Opening a child’s bank account with a debit card can be a big step for both a child and parents. So, it’s important to know what you are getting into before making your decision to move forward with your child’s first bank account and debit card.

This article will provide you options on where to open an account, help walk you through the considerations you might have when getting a bank account with a debit card, the features to look for and the steps involved in opening a child’s bank account with a debit card.

This should help you make an informed decision about whether or not this is right for your family.

Let’s jump right in.

Best Child Bank Accounts With Debit Cards

|

Primary Rating:

4.8

|

Primary Rating:

4.4

|

Primary Rating:

4.4

|

|

Starts at $5.99/mo. (for up to five kids)

|

Free (no monthly fees).

|

Free 30-day trial. Acorns Early: $5/mo. for 1 child. $10/mo. for 2-4 children. Acorns Gold: $12/mo., includes Acorns Early for up to 4 children.

|

Are You Ready to Open a Bank Account and Debit Card for Your Kids?

If you feel ready to open a bank account with a debit card associated with the account, you’ll need to consider your available options. Have a look below at some useful debit cards for teens (or younger).

| App | Apple App Store Rating + Best For | Fees |

|---|---|---|

Greenlight Greenlight | ☆ 4.8 / 5 Customer rating and parental controls | Core: $4.99/mo. Max: $9.98/mo. Infinity: $14.98/mo. (Each plan supports up to 5 children.) |

Copper Banking Copper Banking | ☆ 4.8 / 5 Teen financial independence | Copper $4.95/mo., Copper + Invest: $7.95/mo. |

Acorns Early Acorns Early | ☆ 4.7 / 5 Accessible customer service support | Free 30-day trial. Acorns Early: $5/mo. for 1 child. $10/mo. for 2-4 children. Acorns Gold: $12/mo., includes Acorns Early for up to 4 children. |

Revolut <18 Revolut <18 | ☆ 4.8 / 5 Parent-paid bonuses | No monthly fees |

Current Current | ☆ 4.8 / 5 Innovation and product features | Free (no monthly fees) |

FamZoo FamZoo | ☆ 4.6 / 5 Financial literacy resources | Free trial, then $5.99/mo./family. (Discounts available for longer periods of prepayment.) |

Chase First Banking Chase First Banking | ☆ 4.8 / 5 High customer satisfaction from a major bank without fees | Free |

Axos First Checking Axos First Checking | ☆ 4.7 / 5 Teens ready to learn about money management | Free (no monthly fees) |

| *Apple App Store Rating as of Dec. 11, 2024. | ||

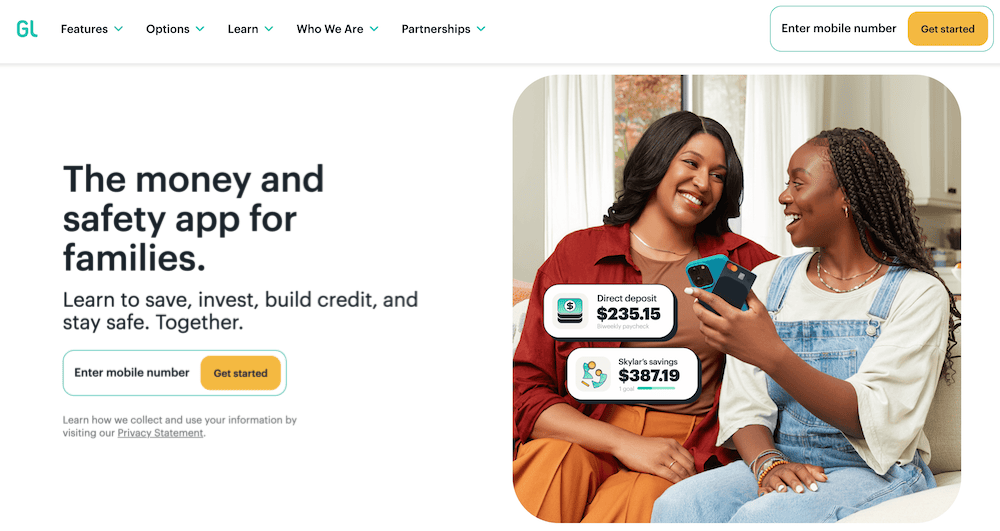

1. Best Rated Overall: Greenlight

- Available: Sign up here

- Price: Free 1-month trial. Core: $5.99/mo. Max: $9.98/mo. Infinity: $14.98/mo. (All plans include cards for up to 5 children)

The Greenlight debit card allows kids to begin spending, but provides parents with peace of mind by giving them control over where their kids can spend money. Parents also can choose to receive alerts that tell them when, and how much, money is spent on the Greenlight debit card.

Greenlight works like a prepaid debit card, allowing you to transfer money onto the card for your child to pay for expenses at approved locations. You can choose how much money to load onto the card, and your child will be cleared to make approved purchases so long as a money balance backs up the card.

If your child asks for extra money to get added to the card, you can have them take a photo of the purchase they want to make and receive your approval. This gives you control and allows you to have discussions with your child about why a purchase might be a good or bad idea.

And if your child has a job, they can add their own funds to the card as well.

Each monthly Greenlight subscription includes debit cards for up to five kids. Replacement cards cost $3.50 each but are free the first time. If you need to replace your card quickly, you can get express delivery for $24.99. The company also offers a personalized card, with your own photo or design, for $9.98 per year.

Greenlight boasts numerous other features, too. For instance, parents can open an investment account for kids to get their children investing in stocks and exchange-traded funds (ETFs) for the first time.

Greenlight also offers monthly savings rewards based on your tier: 2% per annum for Core members, 3% per annum for Max, and 5% per annum for infinity. You may set up “Parent-Paid Interest” between you and your child. This allows you to foot the bill and pay interest on accounts for up to five kids.

The Greenlight debit card is a good choice for parents looking to teach their kids the importance of saving money and making prudent financial decisions. This financial product can be an effective learning tool for helping kids to understand why saving should be a priority and how to simplify paying an allowance or tracking chores.

Greenlight has no minimum age requirements but recommends starting at age 6 or older.

Read more in our Greenlight Card review.

- Greenlight is a financial solution for kids that allows them to spend with a debit card, earn money on savings, and even invest their money.

- Greenlight offers flexible parental controls for each child and real-time notifications of each transaction. And it's the only debit card that lets you choose the exact stores where kids can spend on the card.

- Parents can use this app to teach kids how to invest with a brokerage account through Greenlight Max and Greenlight Infinity plans.

- Families can earn 2% (Core), 3% (Max) or 5% (Infinity) per annum on their average daily savings balance of up to $5,000 per family. Also, Max and Infinity families can earn 1% cash back on their monthly expenditures.

- Unlike many apps that simply provide features and controls, Greenlight is also designed to spark discussions with children about spending, investing, and more, fostering a better educational experience.

- Best-in-class parental controls (can prohibit specific stores)

- Can add brokerage account to invest in stocks

- Intuitive Parent + Kid apps

- Competitive cash back & interest rates

- Parent-Paid Interest

- High price points

- No cash reload options

- No parent / child lending

Related: 13 Best Allowance and Chore Apps for Kids [Easier Family Life]

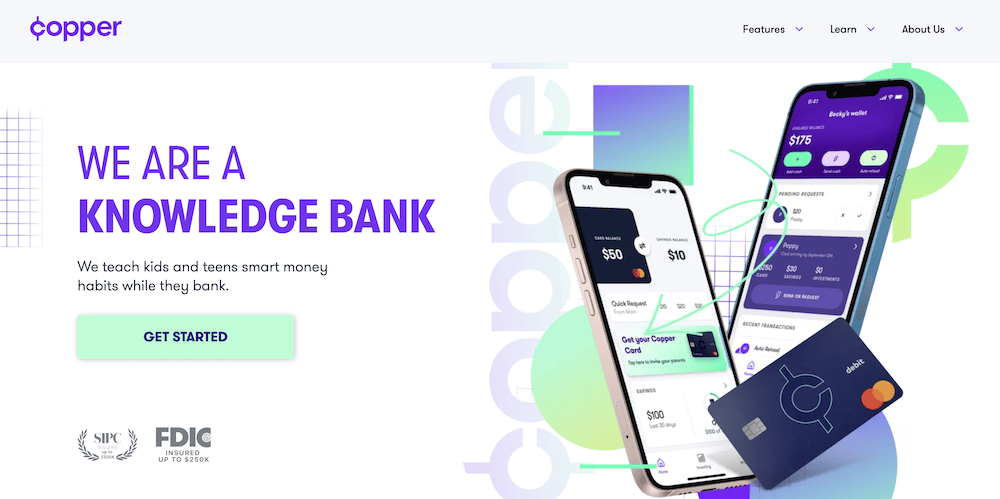

2. Copper Card (Best Debit Card for Kid Independence)

- Available: Sign up here

- Price: 30 days free. Copper: $4.95/mo. and Copper + Invest: $7.95/mo.

Copper Banking was founded on the belief that kids and teens should have equal access to financial education and should be empowered to learn by doing. Now, the company is on a mission to help children gain real-world experience by giving them access to their money in a way that traditional banks can’t.

The Copper app and debit card teaches your child how to make smart financial decisions by creating a platform where parents and their kids can connect. With the Copper app, you get easy snapshots of your accounts. And with the Copper Debit Card, it’s easy to shop in-store or online, including with Apple Pay or Google Pay.

Plus, users get exclusive access to engaging advice curated by a team of financial literacy experts who provide tips on how to take control of their financial future.

Copper Banking Features:

- Send/Request: Kids and parents can easily send and receive money all at the touch of a button.

- Spend: Spend using Apple or Google Pay, or using the Copper Debit Card.

- Withdraw: Access your money from more than 55,000 fee-free ATMs.

- Monitor: Get a snapshot of all your child’s spending in an easy-to-read dashboard.

- Save: Gain quick snapshots of your kid’s savings and helpful tips on how to save even more. Set up savings buckets and save for the things that you want.

- Learn: With the help of Copper’s team of financial literacy experts, gain bite-sized tips on how you can maximize your money and prepare yourself for your financial future.

The basic Copper account includes the above banking features. With Copper + Invest, your child also gets access to automatically curated smart portfolios built with their preferences in mind. Your child is given a questionnaire that helps Copper determine a portfolio based on their age, income, net worth, investment objective(s) and investment horizon. Copper then recommends one of three ETF portfolios—Moderately Aggressive, Aggressive, and Extra Aggressive—made up of thousands of stocks. Parents can review the portfolio to ensure it matches with not just your child’s preferences, but your family’s. (Portfolios can be changed later on by accessing the Support chat.)

Your child can begin investing for as little as $1, then add more contributions down the road. Copper will automatically rebalance the portfolio as needed to make sure it always keeps up with your child’s investment preferences.

Copper is available to kids 6 years and older.

Read more in our Copper Banking review.

- Copper is the digital bank and debit card for teens built with the mission of creating a financially successful generation.

- Send/Request: Teens and parents can easily send and receive money all at the touch of a button.

- Spend: Pay with a digital wallet via Apple Pay or Google Pay or use the physical Copper Debit Card.

- Monitor: Get a snapshot of all your spending in an easy-to-read dashboard.

- Save: Gain quick snapshots of your savings and helpful tips on how you can save even more. Set up savings bucks and save for the things that you want.

- Learn: With the help of Copper's team of financial literacy experts, learn more about how to maximize your money and prepare yourself for your financial future.

- Allowance administration

- Financial education resources

- Network of 55,000-plus fee-free ATMs

- No chores tracking or assignment

- No parental controls beyond notifications

Related: Best Prepaid Debit Cards for Kids and Teens

3. Acorns Early / GoHenry (Best for Customer Service)

- Available: Sign up here

- Price: Acorns Early: $5/mo. for 1 child. $10/mo. for 2-4 children. Acorns Gold: $12/mo., includes Acorns Early for up to 4 children.

A longtime player in the kids’ debit card/financial app space has a new name and a new face: GoHenry, which was acquired in 2023 by Acorns, has officially become Acorns Early.

Many reviewers have long painted Acorns Early/GoHenry as just a way to spend. However, I see it as a real financial solution for minors—a debit card, yes, but also an app-based ecosphere that provides education and experience for the child, as well as ways for parents to keep their kids safe and teach them responsibility.

When you open an Acorns Early account, each child receives an Acorns Early Mastercard debit card that can be used anywhere Mastercard is accepted (so, millions of vendors). Not only can kids spend online and in stores, but they can also use their Acorns Early debit card to withdraw cash from ATMs. The standard Acorns Early debit card itself is included in the monthly subscription. However, your child can also choose to stylize their card with one of 35 different designs—most designs require a $5 one-time fee, though certain “limited edition” designs will be $6.

An Acorns Early account also allows kids to set savings goals, which they can fund manually or via autosave. And it also hosts educational materials to help children and teens alike develop good money habits. One of the more impressive aspects of the program is that it’s explicitly segmented into different age groups, starting with money basics for kids in single-digit ages, then becoming more advanced over time, so the lessons really appear to grow as your children do.

This FDIC-insured account also enjoys a variety of safety features, including chip and PIN protection, secure PIN recovery, and Mastercard’s Zero Liability Protection, which means your child won’t be liable for fraudulent purchases as long as they take care in protecting your card from theft and you promptly report any fraudulent activity.

Acorns Early also offers parents additional peace of mind by providing a number of controls, including:

- Real-time spending notifications

- Card lock/unlock

- Savings goal lock/unlock

- Adjustable spending limits on a per-transaction and per-week basis

- Card category block/unblock for in-store purchases, online purchases, and ATM withdrawals

- Adjustable spending block/unblock at stores that sell age-restricted goods such as firearms and alcohol

Also, kids can only spend whatever money is available on the card because it’s a prepaid debit card. That means parents don’t have to worry about costly overdraft fees or their kids running up a debt.

Acorns Early offers a number of ways to fund the account. Parents, of course, can send money in a pinch whenever they want with instant transfers. They can also set up a regular allowance, or tie payment to chores. (And parents get to approve chores before they pay out—no half-done dishes allowed.) Teens can also receive ACH deposits from their employers. And loved ones can either get “relative accounts” that allow them to send money to your kids, or they can send money via Acorns Early “Giftlinks,” which act similarly to an e-gift card.

GoHenry really stuck out to us as one of the best prepaid debit cards for kids because of their outstanding customer service. Good news there: Acorns Early users should expect a similarly high level of customer support, including seven-day-a-week phone service from 5 a.m. to 7 p.m. PT, as well as 24/7 live chat support.

Parents have two ways of signing up for Acorns Early:

- Signing up for an Acorns Early account for either one or two to four children.

- Signing up for Acorns Gold. Not only does a subscription come with a free Acorns Early account for up to four children, but you can also open an Acorns Early Invest account—a custodial account that allows you to invest for your kids’ future.

Acorns Early has no minimum age requirements but recommends starting at age 6 or older. Learn more in our Acorns Early review.

A note for current GoHenry users: For now, your app, features, and cards will continue to work as normal. However, if you want all of the latest features, you’ll need to download the Acorns Early app from the iOS App Store or Google Play.

- Acorns Early (formerly GoHenry) is a debit card and financial app designed to provide education, experience, and confidence in saving, spending, and earning, to kids ages 6-18.

- Kids get a Mastercard debit card that allows them to spend in stores and online, and withdraw money from ATMs.

- Kids can also earn allowance, complete chores for money, set savings goals, even give to charity.

- Parents can rest easy knowing there are plenty of guardrails in place, including chip-and-PIN technology, Mastercard Zero-Liability Protection, and parental controls such as spending notifications, card locking, and adjustable spending limits.

- Acorns Early also provides educational resources tailored for kids of all ages.

- GoHenry's reputation for excellent customer service among kids' debit card providers will continue through Acorns Early, which is offering everyday phone availability and 24/7 chat support.

- Subscribing to Acorns Gold includes not only a free Acorns Early account for up to four children, but also Acorns Early Invest, a UGMA/UTMA custodial account where you can save toward your kids' future and get a 1% match on up to $7,000 in contributions annually.

- Special offer: Get a free 30-day trial and $5 allowance when you sign up.

- Strong parental controls (including card-use controls and adjustable spending limits)

- Chores and allowance

- FDIC insurance

- Allows for ACH payments

- Convenient "Giftlinks" for non-accountholders to give money to kids' accounts

- Customizable cards ($5-$6)

- No investing feature

- No fee-free ATM network

Related: Acorns Early (Formerly GoHenry) vs. Greenlight

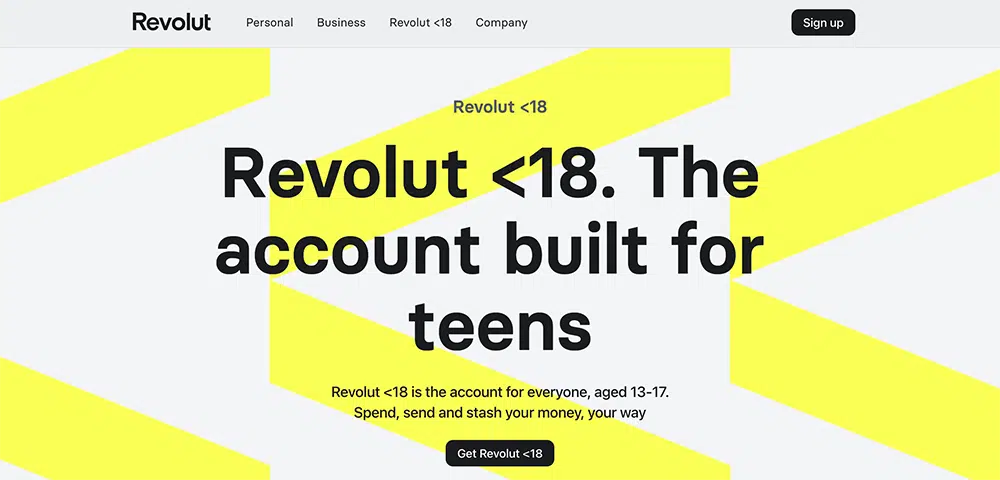

4. Revolut <18 (No-Fee Prepaid Debit Card for Kids)

- Available: Sign up here

- Price: No monthly fees

Revolut <18 is a prepaid debit card for kids designed to teach them money skills for life. Aimed at building healthy money habits from an early age, the unique, customizable card1 empowers parents to have full insight into their kids’ card activity through providing instant spending alerts and parental controls.

You can choose to freeze the card, as well as set controls on how they use the cards online and with contactless payments through your Revolut app. You can also set spending limits on how much your child can use with the prepaid card.

Parents use the card and accompanying app to teach kids about earning, budgeting, saving and even investing money (depending on the plan chosen). You can also use the card to manage chores and allowance, set savings goals as a family, and help your children manage their money.

And if your child did something deserving of a reward? You can send parent-paid bonuses when they complete specific tasks. Simply add money to their digitized piggy bank through the app. You can send and receive money in seconds through Revolut’s payments feature, which allows fast transfers between account holders and also global transfers at transparent rates.

You must have a personal Revolut account before you can open a Revolut <18 account for your children. You can add up to five Revolut <18 accounts per parent account.

To learn more about Revolut <18, visit their site and open an account for yourself and your child.

- Revolut <18 is a prepaid debit card for kids designed to assist parents teach kids ages 6-17 about money. Families can handle chores and allowance, create budgets, set parental controls and more.

- Revolut <18 comes with unique, customizable cards* that parents can use to set up tasks and goals to work on together as a family.

- Prepaid debit card for teens

- Parental controls

- Round-ups

- Chore and allowance management

- Customizable designs (fees apply)

- Children can't load funds, only parents can

- Parents need to have a personal Revolut account

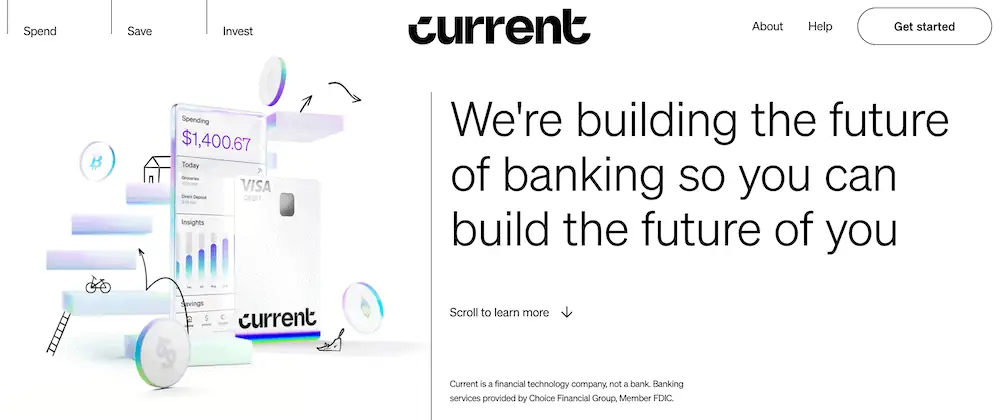

5. Current (Great No-Monthly-Fee Teen Card)

- Available: Sign up here

- Price: Free (no monthly fees)

Current is a banking app designed for families; it offers both parent and teen accounts, with the latter acting like prepaid debit cards that parents load for their children. The Current app allows you to track your teen’s spending in real-time, set limits on how much your children can spend, and even block specific merchants on its Visa-enabled debit cards. You also get the peace of mind that comes with knowing your children’s money is safe because it’s not cash—no temptations, just a tool parents can use to help teach teens financial responsibility.

Among Current’s features:

- No minimum required balances, no fees on transfers to other Current accounts, and no hidden fees.

- Create Savings Pods, or Giving Pods, that allow you to save up for various goals.

- Round-Ups allow you to round up purchases to the nearest dollar amount and store the difference in Savings or Giving Pods.

- Buy and sell 27 different cryptocurrencies with zero trading fees.

Teens will love easy allowance deposits, a card they can use in stores or online, instant gas hold removals when buying gas, and access to more than 40,000 fee-free Allpoint ATMs nationwide. They’ll also have the opportunity to learn about financial responsibility and financial independence through Current’s Budgets feature, which allows them to track their spending and even receive alerts when they get too close to (or exceed) a predetermined limit.

The product has no specifically stated minimum age requirement, but the marketing suggests teens are the target audience. However, you might be able to open an account for a younger child.

Read more in our Current review.

- Current is a financial technology platform that lets teens enjoy not just traditional banking basics, but numerous features meant to simplify spending, streamline saving, and set them on the path toward more organized finances.

- Teens can spend with the Current Visa debit card, which allows them to purchase in-store and online, as well as withdraw money fee-free from more than 40,000 in-network Allpoint ATMs.

- Current Teen Accounts also come with Savings Pods, which earn 0.25% APY and allow you to round up purchases (overages are funneled into your savings).

- Parents can monitor their kids' spending, adjust maximum ATM withdrawal and spending limits, and even toggle spending categories (and the Current debit card itself) on and off.

- Parents can also automate allowance payments, pay for chores, instantly transfer money to their teens, and more.

- Free account (no monthly maintenance fees)

- Good parental controls

- Fee-free ATMs

- Cash reloads

- Gas hold deposits

- 24/7 email and live-chat support

- No direct deposit

- No paired investment account

- No card customization

Related: Best Teen Credit Cards for Building Credit

6. FamZoo (Best for Financial Education)

- Available: Sign up here

- Price: Free trial. Then $5.99/mo., $25.99/6 mos., $39.99/12 mos. or $59.99/24 mos. (all per family)

FamZoo is another service for parents interested in opening prepaid debit cards to manage their children’s spending.

Parents can fund a FamZoo account through numerous routes, including bank transfers, Direct Deposit, even cash. Typically, parents will load their primary funding card, then they will transfer those funds onto their kids’ cards. But you do have the option of directly funding kids’ cards.

There are plenty of safety features, too. And there’s no risk of having your bank account information stolen from FamZoo—because FamZoo never asks for it. Adults can monitor transactions, you can temporarily lock and unlock cards, and you can set up real-time alerts for card activity and remaining balances.

After a free trial, this app costs $5.99 per month, but the price goes down if prepaid in advance.

However, FamZoo rates as our top education choice because of its robust financial education library. Many of the functions have financial literacy in mind, too. For instance, payment checklists teach kids the value of a dollar by tying chores and odd jobs to rewards and penalties.

Spend, Save, and Give accounts separate funds into different purposes. And with “Parent-Paid Interest,” you can teach your kids the power of compound interest over time.

FamZoo has no minimum age requirements but recommends starting earlier rather than later.

- FamZoo is the prepaid debit card used by families to teach children good financial habits from an early age.

- FamZoo lets you fund your account in a variety of ways, including bank account, debit card, payment app, digital wallet, and cash.

- Many of the app's functions also have financial literacy in mind, including Parent-Paid Interest, parental loans, and reimbursements.

- Robust, customizable allowance and chores functions.

- Prepaid card without overdraft fees

- Highly customizable allowance and chores functions

- Strong financial education resource library

- High fee at monthly rate

- No paired investment account

- Weak parental controls

Related: Greenlight vs. Famzoo

7. Axos Bank First Checking (Best Free Debit Card for Teens at an Online-Only Bank)

- Available: Sign up here

- Price: Free (no monthly fees)

First Checking by Axos Bank is the ultimate starter checking account for teens, and it comes with a debit card.

The world of banking can be a little scary, but not with the simplicity and power of Axos’ First Checking Account. It works as a joint checking account between a parent or guardian and their teen, allowing for easy-to-set, customizable parental controls with a debit card dashboard.

