When someone close to us dies, one of the many things we have to deal with is dealing with their life insurance policy. Often, this means receiving a lump sum payout which can be a lot to handle emotionally and financially. It’s important to remember that this money is meant to help you in your time of need and should not be squandered.

That means first covering your pressing needs like funeral expenses, but also paying bills, shedding high cost debt and putting food on the table. From that point, it means looking into how to invest life insurance proceeds for long-term financial security.

Here are some tips on how to invest life insurance proceeds wisely for both short-term and long-term needs.

Table of Contents

What to Do With Life Insurance Money—Best Investment Picks

|

4.5

|

4.6

|

4.8

|

4.7

|

|

Minimum Investment: $500

|

To earn highest interest rate tier: $25k minimum (or $100/mo deposit)

|

Minimum Investment: $10

|

$99 for 1st year; $199 renewal

|

What is Best to Do With Life Insurance Payout Proceeds?

After receiving a life insurance payout, your top priority should be to ensure you are financially secure for the near future. If possible, that means becoming debt free. Set aside enough to cover your living expenses, other necessities, and create a fully-funded emergency fund.

Once you’ve established financial security, make the remaining money grow and work for you by investing it wisely. Life insurance policies don’t provide unlimited money, so you need to use the money they provide strategically.

Consider the following short-term needs before investing anything for the long-term.

1. Pay off outstanding debts

Pay off any high-interest debt you have, such as credit card debt. Eliminating your high-interest debt will save you money in the long run and prevent a significant amount of stress.

You don’t need to rush to pay off low-interest debt, like a mortgage. Mortgages and low-interest student loans are considered “good debt” while credit card debt and other personal loans are considered bad debt.

Even if you do well investing, bad debt can accumulate quicker than your investment gains. Low-interest debt can be paid off slower while you keep enough of your money liquid.

2. Cover living expenses (keep money to pay bills)

Make a list of all of your living expenses, including rent, utilities, phone plans, internet, food, gas, and more.

You need enough money to keep the lights on, so calculate how much money that takes and give yourself a bit of a buffer.

Look through old bank or credit card statements to remind yourself of any expenses you may be forgetting that occur less regularly but can dramatically impact your finances.

Set money aside for these expenses before spending any of it.

3. Build an emergency fund in an interest-bearing account

Depending on your financial situation and life circumstances, you’ll want to keep 3-6 (or more) months of living expenses in a savings account.

Sometimes, tragic events come in pairs or threes and you never know when you might need an unexpected car repair, have your hours reduced at work, or you develop a health issue.

Keep your emergency fund in an interest-bearing account (think high-yield savings account over checking account) so it can grow as it sits providing you peace of mind (and hopefully isn’t touched).

4. Spend on necessities

Don’t feel guilty spending death benefit funds on necessities, such as a roof or vehicle repair. If your shoes are falling apart, go ahead and buy a new pair.

Just don’t spend the life insurance money on luxuries, like a fancy watch, if you want it to last.

Money spent on a whim can deplete quickly, especially if you aren’t currently working and bringing in more of it.

5. Whatever’s left, consider investing

Once you’ve made ends meet and you’ve established a solid financial footing, consider investing the rest of the money so that it can increase your net worth and provide you a source of income for longer.

While we walk through the various options to invest money left to you through a life insurance death benefit, feel free to consult financial professionals like a financial planner.

We recommend a fee only financial planner if you’d prefer to go this route, because they get paid for their services, not by commission or how much you invest with them.

Featured Financial Products

How to Invest Your Life Insurance Benefit

Invest for Income

1. Bonds

Borrowers, such as companies or the government, issue bonds to raise money and fund their operations. The bond works as a loan from investors.

Investors make money from bonds in two ways:

- holding them until the maturity date and collecting interest payments

- selling them at a higher price to someone else before maturity (in addition to collecting interest payments along the way).

Companies send interest payments on bonds at regular intervals in predictable amounts if they have fixed rates.

While you want your life insurance proceeds to grow for your longer-term needs, holding bonds serves as a solid addition to investment portfolios for the income they provide.

