If you want to grow your wealth, compound interest investing is one of the best ways to get there. If you’re wondering what investments have compound interest, below are some of the best compound interest investments available today.

We’ll teach you how to calculate compound interest, what investment accounts to consider, and how growth and capital gains can impact your long-term wealth over time.

Table of Contents

Best Compound Interest Investments and Accounts—Our Top Picks

|

4.1

|

4.4

|

4.5

|

|

Free (no monthly fees).

|

18-month CD @ 4.60% APY

|

Minimum investment: $5,000.

|

What Is Compound Interest?

Compound interest is the process of earning accrued interest on your investments, as well as reinvesting that interest back into the investment. Returning the accrued interest into the investment allows your money to grow at an accelerated rate. Essentially, you’re making money not only on your original investment but also on any previous earnings.

Over time, compound interest can have a dramatic effect on your overall net worth. You can focus on compounding interest in the short term, but you’ll likely earn more money in the long term. For example, most people’s retirement savings result from accumulated interest over many decades.

Calculating compound interest is straightforward. Here is a simplified example of a compound interest formula.

Imagine you invest $100 at a yearly interest rate of five percent. In the first year, you would earn $5 in interest, for a total of $105. In the second year, you no longer earn interest on just $100. Now, you earn interest on $105. As such, you make more than the $5 in interest you earned the year before.

Now, your investment would grow to $110.25 – an increase of five percent on top of the previous year’s earnings. The process continues each year, so your investment will grow exponentially over time if you have a positive rate of return.

The above is a quick example, but if you extrapolate it, you can imagine how much interest you can earn over 30-40 years when you invest thousands of dollars per year. Compound interest works, and the longer you let it work in your favor, the greater the future value.

The power of compound interest is one reason it’s essential to start saving for retirement as early as possible. Even if you can’t afford to contribute sizable amounts of money each month, investing consistently over time will result in significantly more savings than if you wait until later in life to get started.

What Are the Best Compound Interest Accounts?

There are many different types of compound interest accounts. Most of them will require you to use brokerage services to open an investment account. However, with some options, only bank accounts are necessary.

If you’re looking for a place to invest your money and earn compound interest, here are some of the best compound interest accounts and compound interest investments to hold in them. (We also include investments that enjoy compounding returns if held in the account over time. These investments don’t necessarily provide interest payments but they can realize the same benefits of compounding.)

| Compound Interest Account or Investment | Compounding Returns Rate Range | Suggested Investment Horizon | Risk Level | Recommended Offer |

|---|---|---|---|---|

Best Compound Interest Accounts: Short-Term Investments |

||||

| Certificates of Deposit | 2 - 5%+* | 30 days - 5 years | Very Low |  CIT Bank CD CIT Bank CD |

| High-Yield Savings Account | 0 - 5%+* | Short-Term Funds** | Very Low |  Step Banking Step Banking |

| Money Market Accounts | 0 - 5%+* | Short-Term Funds** | Very Low |  CIT Bank MMA CIT Bank MMA |

| Short-Term, Debt-Based Alternative Investments | 2 - 10%* | Varies, but 30 days - 1 year+ | Low |  EquityMultiple Alpine Note EquityMultiple Alpine Note |

Best Compound Interest Accounts: Long-Term Investments |

||||

| Individual Stocks | 10%*** | Varies widely | Medium to Very High^ |  Plynk™ Invest Plynk™ Invest |

| Exchange-Traded Funds (ETFs) | 10%*** | Varies widely | Low to High^ | |

| Mutual Funds | 10%*** | Varies widely | Low to High^ | |

| Long-Term Debt-Based Alternative Investments | 5 - 15% | <1 year - 5+ years | Medium |  Mainvest Mainvest |

| Fine Art | 4% - 12% | 5+ years | Medium |  Masterworks Masterworks |

| Cryptocurrencies | Varies widely | 24 hours - 5+ years | Very High |  eToro eToro |

| Real Estate (Direct Ownership) | 5 - 25%*** | Longer-term, usually 1 year or longer with 5- or 10-year holding or lock up periods common | Low to Medium^ | |

| Online Real Estate Investing + Crowdfunding | 5 - 15%*** | 1 year - 5 years | Medium |  Fundrise Fundrise |

| Real Estate Investment Trusts (REITs) | 5 - 15%*** | Publicly traded REITs can be bought and sold on an exchange while private REITs can have multiyear holding period requirements | Medium to High^ |  Streitwise Streitwise |

| * Historically ** Funds you'd need immediate access to and can be instantly withdrawn as cash or liquid funds *** Depends on investment strategy, time horizon, etc., but average annual investment returns for broad-based stock investments ^ Depends on the type of investment within the asset class |

||||

Best Compound Interest Accounts: Short-Term Investments

Short-term investments represent an option for those looking for stability and liquidity in their investment portfolio. These types of investments typically have a shorter time horizon, meaning you will get your money back sooner rather than later.

One typical short-term investment is a certificate of deposit (CD). Banks and other financial institutions offer CDs, which allow you to invest your money for a predetermined period, usually between six months and five years. At the end of the term, you will receive your original investment plus interest payments at an annual interest rate agreed on ahead of time.

Another popular short-term investment is Treasury bills, debt issued by the US government. Treasury bills are considered very safe investments with a low risk of loss. You can also invest in local and state government municipal bonds and treasury securities like federal treasury bonds.

Ultimately, short-term investments tend to be more liquid assets that give investors fast access to their money should they need it. However, because the investment time frame is shorter, there’s not as much growth potential over more extended periods.

One downside, as mentioned, is these types of investments typically have lower interest rates, meaning less opportunity for meaningful returns on your initial investment. When considering short-term or long-term investments, you must keep all of this in mind and decide the best personal finance option for you.

1. Certificates of Deposit

Certificates of deposit (CDs) are offered by most banks and credit unions and are easy to open and understand. CDs are almost risk-free and insured in the United States for up to $250,000. They are another savings instrument like savings accounts but come with longer-term commitments, varying from three months to five years.

CDs work by lending money to a bank for a set amount of time (the “term length”), with longer term lengths typically involving higher interest rates. Much like any interest-bearing asset, the longer the term length or commitment, the higher interest rate and return you can expect to earn in exchange for losing access to your money for longer.

During the term length, you gain interest on the principal at a rate usually higher than that of a high-yield savings account. If you take money out during the term length, you’ll have to pay a penalty, so it isn’t wise to invest money you anticipate needing in the near future.

Keep in mind that some CDs might have a lower interest rate than inflation and if that happens you may lose money. Depending on your current financial objectives, holding money in a risk-free CD might be one of the best investments for young adults who have short-term financial goals they need to meet.

- CIT Bank is an online bank which offers competitive interest rates on its multiple products

- Earn many times more than the national average interest rate by keeping your cash and other savings in one of CIT Bank's banking products

2. High-Yield Savings Account

High-yield savings accounts are another option for short-term investments. These accounts offer higher interest rates than traditional savings accounts but have similar liquidity to cash deposits in most cases.

One downside of a high-interest savings account is that interest rates can change. Know that even if you get the best interest rate deal possible initially, your rate may drop. For example, during 2020, many different banks dropped their high-yield savings account interest rates numerous times. Events like this often happen during an economic downturn. So, it’s essential to keep an eye on the rates banks offer.

Another thing to watch out for with high-yield savings accounts is fees. Some banks will charge a monthly maintenance fee or other fees for using certain bank account features. Make sure you understand all of the fees associated with your chosen account before signing up.

Ultimately, high-yield savings accounts are a great way to save money while earning a higher rate of return than a traditional savings account. They offer liquidity and safety, making them a good option for those who don’t want to take on as much risk as they would with other types of investments. These accounts are especially good for the money you plan to use in less than five years, like a house down payment fund or a vacation fund. Many people use high-yield savings accounts as goal accounts for that reason.

Save With a SoFi® Checking and Savings Account (Earn up to $300 in Free Cash)

- Available: Sign up here

- Platforms: Web, mobile app (iOS, Android)

- Promotion: Earn up to $300 in free cash

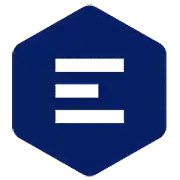

The SoFi Checking and Savings Account sounds like your run-of-the-mill bank account, but it’s more: It’s also a high-yield savings account that earns 10 times the national average percentage yield (APY) and more than the average high-yield account. Better still, it boosts your ability to save right off the bat by rewarding you with $300 upon sign-up.

Sofi Checking and Savings covers all of the basics: no monthly account fees, no minimum balances, and website and mobile app access. But it also has several perks that match or top the competition. Features include:

- Early paycheck reception when you sign up for direct deposit

- FDIC insurance of up to $2 million (vs. $250,000 for most accounts)

- Up to 15% cash back when you spend with local retailers

- No-fee overdraft coverage up to $50

- Round-ups on debit card purchases, which are deposited into your savings “Vault”

And right now, you can get a head start on your savings with qualifying direct deposits.

→ How to get your free cash with SoFi

First, you’ll need to Sign up with SoFi. Then you’ll receive $50 in bonus cash if $1,000.00 to $4,999.99 is sent to your account within a 25-day period, starting from when you receive the first direct deposit. That number jumps to $300 (total) when you receive $5,000 or more.

The higher cash bonus requires you to hit an admittedly high threshold, but the $50 is still a reasonable bonus for a much more manageable threshold.

- SoFi's Checking and Savings Account is a free, no-monthly fee account that offers an above-average yield on the savings side, and up to 15% cash back when using your checking account's debit card.

- SoFi's high-yield savings account currently pays 4.00% APY, which is 10x the national average savings rate, and higher than the average high-yield rate.

- Additional available FDIC insurance of up to $2 million is 8x the typical insured amount at most financial institutions.*

- Round up debit card purchases, and the excess is automatically sent to your savings Vault.

- Special Offer: If you set up a qualifying direct deposit within the promotion period, you can earn up to a $300 cash bonus.**

- No account fees

- Above-average yield (4.0% APY) on its high-yield savings account

- Offers up to $50 of overdraft coverage with minimum monthly direct deposits in place

- Round-ups

- Up to $2 million in FDIC insurance

- Not as competitive yield as other banking institutions

- High direct deposit threshold for maximum cash bonus

3. Money Market Accounts

A money market account (MMA) is a type of savings account that offers a higher interest rate than a standard savings account. They also offer more liquidity than other short-term investments, such as certificates of deposit or treasury bills.

One downside to MMAs is that they typically have lower interest rates than other types of investment options. So, they might not generate compound interest in a meaningful way like other investment options on this list.

Another thing to watch out for with MMAs is the minimum balance required to keep the account open. Some banks will require a minimum balance to be kept in the account at all times. If the balance falls below this level, the bank may charge you a fee.

Some MMAs come with checkbooks, which can be an excellent way to access your money if you need it quickly. These checkbooks are a key difference between a MMA and a high-yield savings account. If you want to access money in your high-yield savings account, you usually have to transfer it to a checking account to use it.

Ultimately, a MMA is a good option for those looking for a higher interest rate than what’s offered in traditional savings accounts while still having access to their money if they need it. Like a high-yield account, you can use a MMA to save for short-term financial goals that you know you want to achieve soon.

Consider opening a MMA with an online bank like CIT Bank. These types of banks tend to pay the highest yields due to their low fixed cost structures.

- CIT Bank is an online bank that offers competitive interest rates on its various products.

- CIT's money market accounts current yield roughly 3x the national average.

- CIT Bank's money market accounts feature no monthly service fees, 24/7 banking, mobile app access, and FDIC insurance of up to $250,000.

4. Short-Term Alternative Investments

Alternative investments is a catch-all term for any investment that doesn’t fall into the categories of stocks, bonds, or cash. It covers a wide variety of investments, from real estate to fine art to sneakers, and it has become increasingly popular as fintech services have opened up once-restrictive markets to the individual retail investor.

Often, because of the less transparent nature of these investments, they’re limited toward investors with more financial resources and understanding, namely accredited investors. These investors meet certain financial requirements (or qualify with recognized credentials) and can gain access to investments that can offer compelling risk-reward characteristics.

Below, we highlight one such option from EquityMultiple, a crowdfunding real estate platform focused largely on commercial real estate investments.