Parents and teens can manage almost every part of the banking experience through a convenient mobile app or through the online desktop portal. Perfect for modern families who always find themselves on the go.

The First Checking account from Axos Bank gives teens their first taste of financial independence by giving them their own checking account (which pays interest!) and free debit card for teens. But it also provides safeguards against teens getting carried away with the money held in their account, such as daily limits on cash transactions ($100) and debit transactions ($500).

Further, you can receive up to $12 in domestic ATM fee reimbursements per month, and you avoid any monthly maintenance, overdraft, and non-sufficient funds fees—essentially making the account free! Meanwhile, users can also earn a modest APY on any balance—lower than the national average rate, but fair for a simple teen checking account and debit card product.

The account carries the highest level of security through biometric authentication techniques like fingerprint readers, voiceprints and facial recognition (pending smartphone feature availability).

The product has a minimum age requirement of 13 and is recommended for ages 13 to 17. It will convert to an Axos Checking Account after the minor reaches the age of majority.

Read more in our Axos First Checking Account review.

- Axos Bank First Checking is a joint checking account targeted for teenagers ages 13-17 and their parents.

- Account holders get a Visa or Mastercard debit card that can be used to spend online or in person, or to withdraw cash at any ATM. (Axos provides up to $12 in monthly domestic ATM fee reimbursements.)

- No monthly maintenance, overdraft, or non-sufficient fund fees.

- The debit card's security features include account alerts, card locking, and daily transaction alerts of $100 (cash) and $500 (debit).

- Currently, you can earn up to 0.10% APY on any balance.

- Free (no monthly maintenance fees)

- ATM fee reimbursements (up to $12 per month)

- Converts to adult checking account after minor reaches age of majority

- No paired investment account

- No robust financial literacy resources

Related: Best Money Apps for Teens Under 18

What is a Child Bank Account With Debit Card?

Today, parents have to keep pace with numerous priorities previous parents couldn’t even imagine. Concerns like social media, cybersecurity, buying stuff online, easy access to information and much more.

With finances, parents of yesterday really only needed to concern themselves with hard currency, or dollars and bills. I remember my parents writing me a check to bring to school each month to pay for my school lunches.

Now? You can just Venmo the payment or submit it through an online portal in most instances.

While checks might still suffice in some areas, many places have moved onward with technological advancement. With how things progress, it seems only more likely this digital transformation will continue, not reverse.

Therefore, as digital banking through an online portal and mobile app interface become the norm for how we buy and sell goods, get paid, transfer money and more, kids need to keep up with the times or risk getting left behind.

That means needing to consider bank accounts with a debit card to make online purchases or keep track of spending activity. Parents need to be laser focused on making sure their kids understand money, as well as how to use it.

Does a Child Need a Checking Account to Get a Debit Card?

In today’s world, it’s hard to get by as a kid without some form of digital banking product like a debit card or credit card.

Having a bank account with a linked card can help parents manage their kids’ finances while also giving them the freedom to make some of their own money decisions—albeit with guardrails installed by parents and enabled by fintech apps.

While cash is still king, that only works for face-to-face transactions. Many of our needs now can be met online and that requires plastic of some sort, namely in the form of a debit card or credit card.

With new apps, though, not all kids need a checking account to get a debit card. Some apps like Greenlight, BusyKid, Acorns Early and more act as prepaid debit cards which attach to an app and ultimately to a bank account of your choosing to control how you transfer money to and from the card.

This can be from performing chores for an allowance, receiving gift money, or even working a job and having money come through direct deposit.

Related: Allowance for Kids: How Much to Give [Age Appropriate Amounts]

What Age Can a Child Have Bank Accounts With a Card?

Bank accounts with a card can serve as a great entry way for kids into the financial world. They offer a chance to manage money while also falling under control of a parent or legal guardian since they’re technically on the account as a joint account holder.

Likewise, prepaid debit cards work just the same. They only allow you to spend the balance held on the card while also making it easier to transfer allowance earned through performing chores or just as part of a set payment schedule.

Getting kids started early with a prepaid kids’ debit card can help them get a head start on navigating the financial system as they get older, providing them familiarity with the different financial products and institutions.

Further, these can help to guide them about how to think about managing their money digitally as opposed to physically, though handling physical cash early on can lead to a more concrete understanding of money for later.

Once kids have mastered how physical money works and the concepts behind it, moving to a digital-based prepaid debit card might serve as a good next step.

This holds especially true since physical cash can’t work as effectively as plastic when ordering items online—something that’s become increasingly the default method for buying goods and services these days.

Most prepaid debit cards require the child to be 18 or older (or, sometimes even 16 or older). Though, you can also get around this situation through the use of adding your child as an authorized user on your existing prepaid debit card.

This provides your child access to a prepaid debit card under your control, allowing you to monitor card activity as well as set spending limits.

When conducting your own due diligence, some factors you’ll want to consider certain features.

Related: Best Teen Credit Cards for Building Credit

What Features Should I Look for in a Kid’s Debit Card?

1. Monthly Service Fees

Many bank accounts with debit cards for kids have account subscription fees you pay to open and maintain an account with this banking provider.

This has become a common way for banks to earn money. For example, this is how Acorns makes money. These monthly or annual fees are commonplace given the low minimum deposit and minimum balance requirement rules established by these mobile banking providers.

