Think you’re too broke to invest? Well, it’s time to start thinking differently. Because with just a little money, you can assemble your own portfolio and start building your wealth.

Just how little is “a little money”? We’ve written before about how to start investing with $1,000, but really, you can start with a lot less than that. In fact, with less than $100, you can buy several top stocks for beginners—making real headway into building a diversified portfolio.

Today, we’re going to help you on your way by outlining some of the best stocks for beginners with little money—a group of shares that each cost between roughly $10 and $30. We’ll also explain why you’d want to invest in stocks in the first place, and a few pieces of information about low-priced stocks.

Also, we can’t stress this enough: You should never buy stocks just because they trade for a low dollar amount. That’s why we’ve selected stocks that have much more to offer than just a low nominal share price.

Disclaimer: This article does not constitute individualized investment advice. These securities appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

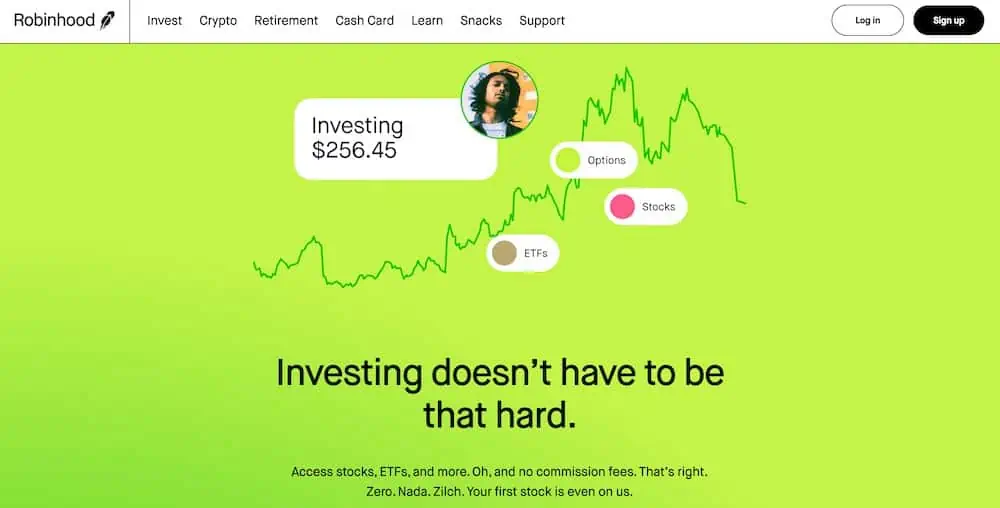

Our Top Stock Trading App for Beginners Pick (No Minimums)

- Robinhood is a pioneer in the investing app world, offering commission-free trades on stocks, ETFs, options, and cryptocurrency, as well as one of the deepest libraries of investing educational content.

- Investing for retirement? Robinhood will match 1% of any IRA transfers or 401(k) rollovers, as well as any annual contributions*, made to your Robinhood Retirement account—and you can get a 3% match on any new contributions if you subscribe to Robinhood Gold.

- Want more advanced trading tools? Download Robinhoold Legend—a desktop trading platform with real-time data, customizable layouts, deeper asset analysis, and more—for free.

- Robinhood's robo-advisory service, Robinhood Strategies, will build you a custom portfolio of stock and bond ETFs (and individual stocks for accounts with at least $500), for a low 0.25% in AUM, which is capped at $250 annually for Robinhood Gold members.

- Robinhood Gold also includes Level II market data provided by Nasdaq, higher interest rates on uninvested brokerage cash, lower margin trading rates, bigger Instant Deposits, and access to the Robinhood Gold Card (a 3% cash-back Visa credit card).

- Special offer: Sign up for Robinhood, link a bank account, and fund your account with at least $10, and receive a randomly selected cash amount between $5 and $200 to put toward certain fractional shares.

- Very good selection of available investments in brokerage accounts

- 1% match on rollovers, IRA transfers, and new contributions to IRAs and Roth IRAs (3% new-contribution match with Robinhood Gold)

- Automated recommended portfolios

- Intuitive interface

- Robo-advisory service (Robinhood Strategies)

- Extensive educational library

- No mutual funds in brokerage or IRAs

- Match doesn't apply to Robinhood Strategies accounts

Why Should I Invest in the Stock Market?

