If you want to beat the market, then you’re looking for “alpha.” And a batch of stock research and analysis software platforms are designed to help you get just that.

Alpha is the measure of your active return on an investment compared to a market index or benchmark designed to represent the market’s movement as a whole. For example. You might compare the performance of an investment to how the S&P 500 performed during the same time. That excess performance is the alpha.

“Capturing alpha” refers to consistently doing better than the average stock trader and making more money in the stock market than statisticians would expect you could achieve. I emphasize “consistently” because you might get lucky with one stock performing better than people anticipated, but to do this consistently takes more than luck. It requires extensive knowledge of current stock market trends and a mastery of how to invest money wisely.

That’s exactly what the best stock market research and analysis apps, tools, and software are designed to help you achieve. While each platform differs, they generally provide a mix of data and news on all sorts of asset classes—typically stocks, mutual funds, and exchange-traded funds (ETFs), but sometimes other investments such as foreign exchange (forex), cryptocurrency, and stock options.

Read on, then, as we shine a light on the best stock research and analysis platforms, including apps, desktop software, and multiplatform tools.

Best Stock Research Apps, Tools, and Software—Our Top Picks

|

4.8

|

4.7

|

4.3

|

4.7

|

|

Premium: 7-day free trial, then $239/yr. ($60 discount)* Pro: $1,920/yr. ($480 discount)**

|

$99 for 1st year; $199 renewal

|

$399/yr. ($100 discount)*

|

$299 for 1st year; $499 renewal

|

1. Seeking Alpha (Best for Investment Research + Stock Recommendations)

- Available: Sign up for Premium | Sign up for Pro

- Best for: Investment research, stock recommendations

Seeking Alpha Premium and Seeking Alpha Pro are all-in-one investing research and recommendation services that offer insightful analysis of financial and business news, stocks, and more—all designed to help you make better investing decisions.

Premium best caters to the needs of beginner and intermediate investors looking for an affordable but all-inclusive one-stop research-and-picks stop.

Seeking Alpha Premium gives you unlimited access to thousands of active authors who deliver stock analysis, which is vetted by in-house editors before they’re read and discussed by millions of users. Seeking Alpha also provides you with stock research tools, real-time news updates, crowdsourced debates, and market data. Users can create their own portfolio of favorite stocks, see how they perform, and receive email alerts or push notifications about their investments.

Pro, meanwhile, is an even more powerful stock subscription service that includes everything in Premium, as well as numerous other sources of stock ideas and investor tools.

What do I get from Seeking Alpha Premium?

A Seeking Alpha Premium subscription can help you manage your portfolio with a large investing community so you can better understand the stock market and manage your financial life.

Whether you’re looking to invest on the go or dedicate time for more in-depth research and analysis, Seeking Alpha Premium provides a wealth of features that meet your needs:

- Unlimited access to expert investor content

- Seeking Alpha Quant Ratings (including S&P 500-beating “Strong Buy”-rated stocks)

- ETF and stock screeners

- A portfolio “health check”

- Earnings calls transcripts

- 10 years’ worth of financial statements

- The ability to compare stocks side-by-side with peers

- Access to dividend and earnings forecasts

- And much, much more

In addition to being able to read anything published on Seeking Alpha, you’ll also see authors’ ratings. That lets you know when you’re reading a piece written by someone with top marks or a poor track record.

How has Seeking Alpha Premium performed?

Among other things, a Seeking Alpha Premium subscription provides access to the service’s Stock Quant Ratings. The Quant Ratings involve an evaluation of each stock based on data such as financial statements, price performance, and analysts’ estimates of future profits and sales. All told, SA looks at 100 metrics for each stock, uses those metrics to compare it to all other stocks in the sector, then assigns ratings and associated scores. It also provides letter grades for five factors (value, growth, profitability, momentum, and earnings-per-share revisions).

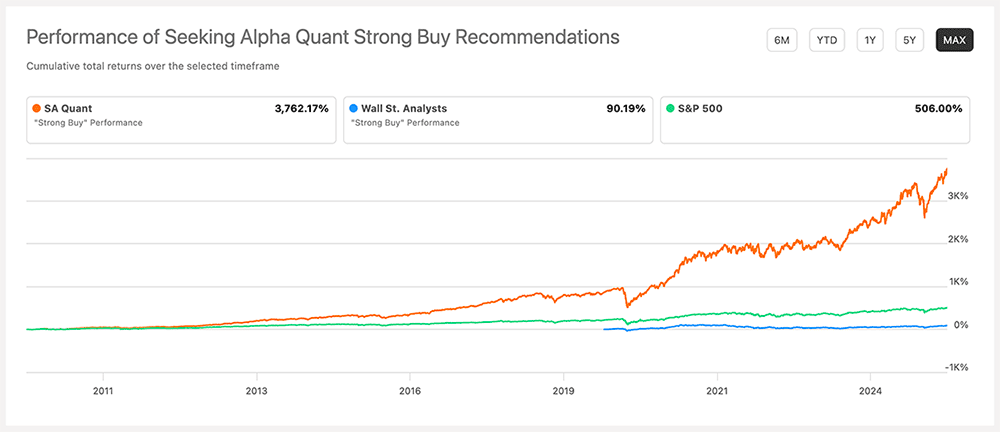

Have a look at the dramatic market outperformance seen by Seeking Alpha’s Quant “Strong Buy” recommendations compared to the S&P 500, as well as to stocks that enjoy “Strong Buy” ratings from Wall Street analysts:

What is Seeking Alpha Pro?

A Seeking Alpha Pro subscription comes with all the features of Seeking Alpha Premium, as well as additional features including:

- Instant access to investment ideas from Seeking Alpha’s top 15 analysts

- The PRO Quant Portfolio for active traders (delivers new high-conviction ideas weekly)

- Exclusive coverage of stocks that have no Wall Street analyst coverage

- Short-selling ideas from SA analysts

- Easy, real-time access to the day’s upgrades and downgrades

The Pro Plan, as the features indicate, targets more advanced and professional investors. Premium is a better fit for most investors (and it’s much less expensive, too).

Why subscribe to Seeking Alpha?

You can read more in our Seeking Alpha review, but in short: Seeking Alpha distills down the relevant financial information for you, so you don’t have to—making it easy for anyone interested in self-directed investments to have a chance at outperforming the market.

Want to try it out? If you use our exclusive links, you can enjoy a free seven-day trial and a discount on your first year’s subscription when you sign up for Premium, or a discount on your first year’s subscription when you sign up for Pro.

- Seeking Alpha Premium and Pro help you find profitable investing ideas, improve your portfolio, research stocks better and faster, track the news to find investing opportunities, and connects you to the world's largest investing community.

- A Premium subscription provides access to Seeking Alpha's stock and ETF ratings, including Seeking Alpha Quant Strong Buy recommendations, which have greatly outperformed the stock market over time.

- Premium also gives you access to Seeking Alpha's portfolio health check, which will analyze your portfolio's quality, risk level, and performance.

- Advanced and professional investors can sign up for Pro, where they'll get everything from Premium, as well as instant access to ideas from SA's top 15 analysts, the PRO Quant Portfolio (for active traders), short-selling ideas, and more.

- Black Friday deal on Premium: New subscribers through our link receive a $60 discount off the price of Seeking Alpha Premium in their first year.*

- Black Friday deal on Pro: New subscribers through our link receive a $480 discount off the price of Seeking Alpha Pro in their first year.**

- Active community of engaged investors and analysts

- Stock screeners, quantitative tools for stock analysis

- Strong track record of market outperformance on stock ratings

- Minimal mutual fund coverage

Related: Best Seeking Alpha Alternatives to Consider

2. Motley Fool Stock Advisor (Best for Buy-and-Hold Investors)

- Available: Sign up here

- Best for: Buy-and-hold growth investors

Motley Fool’s signature product, Stock Advisor, aims to provide investors with one thing: top picks for market-beating stocks from the site’s co-founders.

Stock Advisor is an online investment service that espouses my favorite, plain-vanilla trading style: buy-and-hold. Fool analysts provide recommendations for both “Steady Eddies” and potential high-flying stocks with sound fundamentals—an ideal combination of holdings if you want to generate strong performance without risking extremely high volatility.

Importantly, Stock Advisor doesn’t just give you a list of tickers and call it a day—it also provides investment rationales and research for each pick to help educate you before you buy.

And now, Stock Advisor membership provides access to Motley Fool GamePlan: a hub for retirement and financial planning content and tools to improve not just your portfolio, but your entire financial life. GamePlan outlines three portfolio strategies—Cautious, Moderate, and Aggressive—with picks for mutual funds, exchange-traded funds (ETFs), and stocks, including allocation recommendations. It also hosts a library of content about financial planning, including topics such as everyday finances, health and wellness, and estate planning. And it boasts tools including a variety of calculators, such as credit card interest and mortgage calculators.

How has Motley Fool Stock Advisor performed?

Stock Advisor stock picks have performed exceptionally well over the service’s 22-year existence. The service has made 190 stock recommendations that have historically delivered 100%+ returns.

Overall, the Motley Fool Stock Advisor stock subscription service has returned 740% through July 24, 2024, since its inception in February 2002. This number is calculated by averaging the return of all stock recommendations it has made over the past 22 years. Comparatively, the S&P 500 Index has returned 163% over that same time frame.

What to expect from Motley Fool Stock Advisor

The Motley Fool Stock Advisor service provides a lot of worthwhile resources to members:

- “Foundational Stocks”: 10 stocks that can serve as the foundation of your portfolio, whether you’re a new investor or experienced

- Two new stock picks each month

- Monthly analyst rankings of the service’s top 10 stocks based on their potential to beat the market over a five-year span

- A list of all the service’s active picks, “hold” recommendations, and closed positions

- Recommendations for stock and fixed-income exchange-traded funds (ETFs) you can use to build a diversified portfolio core

- Access to the GamePlan financial planning hub

- Access to Fool IQ, which provides essential financial data and news summaries about all U.S.-listed publicly traded stocks

- Access to a community of investors engaged in outperforming the market and talking shop

The service charges a discounted rate for the first year and has a 30-day membership-fee-back period. Read more in our Motley Fool Stock Advisor review, or sign up for Stock Advisor today.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!

- Discounted introductory price

- Strong outperformance above S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Related: Best Brokerage Account Sign-Up Bonuses, Promotions and Deals

3. Motley Fool Epic (Best Multi-Strategy Stock Picking Service)

- Available: Sign up here

- Best for: Buy-and-holders looking for stock recommendations

Motley Fool Epic isn’t itself a stock-picking service—instead, it’s a bundled selection of four popular Motley Fool stock recommendation products, three of which you can only enjoy by becoming an Epic member:

- Stock Advisor: Buy-and-hold stock picks designed to deliver consistent performance with less volatility. Stock Advisor is the only one of these services you can subscribe to individually. (See our Stock Advisor review.)

- Rule Breakers: Stocks that have massive growth potential, whether they’re at the forefront of emerging industries or disrupting the status quo in long-established businesses. (See our Rule Breakers review.)

- Hidden Gems: Stocks of medium-to-large businesses, selected by Fool CEO and co-founder Tom Gardner for their “all-in, visionary leadership teams.” More so than the other services, Hidden Gems is mindful of macroeconomic and market environments—and how they might dictate how aggressively you should invest.

- Dividend Investor: This recommendation service revolves around producing equity income. Fool analysts target companies that deliver above-average yields and dividend growth, with the hope of producing both competitive total returns and an income stream that should carry you through retirement.

Epic members will get five new picks per month across the various services, can access all active recommendations, and also view Cautious, Moderate, and Aggressive strategies including specific stock allocations.

But Epic is more than just a pile of recommendation services. Among other features, an Epic membership also unlocks access to …

- Fool IQ+: Fool IQ, which comes with Stock Advisor, provides essential financial data and news summaries about all U.S.-listed publicly traded stocks. With Epic, you get Fool IQ+, which includes all the features in Fool IQ, as well as a much wider variety of financial analysis data (earnings coverage, insider trading data, analyst opinions, and more) and advanced charting options.

- GamePlan+: GamePlan, which comes with Stock Advisor, is a hub of financial planning content and tools. GamePlan+, which you get through Epic, delivers a wider array of articles and tools, as well as more in-depth coverage.

- Epic Opportunities: A members-only podcast.

You can learn more by reading our Epic review, or sign up today at Motley Fool.

- Motley Fool's Epic is a discounted combination of four foundational stock-investing services rolled up into one membership.

- Get access to more than 300 recommendations, reports, and analyses across the Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor services.

- Get at least five new stock recommendations every month,

- Membership also unlocks GamePlan+ financial planning content and tools, Fool IQ+ stock research tool, a members-only podcast, and more.

- Limited-Time Offer: Get your first year with the Epic for $299 (vs. $499 usual value)—a 40% discount for new members!—by clicking our link and using the EPICSALE coupon code.*

- Discounted introductory price

- Strong outperformance compared to the S&P 500

- High overall average return for stock picks

- Diversified array of recommendations for investors targeting growth, income, or both

- Additional value from GamePlan financial planning content and tools

- High renewal price

- Not every stock is a winner

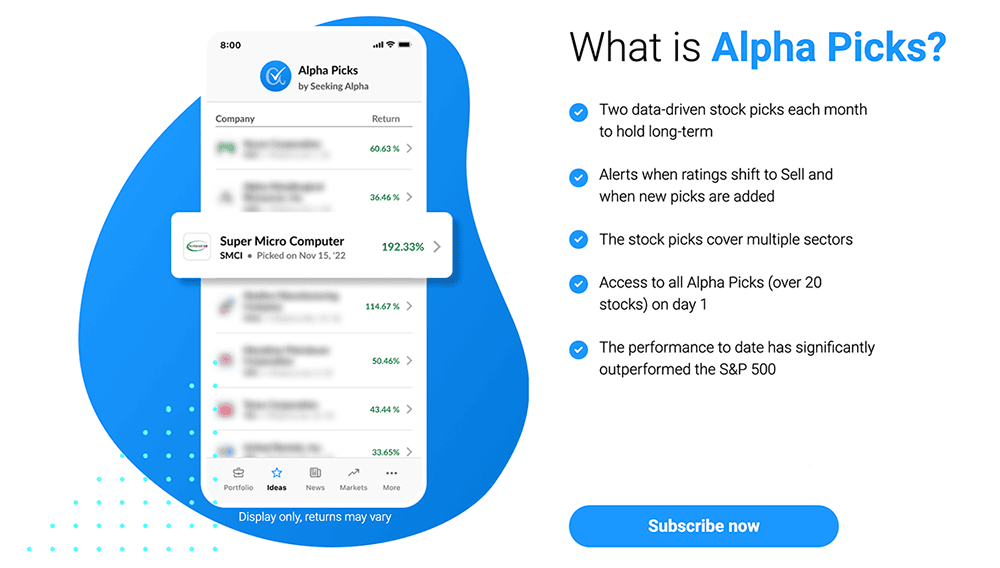

4. Seeking Alpha’s Alpha Picks (Best Data-Driven Stock Recommendation Service)

- Available: Sign up here

- Best for: Buy-and-holders looking for stock recommendations

Are you looking for a way to beat the market consistently? Seeking Alpha’s Alpha Picks might be a great option to consider.

Alpha Picks is a stock selection service that provides you with two of the best stock picks each month that SA determines have the greatest chance for price upside. They base their selections on fundamentals such as valuation, growth, profitability, and momentum—not hype.

The stock selection process relies on Seeking Alpha’s proprietary, data-driven computer Seeking Alpha Quant scoring system (available to Premium and Pro users) to screen and recommend stocks for more conservative “buy-and-hold” investors, but with a bit of modification. Namely, all recommendations must meet the following criteria:

- Hold a Strong Buy Quant rating for a minimum of 75 days

- Market cap greater than $500 million

- Stock price greater than $10

- Is a publicly traded common stock (no American Depository Receipts [ADRs])

- Be the highest-rated stock at the time of selection that has not been previously recommended within the past year (Alpha Picks releases one pick at the start of the month, another in the middle).

So far, so good: Since the service’s launch on July 1, 2022, Alpha Picks has outperformed the S&P 500 by 170 percentage points.

If you sign up for the service, you can expect the following:

- Access to all Alpha Picks on Day 1

- Two new long-term stock picks to buy and hold delivered every month

- Detailed explanations from Seeking Alpha behind why they rate each stock pick so highly

- Notifications when new picks are added, and when a recommendation changes to Sell

- Regular updates on current Buy recommendations

This service is designed for busy professionals interested in building a portfolio that outpaces the market but without the time to commit to finding these opportunities. If you’re interested, you can use our exclusive link to sign up for a discounted first-year price.

- Seeking Alpha's Alpha Picks is a stock picking service designed for busy professionals who might not have the time needed to select stocks for their own portfolio.

- Using a proprietary computer-scoring model, Alpha Picks makes "buy-and-hold" picks that last at least two years.

- Since its launch in 2022, Alpha Picks has delivered market-beating performance, with a remarkable 180% increase compared to the S&P 500's 61%.

- Rigorous backtesting also has shown Alpha Picks' methodology would have strongly outperformed the S&P 500 index between 2010 and 2022 (+470% vs. +290%).

- Special offer: Receive $100 off the first year's subscription price by signing up via our link.*

- Data-driven, computer-generated stock selection process

- Avoids human bias

- Strong backtest performance vs. S&P 500 index

- Competitive price point

- Not enough actual performance data

- No frills, just stock picks and info about them

Related: Best Stock Investment Newsletters

5. Benzinga Pro (Best for Fast, Actionable Market News and Research)

- Available: Sign up here

- Best for: Fast market news and research

Benzinga Pro provides fast, actionable market news and stock research to investors of all kinds, from buy-and-holders to swing and day traders.

The service specializes in providing breaking news on publicly traded companies. Benzinga’s Newsfeed covers all sectors, analyst ratings changes and SEC filings from companies. You can customize these news feeds based on watchlists you create within the platform.

Benzinga’s Newsfeed covers all sectors, analyst ratings changes and SEC filings from companies. You can customize these news feeds based on watchlists you create within the platform.

Other notable Benzinga Pro features include:

- Audio Squawk: A team calls out actionable news during premarket all the way through after-hours trading.

- Insider Trading Tracker: What are corporate insiders (company officers, big stakeholders and other important people) doing? Are they buying? Are they selling? How much do they own? This tool helps you learn more about insiders’ “skin in the game.”

- Stock Scanner: Get real-time, customized updates on the stock market.

- Charting: You can chart stocks within the Benzinga Pro platform, which uses a TradingView developer API (application programming interface).

- Calendar: Get dates for earnings reports, dividends, economic data releases, initial public offerings (IPOs), SEC filings, and more.

- Sign up for Benzinga Pro today and put the fastest real-time news feed, profitable trading ideas, and exclusive content right at your fingertips.

- Benzinga Pro is built for traders and investors to receive actionable market news and research in real time.

- Get exclusive news about earnings, mergers and acquisitions, drug trials, and more.

- Enjoy tools like Benzinga's real-time stock scanner, signals (which includes alerts for events such as price spikes and block trades), and calendar (with dates for events such as earnings reports, dividends, and IPOs), and more.

- Enjoy the experience of professional day traders, who share their real trades throughout each trading session.

Related: Best Day Trading Software, Platforms and Apps

6. Morningstar (Best Research Tools for Fund Investors)

- Available: Sign up here

- Price: Free 7-day trial. Then $34.95/mo., or $199/yr. (53% savings vs. monthly) when you sign up through our link.*

Morningstar Investor is a rich platform of investment research tools designed for the buy-and-hold crowd, and it plugs investors into one of the world’s foremost sources for mutual fund and ETF data and analysis.

Morningstar’s ratings are among the service’s most revered features. The original Star Rating—which measures a fund’s risk-adjusted past returns—has been around since 1985 and helped steer countless investors toward cheaper, better-constructed mutual funds and ETFs. But Morningstar doesn’t just look to the past. Its forward-looking Medalist Ratings use traits such as a fund’s parent organization, the managers responsible for making decisions, and fund strategies to determine a fund’s ability to outperform over the long term. You must be a Morningstar Investor subscriber to access Medalist Ratings.

Morningstar also provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

Stock owners shouldn’t feel left out—Morningstar also provides everything you need for stock research, including equity data, corporate financials, analysis, and even Star Ratings of publicly traded companies.

With Morningstar Investor, you can also:

- Seamlessly and securely link your external accounts to get a holistic view of your assets from one simple dashboard

- Use Morningstar Portfolio X-Ray®, which evaluates what you hold from numerous angles—asset allocation, stock sector, valuation, fees, and more—and can identify any overlaps between accounts that might impact just how diversified you are (or aren’t!)

- Set up stock and fund watchlists

- Enjoy stock news and commentary that’s tailored to your holdings

- Screen for securities that match your investing goals using a variety of performance and valuation metrics

- Follow Morningstar authors so you can check out their latest articles, videos, and podcasts as soon as they’re posted

Not sure if Morningstar Investor is right for you? Try it out with a free seven-day trial. You can check out the current deal, as well as discounted rates for students and teachers, in our details box below.

- Morningstar Investor offers expert research, investing analysis, and advisor-grade portfolio management tools that are tailor-made for buy-and-hold investors.

- Morningstar is one of the most prized sources of mutual fund and exchange-traded fund (ETF) data in the world.

- How does your portfolio stack up? Put it through Morningstar's Portfolio X-Ray, which will provide insights such as whether you have too many overlapping holdings or whether you're paying too much in fees.

- Special Offer 1: Click our sign-up link to receive $50 off your first year of Morningstar Investor. (Annual plan only.)

- Special Offer 2: Students receive one year of Morningstar Investor access for just $25!

- Special Offer 3: Teachers receive a 60% discount on Morningstar Investor access.

- Top-flight fund research and analysis

- Portfolio management tool

- Powerful screener

- Watchlists

- Tailored news and commentary

- Below-average charting

- High monthly billing rate

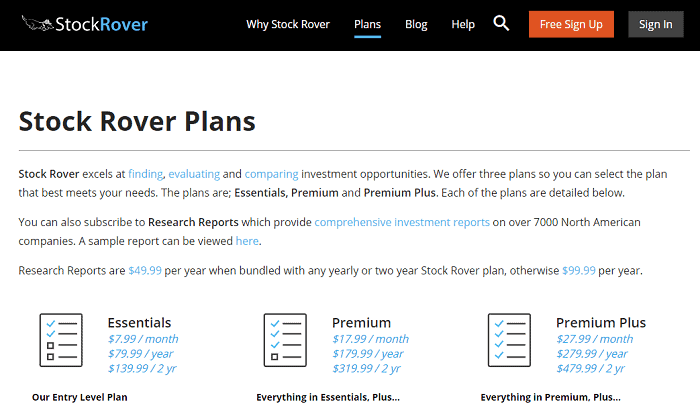

7. Stock Rover

- Available: Sign up here

- Best for: Proprietary research scoring, read-only data feed of your portfolio holdings

Stock Rover is more appropriate for self-directed investors who want to discover their own opportunities and manage their own portfolios.

The service allows you to create real-time research reports that provide a full fundamental and technical overview of a company’s performance. Stock Rover also provides comprehensive ticker, index, portfolio, and watchlist alerts; a real-time stock screener; and robust charting capabilities.

Stock Rover also is a powerful portfolio tracker, offering brokerage integration, detailed performance information, emailed performance reports, in-depth portfolio analysis tools, correlation tools, trade planning and re-balancing facilities.

This service works as a web-based applet and offers a number of useful services and applications, depending on your research and analysis needs.

One of the best features of the web-based app is Stock Rover’s “Brokerage Connect.” This provides you with a read-only data feed of your portfolio holdings. This shows you a comprehensive view of your portfolios, whether they’re in one brokerage account or spread across numerous investment accounts. This view makes Stock Rover one of the best stock tracking and portfolio management apps.

After syncing your brokerage accounts to Stock Rover, details for each portfolio get populated in your Stock Rover dashboard for in-depth analytics and tracking purposes.

Consider signing up for Stock Rover with a free 14-day trial. From there, you can decide if you’d like to upgrade to the service’s premium plans for more robust tracking and analysis.

- Stock Rover is a complete service for investors looking to use screeners, investment comparisons, real-time research reports, model portfolios, charts and more.

- Use this top-rated investment analytics service to identify stocks worth buying and outperforming the market.

- Create an account for free, and you can start a 14-day Premium trial subscription with no credit card needed.

- Hundreds of screening metrics

- Proprietary scoring systems

- Real-time executive summary research reports

- No mobile app

- No crypto or forex data

- US markets only

Best Stock Analysis Apps, Tools, and Software—Our Top Picks

|

4.8

|

4.2

|

4.7

|

|

Free 30-day trial. Essential ($12.95/mo. or $155.40/yr.), Plus ($24.95/mo. or $299.40/yr.), Premium ($49.95/mo. or $599.49/yr.)

|

Free 7-day trial. Essential: $384/yr. Elite: $780/yr. Elite Plus: $1,620/yr.

|

Standard: 1,068/yr.* Premium: $2,136/yr.* Save 20% with coupon code WEALTHUP.

|

8. TradingView (Best Free Stock Analysis App)

- Available: Sign up here

- Best for: Charting, data feeds

TradingView is one of a handful of valuable charting platforms for technical analysis-driven stock traders on this list. Users can view charts, select specific indicators (RSI, Moving Averages, Bollinger Bands, etc.), add trend lines, chat with one another and do it all on repeat.

They have a robust web-based charting system with stock price data (real-time data), historical charts (1D, 5D, 1M, 3M, 6M, YTD, yearly price charts, 5Y and All-Time), strike prices, streaming charts and more. The result? Hopefully, delivering you alpha.

TradingView works well for traders looking to gain an edge on the markets, whether the stock market, forex markets, crypto, futures or more.

TradingView is in the business of delivering competition-crushing charting and trading tools, strategies and insights for you to trade with confidence. They have some of the best stock charts and technical analysis tools. TradingView utilizes 50+ real-time data feeds, historical data, pre-built popular indicators, smart drawing tools, figure charts and valuation analysis.

You can use the platform to conduct customized technical analysis with metrics like volume indicators, MACD, backtesting, etc. Pairing TradingView with a TradeStation or Webull account may capture Alpha through TradingView’s stock charts.

- TradingView provides an easy and intuitive stock charting experience, as well as tools that allow you view and share trade ideas.

- Use this stock analysis app to leverage real-time data and browser-based charts to do your research anywhere.

- Collaborate with 100 million TradingView investors.

- Non-Professional Plans: 30-day free trial, then: Essential ($13.99/mo. or $167.88/yr.), Plus ($28.29/mo. or $339.48/yr.), Premium ($56.49/mo. or $677.88/yr.)

- Professional Plans: 7-day free trial, then: Expert ($99.95/mo. or $1,199.40/yr.) & Ultimate ($199.95/mo. or $2,399.40/yr.)

- Special offer: Sign up using our link and you'll get $15 toward your first subscription.

- Fast, powerful charting software

- Ease of use

- Extensive built-in indicators library (400+)

- Crowd-sourced indicator library (100,000+)

- Chart on 1.3 million+ securities listed on 150+ exchanges from 50+ countries

- Massive user base (70 million+ globally)

- Limited free plan

- Can be overwhelming experience for new users

9. NinjaTrader (Best for Technical Analysis Tools and Free Paper Trading for Beginners)

- Available: Sign up here

- Best for: Technical analysis, futures trading, SIM (paper) trading

NinjaTrader is one of the oldest and best known trading platforms on the market.

Specializing in technical analysis tools, real-time analysis, and a clean, fully customizable charting experience, NinjaTrader allows you to employ a fully automated trading strategy through its own brokerage service for futures, options on futures, and forex trading. And while that might seem like a limited set of assets (especially for being mentioned as a stock trading app and platform), NinjaTrader’s other core strengths are its ability to integrate with other brokers like IBKR, Schwab (TDAmeritrade), and others for an add-on fee and its NinjaTrader Ecosystem.

This community of vendors and plugins enrich the NinjaTrader experience through offering education-rich content for free and, among other things, allows you to attach NinjaTrader to several supporting brokerages to give traders access to other markets, including options on futures, contracts-for-differences (CFDs), and equities.

NinjaTrader’s platform offers advanced charting with more than 100 technical indicators, advanced order types, automated trading, order flow analysis, streaming historical market replay, the SuperDOM (depth of market) tool, and more. The NinjaTrader desktop app is the most customizable of the platform’s versions, offering access to “thousands of trading apps and add-ons,” you can still enjoy most of NinjaTrader’s functions via its web and mobile apps.

Unfamiliar with futures trading? Anyone with an account can use NinjaTrader’s free futures trading simulator, which includes a backtesting engine that lets you use historical market data to simulate automated trading strategies and see how they would have performed.

You can download and use NinjaTrader’s platform for free, but you can reduce your commissions by subscribing to a monthly or lifetime account. Additional data does carry additional costs, however. For instance, for CME Level I top of book data (CME, CBOT, NYMEX, and COMEX), it’s $12 per month and Level II costs $41 per month for non-professional users. Professional users pay $135 per month per exchange. ICE Market data also costs $140 per month per exchange for all users.

NinjaTrader’s robust community and suite of tools have established it as a leading charting software—be it for stocks, futures, forex, or other assets. The burgeoning educational guides, video library and free ongoing webinars provide ample access to the understanding traders need to hone their craft. Plus, the platform offers an easy (and free) way to learn what the platform can offer through its SIM trading environment. Consider signing up for a NinjaTrader account and taking the service for a test-drive.

- NinjaTrader is a brokerage account offering access to futures and forex directly, and several other asset classes through integration with third-party brokers.

- The robust charting tools, technical analysis capabilities, and real-time full depth of market data empower active traders to make informed decisions.

- The NinjaTrader Ecosystem offers access to thousands of vendors and plugins and includes a comprehensive educational offering for traders to improve their understanding and execution of trades.

- NinjaTrader offers a free SIM trading environment designed to employ what you've learned from their ecosystem's educational content without risking your own money.

- If you open and fund a NinjaTrader account, you'll receive up to $250 in commission rates for trades placed within 30 days of your funding date.**

- Excellent charting and technical analysis tools

- Partial and full strategy automation

- NinjaTrader Ecosystem offers apps and add-ons

- Free SIM trading environment suitable for beginners

- Robust educational guides, videos and webinars

- Trading equities requires using a supporting broker

10. TrendSpider (Best for Refining Trading Strategies)

- Available: Sign up here

- Best for: Traders of all experience levels looking to trade more efficiently

- Platforms: Web, mobile app (Apple iOS, Android)

TrendSpider offers a comprehensive platform for traders to create, backtest, and refine trading strategies, scan and analyze the market, and time trades with precision. With its advanced tools and features, TrendSpider is designed to make trading more efficient for both novice and experienced traders.

Among the platform’s powerful tools:

- Robust technical charting and pattern recognition features, such as native multi-timeframe analysis, automatic trendlines, and Smart Checklists

- Raindrop Charts®, which provide a new way to visualize market data, focusing on trading volume at each price level

- Alternative data offerings including information on options flow, analyst actions, market breadth, insider trades, and more

- Data Flow, which enables real-time tracking of market data for all symbols, including analyst estimates, earnings, news, and unusual options flow

- Strategy Tester, which allows users to quickly develop and test trading strategies without any coding required; users can configure entry and exit rules and explore the performance of their strategies directly on the price chart

- Backtesting capabilities for technical, non-technical, and event-based strategies; once a winning strategy is identified, users can deploy it as a trading bot with just one click

Of particular note for traders is TrendSpider’s Scanner feature, which allows you to instantly test any strategy on any market and search for ideal trading opportunities. The stock scanner supports searching through watchlists, indexes, and more than 700 smart lists. Users can mix and match conditions and timeframes, allowing them to express any view in a single scan. The platform also provides a range of pre-made scanners to help users get started.

TrendSpider’s mobile app ensures traders are always connected to their charts and scanners, while the Chrome extension allows users to access real-time charts while browsing the web. The platform also offers extensive educational resources through TrendSpider University and detailed documentation for its features.

The platform also supports integration with external systems using webhooks, enabling traders to build custom alerts and bots that interact with social media channels, private chat servers, email, or order routers connected to brokerage accounts. TrendSpider’s SignalStack service can turn any signal or alert on TrendSpider into a live order in a trader’s account.

Learn more about the platform’s capabilities or sign up for TrendSpider today.

- Hone your trading skills and strategies with the TrendSpider platform, where you can use advanced tools to test trade ideas, scan for opportunities, and perfect your timing.

- Enjoy robust tools including technical charting and pattern recognition features, alternative data, backtesting, and Raindrop Charts.

- TrendSpider's stock scanner supports searching through watchlists, indexes, and more than 700 smart lists.

- Special offer: TrendSpider is offering up to 50% off certain tiers right now.

- Automated order execution

- Intuitive interface

- Chrome extension

- Reasonable pricing

- Mobile app is a companion app, not standalone

- Charts sometimes load sluggishly

11. Trade Ideas (Best for Active, Swing, And Momentum Traders)

- Available: Sign up here

- Best for: Active and swing traders

Trade Ideas employs an artificial intelligence-powered assistant named Holly. This AI becomes your virtual research analyst who never sleeps and instead sifts through technicals, fundamentals, social media, earnings, and more to pick stocks as real-time trade recommendations.

Holly stays busy, too. She runs more than 1 million simulated trades each night and morning before the markets open with more than 60 proprietary algorithms to find you the highest-probability, most risk-appropriate opportunities to invest in stocks.

This stock scanning and analysis tool doesn’t stop there, though. You can also build your own scanners and screeners with over 500 data points and indicators to choose from. You can backtest your trading strategies, and also forward-test them in the real-time trade simulator. This allows you to learn, test, and optimize, without risking your own money.

The powerful service allows you to access real-time streaming trading ideas on simultaneous charts to learn how to trade into risk-reward balanced trades. In other words: You can invest and learn at the same time.

Where Trade Ideas excels

Where Trade Ideas excels is not only giving you the data and ideas you haven’t seen elsewhere, but also how to manage your money. The AI-powered smart risk levels on every chart are suitable for both long-term investors and active traders.

As the stock market evolves, TI’s software adjusts levels and the trading plan to match. The best part? You can learn how to do all of this without risking your principal through a real-time simulated trading environment.

After you’ve grown comfortable with the service and trading, you can choose to go live with the trade ideas and start investing real money by connecting directly through a brokerage like Interactive Brokers or E*Trade. (The full list of available brokers you can use through the service is available on Trade Ideas’ site.)

I’m a newsletter and alert aficionado, so I should point out a couple of Trade Ideas features. For one, it has a standalone alert service in the form of a weekly Swing Picks newsletter. This gives you five new trade ideas in your inbox from the company’s model portfolio every Monday. Trade Ideas’ Standard and Premium subscriptions include these stock picks. Trade Ideas also has a free Trade of the Week newsletter highlighting one stock pick TI has identified for members.

How does Trade Ideas find stock picks?

Trade Ideas finds its Strength Alerts by focusing on a unique approach that emphasizes relative strength. They start by identifying the most effective indicators and chart setups, based on their top-performing algorithms. They proceed by applying statistical analysis to assign weighted values to each indicator and chart setup, allowing for a quantitative evaluation of their significance. Advanced server technology allows TI to evaluate every stock in the market using these weights and then sort them based on which achieved the highest score. Their team of experts curates these findings to ensure subscribers receive only the most promising trade recommendations.

While Trade Ideas offers exceptional value, it’s important to note that there’s a considerable investment required. Note that you must sign up for Premium to receive full access to the Holly experience. However, you can enjoy a big discount by using the code mentioned below.

Consider starting your Trade Ideas subscription with no contract involved. Cancel anytime.

- Trade Ideas is a powerful stock market scanner app that teaches you how to trade and invest, and boasts features such as technical indicators, PiP charts, alerts, even trading tournaments.

- Use Trade Ideas' simulated trading platform to learn how to trade without risking actual money.

- Trade Ideas' TI Premium tier opens up access to the platform's AI investment research assistant, Holly, as well as backtesting, "smart risk" levels, channel bar, and more.

- Special offer 1: Save an additional 22% off the above listed price on any annual subscription when you sign up with our link and enter code YATI22.

- Special offer 2: Save an additional 28% off the above listed price on a Premium subscription when you sign up with our link and enter code YATI28.

- Free live trading room that delivers actionable guidance

- In-browser and desktop interface functionality

- Automated trading capabilities

- AI-powered trade suggestions

- No mobile app

- Pricey subscriptions for some traders

12. E*Trade (Premium Options Analysis Tool)

- Available: Click “Open Account” below

- Best for: Stock options analysis

E*Trade has long been seen as a leading stock trading app for retail investors. It allows you to invest in a wide array of assets, and it provides educational resources that will help you with investment research, portfolio analysis, and building a diversified set of holdings.

E*Trade, like most of the best stock investing apps, offers zero-commission stock, ETF, and options trading. It also has a leg up on some platforms by offering $0 commissions on mutual fund, Treasury, and new-issue bond trading. Investors also have access to futures, micro futures, and futures options, among other investment types.

Like with many zero-commission options trading platforms, though, options still have contract fees. Equity and index options are 65¢ regularly, though they’re reduced to 50¢ if you place more than 30 stock, ETF, or options trades per quarter. (E*Trade also has an options program called the “Dime Buyback Program.” If you close an equity option priced at 10¢ or less, E*Trade won’t charge you a per-contract fee.) A couple other fees worth noting are futures ($1.50 per contract) and secondary bond market trades ($1 each).

E*Trade provides its Options Analyzer Tool to perform several “what-if” scenario analysis of options positions and strategies. Investors can perform this analytical work over multiple time frames, allowing the ability to calculate the probabilities of various outcomes before entering an options order into the platform’s trading system. In short, you can use the E*Trade Options Analyzer tool to dissect your custom-built or pre-built standard options strategies to create an order ticket. In so doing, this powerful options analysis tool allows you to trade options with more confidence, and hopefully for more profit.

E*Trade comes with free access to Bloomberg TV, Thomson Reuters, and TipRanks research. Meanwhile, you’ll have ample research tools at your disposal, including stock, mutual fund, bond, and ETF screeners; trade optimizers; backtesters; and more.

Visit E*Trade and sign up by clicking “Open Account” below.

- E*Trade is one of the best online and mobile trading platforms among discount brokers, offering a full range of investments (including professionally managed accounts). It allows you to invest in stocks, ETFs, mutual funds, options, bonds, futures, micro futures, and futures options.

- $0 commission trading for online U.S.-listed stocks, ETFs, options, mutual funds, Treasuries, and new-issue bonds. (Options have a 65¢ contract fee, or 50¢ at certain volume thresholds.)

- Opening an account is easy and only takes a couple of minutes.

- Bonus: Get between $50 and $10,000* when you click the box below, then open and fund a new investment account using promo code "OFFER25."

