The concept of “buy low, sell high” is popular across a variety of industries. People who buy cheap houses, renovate them, and sell them for more are doing a version of buy low, sell high.

So are people who find collectibles for a few dollars at garage sales and sell them for hundreds on eBay.

This piece focuses on buying and selling stocks. Keep reading to learn how buying low and selling high works, the challenges, how you can try the strategy yourself and more.

What Does Buy Low, Sell High Mean?

Buy low, sell high is a strategy where an investor buys stocks or securities at what is believed to be a low price and then sells them later at a higher price.

Stock prices fluctuate for many reasons, such as stock news stories on apps and market-leading websites, world events, earnings reports, inflation, company scandals and changes in the stock’s industry.

Stock market players feed on this information and drive changes in stocks’ prices on a minute-by-minute basis. A stock price changes as there are shifts in supply and demand for it.

For example, if it comes out that a company is severely in debt, people may sell their shares in fear the company is about to go bankrupt. The lessened supply causes a drop in the stock price. There is a herd instinct that affects stock prices and as the price drops, more people may sell.

An investor who is confident the company won’t go under, but will instead flourish in the future, will wait until they think the stock has gone to, or near, rock bottom and then purchase shares. If the stock later rises, she will then sell when she thinks it’s at, or near, its peak.

Done correctly, this style of investing focuses on value and maximizes profits. Consider employing the investment research software to find these buying opportunities.

Does Buy Low, Sell High Work?

If done correctly, the buy low, sell high strategy works. Over time, the market follows a cycle where people are fearful and sell stocks, then “greedy” and buy stocks, then back to fearful again.

With the buy low, sell high strategy, investors try to do the opposite of the general public. When others are fearful, they buy at low prices. Then, when people start purchasing more stocks again, investors sell at higher prices.

Experienced investors read consumer sentiment surveys to determine where the market finds itself in the economic cycle. They also analyze moving averages with the stock charting apps that show price fluctuations over time.

Investors who use the buy low, sell high strategy either focus on growth stocks, value stocks, or a combination.

Growth stocks are fast-growing companies expected to continue rising at above-average rates. It’s the concept of getting in early at low prices before the price rockets when a company becomes more popular. These types of stocks are volatile, so investors sometimes go through several rounds of buying and selling as the price fluctuates.

Value stocks are ones trading under what investors believe to be their intrinsic value. The stock might be trading lower because of a pending lawsuit, a recession, industry changes, or any variety of reasons. Providing the company’s book value looks promising, investors will buy these stocks at the low price, confident it will become high again later.

While buying low and selling high may seem extremely simple, it’s tricky to determine the best times to buy and sell. A stock that recently became cheaper isn’t guaranteed to go back up again. It might decrease in value even further.

It’s clear which prices were high and low in retrospect, but it can be challenging to pinpoint in real-time. The best stock picking services take this into account when making their recommendations.

Why Is It Hard to Buy Low and Sell High?

It’s challenging to invest in a purely analytical way. Emotions have a way of affecting your decisions. It’s common to develop a fear of missing out (FOMO) when we see others profiting from an investment and we don’t want to “miss the boat” on profitable deals.

Case-in-point: the GameStop market mania of early 2021 when the price continued to climb day after day. Investors took cues from the now infamous r/WallStreetBets Reddit forum and piled into the stock.

After Robinhood and its alternatives closed off the ability to buy the stock, sentiment turned and the stock plummeted. Some investing apps for beginners to experts followed suit and have now come under scrutiny for their actions.

In general, many people end up investing when a stock is at or near its peak price. Then they hold it, hoping it will continue to rise. However, often it doesn’t increase anymore and stabilizes at a price lower investors than where investors bought.

It’s difficult to predict when the market is high or low enough. Some people sell at a loss and others keep holding in hopes the price goes high enough again to make them profitable.

In the meantime, the money tied up in that investment could be used to profit elsewhere, causing considerable consternation if you have investing FOMO.

How Do I Buy Cheap and Sell High?

Suppose you consider yourself an extremely experienced investor and know how to analyze the worth of an investment using stock analysis apps and tools.

In that case, you can determine what you think the intrinsic value of various stocks are and then simply buy them whenever they are below that value and sell them whenever they are higher.