Stocks are one of the best investments for beginners for several reasons:

- They have higher rates of returns than just about any other asset class.

- They can be held in numerous types of investment accounts.

- They’re often understandable and relatable.

A stock is simply a piece of ownership in a company. It allows you to profit from a company’s success—most commonly, from price appreciation in shares of the stock, but in several cases, also from cash distributions (dividends) the company makes to shareholders. Stocks have all sorts of classifications, but here are a few of the basics:

- Growth stocks are shares in companies that have high rates of revenue and earnings growth, which helps drive price gains.

- Value stocks are believed to be under-appreciated by Wall Street. The idea is that at some point, investors will realize that the stock is cheap (compared to, say, its revenues, profits, or other metrics) and buy shares, driving the stock higher.

- Dividend stocks pay out dividends to shareholders. Value stocks and growth stocks alike can be dividend stocks, though you’ll more commonly find higher dividends among value stocks.

Especially early in your investing career, dividend stocks are the ultimate holding given just how much in additional returns they can generate over the long term.

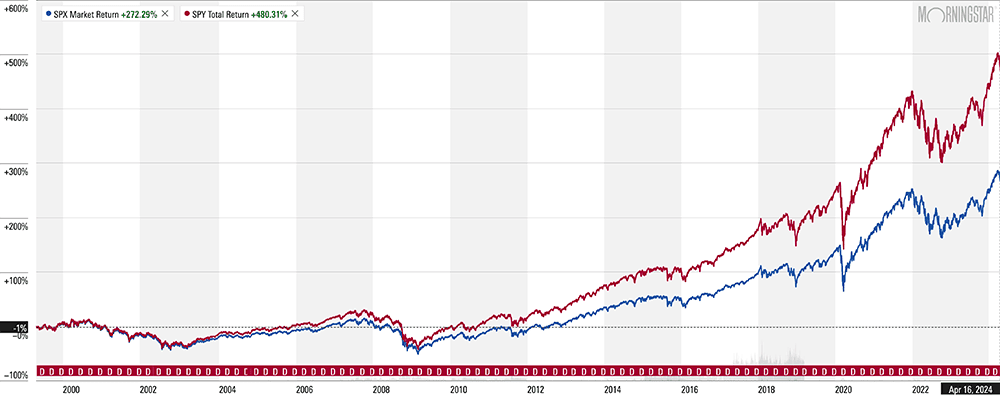

Here’s a look at the return someone could expect if they received just the price returns from an S&P 500 over the past 25 years:

Now look at how much better the return is when you factor in dividends had you had reinvested those dividends back into the S&P 500 (returns illustrated by an S&P 500-tracking ETF; note that expenses are included in performance):

The price return is about 270%. The total return (price plus dividends) is 480%!

Related: 10 Investments that Earn a Great Return [10% or More]

The Best Stocks for Beginners With Little Money

Let’s say you’re starting on your stock investing journey with just, say, $100 or $200.

If you’re lucky enough to have a brokerage account that offers fractional shares, price is no object. No matter how expensive the stock or fund you’re interested in is, you’ll be able to buy a piece of it for very little money—likely $5 or even $1.

However, many of the largest brokerage firms don’t offer fractional shares, and thus beginning investors with little money need to keep an eye on price. For the purposes of this list, then, we’re sticking to stocks that cost roughly between $10 and $30 per share, which will allow someone with even just $100 to buy several different stocks. This provides diversification, which in simplest terms is not putting all of your eggs in one basket.

That said, we’re actually excluding the cheapest stocks—those priced under $1, which are often referred to as penny stocks.

In general, the price of a stock doesn’t tell you much about its quality—a $20 stock is not inherently a better or worse investment than a $500 stock. But extremely cheap shares, especially under $1, can be problematic. Penny stocks that trade on a major exchange like the NYSE or Nasdaq could get kicked off the exchange if they trade under $1 for too long. Meanwhile, sub-$1 stocks that aren’t listed on major exchanges have looser reporting requirements, so there’s less information you can use to make an informed decision, and in general these stocks are more prone to fraud.

