Buying quality stocks is one of the best ways to build wealth. But even Wall Street’s most legendary investors have difficulties determining which stocks are most likely to grow significantly in value.

So … what chance does the average Joe have?

That’s why many people get a leg up by using a stock picking service, which provides subscribers with stock picks to research further or buy right away.

Motley Fool Stock Advisor and Zacks Investment Research’s Zacks Premium are well-respected services and broadly considered two of the best possible options.

In an ideal world, you would have enough time and money where your decision wouldn’t be Motley Fool vs. Zacks Premium – you could just buy them both!

And if you’re lucky enough to fall under this scenario, know that each stock service has enough unique qualities that your investment decisions would benefit from owning both.

But for most people, one stock advisor subscription is all they have money and time for, and that’s OK! They’re both high-quality services that can set investors on the right path.

Still, you’ll have to decide: Is Motley Fool Stock Advisor or Zacks Investment Research’s Zacks Premium the better choice for you?

Read on as we provide a general overview of each stock service, detail what comes with each subscription, explain how the services perform compared to each other (and the broader market), and outline how the services choose the stocks they ultimately recommend.

By the end of this piece, you’ll have all the knowledge you need to decide your own personal winner in the great Motley Fool vs. Zacks debate.

Zacks Premium Overview

- Available: Sign up here

- Price: $249 per year (30-day free trial available)

Zacks Investment Research conducts independent investment research using quantitative analysis centered around corporate earnings estimates. Says founder Len Zacks: “Earnings estimate revisions are the most powerful force impacting stock prices.”

Zacks lures investors in with fun, free content, such as its famous Bull of the Day and Bear of the Day picks, where it selects a stock for each category and explains why it’s wise to buy or smart to sell. It also provides an impressive array of detailed earnings-per-share (EPS) estimates for no cost whatsoever.

If you’re interested in picks, however, you’ll need to subscribe to one of Zacks’ paid services. Zacks Premium, which focuses on stocks generally, is what we’ll focus on today, but Zacks offers numerous products covering investment strategies of all types – momentum, growth, income and value – and not just stocks, but exchange-traded funds (ETFs) and mutual funds, too.

Zacks Premium includes a number of stock-pick lists and other tools that allow you to filter for investments that are relevant to you.

For instance, you’ll get access to Zacks Ranks, and the Zacks #1 Rank List. Stock picks here are based on a proprietary quantitative model rather than equity researchers’ opinions, and they’re generally meant for shorter-term trades (one to three months).

You’ll also get access to Zacks Recommendations, which are built on quantitative analysis and equity analyst insights, and have a timeline of six months or more. Zacks Premium also lets you unlock the Focus List portfolio of 50 longer-term stock picks.

- Zacks Investment Research offers several research products to provide the information subscribers want to know about market opportunities

- Features include: Zacks #1 Rank List, Industry Rank List, Premium Screens, Focus List, Research Reports, Earnings ESP Filter, Zacks #5 Rank List

Related: 18 Best Stock Market Investing Research & Analysis Sites

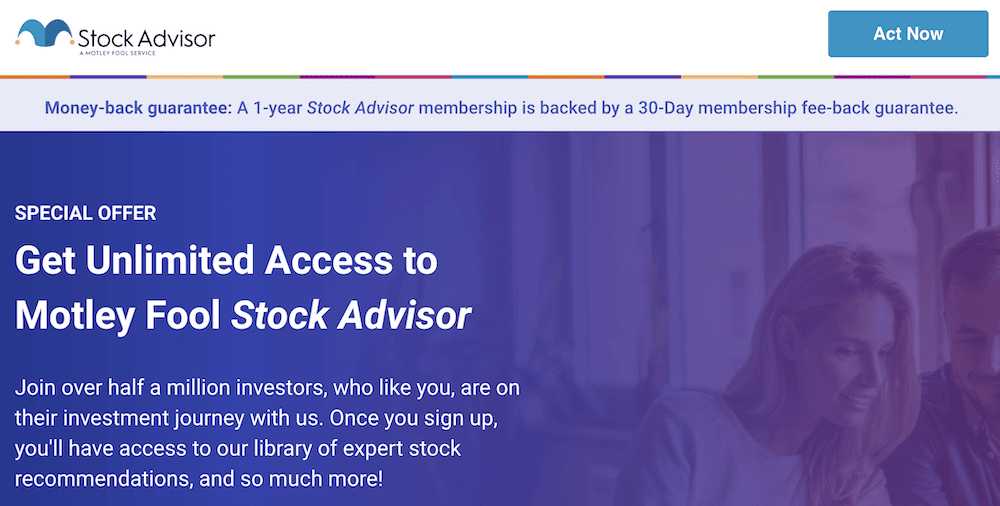

Motley Fool Stock Advisor Overview

- Available: Sign up here

- Price: Discounted rate for the first year, $199 annually thereafter

Motley Fool’s signature product, Motley Fool Stock Advisor, aims to provide you with one thing: top picks for market-beating stocks from the site’s award-winning service.

The service espouses my favorite, plain-vanilla trading style: buy-and-hold.

Likely of little interest to many day traders, this long-term orientation, when invested in the right stocks, can still produce exciting longer-term returns without the risk of higher-risk, high-maintenance trading strategies. And it can do so with little active portfolio management beyond doing your research upfront.

Stock Advisor is my pick of the Motley Fool stock recommendations services (also see Motley Fool Rule Breakers for growth stocks or Motley Fool Everlasting Stocks for conservative stocks you intend to hold long-term) if you want consistent performance with less volatility.

The investment newsletter and service provides recommendations for “Steady Eddies” and potential highflying stocks the service believes boast sound financials and fundamentals.

Stock Advisor offers stock picks with investment rationales, research and other information to help you make sound decisions.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!

- Discounted introductory price

- Strong outperformance above S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Related: 19 Best Stock Research & Analysis Apps, Tools, & Sites

How Has Each Stock Picking Service Performed?

Zacks Premium

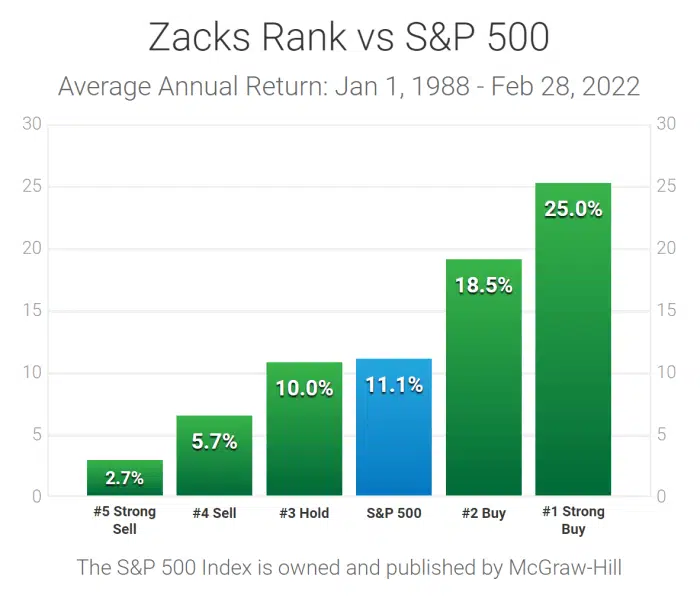

The Zacks #1 Rank stock-rating system has more than doubled the S&P 500 Index with an average gain of 24.97% per year between January 1988 and February 2022, according to Zacks. (The broad market index posted an annualized return of 11.35% during the same time frame, so Zacks’ performance is 2.2x the index.)

Zacks #1 Rank picks have been even better over the past couple years. It returned 33.86% in 2020 (vs. 18.40% for the S&P 500), and it delivered a 34.04% return in 2021 (vs. 28.71% for the index).

Zacks claims that if you invested $10,000 in the S&P 500 in 1988, that would have compounded into $365,919. But if you had invested solely in Zacks #1 Rank stocks, that sum would have turned into a whopping $20,316,699–more than 51 times better than the blue-chip index.

