Vanguard’s target-date funds might very well be the Lean Cuisine your portfolio needs.

I suppose some context is in order. Comedian Patton Oswalt has a bit about going to the frozen-foods section of a grocery store and agonizing over certain Lean Cuisine meals—frozen dinners that have already condensed hours’ worth of cooking into a handful of actions—that involve more steps than others.

And that bit always comes to mind when I write about target-date funds (TDFs).

Your average fund can invest you in, say, thousands of U.S. stocks, hundreds of international bonds, or a few dozen equities within a certain corner of the market. Ultimately, though, you generally have to buy a few of these funds to craft a complete portfolio, then you have to occasionally buy or sell more shares over time to ensure your investment balance is where you need it to be.

That’s great, but target-date funds take even more bricks off your shoulders. The TDF is the ultimate “remove tray from box, put it in the microwave for five minutes, that’s it” fund. That’s because target-date funds are a “portfolio in a can” that are a portfolio unto themselves, typically owning numerous funds to ensure you’re invested in most core strategies. Then they take even more off your plate by owning different percentages of those funds over time so that you always have the appropriate exposure to those strategies as you age.

Today, I want to introduce you to Vanguard’s target-date funds—the Vanguard Target Retirement series—as well as another Vanguard line of retirement mutual funds. I’ll start with a quick intro to TDFs, then help you better understand these Vanguard retirement products.

Disclaimer: This article does not constitute individualized investment advice. Securities, funds, and/or other investments appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

What Is a Target-Date Fund?

Target-date funds are a type of mutual fund that has become popular in retirement planning over the past two decades. They go by different names, interchangeably called several things, including:

- lifecycle funds

- age-based funds

- dynamic-risk funds

But the concept at the core is simple: Target-date funds invest in a more aggressive portfolio of mostly equity funds to start, then gradually shift to a more conservative portfolio of mostly bond funds as they approach a target retirement date.

The target retirement dates are intended to be estimates; they don’t have to be super precise. Generally, most mutual fund families will create target-date funds in five-year increments (say, 2025, 2030, 2035, etc.).

For the investor, the math here is simple enough.

Example

Let’s say you’re 45 years old in 2025, and that you expect to work until age 70. Your expected retirement date would be in the year 2050. So, investing in a target-date fund with a target retirement date of 2050 would be the most logical move.

What if your expected retirement age changes? No problem! Target-date funds are normal mutual funds and can be bought or sold as your needs change.

Note that the target-date fund’s allocation to stocks will generally never go to zero. Retirees need growth too, and most should maintain at least a little exposure to the stock market. The beauty of the target-date fund is that it changes your asset allocation to match your risk tolerance as you age—and it does it automatically without requiring you to actually do anything.

Related: 17 Best Investment Apps and Platforms [Free + Paid]

What Is Asset Allocation?

A lot of investors (and particularly young investors) dream of making a killing picking stocks. And that’s fantastic. Stock picking is stimulating and, if done well, can add some zeros to your net worth!

When push comes to shove, however, your asset allocation strategy is far more important than individual stock picking when it comes to meeting your financial goals. Asset allocation sits at the core of target-date funds and, really, at the core of all financial planning.

But what exactly is asset allocation?

Every planner has their own take, but the basic idea is simple. You diversify your portfolio across different asset classes (stocks and bonds, for instance) that, ideally, move at least somewhat independently of each other. A typical asset allocation will include:

- stocks (or stock mutual funds)

- fixed-income investments (bonds or bond funds)

- cash

- alternative assets such as gold, commodities, or real estate

You arrange the parts so that the overall portfolio has a risk and return profile that makes sense for you. And (importantly!) you rebalance the portfolio when the weights to each asset start to divert from your plan.

Example

Let’s say your ideal asset allocation had you 50% allocated to stocks and 50% allocated to fixed income.

First, let’s say the stock market crashes. Your stock weighting has suddenly dropped to just 40%, and your fixed-income investments have jumped to 60% of your portfolio’s worth. You need to rebalance your portfolio to get back to 50/50. You would do that by selling off some of the fixed-income investments and buying some stock.

Now, let’s say instead that the stock market shoots higher, and you find yourself allocated 60% to stocks and 40% to fixed-income investments. If you wanted to rebalance back to 50/50, you would sell some of your stocks and buy new fixed-income investments.

The idea here is to constantly reduce risk and smooth out your returns by buying low and selling high.

