Cryptocurrency continues to become a more-commonly accepted asset by the day. Once relegated to futuristic sci-fi novels by the likes of Isaac Asimov, cryptocurrencies have become discussed and held by an increasingly diverse set of individuals. A decade ago, only tech-savvy, privacy-focused individuals with a strong skepticism of centralized banking systems dabbled in cryptocurrencies. Now, you can trade them on apps like Robinhood and other stock trading apps.

Just as common as they’ve become in our society, the IRS has not failed to take notice. In fact, they have an established point of view on these cryptocurrencies and have begun to tax them in a specific manner inconsistent with other currencies.

This article talks about cryptocurrency statistics related to markets, taxes and users’ demographics. Together, you will see how normal these virtual currencies have become.

But first, let’s review a few common concepts like what is a cryptocurrency and how are cryptocurrencies taxed.

Table of Contents

What is Cryptocurrency?

A cryptocurrency is a decentralized digital currency tracked and stored through a blockchain system. The currency, or token, grants a blockchain member specific network rights.

Theoretically, no limit exists for the network rights which a blockchain can grant, but they generally fall into four categories:

- Equity Tokens: These tokens, much like a share of stock, grants the holder ownership rights to some underlying asset, entity or process. This means the holder has access to profits generated by the underlying asset or to dividends distributed to equity token holders.

- Utility Tokens: Like equity tokens, utility tokens allow holders to access a closed network of specific services, such as facilitating a medium of exchange between users and service providers.

- Intrinsic Tokens: Similar to utility tokens by granting access to an underlying service backed by the token, except these tokens can go beyond a closed network. Examples of this include Bitcoin, Ethereum, Litecoin and other altcoins (or any virtual currency which isn’t Bitcoin).

- Asset-Backed Tokens: Probably the easiest tokens to value, these come backed by a specific asset like gold, silver, real estate or other hard assets.

When a transaction occurs, it gets digitally recorded on a distributed ledger like the blockchain. Also called a ledger, a blockchain acts as a continuously updated, decentralized and permanent record of all transactions that occur in a specific cryptocurrency. Transactions happen “on-chain” if it records on the blockchain and “off-chain” if it does not get recorded on the distributed ledger.

This ensures no one person holds the central ledger of all transactions and instead exists in multiple locations simultaneously, allowing for independent verification and lack of centralized control. Some common forms of cryptocurrency are Bitcoin, Ethereum, Litecoin, Ripple and many more.

Related: NFT Statistics to Understand [Market, Sales & Trends]

How are Cryptocurrencies Taxed?

Cryptocurrencies got dealt a raw hand by the IRS in 2014 when the agency issued Notice 2014-21, 2014-16, I.R.B. 938. This ruling explained that virtual currencies, better known as cryptocurrencies, get treated as property in the eyes of the IRS.

Possible transactions for your cryptocurrencies include:

- The receipt or transfer of crypto for free, including from an air-drop or a hard fork;

- Cryptocurrency exchanges for goods or services;

- The sale of cryptocurrency; and

- The exchange of cryptocurrency for other types of property, including for other cryptocurrencies (a like-kind exchange, which the Tax Cuts and Jobs Act removed).

When you take part in any of the above crypto transactions, you generally experience tax consequences. Depending on the action taken, you may generate tax liability for yourself.

Because the IRS treats cryptocurrency as a capital asset, you must track your basis in the currency and record it as a capital gain or loss at disposition. That means if you bought $100 worth of Bitcoin in January 2022 and sold it for $1,000 in March 2023, you will have a long-term capital gain of $900 ($1,000 sale price – $100 basis).

If you buy and sell your crypto within a year’s time, it will count as a short-term capital gain. Likewise, if you use your cryptocurrency to facilitate a transaction, meaning you used it to pay for some goods or services as you would a U.S. dollar or other fiat currency, you would pay a similar capital gain on its use to pay.

Doubtlessly, you can see the complications of such treatment if cryptocurrencies ever became a common currency for facilitating commerce.

Cryptocurrency Market Statistics (Growth Statistics)

1. Between 2012 and October 2023, Bitcoin has gained 134,345%

When first launched on Coinbase in 2012 for a price of $22 per USD for $1 million worth of the token, the currency quickly jumped over 311,000% in under a decade (at its all-time high of $68,543). As of October 2023, Bitcoin’s price dropped to $29,578, equating to an all-time gain of 134,345%. (Source: Wikipedia)1

2. The total cryptocurrency market cap is $1,120 billion ($1.12 trillion), or equivalent to the 22rd largest economy globally

Given the major swings of cryptocurrencies and their dramatic rise in recent years, this statistic might become inaccurate in a day’s time. As of October 2023, the total global market capitalization of all cryptocurrencies totals $1,120 billion, making it enough to be the world’s 22nd largest economy by gross domestic product (Source: CoinMarketCap)2.