Investors should note that this is just the performance of Zacks #1 Rank stocks, not all stocks with a Strong Buy recommendation.

Motley Fool Stock Advisor

Stock Advisor members have enjoyed an impressive track record as a result of the stock picks made by The Motley Fool’s Stock Advisor Team.

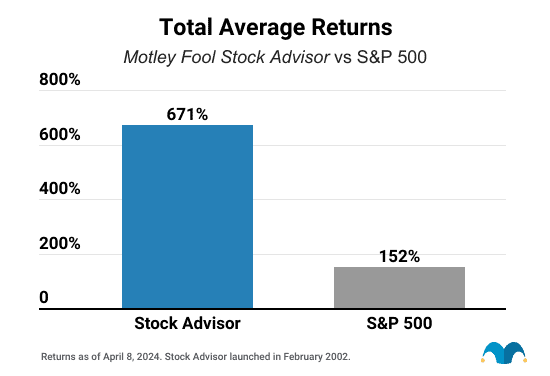

Motley Fool’s investment recommendations and stock picks have delivered substantial outperformance, as illustrated by this chart comparing the portfolio to the S&P 500 benchmark. (And subscribers can access Motley Fool Stock Advisor’s history of recommendations so you can see how each individual pick has done over the years.)

Since inception in February 2002 through April 8, 2024, Motley Fool Stock Advisor has delivered a 671% overall return when using the average return of all their stock recommendations.

Comparatively, the S&P 500 only had a 152% return during that same timeframe, or more than 3x the performance. Motley Fool’s solid track record should instill trust in potential users looking for a stock recommendation subscription service.

What Do You Get with a Zacks Premium Subscription?

Zacks Premium includes updates from the following:

- Zacks Industry Rank

- Equity Research Reports

- Full access to Zacks #1 Rank List

- Zacks Focus List

- Zacks Earnings Expected Surprise Prediction (ESP) Filter

- Premium Screens

- Custom Stock Screener

- Premium Insight Archive

- Weekly Market Analysis

Zacks Industry Rank allows you to sort by more than 250 industry groups sorted. Investors can check out Top Industries at the moment, or they can sort by Industry, Sector, Zacks Rank, Earnings, Earnings Trends, Performance, Fundamentals, Heat Maps, and Charts.

Each Zacks Rank selection includes an extensive Equity Research Report that explains the reasons for each pick. Zacks covers more than 1,000 of the most popular publicly traded stocks, and each report contains independent research from Zacks analysts.

With Zacks #1 Rank List, you can choose to view the entire list or narrow it down to see the top-ranked stocks for Style Scores in Value, Growth, Momentum, VGM (Value, Growth and Momentum) or Income. This allows you to view stocks based on your particular strategy.

Zacks’ Focus List is a 50-stock portfolio of longer-term picks. Specifically, Zacks expects each of these 50 stocks will outperform the broad market over at least the next year.

Zacks Earnings Expected Surprise Prediction (ESP) Filter lets you search for stocks that have a high probability of delivering an upside surprise on their upcoming earnings reports–or are likeliest to miss profit expectations–allowing you to make better-informed trades ahead of their financial releases.

The Premium Insight Archive has up-to-date market information, including the Economic Outlook and Market Strategy reports created by Zacks’ chief equity strategist.

You also receive daily highlights from new research reports by Zacks’ analyst team, and have access to recent upgrades and downgrades.

The Weekly Market Analysis comes out on Mondays and is sent to Zacks Premium members’ emails.

It contains insights into what’s determining the overall market’s direction, as well as how investors should be managing their sector allocation.

The analysis also explains why certain stocks have been added or removed from the Focus List portfolio.

Zacks Premium users also can read articles featuring picks for ETFs and mutual funds. They cover more than 18,000 mutual funds and 1,500 ETFs and rank them one (strong buy) to five (strong sell).