And, of course, some stocks trade for a rock-bottom price for good reason after crashing hard.

One last thing: A low stock price isn’t the same thing as a low valuation. Even stocks that trade for $5 or $10 per share can be considered “expensive” compared to their earnings, sales, and other benchmarks typically used to value a stock.

Now, with all of that out of the way, let’s look at some of the best stocks for beginners with little money invested.

Related: 11 Best Compound Interest Investments [Where to Invest]

Best Stock #1: AT&T

- Sector: Communication services

- Market cap: $123.9 billion

- Dividend yield: 6.3%

- Price as of writing: ~$18/share

AT&T (T) is one of the biggest telecommunications companies in the world—and a great example of how you can find stability and scale even in low-priced stocks.

AT&T is the top carrier in the U.S. by wireless subscribers, ahead of Verizon Communications (VZ) and T-Mobile US (TMUS). While AT&T is ostensibly competing with the pair, all three carriers are pretty much entrenched, with only minimal changes in subscribers. Furthermore, there are very high barriers to entry in this market—telecommunications requires a ton of capital to build out infrastructure—so it would be exceedingly difficult for any company to disrupt AT&T and its brethren.

In April 2022, AT&T divested itself of its media assets through the spinoff and merger of Warner Bros. Discovery (WBD). Shares took an instant hit as those operations were removed and shareholders were granted a stake in that new entity. But the new AT&T is now leaner, more focused, and better capitalized thanks to a $43 billion windfall from the deal.

Shares slumped in early 2023 as investors struggled to make sense of the restructuring and worried that higher rates would create big challenges for this debt-heavy company. But they are up almost 30% from their summer lows, thanks to improved profitability and decent customer growth in its recent earnings reports.

AT&T did have to cut its dividend amid the merger, ending an enviable history of 35 consecutive years of annual dividend increases. But that was only because part of the company disappeared thanks to the spinoff. The new dividend is not only much more manageable—it also remains sky-high, at north of 6% currently. So T stock might not be as glamorous as a high-growth tech stock, this low-priced telecom behemoth boasts staying power and long-term income potential.

Make sure you sign up for The Weekend Tea, WealthUp’s free weekly newsletter that over 10k monthly readers use to level up their money know-how.

Related: 12 Best Stock Trading Apps + Platforms for Beginners

Best Stock #2: NiSource

- Sector: Utilities

- Market cap: $13.1 billion

- Dividend yield: 3.6%

- Price as of writing: ~$29/share

If you’re looking for low-risk investments, the utility sector is the place to go. After all, there are few things more necessary to everyday life than electricity, natural gas, and water.

NiSource (NI) is a natural gas and electric utility company that trades for under $30 per share, and it’s worth a look if you want a reliable income play in your portfolio. Founded way back in 1847, the company operates power plants as well as natural gas distribution to more than 4 million customers in six states across the Midwest and East Coast.

In 2024, NiSource hiked its quarterly dividend to 26¢ per share—up 4% from its previous payout, and 33% better than what it was paying six years ago. That’s good news for investors, who typically buy stocks like NI for their stability and income potential rather than dramatic growth narratives.

Remember: NiSource and many other utilities are regulated, which means they must request permission to raise their prices and usually only do so by a couple percent every year or two. Plus, much of their money tends to be reinvested in infrastructure like electric lines and water pipes, or distributed as dividends to shareholders. So there’s not much growth to be had here.

There’s nothing exciting about buying a natural gas company and harvesting the dividends. But investors with little risk tolerance should love the chance to buy a low-priced stock that should net them reliable returns over time.

Related: 15 Best High-Yield Investments [Safe Options Right Now]

Best Stock #3: Ford

- Sector: Consumer discretionary

- Market cap: $48.5 billion

- Dividend yield: 4.9%

- Price as of writing: ~$12/share

At first blush, Ford (F) might not be the kind of automaker that most investors would believe in for the long haul. It’s dependent on expensive pickup truck sales, which can take a hit whenever the economy hits turbulence. And it’s also lagging behind some of its peers in rolling out next-gen electric vehicles.