Earlier, on November 10, 2021, the cryptocurrency market cap topped out at $2.977 trillion.

Combined with cryptocurrency statistics later in this list, this means a significant wealth of capital gains taxes will be paid by individuals who have purchased a cryptocurrency and now hold it above their basis.

In the coming years, this could trigger a significant amount of capital gains activity.

3. Bitcoin’s total market capitalization is $577 billion

In October 2023, Bitcoin’s market capitalization rested above $577 billion, down from $1.26 trillion in November 2021. Earlier in 2021, it exceeded $1 trillion for the first time.

Meaning, if you wanted to buy every Bitcoin in existence, you would need at least $577 billion to purchase them all. (Source: NY Times)3.

4. The average daily cryptocurrency trade volume has risen dramatically to $53.16 billion per day

When looking at the size of the overall cryptocurrency market alone, you’d have to recognize the asset’s rise to prominence. Marked by continuous headline activity, cryptocurrencies trade in high volumes each and every day as their market capitalizations continue to rise.

Most recently, as of October 2023, the 24 hour average trading volume of all cryptocurrencies globally came to $53.16 billion. Earlier, in November 2021, the 24 hour average trading volume of all cryptocurrencies globally was $130 billion. (Source: CoinMarketCap)2.

5. 2020 saw 2,329 ICOs launch

In 2020, 2,329 ICOs occurred. (Source: Statista)4.

6. There are over 26,309 cryptocurrencies in active circulation

How many cryptocurrencies are there? Over 26,309 are in circulation, but more than 27,000 have ever existed. (Source: Statista)4.

7. As of February 2021, there were nearly 15,000 Bitcoin ATMs globally

Rising rapidly since 2015, the number of Bitcoin ATMs available globally is nearly 15,000. (Source: Statista)4.

8. Bitcoin remains the most popular cryptocurrency, with dominance hitting over 51.5%

According to cryptocurrency exchanges, the most popular cryptocurrency remains as Bitcoin. Bitcoin dominance is currently 51.5%. (Source: CoinMarketCap)2.

9. The 10 most popular cryptocurrencies start with Bitcoin and Ethereum, but include other up-and-comers

The top 10 most popular cryptocurrencies (by market capitalization) are:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (stablecoin)

- Binance (BNB)

- Ripple (XRP)

- USDCoin (stablecoin known best as USDC)

- Solana (SOL)

- Cardano (ADA)

- Dogecoin (DOGE)

- TRON (TRX)

10. There are 667 global cryptocurrency spot exchanges globally

Globally, 667 cryptocurrency spot exchanges exist, with a total 24 hour trading volume of $53.16 billion. (Source: CoinMarketCap)2.

11. The Top 10 Global Crypto Exchanges Account for 79% of Global Daily Trade Volume

The top 10 global cryptocurrency exchanges account for 79% of daily average trade volume. The exchanges, Venus, HitBTC, Bitcoin.com, Changelly, Binance, Upbit, Huobi Global, HBTC, OKEx, and VCC Exchange represent $250.8 billion of trade volume per day. (Source: CoinMarketCap)2.

12. The Top 4 Global Crypto Exchanges Account for 63% of Global Daily Trade Volume

Further demonstrating the top-heavy nature of these global virtual currency exchanges, the top 4 global crypto exchanges account for 63.4% of global crypto trade volume. (Source: CoinMarketCap)2.

13. Global stablecoin volume per 24 hours is $49.35 billion

Globally, the total value of all stablecoins, or tokens tied to a specific stable asset or basket of assets like a fiat currency (e.g., USD, EUR), traded on average each day is $49.35 billion. (Source: CoinMarketCap)2.

14. Global DeFi global volume per 24 hours is $2.7 billion, or 5.07% of the total daily crypto market volume.

The total global volume of DeFi, or decentralized finance, is $2.7 billion, amounting to 5.07% of the global daily average of all crypto volume. (Source: CoinMarketCap)2.

15. Global mining income is $20,180,061,869 per year

This includes rewards and fees earned from mining Bitcoin. $20 billion per year in income will only continue to grow as more cryptocurrencies launch through initial coin offerings (ICOs) and the value of cryptocurrencies continue to climb. (Source: Digiconomist)6.

Related: Income-Generating Assets

16. Global market size of digital payments surpassed 700 billion transactions

In 2020, the total number of digital payments crossed 700 billion, representing 14% growth over the previous year. (Source: Consultancy)7.