Zacks Premium provides both quick overviews of stocks for when you just want a “Snapshot Report,” as well as detailed research reports that can range from five to 20 pages for an individual stock.

You’ll continually be sent updated Zacks Rank and Style Scores, Broker Recommendations Changes, Earnings Estimate Revisions, Earnings Surprises and more, so you’ll constantly have all the latest stock research at your fingertips.

Related: 11 Best Stock Portfolio Tracking Apps [Stock Portfolio Trackers]

What Do You Get With a Motley Fool Stock Advisor Subscription?

The Motley Fool Stock Advisor service provides a lot of worthwhile resources to subscribers.

- “Starter Stocks” recommendations to serve as a foundation to your portfolio for new and experienced investors

- “Best Buys Now” – 10 timely buys chosen from more than 300 stocks the service watches.

- Two new monthly stock picks each month (first and third Thursday of the month) as well as the data and stock analysis of each stock pick to date

- Investing resources with the stock picking service’s library of stock recommendations.

- Access to a community of investors engaged in outperforming the market and talking shop.

Related: Motley Fool Stock Advisor Review

What Does Zacks Investment Research’s Zacks Premium Look For in Its Stock Picks?

As we mentioned earlier, Zacks Investment Research believes earnings estimate revisions are the dominant force that impacts a stock price.

So it’s no surprise that with Zacks Rank–a Zacks Premium feature–stocks’ earnings estimates are widely utilized.

The company is perhaps best known for its expansive earnings per share (EPS) estimates. Institutional investors, such as hedge funds and billionaires, famously rely on earnings estimate revisions when making investing decisions; Zacks brings this data to everyday investors.

Within the Zacks Premium service are several pick sets. Here are three main ones you should be aware of:

Zacks Rank

Zacks’ quantitative model, Zacks Rank, is geared toward short-term investments of around one to three months. These aren’t stocks you’re necessarily meant to buy and hold indefinitely.

There are four main factors behind Zacks Rank, including:

1. Agreement

Zacks checks to see if most analysts covering a stock are adjusting their earnings estimates in the same direction. The higher the percentage of analysts adjusting their estimates upward, the better the score for this factor.

2. Magnitude

The magnitude is the extent of the recent change in the current consensus estimate. For example, a 5% increase in the earnings estimate revision would be viewed more bullishly than a 2% increase, and it would result in a better score for that factor.

3. Upside

Upside is the difference between the “Most Accurate and the consensus estimate.

The “Most Accurate Estimate” is calculated by Zacks based on estimates made closer to the earnings date–the assumption here is that these estimates will have more updated information compared to estimates made near the beginning of the earnings period.

The larger the difference between the estimates, the better.

4. Surprise

Zacks factors in the last several quarters’ earnings-per-share surprise rating. The idea here is companies that have had many positive earnings surprises in the past are more likely to have them in the future.

Put It All Together, And …

All of the components above are given a raw score that is recalculated every night.

The raw scores are compiled into Zacks Ranks and are available to investors every day. These Zacks Ranks are from 1 to 5:

- 1: Strong Buy

- 2: Buy

- 3: Hold

- 4: Sell

- 5: Strong Sell

Zacks Recommendations

While the Zacks Ranks picks are primarily based on stock’s earnings estimates on quantitative models, Zacks still believes models are most effective if employed by analysts who perform fundamental analysis and have knowledge of industries and specific companies.

For this reason, Zacks Equity Research combines quantitative models like Zacks Rank and analyst insights when making Zacks Recommendations – picks for investors looking for stocks to hold over the next six months or longer.

These stocks are ranked on three tiers:

- “Outperform” (Buy): Expected to perform better than the broad market over the next six-plus months

- “Neutral” (Hold): Expected to perform similarly to the broad market over the next six-plus months

- “Underperform” (Sell): Expected to perform worse than the broad market over the next six-plus months.

Focus List

The Focus List is for the longest-term of mindsets. Zacks’ Focus List is a 50-stock portfolio expected to outperform the market over the next 12 months. Zacks Director of Research Sheraz Mian hand-selects each holding from a list of Zacks Rank 1 and 2 stocks.