Asset allocation within a target-date fund takes it a step further. Apart from regular rebalancing due to market moves, the target-date fund’s asset allocation decisions involve gradually reducing the risk (buying fewer and less risky stocks, and buying more bonds) as the fund gets closer to its target retirement date and its final asset allocation.

Make sure you sign up for The Weekend Tea, WealthUp’s free weekly newsletter that over 10k monthly readers use to level up their money know-how.

Related: 15 Best Investing Research & Stock Analysis Websites

Vanguard’s Retirement Funds

Vanguard has two sets of retirement funds:

- Vanguard Target Retirement Funds, a set of target-date funds along with an income fund for investors who are already in retirement

- Vanguard LifeStrategy Funds, a set of balanced funds with fixed strategies designed for investors more actively managing their own retirement portfolios

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

Vanguard Target Retirement Funds

Since its founding in 1976, Vanguard mutual funds and ETFs have arguably done more to lower fees and to improve the overall investing experience for clients than any other company in history. This is the company that invented the low-expense-ratio index fund, and we continue to reap the rewards of that innovation today. Its Target Retirement Funds generally allow for very low minimums of just $1,000 and expense ratios of just 0.08%, the latter of which is about a fifth of the cost of a comparable fund from other providers.

So, let’s take a look at the Vanguard Target Retirement Funds to see which might be the best match for you.

| Fund | Ticker | Expense Ratio* |

|---|---|---|

| Vanguard Target Retirement Income Fund | VTINX | 0.08% |

| Vanguard Target Retirement 2020 Fund | VTWNX | 0.08% |

| Vanguard Target Retirement 2025 Fund | VTTVX | 0.08% |

| Vanguard Target Retirement 2030 Fund | VTHRX | 0.08% |

| Vanguard Target Retirement 2035 Fund | VTTHX | 0.08% |

| Vanguard Target Retirement 2040 Fund | VFORX | 0.08% |

| Vanguard Target Retirement 2045 Fund | VTIVX | 0.08% |

| Vanguard Target Retirement 2050 Fund | VFIFX | 0.08% |

| Vanguard Target Retirement 2055 Fund | VFFVX | 0.08% |

| Vanguard Target Retirement 2060 Fund | VTTSX | 0.08% |

| Vanguard Target Retirement 2065 Fund | VLXVX | 0.08% |

| Vanguard Target Retirement 2070 Fund | VSVNX | 0.08% |

| * Represents "acquired fund fees and expenses," which are the fees and expenses of the underlying funds. | ||

I won’t break down every fund on this list; that would be redundant. But I’ll review a handful that are in very different stages of their asset allocation glidepath to give you a good sampling.

Vanguard Target Retirement 2025 Fund

I’ll start with the Vanguard Target Retirement 2025 Fund (VTTVX). Given that the target date is literally this year, this fund is intended for someone who’s very close to retirement. That said, VTTVX still has a healthy exposure to stocks. Its current allocation is about 51% equities and 49% in bonds and cash. The fund invests in stocks and bonds exclusively through Vanguard index mutual funds. Right now, its largest holdings are the Vanguard Total Stock Market Index Fund Institutional Plus Shares (VSMPX) and Vanguard Total Bond Market II Index Fund Investor Shares (VTBIX), which each account for about 30% of assets.

This brings up an important point: Vanguard’s concept of what constitutes an appropriate portfolio for a person your age might or might not line up with your own preferences. You should always take a look under the hood to make sure you’re comfortable with the level of equity exposure.

Vanguard Target Retirement 2040 Fund

Next up is the Vanguard Target Retirement 2040 Fund (VFORX), which is designed for someone with about 15 years left until retirement, or roughly in their mid-50s.

The 2040 fund invests in a more aggressive allocation with 76% of the portfolio in stocks and the remainder in bonds and cash. Like with VTTVX, the fund leans on VSMPX—at 46% assets right now—to provide the bulk of its equity exposure. But it also has a healthy 31% of assets invested in Vanguard Total International Stock Index Fund Admiral Shares (VTIAX) for the foreign-equity portion of the portfolio.

Vanguard Target Retirement 2060 Fund

And for younger investors, let’s also consider the Vanguard Target Retirement 2060 Fund (VTTSX). This fund is designed for a person looking to retire in 35 years, putting them in their early 30s today. As you might expect, it’s aggressive. The fund invests 92% of its assets in stocks, with the Vanguard Total Stock Market Index Fund again leading the way at 55%, followed by the Vanguard Total International Stock Index Fund at 37%.