Banks, credit unions and other lenders typically make money by taking the deposits held on account and lending them to borrowers. They charge an interest rate to the borrower at a higher rate than they borrow from the depositor.

This difference, called the net interest margin, accounts for the lion’s share of bank earnings.

However, many banks have also gone after non-interest income in the form of fees or services. Items like overdraft fees, account fees, account minimum balance violation fees and much more.

Because most kids will have low account balances and still require automated financial assistance for their needs, many debit cards for teens choose to charge fees as an avenue for earning income.

Thankfully, many of them offer value-added services above and beyond what many traditional banks have, making them worth more to a parent’s peace of mind.

Having parental controls, setting spending limits, maintaining shared mobile app access and more provide parents with an attractive value proposition.

2. Financial Literacy Resources

You’ll want apps that can teach, inform and grow your child’s understanding of finances. That means coming with tools for smarter spending.

Life gets busy and keeping track of your finances can be time-consuming. You don’t always have to see where and how you spend your money.

That’s why many of these apps come with information to highlight spending insights based on your history, budgeting tools to manage your money, saving categories and goals and more.

These all help with managing money, developing a sense of ownership and understanding with finances for kids. Many also come with information through financial literacy resources through videos, articles, tutorials and explainers.

Make sure you review the content covered and navigate through the available libraries of resources to select the most important topics to cover.

3. Parental Controls

Parental controls are one of the key features that a debit card for teens should have. This is easy to set up and can be suited to any parent’s needs by being able to choose what notifications they want, set spending limits, determine which merchants kids can visit and more.

Different transactions need different levels of monitoring, so parental controls allow customization which makes it easier on parents who want a specific view into their kids’ spending activity. You won’t get these on a free debit card.

Parental controls also allow automated allowance payments, setting chores to complete, notifications for all purchases online and off and seeing spending reports.

These parental controls differentiate between a traditional prepaid card and a card offered by a traditional bank.

4. Savings Account Option

The best debit cards don’t just about teach kids about money and develop financial responsibility. They’re also a savings account in disguise, since the money gets drawn from the linked checking account on the card itself and all transactions go through it.

Learning to manage this account can teach kids how to save and budget their money in the short-term but also toward longer-term goals.

5. Online Banking / Mobile Banking App

When looking for a bank account and debit card, having direct access to your account serves as a vital connection to you and your money.

The advantages of having an accessible online banking portal and paired mobile banking app include:

- Financial responsibility. Teaching kids about financial responsibility and giving them their first taste of managing money like adults do: digitally

- Online access. Online banking, mobile app and online access for parents

- Enables saving. Mature teenagers’ checking account allows teens to save for a car, college or other long term goals.

- Avoids having cash. Allows savings without having to keep cash in the house

- Account Security. Security over your account balance and who has access

- Real-time monitoring of account activity. (e.g., checking a child’s spending, cash withdrawals, mobile check deposits, ATM fees, minimum daily balance, real time notifications, etc.)

- Convenience. Have instant oversight on multiple accounts (sometimes even up to five cards) all in one place.

- Timesaving. Instead of waiting in line at a bank or credit union, you can see everything on your mobile app or through the online portal.

- Banking on the go. Likewise, do all your banking needs on your phone (e.g., deposit checks, set up recurring transfers, spend money online, monitor your monthly service fee, etc.)

- Find bank and ATM locations. Most mobile app options from banks also offer convenient bank location features, allowing you to find a bank or member ATM if you need to make ATM withdrawals or stop into the bank or credit union for something

6. Set Spending Limits

When you sign up for a credit card as an adult, chances are your spending limits will be set relatively high. You may start with a $500 credit limit in the beginning but can quickly work your way up to a balance of $5,000 or more if you build a good credit score and history.

For kids however, it might not make sense to give them that much freedom during their early years before they’ve had a chance to develop strong money skills.

Parents can set spending limits by the day, week or month. For example, parents can set limits of $25 per day for children to spend on things they want and need.

Some people have acted better with cash while others might be more comfortable using cards. Cash provides a spending limit that may help them avoid impulse purchases.

Thankfully, with the spending limits parents can set on these cards, you’ve installed a cash-based mentality in a cashless society.

7. Overdraft Protection

Fees for overdraft can be avoided when banks decline charges that would overdraw the account.

One of the best features to look for when choosing a bank account is overdraft fee protection, which can come with prepaid cards or linked debit cards.

This can block purchases from going through, automatically transfer money from another account to cover this purchase or provide a line of credit if you’re short on cash.

Parents should have spending controls for their children. This way they can monitor how much money a child spends.

In the past, kids were not allowed their own debit card or credit card unless they met certain requirements. With mobile apps that allow parents to take control of the card, children can’t spend more than a predetermined amount in any period of time or location.

That means not having to pay for overdrafts: if the debit card for teens won’t allow spending above a preset limit (such as the remaining account balance), children won’t have the ability to buy something that triggers a fee.

Another method for avoiding overdraft fees comes from use of prepaid debit cards for teens. Much like a debit card with spending limits set above the account balance, prepaid debit cards don’t allow you to spend what you don’t have loaded on the card.

Both types of cards place guardrails on overdraft fees, protecting children (and yourself) from costly fees and other banking account issues.