EquityMultiple’s Alpine Notes (Accredited Investors Only)

- Available: Sign up here

- Price: Free

Are you an accredited investor looking for a short-term investment with attractive returns? Meet EquityMultiple’s Alpine Note series.

Alpine Notes are a savings alternative with competitive rates of return on three-, six-, and nine-month notes, providing another means of conservative diversification and short-term yield. Compared to the commercial real estate crowdfunding platform’s other investment offerings, these notes are extremely short-term in nature, and thus an optimal choice for EquityMultiple users who want better liquidity.

While the notes aren’t as liquid as a savings account, they do offer maturity dates that tend to be shorter than your typical CD—and significantly higher rates of return. While this product isn’t FDIC-insured, EquityMultiple does add a degree of protection by assuming the first-loss position in case of default. That means EquityMultiple will purchase a small portion of the aggregate notes issued in a series and will only receive payments after all other investors receive their total principal and interest. Such an arrangement puts their capital at risk, adding skin in the game and aligning their interests with yours.

In case you’re wondering what EquityMultiple does with your funds that justifies paying you such a healthy return, the platform takes the capital you provide and uses it as a line of credit to sponsors who bring real estate investments to EquityMultiple’s core investment platform. The credit allows sponsors to receive surety of funding on initial closing, thus attracting more high-quality investments from high-quality sponsors.

With EquityMultiple’s Alpine Note, you’ll need to be both an accredited investor and have at least $5,000 to participate. If you’re interested in accessing higher yields than traditional CDs or money market accounts, the Alpine Note series is one of the simplest and most efficient ways to take advantage of EquityMultiple’s real estate investment opportunities without tying up your money long-term.

- EquityMultiple offers a yield-focused alternative to savings that bear contractual fixed annual interest rates of 6.00%, 7.05% or 7.4% (all of which are higher than rates currently offered by leading high-yield savings accounts and CDs).*

- The savings-like product offers reasonable levels of liquidity, carrying the option to redeem early to invest into other offerings after holding the note for 30 days.

- Interest accrues and compounds on a monthly basis, enhancing the effective annualized rate of return.

- High rates of return

- No fees on investment

- Ability to withdraw funds for other offerings after 30 days

- EquityMultiple assumes "first-loss position," providing skin-in-the-game alongside other investors

- Only available to accredited investors

- Not FDIC-insured, nor are returns guaranteed

Best Compound Interest Accounts: Long-Term Investments

5. Individual Stocks

You buy a piece of a company that will hopefully increase in value over time when you buy stocks. In effect, this means that as the company grows, so does your investment.

With some stocks, you could receive dividends from the company, giving you an immediate return on your investment. You can often choose to automatically reinvest those dividends, which helps your overall investment grow over time.

There is no guarantee that a stock will increase in value. Stock investments can be volatile, especially during economic uncertainty, but have shown themselves as a strong investment option over long periods of time.

If you want to start investing in stocks, an excellent way to begin is to use an app that offers free stocks to new accounts. That way, you can get your feet wet without stressing about losing your initial principal.

Related: Best Stock Trading Apps for Beginners to Use

6. Exchanged-Traded Funds (ETFs)

An ETF is a type of investment that tracks an index, such as the S&P 500. ETFs follow the index’s value as it goes up or down, reflecting in the underlying value of your ETF. ETFs can be bought and sold in the stock market during regular market hours, and many brokerages offer commission-free ETFs.

Having the ability to buy these low-cost investment vehicles makes them a popular choice for beginning investors. There are many different types of ETFs available, including those that focus on specific sectors of the economy (such as technology or health care) or geographic regions (such as Europe or Asia).

ETFs are a popular investment choice because they offer diversification and can be bought and sold promptly. Robo-advisors offer the capability to invest in ETFs automatically as you make deposits into your brokerage account. These investing apps handle all the investing on your behalf. You answer questions about your financial goals, risk tolerance, age, and preferences.

Consider starting an account with SoFi Invest, a hybrid robo-advisor and self-directed investing app that makes investing easy. The service offers robo-investing into low-cost index funds to invest your money in alignment with your financial goals and preferences.

- SoFi Invest allows you to trade or invest in stocks, ETFs, and options with no commissions and no account minimums. You can also participate in some initial public offerings (IPOs).

- Invest for as little as $5 with fractional shares.

- Robo-advisory services, including goal planning and auto-rebalancing, available for annual 0.25% AUM fee.

- Subscribe to SoFi Plus to unlock more than $1,000 per year in extra value, including a 1% match on recurring investment deposits, preferred IPO access, higher cash-back rewards on certain SoFi credit cards, a six-month APY boost, and more.

- Special offer: Get up to $1,000 in stock when you open and fund a new Active Invest account.*

- Good selection of available investments

- No options contract fees

- DIY and robo-investing options

- Fractional shares

- Doesn't support mutual funds

- Limited trading tools

- No tax-loss harvesting

- No socially responsible robo-advisor functionality

Related: Best Investments for Roth IRA Accounts [Target High-Growth]

7. Mutual Funds

Mutual funds are professionally managed investments that pool money from multiple investors to buy stocks, bonds, or other securities. Mutual funds trade on stock exchanges just like individual stocks, and their prices fluctuate throughout the day.

However, unlike stocks representing ownership in a single company, mutual funds comprise multiple companies. Additionally, they are actively managed by professionals who decide how to invest the fund’s assets.

Because they offer professional oversight, mutual funds are often considered an excellent compound interest investment for beginning investors. Mutual funds typically charge fees for this service. They may also be subject to annual management fees depending on their structure. We recommend considering Schwab and its access to several mutual funds.

- Charles Schwab is one of the best online and mobile trading platforms among discount brokers, offering a full range of investments (including professionally managed accounts). It allows you to invest in stocks, ETFs, mutual funds, options, bonds, futures, micro futures, and futures options.

- $0 commission trading for online U.S.-listed stocks, ETFs, options, mutual funds, and Treasuries. (Options do have a 65¢ contract fee.)

- More experienced traders can find plenty of horsepower in the Thinkorswim platform, which provides advanced charting, screening, complex options trades, access to a trading community, and more.

- Learn with Schwab, too. Schwab offers a wide variety of educational resources and stock news. The accounts offer regular market commentary, tax planning and retirement advice, stock and fund screeners, Schwab courses ranging from “Income Investing” to “Directional Options: Single Options and Spreads," and even access to Onward—Schwab’s quarterly financial magazine.

- Opening a Schwab account is easy and only takes a couple of minutes.

- Excellent selection of available investments

- Commission-free mutual funds and Treasuries

- Schwab Intelligent Portfolios (robo-advisory)

- Thinkorswim platform (absorbed from TD)

- Fractional shares

- No direct cryptocurrency trading

Related: Tax Advantaged Investments & Accounts to Grow Wealth

Other Top Investment Opportunities to Consider

Check out some of these other investment options for other FinTech-enabled investment opportunities popping up. They might represent some of the best assets to buy for your portfolio.

Accredited Investors Only:

|

Primary Rating:

4.5

|

Primary Rating:

4.5

|

Primary Rating:

4.7

|

|

Minimum Investment: $2,500

|

Minimum Investment: $500

|

Minimum Investment: $5,000

|

All Investors Welcome:

|

4.5

|

4.4

|

4.0

|

|

Commission-free trading. Robinhood Gold: Free 30-day trial, then $5/mo.

|

Most funds: 0.85% annual fee. Fundrise Innovation Fund: 1.85% annual fee.

|

Minimum investment: $1,000

|

8. Alternative Investments

An alternative investment is any type of investment other than stocks, bonds, mutual funds, etc. In other words, largely non-stock investments or equity investments unavailable to retail investors. They can include hedge funds, venture capital investments, small business investments, and even collectibles.

Many investors choose alternative investments because they offer the potential for higher returns and a diversification position in their portfolios. They also come with increased risk compared to traditional investments like stocks and mutual funds.

Alternate investments can be attractive, but it’s hard to predict how much money you can make or how liquid the investments will be. For that reason, more traditional investments like dividend stocks or mutual funds are a better option for those starting to invest.

Beginning investors should only consider alternative investments if they have extra money they can afford to lose.

