Here’s something you probably know: Most teenagers don’t have brokerage accounts.

But it’s not from lack of interest.

A surprisingly vast majority of teens understand the virtue of investing. According to Fidelity’s 2023 Teens and Money Study, 90% of teenagers who don’t already invest say they plan on doing so at some point—and 75% plan on starting before they graduate college!

However, just 23% from that same study have actually started investing. Indeed, the average age of a starting investor is in their early 30s. So it’s clear that most people wait until they’re well into adulthood before starting to invest in stocks and funds on their own. And besides, teenagers can’t open their own brokerage account until age 18.

But teens do have options—and given the massive investing edge most teenagers have (but don’t realize), they should consider taking the plunge. In short: The longer you put money to work in the stock market, generally speaking, the more wealth you can accumulate. On top of that, the earlier you learn how to invest, the quicker your financial literacy will improve—leading to better decision-making when you’re saving and investing much larger sums.

My advice: Don’t make your teen figure it out for themselves in their 30s. You should get them started today … and I can help.

Read on as I highlight the best brokerage accounts for teenagers, explain how these accounts work, and answer a few common questions that teens and their parents typically have regarding investing. By the end of this article, you should have everything you need to start your teen on their investing journey.

Table of Contents

Teens’ Big Investing Advantage: Compounding Returns

Here’s something I wish I had learned as a teen: The longer you have money in the market, the longer you can benefit from the power of compounding.

Compounding is when you invest a sum of money, make money from that investment, and reinvest the earnings to make even more money. Given enough time, even small amounts of cash can grow into large sums if you keep reinvesting those earnings.

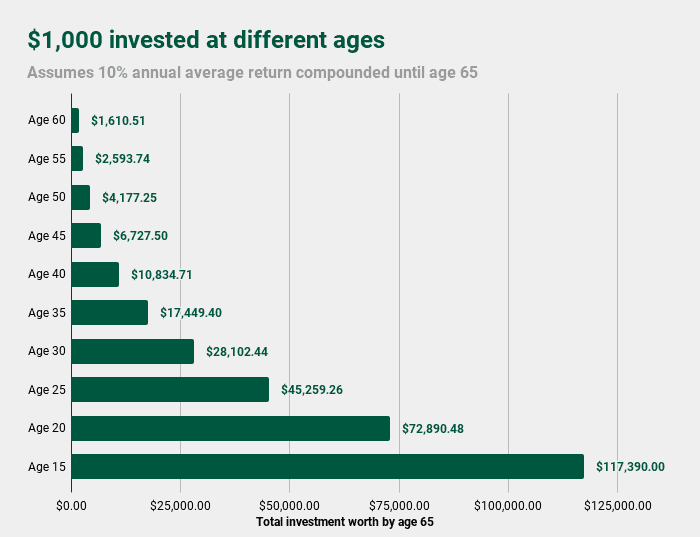

Let’s say you want to invest $1,000 toward your retirement, which most people reach at age 65. When you do that makes a world of difference. Just look at this chart below showing just how much more that money can grow the earlier you put it to work:

That’s right: If a teen invests $1,000 at age 15, and never adds another dime, that money could grow by well more than 100x by the time they retire. (So just imagine how much more money they could retire with if they invested well for the rest of their life!)

Related: 13 Best Compound Interest Investments + Accounts

Investing for Teens: 2 Types of Brokerage Accounts

A brokerage account is the most basic type of investment account. It has no tax advantages, unlike a 401(k) or individual retirement account (IRA). But it allows you to invest in a wide array of assets—typically stocks, exchange-traded funds (ETFs), mutual funds, and more—and there’s no cap on how much you can invest.

There’s just one little problem: Minors can’t open a standard brokerage account for themselves.

But again, I emphasize standard. Teens can still invest (with the help of a trusted adult) through one of two other types of brokerage account:

1. Joint Brokerage Account

A joint brokerage account is owned by two or more people—say, a husband and wife. However, a parent can also open a joint account with their teen. Both account holders have ownership of the assets within the account, and both have a say on investment decisions.

If the main goal of an account is to teach a teen about investing, a joint brokerage account makes a lot of sense. I have to warn you, there are risks—namely, you might not want your teen to be able to buy or sell investments whenever they want—but certain youth accounts provide guardrails to protect against this.