But if you’re looking for a cheap stock, Ford still has something to offer. Consider that in the wake of the recent resolution between automakers and striking labor unions, Ford saw several upgrades, including a nod from investment bank Barclays in November. Even more noteworthy, Bank of America put a $21 price target on the stock after its Q4 earnings—which adds up to roughly 70% gains from current levels. BofA says “the company has made significant progress executing on its One Ford plan and delivering best-in-class vehicles,” and believes Ford is improving its evolution within “electrification, autonomy, and mobility services.”

Furthermore, Ford’s 2023 adjusted (diluted) earnings of $2.01 per share are still more than triple the 60¢ it’s expected to pay out in dividends, so the generous near-5% yield seems like a safe bet for the foreseeable future, too.

The big question mark is what Ford is doing to electrify its fleet of vehicles in the age of climate change. It is investing heavily in the technology, but it recently made the hard choice to cut its 2024 Lightning production in half to defend current profitability as it evolves. The stated long-term goal from Ford is to be producing more than 2 million EVs by the end of 2026 across 30 electrified models. That’s a tall order given recent headwinds for EVs, but Ford is well on its way, with the well-received Mustang Mach-E among the best-selling U.S. models—only behind Tesla’s (TSLA) Model 3 and Model Y.

Related: 10 Best Stock Picking Services, Subscriptions, Advisors & Sites

Best Stock #4: Regions Financial

- Sector: Financials

- Market cap: $18.3 billion

- Dividend yield: 4.8%

- Price as of writing: ~$20/share

Smaller banking stocks stumbled in early 2023 in the wake of the Silicon Valley Bank failure. And while Regions Financial (RF) is very well-established, as one of the 15 largest banks in the U.S., it got caught up in some of the near-term volatility.

But Regions is up about 30% from its 2023 lows thanks to broader negativity abating and hints that the Fed may potentially roll back interest rates in 2024 to boost borrowing activity.

This is an attractive mid-cap banking stock with $135 billion in deposits as of its latest earnings report; it’s cheap in share price, and it’s generous with its dividend. RF’s current dividend yield is just less than triple the S&P 500’s payout. It boosted its payout to 24¢ in 2023, up 20% from the prior year and more than triple the 7¢ per share paid as recently as 2017.

Banking stocks are inherently “cyclical” investments that go up and down based on broader economic activity. However, Regions is a stock that’s not too small to be overly volatile, yet not so big that its shares are out of reach or that it has no room to grow.

The interest-rate environment and broader macroeconomic picture will certainly be worth watching and have an impact on shares. But for investors with little money and a long-term time horizon, RF stock could be a good investment to consider.

Related: 5 Best Vanguard Dividend Funds [Low-Cost Income]

Best Stock #5: Barrick Gold

- Sector: Materials

- Market cap: $31.1 billion

- Dividend yield: 2.2%

- Price as of writing: ~$18/share

Whenever inflation is a concern for investors, it can help to add some hard assets or raw materials to your portfolio. That’s because many hard assets, such as metal and crude oil, are priced in U.S. dollars—and since inflation shrinks the dollar’s worth, that means it takes more dollars to buy, say, an ounce of metal or barrel of oil.

That’s exactly the kind of exposure you can get via Barrick Gold (GOLD), one of the largest dedicated gold miners in the world.

Headquartered in Toronto, Barrick has ownership interests in gold and copper mines across several continents, but primarily in North America, South America, and Africa. According to its 2022 annual report, the company actually grew its net reserves (how much Barrick believes it can mine from its properties) by 6.7 million ounces to an amazing 76 million total ounces thanks to new projects. With gold prices currently at just under $2,420 per ounce, that adds up to a cool $184 billion at current market prices.

Just remember: There’s no guarantee that gold prices will remain high forever, or that those minerals will be easy to extract. Still, it’s clear that Barrick is sitting on a massive store of gold deposits, and this is one of the best mining operators in the world, providing real value to underpin this company’s stock price.