9. Fine Art

Fine art can be an excellent investment if you have the cash to spare and look for something with a little more risk and excitement. Unlike more traditional forms of investment, such as real estate or stocks, fine art is harder to value and predict returns. These characteristics can make it a higher-risk option and has the potential for significantly greater rewards.

The upside of investing in fine art is that it represents an asset that tends to hold its value over time, even appreciate when chosen carefully.

The downside is that buying into the market can be risky because it’s difficult to value and predict returns. Additionally, unlike other investments such as stocks or bonds, no regular income is generated from the artwork.

If you’d like to invest in blue-chip art, consider a service like Masterworks. The investment platform allows you to invest in fractional shares of iconic artworks and build a diversified portfolio curated by the company’s industry-leading research team.

Once purchased, Masterworks securitizes the artwork for fractional investing and holds it for three to ten years to allow for appreciation. You can choose to sell your shares on the secondary market within the platform or wait until the artwork sells, delivering you your pro-rata proceeds, net of fees.

If you’d like to try your hand at investing in blue-chip artworks, consider opening an account with Masterworks to learn more.

- Masterworks allows investors to buy shares in art selected by the platform's team for both high quality and strong value.

- The service offers a secondary market where investors can sell shares if they want to exit their investment early.

- Provides an easy way to invest in art

- Access to dedicated support representative

- Investing requires a call screen consultation

- High fees

- High minimum investment per offering ($15,000), though it can be waived to as low as $500 on a case-by-case basis

Related: How to Invest in Blue Chip Stocks for Starters [Steady Eddies]

10. Cryptocurrencies

Cryptocurrencies, such as Bitcoin, are a relatively new form of investment that has seen significant growth in recent years. Cryptocurrencies work by using blockchain technology rather than relying on central authorities such as banks. The decentralized nature of cryptocurrencies makes them an attractive option if you look for privacy and security in your investments.

The downside of cryptocurrencies is that they are incredibly volatile. The value of Bitcoin, for example, has been known to jump or drop significantly in just a few hours. It’s important to remember this before investing any money into cryptocurrencies and only to do so if you’re comfortable with the risks involved.

Ultimately, cryptocurrencies are a high-risk and potentially high-reward investment option that can add diversity to your portfolio. They also offer a new type of asset class in what has proven to be a burgeoning market, especially among Millennials and Generation Z.

To participate in cryptocurrency investing, consider opening an account with eToro, the leading cryptocurrency trading app.

The service offers a service called Copy Trader that assists you with making trades if you don’t know how to invest in cryptocurrencies by yourself. eToro’s Copy Trader feature mimics the trades of leading traders on the platform, leaving the guesswork out of deciding what to buy and sell for your own portfolio.

Consider opening an account to learn more. They sometimes offers an account sign-up bonus for getting started. Check the product box below for more details.

- The eToro trading platform allows you to buy and sell stocks, ETFs, and options with 0% commission, including no contract fees on options.

- Trade dozens of the most popular cryptocurrencies.

- Not sure what kind of trading strategy you want to employ? eToro allows you to replicate the trades of popular traders automatically, in real time.

- Test out your strategies with eToro's $100,000 practice account.

- $100 minimum deposit to get started.

- Special Offer: Get $10 when you deposit $100 or more.*

- Good selection of available investments

- No options contract fees

- Fractional shares

- Copy trading functionality

- Strong technical analysis tools available

- $100,000 virtual portfolio included for free

- Charges withdrawal fee ($5)

- Doesn't offer robust fundamental tools

- Unavailable in 4 U.S. states (NY, NV, HI, and MN)

Related: Best Commission-Free Stock Trading Apps & Platforms

11. Real Estate (Direct Ownership)

Real estate is an investment that has been around for centuries. It can be a great way to build wealth over time.

There are two ways to invest in real estate: direct ownership or pooled investments (e.g., mutual funds, ETFs, REITs, etc.).

Buying and holding real estate directly can be a great option if you’re looking for long-term stability and like a hands-on approach. When you invest in real estate directly, you become the property owner. However, it’s important to note more work is involved when owning your property, from finding and screening tenants to handling repairs and maintenance yourself.

Suppose you’d prefer to invest in real estate without the need for hands-on ownership. In that case, pooled investments such as mutual funds, ETFs, REITs or crowdfunding platforms can be great options. These types of investments allow you to buy into more extensive portfolios that give your money exposure to many different properties with just one purchase.

