Table of Contents

Wine Investing: The Ideal Alternative Investment?

Buying expensive wines may be one of your favorite activities, but did you know it could make you money? As a tangible asset, wine has a low correlation with global equities and has less long-term market volatility than other investments. Because wine comes from specific regions in finite quantities, the supply does not fluctuate much. As people consume the wine, the supply diminishes and the demand increases. Simple Economics 101. As a result, this makes it an excellent alternative investment option. Plus, as a worst-case scenario, you can drink your wine! This may sound tempting to buy your own wine, store it in your basement, and hope for the best.

Fine Wine vs Stocks

However, if you really want to make a profit, benefits exist to using a company to build your wine investment portfolio, such as Vinovest. Fine wine dramatically outperformed several asset classes during the Great Recession and likely has during the COVID-19 bear market cycle. While history does not necessarily reflect the future, it can serve as a helpful predictor of how investments may perform during similar circumstances. With that, have a look at the following chart to understand the performance of fine wine vs. stocks over the two-year stretch predating and following the Great Recession. As you can plainly see, not only did stocks tumble across the world, but fine wine appeared to have no loss in value from the beginning of October 2007 to October 2009. In fact, returns resumed their ascent after the brief pause and continued to climb throughout the economic recovery.

Fine wine investing might have shown itself to be largely insulated from the market meltdown of the Great Recession, rewarding investors who held onto their wine investments.

Another interesting chart demonstrating fine wine’s investment grade performance can be seen below. This chart maps the correlation of fine wine’s performance against the S&P 500 index over a 20-year span.

In fact, returns resumed their ascent after the brief pause and continued to climb throughout the economic recovery.

Fine wine investing might have shown itself to be largely insulated from the market meltdown of the Great Recession, rewarding investors who held onto their wine investments.

Another interesting chart demonstrating fine wine’s investment grade performance can be seen below. This chart maps the correlation of fine wine’s performance against the S&P 500 index over a 20-year span.

Looking at the graph, the left x-axis shows the value of the S&P 500 while the right x-axis shows the correlation between fine wine performance and the closing S&p 500 value.

A value of 1 shows a direct correlation (i.e., when the S&P 500 advances 1%, so too does the value of fine wine), while -1 implies a reverse correlation (S&P 500 advances 1% and fine wine declines 1%).

As you can see, wine appears largely uncorrelated to the performance of the S&P 500. The values changing considerably over time indicates no statistical correlation between the two asset classes.

Over the two-decade stretch covered in the chart, fine wine served as a low-correlation investment to stocks. This shows investing outside of the stock market can help to diversify a broader investment portfolio and combat volatility seen in sharp stock market sell offs.

While certainly a different interpretation of the “liquid alts” Cliff Asness contemplates, perhaps fine wine meets this grade and acts as a truly uncorrelated asset to stocks? It’s clear to see the long-term potential for wine collecting for investment.

To learn more about one of the companies democratizing wine investing, consider reviewing Vinovest’s process and how the company sets itself apart in a world of countless alternative investment options.

Looking at the graph, the left x-axis shows the value of the S&P 500 while the right x-axis shows the correlation between fine wine performance and the closing S&p 500 value.

A value of 1 shows a direct correlation (i.e., when the S&P 500 advances 1%, so too does the value of fine wine), while -1 implies a reverse correlation (S&P 500 advances 1% and fine wine declines 1%).

As you can see, wine appears largely uncorrelated to the performance of the S&P 500. The values changing considerably over time indicates no statistical correlation between the two asset classes.

Over the two-decade stretch covered in the chart, fine wine served as a low-correlation investment to stocks. This shows investing outside of the stock market can help to diversify a broader investment portfolio and combat volatility seen in sharp stock market sell offs.

While certainly a different interpretation of the “liquid alts” Cliff Asness contemplates, perhaps fine wine meets this grade and acts as a truly uncorrelated asset to stocks? It’s clear to see the long-term potential for wine collecting for investment.

To learn more about one of the companies democratizing wine investing, consider reviewing Vinovest’s process and how the company sets itself apart in a world of countless alternative investment options.

- Vinovest allows you to invest in fine wine and whiskey—investments that aren't correlated with the stock or bond markets.

- Initial questionnaire helps Vinovest build and manage a wine portfolio based on your investment goals.

- Talk with a portfolio advisor to learn more about wine investing or improve your portfolio.