Make sure you sign up for The Weekend Tea, WealthUp’s free weekly newsletter that over 10k monthly readers use to level up their money know-how.

Related: 9 Best Charles Schwab Alternatives

Best Stock #6: Takeda Pharmaceutical

- Sector: Health care

- Market cap: $42.1 billion

- Dividend yield: 4.8%

- Price as of writing: ~$13/share

When beginner investors get started in the stock market, they tend to think only of large U.S.-based companies like Apple (AAPL) or Tesla (TSLA). But you have access to far more stock investments than that, as illustrated by Takeda Pharmaceutical (TAK).

Takeda is a massive pharmaceutical company, with its best-selling gastroenterology drug Entyvio topping $6 billion annually. The Tokyo-based firm is perhaps not as well-known as U.S. based giants such as Pfizer (PFE) and Eli Lilly (LLY), but it is only a bit smaller and operates similarly to other Big Pharma mainstays.

And despite being a Japanese firm, it’s just as easy to trade as U.S. stocks—it’s listed on U.S. exchanges and trades for less than $15 per share.

Generally, health care is a recession-proof sector that can guide your portfolio through times of uncertainty fairly well. After all, sick people simply must buy drugs regardless of their income levels or consumer sentiment. And in the wake of a $62 billion acquisition of Shire in 2019 to bolster its market share and product pipeline, Takeda definitely has the scale and staying power that investors in low-risk stocks should find attractive right now.

If you’re looking for geographic diversification to round out your portfolio, this cheap stock is worth a look. But even if you’re not, Takeda is a multinational health care company that merits consideration anyways.

Related: 11 Best Stock Advisor Websites & Services to Seize Alpha

Best Stock #7: Kimco Realty

- Sector: Real estate

- Market cap: $12.8 billion

- Dividend yield: 5.1%

- Price as of writing: ~$19/share

Kimco Realty (KIM) is one of North America’s largest publicly traded operators of strip malls—or in real estate jargon, “open-air, grocery-anchored shopping centers.” KIM focuses on tenants that are mainstays of local economies, such as grocers, home improvement stores, and pharmacies.

This makes Kimco’s real estate a bit more reliable than traditional mall operators. You see, while delivery has certainly eaten into people’s desire to go to the mall, most people still travel to the grocery store—and thus are more likely to frequent the stores right around them.

Kimco owns interests in nearly 530 U.S. shopping centers and mixed-use assets, adding up to 90 million square feet. And while some of those sites took a ding curing the pandemic, its occupancy rate is now back up to above 95%—approaching pre-pandemic levels. And in the wake of a pending $2 billion merger with rival RPT Realty, KIM has potential upside thanks to a bigger footprint and potential organizational efficiencies in the year to come.

Kimco’s also a different entity called a real estate investment trust (REIT). It trades just like a regular stock, but it has special rules—including that it must return at least 90% of its taxable income back to shareholders. This makes for generous and reliable dividends that are currently about three times what the S&P 500 Index pays.

Admittedly, KIM had to cut its dividend during the pandemic, but it has been building it back up. In December, it raised its quarterly payout to 24¢ per share; encouraging operational improvement helps the likelihood of continued payout increases and an eventual return to the 28¢ it paid in 2019. That’s great news to longtime and new shareholders alike.

Related: 9 Best Real Estate Crowdfunding Sites + Platforms

Best Stock #8: United Microelectronics

- Sector: Technology

- Market cap: $20.9 billion

- Dividend yield: 6.9%

- Price as of writing: ~$8/share

Though priced at under $10 a share right now, Taiwanese semiconductor manufacturer United Microelectronics (UMC) has plenty of potential going forward.

United Microelectronics operates a foundry and provides testing services. So unlike branded chipmakers like Intel (INTC) that spend billions on researching and patenting products, this tech stock simply produces what other semiconductor designers request. The margins aren’t quite as high in this kind of semiconductor operation, but they are much more reliable.