2. Custodial Brokerage Account

A custodial brokerage account (and the assets within) is owned by a minor beneficiary, but an adult helps open the account and acts as a custodian. Frequently, a custodian is a parent, and the beneficiary is their child.

As long as the child is a minor, the custodian determines how account funds are invested and whether withdrawals are made. Withdrawn money must be used to benefit the minor. Once the beneficiary reaches the age of majority in their state (typically 18 or 21), they gain control of the custodial account.

(Editor’s Note: There are two types of custodial accounts: Uniform Gifts to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA). In short, a UTMA account can hold a few more assets than UGMA accounts, but you can learn more with our UGMA/UTMA comparison.)

While minors don’t technically have any authority over how the account’s money is invested, it’s still a worthwhile account type for teenagers: The money is still invested on the teen’s behalf, and parents can help their teen learn by involving them in investment decisions.

Related: 5 Best Under-18 Investment Accounts

Brokerage Accounts for Teens—Our Top Picks

|

Primary Rating:

4.8

|

Primary Rating:

4.3

|

Primary Rating:

4.5

|

|

Core: $5.99/mo. Max: $9.98/mo. Infinity: $14.98/mo. (Each account supports up to 5 children.)

|

No monthly fees.

|

Commission-free equity trading.

|

Best Brokerage Accounts for Teens

1. Cash App Families (Top Teen Investing App With No Monthly Fees)

- Platforms: Web, mobile app (Apple iOS, Android)

- Price: Free* (no monthly fees)

Does your teen need to start learning smart saving, spending, and even investing habits? Cash App Families can accomplish all three—with no monthly fees—putting the power of Cash App into your teen’s hands while keeping their financial safety firmly in yours.

Teens get an account with a designable Cash App Visa debit card, which they can use to spend money where Visa is accepted. Meanwhile, access to Cash App allows them to save money toward specific goals, send money to friends, accept offers for instant discounts at their favorite places, and check out securely in stores and online by using a QR code.

If your teen direct-deposits $300 or more each month, they’ll also unlock a bevy of other features, including getting paid two days earlier, no ATM fees¹ when withdrawing from more than 40,000 in-network ATMs, and one waived out-of-network ATM withdrawal per month.

Cash App Families even has an investing feature with fractional shares, allowing kids to purchase as little as $1’s worth of stocks and Bitcoin (parent permission is required).²

Meanwhile, parents/guardians who sponsor the teen** enjoy some of the best oversight features among teen debit cards. You can monitor your teen’s activity from your own Cash App or receive real-time transaction alerts for their payments and purchases. You control which features—stocks, Bitcoin², sending money, the Cash App Card—your teen can access, and certain spending categories are auto-blocked for teens. can also send money for allowance whenever they want, and built-in tools allow parents and teens to budget and save together.

Parents/guardians must download Cash App (also free), then invite their teen to create a sponsored account. Cash App Families can be used by teens ages 13-17. Use our link to learn more about or sign up with Cash App today.

- Cash App Families is a banking app and debit card that helps teens ages 13-17** learn about, spend, save, and invest money while under the protection of a large suite of parental oversight tools.

- Teens get a customizable Cash App Visa debit card*, can make and receive instant person-to-person payments, can fund their account with direct deposit, and can even buy as little as $1's worth of stocks and Bitcoin.²

- Your teen can earn 3.25% interest on their savings. No fees and no account minimums.³

- Pay your kids an allowance, and use Cash App's tools to save and budget together.

- Safety features such as real-time transaction alerts, account monitoring (from the parent's Cash App), alerts for teen payments to new contacts, contact blocking, feature control, payments control. Also, Cash App auto-blocks certain spending categories to teens, and strangers can't find teens in Cash App search.

