What is the difference between investing in stocks and gambling? In one word, everything.

The stock market is not a game of chance like at a casino or racetrack; it’s a place for investors to make money by buying stocks when they’re low and selling them when they’re high. Novice investors shouldn’t equate these two because they aren’t alike.

While they might seem the same with some types of market trading, investing is all about taking calculated risks with your money. Done correctly and consistently over time, this can lead to compounded returns for not only you, but other market participants.

Gambling, on the other hand, is a zero-sum game where anything you lose the casino wins. There’s no gray area on possible outcomes and shared wealth building. You can use gambling strategies to increase your chances of winning, but you’re playing a game with defined rules and outcomes.

The stock market is a means for building wealth over long periods of time by taking available information and analyzing it to make decisions. You can research stocks to determine the value of a company and its future prospects. Further, you can limit your losses through risk mitigation strategies. Gambling doesn’t allow for such decision-making.

In short: the stock market is not gambling and this article explains why.

Table of Contents

Featured Financial Products

Is the Stock Market Gambling?

Investing in stocks isn’t like gambling because there are rules for investing that can lead you to have higher returns than keeping your funds in cash.

Investors who treat stock market trading like gambling run the risk of placing their money in jeopardy by missing out on gains or losing it altogether. Either outcome makes it difficult to retire comfortably or live a life they want.

Investing in stocks involves managing risk and increasing your chance of profitable returns. It’s not an easy task, but it can lead you to enjoy financial security in the future.

When you look at stocks, the first step you should employ is searching for quality. Ask yourself:

- How well does the company run?

- Does it have favorable business trends?

- Can the company outcompete against its rivals?

- How much is the company worth?

- What are the best case investment returns?

- What are the worst case investment returns?

- How does the company’s valuation compare against competitors?

If the stock trades at or below its worst case, you tend to buy. This is a rational investment decision not motivated by odds of a card landing, but rather of an objective assessment of the company and its future prospects relative to its current price.

It’s an opportunity to turn money into more money through compounding returns.

Gambling doesn’t rely on any specific card table performing better than others. There aren’t mispricing opportunities in the casino to leverage to your benefit over long periods of time.

Gambling is a numbers game plain and simple. The odds exist on a narrow continuum which heavily favors the house. Investing allows for thoughtful research and analysis, assessment of probable risk-adjusted returns and shared wealth among many investors and the company itself.

Everyone can win in the market over enough time. Only one can win with gambling. Therefore, the stock market isn’t gambling.

Falsely equating these two causes many people to avoid investing altogether. To understand further why the stock market isn’t gambling, we need to review what it means to buy stocks.

Related: Teenage Money Management & Financial Planning Apps to Help

Why Stock Investing is Not Gambling

Stock investing is inherently different from gambling for a number of important reasons. Below, we walk through two of the biggest differentiators between gambling and stocks.

→ Stock Represents Ownership

First, stocks represent ownership in a company or venture. Unlike gambling, stocks are an investment that provides an individual with a stake in the company.

This entitles you to a share of the profits made by the company, a claim on assets owned by the company and also a vote in how the company runs. Too often, investors see stocks merely as an investment vehicle and not what it truly represents: ownership in a company.

In fact, you can own multiple shares of stock in the same company to give you a bigger proportional ownership of the company. Buying stock in a company represents purchasing a claim on the assets, debt and equity of the company. And with it, a proportional share in the company’s profits.

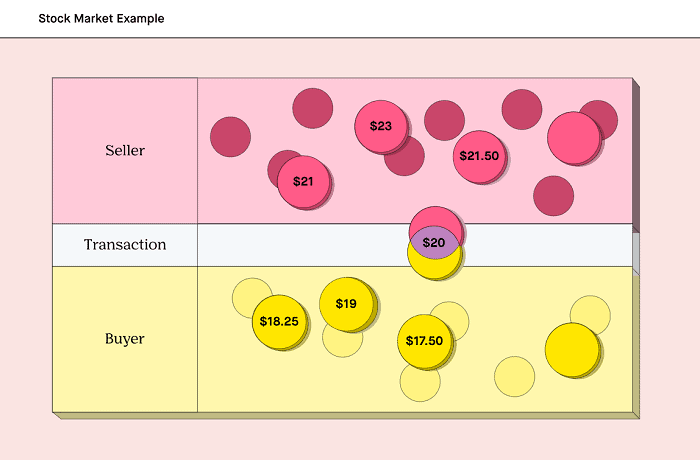

Frequently, many investors see the stock market as trading stocks and not what they’re actually doing: exchanging ownership in different companies.

