Real Estate vs. Stocks

Investing in real estate means you acquire a physical piece of property. Regardless of the type of real estate investment you make, most investors make returns on monthly rental income and/or when they sell the property on account of it being an appreciating asset.

On the other hand, when you buy shares of stock, you purchase a piece of a company. As the company’s value grows, your stock value also grows. You can also receive income in the form of dividends on your shares if you hold onto your stocks over time.

An alternative to purchasing physical property is investing in real estate investment trusts, or REITs. REITs are individual companies that own income-producing assets in the commercial real estate space such as office complexes, retail spaces, hotels and apartment buildings.

Many REITs are publicly traded like stocks and tend to pay higher dividends than their equity counterparts. REITs, like stocks, allow you to reinvest these dividends and build your investment value. For this reason, they are quite a popular option for retirement investment accounts.

Investing in real estate means you acquire a physical piece of property. Regardless of the type of real estate investment you make, most investors make returns on monthly rental income and/or when they sell the property on account of it being an appreciating asset.

On the other hand, when you buy shares of stock, you purchase a piece of a company. As the company’s value grows, your stock value also grows. You can also receive income in the form of dividends on your shares if you hold onto your stocks over time.

An alternative to purchasing physical property is investing in real estate investment trusts, or REITs. REITs are individual companies that own income-producing assets in the commercial real estate space such as office complexes, retail spaces, hotels and apartment buildings.

Many REITs are publicly traded like stocks and tend to pay higher dividends than their equity counterparts. REITs, like stocks, allow you to reinvest these dividends and build your investment value. For this reason, they are quite a popular option for retirement investment accounts.

Stocks

To buy stocks, you will have to go through a online discount broker, or an entity authorized to buy stocks. You can use a brokerage firm, individual broker, and even online platforms or robo-advisors to learn how to invest money in stocks.

Increasingly, many investors choose to use online stock trading apps for their convenience and low costs.

Before the advent of free stock trading apps, working with a brokerage firm required making a minimum deposit and maintaining an account value alongside paying brokerage fees for making trades.

In recent years, apps like Robinhood allow investors to start trading with as little as one stock and zero fees.

Many even offer free stocks for signing up.

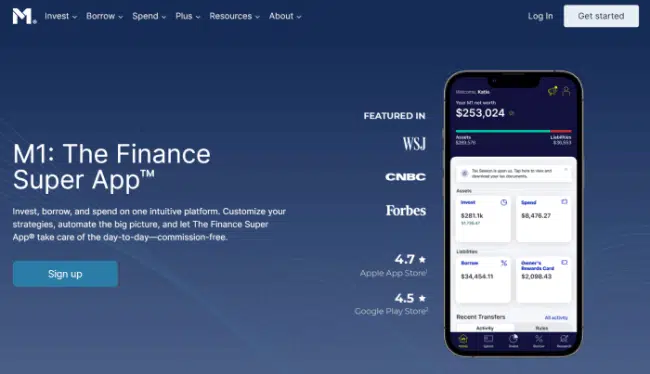

My top pick is M1 Finance, a free stock app that allows investors to set up recurring deposits which automatically get invested into a diversified portfolio of assets.

You can determine which investments you’d like to make yourself or select from the company’s 80+ expertly-curated portfolios that match with various investment objectives.

To buy stocks, you will have to go through a online discount broker, or an entity authorized to buy stocks. You can use a brokerage firm, individual broker, and even online platforms or robo-advisors to learn how to invest money in stocks.

Increasingly, many investors choose to use online stock trading apps for their convenience and low costs.

Before the advent of free stock trading apps, working with a brokerage firm required making a minimum deposit and maintaining an account value alongside paying brokerage fees for making trades.

In recent years, apps like Robinhood allow investors to start trading with as little as one stock and zero fees.

Many even offer free stocks for signing up.

My top pick is M1 Finance, a free stock app that allows investors to set up recurring deposits which automatically get invested into a diversified portfolio of assets.

You can determine which investments you’d like to make yourself or select from the company’s 80+ expertly-curated portfolios that match with various investment objectives.

- M1's Smart Money Management gives you choice and control of how you want to invest automatically, borrow, and spend your money—with available high-yield checking and low borrowing rates.

- Includes an FDIC-insured checking account and an M1 Visa debit card that delivers 1% cash back.

- Unlock perks including higher cash-back rewards on the M1 Owner's Rewards Credit Card, 4.25% APY from high-yield savings, ATM reimbursements, and 0% international fees.

- Invest in stocks, ETFs, and cryptocurrencies.

- Robo-advisor with self-directed investing capability

- Attractive cash-back and APY opportunities

- Doesn't support mutual funds

- Doesn't allow trading throughout the trading day

- Monthly fees for account balances <$10,000

Stock Investing Advantages

Stocks are liquid. With real estate, your money could be tied up for many years until you decide to sell. In the stock market, however, you can buy and sell public company shares at a moment’s notice.

Proven track record of success. Despite the many stock market crashes, buying stocks, reinvesting the dividends and holding for long periods of time has proven to be the greatest wealth generator in history. However, you need to keep your emotions at bay when ups and downs inevitably happen to see actual returns.

Earn dividends. Investing in high-yielding dividend stocks can generate significant passive income which you can then reinvest. If you hold onto these stocks long-term and continue to reinvest the dividends, you will see your net worth snowball after a few decades into true generational wealth.

Easy to diversify your portfolio. According to Warren Buffet, “The goal of the non-professional should not be to pick winners — neither he nor his ‘helpers’ can do that — but should rather be to own a cross-section of businesses that in aggregate are bound to do well.” Basically, with stocks, it is much easier to build a diverse portfolio of investments with investments like index funds across a range of sectors. Whereas with real estate, it is much more difficult to achieve true diversification.

Stocks are liquid. With real estate, your money could be tied up for many years until you decide to sell. In the stock market, however, you can buy and sell public company shares at a moment’s notice.

Proven track record of success. Despite the many stock market crashes, buying stocks, reinvesting the dividends and holding for long periods of time has proven to be the greatest wealth generator in history. However, you need to keep your emotions at bay when ups and downs inevitably happen to see actual returns.

Earn dividends. Investing in high-yielding dividend stocks can generate significant passive income which you can then reinvest. If you hold onto these stocks long-term and continue to reinvest the dividends, you will see your net worth snowball after a few decades into true generational wealth.

Easy to diversify your portfolio. According to Warren Buffet, “The goal of the non-professional should not be to pick winners — neither he nor his ‘helpers’ can do that — but should rather be to own a cross-section of businesses that in aggregate are bound to do well.” Basically, with stocks, it is much easier to build a diverse portfolio of investments with investments like index funds across a range of sectors. Whereas with real estate, it is much more difficult to achieve true diversification.

Stock Investing Disadvantages

An emotional rollercoaster. Investing in the stock market requires a cool head and discipline. Many investors run the risk of losing money because they let their emotions get in the way of their investments and cash out at the wrong time. For instance, during the Great Recession, many financial advisors told clients to sell their assets after the market had crashed, when they really should have been buying at that time.

Short-term volatility. If you’re looking to make money fast, then stock price volatility could work for or against you. Stock prices can vary drastically from day to day. If you don’t understand what’s going on in the market or with the companies you’ve invested in, this could cause you severe stress. However, over the long-term, the highs and lows are usually smoothed out for well-valued stocks.

Capital gains taxes. You may have to pay capital gains taxes after you sell your stocks, and your dividends could also be taxed. On the other hand, there are long-term capital gains rates for those who hold onto stocks for longer than a year.

An emotional rollercoaster. Investing in the stock market requires a cool head and discipline. Many investors run the risk of losing money because they let their emotions get in the way of their investments and cash out at the wrong time. For instance, during the Great Recession, many financial advisors told clients to sell their assets after the market had crashed, when they really should have been buying at that time.

Short-term volatility. If you’re looking to make money fast, then stock price volatility could work for or against you. Stock prices can vary drastically from day to day. If you don’t understand what’s going on in the market or with the companies you’ve invested in, this could cause you severe stress. However, over the long-term, the highs and lows are usually smoothed out for well-valued stocks.

Capital gains taxes. You may have to pay capital gains taxes after you sell your stocks, and your dividends could also be taxed. On the other hand, there are long-term capital gains rates for those who hold onto stocks for longer than a year.

Real Estate

There are numerous ways to invest in real estate, from long-term and short-term rental properties to fixer uppers and house hacking. Understanding your budget, finding the right lender and knowing the amount of work you want to put into your investment ahead of time will help tremendously. A real estate agent in your state, whether it’s a real estate agent in California or Florida, can help you find a property that suits your goals.

Real Estate Advantages

Real Estate Disadvantages

Real estate requires time and money. If you’ve invested in a rental property or fixer-upper, then expect to put a lot of time and money into the project. Being a landlord is no easy task, and you’ll be on the hook for repairs and problems that arise with the home. Your money is tied up. Investing in real estate is highly illiquid, meaning you will not be able to access your returns for quite some time. This is especially true if you pay cash for your rental property. Selling property is also more difficult than selling stocks. Tons of fees. There are many transaction costs involved with buying and selling property. Sellers can expect to pay 6% to 10% of the home’s sale price in closing costs, including agents’ fees, while most brokers charge no fees to sell stocks. Not easy to diversify. To have a truly diversified real estate portfolio that is representative of multiple locations and building types, you will need large sums of money that most laypeople simply don’t have. Thankfully, REITs and crowdfunding apps have made this more achievable. Related:

- Best Credit Cards for No Credit [Starter Credit Cards]

- Best Debit Cards for Teens to Learn About Money

- Best Debit Cards for Kids

An Alternative to Traditional Real Estate: Crowdfunding and REITs

If you don’t feel like taking on the significant risk of buying a rental property and using the BRRRR Method to grow your portfolio, don’t worry. You aren’t alone. In fact, FinTech has taken this risk aversion and made you investment products which allow you to tap into the real estate market without having to possess the properties physically, nor make day-to-day decisions about how to source tenants, manage the property, or make renovations. You can look into some of the crowdsourced real estate investing apps below, use a free online broker like M1 Finance to purchase publicly-traded REITs, or even invest through a service like Streitwise. Read more about each below. Related: Best Video Intercom Systems for Apartments and Office Buildings

How to Invest in Crowdsourced Real Estate

→ Investing in Individual Properties (EquityMultiple)

Some platforms like EquityMultiple allow you to invest in individual properties, specifically commercial real estate. Others, as discussed below, allow you to invest in real estate property portfolios. EquityMultiple carries a minimum $5,000 initial investment and comes with a limitation on the type of investors who can participate.

Namely, EquityMultiple only allows its individual commercial real estate projects to receive investments from accredited investors, discussed more below.

Accredited Investors: While this definition recently changed, from one which usually meant high-net worth/high-income individuals, to now one which focuses on investor experience and knowledge, it typically skews more towards investors with financial wherewithal and familiarity. That said, the new amendments from the SEC allow investors to qualify as accredited investors based on defined measures of professional knowledge, experience or certifications in addition to the existing tests for income or net worth.

These tests for financial resources include having an aggregate net worth of over $1,000,000 and earning over $200,000 in each of the two most recent years or joint income with that person’s spouse in excess of $300,000 in each of those years with a reasonable expectation of reaching the same income level in the current year.

For those interested in learning more about EquityMultiple, consider signing up for an account and going through their qualification process.

Some platforms like EquityMultiple allow you to invest in individual properties, specifically commercial real estate. Others, as discussed below, allow you to invest in real estate property portfolios. EquityMultiple carries a minimum $5,000 initial investment and comes with a limitation on the type of investors who can participate.

Namely, EquityMultiple only allows its individual commercial real estate projects to receive investments from accredited investors, discussed more below.

Accredited Investors: While this definition recently changed, from one which usually meant high-net worth/high-income individuals, to now one which focuses on investor experience and knowledge, it typically skews more towards investors with financial wherewithal and familiarity. That said, the new amendments from the SEC allow investors to qualify as accredited investors based on defined measures of professional knowledge, experience or certifications in addition to the existing tests for income or net worth.

These tests for financial resources include having an aggregate net worth of over $1,000,000 and earning over $200,000 in each of the two most recent years or joint income with that person’s spouse in excess of $300,000 in each of those years with a reasonable expectation of reaching the same income level in the current year.

For those interested in learning more about EquityMultiple, consider signing up for an account and going through their qualification process.

- EquityMultiple is a commercial real estate platform for accredited investors, providing investment opportunities in real estate funds, individual properties, and savings alternatives.

- EquityMultiple has a team boasting decades of real estate transaction experience. Their due diligence process whittles down a large selection of properties, accepting only 5% as target investments that they use to build a variety of portfolios that suit numerous investing objectives.

- The company has made $379 million in distributions since its founding.

- Makes commercial real estate Investments accessible

- Intuitive website design

- High net total returns and distributions paid to investors

- Only available to accredited investors

- High investment minimum to begin

- Fee structure varies by investment, complex at times

→ Investing in Real Estate Portfolios (Fundrise)

While EquityMultiple focuses on investing in individual real estate properties, other companies focus on investment in real estate portfolios, or several properties in one investment. In theory, this diversifies your investment risk while providing you access to several properties simultaneously.

To date, the most popular real estate investment platform offering a portfolio approach is Fundrise. This investment platform provides several options for you to review and invest your money. Their available portfolio options include:

While EquityMultiple focuses on investing in individual real estate properties, other companies focus on investment in real estate portfolios, or several properties in one investment. In theory, this diversifies your investment risk while providing you access to several properties simultaneously.

To date, the most popular real estate investment platform offering a portfolio approach is Fundrise. This investment platform provides several options for you to review and invest your money. Their available portfolio options include:

- The Starter Portfolio – This option allows investors to start investing in real estate with as little as $10.

- Core Portfolios (Supplemental, Balanced, and Long-Term Growth) – Each of these “Core Portfolios” comes with a higher minimum investment of $1,000 and targets a different investment objective. Supplemental aims to provide additional passive income from real estate investing on the Fundrise platform, Long-Term Growth invests money for the primary goal of capital appreciation, while Balanced focuses on both of these investment objectives. By offering these investment portfolio options, investors can choose which investment objective best aligns with their financial goals.

- Regardless of your net worth, you can now benefit from real estate’s unique potential for generating consistent cash flow and long-term gains with Fundrise starting as low as $10.

- Enjoy set-it-and-forget-it managed portfolios with standard Fundrise accounts, or actively select the funds you want to invest in with Fundrise Pro.

- Diversify your portfolio with real estate, private tech investing, or private credit.

- Low minimum investment ($10)

- Accredited and non-accredited investors welcome

- IRA accounts available

- Highly illiquid investment

→ Investing in Rental Real Estate Renovations (Groundfloor)

Groundfloor is a different type of investment platform from the two others listed above.

Instead of taking an ownership interest in those properties (though EquityMultiple does also offer some debt investment opportunities), Groundfloor acts as a crowdsourced real estate investing platform focused on debt investments.

The platform focuses on purchasing fixer-uppers, performing the maintenance and upgrades, and then flipping them for a profit.

Groundfloor provides financing for short-term residential real estate loans and pays the platform’s investors interest. The service reviews loan applications submitted by flippers and offers investors the ability to fund notes it believes will perform. In exchange, investors receive a set amount of interest from their loan as well as a return of principal. Most loans have a 6-12 month term, but some can extend to 18 months.

Groundfloor is a different type of investment platform from the two others listed above.

Instead of taking an ownership interest in those properties (though EquityMultiple does also offer some debt investment opportunities), Groundfloor acts as a crowdsourced real estate investing platform focused on debt investments.

The platform focuses on purchasing fixer-uppers, performing the maintenance and upgrades, and then flipping them for a profit.

Groundfloor provides financing for short-term residential real estate loans and pays the platform’s investors interest. The service reviews loan applications submitted by flippers and offers investors the ability to fund notes it believes will perform. In exchange, investors receive a set amount of interest from their loan as well as a return of principal. Most loans have a 6-12 month term, but some can extend to 18 months.

- Groundfloor is a crowdsourced real estate investing platform which offers high-yield, short-term real estate debt investments.

- Offers collateralized, secured real estate debt with 1-month, 3-month, and 12-month terms.

- Has delivered consistent 10%+ returns over past eight years with repayments received in 6-9 months on average.

- Offers after-tax and IRA investment options.

- Special offer: When you fund your account with at least $1,000, you will receive a $50 credit to invest on Groundfloor*.

→ Investing in Public REITs (M1 Finance)

M1 Finance is a free stock trading app which allows investors to buy individual stocks or fund investment portfolios according to their investment goals.

You can choose to build a portfolio yourself or select from 80+ expertly-curated portfolios, including ones that invest in publicly-traded REITs.

The app charges no trading commissions and allows you access to a wide investing universe of REITs and other real estate focused investments. The app only provides the ability to invest in publicly-listed securities found on stock exchanges.

M1 Finance is a free stock trading app which allows investors to buy individual stocks or fund investment portfolios according to their investment goals.

You can choose to build a portfolio yourself or select from 80+ expertly-curated portfolios, including ones that invest in publicly-traded REITs.

The app charges no trading commissions and allows you access to a wide investing universe of REITs and other real estate focused investments. The app only provides the ability to invest in publicly-listed securities found on stock exchanges.

- M1's Smart Money Management gives you choice and control of how you want to invest automatically, borrow, and spend your money—with available high-yield checking and low borrowing rates.

- Includes an FDIC-insured checking account and an M1 Visa debit card that delivers 1% cash back.

- Unlock perks including higher cash-back rewards on the M1 Owner's Rewards Credit Card, 4.25% APY from high-yield savings, ATM reimbursements, and 0% international fees.

- Invest in stocks, ETFs, and cryptocurrencies.

- Robo-advisor with self-directed investing capability

- Attractive cash-back and APY opportunities

- Doesn't support mutual funds

- Doesn't allow trading throughout the trading day

- Monthly fees for account balances <$10,000

→ Investing in REITs (Streitwise)

A popular alternative to crowdsourced real estate investing is to invest in real estate investment trusts (REITs). This is a more liquid option which allows investors to purchase shares of a REIT through a service like Streitwise.

REITs are bought and sold similar to stocks and can be bought on most major exchanges. You receive dividends and can sell your shares at any time.

I recommend using Streitwise to invest directly in the company’s commercial real estate-focused REITs. The service boasts an above-average yield, most recently paying out at an annualized 8.4% rate, more than twice the publicly-traded REIT average.

Historically, the service has paid out at an annualized 9.57% rate and targets investments which can return 8-9% per year. The company credits their expertise in sourcing, property management and controlling costs for producing these attractive yields. Sign up by clicking the button below to learn more.

A popular alternative to crowdsourced real estate investing is to invest in real estate investment trusts (REITs). This is a more liquid option which allows investors to purchase shares of a REIT through a service like Streitwise.

REITs are bought and sold similar to stocks and can be bought on most major exchanges. You receive dividends and can sell your shares at any time.

I recommend using Streitwise to invest directly in the company’s commercial real estate-focused REITs. The service boasts an above-average yield, most recently paying out at an annualized 8.4% rate, more than twice the publicly-traded REIT average.

Historically, the service has paid out at an annualized 9.57% rate and targets investments which can return 8-9% per year. The company credits their expertise in sourcing, property management and controlling costs for producing these attractive yields. Sign up by clicking the button below to learn more.

- Begin earning passive income in private real estate for ~$3,500.

- Streitwise REIT provides investors with access to stable, institutional-quality commercial properties.

- As of 4Q2023, Streitwise paid a quarterly dividend at an annualized rate of 7.2% since 2017, net of fees. This roughly doubles the average paid by public REIT alternatives.

- Strong performance track record vs. industry peers

- Lower fees than other funds (2%/yr., w/o syndicator fees)

- DRIP program

- High investment minimum (~$3,500)

- Illiquid

- Penalty for redeeming shares within five years

Diversifying Your Portfolio

As an investor, it’s never a good idea to put all of your eggs in one basket. Therefore, when it comes to investing in stocks and real estate, most Americans do both. According to the U.S. Census Bureau, 60% of U.S. households are owner-occupied, and the Bureau of Labor Statistics says 55% of American workers participate in an employer retirement plan, meaning they have some exposure to the stock market. Ultimately, stocks and real estate both have their benefits. Make sure to do your research and determine what you’re willing to risk before moving forward. Going in with a plan, and having the willingness to be flexible with that plan, is the key to generating significant returns.