8. Age Restrictions and Limits

Some financial products limit access by requiring users to be a certain age. Banking apps with debit cards like Acorns Early provide access to kids as young as 6 while the American Express doesn’t offer cards to kids below 18.

Likewise, Greenlight and FamZoo have no age restrictions on who can have a debit card. You can be any age minor: a young child, a teen or even a teen entering college. Check with your banking institution to learn about what rules they place on age restrictions and limits.

9. Age Transfer

Because these banking products target minors, that inevitably means the account will need to phase out or evolve into something else owned by an adult.

Fortunately, many bank accounts for teens will likely convert into the bank’s adult version of the account. For example, if you have a checking account for teens, this account would convert to a regular checking account available to anyone the age of majority.

However, depending on your prepaid card provider, your account may not convert into an adult equivalent as one may not exist. In this case, you can likely use your card until it expires.

Consult the provider for more information and inquire about any product development which might allow you to transition to a new adult product or if they can refer you to a banking partner.

10. Minimum Deposit

Likely, many teen savings accounts and teen checking accounts for kids won’t require a sizable minimum deposit to open a child’s account.

Options like Capital One’s Money Teen Checking Account, the Copper Debit Card, Greenlight’s debit card, BusyKid, and many others have no minimum deposit requirement, allowing you to open the account with any amount you wish.

Likewise, many other teen checking account options avoid requiring a minimum deposit or maintaining a minimum daily balance.

Teen savings accounts held at a bank or credit union or through a joint account holder arrangement might have different rules and you should be mindful of these terms before opening an account.

Be sure to check your monthly statement cycle for any monthly fees that might get triggered through failing to meet any account minimums.

Related Child Bank Account and Debit Card Questions

What Happens to My Child’s Card When Turning 18?

Because these banking products target minors, that inevitably means the account will need to phase out or evolve into something else owned by an adult.

Fortunately, many bank accounts for teens will likely convert into the bank’s adult version of the account. For example, if you have a checking account for teens, this account would convert to a regular checking account available to anyone the age of majority.

However, depending on your prepaid card provider, your account may not convert into an adult equivalent as one may not exist. In this case, you can likely use your card until it expires.

Consult the provider for more information and inquire about any product development which might allow you to transition to a new adult product or if they can refer you to a banking partner.

What are Kids’ Bank Cards?

Kids’ bank cards are debit cards which allow kids to spend money at retailers, make deposits and withdrawals at participating ATMs, and avoid carrying cash but still having money in their pocket.

One type of bank card is a debit card attached to a bank account. This works by debiting against the cash balance each time the card gets used for a purchase.

Likewise, you can also have a prepaid debit card which loads a balance onto a card and has funds deplete as you spend them (or increase as you reload the card).

The principle behind both remains the same: have a balance backing the available spending limit of the card. The difference comes from having a balance held directly on the card or through a bank account backing the card.

How Do I Get a Kids Bank Account?

Getting a kids bank account is a simple process. It involves conducting a search of available products and offerings on the market, determining which checking account and/or savings account make the most sense for your needs, and then submitting an application to the company.

From there, you need to provide necessary documentation substantiating your identity, citizenship and proof of residence.

Afterward, the company will walk you through the account set up to open your deposit accounts with a kid’s debit card, prompt you to activate your card, transfer funds and begin using the account.

For more details on how to open a bank account for a minor, we have a resource which walks you through how to open these FDIC insured financial products.

Also, consult this guide on debit card age requirements and also this primer on how prepaid debit cards work for these associated products on your kid’s account.

Can My Kid Have a Bank Account?

If you want my child to sign up for a card for a bank account with debit card, you will need to open a joint account and serve as a joint account holder with your child.

However, the rules do vary with different banks, credit unions and mobile app options which cater toward offering accounts for kids.

Some options only allow a legal guardian to list themselves as the joint account holder while others won’t allow minors to have a debit card under their own name until the age of 16 or even 18.

Others still allow kids of any age to have a kids savings account, kid’s checking account or kid’s debit card. It makes sense to start first with your own banking institution to learn about their options.

Though, be warned, many established banks and credit unions might not offer the level of parental controls you want for your kid’s debit card, checking account or other deposit accounts (i.e., savings accounts).

But even if you can get one from your current bank, you don’t want to just hand your child a debit card. You might want more insight and control over their spending so you can introduce good money habits.

Such options include having a joint prepaid debit card with your child, allowing you both to manage the money jointly and agree on what the card can be used for.

These cards give children the control they seek over their own cash but also allow parents to monitor the spending and offer useful guidance when needed.

Traditional banks don’t often have these controls available to you, making this a difficult task without the tools necessary to oversee account management.

Instead, a new breed of financial companies have emerged to empower parents to make money decisions with their children and equip them with the capabilities to manage money in a way they’d like.

Disclosures

Revolut <18

1 Customized cards may require fees.

![Check Out the New 401(k) Contribution Limits for 2026 [Save More for Retirement] 78 number blocks switching from 2025 to 2026.](https://youngandtheinvested.com/wp-content/uploads/2025-to-2026-blue-background-1200-600x403.webp)

![7 Best Microsavings Apps [Save Money, Reach Your Goals] 80 best microsavings apps](https://youngandtheinvested.com/wp-content/uploads/best-microsavings-apps-600x403.webp)