If your employer offers a high-deductible health plan (HDHP), they might offer a health savings account (HSA) as well. HSAs provide triple tax advantages when you use them to invest, making them a good option for socking away extra cash. Contributions are made on a pre-tax basis, investments grow tax-free, and there’s no income tax on withdrawals used to pay medical expenses. Not bad, right?

But what if your new employer offers a better HSA account than your former employer? I’m talking lower account fees, better investment options, and other perks. Can you move your HSA money, or does it need to stay with your old provider?

I’ve got some good news: You can roll over or transfer those funds to a different HSA provider. But there’s also some “meh” news: One option for moving HSA money is slightly more complicated than the other.

If you’re interested in doing an HSA rollover, here’s what you need to know.

Related: How to Use Your HSA for Retirement

What Is an HSA Rollover?

An HSA rollover involves taking money out of one HSA and depositing it into another HSA. However, you can only do one HSA rollover per year.

It’s also worth noting that an HSA “rollover” is technically different from an HSA “transfer.” The rollover process is slightly more complicated, but we’ll get into how rollovers and transfers work shortly.

What Happens to Your HSA When You Quit Your Job?

While most HSA rollovers are triggered by a change in employment, you’re not required to roll over your HSA funds when you change jobs. HSAs are employee-owned. So, even if you quit your job, your HSA funds still belong to you. You’ll still be able to access your account, contribute if you’re covered by an HDHP, and take distributions for qualified healthcare expenses without penalty.

Related: HSA vs. HRA: How Different Are They?

How Long Do You Have to Rollover HSA Funds?

With a rollover, you request a check from your HSA provider for the total amount in your HSA. After you receive the check, you have 60 days to deposit the funds into a different HSA with another HSA provider.

If you fail to make the deposit in that timeframe, the IRS considers it a taxable distribution. You could also be saddled with a 20% tax penalty. However, the penalty doesn’t apply to distributions made after you become disabled, turn 65 years old, or die.

Related: When is Having a Health Savings Account and HDHP a Bad Idea?

What Are the Benefits of an HSA Rollover?

Completing an HSA rollover or transfer can have several benefits, including the following.

Simpler to Track

Having to track healthcare spending across two or more HSA accounts can be unnecessarily complicated. Moving all your HSA funds into one account simplifies things.

Lower (or No) Account Minimums

If your existing HSA provider has a high account minimum, it can feel like a portion of your money is always tied up. Moving funds to a new HSA provider with lower or no account minimums can free up your funds.

Access to Investment Accounts

Certain HSAs offer access to investment accounts, typically when you meet a certain minimum account balance. Investment options include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more. Moving HSA money to an account that allows Investing can help you take advantage of tax-free growth.

Lower-Cost Investment Options

Different HSAs offer different investments, and expense ratios on investments can vary. If a rollover results in lower-cost investment options, it could be worth considering.

Potential Reduction in HSA Fees

Fees can vary from one HSA account to another. If you discover an HSA provider that offers lower fees, moving your HSA money to that provider could save you some cash.

Easier Tax Reporting (One Form 1099-SA)

Instead of receiving a 1099-SA form for multiple accounts, consolidating HSA funds into one account means you’ll get just one 1099-SA form each year, which could mean less complexity and fewer headaches at tax time.

Related: How to Choose Between a Low and High Deductible Health Plan

HSA Rollover vs. HSA Transfer

There are two basic ways to move cash and investments from one HSA to another: HSA rollovers and HSA transfers. Plus, transfers can either be trustee-to-trustee transfers or in-kind transfers. Here’s a quick look at each method.

HSA Rollovers

HSA rollovers are more hands-on than HSA transfers. With a rollover, your current HSA custodian sends you a check to deposit with your new HSA provider. As mentioned earlier, you have 60 days to make the deposit, or the IRS could hit you with a 20% tax penalty. You’re also limited to one HSA rollover every 12 months.

If you complete an HSA rollover, the HSA funds don’t count as taxable income for federal tax purposes, but it isn’t tax deductible, either.

A rollover also doesn’t count against the total HSA contribution limit set by the IRS for that year. So, for 2025, you can still contribute the full $4,300 if you have self-only coverage under a HDHP ($4,400 for 2026) or $8,550 if you have family coverage ($8,750 for 2026), plus an additional $1,000 If you’re at least 55 years old at the end of the year, even if you roll over HSA funds from one account to another.

Trustee-to-Trustee Transfers

A trustee-to-trustee transfer is a little less complicated than an HSA rollover, and you won’t need to worry about receiving or depositing a check. Instead, your current HSA provider works directly with your new provider to transfer funds.