- Low investment minimums of $1,000 for wine and $300 for whiskey.

- Special offer #1: If you refer a friend to Vinovest, you and your friend will each enjoy three months of fee-free investing once your friend funds their account.

- Special offer #2: Receive 5% off all management fees if you enable auto-investing.

- Relatively low investment minimum

- Good liquidity

- Reasonable fees for high account balances

- Relatively high fees for low account balances

- Early liquidation fees might apply

- Prospective investors might miss some fee information; fee disclosures spread across multiple pages in FAQs

About Vinovest’s Process – Sommeliers

Before you open your Vinovest account, you might consider learning a bit more about the company and why their expertise separates them from other alternative investing opportunities.

In the world of wine, it’s easy to get lost in the numerous types, vintages, regions, histories, palettes and more. So many considerations weave into an evaluation of wine, that an inexperienced investor might not know where to begin.

In order to navigate your way through this rich industry, you need the help of an expert curator. In the wine market, that person goes by the title Master Sommelier.

Master Sommeliers assess the qualities of wine to global standards, and must meet rigorous preparation and examinations to earn their prestigious credentials. In simple terms, they act as wine experts.

To become a sommelier, you must undergo four stages of training. Though, like many designations, you have choices for which to pursue. In the wine community, the premier certifying organization is the Court of Master Sommeliers.

This group awarded their first Master designation in 1969 in the U.K. and later became the “premier international examining body,” counting fewer than 300 amongst its credentialed members. Roughly 170 of them reside within the American chapter.

This matters for your choice to invest through Vinovest because the wine advisory team on staff includes three sommeliers, two Masters and one Advanced. This group, dubbed the Vinovest Advisory Council, oversees the selection of wines that go into your investment portfolio.

Having these Sommeliers on staff shows a commitment to quality investments in your portfolio and a true passion for the wine industry.

Before you open your Vinovest account, you might consider learning a bit more about the company and why their expertise separates them from other alternative investing opportunities.

In the world of wine, it’s easy to get lost in the numerous types, vintages, regions, histories, palettes and more. So many considerations weave into an evaluation of wine, that an inexperienced investor might not know where to begin.

In order to navigate your way through this rich industry, you need the help of an expert curator. In the wine market, that person goes by the title Master Sommelier.

Master Sommeliers assess the qualities of wine to global standards, and must meet rigorous preparation and examinations to earn their prestigious credentials. In simple terms, they act as wine experts.

To become a sommelier, you must undergo four stages of training. Though, like many designations, you have choices for which to pursue. In the wine community, the premier certifying organization is the Court of Master Sommeliers.

This group awarded their first Master designation in 1969 in the U.K. and later became the “premier international examining body,” counting fewer than 300 amongst its credentialed members. Roughly 170 of them reside within the American chapter.

This matters for your choice to invest through Vinovest because the wine advisory team on staff includes three sommeliers, two Masters and one Advanced. This group, dubbed the Vinovest Advisory Council, oversees the selection of wines that go into your investment portfolio.

Having these Sommeliers on staff shows a commitment to quality investments in your portfolio and a true passion for the wine industry.

Fine Wine as an Investment Class

Until recently, wine did not qualify as a type of investment vehicle in the traditional sense, mainly because of its inaccessibility from most retail investors. The most common asset classes include investments like stocks, bonds and real estate.

Often, these asset classes make up the majority of investors’ portfolios, though a diversified portfolio will work to your benefit in the long-run. This means considering alternative investments which do not correlate with these major asset classes directly.

Several alternative investment options include things like private equity, hedge funds, artwork, commercial real estate, commodities, and other exotic investments.

Typically, these alternatives only come available to accredited investors, a type of investor in which the SEC recently updated how to become one.

Under the new rules, individuals no longer need only to meet specific income or net worth tests. Instead, they can demonstrate they have the knowledge and expertise to participate in sophisticated investments.

Investors may now qualify as an accredited investor based on defined measures of professional knowledge, experience or certifications in addition to existing tests for income or net worth.

Many investment companies in recent years have sought to provide alternative investments to non-accredited investors.

Companies like Vinovest, FundRise and MasterWorks have seized on this trend and developed investment opportunities targeted toward smaller investors.

Vinovest has spearheaded the retail investment in wine through its opportunities for both non-accredited and accredited investors, alike, to invest in fine wine as an investment class.

Until recently, wine did not qualify as a type of investment vehicle in the traditional sense, mainly because of its inaccessibility from most retail investors. The most common asset classes include investments like stocks, bonds and real estate.

Often, these asset classes make up the majority of investors’ portfolios, though a diversified portfolio will work to your benefit in the long-run. This means considering alternative investments which do not correlate with these major asset classes directly.

Several alternative investment options include things like private equity, hedge funds, artwork, commercial real estate, commodities, and other exotic investments.

Typically, these alternatives only come available to accredited investors, a type of investor in which the SEC recently updated how to become one.

Under the new rules, individuals no longer need only to meet specific income or net worth tests. Instead, they can demonstrate they have the knowledge and expertise to participate in sophisticated investments.

Investors may now qualify as an accredited investor based on defined measures of professional knowledge, experience or certifications in addition to existing tests for income or net worth.

Many investment companies in recent years have sought to provide alternative investments to non-accredited investors.

Companies like Vinovest, FundRise and MasterWorks have seized on this trend and developed investment opportunities targeted toward smaller investors.

Vinovest has spearheaded the retail investment in wine through its opportunities for both non-accredited and accredited investors, alike, to invest in fine wine as an investment class.

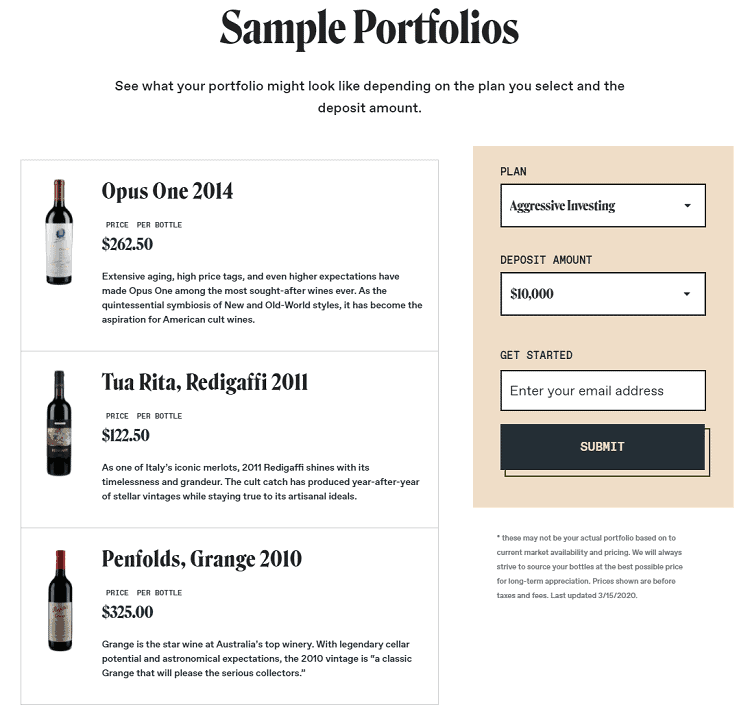

Vinovest’s Portfolios

As stated above, all types of investors, accredited and non-accredited, may invest in Vinovest. You’ll need $1,000 to open your account, allowing you to invest in a truly liquid asset.

When you open your account and make an initial deposit, Vinovest provides three primary portfolios for your investment.

What should be noted ahead of time, however, is that Vinovest does not securitize the wine, meaning you own the bottle in your portfolio and not some share which represents ownership interests.

Stated simply: you own the bottle or case of wine as a hard asset. This exempts investors from falling under applicable securities laws, meaning anyone can buy through the Vinovest platform.

This allows accredited investors and non-accredited investors alike to participate in fine wine investing on Vinovest.

The three fine wine investment plans include conservative, balanced, or aggressive. When you open your account, Vinovest asks you a series of questions to gauge your risk profile. It will recommend a portfolio based on these answers.

To read brief descriptions of these portfolios, consider the list below:

As stated above, all types of investors, accredited and non-accredited, may invest in Vinovest. You’ll need $1,000 to open your account, allowing you to invest in a truly liquid asset.

When you open your account and make an initial deposit, Vinovest provides three primary portfolios for your investment.

What should be noted ahead of time, however, is that Vinovest does not securitize the wine, meaning you own the bottle in your portfolio and not some share which represents ownership interests.

Stated simply: you own the bottle or case of wine as a hard asset. This exempts investors from falling under applicable securities laws, meaning anyone can buy through the Vinovest platform.

This allows accredited investors and non-accredited investors alike to participate in fine wine investing on Vinovest.

The three fine wine investment plans include conservative, balanced, or aggressive. When you open your account, Vinovest asks you a series of questions to gauge your risk profile. It will recommend a portfolio based on these answers.

To read brief descriptions of these portfolios, consider the list below:

- Conservative Portfolio. These wines only come from established wineries in mature wine markets. These wines seek to provide portfolio stability and remain largely insulated from swings seen in more aggressive wine investments from lesser known wineries and markets.

- Balanced Portfolio. These wines come from more-established wineries. They have shown consistent pricing historically and come from mature wine markets.

- Aggressive Portfolio. Wines in this portfolio come from wineries in emerging wine markets from around the world. These wines have averaged returns above those of conservative and balanced portfolio wines.

Wine Storage and Insurance

When you open an investing account with Vinovest, this will have you deposit money and authorize Vinovest to create a personalized portfolio of wine based on the risk preferences shared during your sign-up. The wines selected will also depend on the amount you have deposited. When you purchase wine investments through Vinovest, you buy actual wine, not ownership or interests in wine. Therefore, Vinovest agrees to store your wine in their secure facilities. As a note, this wine belongs to you and not Vinovest; ownership of the wine legally passes to you and does not become an asset of Vinovest. In exchange for a management fee, discussed below, Vinovest stores the in optimal conditions on your behalf and purchases insurance on this wine, protecting it at full current market value. To right-size this insurance coverage, Vinovest undergoes annual appraisals of the wine held on your behalf. When you purchase wine through Vinovest, they store your wine in a state-of-the-art facility which provides optimal storage conditions, including temperature, humidity, and security around-the-clock. Storing your wine in these conditions provides an opportunity for your wine to age optimally, improve in quality and taste, as well as provide the best opportunity to earn a return on your investment. Vinovest stores your wine in facilities around the world, close to the primary sourcing wineries. Vinovest maintains operations in places like Switzerland, France, the U.K and other trade hot spots. Vinovest chooses storage facilities which avoid paying VAT taxes or other excise taxes levied when buying and selling wine. Further, Vinovest only uses bonded storage facilities which offer the ability to purchase full insurance coverage on the replacement value of your wine.

Does Vinovest Charge Fees?

Simply put: yes. Vinovest must charge fees to fund their operations, including sourcing, storing, insuring, selling and transporting your wine. They do so by assessing a 2.85% annual assets under management fee which covers all included services for optimizing your investment. Should you wish to invest in wine on your own, you can expect to encounter significantly higher costs as a percentage of your investment. Costs related to building optimal storage conditions, sourcing, insuring and selling your wine would outnumber any returns you might expect to receive absent making a significant investment to scale these costs in line with your investment. Vinovest can offer its services at this low cost on account of the streamlined investment process and expertise in investing in fine wine. Compared to some other popular alternative investments (e.g., hedge funds), Vinovest’s 2.85% fee appears like a bargain. For those who wish to invest $50,000 or more, these fees come down to 2.5%. The service collects their fee by using any uninvested funds held in your account and does not require a separate payment. This cash will go toward paying Vinovest’s management fees. If there are amounts left after the payment of your management fees, you can leave such an amount in your account or ask for it to be returned to you.

Can I Drink My Wine?

Yes, you may drink the wine you purchase through Vinovest. You may submit a request through their platform to have any of your bottles shipped to the address of your choosing. This will cost you a shipping charge, however. One benefit to using Vinovest to purchase and drink your wine comes from their ability to leverage their scale to get fine wines at below-retail rates. This means, if you want to get fine wines for lower cost, Vinovest will happily use its buying clout to get you a better price than you might get on your own.

What Types of Returns Can I Expect?

According to Zhang, Vinovest’s CEO, wine has outperformed most major market indices in the past 35 years.

“Fine wine has provided year on year returns of 11.6% on average since the mid-80s, and most recently 13.6% gains over the past 15 years, meaning that it actually outperformed the S&P 500.

It has also shown less price fluctuation than traditional alternative assets like gold and real estate.”

Further, despite overall outperformance, wine has shown itself as a far less volatile investment. Zhang notes, “The advantage to investors is that these assets won’t rise and fall with the traditional markets. They may offer a more stable return.

“For one thing, you won’t see prices quoted daily, weekly, or even monthly. In volatile markets, that’s a good thing. Fine wine has less long term volatility.

“The team at Vinovest measured their portfolios’ correlation in the last two market downturns. They found it to be negative, meaning it provided good diversification.” [Emphasis added].

As with all investments, fine wine carries unique investing risks. You should consider these risks as well as other garden-variety risks tied to investing before proceeding with an account opening.

Further, past performance is not necessarily an indicator of future results.

According to Zhang, Vinovest’s CEO, wine has outperformed most major market indices in the past 35 years.

“Fine wine has provided year on year returns of 11.6% on average since the mid-80s, and most recently 13.6% gains over the past 15 years, meaning that it actually outperformed the S&P 500.

It has also shown less price fluctuation than traditional alternative assets like gold and real estate.”

Further, despite overall outperformance, wine has shown itself as a far less volatile investment. Zhang notes, “The advantage to investors is that these assets won’t rise and fall with the traditional markets. They may offer a more stable return.

“For one thing, you won’t see prices quoted daily, weekly, or even monthly. In volatile markets, that’s a good thing. Fine wine has less long term volatility.

“The team at Vinovest measured their portfolios’ correlation in the last two market downturns. They found it to be negative, meaning it provided good diversification.” [Emphasis added].

As with all investments, fine wine carries unique investing risks. You should consider these risks as well as other garden-variety risks tied to investing before proceeding with an account opening.

Further, past performance is not necessarily an indicator of future results.

Do I Pay Taxes on My Wines?

Buying and selling wine acts like any other investment class in the United States. Therefore, any loss or gain you experience qualifies for standard capital loss and gains treatment.

If you sell more than $20,000 of wine in one calendar year, Vinovest will issue you a 1099. For all sales less than this amount, you must self-report your gains/losses.

Generally, no matter the type of investment account, any gains or losses recognized on the sale of assets will constitute a taxable event.

Buying and selling wine acts like any other investment class in the United States. Therefore, any loss or gain you experience qualifies for standard capital loss and gains treatment.

If you sell more than $20,000 of wine in one calendar year, Vinovest will issue you a 1099. For all sales less than this amount, you must self-report your gains/losses.

Generally, no matter the type of investment account, any gains or losses recognized on the sale of assets will constitute a taxable event.

Can I Make Regular Deposits?

If you operate like me, you often want to make automated deposits each pay period and have the investment service handle the purchases you pre-select. This removes the emotion out of buying and allows your assets to grow with time. Vinovest allows you to make automatic deposits into your account and even offers a 5% discount on all management fees so long as you have “Auto Invest” active on a monthly cadence. This will help to place your active or passive income into assets that appreciate in value.

Can I Invest in More Than Just Wine?

If you prefer a spirit with a little more bite, Vinovest now allows users to invest in whiskey. You can buy entire casks of American Whiskey from the likes of Whistle Pig and Breckenridge, or Scotch from Macallan, Highland Park, and more. You’ll receive a sample bottle from your cask every year, and if you decide it’s too good to sell, they’ll bottle the rest for you. Just note that Vinovest’s whiskey investing currently only offers managed accounts, with similar terms and fees as Vinovest’s wine-based managed accounts. Whiskey investing has an even lower minimum to start, at just $300 within the Vinovest platform.

4 Steps Used by Vinovest to Review Wine Investments

Vinovest handles the logistical and selection aspects of your fine wine investing. This leaves you to serve as the investor, choosing which portfolio best suits your investing goals.

Vinovest reviews and certifies the authenticity of your wine, stores it in optimal conditions, and ships it to buyers’ locations when it sells.

From signing up to selling, the process only takes four easy steps to turn a hobby like wine drinking into wine collecting for investment a serious business.

Vinovest handles the logistical and selection aspects of your fine wine investing. This leaves you to serve as the investor, choosing which portfolio best suits your investing goals.

Vinovest reviews and certifies the authenticity of your wine, stores it in optimal conditions, and ships it to buyers’ locations when it sells.

From signing up to selling, the process only takes four easy steps to turn a hobby like wine drinking into wine collecting for investment a serious business.

Step 1: Sign Up and Take a Questionnaire

Vinovest does not require you to be a master sommelier to sign up. You simply enter your information and take a short quiz designed to pick the best bottles of wine for you based on your risk tolerance and investment horizon. The master sommeliers help to pick investment grade wine which has a higher likelihood to appreciate in value over time.Step 2: See Your Wine Investment Portfolio

Their algorithm will create your customized portfolio based on their wine investment advice and show which wines they will invest in for you. They make an effort to choose the best wine to invest available in 2020 onward. You can learn more about each bottle and its origin by clicking into the wine.Step 3: Fund Your Account, Vinovest Authenticates Your Wine

Once you fund your Vinovest account ($1,000 minimum), Vinovest reviews, authenticates and stores your wine in a facility that keeps ideal temperature and humidity conditions around the clock. Vinovest also insures your wine at full replacement value.Step 4: Track and Manage Your Wine

Log into your Vinovest account at any time to check your portfolio and the selected wine investment fund to see how it performs. You can request photos of your wine or even see it in person if you are in the area. You can sell a portion, or your full portfolio, whenever you wish. Vinovest will help to find a buyer and deliver your wine to the buyer’s location. The entire process usually lasts four to six weeks. The minimum balance for Vinovest is $1,000 and you pay a 2.85% annual fee to cover labor, storage, authenticity guarantee, portfolio rebalancing, and insurance. You can lower your annual fee to 2.5%, as well as get one-on-one expert guidance and extra rare wines, if your minimum balance is $50,000 or greater. Consider the long-term potential growth in value of this investment and look more into the investment potential. You might find the lack of volatility and consistent returns as reasons for why fine wine investing might be one of the best investments for young adults.- Vinovest allows you to invest in fine wine and whiskey—investments that aren't correlated with the stock or bond markets.

- Initial questionnaire helps Vinovest build and manage a wine portfolio based on your investment goals.

- Talk with a portfolio advisor to learn more about wine investing or improve your portfolio.

- Low investment minimums of $1,000 for wine and $300 for whiskey.

- Special offer #1: If you refer a friend to Vinovest, you and your friend will each enjoy three months of fee-free investing once your friend funds their account.

- Special offer #2: Receive 5% off all management fees if you enable auto-investing.

- Relatively low investment minimum

- Good liquidity

- Reasonable fees for high account balances

- Relatively high fees for low account balances

- Early liquidation fees might apply

- Prospective investors might miss some fee information; fee disclosures spread across multiple pages in FAQs

Why I Will Continue Using Vinovest to Diversify My Portfolio

After exploring Vinovest’s service, I feel confident the platform can offer superior, risk-adjusted returns compared to other investment options. While the account will not be as safe as a certificate of deposit (CD) or high-yield savings account, it should provide more attractive returns over longer periods of time. At the moment, I have a significant amount of cash held in savings accounts, bonds, or other low-risk investments to preserve liquidity in the event my wife and I choose to purchase a house this year or next. Even with that, I plan to continue investing on Vinovest’s platform going forward. The added long-term portfolio diversification and acceptable risk profile appear attractive for holding a portion of my overall portfolio. Traditionally, my alternative investments remained relegated to the LendingClub platform due to its powerful income-generating assets. I found the cash flow useful for diversifying my portfolio and consistent during times of stock market volatility. In recent years, however, I found the large time commitment that came from filtering, researching and capturing alpha proved overly cumbersome. While Vinovest will never represent the majority of my overall investment portfolio, nor should it, I do think it will serve as a useful alternative investment option. With time, as the platform matures and the company brings more investors and wines into the investing fold, we will have a greater sense for the true risks and returns involved. If what you read in this review sounds interesting, consider opening an account with Vinovest and making your initial $1,000 deposit. Learn more as you go and decide for yourself if this alternative investment platform makes sense for your portfolio.

- Vinovest allows you to invest in fine wine and whiskey—investments that aren't correlated with the stock or bond markets.

- Initial questionnaire helps Vinovest build and manage a wine portfolio based on your investment goals.

- Talk with a portfolio advisor to learn more about wine investing or improve your portfolio.

- Low investment minimums of $1,000 for wine and $300 for whiskey.

- Special offer #1: If you refer a friend to Vinovest, you and your friend will each enjoy three months of fee-free investing once your friend funds their account.

- Special offer #2: Receive 5% off all management fees if you enable auto-investing.

- Relatively low investment minimum

- Good liquidity

- Reasonable fees for high account balances

- Relatively high fees for low account balances

- Early liquidation fees might apply

- Prospective investors might miss some fee information; fee disclosures spread across multiple pages in FAQs

![9 Best Non-Stock Investments [Alternatives to the Stock Market] 24 best non-stock investments](https://youngandtheinvested.com/wp-content/uploads/best-non-stock-investments.jpg.webp)