It’s never been easier nor cheaper to get your financial life in order. You can thank the proliferation of free portfolio trackers for that.

My routine from a few years ago might sound familiar to you. I’d wake up and say to myself, “Let’s see how the ol’ finances are doing.” So, I’d log into my bank account to get a glimpse of my savings and checking balances. Then I’d log into my brokerage account and check out premarket action, make sure there weren’t any holdings that needed immediate attention. Then I’d try to log into my company’s 401(k) site, realize I’d forgotten the password and hadn’t stored it, messed around for a couple minutes resetting that, then finally got access to my retirement holdings.

In other words: My routine was a pain in the rear. I simplified that by plugging myself into a free portfolio tracker—and if my patchwork routine sounds anything like yours, take a few minutes to consider doing the same!

Today, I’ll talk to you about free portfolio trackers and portfolio management software. We’ll briefly cover what these programs do, then we’ll look at a few of the best portfolio trackers in the space. If I’ve done my job, by the end of it, you’ll have found an option that helps you declutter and refocus your financial life.

Free Portfolio Trackers—Our Top Picks

|

Primary Rating:

4.5

|

Primary Rating:

4.2

|

Primary Rating:

4.1

|

|

Free (no monthly fees for tools); Starts at 0.89% AUM for wealth management services

|

Free Plan: Free. Starter: $10/mo.* Investor: $16/mo.* Expert: $21/mo.*

|

Essentials: $7.99/mo. or $54.99/yr. Premium: $17.99/mo. or $124.99/yr. Premium Plus: $27.99/mo. or $194.99/yr.

|

Best Free Portfolio Trackers

1. Empower (Best Free Portfolio Tracker)

- Available: Sign up here

- Platforms: Web, mobile app (Apple iOS, Android)

Empower (Personal Capital is now Empower) is one of the most popular portfolio trackers on the market. It currently boasts 3.5 million users, some of whom use free tools such as the Personal Dashboard, and some of whom use the Wealth Management service.

Empower’s free tools

The free Personal Dashboard makes it easy for people to add all their financial accounts in one place, including credit cards, savings, checking, loans, and tax-advantaged investment accounts.

Empower also provides a free Investment Checkup tool to assess your portfolio risk, analyze past performance, and get a target asset allocation for your portfolio. The tool will help you identify overweight and underweight sector investments (perhaps you have too much allocated to utilities, and not enough to healthcare, for example) and assess your diversification.

You can even compare your portfolio to both the S&P 500 and Empower’s “Smart Weighting” Recommendation, which suggests that investors more equally weight their portfolios across size, style, and sector—unlike the S&P 500, where the biggest stocks have the most effect on the portfolio, and there are huge differences in how much each sector is weighted.

The Empower Fee Analyzer helps you examine the fees you pay in your accounts, whether that’s advisory fees, sales charges, expenses, and other costs.

Other investing and personal finance tools include a savings planner, retirement planner, financial calculators, and more.

These services, of course, are also available with Empower’s full-service Wealth Management account—along with a number of other perks.

Empower’s Wealth Management services

The Wealth Management plan better suits investors who want a fuller advisory experience. The service pairs automated tools with human management.

After you enter your risk tolerance, goals, time frame, and personal preferences, Empower creates a recommended portfolio. The portfolios are diversified across multiple asset classes and rebalanced when necessary. The six asset classes include:

- U.S. stocks

- International stocks

- U.S. bonds

- International bonds

- Alternative investments

- Cash

Customers have the option to incorporate socially responsible investing (SRI) into their investments, too. In short, that means you can choose to invest only in companies that have positive environmental and social impacts.

Investors enjoy access to financial advisors who can help them make various financial decisions, from retirement planning to college savings to stock options and more. Empower’s financial advisors are available 24/7 by phone, live chat, email, or web conference.

Note that the Wealth Management plan has a minimum initial investment of $100,000. Investors with between $100,000 and $250,000 have access to a team of financial advisors. Those with more than $250,000 have access to two dedicated financial advisors. There are extra benefits for people who invest over $1 million, including lower fees.

Wealth Management fee tiers

Empower has two fee structures: one for clients who invest up to $1 million, and one for clients who invest $1 million or more. In both cases, the fees are a percentage of assets under management, charged annually.