Contact your current HSA provider to initiate this type of transfer. You might have to complete a trustee-to-trustee transfer form or follow other procedures.

Unlike an HSA rollover, there’s no limit on the number of times you can complete a trustee-to-trustee transfer per year. There are also no tax implications, and the transferred funds don’t count against the annual contribution limit for HSAs.

In-Kind Investment Transfers

A transfer is slightly more complicated if your HSA balance is invested, but it’s still possible to move your investments with certain HSA providers. It depends on their rules, though.

To do so, your new provider must provide an in-kind transfer option. With an in-kind transfer, specific investments can be transferred from your former provider to your new HSA account. For instance, if you’ve invested your HSA balance in specific mutual funds or ETFs, you could mirror those investments in your new account.

If an in-kind transfer isn’t permitted, your best bet might be to liquidate your investments and then move the cash to your new HSA account through a rollover or trustee-to-trustee transfer.

My own experience moving investments to a new HSA

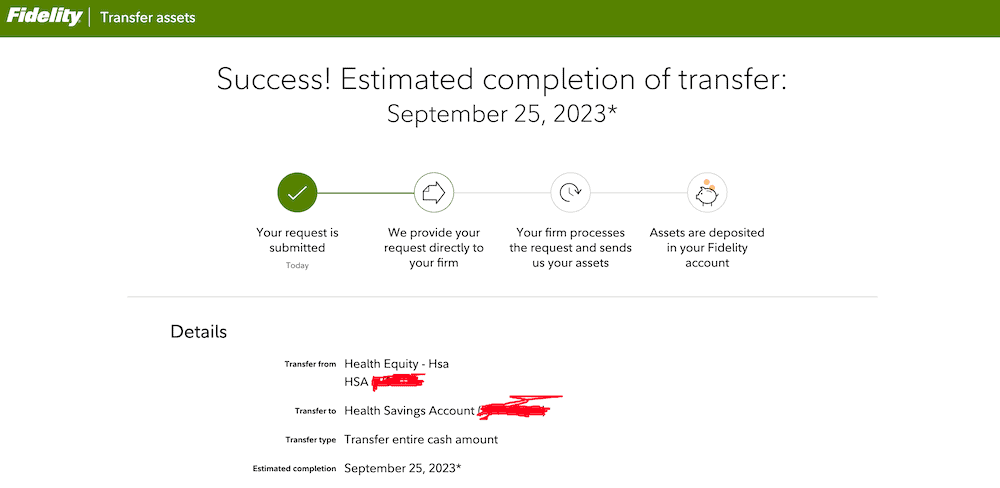

I recently completed my own HSA transfer to move funds from an old HealthEquity HSA (from when I worked at Google) to my new Fidelity HSA.

The process was relatively straightforward, but I did have to liquidate my holdings in my HealthEquity account prior to initiating the transfer to my new Fidelity HSA. This is because I wasn’t allowed to move actual investment positions from one account to another, only cash. As a result, the transfer will take a few extra days than expected, because it will take two or three days for the sales transactions to process and settle before HealthEquity can transfer funds to my new Fidelity HSA. However, after a few easy clicks inside the Fidelity HSA transfer portal, I successfully moved the money from one account to another.

Related: How to Start a Retirement Plan + Build Retirement Savings

Other Types of HSA Rollovers

So far, I’ve discussed ways to move money or investments from one HSA to another HSA. However, you can also shift money from certain retirement accounts to health savings accounts.

IRA-to-HSA Rollovers

You can generally transfer a portion of your individual retirement account (IRA) to an HSA with a qualified HSA funding distribution. Note, however, that you can’t move funds from a SEP IRA or SIMPLE IRA if an employer contribution to this type of IRA is made in the same tax year in which an IRA-to-HSA transfer would be made.

Moving funds from an IRA to an HSA can only be completed with a trustee-to-trustee transfer. You’re generally allowed to make only one IRA-to-HSA transfer during your lifetime; however, if you complete a qualified HSA funding distribution during a month when you have self-only coverage under a HDHP, you can make another IRA-to-HSA transfer later in the tax year if you change to family coverage.

Any amount you move from an IRA to an HSA will count toward the annual IRS contribution limit set for HSAs. So, for example, if you transfer $2,000 from your IRA to your HSA in 2025, you’ll only be able to contribute an additional $2,300 to your HSA if you have self-only HDHP coverage or $6,550 if you have family coverage, plus an additional $1,000 if you’re at least 55 years old.

This type of transfer generally isn’t treated as a taxable event (i.e., the transferred funds aren’t taxable or deductible). However, if you’re not eligible to make HSA contributions during a “test period” (other than because of death or disability), the amount transferred will be treated as taxable income and subject to a 10% penalty. The testing period begins with the month in which the IRA-to-HSA transfer is made and ends on the last day of the 12th month following that month. For example, if a transfer is completed on Sept. 6, 2025, the testing period ends on Sept. 30, 2026.

YATI Tip: You can transfer funds from either a traditional or Roth IRA, but an IRA-to-HSA transfer typically makes sense only with traditional IRA funds. Moving money from a traditional IRA to an HSA essentially turns tax-deferred funds (i.e., you’ll owe tax when you withdraw the funds) into tax-free funds (i.e., no tax on withdrawals) as long as you ultimately use the money for qualified medical expenses. However, you don’t get the same benefit by transferring money from a Roth IRA to an HSA because it’s already treated as tax-free in the Roth account.

Can you roll over an HSA to an IRA?

While you can move IRA funds to an HSA, you can’t do an HSA-to-IRA rollover. You probably wouldn’t want to, either. With an HSA, you can withdraw funds tax-free at any time for qualified healthcare expenses. If HSA funds were moved to a traditional IRA, that benefit would be lost and withdrawals would be taxed even if the money is used for medical expenses.

Moving HSA funds to a Roth IRA would also be treated as a taxable event, so you would have to pay federal income tax in the year the transfer is completed.

The withdrawal rules for IRAs are more strict, too. If you make withdrawals from your IRA before age 59½, that amount (or part of it) could be subject to income tax and a 10% tax penalty.

401(k)-to-HSA Rollovers

While you might want to move money from a 401(k) plan to an HSA, it’s not possible to do a direct rollover. Instead, you first need to transfer the 401(k) funds to an IRA, then you can move them to an HSA.

Can you roll over an HSA to a 401(k)?

You can’t move HSA funds to a 401(k) account, either. And, for the same reason noted above for transfers from traditional or Roth IRAs, it might not make sense to do so anyway.

Related: IRA vs. 401(k): How These Retirement Accounts Differ

Where Can I Open a Health Savings Account?

Several HSA providers offer the ability to invest your HSA balance. Our top pick is Fidelity because the company offers the best options for self-directed investors. Here are some details about Fidelity’s HSA offerings.

Fidelity HSA

- Available: Sign up here

- Debit card: Yes

- Insured: Yes (Uninvested cash is insured)

- Minimum balance: $0

- Minimum to invest: $0 for Fidelity HSA, $10 for Fidelity Go HSA

- Investment options: Stocks, bonds, mutual funds, ETFs (investments depend on account type)

Fidelity offers two options for HSA accounts: the Fidelity HSA or the Fidelity Go HSA.

The self-directed Fidelity HSA is best for people who prefer to handle their own investments. With this account, you can invest in stocks, bonds, mutual funds, and ETFs. It’s also a rarity in that it allows you to buy fractional shares of stock. You’ll also benefit from commission-free trades, minimal fees, and no account minimums. This HSA account also comes with a debit card that you can use for qualifying healthcare expenses.

These features make the Fidelity HSA a good option for those seeking the flexibility of a self-directed account, as well as individuals or families who might not have a ton of extra cash to set aside for healthcare expenses.

People seeking a managed account could opt instead for Fidelity Go HSA, a robo-advised HSA solution. Answer just a few questions, and Fidelity Go will build a portfolio for you. Funds in a Fidelity Go account are invested in Fidelity Flex mutual funds, which feature no management fees and often no fund expenses.

- Maintenance/other recurring fees: None

- Investment fees: Fidelity HSA: No fees. Fidelity Go HSA: No advisory fees for balances under $10,000; $3/mo. for a balance of $10,000-$49,999, 0.35%/yr. for balances of $50,000 and above.

- Minimum balance to invest: Fidelity HSA: $0. Fidelity Go HSA: $10.

- Investment options: Fidelity HSA: Stocks, bonds, ETFs, mutual funds. Fidelity Go HSA: Fee-free Fidelity Flex mutual funds.

- Maximum investment flexibility via self-directed Fidelity HSA accounts

- Low/no minimum to invest depending on type of account

- No fees for Fidelity HSA

- No fees on low- to mid-balance accounts for Fidelity Go HSA

- Can buy fractional shares

- Mobile app

- Bill pay

- FDIC-insured cash accounts

- SIPC-insured investment accounts

- Regressive fee structure for managed Fidelity Go HSA investment accounts

Related:

![What Is a Bare-Bones Budget [And How Do I Create One]? 22 budgeting piggy bank tight clamp bare-bones 1200](https://youngandtheinvested.com/wp-content/uploads/budgeting-piggy-bank-tight-clamp-bare-bones-1200-600x403.webp)