Vanguard Target Retirement Income Fund

You’ll notice that the Vanguard Target Retirement Income Fund (VTINX) is the only entry without a year attached to its name. Like the other Target Retirement Funds, VTINX is a balanced fund (read: stocks and bonds)—currently, it offers a 30/70 split of stocks and bonds. However, unlike the target-date funds, VTINX doesn’t change its allocation to meet a particular age’s needs. Instead, it’s a conservative fund designed for investors already in retirement who want to largely generate income with a little potential for capital appreciation.

Related: Beginner’s Guide to Fidelity Target-Date Funds

Vanguard LifeStrategy Funds

Target-date funds are based on the simple but powerful premise that, all else equal, your asset allocation should glide from more aggressive to more conservative over time. As a result, target-date funds gradually lighten up on stocks and go heavier into bonds as they reach their target retirement date and final asset allocation.

But it’s not always that simple, and age is not the only variable that matters.

A proper financial plan also considers things like sources of income from pensions or Social Security, other investments you might own, any planned inheritance, the overall health and attractiveness of both stocks and bonds, and your personal attitude and feelings toward risk.

For most investors most of the time, a target-date fund is a great tool. But given all of these additional factors, it may or may not be the best tool for you.

And that’s where Vanguard’s LifeStrategy Funds come into play. If you are willing and able to do a more comprehensive financial plan, the LifeStrategy Funds give you an off-the-shelf professionally managed asset mix that is set to your target and doesn’t glide more conservatively over time.

Vanguard currently offers four LifeStrategy Funds:

| Fund | Ticker | Expense Ratio |

|---|---|---|

| Vanguard LifeStrategy Income Fund | VASIX | 0.11% |

| Vanguard LifeStrategy Conservative Growth Fund | VSCGX | 0.12% |

| Vanguard LifeStrategy Moderate Growth Fund | VSMGX | 0.13% |

| Vanguard LifeStrategy Growth Fund | VASGX | 0.14% |

| * Represents "acquired fund fees and expenses," which are the fees and expenses of the underlying funds. | ||

- The LifeStrategy Income Fund (VASIX) is allocated 20% to stocks and 80% to bonds and is designed for a conservative investor with a three- to five-year horizon. The emphasis is heavily on income as opposed to growth.

- The LifeStrategy Conservative Growth Fund (VSCGX) is slightly more aggressive and has a targeted allocation of 40% stocks and 60% bonds. The time horizon is expected to be five years or more.

- The LifeStrategy Moderate Growth Fund (VSMGX) is Vanguard’s version of the classic 60/40 portfolio with a targeted allocation of 60% stocks and 40% bonds. The time horizon is expected to be five years or more.

- The LifeStrategy Growth Fund (VASGX) is the most aggressive allocation and has a targeted allocation of 80% stocks and 20% bonds. The time horizon is expected to be five years or more.

There is one point to consider here regarding taxes.

If you hold a more aggressive LifeStrategy fund for years, then opt to trade it in for a more conservative option, you might get zapped with a large tax bill due to years of capital gains. In a target-date fund, that process will be more gradual—you’ll pay capital gains taxes due to the internal selling of the target-date fund as it gradually sells stock funds and buys bond funds—but you will generally spread the pain over several tax years, and only receive a big tax bill if you actually sell out of the target-date fund.

Related: Capital Gains Tax: What Is It, Rates, Home Sales + More

Make sure you sign up for The Weekend Tea, WealthUp’s free weekly newsletter that over 10k monthly readers use to level up their money know-how.

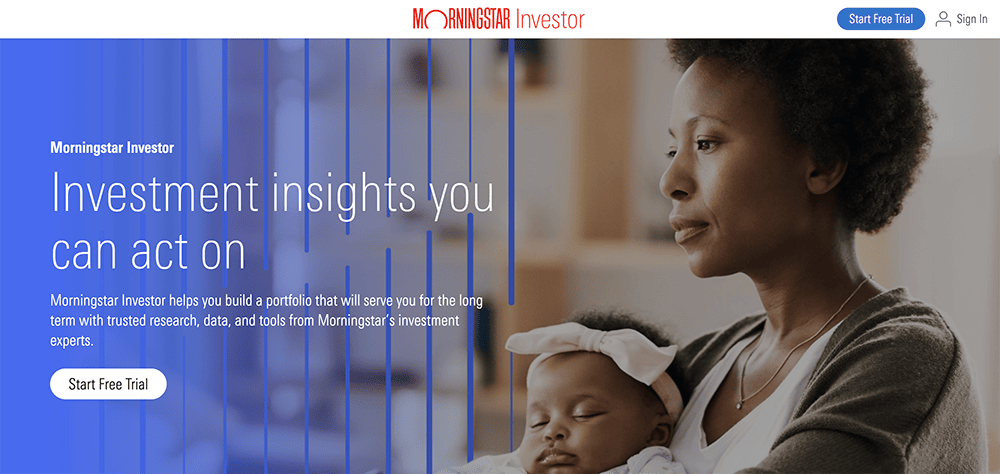

Learn More About These and Other Funds With Morningstar Investor

If you’re buying a fund you plan on holding for years (if not forever), you want to know you’re making the right selection. And Morningstar Investor can help you do that.

