The 2024 tax season is upon us, so the time to get started on your tax return is now.

That sentence might have just filled you with dread. That’s OK—very few people actually like doing their taxes. But tax software can lessen the burden, and the best tax software can actually make it quite easy.

To help make filing your taxes easier, I researched several of the major providers’ offerings for 2024 to help you choose the ideal way to file your taxes online. The math behind calculating your tax liability will be the same with each tax software, but functionality, features offered, and forms needed for preparing your tax return will differ by company, product, and your tax situation.

Read on to learn about the best tax software for 2024 (2023 tax year). This review focuses on well-known, widely used tax preparation software. Our goal here is to not just point out features, but help you determine which features matter most to you and are worth paying for—and which features maybe aren’t worth the cost because you don’t need them for your circumstances.

Best Tax Software—Our Top Picks

|

Primary Rating:

4.7

|

Primary Rating:

4.6

|

|

DIY Options: $0-$71.20.* TurboTax Live Assisted ($0-$135.20) and TurboTax Live Full Service (Starting at $80.10) also available.** State filings are additional charges for paid products.***

|

DIY Options: Free: $0. Deluxe + State: $49. Premium: $75. Self-Employed: $89.* Online Assist, In-Person Assistance, and Drop-Off also available.**

|

The Best Tax Software Options for You

The tax software market has several options, ranging from high-powered online tax software to affordable DIY solutions.

What’s important to remember when choosing tax software is to find the best fit of options for you. Do you need tax assistance or advice? Consider paying more for the live support offered by many of the best tax software packages. Can you handle most of the heavy-lifting by yourself because you either have a simple tax situation or know your way around all the tax documents you need to prepare your own return? Don’t pay for all the bells and whistles and opt for a stripped down discount tax software package.

We surveyed the tax prep software landscape to find the best tax software options available for individual taxpayers. Here’s what we found:

TurboTax (Top Choice)

- Available: Start Your Return

- What TurboTax Deluxe can do: Everything handled by TurboTax Free Edition; additionally, can manage itemized deductions (Schedule A), charitable contributions and HSA distributions (1099-SA).

- What TurboTax Deluxe can’t do: Deductions and expenses from side hustles or self-employed work (Schedule C), capital gains and losses on investments and crypto (Schedule D), rental property income (Schedule E).

TurboTax remains the king of tax software in 2024. It doesn’t just have one of the most well-known brands—this software has it where it counts, boasting a smart interface and all the features you’d expect from a high-powered program.

TurboTax Deluxe is the most popular tax package offered by the company and covers W-2 income, itemized deductions found on Schedule A, and health savings account (HSA) distributions on 1099-SA.

If you need to report a more sophisticated tax situation, you’ll need to upgrade to TurboTax Premier. This tax software package assists you with calculating your investment and rental income as it comes fully-equipped with in-program support for Schedules D, E, and K-1. Further, if you have any crypto transactions, gains or losses to report, you’ll need to pony up for this package.

For those with greater needs on account of self-employment or business income (such as from freelancing or gig work), TurboTax Self-Employed provides everything in the Premier version as a baseline but also adds additional support for many self-employment tax deductions of note like the home office deduction (both standard and simplified), additional deduction assistance with special features for freelancers and independent contractors.

And if you don’t feel you can handle all this power by yourself or even need some extra assistance from a tax professional, you can reach out to one of them through two higher-tier service options: TurboTax Live and TurboTax Live Full Assistance.

TurboTax Live offers a one-on-one review with either a CPA or enrolled agent before you file to assist with your return. You can have unlimited, on-demand advice, depending on your needs. These tax professionals will also assist with reviewing your return before you file.

Simply make an appointment to fit your schedule or request a live talk. (Don’t worry, you don’t need to look your best. They can’t see you, only you can see them; they just have a view of your screen to provide better guidance). Also, you can receive tax advice all year with the Self-Employed version, providing better financial planning.

If you’d like a tax expert to prep, sign, and file your taxes for you, you’ll need to upgrade to their highest tier: TurboTax Live Full Service. With this highest level of service also comes the highest level of pricing. (See box below for full pricing details.) While pricey, these are often cheaper options than using a tax professional outside of the software package.

Regardless of your service tier, when touring through the tax software and preparing your tax return, the program provides numerous simplified prompts on what to do with each section. These messages aid you in preparing your return correctly and smoothly. Along the way, TurboTax’s software performs regular checks to see if you qualify for numerous tax deductions and credits based upon the information entered into the tax software.

For those filing a basic return (i.e., only claiming the standard deduction without further adjustments) on a Form 1040, TurboTax allows you to file your federal and state tax returns for free. However, for those who wish to itemize their deductions or use some of its other, more-powerful features, they will need to consider upgrading to some of TurboTax’s other paid versions.

TurboTax pros

- High-powered tax software capable of handling most taxpayers’ needs.

- Includes tiered-access to tax professionals.

TurboTax cons

- Pricey software solution, depending on needs.