The semiconductor industry slumped in 2022 thanks to fears of economic slowdowns that could weigh on consumer spending (and semiconductor demand as a result). And, of course, there’s the much-publicized supply chain disruption, which has plagued the industry over the past few years and held back sales simply because the products can’t get to end-users and manufacturers in a timely manner.

But semiconductors are back in favor as they work through these lingering challenges, and because of a rosier economic outlook for Europe and Asia—not to mention the recent United States Chips and Science Act, which aims to inject $280 billion into the industry.

Any risk of a consumer spending slowdown could once again undercut chip stocks. But UMC has weathered the past few years pretty well.

Related: 15 Best Stock Research & Analysis Apps, Tools and Sites

Best Stock #9: Nordstrom

- Sector: Consumer discretionary

- Market cap: $3.4 billion

- Dividend yield: 3.6%

- Price as of writing: ~$20/share

Nordstrom (JWN) is an a fashion retailer that provides apparel, shoes, beauty products and more through its namesake stores as well as Nordstrom Rack upscale discount outlets.

Shares are down pretty significantly over the last few years, thanks to a post-pandemic pop in 2021 wasn’t sustainable after all that pent-up demand was deployed. But now that revenue reductions are priced into shares, JWN can be more realistic about the future in 2024 and beyond. Plus, there might be potential merger and acquisition (M&A) surrounding the stock.

Results are getting more consistent, with the company reaffirming its outlook after its November earnings report thanks to moves to defend margins and profitability in the face of a revenue slowdown. And while the dividend was suspended during the pandemic and then restarted at roughly half what it previously was, the now-19¢ quarterly dividend is only about 40% of next year’s projected earnings. That hints that the payouts aren’t just sustainable, but ripe for additional increases in the coming years even if profits are slow to grow.

Admittedly, there is some serious risk here in light of recession risks. But as 2023 showed us, a lot of the negativity about inflation and higher borrowing costs has failed to trip up the U.S. consumer so far. If that proves true going forward, JWN is in a position to do quite well.

Make sure you sign up for The Weekend Tea, WealthUp’s free weekly newsletter that over 10k monthly readers use to level up their money know-how.

Related: 12 Best Investment Opportunities for Accredited Investors

Frequently Asked Questions (FAQs)

What other investments make sense for beginner investors?

If you’re looking for low-priced investments, exchange-traded funds (ETFs) and mutual funds are also good options. These vehicles provide built-in diversification, allowing you to make a stock market investment of dozens, hundreds, and even thousands of shares with a single holding, rather than going out and purchasing multiple individual stocks yourself. In exchange, you’ll pay an annual fee that is taken directly out of the fund’s performance (and if you’re buying a mutual fund, a fee might also be taken from your initial investment).

Many ETFs and some mutual funds are index funds, meaning that instead of human stock pickers, they track a rules-based index of stocks, bonds, and other investments. As a result, index funds often offer cheaper fees.

Why funds instead of stocks? Well, when you start investing, you might not have confidence in your own research—and ETFs and mutual funds take that weight off your shoulders. Funds also let you buy a wider portfolio for the same price as a few stocks. Imagine if you wanted to buy 100 different stocks that each cost an average of $30 per share—that’d be $3,000 out of your pocket. But an ETF might hold a piece of all 100 of those stocks for you, and the ETF shares might cost just $30 or $40.

Related: Best Monthly Dividend Stocks for Frequent, Regular Income

Is my stock market investment safe?

Simply put: Investing involves risk. And as you probably read when you signed up for your stock trading account, you can lose money in stocks. You can improve your chances of making money by doing research and holding over a long period of time rather than making short-term trades—indeed, the stock market has always trended higher over the long term. But short-term swings in the market can be uncomfortable, and individual companies can and do go bust.

You’ll need to think about how much risk you can stomach, known as your risk tolerance. Depending on your risk tolerance, you might be fine buying, say, a few risky growth stocks … or you might want to just stash your money in a diversified, broad-market ETF.

But there’s no 100% guarantee of safety—not in stocks, not in bonds, not in any type of investment.

Especially once you start amassing a larger amount of money, it might make sense to consult with a financial advisor to discuss both how much risk you’re willing to take, and how to manage that risk.