→ The Value of a Company Drives Its Stock Price

The value of the stock can be worth more or less than what you bought it for at any given time, but, over enough time the value should converge on the net present value of the company’s expected future earnings. These stock price fluctuations lead to various risk-adjusted returns and create shared wealth among many investors in the economy. Everyone can win in the stock market while only one can win in gambling.

The value of a company’s current and future earnings drive its stock price. If the company looks to increase its earnings going forward, its stock qualifies as an appreciating asset as its price is likely to go up. Investors attempt to assess which companies are the best assets to invest in and use stock investing apps to issue buy orders through their brokers when they find companies they believe will grow.

Stock prices fluctuate because investors constantly try to assess the profit-making potential of companies and how much will remain leftover for shareholders. This constant bull and bear debate on profitability drives stock market prices. Further, the outlook for business conditions always changes and stock prices reflect this uncertainty.

Businesses who stand to benefit see their share prices climb. Businesses who get left worse off tend to see their share prices fall.

Assessing the future earnings prospects of a company is complex.

Investors try to use investment research software and tools to measure performance against peers, while others outsource this to experts and use stock picking services or investment newsletters to find the best companies in the market.

For instance, stock advisory services like Motley Fool’s Stock Advisor attempt to identify companies poised to perform consistently over long periods of time. The service calls these “Steady Eddies” and recommends them for every investor’s portfolio due to their sustainable returns and resilient decision-making.

Regardless of the strategy used by investors to find stocks, they all attempt to assess the value of a company. The market’s movements may appear random in the short-term, called the random walk theory. Though, over long enough periods of time, companies should trade in line with their profit performance and what the market expects them to earn going forward.

The price of a stock should reflect the present value of all the future profits the company stands to make with a minimum book value of the net equity possessed by the company on its balance sheet. Because, reasonably, a stock should at least trade for its net book value. $1 of cash on a balance sheet is worth $1 of equity.

A stock can survive for a period of time by only making losses because it can expect to earn profits in the future as it invests in its business now.

Gambling, on the other hand, is a zero-sum game. That means gambling merely takes money from one party and hands it to another (often the house, or the casino). No value gets created in this system. With investing, the overall value of an economy can increase, and with it, the value of the investments people hold.

Investing and the wealth creation it promotes should not ever be equated with the zero-sum nature of gambling.

How is Investing Different from Gambling?

Investing also differs from investing in a number of other ways.

→ Perceived Risks and Zero-Sum Game

Undoubtedly, both investing in the stock market and gambling at the casino involve risk. In both situations, you need capital, otherwise you can’t participate. Where these two activities differ comes with the risks taken on and how much they can tolerate.

Investors are generally aware of the potential risks that they take when investing in stocks. In fact, an investor may be willing to risk more than gambling at a casino. But that occurs because of the risk-adjusted returns seen in investing and the probabilities of success, especially by diversifying their investments across multiple assets.

While investing offers the potential for high returns over time, it also offers the ability to keep some of what gets invested should the investment sour.

For example, an investor might buy stocks which then move lower temporarily (or permanently) in value. This could cause the investor to lock in losses because the risk involved in that investment couldn’t be tolerated. Despite the loss, they kept some of their invested capital.

Gambling is a game where you’re betting on random events and there’s no way to predict what will happen next. You might also lose everything you’ve gambled.

Investing also carries asymmetrical risk. That means the best way to invest $1,000 could lead to $2,000, $10,000, or even $1,000,000 if invested long enough in quality companies.

Investments do not always follow a normal distribution of returns. In fact, some small companies could theoretically follow a power law curve, meaning the distribution of returns is heavily skewed. This is another way of saying a small number of firms can capture a large percentage of a total industry’s returns.

For example, Bitcoin is merely one virtual coin in the cryptocurrency market, and yet, its returns to date have far outpaced others. Bitcoin’s returns have followed a power law curve and seen exponential returns for early investors.

Gambling involves a certain range of outcomes with losses only being zero-sum. They are an all-or-nothing endeavor. If you win, they lose and vice versa.

Featured Financial Products

→ Ability to Limit Losses through Risk Mitigation Strategies

Another difference between investing and gambling comes from the ability to limit losses through risk mitigation strategies. In effect, closing out a position or buying insurance in the form of options.

One specific type of trade, called a stop-loss, allows investors to do just that: stop a loss by selling a stock if it falls to a certain level. Similarly, you can set a stop-loss order to buy back stock if it goes too high when you’ve shorted stocks on apps like Robinhood or Webull.

Sometimes, investors conscientious of risk will place a stop-loss order of 5-10% below their purchase price as a risk mitigation strategy. You can also place a limit order on swing trading to sell shares at a target upside price to lock in a gain.

Another method of protecting your downside in investing is through options. When employed correctly, you can protect against market volatility on your long positions through buying puts (ability to sell at a designated price between now and its expiration date) or for when you short stocks, from buying calls (ability to buy at a designated price between now and its expiration).

→ Time Horizons

Another major difference comes from the timing of investing vs. gambling. Gambling activities usually have a limited time period to participate. If the dealer deals the cards for that hand, you can’t play. While trading can also have a limited timeframe, it doesn’t necessarily need to if you intend to buy and hold the stock for many years.

Further, many companies pay dividends to their shareholders as a reward for holding their stock. You can also lose money on paper but still receive dividends from the company.

With gambling, you either win or lose on the money you bet. There’s no gray area.

→ Available Information

One other difference between investing and gambling comes from the availability of information.

Unlike investing, gambling offers less information for you to consider. You may pick up a few signs from the table or hear grumbling from your fellow blackjack players on whether the odds are in favor of players or against. Other than knowing the rules of the game, that’s all you’ll get.

Investing couldn’t be more different. You can find a veritable smorgasbord of information online through sources like:

- stock news apps

- investment research websites

- stock tracking and portfolio management apps

- stock forums and chat rooms

- analyst reports

- conference calls

- annual reports

Gamblers don’t know anything to gain an edge on their competition. If anything, the casino goes to great lengths to keep you from developing one.

Is Options Trading Gambling?

The answer to this question depends. Options strategies can provide insurance on your investments by protecting against unexpected market changes. When employed this way, options can be a valuable tool to help investors manage risk.

Options trading isn’t gambling any more than making an investment is. That is, unless they get used as short-term speculative bets on which way a stock may go. If options are used incorrectly, they can be dangerous and even lead to significant losses. Like gambling, the premiums you pay or receive can get lost completely with options.

Even with the benefit of knowledge, there’s no guarantee you’ll make money from options trading when compared to investing in stocks or bonds. In this sense, options trading equates to gambling.

Is Day Trading Gambling?

Day trading might seem like gambling to the uninitiated. Day trading relies on market signals to develop a sense for where a stock may head. Day traders take risk by investing in stocks, hoping to make a profit on short-term trades. Disciplined day traders set tight risk mitigation rules in place to guard against a trade turning against them.

Without these internalized rules to manage risk, the day trading process is a lot like gambling in many ways. You place bets on what you believe will happen in the market and whether it will be up or down.

There’s an element of risk-taking involved with both activities as well; if your predictions turn out incorrect, then you may lose money. Successful day traders do not rely on luck and cannot get away with the risks taken by gamblers who may see themselves as lucky if they win a hand of blackjack or dice. Instead, effective day traders have discipline and take calculated risks to make money when it is there to be made.

This form of day trading doesn’t equate to gambling due to the educated guesses and risk management strategies undertaken. That’s not to say day traders all have these systems in place. Some may dabble in penny stocks on Robinhood and Webull, cryptocurrencies or other assets that carry inherently high levels of risk.

Not having effective controls in place can make this kind of day trading gambling.

Is Investing in the Stock Market Gambling?

Gambling and investing are actually very different. Equating the two is a mistake and one that has perpetuated into a myth. Investing is one of the most reliable ways to grow your money while gambling relies on luck to make a buck.

Investing is about buying and selling assets with the goal of making a profit. Gambling, on the other hand, is all about betting that you will win something without any real knowledge of what your odds are or how much risk you’re taking on to get there. It also requires having a winner and a loser. The stock market isn’t zero sum – meaning when the stock market does well, invested money can benefit multiple parties.

For these reasons, investing in the stock market isn’t gambling.