Related: Best Stock Portfolio Tracking Apps

2. Dividend Stocks

Despite being associated with lower long-term returns than many other asset classes, dividend stocks still serve as a compelling option in some cases.

Dividends are regular cash payments issued to shareholders. When thinking of high-yield investments, these likely represent the most direct way to consider how an investment can put money back in your possession.

Because of this direct cash transfer, dividends also tell a lot about the risk profile of a stock.

When thinking about the risks involved with a stock that pays dividends (or not), consider some of these factors:

- The dividend should be far more consistent and declared in a similar (or growing amount) each quarter. Whether the stock goes up or down, the dividend comes to your brokerage account just the same. Even if your stock underperforms for a while, these dividends should give you something of value and make it easier to hold onto the stock during a market swoon or period of underperformance.

- Dividends tend to buffer significant falls in price, assuming economic circumstances don’t warrant cutting dividends. Also, dividend payments remain fixed in dollars per share terms, but dividend yields can rise when a stock’s price falls. That measure represents the amount of money you can expect to return based on the company’s current share price in a year. As a stock’s price falls, you’re paying less for that same dividend—assuming the company doesn’t cut it.

- Dividends represent stability to investors. Each period, the company needs to have a certain amount of cash go out the door to investors. This minimum level of cash flow going off the balance sheet means companies need to be less risky and plan for this ongoing cost as part of their corporate strategy.

As mentioned above, companies can—and some will—slash their dividends in times of economic uncertainty. While usually one of the last items for a company to cut, because it usually results in the stock plunging—people buy dividend stocks for their consistency.

When the company threatens that consistency, investors tend to sell in favor of other investment options.

Look for companies with a consistent history of dividend growth and high yields. Further, you want to monitor payout and debt to equity ratios.

Payout ratios represent the amount of dividends paid out in relation to a company’s net income.

As companies payout more of their net income in dividends, this represents a higher dividend payout ratio, but also a greater risk the company can’t continue reinvesting in its business.

When a company pays out 50% or less of their net income in dividends, this usually represents a safer dividend investment. Above this, it shows too much of the company’s earnings go toward paying a dividend to investors.

Debt-to-equity ratios show how much debt a company uses to fund its operations and ongoing investments. Lower debt-to-equity ratios represent lower risk companies, all things equal.

If a company fails to grow their income, the debt costs can eat an increasing share of their cash flow, limiting a company’s ability to grow or even survive.

Conservative investors tend to find more comfort in dividend stocks with good dividend growth, yields, payout ratios and debt-to-income scores because they have less risk tolerance and still get rewarded for their investment choices through regular dividend payments.

Related: How to Research Stocks Before You Buy [How to Pick Stocks]

3. Real Estate

Real estate can be an excellent way to create a passive income. Some people choose to buy properties to rent out to tenants. If you can afford to purchase and manage short-term or long-term rentals, it can be very profitable.

However, there are ways to receive money from real estate without such a substantial upfront cost and hassle as well.

You could invest in online real estate investments with companies such as Fundrise for non-accredited investors or YieldStreet for accredited investors.

These platforms allow you to invest in pieces of properties like apartments, commercial real estate, multi-family housing, and more that you couldn’t afford on your own. You receive money from dividends, property sales, or both.

An even simpler way to make money from real estate is by purchasing real estate investment trusts (REITs).

A REIT is a company that pools investors’ money to buy and manage real estate properties. Usually, these are commercial or high-end properties. You can buy REITs in standard brokerage accounts or through private offerings. Investors receive dividends for as long as they hold their REITs and can sell a REIT at any time, possibly even for more than they originally paid.

Another option is to buy real estate exchange-traded funds (ETFs). These funds invest the majority of their assets in equity REIT securities and are passively managed. Just like with REITs, you receive dividends while you hold the ETF and can sell whenever you want, typically for more money.

Note that for both types of investments, your dividends carry a variety of tax treatments, depending on the nature of the dividends paid.

REIT dividends can constitute three tax treatments:

- A tax-free return of capital

- ordinary income

- capital gain

Make sure you understand the tax implications of the passive income tax rates and rules that apply to REITs.

4. Alternative Investments

Sometimes, more “alternative” investments can have higher gains than standard investments.

Don’t make your entire investment portfolio consist of alternative investments, but owning some might help you if the stock market takes a downturn.

One of the first investments that may have come to your mind when you hear “alternative investments” might be cryptocurrency.

However, at this point, crypto’s gone mainstream enough that it may not feel very alternative anymore. Nearly 70 million people around the world use blockchain wallets. Today, it’s possible to trade cryptocurrencies on apps like Robinhood.

Another alternative investment growing in popularity is fine wine. According to the investment consultancy Knight Frank’s 2021 Wealth Report, fine wine appreciated 127% over the last decade.

Wine isn’t strongly correlated with the stock market and can be up even during a recession. Vint and Vinovest are two popular wine investing platforms.

Blue-chip art, peer-to-peer lending, and mineral rights are just a few other alternative investments to consider.

Featured Financial Products

Related: 11 Best Non-Stock Investments [Alternatives to the Stock Market]

5. Consider an Annuity

Annuities provide a guaranteed income stream, so you never have to worry about completely running out of money.

You can purchase annuities from an insurance company, bank, independent broker, or other established, reputable financial groups.

There are a variety of annuities to choose among. Some are bought by paying a lump sum, which you could easily do after receiving a death benefit. Others can be purchased through making a series of payments.

You have to decide if you want a fixed annuity with a consistent interest rate or a variable annuity where the return depends on the performance of the underlying investments.

Variable annuities have higher growth potential, but also carry more risk because you may not receive as much money.

Discuss annuity options with an insurance company, certified financial planner or other qualified financial professional to decide which type of annuity might be best for you.

While these can generate income and guaranteed payments, make sure to incorporate these as part of a broader financial planning effort and not as your entire investment strategy.

In some cases, you might consider a purchasing a permanent life insurance policy for its financial flexibility and ability to build a tax-advantaged cash value over time.

Related: Best Income-Generating Assets [Invest in Cash Flow]

Invest for Growth

Investing for growth means you buy investments that focus on capital appreciation. You don’t receive money until you sell the investment, but if you hold it long enough, you have the potential to make much more money than you spent.

If you were issued a lump sum payment from an insurance company, this might be a wise option for you. You can store your growth investments in taxable brokerage accounts and tax-advantaged accounts to build long-term wealth. Each type of account has its own set of advantages.

Retirement accounts are either tax-deferred, meaning you don’t have to pay taxes until later, or funded with post-tax money that grows tax-free. These tax benefits can save you a significant amount of money.

Taxable brokerage accounts, unlike retirement accounts, have no contribution limits. You can invest as much money as you want.

Additionally, money in taxable brokerage accounts is liquid. You can sell stocks, index funds, and other liquid investments at any time. When you withdraw cash from the sales, you don’t pay any early withdrawal penalties. Consider putting portions of your life insurance death benefit in both types of accounts to build long-term wealth. Below, read about three of the best growth investments to hold.

Related: Best Commission-Free Stock Trading Apps & Platforms

6. Growth Stocks

Investing is a way of setting aside money that will work for you so in the future, you can reap all the benefits from your hard work.

Perhaps said best by legendary investor Warren Buffett, investing is “…the process of laying out money now to receive more money in the future.”

Investing aims to put your money to work and grow it over time. Growth stocks take this to another level by seeking capital appreciation as their main investing goal.

Growth stocks belong to growth-oriented businesses, including industries such as technology, healthcare and consumer goods.

Growth companies traditionally work well for investors focused on the future potential of companies.

Growth companies focus on reinvestment and continuous innovation, which typically leads them to pay little to no dividends to stockholders, opting instead to put most or all its profits back into expanding its business.

Some popular growth companies include firms like Google, Apple and Tesla.

Despite constantly reinvesting in the business, growth stocks are not without risk. Companies can make poor decisions, markets overvalue stocks, and economic mishaps can derail companies with even the best prospects.

However, growth stocks as a whole tend to provide the best return on investment over time if you can tolerate the volatility that comes with them.

But, take risks cautiously. While growth companies have a higher probability of providing an excellent return when compared to other types of investments, you should balance how much risk you are willing to tolerate.

Some companies grow at breakneck speed but have valuations to match. Taking on too much risk can undermine a portfolio and tank returns.

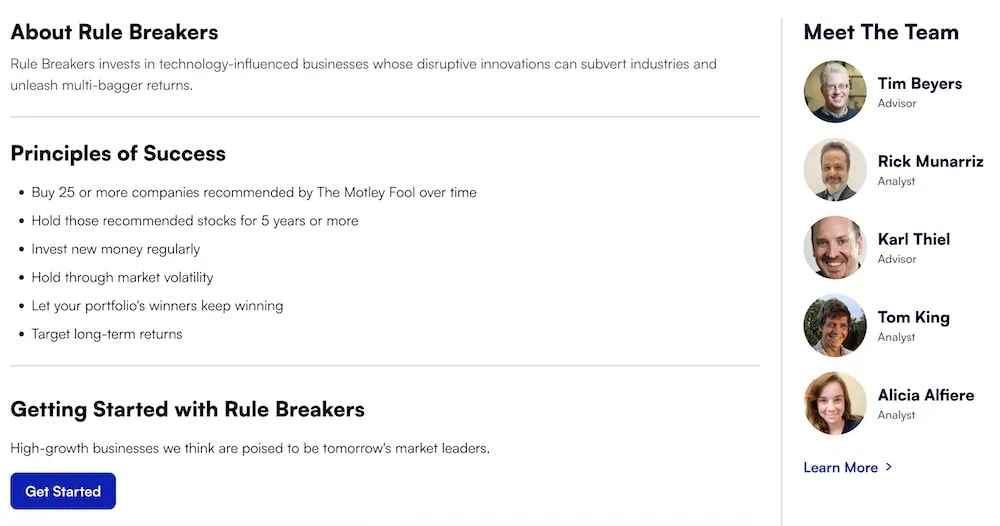

You might consider using an award-winning service like Motley Fool’s Rule Breakers (now part of Epic) to find high-growth stocks that have potential to outperform the market.

Take a look below at the details of this service and whether it might make a good addition to your investor toolkit.

Motley Fool Rule Breakers (Now Part of Epic): Best for Long-Term Investors Looking for Growth Stocks

- Available: Sign up here (must subscribe to Motley Fool Epic to get Rule Breakers)

- Best for: Investors who want growth-stock picks

- Price: Discounted price for the first year (shown below)

Motley Fool Rule Breakers, which is now an exclusive part of Motley Fool Epic, recommends stocks that the Rule Breakers team believes have massive growth potential. In some cases, these companies are at the forefront of emerging industries—in others, they’re disrupting the status quo in long-established industries.

This technology-centric portfolio isn’t about picking what’s popular now—it’s about looking for stocks that will eventually become the next big thing. That means these Motley Fool picks have the potential to be nauseatingly volatile … but also to rocket higher exponentially.

Rule Breakers’ team has six rules it follows before making stock recommendations to subscribers:

- Only invest in “top dog” companies in an emerging industry. As Motley Fool puts it: “It doesn’t matter if you’re the big player in floppy drives—the industry is falling apart.”

- The company must have a sustainable advantage.

- The company must have strong past price appreciation.

- The company needs to have strong and competent management.

- There must be strong consumer appeal.

- Financial media must overvalue the company.

In other words, Rule Breakers’ team considers a number of factors before it ever recommends a stock to its users. If it’s not a well-run company with a sustainable advantage over its competitors, and it’s not in an emerging industry, it probably won’t get past Rule Breakers’ velvet ropes.

What to expect from Motley Fool’s Rule Breakers

In addition to getting access to the whole Motley Fool Rule Breakers portfolio, you’ll receive one new stock pick every month (complete with full analysis and risk profile) and a ranking of the team’s 10 favorite picks out of Rule Breakers’ hundreds of recommendations.

And because you must subscribe to Epic to get Rule Breakers, you’ll also unlock:

- Stock Advisor: Buy-and-hold stock picks designed to deliver consistent performance with less volatility. You can also subscribe to Stock Advisor individually.

- Hidden Gems: Stocks of medium-to-large businesses, selected by Fool CEO and co-founder Tom Gardner for their “all-in, visionary leadership teams.”

- Dividend Investor: Fool analysts target companies that deliver above-average yields and dividend growth, with the hope of producing both competitive total returns and an income stream that should carry you through retirement.

- Fool IQ+: An upgraded version of Stock Advisor’s Fool IQ. This tool provides detailed financial data, analysis, and news about all publicly traded, U.S.-listed stocks, as well as advanced charting options.

- GamePlan+: An upgraded version of Stock Advisor’s GamePlan. GamePlan is a hub of financial planning content and tools; GamePlan+ delivers a wider array of articles and tools, as well as more in-depth coverage.

- Epic Opportunities: A members-only podcast from Motley Fool.

You can get Epic at a discounted rate for your first year, and it has a 30-day membership-fee-back period. If you’re interested in Rule Breakers, you can learn more in our Epic review or sign up for Epic today.

- Motley Fool Rule Breakers, which is now an exclusive part of Motley Fool Epic, puts investors in the heart of innovation, focusing on growth recommendations centered around emerging industries.

- The Motley Fool has discontinued the standalone Rule Breakers service. Now, you can access Rule Breakers as part of Motley Fool's Epic subscription, which also includes Stock Advisor, Hidden Gems, Dividend Investor.

- Through Epic, you will also enjoy access to the Fool IQ+ research and data platform, the GamePlan+ financial planning platform, and the Epic Opportunities podcast.

- Limited-Time Offer: Get your first year with the Epic for $299 (vs. $499 usual value)—a 40% discount for new members!—by clicking our link and using the EPICSALE coupon code.*

- Discounted introductory price

- Strong outperformance compared to the S&P 500

- High overall average return for stock picks

- Diversified array of recommendations for investors targeting growth, income, or both

- Additional value from GamePlan+ financial planning content and tools

- High-growth stocks carry volatility

- High renewal price

- Not every stock has positive returns

Related: 13 Best Stock & Investment Newsletters for Inbox Alpha

7. Steady Eddies (Blue Chips)

“Steady Eddie” investing focuses on blue-chip companies with consistent results and long-term growth.

They offer dependable, high-conviction investment opportunities you can rely on to hold steady even when the going gets tough.

These companies tend to perform well on account of having a strong economic moat, or competitive advantage, they’ve built for themselves in a mature business.

They can build a moat in many ways, such as offering unique products and services, owning a patent or novel technology, having a significant first-mover advantage in a market, or another compelling reason why this company will likely be around for years to come.

Steady Eddies also tend to be the largest companies, and thus not have high growth prospects. However, they often can do well in any economic environment.

To the point, these companies offer resiliency during market uncertainty and can rely on incredibly stable and recurring sources of revenues—offering investors a higher chance for realizing long records of positive returns and an investment that can stand the test of time.

If you’d like help with finding high-quality companies that provide steady returns over time, you might consider another service from Motley Fool called Stock Advisor.

Below, we talk more about the service, including the types of companies the stock picking service recommends and the returns they’ve achieved to date.

Motley Fool Stock Advisor: Best for Buy-and-Hold Investors

- Available: Sign up here

- Best for: Buy-and-hold growth investors

- Price: Discounted rate for the first year (shown below)

Motley Fool’s signature product, Stock Advisor, aims to provide investors with one thing: top picks for market-beating stocks from the site’s co-founders.

Stock Advisor is an online investment service that espouses my favorite, plain-vanilla trading style: buy-and-hold. Fool analysts provide recommendations for both “Steady Eddies” and potential high-flying stocks with sound fundamentals—an ideal combination of holdings if you want to generate strong performance without risking extremely high volatility.

Importantly, Stock Advisor doesn’t just give you a list of tickers and call it a day—it also provides investment rationales and research for each pick to help educate you before you buy.

And now, Stock Advisor membership provides access to Motley Fool GamePlan: a hub for retirement and financial planning content and tools to improve not just your portfolio, but your entire financial life. GamePlan outlines three portfolio strategies—Cautious, Moderate, and Aggressive—with picks for mutual funds, exchange-traded funds (ETFs), and stocks, including allocation recommendations. It also hosts a library of content about financial planning, including topics such as everyday finances, health and wellness, and estate planning. And it boasts tools including a variety of calculators, such as credit card interest and mortgage calculators.

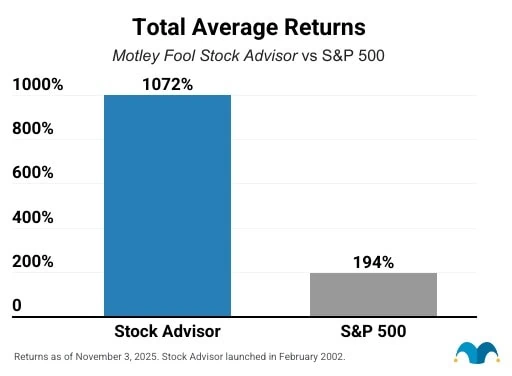

How has Motley Fool Stock Advisor performed?

Stock Advisor stock picks have performed exceptionally well over the service’s 22-year existence. The service has made 190 stock recommendations that have historically delivered 100%+ returns.

Overall, the Motley Fool Stock Advisor stock subscription service has more than quintupled the return of the S&P 500 since Stock Advisor’s inception in February 2002 through Nov. 3, 2025. This number is calculated by averaging the return of all stock recommendations it has made over the past 23 years.

What to expect from Motley Fool Stock Advisor

The Motley Fool Stock Advisor service provides a lot of worthwhile resources to members:

- “Foundational Stocks”: 10 stocks that can serve as the foundation of your portfolio, whether you’re a new investor or experienced

- Two new stock picks each month

- Monthly analyst rankings of the service’s top 10 stocks based on their potential to beat the market over a five-year span

- A list of all the service’s active picks, “hold” recommendations, and closed positions

- Recommendations for stock and fixed-income exchange-traded funds (ETFs) you can use to build a diversified portfolio core

- Access to the GamePlan financial planning hub

- Access to Fool IQ, which provides essential financial data and news summaries about all U.S.-listed publicly traded stocks

- Access to a community of investors engaged in outperforming the market and talking shop

The service charges a discounted rate for the first year and has a 30-day membership-fee-back period. Read more in our Motley Fool Stock Advisor review, or sign up for Stock Advisor today.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!

- Discounted introductory price

- Strong outperformance above S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Related: Best Stock Market Investing Research & Analysis Websites

8. Index Funds

Index funds follow a benchmark index, such as the S&P 500. Index funds are considered low risk because they are highly diversified.

You can usually get an S&P 500 index fund or another index for a low price and minimal fees. The expense ratio is low because the funds are passively managed.

You’re also saving money because index funds tend to be tax-efficient. Since index funds have a low turnover ratio, meaning account managers don’t buy in and out of investments often, they have greater tax-efficiency than actively managed funds.

The low turnover also means there aren’t often capital gains taxes for shareholders to pay.

Perhaps most importantly, index funds typically have high returns that beat most actively managed mutual funds. When choosing an index fund to invest in, make sure to compare expense ratios.

Featured Financial Products

Related: Best Stock Trading Apps for Beginners

Related Questions on How to Invest Life Insurance Proceeds

Do Beneficiaries Pay Taxes on Life Insurance Proceeds?

Typically, beneficiaries don’t have to pay taxes against the life insurance proceeds, or the death benefit, they receive.

Life insurance proceeds aren’t usually taxable, but any interest received is considered taxable income. However, there are a few exceptions.

If the insured individual holds a life insurance policy that pays cash dividends, the dividends don’t count as income on the taxpayer’s return.

Provided the amount received doesn’t exceed the net premiums paid on the policy, this passive income gets favorable tax treatment.

One of the exceptions occurs when life insurance ownership is transferred to another person for cash or other valuable consideration.

Meaning, if you buy or sell the life insurance contract, like any other time a sale occurs, taxes sneak in. They can apply under something the IRS calls the transfer-for-value rule.

When this happens, you can exclude the price you paid and any additional premiums you pay after the purchase.

For example, suppose you bought a $500,000 life insurance policy for $120,000. You paid $100,000 in premiums before the insured passed away and the death benefit was paid out.

You could then exclude the costs you already paid, meaning $120,000 + $100,000 = $220,000, from your income.

To make everything a bit trickier, this exception has exceptions of its own. The IRS Publication 525 has more details you can review to see if your life insurance death benefit situation would be taxed.

How Do You Live Off a Life Insurance Payout?

Even a high death benefit from a life insurance company can disappear quickly if you don’t manage the funds appropriately.

If you want to live off a death benefit, start by paying off high-interest debt because that will save you money long-term.

Once you have enough money set aside for bills, necessities, and a fully-funded emergency fund, invest the money so it can grow rather than keep depleting.

You might choose to focus on investing for income so you continuously receive dividend payments.

Alternatively, you could also invest for growth and buy assets known to grow in value. Later, you can sell these investments for a profit when you need more money.

Many people choose to do a combination of both. Basically, if you want to live off a death benefit, you need to make your money grow and work for you.

Related: How to Make Money in Stocks [Investing in the Stock Market]

Can You Put Life Insurance Proceeds Into an IRA?

Once life insurance companies pay a death benefit, the recipient can do anything they want with the money.

You can’t directly roll over the life insurance proceeds, however, you can use what you cash out.

But, remember, this money is usually tax-free and not earned income and you can’t contribute more to an individual retirement account (IRA) than you made each year.

Let’s say you and your partner were full-time workers. Money was tight, so you hadn’t maxed out your retirement accounts yet that year and you and your partner had top-notch life insurance policies.

After your partner passed away, you received a sizeable lump sum death benefit.

You could certainly use some of that money to max out an IRA as long as the amount doesn’t exceed the income you made that year.

The life insurance payout doesn’t constitute earned income, the only type of money you can place inside an IRA.

If you and your partner were married and filed jointly, you could contribute even if you didn’t work that year as long as the joint return showed enough earned income.

However, if you were unmarried and not working, the life insurance benefit isn’t earned income you could contribute.

Related: Best Investments for Roth IRA Accounts [Target High-Growth]

Is It Better to Take the Lump Sum Death Benefit for Life Insurance?

The vast majority of people choose to take the lump sum payout. Those who don’t can instead opt for a retained asset account.

Receiving a lump sum from the life insurance company allows you to quickly pay off any debt before more interest accumulates.

It also gives the life insurance beneficiary the possibility to invest the money that isn’t needed right away so it can grow.

Some people don’t trust themselves with substantial amounts of money from life insurance payouts while grieving. Others don’t trust themselves with significant amounts of money, period.

Anyone who eases pain with “retail therapy” might fare better having the death benefit paid out in a retained asset account.

Retained asset accounts are controlled by a life insurance company and work like checking accounts.

The life insurance death benefit in the account earns a low interest rate and you can withdraw money with the provided checkbook.

As long as you are careful with your money, the lump sum payout is the better option.

How Do I File a Claim With the Life Insurance Company for Life Insurance Proceeds?

You can’t receive your life insurance death benefits until you file a life insurance claim. Contact your agent or the life insurance company directly.

Many people keep life insurance policies in a home safe. If you can’t remember the name of the insurance company and can’t find the policy, check your bank statements.

When you contact the insurance agent, have them pull up your life insurance policy to verify you are listed as a beneficiary.

The insurance company can tell you where to find the claim form. You will need to fill out that form and send them a certified copy of the death certificate.

Be prepared to answer whether you want the money as a lump sum or kept in a retained asset account.

As long as there aren’t signs of fraud or other issues (for example, a term life insurance policy doesn’t cover death from self-inflicted wounds), you should receive payment from the life insurance coverage in a few days or weeks.

Featured Financial Products

Related: Best Brokerage Account Sign-Up Bonuses, Promotions and Deals

![10 Best Non-Stock Investments [Alternatives to the Stock Market] 51 best non-stock investments](https://youngandtheinvested.com/wp-content/uploads/best-non-stock-investments.jpg.webp)

![10 Investments That Earn a Great Return [10% or More] 52 investments that earn a 10% return](https://youngandtheinvested.com/wp-content/uploads/investments-that-earn-a-10-return.webp)