- Some product support features aren’t as useful on lower tiers, often necessitating upgrading to a higher price tier to get the service you need.

- TurboTax does not reveal the full cost of your return until the end of the process, sometimes resulting in sticker shock on more complex filings.

See our TurboTax review.

- TurboTax is the most popular self-guided tax preparation software on the market for individuals and small businesses.

- The software integrates with other powerful Intuit products to get you the maximum refund and guides you through the process.

- Need a helping hand? TurboTax Live allows you to reach out for assistance from a tax professional.

- Can handle the most complex tax situations

- Offers live tax assistance and preparation

- Intuitive interface and Q&A format

- Complex, often confusing pricing system

- Software comes with significant horsepower but a price to match

Related: Tax Preparation Checklist [Get Your Tax Documents In Order]

H&R Block (Best for Complicated Returns)

- Available: Start Your Return

- What H&R Block Deluxe can do: Everything handled by H&R Block Free; additionally, can manage itemized deductions (Schedule A) and HSA distributions (1099-SA).

- What H&R Block Deluxe can’t do: Deductions and expenses from side hustles or self-employed work (Schedule C), capital gains and losses (Schedule D), rental property income (Schedule E).

H&R Block can help with more-complicated returns because they combine their online tax software with their extensive network of many tax professionals.

In fact, you have the ability to begin working with the software to prepare your return and then choose to visit a local H&R Block tax professional. This can happen at any point in the tax return preparation process should you need in-person assistance and allow for smooth information transfer. Depending on your tax professional needs, in-office visits are available for an additional fee.

H&R Block offers a free version which is more robust than the other free tax software versions reviewed here. H&R Block’s version allows you to claim the child and earned income tax credits, student loan interest, and retirement and Social Security income.

As an additional feature, H&R Block’s tax software allows you to upload PDFs of your tax forms to make the data input part of the tax return quick and simple.

H&R Block pros

- Offers the chance to do your own return but has in-person professional help available as needed for a fee.

- Offers Refund Advance Loans to tax filers who will receive a refund but may need money sooner, especially those who claim the earned income tax credit and must wait until mid-February.

- Preparing Schedules 1-3 is included in the free version of the software

H&R Block cons

- Isn’t as cheap as competitors.

- In-office assistance is available, though pricing can be steep if you have a simple question to answer.

See our H&R Block review.

- H&R Block is a leading tax brand that provides powerful software capable of assisting you with tax returns, no matter how simple or complex.

- Software includes five free federal e-files and audit support.

- Intuitive Q&A style format for DIY tax preparation.

- Get live assistance from a tax expert online, or meet with a tax professional in-person at a physical H&R Block location, on higher-tier plans.

- High-powered tax software tailored to different tax needs

- Offers online and in-person access to tax professionals (for additional fees)

- Has tax refund advance products available to get your refund faster

- Can drop-off tax documents with a professional to prepare your return

- State returns cost extra on most plans

Related: Does My Child Have to File a Tax Return?

Cash App Taxes (Best Free Tax Software for Semi-Complex Returns, AGI > $79,000)

- Available: Start Your Return

- What Cash App Taxes can do: Handles most tax situations—for free.

- What Cash App Taxes can’t do: Doesn’t offer access to tax professionals for preparing your tax return, nor handle multi-state income tax return filing or if you earned foreign income. Can’t handle business taxes and doesn’t offer import of trade activity (such as crypto or stocks), requiring you to input these transactions manually, one-by-one.

Cash App Taxes is the former Credit Karma Tax software platform that the Justice Department required Intuit to divest before completing its acquisition of Credit Karma in 2020. Now, the completely free tax software platform is offered by Square under the Cash App Taxes brand.

It features a basic, no-frills tax platform designed to handle state and federal taxes for free—no matter the complexity of your tax situation. The only snag? No professional tax assistance or preparation is made available through the platform. So, you’ll simply need to grab your necessary IRS forms and begin preparing your own return. If you know what you’re doing, that makes Cash App Taxes the most affordable tax software on the market as there are no hidden fees or charges. They offer the same types of guarantees around tax refund accuracy, getting you your maximum refund and even provide you with audit defense—all free of charge.

If you’re not in need of a tax pro, that makes Cash App Taxes the best online tax software for DIY filers in our estimation. It can handle everything from self-employment income to investment income, crypto transactions, business expenses, health savings account contributions and distributions and more. Consider Cash App Taxes if you feel comfortable in the driver’s seat for preparing your own tax return.

Cash App Taxes pros

- Completely free tax software, no hidden fees or charges

- Offers up to six-day advance of any tax refunds through a Cash App account

Cash App Taxes cons

- No available tax pro assistance or advice available

- Cash App Taxes (formerly Credit Karma Tax) is a simple, straightforward filing service that allows you to prepare federal and state tax returns for free.

- No paid tiers, no add-on services.

- If you elect to deposit your tax refund into your Cash App account, you can receive your refund up to six days early.

- Cash App Taxes will provide assistance retrieving past returns if you filed using Credit Karma Tax previously.

- Free federal and state filing, no exceptions

- Free audit defense with every return

- No professional tax support options

- Can't do business taxes

- Can't do multi-state filings and several other complex situations

- Must enter investment and crypto transactions manually, one-by-one

Related: Federal Tax Brackets and Rates

H&R Block Free (Good Free Tax Software for Simple Returns, AGI > $79,000)

- Available: Start Your Return

- What H&R Block Free can do: Income from wages (W-2) and unemployment income (1099-G), income from bank interest (1099-INT) and dividends (1099-DIV), student loan interest (1098-E), Schedules 1, 2 and 3, Child Tax Credit (1040, Schedule 8812).

- What H&R Block Free can’t do: Store tax returns for six years, child and dependent care expenses (Form 2441), Itemized deductions (Schedule A), deductions and expenses from side hustles or self-employed work (Schedule C), HSA distributions (1099-SA).

Let’s get straight to it: What exactly qualifies as a “simple” tax return? For the purposes of this review, I define it as a return with only salary income from a Form W-2 and minimal added income sources (i.e., interest or dividend income of $1,000 or less); only claims the standard deduction (nothing is itemized); and potentially qualifies to claim the refundable Earned Income Tax Credit or Child Tax Credits.

In other words, very minimal time investment needed to prepare your return and little complexity in your tax circumstances. Hence “simple.”

And while some tax software packages come jam-packed with features (hello TurboTax Self-Employed), you don’t always need to bring a gun to a knife fight. Sometimes simple circumstances call for simple solutions. In the world of tax preparation software, the best free tax software undoubtedly is H&R Block Free. This version handles simple returns at a reasonable price and still brings the user-friendly design and format the more powerful version provides.

Stated succinctly: The H&R Block Free version stands out among its peers.

To illustrate, most free software only allows you to prepare and file your Form 1040 with a few tax credits (i.e., earned income and child tax credits) should you qualify. The H&R Block Free version sweetens the deal by also allowing you to prepare and file Schedules 1, 2, and 3—very common forms many taxpayers need to file their returns.

H&R Block Free grants you access to report (though not calculate) important items like business income and expenses, alimony and child support, deductible student loan interest, specific retirement contributions, the alternative minimum tax (though not likely something you will encounter using the Free version since this has a complicated set of items for calculating), the tax credit for dependent care expenses, the Lifetime Learning Credit, and the Saver’s Credit. The software allows you to include this information in its free version; no other competitors we reviewed do the same. You’re getting more for less (or nothing)!

The H&R Block Free version also carries the intuitive Q&A format and provides an easy to use interface. If you don’t have all of your information gathered at once and wish to fill out sections in a different order than it requests information, you can skip around and keep track of your progress in the top banner display.

H&R Block Free pros

- Offers ability to prepare Form 1040 plus Schedules 1, 2, and 3—more than most other free versions.

- If you’re due a refund but need the money sooner—especially applicable to those who claim the Earned Income Tax Credit and must wait until mid-February—you can receive a refund advance loan on a debit card.

- Comes with free audit support with additional assistance from the company’s Worry-Free Audit Support, providing direct contact with an enrolled agent.

H&R Block Free cons

- In-office service price is a value if you have several questions you need answered, but potentially not worth it if you only have one or two questions.

- Can’t handle factors such as investment income, rental income, crypto income, self-employed income, etc.

- H&R Block Free is a leading tax brand that provides powerful software capable of assisting you with your federal and state tax returns.

- Software includes five free federal e-files and audit support.

- Intuitive Q&A style format for DIY tax preparation.

- Add unlimited expert help, including screen-share and on-demand chat and video, for $40.

- Online and in-person access to tax professionals (for additional fees)

- Has tax refund advance products available to get your refund faster

- Easy to switch if you filed via other tax software last year

- In-office service is a poor value if you only have one or two questions

- Can't handle investment or crypto transactions, nor rental or self-employment income

- Can't digitally organize your tax documents for previous years

Related: How Are Social Security Benefits Taxed?

e-File (Best Value)

- Available: Start Your Return

- What e-File Deluxe can do: Everything handled by e-File Free Edition; additionally, can deduct mortgage interest (Schedule A) and retirement income (Form 1099-R) for filers with up to $100,000 in income.

- What e-File Deluxe can’t do: All itemized deductions (Schedule A), business income (Schedule C)

On cost, e-File compares favorably to competitors reviewed here, amounting to half the price of many comparable programs. And e-File has captured market share primarily by offering its product at a low price point.

To many, it demonstrates remarkable value. The product offers a free basic federal e-file, preparing your federal return for free, and then a competitive price per state return. However, there are stipulations for meeting these low cost hurdles. In particular, you must earn less than $100,000 and also be single or married, filing jointly with no dependents.

e-File pros

- Great budget pick. Cost-effective if you meet the restrictive criteria for its free product.

- Its premium product costs less than half the costliest TurboTax product.

- Best for people with very simple tax situations.

- Full phone and online support with Deluxe and Premium products.

e-File cons

- Simpler design and functionality of its free software version aren’t appropriate for a more complex tax situation.

- The best option if only looking for bare functionality at the best price. But buyer beware: if you can’t handle your tax return by yourself, this might be a poor option between its functionality and lack of assistance options.

- Considered the best value if you know what you’re doing with your return and have little doubt about the forms needed or positions you plan to take.

See our eFile review.

- e-File is one of the best budget options for filing your taxes, offering free federal filing and cheaper subscription tiers compared to many competitors.

- While free filing software is available, filing status must be single or married filing jointly with no dependents, taxable income must be less than $100,000, and other requirements must be met.

- Budget-priced software

- Appropriate for tax DIYers

- Full phone and online tech support with Deluxe and Premium

- No live tax assistance options

- Free software could have difficulty with more complex tax situations

Related: Do You Have to File Taxes This Year?

TaxSlayer (Best for Ease of Use)

- Available: Start Your Return

- What TaxSlayer Classic can do: Everything in TaxSlayer Simply Free, additionally can handle all individual and joint taxpayer situations without business or self-employment income

- What TaxSlayer Classic can’t do: Can’t handle business, self-employment income

TaxSlayer has some easy-to-use features that make it a great elementary-level tax software to use. The software includes videos to explain each step of the process, associated definitions, and resources to answer your questions if they should arise.

TaxSlayer appears to be the best option if you have a high level of comfort doing your own taxes and don’t have a desire to pay full freight for some of the more powerful software packages mentioned above. It doesn’t come equipped with the flash of TurboTax or H&R Block, and it doesn’t charge for assistance. (Though should you want to skip the line and get help more quickly, you can skip the line with the TaxSlayer Premium tier, at a more affordable price than competitors’ similar products.)

Where TaxSlayer differs, aside from price and design, is how it prices its products. In fact, TaxSlayer chooses to price its offerings in line with the level of support you need and not what each level of software can do. In other words, the cheapest and most expensive software packages from TaxSlayer offer the same functionality, just different levels of support. Nearly every tax form and situation comes available with all versions and can handle tasks as important as itemizing deductions, claiming credits, tracking investment income, capital gains and losses, rental income and more. One exception is if you have business or self-employment income to report; this requires upgrading to TaxSlayer Self-Employed.

For those with few questions about how to handle their situation nor a desire to prepare taxes with appealing visual effects and on-screen explanations along the way, TaxSlayer pairs an easy-to-use design with value and support if you feel the need to pay for it. The only free support you will receive comes from technical questions and are addressed through email.

The Premium and Self-Employed packages offer “Ask a Tax Pro,” where users submit their questions directly through their TaxSlayer accounts. Afterward, TaxSlayer’s tax professional reaches out within one business day via phone or email to provide tax help. Unlike the major online tax providers, the tax help does not come with a video or face-to-face encounter.

Of special note: for Self-Employed package purchasers, tax pros specialize in self-employment tax items, providing the best-suited tax help for your situation.

In review, the program does not come with many fancy features, but this could be what makes it so easy to use (and cost effective). Despite this stripped-down look, TaxSlayer gets the job done at an affordable price point. The software option offers free minimal federal tax return functionality and one free state return. Each additional state return costs extra (see box below for pricing details).

TaxSlayer pros

- Offers explanatory video tutorials on numerous sections of the return.

- Pricing largely based on the amount of support you’ll need rather than software capabilities.

- Unlimited phone and email phone support to answer tax questions.

TaxSlayer cons

- Not a very sleek look or feel; employs a minimal design.

- Stripped-down capabilities make the software less suitable to more complex tax returns.

See our TaxSlayer review.

- TaxSlayer is a strong filing choice for beginner DIYers who want to learn as they go, offering step-by-step instructions and video tutorials.

- Premium and Self-Employed subscribers can submit questions to tax professionals through "Ask a Tax Pro." (And Self-Employed subscribers have access to specialists in self-employment tax items.)

- Free filing, with no restrictions on TaxSlayer Classic, to active-duty military personnel