- Excellent selection of available investments

- Commission-free mutual funds and Treasuries

- Automated portfolio builders and prebuilt mutual fund and ETF portfolios

- Separate apps for power users and casual users

- Limited availability of fractional shares (only in DRIP plans or robo-created portfolio)

- No direct cryptocurrency trading

13. Webull (Free Stock Analysis App)

- Available: Sign up here

- Best for: Free trades, in-app stock analysis tools

Webull is a commission-free stock trading app that focuses on traders who utilize technical analysis. Webull offers not only commission-free trading to its users, but also a significant number of technical research resources for individuals looking to invest in stocks, bonds, options, and cryptocurrencies.

One such example is a free three-month trial of NASDAQ TotalView Level 2 Advance quotes, which provide a real-time sense of how deep the market for a security is, the pending trade offers at various bids and asks, and whether market momentum might shift in favor of higher or lower stock prices. After three months, users can subscribe to the service for a low monthly fee of $1.99/mo.

You can also tap the app’s built-in community for stock ideas based on recent market developments. Power users who openly post their trading activity on the platform sometimes provide ample ideas for stocks to research further.

You can use the tools on the app to review charts, read news stories, track stocks and review any summary-level research activity published by Wall Street analysts. For those interested in using this self-directed investing app for market analysis and investing, it offers the following technical indicators:

- Exponential moving averages (several timeframes)

- Bollinger Bands

- Money Flow Index

- MACD

- RSI

For those looking to rely on fundamental analysis to inform their investing strategies, Webull offers the following fundamental research tools:

- Financial and stock news

- Corporate and market press releases

- Analyst recommendations, estimates and price targets

- Historical and projected earnings per share (EPS)

- Revenue and earnings data

- Insider holdings and transactions

- Financial calendars

- Stock screeners

- Watchlist and alerts

Additionally, Webull also offers margin loans to traders, extended-hours trading, customer service through email and chat, as well as the ability to sell stocks short. As a bonus for opening your account, if you deposit a nominal amount of money you can also earn free stocks.

Read more in our Webull review.

- Webull is a low-cost trading and investing app that allows you to invest in stocks, ETFs, options, futures, commodities, and crypto, and even participate in initial public offerings (IPOs).

- No-commission stock, ETF, and option trades (and many options have $0 contract fees).

- Trading features such as charting tools, technical indicators, customizable screeners, real-time stock alerts, and group orders.

- Let Webull manage your money for you with Webull Smart Advisor, which combines Webull's in-house investment expertise and artificial intelligence to build, manage, and rebalance an ETF portfolio for you.

- Sign up for Webull Cash Management to earn up to a 4.1% APY on uninvested cash.

- New users get one free month of Nasdaq TotalView's Level 2 Quotes service. (That subscription costs $2.99/mo. thereafter.)

- Subscribe to Webull Premium and receive a premium APY on uninvested cash in individual and joint cash accounts, premium margin rates, a 3% match when you transfer or roll over your IRA, and an extra 3.5% match on qualifying IRA contributions.

- Special offer: Make an initial deposit of at least $2,000 and receive 1.) a $100 cash bonus, 2.) a 2% match of your deposit (up to a maximum bonus of $20,000), 3.) a 30-day voucher for Webull Premium, 4.) a 30-day 4.0% APY booster on uninvested cash (for a total of 8.1%).**

- Good selection of available investments

- Fractional shares

- Powerful technical analysis tools

- Offers robo-advisory services

- Accessible to beginning and intermediate users

- Voice commands

- Offers highly competitive APY through Webull Cash Management

- Does not support mutual funds

14. Finviz

- Available: Sign up here

- Best for: Free stock analysis platform features

Finviz is a stock analysis and stock screener software with both a free version and a paid premium version.

The free version of Finviz, which is ad-supported, is one of the most powerful free stock screeners you’ll find. Investors can screen for metrics broad and narrow, from country, stock exchange and market capitalization to quick ratio, sales growth over the past five years, and insider transactions. You can even screen for various technical indicators, including common simple moving averages, RSI, and even various chart patterns.

Once your stocks are displayed, you can view dozens of data points, including numerous valuation metrics—P/E, P/B, price-to-sales (P/S) and price-to-free-cash-flow (P/FCF), among others—earnings per share (EPS) estimates, short-selling data, and performance figures.

And a tip for investors who simply love watching the market: Finviz’s “heat maps” illustrate performance from the S&P 500, full U.S. stock market, world stocks, even ETFs in an engaging visual format that allows you to drill down into each individual stock or fund.

Simply opening a free registered account with Finviz will also allow you to add 50 screener presets and customize your layout. But if you sign up for the paid Finviz*Elite, you can unlock premium features, including (but not limited to):

- Real-time quotes and data

- Pre-market and after-market stock data

- Backtesting

- Email alerts

- Fundamental charts

- 100 portfolios per user and 100 tickers per portfolio

- 200 screener presets

- Officer information

Consider signing up and starting a subscription. If you’re not satisfied, you can request a full refund within the first 30 days of subscribing. Also, by becoming a Finviz*Elite member, you can remove all ads from your platform.

- Finviz*Elite offers real-time data and access to extended hour sessions

- Advanced charting and overlays with indicators, technical studies and interactivity

- Backtesting with technical indicators to test trading strategies over the last 24 years

- Proprietary correlation algorithms optimized for financial markets

15. TradeStation Analytics (Free w/TradeStation Brokerage Account)

- Available: Sign up here

- Best for: Brokerage with stock analysis tools

TradeStation Analytics helps you analyze stocks, options, ETFs, stock futures and cryptocurrency markets. You have access to backtesting, historical intraday data, and extensive charting capabilities.

Users also receive personalized support from their brokerage professionals. The company provides state-of-the-art trading technology which caters to active individual and institutional traders.

TradeStation Analytics helps you to find the right opportunities in real-time, when to get into and out of trades, and discover hidden opportunities with technical and fundamental analysis.

You can monitor and rank up to 1,000 ticker symbols in real-time with access to more than 180 technical and fundamental indicators useful for valuing a stock and identifying likely price action. TradeStation is one of the best trading software platforms on this list.

If you have a TradeStation brokerage account, you can use TradeStation Analytics for free. You can still get the software without a TradeStation brokerage account, for a monthly fee of $99 for non-professionals and $199 for professional subscribers.

- TradeStation is a powerful trading platform that allows you to invest in a wide array of products, including stocks, ETFs, mutual funds, options, bonds, forex, futures, micro futures, and futures options. You can also participate in IPOs through TradeStation.