Each of these picks comes with a comprehensive Equity Research Report that explains the investment case behind the holding.

- Zacks Investment Research offers several research products to provide the information subscribers want to know about market opportunities

- Features include: Zacks #1 Rank List, Industry Rank List, Premium Screens, Focus List, Research Reports, Earnings ESP Filter, Zacks #5 Rank List

Related: Motley Fool Rule Breakers Review

What Does Motley Fool Stock Advisor Recommend Newsletter Subscribers Do With Its Stock Picks?

The Motley Fool Investing Philosophy educates how Stock Advisor makes stock recommendations to subscribers. It boils down to six rules:

The service has six rules they follow before making stock recommendations to subscribers:

1. Buy 25+ companies recommended by the Motley Fool over time to maintain a diversified portfolio.

By holding a diversified portfolio of high-potential stocks, you can increase your likelihood of making money in stocks.

The Fool says “A well-diversified portfolio typically contains 25-30 company stocks, with the more stocks you own and the longer you hold them increasing your likelihood of making money.”

2. Hold these recommended stocks for at least five years (longer is even better).

When you carry a longer time horizon for individual stocks, ETFs and mutual funds, you have a higher likelihood of investing and not gambling with your investments.

3. Invest new money frequently and regularly.

Motley Fool’s investment strategy includes the continual reinvestment of cash. By having more scratch to add to your portfolio, you can avoid needing to sell your best stocks just to capture new opportunities from Motley Fool stock picks.

Setting aside money from each paycheck, even if it’s just investing small amounts of money, can snowball into generational wealth.

Beginner investors especially should follow this investing style, as it will allow you to start small while you’re still learning and developing a personal finance framework for yourself–then invest big when you have both more resources and more stock-market knowhow.

4. Hold your investments during periods of stock market volatility.

Napoleon Bonaparte defined a military genius as “the [person] who can do the average thing when everyone around [is losing their minds],” but this also best describes successful investors.

When the market melts down, some investors panic-sell at lower prices as the major indexes tumble, then they often only buy back into the market once much of the recovery is in the rear-view mirror.

In other words, rather than “buying low and selling high,” they’re doing the opposite–guaranteeing inferior returns. For the most part, staying calm and staying put results in far better returns.

But it’s not easy. Beginner investors and seasoned pros alike will find this task difficult without the proper defensive positions in place.

Learn how to hold during periods of market volatility, and you’ll learn how to outperform everyone around you.

5. Let your winners keep winning.

“Winning companies tend to keep winning.” Yes, it’s possible that a crappy company might have a couple of weeks of good luck, or become the latest meme stock, but for the most part, companies that show solid potential for a few years can keep the momentum up for even longer.

6. Target long-term returns.

When you invest, you can’t think in terms of days or months. You need to think about the long game, investing for years–Motley Fool says you should “aim to achieve excellent returns over a 5- to 25-year period.”

That’s a lot of time to let the powers of compound interest work in your benefit. Thousands of dollars now can turn into literally millions with enough patience and discipline. So, when you invest, invest with a timeline of at least five years in mind.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!

- Discounted introductory price

- Strong outperformance above S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Related: 9 Best Stock Charting Apps [Free + Paid Software Options]

The Final Say: Motley Fool vs Zacks

While Motley Fool Stock Advisor and Zacks Premium Investment Research are valuable resources for investors, the services aren’t identical, and some may find one service superior to the other.

Which service works for you might ultimately come down to what type of investor you are.

The variety of Zacks Premium pick sets geared toward short-, medium- and long-term picks alike might be better geared for more active investors who might not want to sit on all of their holdings for 10 or 20 years.

Meanwhile, Motley Fool Stock Advisor and its long-term philosophy is much more ideal for the typical long-term buy-and-holder.

Related:

![9 Best Schwab ETFs to Buy [Build Your Core for Cheap] 27 best schwab etfs to buy](https://youngandtheinvested.com/wp-content/uploads/best-schwab-etfs-to-buy-600x403.webp)