Fees for clients with $1 million or less:

- $100,000-$1,000,000: 0.89%

Fees for clients with more than $1 million:

- First $3 million: 0.79%

- Next $2 million: 0.69%

- Next $5 million: 0.59%

- Over $10 million: 0.49%

Regardless of how much money you bring to the table, if you sign up, you will be given the option to schedule an initial 30-minute financial consultation with an Empower advisor.

- Empower (formerly Personal Capital) offers both a free set of portfolio, net worth, and cash flow tracking tools, as well as paid asset management service.

- Link Empower to your bank and investing accounts, credit cards, and more to see a single view of useful information and data, including your net worth.

- Empower Wealth Management offers unlimited advice and retirement planning help, as well as managed ETF portfolios, for accounts with between $100,000 and $250,000 in assets. Higher asset tiers include access to dedicated financial advisors, retirement specialists, and more investment options (including stocks, options, real estate, and private equity).

- Free portfolio tracker

- Free net worth, cash flow, and investment reporting tools

- Dedicated investment advisor

- Free tax-loss harvesting

- Dividend reinvestment

- Automatic rebalancing

- 5-day-a-week live customer support, 24/7 email support

- High minimum for investment management ($100k)

- High investment management fee (0.89% AUM)

Related: 8 Best Personal Capital Alternatives

2. Sharesight (Best Investment Portfolio Tracker App, Including Dividends)

- Available: Sign up here

- Platforms: Web, mobile app (iOS, Android)

Sharesight has an award-winning performance and tax reporting platform that empowers you to track stocks and exchange-traded funds (ETFs) from more than 60 exchanges worldwide. It also allows investors to track more than 100 global currencies and follow unlisted, alternative investments such as fixed interest and investment properties.

All of this and more are available via Sharesight’s easy-to-use online portfolio tracker.

The service prides itself on being a spreadsheet replacement, allowing you to know the true performance of all listed holdings, across multiple asset classes, in a single place.

With powerful sorting features and the option to exclude closed positions, you can actively compare the performance of your holdings to numerous benchmarks of your own choosing. You also can see the impact of capital gains, dividends and currency fluctuations (if investing internationally) on your portfolio and against your benchmark.

These reasons alone qualify Sharesight to make this list, but where it truly excels is its dividend-tracking capabilities.

Income-generating assets are a powerful source of passive income for investors, but it’s important to know exactly how much cash they’re sending you. You can do that via the website’s Taxable Income report, which allows you to see a running total of all your dividends, distributions, and interest payments over any time period. It can even break up distributions by local and foreign income. You can also use the platform to project expected dividend income based on announced dividend payments. And no more digging for dividend dates.

All you need to do is upload your holdings by either connecting to your broker or stock trading app, uploading a spreadsheet or manually entering your trading history or opening balance. Sharesight integrates with more than 200 online brokers worldwide and can readily add ones not yet available to the service with a simple request.

To get started, visit the Sharesight website. You can join the Free plan, which allows you to track up to 10 holdings in one portfolio, and also provides a demo portfolio you can use to explore Sharesight. To track your full portfolio, you’ll need to upgrade to one of Sharesight’s paid subscriptions, which are discounted if you buy them on an annual basis through our link.

- Performance and tax reporting to track your shares and ETFs from more than 60 exchanges worldwide.

- Automatically track more than 100 global currencies and unlisted investments in an easy-to-use portfolio tracker.

- Automatically track dividends and distributions from more than 240,000 global stocks, exchange-traded funds, and mutual funds, going back up to two decades.

- More than 500,000 users from over 100 countries with 3 million individual holdings tracked and 200+ brokers supported rate it as 4.1 / 5 stars on Trustpilot.

- Tracks investments across multiple accounts

- Creates Dividend Income Report to forecast distributions

- Powerful tax reporting feature

- High customer ratings

- Limited support for crypto beyond major options

- Pricey solution for some investors

Related: How to Get Free Stocks for Signing Up: 10 Apps w/Free Shares

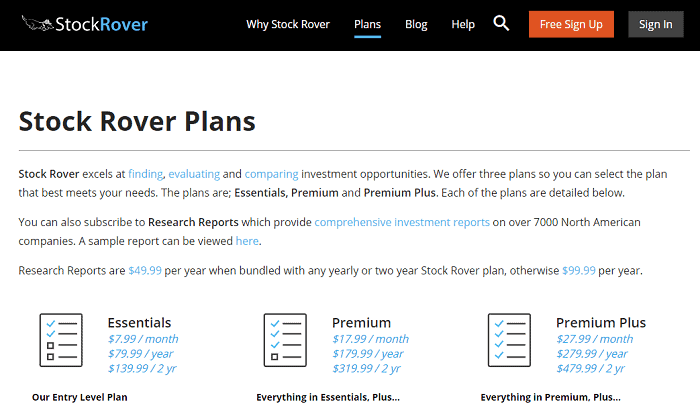

3. Stock Rover (Best Free Portfolio Management Software)

- Available: Sign up here

- Platforms: Web, mobile app (Apple iOS, Android)