17. Bitcoin blockchain is estimated to be nearly 500 GB in size as of August 2023

Growing exponentially over the last decade as transactions get recorded, the blockchain for Bitcoin now amounts to almost 500 GB in size as of August 2023. (Source: Statista)4.

18. Global market size of Bitcoin transactions surpassed 120 million

In 2020, the total number of Bitcoin payments surpassed 120 million, representing a small but growing percentage of total digital payments. (Source: Digiconomist)6.

19. The average number of digital payments amount to almost 100 digital transactions per year per person

The global average of annual digital transactions per person is almost 100. This includes cryptocurrency, contactless payments, digital orders and online payments. (Source: Consultancy)7

20. Tesla is the only member of the S&P 500 to announce acquisition of Bitcoins

As of October 2023, Tesla is the only company to announce the acquisition of Bitcoins. As the cryptocurrency becomes more popular and widely-accepted, many other S&P 500 constituents will likely follow. (Source: Digiconomist)6.

21. The frequency of cryptocurrency theft increased between 2020 and 2021 by 19%, but is less by dollar value

Between 2020 and 2021, the overall frequency of cryptocurrency theft increased, but the value stolen in 2020 is 19% higher than that in 2021. This could indicate a maturing market. (Source: Statista)4.

22. $620m of crypto was stolen in 2022, but ~80% has since been claimed and recovered

Over $620m of cryptocurrency had been stolen in 2022 through the Ronin Nework breach, but roughly 80% of this has since been recovered. (Source: Statista)4.

23. Industry with highest accepted rate of BitPay payments was prepaid/gift cards at 26.3%, lowest is Consumer Electronics at 1.74%

Industries vary by acceptance rate of Bitcoin for payment of goods and services, but the highest rate of acceptance came from the prepaid debit card /gift card industry and lowest from Consumer Electronics.

Tesla became the first auto company, and first in overall S&P 500 to acquire Bitcoin in anticipation as a form of payment. (Source: Statista)4.

Related: Best Debit Cards for Teens to Become Money Savvy

24. Approximately 16% of Americans use cryptocurrency

According to Pew Research, approximately 16% of Americans use cryptocurrency in some shape, form or fashion. How many people use cryptocurrency in the U.S., then? About 53 million people.

How many people own cryptocurrency? IRS tax returns will show the best indication of this figure, but it is likely a similar amount. (Source: Pew Research)5

Related: 60 Personal Finance Statistics You Might Not Know (But Should!)

Cryptocurrency Users Statistics and Cryptocurrency Demographics

Have a look at the following statistics on cryptocurrency users and demographics. You might find the crypto world becoming far more mainstream than you thought.

In just two years, the number of individuals holding at least one cryptocurrency in a Blockchain wallet has nearly doubled from 40m to 70m. Will this growth continue?

Related: Crypto for Kids: How to Open a Crypto Account for Minors

25. Over 85 million people use Blockchain Wallets worldwide

A blockchain wallet, or cryptocurrency wallet, is a device, medium or other program or service which can store your cryptocurrency.

This wallet not only stores your cryptocurrency information, but it also encrypts the data and only allows you to log in with your credentials to facilitate a smart contract, crypto transaction or other legally binding transaction.

Over 85 million people use a blockchain wallet worldwide. About a third of Nigerians use a cryptocurrency, while 1 in 5 in Vietnam and the Philippines do (Source: Statista)4.

Related: Best Credit Cards for Teens

26. A social media post about crypto appears every 2 seconds

A recent analysis by Reuters shows between 14,000 and 32,000 daily tweets appear on Twitter. A subreddit with over 2.0 million members posting regularly each day.

Facebook sees significant amounts of discussion in numerous groups. Telegram hosts live discussions about cryptocurrencies around the globe. Social media the world over is flush with discussion about cryptocurrencies. (Source: Reuters)8.

Since 2015, several new crypto-trading platforms and investment apps have cropped up to facilitate crypto transactions.