12. Real Estate (Online + Crowdfunding)

Online real estate investing and real estate crowdfunding are lesser-known forms of investing. Multiple investors pool their money together to invest in various projects, such as real estate. Online real estate investing and crowdfunding take amounts varying from small to large from many different investors instead of significant investments from a few individuals.

It’s an attractive option for those who don’t have money to buy into more traditional forms of real estate investment. A structure like this can be especially beneficial for investors with smaller amounts of money to invest. They may want to get involved with property ownership but might not otherwise have enough cash on hand to do so.

The downside is that you may lose control over exactly how you invest and which properties your pooled funds target. Additional fees may also be associated with the investment process. Before getting involved, you should understand the risks involved and how much return you might expect from these investments.

You might consider the most popular online real estate investing platform, Fundrise. The platform provides diversification by allowing its investors to access several funds, each of which holds a number of properties and is designed to provide varying levels of risk and income.

Getting started only requires an initial $10 investment to explore the opportunities.

- Regardless of your net worth, you can now benefit from real estate’s unique potential for generating consistent cash flow and long-term gains with Fundrise starting as low as $10.

- Enjoy set-it-and-forget-it managed portfolios with standard Fundrise accounts, or actively select the funds you want to invest in with Fundrise Pro.

- Diversify your portfolio with real estate, private tech investing, or private credit.

- Low minimum investment ($10)

- Accredited and non-accredited investors welcome

- IRA accounts available

- Highly illiquid investment

Related: Which Type of Real Estate Investment is Right for You? 8 to Know

13. Real Estate Investment Trusts (REITs)

Real estate investment trusts, or REITs, are a type of pooled investment that allows you to invest in real estate without needing to purchase a property yourself. A model like this can be an excellent option for those who want the benefits of real estate ownership but don’t have the time or resources to manage their properties.

REITs work by pooling money from many different investors and then investing it into various forms of real estate. Investments can include anything from residential housing, to apartment complexes, office buildings and shopping malls. Because REITs offer immediate access to a range of properties, they’re an attractive option for those looking for diversification in their portfolio.

One downside is that you lose control over which specific properties your money is invested in, as with any pooled investment. Additionally, REITs can be riskier than some other forms of investment.

If you’d like to explore investing in REITs, consider Streitwise. For several years, this private REIT fund has beaten REIT industry peers in yields and investment returns. The initial minimum is on the higher side at ~$5,000. Still, the high-yielding investment appears to deliver solid returns. It works well as a passive income idea for your overall investment portfolio.

- Begin earning passive income in private real estate for ~$3,500.

- Streitwise REIT provides investors with access to stable, institutional-quality commercial properties.

- As of 4Q2023, Streitwise paid a quarterly dividend at an annualized rate of 7.2% since 2017, net of fees. This roughly doubles the average paid by public REIT alternatives.

- Strong performance track record vs. industry peers

- Lower fees than other funds (2%/yr., w/o syndicator fees)

- DRIP program

- High investment minimum (~$3,500)

- Illiquid

- Penalty for redeeming shares within five years

Related: Best Investment Opportunities for Accredited Investors

Can the Best Compound Interest Investments Make You Rich?

The answer to this question is yes. Compound interest can make you rich, but there are a few things you need to do to achieve this.

First, you need to start investing as early as possible, so the effects of compounding have more time to work in your favor. Investing in your 20s and 30s is an excellent idea and a decision that can seriously pay off down the road. Remember, you don’t have to invest a lot to get started. Every little bit counts.

Secondly, invest your money in investment vehicles that offer high returns, such as stocks and mutual funds. Investing like this can also help create passive income, especially if you earn dividend payments. Take the time to learn about various funds and your options before choosing them. The more knowledge you have, the better.

Finally, resist the temptation to spend all of your hard-earned money. Budget, plan, save and invest regularly. Please pay attention to your money and track it as it grows through compounding. If you can do these things over time, you will likely see your wealth grow, which will help you eventually reach financial freedom.

While it takes time to become wealthy through compound interest investments, it is possible with enough time and patience.

Related: