The stock market can be tricky. You can’t rely on your gut alone to choose the best stocks. Instead, most investment professionals use fundamental analysis to determine which stocks are “on sale” and likely to rise in value.

However, rather than scouring the internet for a company’s financial information, doing hours of calculations, and comparing those numbers to its industry peers, it’s easier to use stock analysis tools.

Below you’ll learn the top metrics that fundamental analysts use, today’s best tools that will conduct fundamental analysis for you, and more.

Best Fundamental Analysis Tools—Top Picks

|

4.8

|

4.6

|

4.6

|

|

Premium: 7-day free trial, then $239/yr. ($60 discount)* Pro: $1,920/yr. ($480 discount)**

|

Free Stock w/Deposit ($105 value)

|

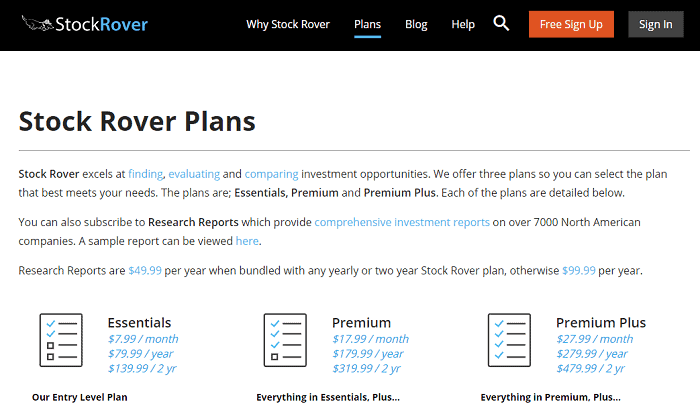

Essentials: $7.99/mo. / $54.99/yr; Premium: $17.99/mo / $124.99/yr; Premium Plus: $27.99/mo / $194.99/yr

|

Best Tools for Conducting Fundamental Analysis

1. Seeking Alpha Premium & Pro

- Available: Sign up for Premium | Sign up for Pro

Seeking Alpha has an abundance of tools that conduct fundamental analysis for you.

One example is “Fundamental Charting.” An algorithm analyzes a company’s fundamental factors from the income statement, balance sheet, and cash flow statements to determine a “Main Street” price per share. It then compares the “Main Street” price to the actual price and creates a chart showing you whether the stock is oversold (bargain), overbought (might want to sell), or if it may be best to hold.

Seeking Alpha also has a wide selection of stock screeners, including “Top Yield Monsters,” “Top Value Stocks,” and “Top Stocks by Quant.”

Seeking Alpha’s Premium and Pro products work for intermediate investors who mainly want to be told the best stocks, as well as advanced investors who want to thoroughly analyze stock market data themselves.

Check out our review, or use our exclusive links to sign up for Seeking Alpha Premium or Seeking Alpha Pro, and you can enjoy any free trials and/or discounts listed below.

- Seeking Alpha Premium and Pro help you find profitable investing ideas, improve your portfolio, research stocks better and faster, track the news to find investing opportunities, and connects you to the world's largest investing community.

- A Premium subscription provides access to Seeking Alpha's stock and ETF ratings, including Seeking Alpha Quant Strong Buy recommendations, which have greatly outperformed the stock market over time.

- Premium also gives you access to Seeking Alpha's portfolio health check, which will analyze your portfolio's quality, risk level, and performance.

- Advanced and professional investors can sign up for Pro, where they'll get everything from Premium, as well as instant access to ideas from SA's top 15 analysts, the PRO Quant Portfolio (for active traders), short-selling ideas, and more.

- Black Friday deal on Premium: New subscribers through our link receive a $60 discount off the price of Seeking Alpha Premium in their first year.*

- Black Friday deal on Pro: New subscribers through our link receive a $480 discount off the price of Seeking Alpha Pro in their first year.**

- Active community of engaged investors and analysts

- Stock screeners, quantitative tools for stock analysis

- Strong track record of market outperformance on stock ratings

- Minimal mutual fund coverage

Related: 7 Best Seeking Alpha Alternatives [Competitors’ Sites to Use]

2. Moomoo

- Available: Sign up here

Moomoo lets you screen stocks not just on U.S. exchanges, but also those on the Hong Kong and China’s Shanghai and Shenzhen exchanges as well. That makes Moomoo an excellent choice for people who want more foreign stocks than the average investor.

The app lets you see the gain & loss of major indices, the average gain & loss across market sectors, and the distribution of advancers & decliners.

A variety of filters let you see which stocks have been moving the most. Many are geared toward technical analysis, but there are helpful fundamental analysis filters as well.

Moomoo has a news feed to keep you up-to-date on stocks, as well as a social network where you can follow other users and write your own updates. There are also discussion groups about numerous investing topics.

The best part about Moomoo? It’s free and comes with free stocks for signing up!

- Moomoo is an all-in-one investment app geared toward stock, ETF, and options traders who want to work with real-time market data at the ready.

- The service offers free Level 2 market data, offering more insight into the trading activity below the NBBO surface shown on many financial data sites.

- Use the service's powerful stock charting software capabilities to find trading opportunities.

- Get a great return on uninvested cash: Moomoo currently offers a 4.1% APY from its cash sweep program, though current promo offers 8.1% for a limited time.

- Special offer: New users get up to $1,000 in free NVDA stock when they sign up using our link and make a qualifying deposit,* as well as a three-month APY boost (to a total 8.1% APY on uninvested cash).

- Additional special offer for transfers: New customers who transfer assets into a Moomoo account can also receive a 3% match on their transfer up to $20,000 (for a reward cap of $600). New users who transfer in $50,000 or more and maintain for three days will also receive two suite tickets to a New York Mets game.

- Free Level 2 market data

- Free powerful stock charting software

- Free paper trading

- Low margin rates

- Fewer features than peers

- No robo-advisor functionality

Related: 11 Best Commission-Free Stock Trading Apps & Platforms

3. Stock Rover

- Available: Sign up here

Stock Rover’s screeners and watchlists make it easy to conduct fundamental analysis. It has more than 140 pre-built screeners and 500-plus screenable metrics to help you get started.

Premium and Premium Plus members can weight criteria, screen historical data, and make equations using past and present data alike. Stocks are ranked, and your top choices appear on top.

Do you like a stock screen but wish it were a bit different? Stock Rover lets members modify existing screens or even create custom screens from scratch; a customization that allows investors to develop highly specific filters.

- Stock Rover is a complete service for investors looking to use screeners, investment comparisons, real-time research reports, model portfolios, charts and more.

- Use this top-rated investment analytics service to identify stocks worth buying and outperforming the market.

- Create an account for free, and you can start a 14-day Premium trial subscription with no credit card needed.

- Hundreds of screening metrics

- Proprietary scoring systems

- Real-time executive summary research reports

- No mobile app

- No crypto or forex data

- US markets only

Related: Best Stock Trading Software Platforms for Beginners

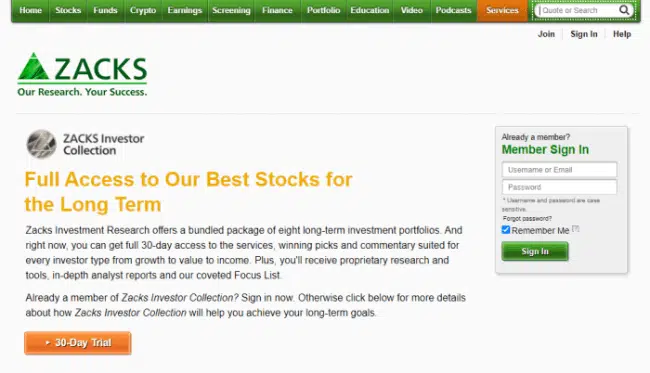

4. Zacks Premium

- Available: Sign up here

Zacks Investment Research is well-known for its Bull/Bear of the Day stock picks. However, while Zacks has an abundance of free resources on the website, you’ll need to sign up for Zacks Premium to use the powerful research tools.