- The platform comes equipped with trading and investing tools that are useful to seasoned professionals and new traders alike. Identify trading opportunities, explore option markets visually, even create your own trading tools with TradeStation's proprietary programming language.

- TradeStation's brokerage services and trading education resources are recognized by respected industry reviewers.

- Excellent selection of available investments

- Professional trading features and capabilities

- Intuitive trading interfaces and tools

- Competitive pricing for trading volume

- Varied and confusing fees for specific actions/events

- Mac users can only run TradeStation desktop platform through a Windows emulator

16. TC2000

- Available: Sign up here

- Best for: Stock charting, technical indicators

TC2000 is an easy-to-install stock screening and scanner software that allows you to build watch lists, follow stock news, receive stock alerts, conduct stock scans, and sort and make personal notes on stock opportunities.

The heart and soul of TC2000 is the service’s Condition Wizard. The tool allows you to build for any condition you might think of on any indicator, step-by-step. The investment software provides more than 70 technical indicators with 10 drawing tools. While this doesn’t require formula writing, you can develop your own and watch “flex” conditions unfold over time.

TC2000 features more than 70 technical indicators with 10 drawing tools. TC2000 does have backtesting, but if especially powerful backtesting is important to you, you might need to look elsewhere.

Please note: The company’s brokerage services are $4.95 per trade, I’d recommend signing up for TradeStation or another free trading app to execute trades.

- TC2000 is a market research platform providing tools and analysis software for identifying opportunities to capture alpha.

- Receive a $25 discount for signing up today!

Best Stock Research Apps, Tools, and Software (Investment Research Software)

A useful stock market research app will contain statistics and analyses from several reputable sources. You need to be able to quickly see relevant news as well as various stocks’ long-term trends.

Some of the best investment research websites are purely informational, while others both educate you and let you also buy stocks straight from their app. Paired with the best investing apps, these stock market research apps can be useful for building your wealth.

Features of the Best Stock Research App, Tool, and Software

→ Comes at a Fair Price.

Most stock research apps come with a free trial to demo the product and understand if the service is worth the eventual price you’ll pay. Some services charge on a monthly basis while others charge on an annual basis.

If you choose only to rely on free services, you might get what you pay for. Premium services can quickly justify their price tags if they deliver stock research that allows you to outperform the market consistently.

That alpha is worth its weight in gold if you have money to invest and take advantage.

You should always purchase apps that meet your needs but only pay the minimum price to do so. If you don’t use the fancy add-ons and can’t justify the price, you shouldn’t subscribe to that tier if a lower one will do.

→ Provides Trusted, Transparent Research.

If you want to understand the stocks on the platform, you need to see the details provided by the stock research tools. The best stock research software and websites will provide actionable information for you to evaluate stocks and make an investment decision.

This can include things like real-time data, stock analysis tools and other resources. But a stock research tool doesn’t necessarily need to include such details. Instead, it can perform in-depth analysis and provide an investable narrative for why the stock should be in your portfolio.

Regardless of the details provided, you should be able to trust the stock research and see dependable recommendations or information.

→ Uses Fundamental and Technical Analysis.

The two primary forms of stock research are fundamental and technical analysis. The former relies on the financial performance of a business, including how it manages its assets and liability as well as how it utilizes them for growth.

Technical analysis uses price action as an indicator for when you should buy or sell a stock.

Both of these should combine to understand which stocks make the best choices for your portfolio now and into the future.

Best Stock Analysis Apps, Tools, and Software

The best stock analysis software can also help improve your success with the stock market. Common features include simulations, backtesting (letting you test trading strategies using historical market data), stock charting software and designing a trading or investment plan.

The best stock analysis app for you will depend on your preferences, needs, and whether or not you have programming experience. Now that we’ve reviewed the best and acclaimed stock analysis software options, let’s cover the features you should look for next.

Features of the Best Stock Analysis App and Software

Many of the same features you should look for in a stock research app will also apply to stock analysis apps. Understandably so, as they should carry the same features in their respective right.

Below, you might see some retreaded features to pick an app based upon, but when they’re right, they’re right.

→ Comes at a Fair Price.

Once again, like stock research apps, you want to get what you need and not pay for what you don’t want. Some stock analysis software comes with a free trial to demo the product and understand if the service is worth the eventual price you’ll pay.

You will see some have the option to pay-as-you-go or opt for an annual or bi-annual subscription for cheaper rates than on a monthly plan alone.

→ Provides Relevant Tools, Educational Resources and Customer Support.

Understanding the indicators, tools and horsepower of your stock analysis app will make all the difference. That means you might need to brush up on some of the terminology or concepts covered with an analysis tool.

The best stock analysis app will provide tools and educational resources to learn what you need and room to continue growing.

Additionally, you’ll also want responsive customer support if you have questions you can’t answer by yourself. Having a dependable customer support system will make all the difference when you need help navigating something in the app.

→ Multiple Watchlist and Tracking Tools.

Proper stock analysis requires watching stocks for buy and sell signals. You’ll need powerful watchlist and tracking tools to do this.

The best stock analysis apps allow you to track from a single window and utilize stock screeners, real-time data alerts and notifications and more to inform your decision-making.

→ Powerful Charting Tools.

Stock analysts also rely on charting tools to measure entry and exit points from a stock. You’ll require historical charting capabilities to identify long-term trends as well as intraday charts for second-by-second movements.

Having the ability to overlay stock indicators and utilize drawing tools are of vital importance when performing technical analysis. Make sure your stock analysis tools carry this functionality.

Best Stock Research and Analysis Apps, Tools and Websites

Now that you know more about these investment research and analysis apps, you can choose the best stock market research app and best stock analysis app for your needs.

Investor Peter Lynch once said, “If you don’t study any companies, you have the same success buying stocks as you do in a poker game if you bet without looking at your cards.” To excel in the stock market, you need to put in some work.

Investing in stock market research and analysis apps and software may seem like an unnecessary expense, but if you play your cards right, they can make you far more money than they cost. If you’re going to play the stock market, look at your cards.

How Do I Find the Best Stocks?

Finding the best stocks can take work through use of screeners, strict profitability and performance criteria, as well as projections for understanding where a stock might go.

Services mentioned below can help you to uncover the best assets to invest in. Consider using one or two (maybe even three) to find those best stocks to buy.

Of special note are Seeking Alpha Premium and the services from Motley Fool above. All of these have outperformed the S&P 500 significantly, leading them to be great at finding long-term stock buys to hold in your portfolio.

![6 Best Seeking Alpha Alternatives [Competitors' Sites to Use] 98 best seeking alpha alternative](https://youngandtheinvested.com/wp-content/uploads/best-seeking-alpha-alternatives.webp)