- Features such as two-day early payment, free in-network ATM withdrawals, and a monthly reimbursement for an out-of-network ATM withdrawal are unlocked when $300+ is direct-deposited each month.¹

- Free account and Visa debit card*

- Excellent parental controls (including feature lock and real-time transaction alerts)

- Stock and Bitcoin investing²

- Fractional shares²

- Customizable cards ($5+)

- FDIC insurance available on a pass-through basis (if certain conditions are met)***

- Certain benefits, such as free in-network ATM withdrawals¹, require direct deposit of at least $300 monthly

- Parents can give money, but no dedicated allowance features

2. E*Trade (Top Custodial Account From a Major Brokerage)

- Platforms: Web, mobile app (Apple iOS, Android)

- Price: No monthly fees or trading commissions on stocks and ETFs through E*Trade’s Custodial Account

Most people know E*Trade as one of the leading providers of individual brokerage accounts, but you can also put the powerful platform to work saving for your child’s future, though a custodial account (and even a custodial IRA).

E*Trade’s custodial account for teens (and generally any minor) allows you to open up a custodial account that offers the chance to build a personalized portfolio through thousands of stocks, bonds, ETFs, and mutual funds, or you can have E*Trade select your holdings for you through its Core Portfolio robo-advisory service (minimum account size of $500 is needed to use this product). Further, you can choose to open a traditional custodial IRA or a custodial Roth IRA for children under age 18 who have earned income.

Just like with its individual brokerage accounts for adults, E*Trade custodial accounts offer zero-commission stock, ETF, and options trading. It also has a leg up on some platforms by offering $0-commission mutual fund, Treasury, and new-issue bond trading.

And if you want to learn more about investing—or want your young one to learn alongside you—E*Trade also boasts educational resources, including articles, videos, classes, monthly webinars, and even live events.

For a limited time, E*Trade offers a new account funding bonus (when you use reward code “OFFER25”). Check out the corresponding funding amounts and bonuses in the box below.

- E*Trade is one of the best online and mobile trading platforms among discount brokers, offering a full range of investments (including professionally managed accounts). It allows you to invest in stocks, ETFs, mutual funds, options, bonds, futures, micro futures, and futures options.

- $0 commission trading for online U.S.-listed stocks, ETFs, options, mutual funds, Treasuries, and new-issue bonds. (Options have a 65¢ contract fee, or 50¢ at certain volume thresholds.)

- Opening an account is easy and only takes a couple of minutes.

- Bonus: Get between $50 and $10,000* when you click the box below, then open and fund a new investment account using promo code "OFFER25."

- Excellent selection of available investments

- Commission-free mutual funds and Treasuries

- Automated portfolio builders and prebuilt mutual fund and ETF portfolios

- Separate apps for power users and casual users

- Limited availability of fractional shares (only in DRIP plans or robo-created portfolio)

- No direct cryptocurrency trading

To open a free E*Trade custodial account, click “Open Account” below.

3. Greenlight App (Best Investment Account With Parental Controls)

- Available: Sign up here

- Price: Greenlight Max: $9.98/mo. Greenlight Infinity: $14.98/mo.

Greenlight, through its Max and Infinity tiers, is an investment account for kids that comes paired with a debit card and bank account.

It’s easy to use and can double as a savings account and banking apps for teens. The investing app will teach the basics of investing, how to invest in stocks and ETFs, and more.

It works best if parents and/or grandparents are involved in the process because it requires linked accounts from the adults’ banks or brokerages. Plus, parents and guardians will need to approve trades made in the investment account.

The all-in-one plan teaches them important financial skills like money management and investing fundamentals—with real money, real stocks and real-life lessons.

You can use the investing feature to:

- Start investing with as little as $1 in your account

- Buy fractional shares of companies you admire (say, kid-friendly stocks)

- No trading commissions beyond the monthly subscription fee

- Teens can only invest in U.S.-listed stocks and ETFs that have either a market capitalization over $1 billion or a three-month average daily dollar volume of more than $500,000

- Parents must approve every trade directly in the app.

Each account supports up to five kids.

Consider opening a Greenlight Card + Max or Infinity account to start investing in a joint investment account as a teenager today. Or, you can learn more in our Greenlight review.

- Greenlight is a financial solution for kids that allows them to spend with a debit card, earn money on savings, and even invest their money.

- Parents can use this app to teach kids how to invest with a brokerage account through Greenlight Max and Greenlight Infinity plans.

- Greenlight offers flexible parental controls for each child and real-time notifications of each transaction. And it's the only debit card that lets you choose the exact stores where kids can spend on the card.

- Families can earn 2% (Core), 3% (Max) or 5% (Infinity) per annum on their average daily savings balance of up to $5,000 per family. Also, Max and Infinity families can earn 1% cash back on their monthly expenditures.

- Unlike many apps that simply provide features and controls, Greenlight is also designed to spark discussions with children about spending, investing, and more, fostering a better educational experience.

- Best-in-class parental controls (can prohibit specific stores)

- Can add brokerage account to invest in stocks

- Intuitive Parent and Kid apps

- Competitive cash back and interest rates

- High price points

- No cash reload options

- No parent / child lending

Related: Best Greenlight Alternatives

4. Acorns Early (Round-Ups, Custodial Account With a 1% Match)

- Available: Sign up here

- Price: Acorns Bronze: $3/mo. Acorns Silver: $6/mo. Acorns Gold: $12/mo.

Acorns is an investing app geared toward minors, young adults, and millennials by offering “Round-Ups”: The app rounds up purchases made on linked debit and credit cards to the nearest dollar, then invests the difference on your behalf.

For example, if you purchase a coffee for $2.60 on a linked credit card, Acorns automatically rounds this charge up to $3.00 and puts the 40-cent difference aside. Once those Round-Ups reach at least $5, they can be transferred to your Acorns account to be invested.

The Acorns investment offering itself is a simple, automated platform that uses pre-built portfolios of ETFs to keep investors exposed to stocks and bonds. While it doesn’t have much to offer intermediate investors who want variety in their portfolios, Acorns’ basic approach makes it one of the best investment apps for beginners.

It also features a powerful way to accelerate your savings: Later Match. While most people are aware that employers will sometimes match funds you contribute to your 401(k), “matches” are virtually unheard of in retirement accounts like IRAs, where there’s no employer to kick in extra cash. However, Acorns itself will match 1% or 3% on new contributions to IRAs for Silver and Gold subscribers, respectively.

Here’s more about what you can expect from Acorns’ varying subscription options:

- Acorns Bronze ($3 per month): Includes an Acorns Invest investment account, as well as Acorns Later for tax-advantaged investment options such as Roth IRAs. Also includes Acorns Checking, a bank account that has no account fees, lets you withdraw fee-free from more than 55,000 ATMs nationwide, and Smart Deposit, which allows you to automatically invest a bit of each paycheck into your Acorns accounts.

- Acorns Silver ($6 per month): Everything in Acorns Personal (Acorns Invest, Later, and Checking), plus Premium Education, which are live onboarding sessions covering account setup, Round-Ups, setting up recurring investments, and more; Emergency Fund; and a 25% bonus on Acorns Earn rewards (up to $200 per month).

- Acorns Gold ($12 per month): Everything in Personal Plus, plus Acorns Early, which allows you to open the Acorns Early Invest custodial investment accounts, with a 1% match, so you can begin investing for your child while they’re a minor; custom portfolios that allow you to hold individual stocks; live Q&As with financial experts; a 50% match on Acorns Earn rewards (up to $200 per month); $10,000 in life insurance; even the ability to set up a will for free.

Sign up for Acorns today (and subscribe to Acorns Gold for an Acorns Early Invest account), or learn more in our Acorns review.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Silver tier includes perks such as a 25% match on Acorns Earn rewards (up to $200/mo.), generous APYs on Checking and Emergency Fund, and live Q&As with investing experts.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts for children with 1% contribution matches.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions in your first year.*

- Special offer: Get a free $20 bonus investment when you sign up with our link and start making recurring investments.**

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Silver and Gold)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Gold for any self-directed investing options

Related: 12 Best Stock Trading Apps + Platforms for Beginners

5. Copper Card (Best for Kid Independence)

- Available: Sign up here

- Price: Variable pricing on Copper and Copper + Invest plans

Copper Banking was founded on the belief that kids and teens should have equal access to financial education and should be empowered to learn by doing. Now, the company is on a mission to help children gain real-world experience by giving them access to their money in a way that traditional banks can’t.

The Copper app and debit card teaches your child how to make smart financial decisions by creating a platform where parents and their kids can connect. With the Copper app, you get easy snapshots of your accounts. And with the Copper Debit Card, it’s easy to shop in-store or online, including with Apple Pay or Google Pay.

Plus, users get exclusive access to engaging advice curated by a team of financial literacy experts who provide tips on how to take control of their financial future.

Copper Banking features

- Send/Request: Kids and parents can easily send and receive money all at the touch of a button.

- Spend: Spend using Apple or Google Pay, or using the Copper Debit Card.

- Withdraw: Access your money from more than 55,000 fee-free ATMs.

- Monitor: Get a snapshot of all your child’s spending in an easy-to-read dashboard.

- Save: Gain quick snapshots of your kid’s savings and helpful tips on how to save even more. Set up savings buckets and save for the things that you want.

- Learn: With the help of Copper’s team of financial literacy experts, gain bite-sized tips on how you can maximize your money and prepare yourself for your financial future.

The basic Copper account includes the above banking features. With Copper + Invest, your child also gets access to automatically curated smart portfolios built with their preferences in mind. Your child is given a questionnaire that helps Copper determine a portfolio based on their age, income, net worth, investment objective(s) and investment horizon. Copper then recommends one of three ETF portfolios—Moderately Aggressive, Aggressive, and Extra Aggressive—made up of thousands of stocks. Parents can review the portfolio to ensure it matches with not just your child’s preferences, but your family’s. (Portfolios can be changed later on by accessing the Support chat.)

Your child can begin investing for as little as $1, then add more contributions down the road. Copper will automatically rebalance the portfolio as needed to make sure it always keeps up with your child’s investment preferences.

Copper is available to kids 6 years and older.

Read more in our Copper Banking review.

- Copper is the digital bank and debit card for teens built with the mission of creating a financially successful generation.

- Send/Request: Teens and parents can easily send and receive money all at the touch of a button.

- Spend: Pay with a digital wallet via Apple Pay or Google Pay or use the physical Copper Debit Card.

- Monitor: Get a snapshot of all your spending in an easy-to-read dashboard.

- Save: Gain quick snapshots of your savings and helpful tips on how you can save even more. Set up savings bucks and save for the things that you want.

- Learn: With the help of Copper's team of financial literacy experts, learn more about how to maximize your money and prepare yourself for your financial future.

- Allowance administration

- Financial education resources

- Network of 55,000-plus fee-free ATMs

- No chores tracking or assignment

- No parental controls beyond notifications

Related: The 13 Best Investment Apps for Beginners

Other Types of Investment Accounts

Teens don’t necessarily have to start investing through the brokerage accounts mentioned above. Several other accounts provide access to investments, though they come with their own unique rules, perks, and limitations.

1. Custodial (IRA)

Custodial IRAs—which can be traditional IRAs or Roth IRAs—function similarly to custodial brokerage accounts in that an adult custodian sets the account up for the minor child; the child is the owner, but an adult manages the account; and the child assumes control of the account when they reach the age of majority. IRAs function mostly just like a brokerage account, and typically offer the same investment selections, but they have different contribution and tax rules.

With a traditional IRA, money is placed into the account on a “pre-tax” basis. So if you fund the account with earnings that have already been taxed, you can deduct those contributions from your taxes. Money in the account grows tax-free, then you pay taxes on any withdrawals. You’re also charged a 10% penalty on any withdrawals before age 59½, with some exceptions.

With a Roth IRA, you contribute “after-tax” money, so you don’t get any deductions. But that money grows tax-free in the account, and you don’t pay taxes when it’s time to withdraw. You can withdraw contributions whenever you want without penalty, and you can take out earnings without penalty once you’re 59½ as long as the account has been open for at least five years.

Considering a teen’s tax rate is almost sure to be lower when they’re young than when they retire, Roth IRAs are usually the better choice for a teen.

Both IRAs and Roth IRAs have a $7,000 annual contribution limit in 2025 (the same as in 2024); also, contributions to a custodial IRA or custodial Roth IRA can’t exceed the teenager’s earned income that year.

2. 529 Plans

Parents who want to save for their teen’s college and other educational costs should strongly consider 529 plans. These investment accounts are operated by individual states, and while they can offer a range of asset selections, they can also be limited—say, just a few funds.

Parents contribute after-tax dollars to a 529 plan, and the money grows tax-deferred until it’s ready to be withdrawn. 529s have no annual contribution limits.

Distributions from 529 plans are tax- and penalty-free as long as they’re used on qualified education expenses, which include tuition, fees, books, supplies, equipment, room and board, and other related expenses for college, vocational school, and other post-secondary educational institutions. They can also be used on K-12 tuition. However, earnings withdrawn and used for any other purpose are taxed and face a 10% penalty.

Leftover funds can be transferred to a family member’s 529 account or ABLE account (a savings account for people with disabilities). However, starting in 2024, a beneficiary can also transfer up to $35,000 of leftover money in a 529 plan into a Roth IRA in his or her name. Any rollover is subject to annual Roth IRA contribution limits, and the 529 account must have been open for at least 15 years.

3. Coverdell Education Savings Accounts (ESAs)

Similar to 529 plans, Coverdell education savings accounts (ESAs) are used to invest for a minor’s education expenses, but the minor doesn’t own the account, nor do they make investment decisions.

Just like a 529 plan, money is invested and distributions are tax-free if used for qualified education expenses. Funds aren’t limited to higher education, either; they can be used for primary and secondary schools as well.

ESAs have several limiting factors, however. For instance, families can only contribute to an ESA if their modified adjusted gross income (MAGI) is under the limit set for that tax year.

“They’re limited to annual contributions of just $2,000 per beneficiary. So immediately, you’re handcuffed,” adds Mike Ramirez, Manager of Financial Planning and Certified College Planning Specialist at EP Wealth Advisors’ San Diego office. “Also, once the beneficiary turns 30, that fund has to be fully distributed. So if your student didn’t go to school, didn’t use the funds, then those funds have to be distributed, so they’ll be subject to tax and a 10% penalty. You can’t get around it like you can with a 529.”

Related: 9 Best Online Stock Brokers for Beginners

How Do Investment Accounts for Teens Affect Financial Aid?

One consideration when you’re determining what kind of investment account your teen should have is how it will affect financial aid. Specifically, the Free Application for Federal Student Aid (FAFSA) weighs some types of savings differently than others when it comes to the Student Aid Index (SAI)—a number that determines student financial aid eligibility—so here’s what you should know:

Custodial IRA

Money in any retirement account doesn’t affect financial aid eligibility, so custodial IRA savings won’t affect your FAFSA. However, if you withdraw earnings from a custodial IRA, that money counts as taxable income, which could negatively affect eligibility.

529 Plan

A 529 plan affects financial aid, but only slightly. 529 plans will virtually always be a parental asset; only up to 5.64% of a parental asset’s value is considered when calculating the SAI.

Coverdell ESA

A Coverdell ESA also affects financial aid, but minimally. Like a 529 plan, a Coverdell ESA is usually owned by the parent. Thus, only 5.64% of ESA assets are taken into account when calculating the SAI.

Joint Brokerage Account

Joint brokerage accounts can have a fair-sized impact on financial aid. With a joint brokerage account, 50% of the account’s value is a parental asset and counted at the 5.64% rate … but the other 50% is considered a student asset and counted at the 20% rate.

Custodial Brokerage Account

Custodial brokerage accounts that aren’t retirement accounts can have a significant impact on financial aid because the assets belong to the teen but don’t have the protections of retirement accounts. Federal financial aid formulas consider 20% of the money in a custodial account available for college costs.

In general, brokerage accounts with low funds shouldn’t make a huge difference, but accounts with substantial funds have more effect on aid.

Related: 11 Education Tax Credits and Deductions for 2023

Do Teens Pay Taxes on Earnings Made in Their Accounts?

Depending on how much money from interest, dividends, and other unearned income a beneficiary earned in a custodial account, the teen might be subject to the “kiddie tax.”

Any beneficiary who is under age 19 (or under age 24 and a full-time student) doesn’t have to pay taxes on the first $1,350 of unearned income for the 2025 tax year. The next $1,350 is taxed at the teen’s marginal tax rate. Any unearned income over $2,700 is taxed at the parents’ rate.

Do Parents Pay Gift Taxes for Contributions Made to Their Teens’ Accounts?

For a joint brokerage account, if only the parent contributes money, half of the account value could be counted as a taxable gift. For a custodial account, the full amount is considered a gift because the money immediately becomes property of the child. However, even if the gift tax rules are triggered, no tax would be due unless the parent expects to surpass the lifetime gift tax exemption limit. For 2025, that limit is $13.99 million. The gift tax rules can be tricky, so consider speaking with a tax professional about any gift tax implications if you want to open a joint brokerage account.

Which Brokerage Account for Teens is Best?

Whether a custodial account or joint brokerage account is better for your teen largely depends on how much control you want the teen to have over the account and who you want to own the assets.

With a custodial account, all assets belong to the teen, but the adult controls the investments and withdrawal decisions. In a joint brokerage account, both owners own the assets and can make investment choices; thus, the teen can have more control over a joint account than they can with a custodial account.

Related:

- Student Loan Interest Deduction: How Much, Eligibility + More

- Bloom Investing for Teens Review [Paid Teen Investing App]

- How to Get Free Stocks for Signing Up: 7 Apps w/Free Shares

Disclosures

Cash App Families

Cash App is a financial services platform, not a bank. Banking services provided by Cash App’s bank partner(s). Prepaid debit cards issued by Sutton Bank. Member FDIC. See Terms and Conditions. Direct deposit and instant discounts provided by Cash App, a Block, Inc. brand.

* Free Cash App Cards come in black, white, pink, or glow-in-the-dark. Card use fees apply.

** To view the eligibility requirements for sponsoring a teen, please visit the Sponsored Accounts section of the Cash App Terms of Service.

*** Your balance is eligible for FDIC pass-through insurance through our Program Banks Wells Fargo Bank, N.A. and/or Sutton Bank, Members FDIC for up to $250,000 per customer when aggregated with all other deposits held in the same legal capacity at each Program Bank above, if certain conditions are met. Cash App is a financial services platform, and not an FDIC-insured bank. Prepaid debit cards issued by Sutton Bank, Member FDIC. See terms and conditions (https://cash.app/legal/us/en-us/card-agreement).

Cash App is a financial services platform, and not an FDIC-insured bank. Prepaid debit cards issued by Sutton Bank, Member FDIC. See terms and conditions.

¹ Cash App reimburses ATM fees for all in-network withdrawals when you deposit at least $300 monthly of Qualifying Deposits into Cash App, or spend $500 or more in Qualifying Purchases using your Cash App Card or Cash App Pay in a calendar month. Service fees may apply. See terms https://cash.app/legal/us/en-us/tos) for more details.

² Brokerage services provided by Cash App Investing LLC, member FINRA/SIPC, subsidiary of Block, Inc. Bitcoin services provided by Block, Inc. Bitcoin services are not licensable activity in all U.S. states and territories. Block, Inc. operates in New York as Block of Delaware and is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Investing and bitcoin are non-deposit, non-bank products that are not FDIC insured and involve risk, including monetary loss. Cash App Investing does not trade bitcoin and Block, Inc. is not a member of FINRA or SIPC. For additional information, see the Bitcoin and Cash App Investing disclosures. Additional fees for securities may apply such as regulatory fees and fees to transfer securities externally. Please see our House Rules for more information. Fractional shares investing may involve additional risks such as non-transferability. For additional information regarding the unique risks and limitations of fractional shares, please see your Investing Customer Account Agreement.

³ Customers can qualify for Cash App Green by spending $500 in Qualifying Purchases using your Cash App Card or Cash App Pay per month, or by depositing $300 of Qualifying Deposits per month. Eligibility restrictions apply to some benefits. See Terms and Conditions (https://cash.app/legal/us/en-us/tos) for more information. To earn the highest interest rate on your Cash App savings balance, you need to (a) have a Cash App Card, or sponsor one or more sponsored accounts, and qualify for Cash App Green or (b) have a sponsored account with sponsor approval. Customers can qualify for Cash App Green by spending $500 in Qualifying Purchases using your Cash App Card or Cash App Pay per month, or by depositing $300 in Qualifying Deposits per month. See terms and conditions for more information on how to qualify. If you are signed up to earn interest, Cash App will pass through a portion of the interest paid on your savings balance held in an account for the benefit of Cash App customers at Wells Fargo Bank, N.A., Member FDIC. Exceptions may apply. Savings yield rate is subject to change.