Stock Rover helps you keep tabs on your portfolio with detailed performance information, email performance reports, in-depth portfolio analysis tools, correlation tools, trade planning, and re-balancing facilities.

The web-based applet works well as a stock tracking app for Windows, but also functions on Mac, mobile and tablets as well.

You can subscribe to this service for a number of applications, but it provides a comprehensive alerting facility, allowing you to find out immediately when something happens that you need to know.

The stock screener can also find instances where companies trade below their perceived fair value, signaling opportunities to buy stocks with a built-in margin of safety.

Stock Rover’s “Brokerage Connect” provides an investor with a read-only data feed of their portfolio holdings, providing you a comprehensive view of your portfolios spread across numerous investment accounts.

When you connect your Stock Rover account to your brokerage accounts, details for each portfolio get delivered to Stock Rover for analytics and tracking purposes.

Consider signing up for Stock Rover with a free 14-day trial. Stock Rover’s Free plan provides comprehensive information on stocks, ETFs and funds while also offering a number of other great free features such as analyst estimates, in-depth news and a flexible earnings calendar. If this is sufficient for your needs, you won’t need to upgrade to a premium plan. However, if you’d like to get more from the service, you’ll need to upgrade to the service’s premium plans for more robust stock portfolio tracking and analysis.

- A complete service for investors looking to use screeners, investment comparisons, real-time research reports, model portfolios, chart and more

- Use this top-rated investment analytics service to identify stocks worth buying and outperforming the market

- Hundreds of screening metrics

- Proprietary scoring systems

- Real-time executive summary research reports

- No mobile app

- No crypto or forex data

- US markets only

Related: 15 Best Investment Apps and Platforms [Free + Paid]

4. SigFig

- Available: Sign up here

- Platforms: Web, mobile (iOS, Android), Windows 8, Apple Watch

SigFig’s Portfolio Tracker lets you sync outside brokerage and retirement accounts so you can keep track of your balances, analyze your portfolio, and even set up automatic optimizations such as rebalancing and dividend reinvestment.

SigFig offers two services:

- A portfolio tracker (free)

- A managed account (free up to the first $10,000 invested, 0.25% annually after that)

SigFig’s free portfolio tracker itself is a pretty straightforward product. You can connect brokerage accounts, 401(k)s, IRAs and more. From there, the software will provide regular snapshots of your portfolio’s performance and allow you to monitor your holdings in one place.

However, the Portfolio Tracker largely exists to drive people toward SigFig’s asset management product, which includes the synced accounts and dashboards, as well as a host of other features, including:

- Free portfolio monitoring

- A free initial consultation to an investment advisor to plan your portfolio

- Free unlimited access to investment advisors after that

- Live customer support (by phone or by chat)

- Low-fee portfolio management

- Diversification optimization

- Automated rebalancing

- Dividend reinvestment

- Tax-loss harvesting

SigFig’s asset management is performed through exchange-traded funds representing each asset, including U.S., developed-market and emerging-market stocks, U.S. bonds, municipal bonds, real estate, and more.

Of particular note is SigFig’s access to investment advisors. While SigFig’s asset management is primarily handled via robo-advisor, you’re still able to get in touch with humans if you’re looking for more personalized guidance—certainly a step above other robo-advisory services.

I will point out that SigFig does require a minimum $2,000 account balance to take advantage of its asset management services. That’s not a particularly high threshold, but it is higher than many other robo-advisory products.

- Get started on optimizing your portfolio with SigFig's free portfolio tracker, or take the next step with its free-to-low-fee robo-advisory asset management services.

- SigFig Asset Management can design a custom portfolio for you within minutes, then take care of tasks such as rebalancing and reinvesting dividends.

- While your portfolio will be managed by a robo-advisor, SigFig offers a free consultation with an investment advisor to plan out your portfolio, and unlimited access to human professionals after that.