What kind of brokerage account should I use?

If you’re just starting out, chances are you’ll need to use a brokerage account—the most basic type of investment account there is. Your typical online brokerage account will allow you to invest in stocks, ETFs, and mutual funds; some also allow you to invest in options, bonds, cryptocurrency and more.

Nowadays, brokerage accounts have their own investment apps, which allow you to do much more than buy and sell stocks. These apps can also help you manage your investment portfolios, research investments, and track your wealth over time—all from the comfort of your home (or on the go).

If you’re looking for a place to start your search, consider our list of the best investing apps for beginners. Each stock brokerage account has specifically been selected for their relative ease of use, low costs, and other beginner-friendly attributes. Below, we highlight our top pick for beginners, Robinhood—but if it doesn’t have the features you’re looking for, feel free to explore the other options on our top beginner apps list.

Robinhood (Best Stock Trading App for Beginners)

- Available: Sign up here

- Best for: Beginner traders

- Platform: Web, mobile app (Apple iOS, Android)

Robinhood is a pioneer of commission-free trading, jumping into the investing public’s consciousness in 2013 when they rolled out commission-free trading. They remain a standout option for cost-minded investors thanks to their continued $0 commissions on stocks, ETFs, and options, as well as for its fractional trading, which allows people to invest with as little as $1.

More importantly, though, Robinhood has evolved from a bare-bones app appealing to mostly beginner investors to a fuller-featured account suitable for a wider range of experience levels.

For instance, Robinhood now offers individual retirement accounts (IRAs) and Roth IRAs via Robinhood Retirement. Functionally, it comes up short compared to many other IRA providers because of its investment options. It offers just stocks and ETFs; like with its brokerage account, mutual funds aren’t available.

Sign up for a Robinhood brokerage account or Robinhood retirement account today. Robinhood investment accounts carry up to $500,000 of Securities Investor Protection Corporation coverage.

- Robinhood is a pioneer in the investing app world, offering commission-free trades on stocks, ETFs, options, and cryptocurrency, as well as one of the deepest libraries of investing educational content.

- Investing for retirement? Robinhood will match 1% of any IRA transfers or 401(k) rollovers, as well as any annual contributions*, made to your Robinhood Retirement account—and you can get a 3% match on any new contributions if you subscribe to Robinhood Gold.

- Want more advanced trading tools? Download Robinhoold Legend—a desktop trading platform with real-time data, customizable layouts, deeper asset analysis, and more—for free.

- Robinhood's robo-advisory service, Robinhood Strategies, will build you a custom portfolio of stock and bond ETFs (and individual stocks for accounts with at least $500), for a low 0.25% in AUM, which is capped at $250 annually for Robinhood Gold members.

- Robinhood Gold also includes Level II market data provided by Nasdaq, higher interest rates on uninvested brokerage cash, lower margin trading rates, bigger Instant Deposits, and access to the Robinhood Gold Card (a 3% cash-back Visa credit card).

- Special offer: Sign up for Robinhood, link a bank account, and fund your account with at least $10, and receive a randomly selected cash amount between $5 and $200 to put toward certain fractional shares.

- Very good selection of available investments in brokerage accounts

- 1% match on rollovers, IRA transfers, and new contributions to IRAs and Roth IRAs (3% new-contribution match with Robinhood Gold)

- Automated recommended portfolios

- Intuitive interface

- Robo-advisory service (Robinhood Strategies)

- Extensive educational library

- No mutual funds in brokerage or IRAs

- Match doesn't apply to Robinhood Strategies accounts

Related:

- 8 Best Stock Portfolio Tracking Apps [Stock Portfolio Trackers]

- The 7 Best Vanguard Index Funds for Beginners

- The 9 Best ETFs for Beginners

Jeff Reeves held shares of T as of this writing. He did not hold a position in any of the other aforementioned recommended securities.

![The 9 Best ETFs for Beginners [2025] 36 a hand taking a slice of a pie chart.](https://youngandtheinvested.com/wp-content/uploads/pie-chart-index-fund-etf-wooden-table-1200-600x403.webp)