If your stocks drop below the value you anticipated, and you don’t have an urgent need for those funds, you may want to hold onto those shares until they rebound up to at least original levels.

In general, choosing the best long-term investments for teenagers and young adults is safer than day trading or other short-term investments.

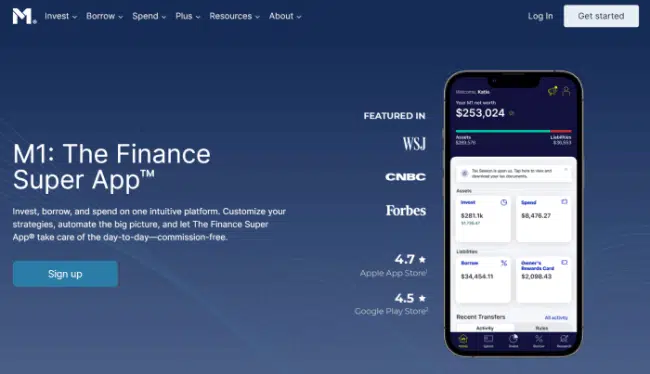

1. M1 Finance

- Available: Sign up here

- Price: $0 trades and no portfolio management fees

With any investment strategy, it’s always recommended to have a diversified portfolio. The free investment service, M1 Finance, is an excellent place to create your portfolio. The platform is known for its pie system that consists of different investment “slices.”

After the robo-advisor asks questions about your financial goals, it recommends a diversified portfolio. If you think they nailed it, you can keep it as it is. Any investment slices you disagree with, you’re welcome to replace with other stocks or securities.

These investments are meant to build long-term wealth and aren’t designed for people whose primary strategy is risky day trading. You simply take advantage of the customization and automation features and then let your investments rise.

M1 Finance doesn’t charge any commissions or management fees. It’s also possible to open a high-yield checking account with them.

When you sign up, they offer a free sign-up bonus for opening an account and making a minimum deposit. Further, you can roll over assets from other accounts to get a bigger bonus.

Read more about the app in our M1 Finance review.

- M1's Smart Money Management gives you choice and control of how you want to invest automatically, borrow, and spend your money—with available high-yield checking and low borrowing rates.

- Includes an FDIC-insured checking account and an M1 Visa debit card that delivers 1% cash back.

- Unlock perks including higher cash-back rewards on the M1 Owner's Rewards Credit Card, 4.25% APY from high-yield savings, ATM reimbursements, and 0% international fees.

- Invest in stocks, ETFs, and cryptocurrencies.

- Robo-advisor with self-directed investing capability

- Attractive cash-back and APY opportunities

- Doesn't support mutual funds

- Doesn't allow trading throughout the trading day

- Monthly fees for account balances <$10,000

2. Motley Fool – Stock Advisor Investment Research

- Available: Sign up here

- Price: Discounted first-year rate (see below)

If you’re looking to invest part of your portfolio outside of index funds (my preferred investing method), consider purchasing the stocks vetted by Motley Fool’s Stock Advisor service.

Stock Advisor is an online investment service that espouses my favorite, plain-vanilla trading style: buy-and-hold. Fool analysts provide recommendations for both “Steady Eddies” and potential high-flying stocks with sound fundamentals—an ideal combination of holdings if you want to generate strong performance without risking extremely high volatility.

The service has a strong track record of outperforming the market. And should that outperformance continue, a service like Stock Advisor could help you build generational wealth.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!

- Discounted introductory price

- Strong outperformance above S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Final Thoughts

Buy low, sell high is a simple concept to understand, but it can be challenging in practice. Even with thorough research conducted, public sentiment is hard to predict and pinpointing highs and lows is much easier in retrospect than ahead of time.

A diversified portfolio, such as the ones you can create with investing apps like M1 Finance with stock selections from a service like Motley Fool’s Stock Advisor, gives you your best shot at coming out ahead.

When you invest long-term, stock volatility is less of a concern as you can wait out the lows and later sell at the highs.

Think of stock highs and lows like a roller coaster. Don’t stress about getting stuck at a certain point. Instead, know you’re in it for the full cycle and enjoy the ride.