- Free, unlimited phone and email support

- Step-by-step instructions and video tutorials

- Less suitable for complex returns

- Sometimes clumsy interface

- No document uploading or importing features on Simply Free plan

Related: 30 Tax Statistics and Facts That Might Surprise You

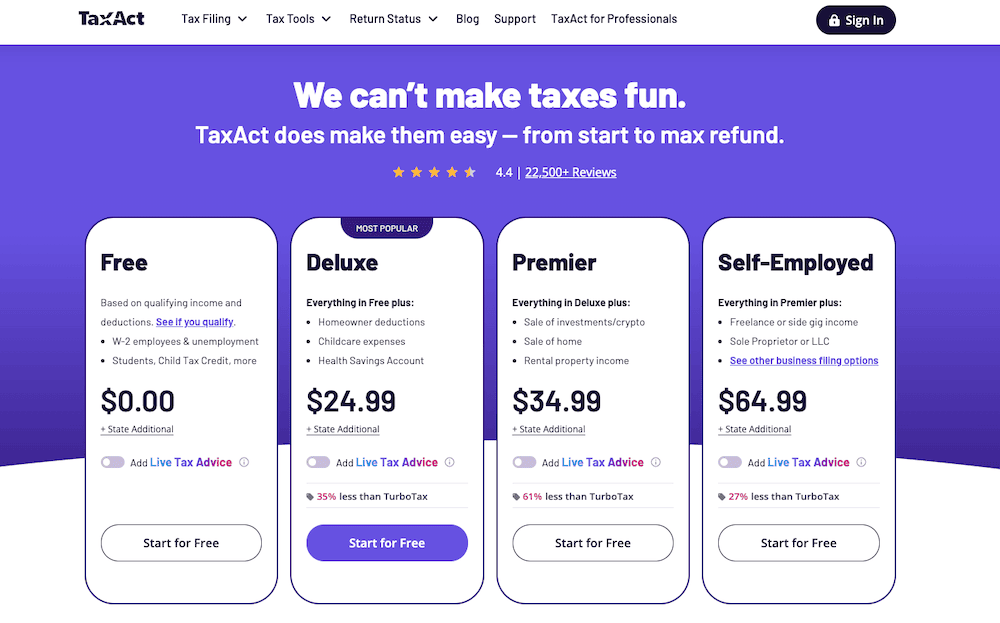

TaxAct

- Available: Start Your Return

- What TaxAct Deluxe can do: Everything in TaxAct Free, additionally can handle itemized deductions (Schedule A), child and dependent care credit, student loan interest deduction, mortgage interest deduction, health savings accounts (1099-SA)

- What TaxAct Deluxe can’t do: Can’t handle business, self-employment income

TaxAct is a lower-cost tax software program suitable for simpler returns. It offers most of the standard options found in most tax software, including being able to import your previous year’s return, as well as this year’s W-2 and some 1099s. TaxAct does offer numerous planning tools and calculators, alongside suggested tax deductions and credits that self-employed individuals will find of use.

When lining up TaxAct’s products against those of H&R Block and TurboTax, you might not find them as visually appealing, nor will they wow you with all the bells and whistles. However, TaxAct makes up for this shortcoming by offering far more competitive pricing and delivering good functionality.

Finally, much like other online tax software companies, TaxAct provides a couple backstops. For one, if TaxAct’s software causes either a larger tax liability or smaller refund than you receive using the same data through another tax-prep product, TaxAct claims it will refund the difference in the refund or liability (up to $100,000) and refund any applicable software fees. TaxAct also offers to cover any legal costs or penalties up to $100,000 that accrue as a result of using their system and claiming an errant tax position. Another feature (for a premium price) offered through TaxAct is their Audit Defense program, which offers a comprehensive response to any possible IRS audits.

TaxAct pros

- Good functionality at a fair price.

- Offers protection against not receiving your maximum refund.

TaxAct cons

- Not geared toward more complicated returns.

See our TaxAct review.

- TaxAct is a lower-cost, low-frills tax software program that's best used on simple returns.

- TaxAct also comes with useful tax planning tools and calculators.

- Import last year's return, as well as W-2s and 1099s.

- All of TaxAct's software options include free, unlimited access to tax experts if you start your return by March 20, 2023.

- Accuracy guarantee of up to $100,000

- Double-Check tool reviews returns for errors and overlooked tax breaks

- Not optimal for more complex returns

Related: Best Debit Cards for Kids and Teens

IRS Free File and Free File Fillable Forms (Best Free Tax Software, AGI <$79,000)

- Available: Start Your Return

- What IRS Free File and Free File Fillable Forms can do: Free File handles all federal tax situations for free if your AGI is less than $79,000 (Free File); if you can do your own return, no income limits to do your own tax return (Free Fillable Forms).

- What IRS Free File and Free File Fillable Forms can’t do: Free File handles all federal tax situations but does sometimes require you to pay for state tax return preparation depending on tax software company selected as part of the program; no limitations on Free Fillable Forms.

Each year, the IRS partners with tax preparation companies to offer free federal tax returns to individuals who make less than $79,000 in adjusted gross income per year. You can select from up to eight tax software companies to prepare your federal return for any situation. One catch: you might need to pay for your state return, depending on the software package you choose. Additionally, you can’t be offered any financial banking products as part of the experience. For example, if you need a refund advance, you’d need to apply for one of the paid programs above.

If you want to do your returns by yourself, you can use the IRS’s Free Fillable Forms—there is no AGI threshold to meet. This doesn’t include state or local tax forms, however. You’ll also need to make sure the numbers pencil out; you won’t be able to make changes once you submit without filing an amended return.

IRS Free File Taxes and Fillable Forms pros

- Free federal returns.

- Offers access to eight different companies’ software packages to prepare your return.

IRS Free File Taxes and Fillable Forms cons

- Can’t access banking products you might receive through paid programs (e.g., refund advance).

- May need to pay for state tax return preparation.

- Can encounter math errors if using Fillable Forms by hand.

- The IRS offers two free tax services: Free File and Free File Fillable Forms.

- With Free File, individuals who make less than $73,000 in annual adjusted gross income can use one of several branded tax software products to file their federal returns for free.

- With Free File Fillable Forms, individuals who make any amount of income may download any federal tax forms they need.

- Free use of branded tax software for federal filing

- Free forms for DIYers

- May need to pay for state returns

- Fillable Forms doesn't offer include state or local forms

- Human error could be problematic if using Fillable Forms by hand

How Do the Best Tax Software Packages Compare?

The companies covered in this review offer multiple packages based on your needs. Have a review of them all in a side-by-side look at the top providers and what each can do:

| Pricing Options* | Import Return into Tax Software? | Service & Support | Audit Assistance | |

|---|---|---|---|---|

TurboTax TurboTax | TurboTax: Deluxe: $39 Premier: $89 Self-Employed: $129 (+$39/state for DIY) TurboTax Live Assisted (Full Service): Basic: $0 ($169) Deluxe: $89 ($219) Premier: $139 ($329) Self-Employed: $169 ($359) (+$49/state for Live Assisted / Full Service) Simple tax returns free | Yes; may import PDF of return from previous software | 24/7 live support | Provides basic audit support for all returns and personalized audit assessment with Premier |

H&R Block | Basic: $25 Deluxe + State: $49 Premium: $75 Premium & Business: $89 (+$39.95/state) (Deluxe + State, Premium, and Premium & Business include 1 state) Simple tax returns free | Allow for a W-2 photo import; can import previous year’s return information from H&R Block on all non-free versions | Phone and live chat; in-person assistance at branch network | Peace of Mind®, In-person audit support |

TaxAct | Deluxe: $24.99 Premier: $34.99 Self-Employed: $64.99 (+$39.99/state for Free; $44.99 for Deluxe, Premier and Self-Employed) Simple tax returns free | Yes, may import last year’s tax information or third-party software information. May import PDF files of IRS forms from TurboTax and H&R Block | Live support via phone call after submitting help request | Audit Defense services |

TaxSlayer | Classic: $22.95 Premium: $42.95 Self-Employed: $52.95 (+$39.95/state) Simple tax returns free | May upload PDF of previous year’s return; pulls in data automatically if used TaxSlayer previous year | Email or phone, FAQs, video tutorials, definitions of key terms. Priority support for Premium an Self-Employed plans | Audit protection included in Premium and Ultimate plans |

eFile | Deluxe: $20.99 Premium: $37.49 (+$22.49 for each additional state return) Simple tax returns free | No | None displayed | |

Cash App Taxes | Free, no fees | No | Support Library, no live support offered | Provided |

| * Prices subject to change; consult individual sites for most accurate and updated pricing. | ||||

What Is Tax Software?

To make your life easier when complying with the sometimes-onerous tax return standards in the United States, tax preparation software compiles the numerous rules and regulations for federal and state income taxes for you to prepare on your own computer and time.

You can use tax software either online or have it directly installed and run on your computer. Both versions come equipped with prompts, forms, and information to assist individuals and businesses prepare their income taxes. Because of the simplicity and on-demand nature of tax software, many choose this path to file their taxes.

Additionally, for those who file their own taxes using tax software each year, most programs allow you to pull in the previous year’s return and auto-populate information. Further, tax software eliminates the need for taxpayers to prepare their returns on actual forms.

Instead, after inputting your required information, the tax software populates the fields in the necessary forms on your behalf, removing the headache of navigating different forms and schedules.

The tax software helps by taking simple or complex tax situations alike and providing understandable prompts for the user to submit the necessary information. From here, the software compiles the information and completes the tax return for you. At this juncture, you can either send the completed tax returns (federal and state) via mail or digitally through e-file, the IRS’ preferred manner for transmitted your completed tax return.

And the best part? No math! Computers handle the heavy lifting and eliminate the possibility of simple arithmetic errors. This proves immensely useful when it comes to tax time because no one wants to make mistakes and catch the attention of the IRS. Instead, you want to file your federal and state tax returns without headache or controversy.

Tax Software vs Tax Accountant

Tax Software Pros

- Offers an intuitive, Q&A-based format. Most tax software asks for simple information like your name, address, filing status, and dependent information. It asks you for specific information with detailed instructions of where to look on your W-2, 1099s, or other IRS tax forms. The tax software walks you through your income sources (e.g., earned income, passive income, investment income, etc.) by type and follows with a detailed Q&A about certain expenses which might be tax deductible. The software will ask about common tax deductions in addition to those you might not have known about.

- No hassle with filing. Tax software also helps make filing your return easy. If the software is worth its cost, you should be tasked with inputting your information, reviewing it for errors, and then submitting it to the IRS. You can do this either through printing and mailing it or e-file, the electronic transmission service used by the IRS. Tax software offers this advantage and dramatically reduces the time necessary to receive your refund directly deposited into your bank account.

Tax Software Cons

- More technical questions require extra help. If you have very complicated taxes to handle, sometimes you need more guidance than what the on-screen prompts provide. In fact, your complex tax situation might require a tax expert’s discerning review to have full capability of advising you beyond the tax software’s programmed abilities.

Tax Accountant Pros

- CPA or tax professional has the ability to provide tailored advice based on your tax situation. Depending on your needs, you may require more hands-on assistance preparing your taxes. Often, even the most robust tax software programs lack the wherewithal to handle complex tax situations. Or, in the cases when tax software can handle your tax circumstances, you might not have the time to complete your tax return in a timely manner. In this circumstance, it could make sense to consider handing over your tax forms to a professional and have your taxes prepared for you. Some things in life are worth paying a premium for, and peace of mind certainly qualifies.

- If you have a dispute which requires a finer understanding of tax laws. Some situations may present in your personal or professional life where no clear tax regulation or laws exist for which to guide you on how to claim certain positions on your tax return. By having a tax professional handle these circumstances on your behalf would be strongly advised and go well beyond the scope of tax software.

- You have little-to-no-understanding of tax preparation and don’t feel you can handle the task on your own. Stated simply, taxes can be difficult to grasp. There are so many formulas and numbers to know. Which number goes where? Do I have any Section 1231 loss carryovers or MACRS depreciation to claim on my rental property? Don’t worry, you’re not alone in finding these questions difficult to answer. If you don’t feel you can navigate your tax forms and the tax software, it would be advised to seek a certified tax preparer to aide you in preparing and filing your tax return.

- If you are likely to be audited by the IRS. In this case, it is strongly advised to seek the assistance of a paid preparer.

Tax Accountant Cons

- Expensive. Professional service and advice comes with a price. In many cases, receiving paid tax advice can be costly, especially compared to using tax software. However, if any of the above pros apply, avoiding IRS penalties and fines (or worse) make the cost well worth it.

- You have a simple tax situation. If you have the same tax situation as previous years and no major life changes have occurred in your life, it could be easier (and cheaper) to prepare your own return. Most of the tax software packages include free versions for handling such tax situations. If you only claim the standard deduction and no other complexities exist for your tax situation, paying a tax professional might act as a poor use of your financial resources.

- Time crunch. If you tend to procrastinate when it comes to filing your taxes, it might be hard to find an available tax preparer as the tax filing deadline looms. With tax software, you can prepare them at your own pace and not be dependent on someone else’s availability.

Tax Software Buyer’s Guide

Because the market is flooded with tax software packages, you should narrow down some key considerations before you settle on any one product. The following items are the most common things to look for when deciding which tax filing software package is best for your needs.

1. Ease of Use

The rationale for using tax software? Make tax prep and filing a tax return less complicated. Therefore, picking an intuitive, easy-to-understand tax filing software package would make the most sense. Also, it helps to have tax software that either automatically populates the previous year’s tax info, or allows you to upload it, rather than having to manually enter all that information again.

If you’re considering changing software packages, you will want one that can integrate smoothly with your own software. This cross-functionality makes switching so much less painful when it comes time to pulling in your old data.

2. Cost of Software

Consumers are cost-conscious when it comes to most products, so why should tax software be any different?

If you’ve read all of our reviews, you know prices can run the gamut, from free tax software to $200-plus premium plans for very complicated tax situations requiring multiple forms and professional assistance. Our advice: Make sure you’re not overpaying for software you don’t need; but don’t skimp if what you need is only available in a higher-tier package.

Put more simply: Pay for what you need, but don’t pay for what you don’t.

If you want to avoid ponying up for paid tax software, check to see whether you qualify to file your federal tax returns for free through the IRS Free File program. If your adjusted gross income (AGI) is less than $79,000, you might qualify for free guided tax preparation from more than 10 branded tax software providers.

3. Design and Interface

Believe it or not, looks matter. An intuitive interface can make all the difference when preparing your taxes, so use software with a design that makes sense to you. Especially if you’re a newcomer, you want a package that delivers accessible explanations of what is happening as you work on your return (rather than a package that forces you to chase down answers).

4. Service and Support

If you have a simple tax situation and/or you’re proficient at navigating the IRS’s tax forms, service and support might not be important to you. However, if you’re an inexperienced filer and/or have a complicated return, it’s nice to have a knowledgeable tax pro within reach if you hit a brick wall while you’re working on your taxes.

Several tax programs, including some on our list, offer varying levels of assistance by tax professionals, including licensed CPAs. We highly recommend this if you have a complex return, as these are more likely to be audited by the IRS.

Important Tax Documents

Each year, when you file your taxes, you will need certain forms to complete your tax return. Below are the most common forms tax filers use to prepare their tax returns.

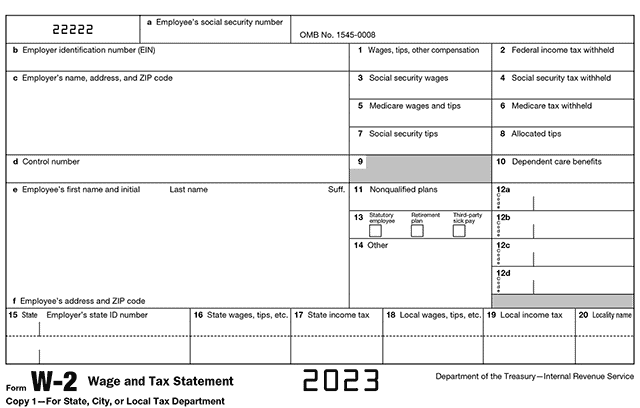

1. W-2 (Wage and Salary Employee)

Form W-2 is the most common form that tax filers need to prepare their income tax returns each year. This document comes from your employer through the mail and contains income, benefits, and deductions information regarding your employment.

In particular, this important form provides details about taxes withheld from your pay, money saved in employer-sponsored retirement accounts, dependent care expenses paid for through your flexible spending account, health savings account (HSA) contributions and other compensation-related items.

By law, these must be sent to employees by Jan. 31 each year or the employer may face fines from the IRS. Otherwise, you should contact your employer and possibly the IRS if you have not received this form through the mail by that time.

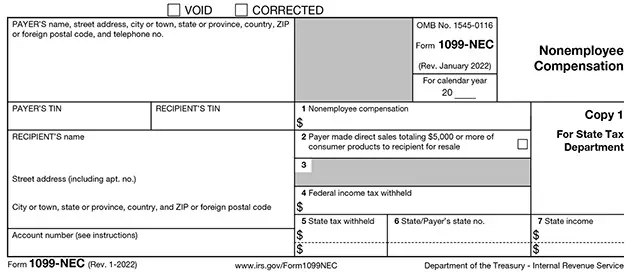

2. Form 1099 (Contractor, Gig-Economy Workers, Freelancer)

Form 1099 provides information about income you may have earned as a contractor. There are numerous types of 1099 forms, such as those for dividends (1099-D), rental income, canceled debt (1099-C), foreclosed homes, and other types of miscellaneous income not included on a W-2 form. The most common form is the 1099-NEC, which covers self-employed income.

This form is most commonly how gig-economy workers, freelancers, and contractors identify their taxable income. The threshold for being required to send 1099-NEC forms is $600. Below this amount, the principal paying the contractor is not required to provide a 1099-NEC. See this article for more ways on how 1099s vs W-2s compare.

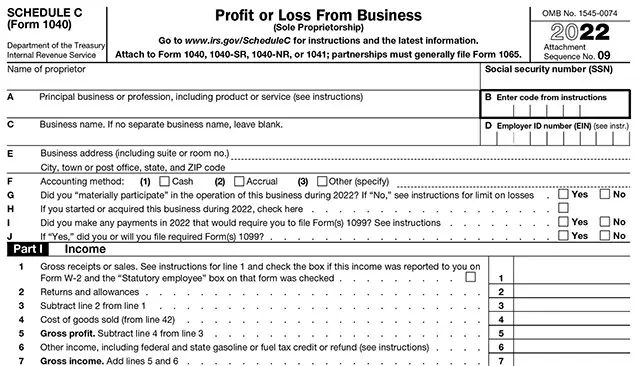

3. Schedule C (Small Business Owner)

Also known as Form 1040, Profit and Loss, Schedule C is a year-end tax form used to report profits and losses if you own a small business (sole proprietorship or single-member LLC). Any business startup costs, operating expenses, or other related items will be listed on this form.

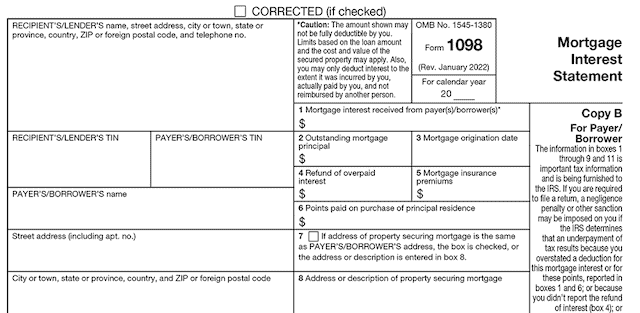

4. Form 1098 (Eligible Expenses to Deduct)

Form 1098 provides eligible expenses to deduct against your taxable income. The three items covered are:

- Mortgage interest paid (standard Form 1098)

- Eligible student loan interest paid (Form 1098-E)

- Tuition costs paid (1098-T)

If you are a student or pay on student loans, you should use these forms to see if you are eligible to take various qualified deductions.