our details box below.

- Morningstar Investor offers expert research, investing analysis, and advisor-grade portfolio management tools that are tailor-made for buy-and-hold investors.

- Morningstar is one of the most prized sources of mutual fund and exchange-traded fund (ETF) data in the world.

- How does your portfolio stack up? Put it through Morningstar's Portfolio X-Ray, which will provide insights such as whether you have too many overlapping holdings or whether you're paying too much in fees.

- Special Offer 1: Click our sign-up link to receive $50 off your first year of Morningstar Investor. (Annual plan only.)

- Special Offer 2: Students receive one year of Morningstar Investor access for just $25!

- Special Offer 3: Teachers receive a 60% discount on Morningstar Investor access.

- Top-flight fund research and analysis

- Portfolio management tool

- Powerful screener

- Watchlists

- Tailored news and commentary

- Below-average charting

- High monthly billing rate

Best Stock Advisors for Day Trading

While this list primarily focuses on long-term investment-oriented stock subscriptions, you may also have interest in the best stock advisors for day trading.

6. Trade Ideas (Best for Active Day and Momentum Traders)

- Available: Sign up here

- Best for: Day traders and long-term investors

- Price: TI Basic: $1,068/yr. (paid annually); TI Premium: $2,136/yr. (paid annually). Additional discounts available with a code found in the box below.*

Trade Ideas is a powerful and versatile stock scanner with one of the most innovative top-tier plans among the research tools we review.

The free, basic version of the service offers features such as PiP charts, technical indicators, “Stock Racing,” and trading tournaments, while a paid TI Basic plan adds on real-time data, up to 10 charts on-screen at once, real-time paper trading, in-app trading, and more.

But where Trade Ideas really shines is its Premium tier, which opens up access to an exclusive artificial intelligence virtual research assistant (Holly) that constantly sifts through technicals, fundamentals, social media, earnings, and more to provide real-time stock trade recommendations. The AI assistant runs more than 1 million simulated trades each night and morning before the markets open with more than 60 proprietary algorithms to find you the highest-probability, most risk-appropriate opportunities to invest in stocks.

Trade Ideas also allows you to build your own scanners and screeners with over 500 data points and indicators to choose from. You can backtest your trading strategies, and also forward-test them in the real-time trade simulator. This allows you to learn, test, and optimize, without risking your own money. It also provides access to real-time streaming trading ideas on simultaneous charts to learn how to trade into risk-reward balanced trades. Translation: You can invest and learn at the same time.

Where Trade Ideas excels

Where Trade Ideas excels is not only giving you the data and ideas you haven’t seen elsewhere, but also showing you how to manage your money. The AI-powered “smart risk” levels on every chart are suitable for both long-term investors and active traders. As the stock market evolves, TI’s software adjusts levels and the trading plan to match.

The best part? You can learn how to do all of this without risking your principal through a real-time simulated trading environment.

After you’ve grown comfortable with the service and trading, you can choose to go live with the trade ideas and start investing real money by connecting directly through a brokerage like Interactive Brokers or E*Trade. (The full list of available brokers you can use through the service is available on Trade Ideas’ site.)

I’m a newsletter and alert aficionado, so I want to point out a couple of Trade Ideas products. For one, it has a standalone alert service in the form of a weekly Swing Picks newsletter. This gives you five new trade ideas in your inbox from the company’s model portfolio every Monday. Trade Ideas’ Standard and Premium subscriptions include these stock picks. Trade Ideas also has a free Trade of the Week newsletter highlighting one stock pick TI has identified for members.

Trade Ideas is among the pricier products we review, but it offers exceptional value, especially in the Premium tier. Sign up for any of Trade Ideas’ tiers through our exclusive link, and you can enjoy a significant discount on paid tiers by using the code mentioned in the box below.

- Trade Ideas is a powerful stock market scanner app that teaches you how to trade and invest, and boasts features such as technical indicators, PiP charts, alerts, even trading tournaments.

- Use Trade Ideas' simulated trading platform to learn how to trade without risking actual money.

- Trade Ideas' TI Premium tier opens up access to the platform's AI investment research assistant, Holly, as well as backtesting, "smart risk" levels, channel bar, and more.

- Special offer 1: Save an additional 22% off the above listed price on any annual subscription when you sign up with our link and enter code YATI22.

- Special offer 2: Save an additional 28% off the above listed price on a Premium subscription when you sign up with our link and enter code YATI28.

- Free live trading room that delivers actionable guidance

- In-browser and desktop interface functionality

- Automated trading capabilities

- AI-powered trade suggestions

- No mobile app

- Pricey subscriptions for some traders

7. Top Dog Trading

- Price: $150/mo.

Top Dog Trading is an interactive trading course that teaches traders how to use various indicators and stock analysis tools in order to make more accurate trades. The program provides an overview of a variety of technical analysis techniques, such as drawing trend lines, identifying breakouts, reading candlesticks charts and understanding stop-loss orders.

This course is for beginners or intermediate level stock traders who want great advice on what stocks are best to buy at the moment.

Top Dog Trading also offers a video newsletter service that is delivered to your inbox three times per week. The newsletter reviews Top Dog’s personal stock picks as well as a variety of other subjects, such as market updates and trading tips for beginners.

Should You Buy Recommendations From These Services?

If you have serious interest in investing with these stock advice services, I suggest starting small and cautiously with their recommendations. Consider following along with a paper trading account available through free stock apps. These accounts allow you to place trades without placing actual trades and putting your money at risk.

Apps like Webull offer this functionality for free. By a free paper trading service, you can test the recommendations of the advice services and how they perform relative to the market.

Always Perform Your Own Due Diligence

I recommend several services here because you should never let one single source represent your stock investing choices. If you find an interesting stock pick, research it more on your own. Only after performing your own due diligence should you invest.

Consider pairing some of the best investment research sites to your subscription to get more in-depth and objective views of the stocks recommended. You can also combine these subscriptions with the best investing apps for beginners, allowing you to invest in the market with ease.

Best Stock Advice Services, Subscriptions & Sites

The internet is filled with people who give others stock advice, despite knowing very little about investing. Stick with experts’ opinions when researching stocks you’re considering purchasing.

The websites above use professional analysts to choose investment recommendations and have proven themselves trustworthy over the years. Just remember that stock trading is never without some risk. For that reason, stocks should only be a portion of your well-balanced investment portfolio.

![6 Best Money Market Funds [Protect Your Savings, 2026] 50 a businessman protects his savings in the safe.](https://youngandtheinvested.com/wp-content/uploads/money-market-funds-safe-safety-security-1200-600x403.webp)