One of Zacks Premium’s top benefits is access to more than 45 premium screens designed to help you beat the market. A few fundamental analysis screen examples include PEG, Return on Equity, and Highly Ranked Undervalued Stocks.

In addition to premium screens, members get access to Zacks #1 Rank List, the Earnings Expected Surprise Prediction (ESP Filter), Industry Rank List, research reports, and more. The ESP filter, unique to Zacks Investment Research, shows stocks that have high probabilities of beating their quarterly earnings estimates.

- Zacks Investment Research offers several research products to provide the information subscribers want to know about market opportunities

- Features include: Zacks #1 Rank List, Industry Rank List, Premium Screens, Focus List, Research Reports, Earnings ESP Filter, Zacks #5 Rank List

Related: Zacks vs Motley Fool: Which Stock Picking Service Is Better?

5. Benzinga Pro

- Available: Sign up here

Benzinga Pro offers up-to-date stock market news and data, as well as other features, including:

- Movers (up-to-the-minute feed of the biggest gainers and losers in the stock market

- Screeners (to scan stocks in line with your fundamental analysis strategy)

- Signals (tells about price spikes, block trades, etc.)

- A community chat

- And more

The service claims they have “the only stock screener you need.” Benzinga Pro’s screener lets you search and filter stocks by any attribute.

- Benzinga Pro is built for traders and investors to receive actionable market news and research in real time.

- Get exclusive news about earnings, mergers and acquisitions, drug trials, and more.

- Enjoy tools like Benzinga's real-time stock scanner, signals (which includes alerts for events such as price spikes and block trades), and calendar (with dates for events such as earnings reports, dividends, and IPOs), and more.

- Enjoy the experience of professional day traders, who share their real trades throughout each trading session.

Related: 12 Stocks for Kids: Kid-Friendly Stocks to Begin Investing

6. MetaStock

- Available: Sign up here

MetaStock has provided investors with stock charts and analysis tools for more than 30 years. While they focus primarily on technical analysis, they have some useful tools for fundamental analysis as well.

The software’s Fundamental Analyzer has five tabs:

- Fundamental Tab: Lets you quickly see information on a stock, such as the industry sector, market cap, earnings per share, annual dividend, dividend yield, and more.

- Revenue Tab: Displays the quarterly and annual net income compared to revenue. It shows information from the last eight quarters or four years.

- Performance Tab: Provides information about annual earnings per share, annual dividends, annual growth rate, and more.

- Estimates Tab: Shows EPS quarterly estimates, total revenue quarterly estimates, EPS annual estimates, and total revenue annual estimates.

- Scanner Tab: Allows investors to search for companies based on their chosen criteria. Stocks can be sorted by average volume, closing price, annual dividend, EPS, P/E ratio, and much more.

All of MetaStock’s tools are customizable and extremely powerful once you have mastered them. (Note: MetaStock’s software is only compatible with Windows.)

Related: 15 Best Stock Market Investing Research & Analysis Sites

7. Morningstar

- Available: Sign up here

Morningstar Investor is a rich platform of investment research tools designed for the buy-and-hold crowd, and it plugs investors into one of the world’s foremost sources for mutual fund and ETF data and analysis.

Morningstar offers a healthy screen for stocks, which allows you to sort equities by size, sector, industry, and various valuation, financial, and other fundamental metrics. But where it shines is funds, offering one of the best screening services for mutual funds, exchange-traded funds, and closed-end funds (CEFs) alike. You can look for funds by asset class, Morningstar Category, share-class type, assets under management, fees, and more. You can also look for funds based on Morningstar’s proprietary ratings.

Morningstar’s ratings are among the service’s most revered features. The original Star Rating—which measures a fund’s risk-adjusted past returns—has been around since 1985 and helped steer countless investors toward cheaper, better-constructed mutual funds and ETFs. But Morningstar doesn’t just look to the past. Its forward-looking Medalist Ratings use traits such as a fund’s parent organization, the managers responsible for making decisions, and fund strategies to determine a fund’s ability to outperform over the long term. You must be a Morningstar Investor subscriber to access Medalist Ratings.

Morningstar also provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

Stock owners shouldn’t feel left out—Morningstar also provides everything you need for stock research, including equity data, corporate financials, analysis, and even Star Ratings of publicly traded companies.

With Morningstar Investor, you can also:

- Seamlessly and securely link your external accounts to get a holistic view of your assets from one simple dashboard

- Use Morningstar Portfolio X-Ray®, which evaluates what you hold from numerous angles—asset allocation, stock sector, valuation, fees, and more—and can identify any overlaps between accounts that might impact just how diversified you are (or aren’t!)

- Set up stock and fund watchlists

- Enjoy stock news and commentary that’s tailored to your holdings

- Follow Morningstar authors so you can check out their latest articles, videos, and podcasts as soon as they’re posted

Not sure if Morningstar Investor is right for you? Try it out with a free seven-day trial. You can check out the current deal, as well as discounted rates for students and teachers, in our details box below.

- Morningstar Investor offers expert research, investing analysis, and advisor-grade portfolio management tools that are tailor-made for buy-and-hold investors.

- Morningstar is one of the most prized sources of mutual fund and exchange-traded fund (ETF) data in the world.

- How does your portfolio stack up? Put it through Morningstar's Portfolio X-Ray, which will provide insights such as whether you have too many overlapping holdings or whether you're paying too much in fees.

- Special Offer 1: Click our sign-up link to receive $50 off your first year of Morningstar Investor. (Annual plan only.)

- Special Offer 2: Students receive one year of Morningstar Investor access for just $25!

- Special Offer 3: Teachers receive a 60% discount on Morningstar Investor access.

- Top-flight fund research and analysis

- Portfolio management tool

- Powerful screener

- Watchlists

- Tailored news and commentary

- Below-average charting

- High monthly billing rate

Related: 15 Best Stock Research & Analysis Apps, Tools and Sites

What Is Fundamental Analysis?

Fundamental analysis focuses on finding the intrinsic value, or fair market value, of a stock. Once an investor determines what they believe to be a stock’s intrinsic value, they can compare it to the actual current stock price to determine whether shares are undervalued or overvalued.

Fundamental analysts, then, typically are also value investors.

You’ll also find that fundamental analysis is frequently contrasted with the technical analysis investment strategy. Technical analysis assumes a company’s stock price is determined by price trends and patterns on stock charts. Fundamental analysis typically focuses on long-term investments, while technical analysis is often used for intraday and other short-term stock trades.

Why Do Investors Use Fundamental Analysis?

Fundamental analysis can help investors find undervalued stocks to buy. These under-appreciated stocks are often wise long-term investments because they can appreciate not just from growth in the company, but also from “catching up” to their intrinsic value.

Remember: A company’s share price might currently be in a bear market or on a bull run, but that doesn’t mean it’ll stay that way over the long term.

It’s also a solid strategy for comparing a company to its peers. It’s essential not to analyze stocks in a bubble, but to compare them to other investments—usually competitors in the same industry.

What Are Popular Fundamental Analysis Tools That Value Investors Use?

Numerous “metrics”—various forms of measuring stock qualities—should play a part in your decision making. No single metric will ever give you a complete picture of a stock.

Here are a few metrics that are popular in fundamental analysis:

Price-to-earnings (P/E) ratio

Price-to-earnings (P/E) ratios can help you determine how much companies are worth and how willing people are to buy their stock.

To find a stock’s P/E ratio, you divide the stock price by a company’s earnings per share (EPS).

Undervalued stocks often have low P/E ratios compared to their peers. Stocks with high P/E ratios might be overvalued. But like we said, one metric doesn’t tell the whole story.

Price/earnings-to-growth (PEG) ratio

Price/earnings-to-growth (PEG) ratios are useful in figuring out how a stock’s current price compares to its intrinsic value.

To calculate a company’s PEG ratio, take its P/E ratio and divide it by the expected growth rate percentage. So, let’s say a stock has a P/E ratio of 14 and the expected growth rate is 10%. The calculation for the PEG ratio would be (14 / 10), or 1.4.

PEG is based around 1.0. A PEG ratio over 1.0 signals that a stock might be overvalued, whereas a ratio under 1.0 indicates it might be undervalued.

Price/earnings-to-growth is a great tool for comparing stocks of any type, because it factors in growth. Measured by PEG, a high-growth stock with a moderate P/E might be considered a much better value than a low-growth stock with a low P/E.

The one downside: It’s based on expected growth rates, which are merely estimates from analysts. There is no guarantee the company will grow at the rate the pros expect.

Price-to-sales (P/S) ratio

Price-to-sales (P/S) ratios compare companies’ stock prices to their sales, aka revenues.

To find a company’s P/S ratio, divide its total market capitalization—the share price multiplied by the number of outstanding shares—by its trailing 12-month revenue. (Or, divide the share price by the revenue-per-share figure, if you have it.)

Like with P/E, low P/S ratios are considered a sign of a potential value. While a ratio of 1.0 or lower is generally a sign that a stock is undervalued and worth buying, again, you want to compare one stock’s P/S to other similar stocks.

Keep in mind that a company’s P/S ratio has nothing to do with whether a company’s business model is actually profitable—just how much money it rakes in. However, that makes this a fitting valuation ratio for younger growth stocks that have yet to become profitable.

Price-to-book (P/B) ratio

Price-to-book (P/B) ratios compare companies’ market capitalization to their book values. To find a stock’s P/B ratio, divide the stock price by its book value per share (BVPS).

Book value refers to an asset’s carrying value on a balance sheet. It’s the tangible net asset value of a business, which you get by simply subtracting intangible assets (patents, liabilities, etc.) from total assets.

Any P/B value below 1.0 indicates a stock is worth less than its tangible assets, and thus it might be undervalued. Some fundamental analysts will consider any stock with a P/B under 3.0. A stock’s P/B ratio is frequently looked at in conjunction with its return on equity (RoE).

Return on equity (RoE)

Some investors consider RoE one of the most essential fundamental analysis factors when evaluating a stock.

RoE measures how much profit a company has earned compared to its equity. Effectively, it helps you determine just how well a company handles money from shareholders.

To calculate RoE, take a company’s net income and divide it by average shareholder equity. You want this number as high as possible compared to same-size companies in the same industry.

A return on equity of at least 15% to 20% is considered good value. When a company improves its ROE over time, that’s a sign it’s becoming more efficient.

Enterprise value (EV)-to-revenue

Enterprise value (EV), also known as total enterprise value, is a company’s entire value. It includes the business’s market capitalization, cash on the balance sheet, and any debt.

EV is especially important as it pertains to mergers and acquisitions, as an acquiring company would need to factor in not just how much the company’s operations are worth, but how much cash it holds and how much additional debt it would have to pay off.

To calculate EV, add the market capitalization, debt, and preferred stock. Then, subtract cash.

Value investors often look for businesses with ample cash and cash flow compared to EV. But keep in mind that debt isn’t always considered bad.

EV-to-revenue (EV/R) compares a company’s enterprise value to its sales. Typically, 1.0 to 3.0 is a good EV/R multiple, but higher multiples are expected in some industries.

EV-to-EBITDA

EBITDA stands for earnings before interest, taxes, depreciation, and amortization. To find a company’s EBITDA, find the sum of its net income, interest, taxes, depreciation, and amortization. (Amortization is an accounting function in which the worth of an intangible asset is lowered over time.)

EBITDA is sometimes used instead of net income to understand a company’s performance financially. It can work well when comparing companies within the same industry.

An EV-to-EBITDA multiple, also referred to as an enterprise multiple, helps determine the value of a company. Usually, any value under 10 is considered above average and signals the stock may be undervalued.

Dividend payout ratio

A dividend payout ratio is the total amount of dividends paid to shareholders in relation to the company’s net income. You can calculate a dividend payout ratio by taking the total annual dividends divided by the annual earnings.

Dividend payout ratios can often speak to both the strength of a dividend and the likelihood it will be raised in the future. A low dividend payout ratio (say, 1% to 33%) indicates a well-covered dividend with plenty of room for growth. A moderate payout ratio (33%-66%) can still indicate a sustainable payout, though room for future dividend growth might be moderate. The closer to 100% that ratio gets, however, the likelier the dividend could be on shaky ground.

Also, like almost anything else, what constitutes a low or high dividend payout ratio is relative; compare your stock’s ratio to its competitors.

Dividend yield

A company’s dividend yield is the percentage of its share price that it pays out in dividends every year. The remaining money not paid out is retained by the business to help it grow.

A dividend yield can be calculated in multiple ways. For a stock that pays out a regular dividend, annualize the most recent dividend and divide it by the share price. For example, a company that paid $1.25 quarterly would pay $5 annually; if its share price was $100, the dividend yield would be 5%.

However, for a stock fund, you would take all the dividend payments from the past year, add them up and divide that by the fund’s share price. So, if a fund paid $1.25, $1.50, $1.00 and $1.25, it would have paid $5 over the past year; if its share price was $100, the dividend yield would be 5%.

What constitutes a “high” dividend yield is relative. But investors often compare a stock’s yield to the S&P 500’s yield and/or the yield on the 10-year Treasury; anything higher is typically considered favorable.

Similar to dividend payout ratios, investors should be wary of extremely high dividend yields, as paying out too much money may hinder the company’s growth.

Related Questions on Stock Market Research

How does fundamental analysis differ from technical analysis?

Fundamental and technical analysis use different methods for determining which stocks are likely to have the best future prospects.

Fundamental analysis is examining related economic and financial factors to find a stock’s intrinsic value. This type of analysis begins by looking at financial reports. It considers a stock’s P/E ratio, PEG ratio, EV, and other metrics that provide a picture of a company’s financial performance.

Technical analysis assumes fundamentals are already built into a stock’s current price. This strategy aims to determine a stock’s future price by looking at:

- Chart patterns

- Price trendlines

- Momentum indicators

- Support and resistance levels

- Simple moving averages

Fundamental analysis typically is used more by long-term investors, while technical analysis is a favorite of day traders and swing traders. Some investors incorporate both strategies.

What are the types of fundamental analysis?

The two categories of fundamental analysis are quantitative and qualitative.

Quantitative analysis is statistically driven and calculates the value of stocks by analyzing numbers. An investor using quantitative analysis looks at financial statements, the balance sheet, the cash flow statement, quarterly performance, debt, and more.

Qualitative analysis is more about how consumer perceptions affect future prospects than hard statistics. Investors using qualitative analysis focus on a company’s demand, goodwill, consumer behavior, labor relations, and brand recognition.

How can I access a company’s financial statements?

The U.S. Securities and Exchange Commission (SEC) has an Electronic Data Gathering, Analysis, and Retrieval (EDGAR) filing system that all publicly traded companies use to submit documents to the SEC.

Investors can use the EDGAR search tool to find companies’ financial statements and other filings.

How can I compare companies?

When you’re choosing stocks to invest in, you can use many metrics to compare companies. Don’t rely on “hot tips”; conduct your own research.

Metrics you might use to compare companies include (but aren’t limited to):

- Price-to-earnings (P/E) ratio

- Price-to-earnings growth (PEG) ratio

- Price-to-sales (P/S) ratio

- Price-to-book (P/B) ratio

- Return on equity (ROE)

- Enterprise Value (EV) / Revenue

- EV-to-EBITDA

- Dividend payout ratio

- Dividend yield

All of these metrics are explained in more detail in earlier sections.

Doing all of the calculations and comparisons on your own can be time-consuming and complex. Rather than doing all of the necessary calculations yourself, it can be helpful to use tools that gather the research and do the math for you.

Related:

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 46 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)

![How to Use Your HSA for Retirement [Tax-Efficient Investing Tool] 47 how to use your HSA in retirement](https://youngandtheinvested.com/wp-content/uploads/how-to-use-your-hsa-in-retirement-600x403.png.webp)