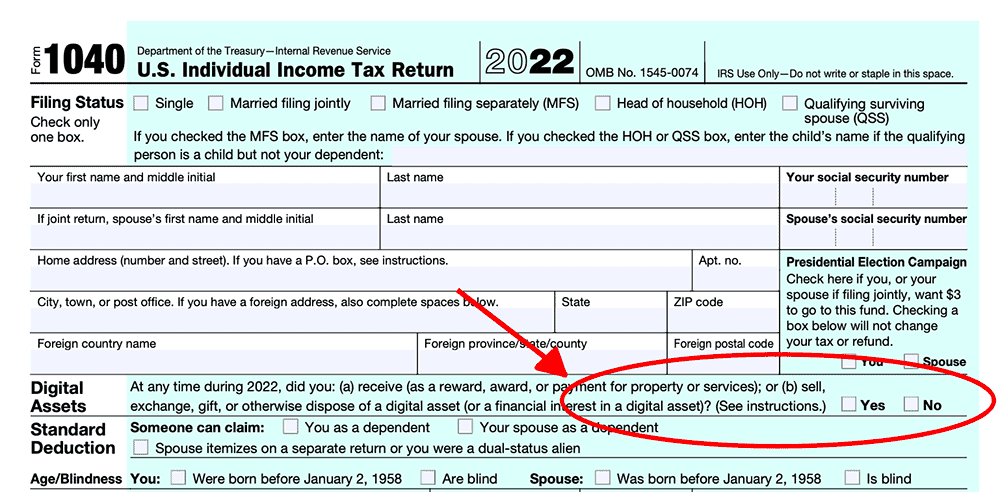

Despite the IRS including a question on page 1 of Form 1040 about crypto transactions you may have been part of during the year, many likely still fail to report any tax liability (Source: IRS)9.

Related: Best Investing Research & Stock Analysis Websites

27. Developing an algorithm which can find crypto market-moving signals costs between $500,000 and $1 million

According to Bluesky Capital, developing an algorithm which can identify and trade based on crypto market-moving signals costs $500,000 to $1 million of upfront capital.

This relies on the skilled software engineering labor to scrape, process and convert into actionable trading insights. (Source: Reuters)8.

Related: Best Investment Apps for Beginners

28. The preferred term for cryptocurrency has become “virtual currency”

In 2013, over half of the incidences of “crypto-currency” appeared by the name “Bitcoin.” Since 2019, roughly half have of such occurrences have now become referred to as a catch all “virtual currency”. (Source: OECD)10.

Related: Best Debit Cards for Kids

29. Nigerians report the most common ownership and use of virtual currencies (32%), with U.S. coming in 9th at 6%

Of respondents to a Statista Survey, Nigerians reported the most common ownership and use of crypto currencies. A reported 32% of Nigerians say they have owned or used crypto at some point in 2020.

The U.S. respondents showed approximately 6% of Americans can make the same claim. (Source: Statista)4.

Related: Best Free Debit Cards for Kids & Teens

30. The Bitcoin community is disproportionately Male. 85.77% of Bitcoin community engagement comes from Males as opposed to 14.23% from females.

Bitcoin investors appear to be disproportionately male, with 85.77% of Bitcoin community engagement coming from males. This compares to 14.23% for females. (Source: Coin.Dance)11.

31. More males are aware of Bitcoin than Females.

Statista conducted a survey where they revealed the awareness of Bitcoin among males and females in America. Males show a slightly higher level of awareness, with 78% of survey respondents reporting awareness of Bitcoin. Females reported a 71% awareness rate of Bitcoin. (Source: Statista)4.

32. A survey shows white respondents are more aware of Bitcoin as compared to 66% for Hispanic and 61% for Black respondents

Statista conducted a survey where they revealed the awareness of Bitcoin among different races in America. White respondents showed the highest level of awareness of Bitcoin’s existence at 80% penetration, Hispanic and Black respondents had 66% and 61% awareness of Bitcoin, respectively. (Source: Statista)4.

33. 67% of Millennials Look to Bitcoin as a Safe Haven Asset as Compared to Gold

A global survey conducted by J.P. Morgan Chase found that millennials place more trust in Bitcoin during tough economic climates than gold. 67% of millennials said they’d prefer Bitcoin in their portfolio to weather volatile financial markets than gold.

J.P. Morgan believes this built-in preference for Millennials will make Bitcoin’s long-term value potential substantial. (Source: Bitcoin.com)12.

Related: Best Brokerage Account Sign-Up Bonuses, Promotions and Deals

Cryptocurrency Environmental Impact Statistics (Carbon, Power)

Cryptocurrencies have democratized access to a number of new financial services globally. As they have grown, so too has their environmental footprint tied to crypto mining. Learn about the myriad of negative side effects seen from crypto-miners and their environmental impact.

Can countries find a way to green crypto in more ways than just a financial one?

34. Mining cryptocurrency uses more electricity than Argentina, or 121.36 terawatt-hours (TWh) per year

Mining cryptocurrency is a very power-intensive process. This requires the use of sophisticated computers specifically designed to mine cryptocurrency in the hopes of earning a partial token in exchange for solving an alphanumeric code to place the latest transactions onto a token’s respective blockchain.

Globally, crypto miners use 121.36 terawatt hours (TWh) per year to run their computers, amounting to more electricity usage than the entire country of Argentina. (Source: BBC)13.

Related: Alarming Data Privacy Statistics, Trends and Facts

35. Bitcoin mining using enough energy to power over 10m homes per year

Making a simplifying assumption that the average American household uses 12,000 kilowatt hours (kWh), or 1,000 kWh per month, we can estimate that over 10m American homes could be powered by the amount of energy used by Bitcoin miners.

121.36 TWh / 12,000 kWh = 10,113,333 homes.

36. If Bitcoin was a country, it would be in the top 30 energy users worldwide

If Bitcoin was a country, it would be in the top 30 energy users worldwide. (Source: BBC)13.

37. Tesla received $1.5 billion in environmental subsidies in 2020, which it then used to buy Bitcoin.

In 2020, Tesla received environmental tax subsidies worth $1.5 billion, which it then used to buy Bitcoin. Tesla recently began accepting Bitcoin for the purchase of its cars.

But buyer beware, using cryptocurrencies to purchase a good or service can trigger a capital gain or loss, depending on your cost basis in the cryptocurrency. (Source: BBC)13.

38. The amount of carbon emissions resulting from mining Bitcoin is greater than all of New Zealand

The amount of annual carbon emissions from mining Bitcoin amounts to more than all of New Zealand, including their power, transportation, industrial, commercial and residential emissions. (Source: NY Times)3.

39. Bitcoin consumes roughly the same energy as all global data centers

Based on the current market price for Bitcoin, it is estimated the entire Bitcoin network could consume 185 TWh per year at its full peak. This amounts to roughly the same figure of energy consumed by data centers globally. (Source: Digiconomist)6.

40. Carbon emissions from Bitcoin mining is greater than that of global gold mining

Based on the estimated amount of global carbon emissions tied to gold mining, 81 million metric tons of CO2, Bitcoin mining produces more global carbon emissions. (Source: Digiconomist)6.

41. Kentucky passed legislation to introduce energy and tax breaks for crypto mining operations

In March 2021, the state of Kentucky passed legislation which would provide energy and tax breaks for crypto mining operations. Specifically, crypto miners will no longer need to pay sales tax on electricity purchased for the specific intent to mine cryptocurrencies. (Source: CoinDesk)15.

42. One Bitcoin transaction’s carbon footprint is equivalent to 735,121 Visa transactions or 55,280 hours of watching YouTube

The energy and carbon intensity of Bitcoin mining has an equivalent carbon footprint of 735,121 Visa transactions or watching 55,280 hours of YouTube. (Source: Digiconomist)6.

43. Annual electricity costs on Bitcoin mining are $4,466,697,344

Assuming a global fixed rate of $0.05 per kilowatt-hour (kWh), over $4.45 billion gets spent on electricity costs for Bitcoin mining. (Source: Digiconomist)6.

44. The estimated ratio of electricity costs to total miner income is 22.13%

Of the total Bitcoin mining income generated each year on average ($20,180,061,869), miners spent 22.13% of their income on electricity costs ($4,466,697,344 / $20,180,061,869). (Source: Digiconomist)6.

Related: Best Passive Income Ideas and Investments

45. Central processing units cannot mine Bitcoin as quickly as graphic processing units, resulting in greater electricity consumption

Early in Bitcoin’s history, miners relied on traditional central processing units (CPUs) to mine Bitcoin. Shortly thereafter, miners realized graphic processing units (GPUs) could mine Bitcoin much faster.

Mining is a lot of repetitive work, processing significant amounts of hashes per second, something better equipped for GPUs, because they come equipped with more arithmetic logic units (ALUs) than CPUs. (Source: Joule)16.

46. More than 60% of the Bitcoin network’s hash rate depends on non-renewable energy sources

For total global energy consumption by Bitcoin miners, over 60% of power consumed comes from non-renewable energy sources. Primarily, this includes coal-fired generation technology. (Source: Digiconomist)6.

47. Bitcoin emissions alone could increase average global temperature above +2°C

If Bitcoin mining continues to use primarily coal-fired electricity to power its operations, projected energy usage from mining could be enough to produce enough CO2 emissions alone to push global temperatures above the 2°C target set by the Paris Climate Accord (Source: Nature)17.

48. 72% of Bitcoin mining occurs in China, where nearly 66% of electricity comes from coal power

The vast majority of Bitcoin mining occurs in China, a country with nearly 66% of its annual power production coming from coal-fired generation. (Source: FT)18.

49. Bitcoin carbon emissions sit between American Airlines’s CO2 emissions and the US Federal Government

The amount of carbon emissions from Bitcoin mining places it as a top polluter globally, seated between American Airlines’ tally (world’s largest airline, carrying 200m passengers per year), and the entire US Federal Government. (Source: FT)18.