Morningstar Investor provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

With Morningstar Investor, you’ll enjoy a wealth of features, including Morningstar Portfolio X-Ray®, stock and fund watchlists, news and commentary, screeners, and more. And you can try it before you buy it. Right now, Morningstar Investor is offering a free seven-day trial. You can check out the current deal, as well as discounted rates for students and teachers, in our details box below.

- Morningstar Investor offers expert research, investing analysis, and advisor-grade portfolio management tools that are tailor-made for buy-and-hold investors.

- Morningstar is one of the most prized sources of mutual fund and exchange-traded fund (ETF) data in the world.

- How does your portfolio stack up? Put it through Morningstar's Portfolio X-Ray, which will provide insights such as whether you have too many overlapping holdings or whether you're paying too much in fees.

- Special Offer 1: Click our sign-up link to receive $50 off your first year of Morningstar Investor. (Annual plan only.)

- Special Offer 2: Students receive one year of Morningstar Investor access for just $25!

- Special Offer 3: Teachers receive a 60% discount on Morningstar Investor access.

- Top-flight fund research and analysis

- Portfolio management tool

- Powerful screener

- Watchlists

- Tailored news and commentary

- Below-average charting

- High monthly billing rate

Frequently Asked Questions (FAQs)

Do I have to buy the Vanguard Target Retirement Fund that most closely matches my age or retirement date?

Absolutely not. Age and time to retirement are important factors to consider when building an asset allocation, and Vanguard target-date funds are designed to make the process as easy and pain-free as possible. The idea is to make your portfolio appropriate for “a person your age.”

But age and time to retirement are by no means the only factors to consider. You might be more inclined to take risk than a typical person your age because you have other sources of income, expect to receive an inheritance or any number of other factors. You might be less inclined to take risk because you know you have major expenses, such as a wedding or educational expenses, on the horizon. And let’s not forget the market itself. If stocks are more attractively priced that bonds (or vice versa), you might feel it prudent to have a higher or lower allocation to stocks or bonds than your age alone would dictate.

Target-date funds are a fantastic tool, but you can absolutely tweak the way you use them.

Related: Best Vanguard Index Funds for Beginners

How often should I revisit my Vanguard Target Retirement Funds?

The main selling point of target-date funds is that you don’t have to actively manage them. They are designed to glide you towards an appropriate allocation as you age. That said, your personal situation can change over time, and that may mean that the specific Vanguard Target Retirement fund you’ve chosen is no longer the best fit. Perhaps you took retirement early, or decided to postpone it. Perhaps you recently experienced a major bear market and want to use the opportunity to buy a larger allocation to stocks on the cheap.

You should review your target-date funds after any major financial event in your life. But doing at least a casual review once a year is also a good idea. Chances are good that you won’t ultimately need to make changes. These things are designed to be buy-and-hold investments, after all. But doing an annual review forces you to take stock of your financial life and might help you to adjust your savings goals as you age.

Should I invest in Vanguard Target Retirement Funds in my IRA or in my taxable brokerage account?

Vanguard Target Retirement Funds are perfectly suitable for both individual retirement accounts (IRAs) and taxable brokerage accounts. Where you choose to hold yours may be affected by what other assets you own and how those assets are taxed. As a general rule, it makes sense to hold the least tax-efficient investments in a tax-deferred account like an IRA and the most tax-efficient holdings in a taxable account.

As an example, a stock or mutual fund you plan to buy and hold for years or even decades will generate minimal taxable gains, so holding it in a taxable account won’t hurt you (at least until you ultimately sell). But bonds tend to throw off a lot of taxable income, so holding them in an IRA will generally be preferable.

Target-date funds are generally pretty tax efficient, in that there is rarely a lot of short-term capital gains. So, you should do an inventory of your investments and rank them by tax efficiency to determine which ones you should put in your IRA first.

Related: