When people have money above their lifestyle needs (and wants) available for other uses, they can choose to invest for the opportunity to generate greater returns on their money. This money can compound with sufficient time in the market and result in significant returns as stock markets go higher.

However, not all stock market wealth comes from ordering your investment decisions in the flow of buying low and selling high. In fact, the opposite can also hold true: selling high and buying low, as is the case with short selling stocks.

This practice carries inherent and acute risk as you have made a bet on the company’s stock going down instead of up. In a short sale, your outcomes are bounded by two options:

- Finite gains (the stock can only go to $0)

- Infinite losses (stock price can go up endlessly)

Some investing platforms allow short selling stocks, bonds, index funds, and other assets, while some others do not. Two popular investing apps which have come onto the market in the past handful of years are Robinhood and Webull.

This post explores the ability to sell stocks short on these two Millennial-friendly investing apps (including whether you can short Robinhood stock on Robinhood and Webull) and how you go about doing it. Spoiler: Webull lets you short stocks while Robinhood does not.

Table of Contents

What is Short Selling?

When investors short sell, or “short” a stock, market, or other asset, they have made the bet that the asset price will decline.

When short selling, an investor uses a margin account to open a position by borrowing shares of a stock or other asset in which the investor holds conviction will decrease in value by a predetermined future date—the expiration date.

This is the date when the asset must be returned to the lender for the borrowed amount.

The investor will pay interest on this borrowed asset as compensation to the lender. The investor executes the trade by selling these borrowed shares at the current market price to investors willing to pay this price.

At this point, the investor faces the obligation to return those shares to the lender by the expiration date but also hopes to repurchase the same amount of shares for a lower value when returning them.

In effect, the investor has bet that the price will decline and will then have the ability to repurchase the asset at a lower price. Once repurchased for less, the investor returns the same amount to the lender for less, netting the difference as profit.

→ Short-Selling Example

Imagine a trader who believes that ABC stock—currently trading at $100—will decline in price in the next two months.

Perhaps identified using investment research software, the trader borrows 100 shares of ABC from a broker and sells them to another investor for $10,000 (100 shares * $100/share). The trader has now “shorted” or can be considered as “short” 100 shares of ABC.

This occurs because they sold the stock which they did not own but instead borrowed.

This short sale occurred as a result of borrowing the shares from the broker, something not always possible if many other traders also heavily short the stock, limiting the availability of shares to borrow and sell short.

After a month passes, ABC company reports poor financial results below market expectations, causing the stock to decline significantly in value to $80/share (a 20% decline).

The trader decides the time is right to “close the short position” by purchasing 100 shares of ABC for $80/share ($8,000 total) on the open market and then return the borrowed shares to the broker.

The trader made a $2,000 profit on the short sale (excluding commissions and related interest paid on the margin account). Specifically, $100/share – $80/share * 100 shares = $2,000 profit.

Conversely, if the trader made a poor bet and ABC reported better-than-expected results and the price jumped 20%, they would have lost money on the position.

Specifically, they would have lost $2,000 (not including commissions and interest). $100/share – $120/share * 100 shares = $2,000 loss.

Short selling is a highly speculative trading strategy as the risk of loss on a short sale is theoretically infinite because the price of any asset can climb to infinity.

On the other hand, short selling has a return asymmetry because the short-seller can only earn a finite gain as a result of the stock only having the ability to decline to $0.

For an easier illustration of how short selling works, have a look at the following short selling infographic.

Can You Short on Robinhood?

In the scenario described above under the generally-accepted definition of shorting stock, Robinhood does not allow this trading ability.

Shorting stocks on Robinhood is not possible at present, even with a Robinhood Gold membership, the premium subscriptions which allows Robinhood investors to use margin for leveraging returns. Instead, you must either use inverse ETFs or put options.

Instead, you should consider opening an account on Webull, a platform which allows short selling.

- Webull is a low-cost trading and investing app that allows you to invest in stocks, ETFs, options, and crypto, and participate in initial public offerings (IPOs). Webull has also expanded its U.S. offerings to include futures and commodities trading.

- Commission-free trades on stocks, ETFs, and options.

- Trading features include charting tools, technical indicators, customizable screeners, real-time stock alerts, and group orders.

- Let Webull manage your money for you with Webull Smart Advisor, which combines Webull's in-house investment expertise and artificial intelligence to build, manage, and rebalance an ETF portfolio for you.

- New users also get one free month of Nasdaq TotalView's Level 2 Quotes service. (That subscription costs $2.99/mo. thereafter.)

- Sign up for Webull Cash Management to earn a 5.0% APY without fees or minimums.

- Special offer: Open an account and deposit at least $500 to receive 20 free fractional shares, collectively worth between $60-$90,000.*

- Good selection of available investments

- Fractional shares

- Powerful technical analysis tools

- Offers robo-advisory services

- Accessible to beginning and intermediate users

- Voice commands

- Offers highly competitive APY through Webull Cash Management

- Does not support mutual funds

However, if you’d like to see alternative methods for profiting from a stock’s downfall on Robinhood, see the following section.

→ How to Short a Stock on Robinhood with Inverse ETFs

At present, the only methods for shorting stocks on Robinhood comes from use of inverse ETFs available on Robinhood or through option trading. Shorting on Robinhood would require these two trading strategies for benefiting on the decline in an asset’s price.

Some popular Robinhood inverse ETF options include:

Note that these two inverse index funds Robinhood has available come with higher average associated expense ratios and also invest with the goal of having the market indices they follow decline in value.

Further, the UltraPro Short QQQ index moves three times in magnitude inversely to the corresponding index (Nasdaq, or the normal index fund QQQ).

In other words, this inverse ETF would experience a 3% return (not including underlying expense ratio or tax consequences) if the Nasdaq Composite decreased by 1%.

Likewise, it would decrease by 3% if the Nasdaq Composite increased by 1%. Be mindful of this risk exposure with Robinhood short trading on inverse ETFs.

→ How to Buy Put Options on Robinhood

Another strategy is through the use of options trading, discussed here in more detail. In short, when betting on the decline in a stock’s price, you can sell call options or buy put options. More complex strategies exist and are beyond the scope of this article.

These time-sensitive securities provide the owner the right (though not the obligation) to sell a fixed number of shares of the underlying stock’s price at a pre-determined amount.

This price, known as the strike price, remains a price at which the holder can exercise the put option up until a specific date in the future.

Step 1. Select Your Stock Option

Once you find the security you’d like to short on Robinhood, click the “Trade” button and then the “Trade Options” button that appears. Below, I use Google shares (Alphabet) as an example.

Next, the app will take you to a screen displaying the available options (buying or selling calls or puts).

To profit on the decline in a stock’s price, you will need to buy put options or sell call options.

Step 2. Choose Maturity Date, Buy/Sell and Call/Put Designations

In this step, you will need to choose the intended maturity date you would like trade options on Robinhood. Because we want to short on the Robinhood app, we would need to buy a put option or sell a call option.

This example only contemplates buying a put option. Once selected, the screen will then show you the available put options for that maturity date as well as the most recent option and strike prices.

After selecting the date, you will need to choose whether you would like to buy or sell a call or put option. Sticking with buying puts, the app will also show you the current breakeven price for each put option.

This is the price in which the stock must fall for you to recover the premium you paid.

Step 3. Select Number of Contracts to Purchase

After running through the previous screen to select the specific put option for shorting the targeted stock, you will need to indicate how many contracts you intend to purchase (one contract represents 100 shares of the underlying stock) and the maximum price you would pay.

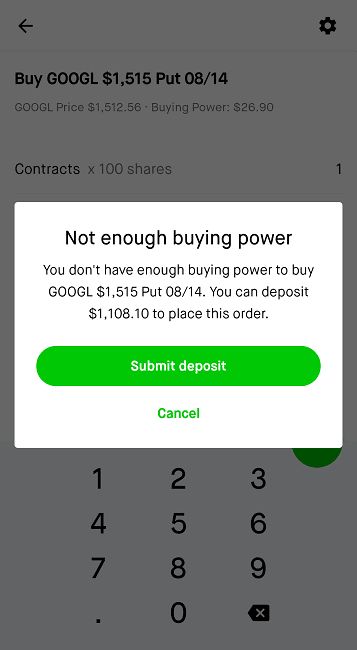

Robinhood then calculates your anticipated trade cost and asks you to review your decision before submitting. If you have insufficient funds in your account, you must make a deposit like the screen shown below.

Can You Short Sell on Webull?

Yes. Webull, unlike Robinhood, does allow traders the ability to short stocks. However, Webull has short selling restrictions and requirements traders must adhere to before shorting a stock on Webull. Primarily, Webull stipulates traders must:

- Have a margin account with Webull

- Maintain a net account value of $2,000 or greater

This Robinhood alternative also allows the same opportunities to profit from a security’s decline in value as Robinhood. You may purchase inverse ETFs on Webull or use various options strategies to capture value in the decline of an asset’s price.

How to Short a Stock on Webull

Once you meet the Webull short selling requirements above, you may proceed with shorting stock on Webull.

As a reminder (and in case you skipped the explanation above), when you place a short sell order on Webull, the company acts as an intermediary on your behalf to “borrow” the shares from another investor, opening your short position, and selling these borrowed shares into the market at the current price.

When you are ready to close your short position (or must because of a margin call), Webull then “buys back” those shares in the open market and returns them to the lender.

After closing your short position, you net the difference between the price at which you initially sold short the shares, and then at the price you re-purchased them in the market. If you sold at a higher price than you bought, this difference is your profit. If you sold for less than you bought, you realized a loss.

Below you will find the specific steps on how to short a stock on Webull.

- Step 1: Go to the “Watchlist” tab on the main screen

- Step 2: Lookup a stock and select it by tapping on it

- Step 3: Verify a purple, downward arrow icon appears on the top right of the individual stock page

- Step 4: If the icon appears, you can short sell this stock on Webull

- Step 5: Tap the “Trade” button on the bottom left

- Step 6: Select “Sell” as the order direction

- Step 7: Fill out all the required fields shown on this order submission screen

- Step 8: Submit the sell order and wait for it to be filled

- Step 9: If the order fills, go to the “Home” tab to see your order execution

- Step 10: The short position will be displayed in your “Position” section as a negative quantity

What are Webull’s Short Selling Fees?

When selling stock short on Webull, you will need to borrow the shares of a company’s stock before you can sell them. Therefore, the cost associated with a short sale on Webull is the borrowing fee paid for this company’s stock in a margin account.

The borrowed stock’s margin loan rate changes on a daily basis based on prevailing market conditions. This margin interest is a method for how Webull makes money.

Just as you would calculate interest on margin trading, the short selling fee on Webull calculates on a daily basis (and is charged monthly) according to the following formula:

Daily Margin Interest (Short Position) = (Daily Market Value of the Borrowed Stocks @ Market Close * Stock Loan Rate for That Stock) / 360 days

How to Open an Account on Webull

Now that you know Webull can be used for shorting stocks, consider opening an account with the best free stock trading app and following the stock shorting steps outlined above. You will receive free stocks with a nominal initial deposit.

Click the link below to begin your sign-up process and add funds to explore the world of short selling on Webull.

- Webull is a low-cost trading and investing app that allows you to invest in stocks, ETFs, options, and crypto, and participate in initial public offerings (IPOs). Webull has also expanded its U.S. offerings to include futures and commodities trading.

- Commission-free trades on stocks, ETFs, and options.

- Trading features include charting tools, technical indicators, customizable screeners, real-time stock alerts, and group orders.

- Let Webull manage your money for you with Webull Smart Advisor, which combines Webull's in-house investment expertise and artificial intelligence to build, manage, and rebalance an ETF portfolio for you.

- New users also get one free month of Nasdaq TotalView's Level 2 Quotes service. (That subscription costs $2.99/mo. thereafter.)

- Sign up for Webull Cash Management to earn a 5.0% APY without fees or minimums.

- Special offer: Open an account and deposit at least $500 to receive 20 free fractional shares, collectively worth between $60-$90,000.*

- Good selection of available investments

- Fractional shares

- Powerful technical analysis tools

- Offers robo-advisory services

- Accessible to beginning and intermediate users

- Voice commands

- Offers highly competitive APY through Webull Cash Management

- Does not support mutual funds

How is Short Selling Regulated?

The Financial Industry Regulatory Authority, Inc. (FINRA) enforces the rules and regulations around short-selling to ensure investors and broker-dealers adhere to required maintenance margins which must be followed for margin accounts.

Further, the New York Stock Exchange (NYSE) and Federal Reserve set and monitor minimum values for the amount of funding which must remain in margin accounts— known as maintenance margin.

In the event an investor’s account balance falls below the minimums required, the investor receives a margin call indicating more funds must be deposited or the position will be liquidated by the broker.

Pros and Cons of Short Selling

As mentioned above, selling short can result in a costly decision if the trader makes a wrong bet on the direction a stock will trade. In the inverse scenario, when a trader buys a stock, the maximum loss comes to 100% of the capital put at-risk as the stock price moves to $0.

However, when a trader shorts a stock, the potential loss can result in something more than capital initially invested. Because no ceiling exists for a stock’s price, the losses realized can be limitless.

In the event of a short squeeze, or when a heavily shorted stock moves sharply higher, usually in response to a positive development in the company’s financial circumstances.

This news can force short sellers to close their positions rapidly, adding to a significant amount of upward pressure (hence the name, short “squeeze”) on the stock’s price. In turn, this quick movement “squeezes” short sellers out of their positions.

Further compounding the pain is the interest paid on the borrowed stock in the trader’s margin account. Even in a situation where the trader profited from the shorted stock’s price decline, the overall profit would still reflect the cost of margin interest.

Short-Selling Pros

- Potential for high profits on little (relative) capital investment

- Leveraged investments possible

- Hedge against other holdings

Short-Selling Cons

- Potentially unlimited losses

- Margin account necessary

- Margin interest incurred

- Short squeezes

As another added complication for short selling stocks, when it comes time to close a short position, finding enough shares to cover, or buy to close, can become difficult.

This usually occurs when numerous short sellers look for stock to buy and close their positions at the same time, as is the case of a short squeeze described above.

Conversely, short selling can offer the prospect of a high risk, high reward scenario in a market defined by downward movement.

If the short seller can correctly predict the movement of a stock to the downside and make the appropriate short sales to capture this belief, they can earn a good return, especially considering margin lending allows for more capital to be used than the initial margin contribution in the account.

Using margin provides leverage, meaning the trader did not need as much capital to realize the same gain.

Short Selling as a Hedging Strategy

When most people think about short selling, they often equate this with pure speculation, or investing in stocks, property, or other ventures with the hope of gain but with the risk of loss.

While certainly true in many cases, many people also pursue short selling for another useful purpose: hedging, or the act of taking an inverse position to offset the risk of loss.

Investors wish to manage risk and often employ hedging strategies to mitigate portfolio volatility, sometimes through short selling. Hedging primarily aims to protect portfolios as opposed to pure profit motive seen in speculation.

Because hedging can come with significant costs, many retail investors do not consider it during normal times.

However, for the more engaged investors who understand what hedging (e.g., short-selling, using options, or buying inverse ETFs) can do for a portfolio in the long-term, they have a keen eye on building wealth and protecting it.

Investors can preserve their wealth through use of hedging, especially alongside these best investments for young adults:

- contributing to tax-advantaged investments,

- building passive income through income-producing assets,

- investing in index funds and

- diversifying into alternative investment options

With respect to the costs of pursuing a hedging strategy, investors face two primary costs:

- Transactions costs of putting a hedge into place. This includes expenses associated with short sales (e.g., margin) or, in the case of options, the premiums paid for protective options contracts.

- Opportunity cost of portfolio. If the market moves higher (or counter to your underlying position), by hedging your portfolio, you have effectively capped your portfolio’s upside.

To illustrate the opportunity cost faced by using a hedging strategy, let’s consider a straight-forward example involving the purchase of a hedging product against the S&P 500 index. As a result of the hedge, an investor’s portfolio now only moves with a 50% correlation to the S&P 500 (Beta = 0.5).

This hedge now reduces volatility but also caps upside (and downside potential). This strategy would result in half the movement of the S&P 500 to the upside or downside, or, as an example a 10% increase in the S&P 500 would result in a 5% increase in the portfolio’s value and vice versa.

Short-Selling Serves Many Purposes

If you use short-selling to hedge positions or purely to speculate, use it wisely. The ultimate goal should inevitably include building wealth for the long-term.

As mentioned above, consider using this strategy as part of a broader effort to build and preserve your net worth. Pair this with the best stock analysis tools.

Depending on your preferences and investing objectives, both Robinhood and Webull offer the ability to take inverse positions or outright short-sell. The former only offers inverse ETFs and options strategies whereas Webull offers a more complete suite of shorting options.

Getting started on either platform poses little challenge and setting up accounts costs you nothing. Neither service charges commissions nor maintenance fees and both offer you a free share of stock to get started.

Further, you can use both as micro-investing apps to get started slowly with small amounts of money.

Both allow swing trading and can allow day trading after meeting certain conditions.

It can be unnerving to short sell if you are not already an experienced investor. Beginner investing apps don’t allow novice investors to short sell without demonstrating market knowledge developed from formal education, work experience, following stock news and more.

Just make sure only to invest money you can spare. Also, make sure to do your stock research and analysis before making any investment decisions.

When you put the initial work in upfront, your money will start to work for you down the road and grow your net worth, another important factor in reaching financial independence.