50. Bitcoin has the highest carbon footprint per dollar of inflow

The modest amount of money going into Bitcoin produces a significant, outsized environmental impact through the production of carbon emissions. The FT estimates for each $1 billion of capital inflow to Bitcoin, an additional 5.4m tons of CO2 emissions occur, higher than any other investment opportunity available to humans. (Source: FT)18.

51. A Bitcoin purchase worth $50,000 has a carbon footprint of 270 tons, or 60 internal combustion cars

With the amount of carbon emissions produced from Bitcoin mining, the FT estimates making a purchase worth $50,000 USD with Bitcoin produces 270 tons of CO2, equivalent to 60 internal combustion cars. (Source: FT)18.

Cryptocurrency Tax and Economic Statistics

Virtual currencies have had a major impact on the investing side of the equation, but can it make the leap into facilitating commerce globally?

Also, can it sidestep its current treatment as a capital asset in many countries, as opposed to an actual currency? This change will unlock cryptocurrencies’ widespread use as a fiat currency replacement.

52. The IRS thinks a massive amount of underreporting exists for bitcoin gains.

In 2015, the IRS served a “John Doe” summons on Coinbase, the largest platform for exchanging bitcoin into U.S. dollars by the end of 2015.

This notice sought information from Coinbase on a wide range of records and documents regarding American individuals who transacted in the cryptocurrency but didn’t report their activity on their tax returns (Source: Journal of Accountancy)17.

The summons included a request for information that covered 8.9 million transactions and 14,355 account holders. At the time, Coinbase claimed to have 5.9 million customers on the platform who traded $6 billion in Bitcoin.

Today, Coinbase has 43 million verified users with over $455 billion in total cryptocurrency volume traded, a small fraction of the overall market (Source: Coinbase)18.

Related: Federal Tax Brackets and Rates for 2022 and 2023

→ What Counts as a Taxable Event for Cryptocurrencies?

→ What Doesn’t Count as a Taxable Event for Cryptocurrencies?

Related: Best Tax Software

53. Only 802 individuals reported Bitcoin-related transactions in 2015

Per a lawsuit filed by the IRS and Coinbase, only 802 individuals reported Bitcoin-related transactions in 2015. (Source: NY Times)14

Related: Best Accounting Software for Rental Properties

54. Fewer than 150,000 people may have claimed cryptocurrency activity on tax returns in 2019

Based on analysis conducted in the Wall Street Journal, fewer than 150,000 individuals could have reported cryptocurrency transactions on their 2019 tax year tax returns.

This pales in comparison to the millions who currently own the cryptocurrency in the U.S. (Source: WSJ)21.

Related: Best Rent Collection Apps and Software

55. Global accountancy firms recommend classifying virtual currencies as “intangible assets other than goodwill”

Because of the highly unique nature of virtual currencies, a number of leading global accountancies recommend classifying virtual currencies as “intangible assets other than goodwill.” This stands in opposition to creating an entirely new asset class and aligns with one adopted by most tax administrations. (Source: OECD)10.

56. 30 countries have guidance available in their jurisdiction on the classification of crypto-assets while 13 do not

Each country is different, but 30 countries included in an OECD analysis from 2020 state they have guidance available from their tax administration on the appropriate classification and treatment of crypto-assets. 13 said they do not. (Source: OECD)10.

57. 12 countries or jurisdictions ban the use of virtual currencies or any transaction involving virtual currencies

As of 2020, 12 countries or jurisdictions outright ban the use of virtual currencies, transactions or some component of the crypto value chain.

These countries or jurisdictions include: Bangladesh, Bolivia, Iraq, Morocco, Nepal, North Macedonia, Lesotho, Russia, Saudi Arabia and Algeria. Others prohibit commercial trading platforms instead of transactions involving virtual currencies. (Source: OECD)10.

58. 2 countries ban virtual currencies as a means of payment

Ecuador and Indonesia ban virtual currencies as a means of payment. (Source: OECD)10.

59. 24 countries do not take the view that virtual currencies are equivalent to sovereign (fiat) currencies

According to a report by the OECD, 24 countries do not view virtual currencies as equivalent to fiat currencies.

They include: Argentina, Australia, Austria, Canada, Chile, Estonia, Finland, France, Germany, Hungary, Ireland, Israel, Latvia, Mexico, the Netherlands, Nigeria, Portugal, Singapore, the Slovak Republic, Slovenia, South Africa, Spain, the United Kingdom, and the United States. (Source: OECD)10.

60. Most countries view the creation of virtual currencies as a taxable event

Most countries take the position that the creation of a virtual currency through mining, air-drop, or ICO constitutes a taxable event. Likewise, the disposal of a virtual currency through a transaction triggers a taxable event as well.

In cases where the receipt of a new unit of virtual currency is not considered to be a taxable event, this means that the first taxable event will happen on the disposal of a new unit. (Source: OECD)10.

First Taxable Event for Mined Virtual Currencies Under Income Taxes

| First Event on Receipt of New Tokens From Mining | First Event on Disposal | Different Approaches for Businesses / Regular Traders & Individuals / Occasional Traders |

|---|---|---|

| Andorra | Croatia | Australia |

| Argentina* | Czech Republic | Canada |

| Austria** | Denmark | Germany |

| Cote d'Ivoire | Estonia | Hong Kong |

| Colombia | France | Netherlands |

| Croatia | Latvia | Norway |

| Estonia | Lithuania | Singapore |

| Finland | Poland | Sweden |

| Japan | Slovak Republic | Switzerland |

| Luxembourg** | ||

| New Zealand | ||

| Slovenia | ||

| South Africa | ||

| United Kingdom | ||

| United States |

** Mining is considered as a commercial activity and therefore taxed on an ongoing basis.

Source: Responses to OECD's questionnaire to delegates.

Note: The above tax treatments are subject to change and accurate as of the publication of the OECD's 2020 Report on Overview of Treatments for Virtual Currencies.

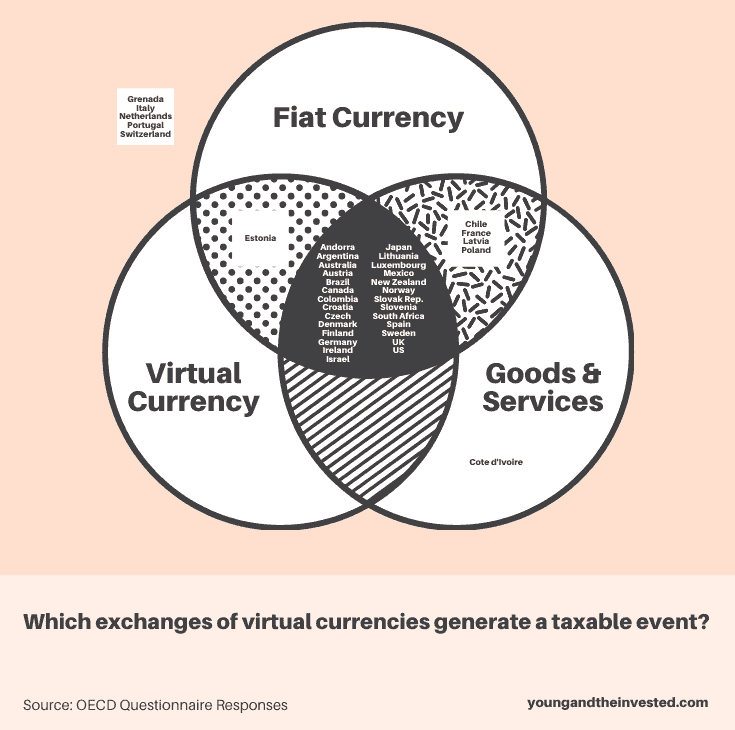

61. Depending on the type of exchange, you may or may not generate a taxable event

Seen in the chart below, you can see when each type of exchange counts as a taxable event by each country responding to the OECD’s questionnaire. (Source: OECD)10.

Cryptocurrency Crime Statistics

Opponents say that cryptocurrency is widely used in criminal activity such as money laundering and other financial crimes, among graver offenses. Yet, could cryptocurrency be really that nefarious? These crypto crime statistics can show us whether this is possible.

62. Cryptojacking, or the unauthorized use of machines to mine cryptocurrency without the owner’s knowledge, is quickly becoming a leading cyber threat. The value of global cryptocurrency theft in 2020 totaled $513 million, a significant increase from 2019’s $371 million. (Source: CipherTrace)22

63. Globally, cybercrimes involving cryptocurrencies racked up $1.9 billion in 2020 alone. (Source: CipherTrace)22

64. A study found that two hacking groups claimed responsibility for about 60% of all recorded crypto thefts, worth more than $1 billion. (Source: Insights)23

65. A study found that 270 accounts are responsible for 55% of all cryptocurrency money laundering. (Source: ChainAnalysis Insights)23

66. Relatedly, another report states that 50-80% of initial coin offerings (ICOs) were designed and created as fraudulent activities, but organizers realized their projects wouldn’t materialize. (Source: Satis Group)24

67. Another significant statistic that is often overlooked about cryptocurrency is the number of exit scams. A 2019 Ponzi scheme disguised as PlusToken netted $2.9 billion for the scammers. Likewise, in 2020, WoToken defrauded investors out of $1.1 billion. (Source: CipherTrace)22

68. 73% of the cryptocurrency crimes in 2020 are estimated to be fraud. (Source: CipherTrace)22

69. Meanwhile, 50% of all cryptocurrency thefts in 2020 came from hacks and frauds related to decentralized finance (DeFi). This amounted to $129 million. (Source: CipherTrace)22

70. Furthermore, around $41.2 million worth of Bitcoin transferred from the US to criminals in 2020. (Source: CipherTrace)22

71. In 2020, $3.5 billion were sent to Bitcoin wallets associated with criminal activity. (Source: CipherTrace)22

Hope for Cryptocurrencies

72. Despite cryptocurrency’s susceptibility to be used for money laundering, only 0.24% of all transactions are illegal. (Source: CoinTelegraph)25

73. By that volume, less than 0.5% of Bitcoin’s yearly transactions boil down to illicit activity. (Source: CipherTrace)22

74. Furthermore, crime involving cryptocurrencies dropped from $4.5 billion in 2019 to just $1.9 billion in 2020. This is attributed to the fact that more and more legitimate cryptocurrencies are emerging. (Source: CipherTrace)22

75. The average value acquired by crypto criminals in 2020 was 58% lower than in 2019. (Source: CipherTrace)22

76. One positive outcome from a hack is that the cryptocurrency exchange KuCoin was able to recover more than 80% of stolen funds from a $281-million-hack in 2020. (Source: CipherTrace)22

Cryptocurrency Statistics 2021, 2022 + 2023 Sources:

- Wikipedia (https://en.wikipedia.org/wiki/History_of_bitcoin)

- CoinMarketCap (https://coinmarketcap.com/)

- NY Times (https://www.nytimes.com/2021/03/09/business/dealbook/bitcoin-climate-change.html)

- Statista (https://www.statista.com/topics/4495/cryptocurrencies/)

- Pew Research (https://www.pewresearch.org/fact-tank/2021/11/11/16-of-americans-say-they-have-ever-invested-in-traded-or-used-cryptocurrency/)

- Digiconomist (https://digiconomist.net/bitcoin-energy-consumption)

- Consultancy (https://www.consultancy.uk/news/25975/global-market-size-of-digital-payments-industry-soares)

- Reuters (https://www.reuters.com/article/us-crypto-currencies-algos-insight/making-sense-of-chaos-algos-scour-social-media-for-clues-to-crypto-moves-idUSKCN1UC0HX)

- IRS (https://www.irs.gov/individuals/international-taxpayers/frequently-asked-questions-on-virtual-currency-transactions)

- OECD (https://www.oecd.org/tax/tax-policy/taxing-virtual-currencies-an-overview-of-tax-treatments-and-emerging-tax-policy-issues.pdf)

- Coin.Dance (https://coin.dance/stats/gender)

- Bitcoin (https://news.bitcoin.com/jp-morgan-sees-millennials-bitcoin-preference-over-gold-as-foundation-for-its-long-term-success/)

- BBC (https://www.bbc.com/news/technology-56012952)

- NY Times (https://www.nytimes.com/2016/11/19/business/dealbook/irs-is-seeking-tax-evaders-who-use-bitcoin.html?_r=0)

- CoinDesk (https://www.coindesk.com/policy/2021/03/18/kentucky-legislature-approves-bills-providing-incentives-for-crypto-miners/)

- Joule (https://www.cell.com/joule/fulltext/S2542-4351(19)30087-X)

- Nature (https://www.nature.com/articles/s41558-018-0321-8)

- Financial Times (https://www.ft.com/content/e4e8b571-c61c-499d-ad1b-f4bfb48e65c7)

- Journal of Accountancy (https://www.journalofaccountancy.com/issues/2018/mar/irs-summons-of-coinbase-records.html)

- Coinbase (https://www.coinbase.com/about)

- Wall Street Journal (https://www.wsj.com/articles/the-irs-sets-a-trap-for-cryptocurrency-tax-cheats-11601026202)

- CipherTrace (https://ciphertrace.com/2020-year-end-cryptocurrency-crime-and-anti-money-laundering-report/)

- ChainAnalysis Insights (https://blog.chainalysis.com/reports/crypto-crime-hacks/)

- Satis Group (https://research.bloomberg.com/pub/res/d28giW28tf6G7T_Wr77aU0gDgFQ)

- Cointelegraph (https://cointelegraph.com/news/debunking-the-myth-cryptocurrency-is-used-for-criminal-activity)