- Asset Management requires a $2,000 minimum.

- Free portfolio tracker

- Very low management expenses

- Excellent access to financial professionals

- Free tax-loss harvesting

- Dividend reinvestment

- Automatic rebalancing

- 5-day-a-week live customer support

- No savings/cash management option

- Relatively high minimum for robo-advisory services

Related: 15 Best Stock Research & Analysis Apps, Tools and Sites

5. Stifel Wealth Tracker

- Available: Sign up here

- Platforms: Web, mobile app (Apple iOS, Android)

The Stifel Wealth Tracker app is a free, basic stock and wealth tracker that allows you to get not just your investment life into shape, but your full financial picture.

Stifel Wealth Tracker allows you to sync bank, investment, and retirement accounts, as well as other financial products—mortgages, credit cards, and dozens of other accounts you might be making payments on. The dashboard will provide you with a look at your assets (including equity, fixed income, alternative investments, and others), as well as liabilities (including loans, credit cards, mortgages, and more.)

Not sure whether your holdings line up with your financial goals, risk appetite, and investing horizon? You can fill out a risk assessment that will help you better understand your portfolio—and determine any shifts you might need to make.

One perk of particular note: You can get free access to Stifel’s equity research reports. I’ve personally used Stifel research in multiple professional capacities, and they’re a cut above much of the free stock research you receive through other platforms.

The wealth tracker app itself, however, has its issues. Syncing accounts was not a flawless experience, and holdings pages leave much to be desired. I’ll also point out that both the iOS and Android app stores are riddled with complaints about general app bugginess.

- Connect all of your financial, investing, and retirement accounts in one place with the free Stifel Wealth Tracker.

- Get a full view of your financials, including assets (stocks, bonds, alternatives, and more) and liabilities (mortgages, credit cards, etc.), and keep track of your net worth.

- Free portfolio tracker

- Portfolio analysis and holdings suggestions

- Free access to Stifel equity research

- Below-average user experience

Related: 7 Best Stock Portfolio Management Software Tools + Apps

Best Stock Portfolio Tracker Options [Paid]

Sometimes, you might need a little more functionality than what a free portfolio tracker provides. Or in some cases, you might want to pay for a service that not only includes portfolio tracking, but other important functions—say, investment research or stock recommendations.

Here, then, are a few paid options that deliver something more, in one way or another, than the free portfolio trackers mentioned above.

6. Seeking Alpha (Best Stock Tracker with Investment Research + Stock Recommendations)

- Available: Sign up here

- Platforms: Web, mobile (iOS, Android)

Seeking Alpha Premium caters to the needs of intermediate and advanced investors looking for an affordable, all-inclusive, one-stop-shop for their investing needs.

SA Premium is an all-in-one investing research and recommendation service that offers insightful analysis, financial news, stock research, and more—all designed to help you make better investing decisions.

Whether you’re looking to invest on the go or dedicate time for more in-depth research and analysis, Seeking Alpha provides features that meet your needs.

No other site provides what Seeking Alpha does, providing unlimited access to everything from:

- Earnings calls transcripts

- Seeking Alpha Author Ratings and Author Performance metrics

- 10 years’ worth of financial statements

- Ability to compare stocks side-by-side with peers

- Access to dividend and earnings forecasts and much, much more.

Why subscribe to Seeking Alpha?

Seeking Alpha distills relevant financial information for you so you don’t have to—making it easy for anyone interested in self-directed investing to have a chance at outperforming the market.

Consider starting a 7-day free trial through our link to take advantage of SA’s Premium service and see if it makes sense for your needs.

- Seeking Alpha Premium and Pro help you find profitable investing ideas, improve your portfolio, research stocks better and faster as well as track the news to find investing opportunities.

- Receive up to 15 investing newsletters filled with stock research and analysis, commentary and recommendations.

- Get access to the world's largest investing community.

- Use Seeking Alpha Premium's Seeking Alpha Stock Ratings to find stocks likely to outperform and make you money.

- Seeking Alpha Premium's proprietary quant records have an impressive track record leading to massive market outperformance.

- Special offer on Premium: New subscribers through our link receive a $30 discount off the price of Seeking Alpha Premium in their first year.*

- Special offer on Pro: New subscribers through our link receive one month of Pro for $99.**

- Active community of engaged investors and analysts

- Stock screeners, quantitative tools for stock analysis

- Strong track record of market outperformance on stock ratings

- Minimal mutual fund coverage

Related: Seeking Alpha Review: Are the Premium or Pro Plans Worth It?

7. Vyzer (Best Investment Tracking App for High-Net-Worth Individuals)

- Available: Sign up here

- Platforms: Desktop (Windows, macOS, Linux), web, mobile (iOS, Android)

Vyzer represents the best investment tracking app for high-net-worth individuals found on this list. It offers investment portfolio tracking, financial planning tools, and wealth management solutions for both public and private investments.

The digital wealth management platform also distinguishes itself by serving as the only service that combines public and private investment performance tracking. Vyzer keeps tabs on all of your investments in one place, providing a comprehensive view of your entire portfolio so you can easily monitor its performance. It supports all of the following accounts and asset classes:

- Real estate (syndications, funds, rental properties)

- Private equity funds (venture capital, hedge funds, debt funds)

- Private companies (startups and small-to-mid-sized enterprises)

- Investment accounts (Brokerage accounts, pension plans, 401(k), IRA, Roth IRA)

- Bank accounts (18,000+ banks worldwide)

- Crypto (Binance, Coinbase, BTC + ETH addresses, and more)

- Precious metals

- Collectibles

You can even track investments you co-hold with others, and organize your investments under different holding entities.

Vyzer is designed for investors with diverse portfolios and multiple sources of income. It allows users to forward or upload any financial documents (think spreadsheets, investment documents, Schedule K-1s, quarterly statements, and more) and have the platform translate them into new assets or liabilities or update existing ones. After you link your bank accounts to the platform, Vyzer analyzes your transaction data with artificial intelligence to identify which transactions link to which assets or liabilities you’ve added to your account. This feeds the system’s cash flow tools.

Once you load all of your assets and liabilities into the dashboard, you can produce a cash flow forecast based on scheduled distributions, capital calls, expenses, and more.

Curious about how your peers handle their investments? Vyzer members can anonymously view each other’s portfolios to understand the financial products and funds they’ve invested in.

Vyzer has four different subscription tiers—one free, and three paid:

- Starter (Free): Like many free tiers, this is a “light” offering that provides limited functionality, including manually adding up to three items and syncing up to three financial institutions. This is recommended for users who are on the fence about Vyzer and want to take the software. Just note that the free tier does not include access to the mobile app.

- Plus ($29/mo., billed annually): This provides full Vyzer functionality (including mobile app access), as well as a much higher number of connections. Specifically, you can manually add up to 15 items and sync up to 10 financial institutions. It also includes Basic support (online chat and email assistance, responses typically within one business day).

- Premium ($79/mo., billed annually): This plan, geared toward much larger, more complex portfolios, has similar functionality as the Plus plan, but with more reporting features and far more connections. Specifically, with Premium, you get 120 manually added items, 30 synced institutions, and 30 cash flow scenarios. Support is also upgraded, to Preferred (faster response times, usually within a few hours).

- Family Office ($699/mo., billed annually): This tier is recommended for ultra-high-net-worth individuals (UHNWIs—investors with a net worth of $30 million or more) who want comprehensive family office services. All Vyzer features are unlocked with this plan (naturally), plus you’re given a private account manager and Priority support (response in an hour or less, as well as phone support).

Empower, found earlier on this list, is the closest comparison to Vyzer. The platform is different from Empower in four main ways:

- Vyzer doesn’t offer active wealth management.

- Vyzer can track more asset classes than Empower.

- Vyzer offers more flexibility in adding new data to your account, and requires less effort.

- Vyzer charges a flat monthly fee (or a discounted annual fee) that you pay from outside with your investments, say with a credit card. Empower takes its fees from portfolio performance.

If you are a sophisticated investor with a complex portfolio to track, consider signing up with Vyzer to follow everything in a single platform. Remember: If you’re on the fence, you can begin with a free Starter account—but if you’re ready to get all of your accounts synced up, you can sign up for one of the three paid subscription tiers.

Read more in our Vyzer review.

- High-net-worth (HNW) investors can keep track of public and private investments with Vyzer, which provides portfolio tracking, wealth management, and financial planning tools.

- Enjoy comprehensive, holistic insight into your investment portfolio.

- Platform includes robust cash flow planning tools to make the most of your cash.

- Find new opportunities by seeing what other high-net-worth investors within the Vyzer community are doing.

- Can track a portfolio of public and private investments

- Can generate easy-to-view data from uploaded documents and linked bank accounts

- Fair fees under new tiered fee structure

- No active wealth management offerings

- Free Starter tier is heavily limited and has no mobile app access

Related: 9 Best Day Trading Platforms [Apps + Software]

8. Kubera (Best Portfolio Tracking App for All Assets)

- Available: Sign up here

- Platforms: Web, mobile (iOS, Android)

Kubera is one of the most advanced portfolio trackers on the market. It boasts thousands of bank connections, more global currencies than any other service, and detailed information about all of your investments.

Kubera is the ideal product for young professionals, homeowners, real estate professionals, and even cryptocurrency investors, among others. It allows you to keep track of your comprehensive portfolio holdings and analyze data from markets around the world.

The service is ideal for customers with international holdings, too. The service boasts connectivity to more than 20,000 banks, brokerages, and other investment institutions around the world. You can track global stocks—Kubera supports major stock exchanges in the U.S., Canada, U.K., Europe, Asia, Australia, and New Zealand—bonds, mutual funds, foreign exchange, precious metals, cryptocurrencies, NFTs, and more. You can also track real estate, automobiles, even domain names.

The platform allows you to view your holdings’ values and even estimated resale values at any given time without having to search through complicated paperwork.

In short: This service offers the functions of several portfolio management apps all in one place.

Want to explore Kubera to see if it’s right for you? Start with a risk-free 14-day trial; after that, you can choose a monthly or annual plan.

- Kubera tracks all your assets in one place—traditional & crypto.

- Can access financial information from 20,000+ global banks, brokerages, and financial institutions.

- Keeps all details in one place to build a complete view into your net worth as simple as a spreadsheet.

- Easy to use

- Connects to more than 20,000 financial institutions around the world

- Values a high assortment of assets

- No financial planning tools

- Above-average cost

- No mobile app

9. Morningstar Investor (Best Portfolio Management Software for Asset Allocation + Sector Weightings)

- Platforms: Web

- Available: Sign up here

Morningstar Investor is a rich platform of investment research resources for the buy-and-hold crowd, and one of its most important features is its net worth and portfolio management tools.

Within Morningstar’s portfolio manager, you can link up savings, checking, investment, and other accounts from more than 15,000 financial institutions to keep an eye on your nest egg, cash flows, and investments. Or if you’d just like to keep track of a few of your holdings, you can manually input basic information about your stocks, funds, even individual bonds and cash.

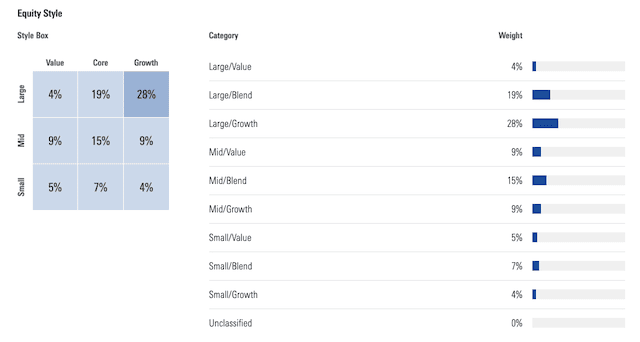

One of my favorite tools within the portfolio manager is Morningstar X-Ray, which evaluates your portfolio and tells you where you stand on asset allocation, sector concentration, geographic holdings, and even equity styles (large/mid/small, value/core/growth). It also tells you how your portfolio compares to benchmark portfolios with varying amounts of risk.

If you hold a mix of individual stocks and funds, you’ll want to check out the Stock Intersection feature, which shows you how much of your portfolio you really have invested in a stock. Many of your funds might hold large positions in the same stock or handful of stocks, leaving you overexposed and less diversified than you realize.

With Morningstar Investor, you can also:

- Research thousands of stocks, mutual funds, and ETFs using Morningstar’s screening and charting tools, as well as its proprietary ratings systems.

- Set up stock and fund watchlists

- Enjoy stock news and commentary that’s tailored to your holdings

- Screen for securities that match your investing goals using a variety of performance and valuation metrics

- Follow Morningstar authors so you can check out their latest articles, videos, and podcasts as soon as they’re posted

Not sure if Morningstar Investor is right for you? Try it out with a free seven-day trial. You can check out the current deal, as well as discounted rates for students and teachers, in our details box below.

- Morningstar Investor offers expert research, investing analysis, and advisor-grade portfolio management tools that are tailor-made for buy-and-hold investors.

- Morningstar is one of the most prized sources of mutual fund and exchange-traded fund (ETF) data in the world.

- How does your portfolio stack up? Put it through Morningstar's Portfolio X-Ray, which will provide insights such as whether you have too many overlapping holdings or whether you're paying too much in fees.

- Special Offer 1: Click our sign-up link to receive $50 off your first year of Morningstar Investor. (Annual plan only.)

- Special Offer 2: Students receive one year of Morningstar Investor access for just $25!

- Special Offer 3: Teachers receive a 60% discount on Morningstar Investor access.

- Top-flight fund research and analysis

- Portfolio management tool

- Powerful screener

- Watchlists

- Tailored news and commentary

- Below-average charting

- High monthly billing rate

Related: 8 Best Stock Picking Services, Subscriptions, Advisors & Sites

What Is a Stock Portfolio Tracker?

You might be thinking to yourself, “Why do I need a stock portfolio tracker? When I log into my brokerage account, it shows me everything I own.” That’s true! If the entirety of your financial life is tied up in a single brokerage account, chances are you don’t really need a more comprehensive portfolio tracker.

But a lot of people have more than just a brokerage account. They almost certainly have one or two bank accounts, they might have a workplace 401(k) and maybe even an IRA to boot, and they might have other accounts detailing additional financial assets.

For those people, portfolio management software makes a lot of sense.

Organization is certainly part of the appeal, but consider everything that portfolio trackers can do. Among other things, they can:

- Sync up your banking, investing, and other financial accounts

- Provide a single place to monitor accounts

- Help you establish and track your progress toward financial goals

- Plan for retirement, including help with tax optimization

- Research investment options

- Fund fee optimizer that tells you whether you’re overpaying for investments

In other words: Not only do portfolio trackers help you get a holistic view of all of these accounts—they can actually help you make smarter investment decisions.

Here’s a for-instance. I manage my 401(k) and IRA differently, with separate goals for each. That said, a free portfolio tracker helped me realize that while I was doing a good job keeping out overlap, I wasn’t doing a perfect job. I was overweight in a couple of areas I wanted to pull back from. It’s a common problem. And thanks to tools like these, people can realize, say, they have more of their nest egg invested in bonds than they hoped, or they’re under-exposed to small caps—and they can do something about it.

Portfolio trackers can also evaluate funds you hold to see how fee-friendly (or fee-fat) they are, help you keep track of dividend income, and provide other services that your broker might not—or that your broker might only be able to do within your brokerage account, but not across all your financial accounts.

Related: 15 Best Investing Research & Stock Analysis Websites

Investment Portfolio Trackers: FAQs

What is an investment portfolio tracker?

An investment portfolio tracker keeps tabs on all of your various investments—stocks, bonds, funds, and more. While some of the most basic portfolio trackers involve uploading files, most modern portfolio trackers simply sync up with your accounts and provide all the information you need in one comprehensive dashboard.

Portfolio trackers often go beyond tracking, too, allowing you to analyze and even optimize your portfolio. They’re also often delivered alongside other products and services, such as budgeting tools, net worth trackers, robo-advisories, asset management, and more.

What is the best way to track investments?

When you have multiple brokerage and other investment accounts from different financial institutions, it can be difficult to keep track of all your investments.

Spreadsheets can take a substantial amount of time, are prone to human error, and don’t give you advice on adjustments to make. Some people choose to hire portfolio managers to track their investments, but these professionals can be expensive. And while some managers do allow for a lot of input on your part, others strictly stick with their own investment management system, leaving you with very little control.

Investment portfolio management software, however, is a great way to track all of your holdings, across all accounts, in one place, while taking as much control as you want. This type of software makes it simple to track your net worth, can show redundancies in your investments, lets you try various investment scenarios, and more.

Is there an app that tracks your stock portfolio?

Yes, there are mobile apps that can track your stock portfolio and let you handle portfolio management. Empower, Stock Rover, and Seeking Alpha all offer mobile apps, and they’re explained in previous sections.

How can I see all my financial accounts in one place?

The best way to view all your financial accounts in one place is to use portfolio management software that supports syncing up bank, investment, retirement, and other accounts. These programs typically will show you your net worth, help you optimize your portfolio, and allow you to make adjustments where necessary.