If you need a little extra cash, you’ve got a wealth of options right at your fingertips. Dozens of money-making apps allow you to run a side hustle from your smartphone or tablet—some are extremely easy, some are downright fun, and several even run in the background, allowing you to earn money without any real effort!

And if you’re feeling particularly motivated, you can use as many of them as you like.

If there’s one problem, it’s that there are so many of these apps that it can be hard to explore them all. Fortunately for you, we’ve reviewed scores of money-making apps and narrowed the list down to only the best choices, then broken them into categories so you can easily find the app (or apps) that interest you the most.

Table of Contents

The Best Money-Making Apps: What Kinds You’ll Find

Here are the eight categories that we’ve broken our selection of money-making apps into:

- Survey Apps: Marketers want as much information on their potential customers as possible—their demographics, what they like to buy, product awareness, future purchasing plans, and more. Survey apps pay you for this valuable information.

- Shopping Rewards Apps: If you already enjoy shopping online, you can often save money or earn cash rewards by shopping with specific retailers. It’s a win for the business (because you’re choosing them over competitors for your online purchases) and a win for you (because what you’re buying is more affordable).

- Cash-Back Apps: Cash-back apps are similar to shopping rewards, though they’re usually extended to restaurants, gas stations, and other establishments. Cash-back apps’ rewards are also strictly limited to … well, cash. Cash from a money app can be funneled back to you in several ways, including through PayPal, money on a card, or a direct deposit into your bank account.

- Banking and Investing Apps: Banking and investing apps take your existing money and put it to work for you—making more money! These apps are less time-consuming than most money-making apps, though the rewards can often take longer to reap. Sometimes, they offer lucrative sign-up rewards.

- Passive Income Apps: Passive income apps allow you to earn extra cash (or save it) just by letting them run in the background. They don’t make money as quickly as other options, but once they’re set up, they take little to no extra effort.

- Video Game and Gaming Apps: Game creators test out new games to work out bugs and learn how they can improve them. While many people would volunteer to test games for free, you can get paid to play!

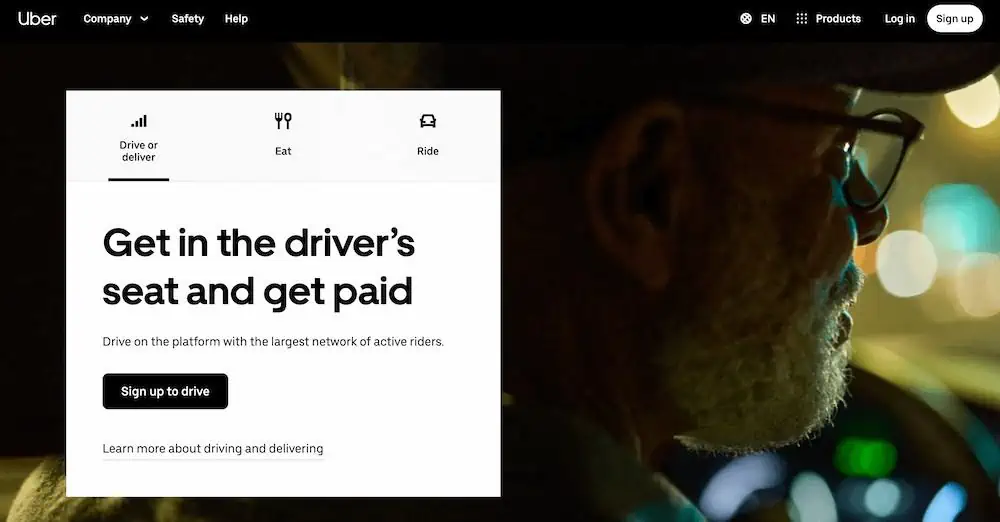

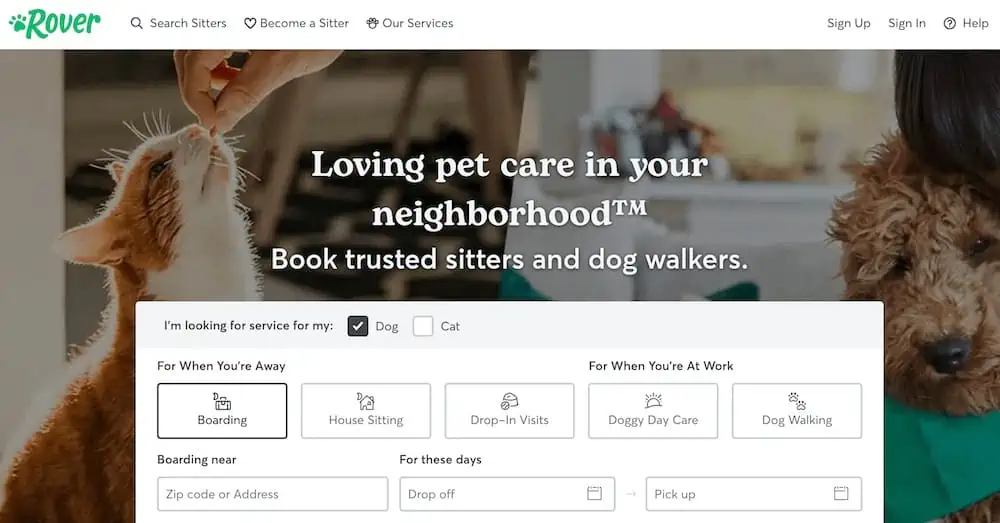

- Gig Economy Apps: Gig economy apps are actual jobs. On the one hand, they require more effort and skill than most of the other money-making apps mentioned here. On the other hand, you can make money much faster with them, and they typically still offer time flexibility.

- Money-Saving Apps: Money-saving apps make saving money second nature. If you struggle to save money, these apps can help you set aside cash automatically.

There’s no rule saying you can only use one money-making app. Feel free to use as many of these as your time allows.

Most of the following apps are available on the iOS App Store and the Google Play Store, but a few are limited to just one or the other.

Also, some apps come with sign-up and other new-member bonuses. We’ve denoted in the header whenever that’s the case, and we explain how to earn those bonuses in the product description boxes below.

Survey Apps

| App Name | Cost | Available on |

|---|---|---|

Swagbucks Swagbucks | Free | Web, mobile (iOS, Android) |

Survey Junkie Survey Junkie | Free | Web, mobile (iOS, Android) |

MyPoints MyPoints | Free | Web, mobile (iOS, Android) |

Branded Surveys Branded Surveys | Free | Web, mobile (iOS, Android) |

InboxDollars InboxDollars | Free | Web, mobile (iOS, Android) |

ySense ySense | Free | Web, mobile (iOS, Android) |

Rakuten Insight Rakuten Insight | Free | Web, mobile (iOS, Android) |

LifePoints LifePoints | Free | Web, mobile (iOS, Android) |

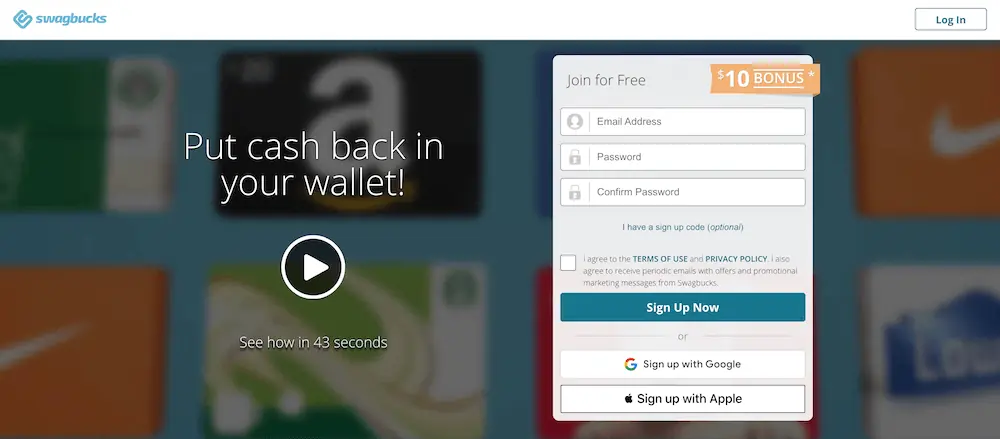

1. Swagbucks ($10 Bonus)

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile app (iOS, Android)

Swagbucks is one of the most popular money-making apps because it allows you to earn cash or gift cards by doing everyday activities. For example, you can make money by taking online surveys, playing games, watching videos, even doing live trivia.

To get started, sign up for a Swagbucks account and begin participating in some routine tasks offered through the app. Each task earns you “SB” (Swagbucks), which you can cash in for gift cards or cash back on PayPal. Or, you can put your SB rewards toward sweepstakes where you can win big prizes.

You can earn a free $10 bonus for signing up, and you can earn additional money by referring friends to the app.

- Get paid to answer surveys, watch videos, and shop online with Swagbucks.

- Earn "SB," which you can redeem for PayPal cash, prepaid Mastercards, or gift cards at dozens of retailers, including Amazon, Target, Dunkin', and GameStop.

- Minimum cash-out: Amazon gift cards: $1 (100 SB); most other cards: $3 (300 SB); PayPal: $25 (2,500 SB).

- Age restrictions: Must be at least 13 years old to participate.

- Special offer: New users receive a $10 bonus when you spend at least $25.*

- Pays you for easy tasks

- Offers gift cards from numerous merchants

- Offers cash back

- Teens can participate (ages 13+)

- Not a lucrative side hustle

Related: How to Invest Money: 5 Steps to Start Investing w/Little Money

2. Survey Junkie

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile app (iOS, Android)

Survey Junkie is a paid-survey service that’s trusted by millions of users. The platform matches users with surveys that are most relevant to them. You complete surveys on your own time and earn points for doing so.

Each point earned through Survey Junkie is worth 1 cent. Once you have at least $5 worth of Survey Junkie points, you can redeem them for virtual gift cards from popular merchants including Starbucks, Target, and iTunes. You can also get Visa gift cards or even receive cash back via PayPal or bank transfer.

- Survey Junkie lets you get paid for taking surveys and sharing your online browsing history.

- On average, members who take 3 surveys daily and opt-in to share their browsing info earn as much as $40 per month.

- Survey Junkie points can be redeemed for rewards including cash through PayPal or bank transfer and gift cards for Amazon, Target, Walmart, Sephora, Starbucks, Visa, iTunes, and more.

- Minimum cash-out: $5 (500 points).

- Age restrictions: Must be at least 18 years old to participate.

- Pays you for easy tasks

- Offers gift cards from numerous merchants

- Offers cash back

- Some teens can participate (ages 16+)

- Not a lucrative side hustle

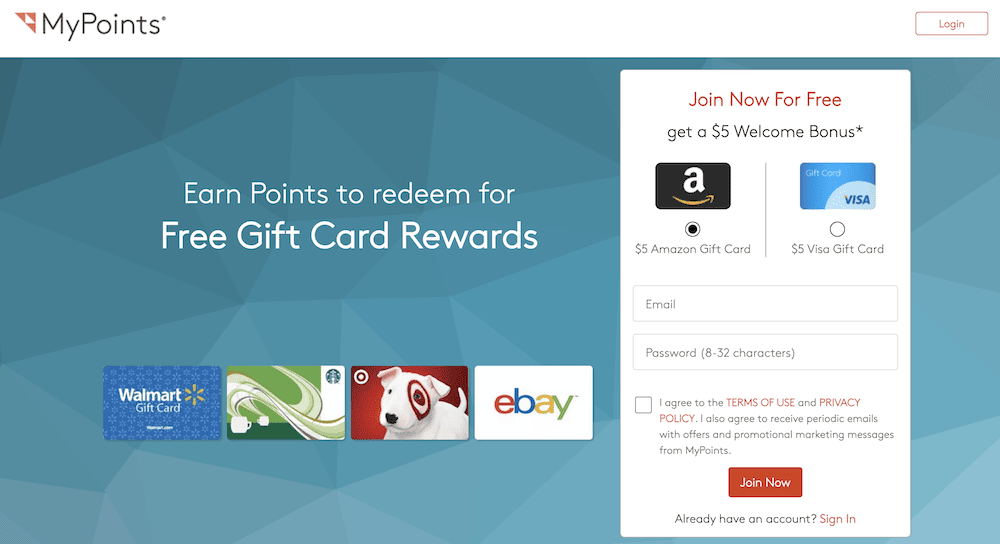

3. MyPoints ($5 Bonus)

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile app (iOS, Android)

With MyPoints, you participate in activities such as online games/puzzles/trivia, taking surveys, watching ads, even shopping for groceries, to earn points. In some cases, you’ll also earn points for trying out trial services from the likes of Disney+, HelloFresh, and AT&T.

Depending on the activity, you can earn points toward gift cards from the likes of Target, Starbucks, and Sephora; coupon codes; cash; or cash back on purchases. And MyPoints features a very low minimum withdrawal of just $3.

- MyPoints lets you get paid for completing various tasks like surveys, but also for playing games, trivia, puzzles, bingo, and more.

- You can redeem your points earned within the app toward gift cards at stores including Target, Starbucks, Apple, Sephora, eBay, and more.

- Minimum cash-out: $3 (500 points).

- Age restrictions: Must be at least 13 years old to participate. Teens age 13 to 17 must have parental consent.

- Special offer: Earn a $2 welcome bonus when you sign up for MyPoints via our link.*

- Pays you for easy tasks

- Offers gift cards from numerous merchants

- Offers cash back

- Teens can participate (ages 13+)

- Not a lucrative side hustle

Related: 26 Best Online Jobs for Teens [Earn Money at Home, Age 13+]

4. Branded Surveys ($1 Bonus)

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile app (iOS, Android)

Branded Surveys has paid out more than $36 million to more than 3 million users.

The surveys made available to you will depend on your interests and profile information, as well as what research partners currently need. Each survey earns points; you can cash out once you’ve accumulated at least 500 points. Depending on survey length, users make anywhere from 50 cents to $5 per survey.

You can use your points toward gift cards from more than 100 brands, receive cash in your PayPal or bank account, or even make a charitable donation.

- Branded Surveys, which boasts more than 3 million users, pays you to take surveys to share your thoughts on future products and services.

- You earn points for completing each survey and can redeem them toward cash (paid via direct deposit or PayPal), gift cards at more than 100 merchants including Amazon and Apple, or even donations to your favorite charity.

- Earn anywhere from 50¢ to $5 per completed survey (longer ones tend to pay more).

- Minimum cash-out: $5 (500 points).

- Age restrictions: Must be at least 16 years old to participate normally. Those under 16 must have parental consent and use their parent's account.

- Special offer: Get 100 free points (worth $1) for signing up.

- Pays you for easy tasks

- Offers gift cards from numerous merchants

- Offers cash back

- Teens can participate (younger teens need parental consent)

- Not a lucrative side hustle

5. InboxDollars ($5 Bonus)

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile app (iOS, Android)

InboxDollars helps users make extra money from doing simple tasks. Like with other money-making apps, brands pay InboxDollars for consumer opinions—which is where you come in. You can earn free cash by participating in several activities, including taking surveys and reading emails. You can also earn cash-back rewards for online shopping, spending on games, and even buying groceries.

Better still: There’s no complex points system. Your earnings show up as real cash. Simple as that.

This passive income app isn’t a substitute for a full-time job, but it’s a great way to earn some extra money with only a little additional work on your part. And to entice new customers, InboxDollars is currently offering a $5 bonus to get started.

- InboxDollars allows you to earn cash by taking surveys or reading emails, and earn cash-back rewards for online shopping and even spending on games.

- Minimum cash-out: $15.

- Age restrictions: Must be at least 18 years old or the age of majority in your state or province, whichever is greater, to participate.

- Special offer: Sign up via our link and get a $5 bonus.

- Pays you for easy tasks

- Offers gift cards from numerous merchants

- Offers cash back

- No confusing points system

- Not a lucrative side hustle

Related: 10 Investments that Earn a Great Return [10% or More]

6. ySense

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile app (iOS, Android)

ySense is an online community that offers multiple earnings options, including taking paid surveys, testing new apps, signing up for websites, watching videos, and more.

ySense suggests completing the “daily checklist,” which includes a couple of surveys and a couple of offers; doing so can earn you up to 16% in bonuses. Cash rewards are paid out through PayPal, Payoneer, and Skrill.

- ySense is a global online community with multiple opportunities to earn money

- Get paid to take surveys, try new products, download apps, signup for websites, watch videos, and more.

- Minimum cash-out: $3 for certain gift cards, $5.05 for Skrill, $10 for PayPal, and $52 for Payoneer.

- Age restrictions: Must be at least 13 years old to participate.*

- Pays you for easy tasks

- Offers gift cards from numerous merchants

- Offers cash back

- Cash-back available through several payment platforms

- Teens can participate (ages 13+)

- High minimum cash-out minimum ($52) for Payoneer

- Not a lucrative side hustle

7. KashKick

- Available: Sign up here

- Price: Free

- Platforms: Web

KashKick is a rewards and loyalty platform that works with marketers to pass some of their marketing budgets on to you, the user.

KashKick shares things in common with several types of money-making apps. For instance, you can take surveys, grind at games, or watch ads to earn real money. But it’s also a cash-back app, given that you can get cash back when you shop deals ranging from games to subscription services to investment apps and more. You can also make money by inviting friends.

KashKick doesn’t use a complicated points system; you always know exactly how much money you have earned. Some deals only offer a little extra cash, while others might offer as much as $50. Once you reach at least $10, you can cash out to a PayPal account.

- KashKick is a rewards and loyalty platform that primarily awards cash back for taking surveys, but you can also grind at games or watch ads to earn real money.

- Some deals earn as little as 50 cents, while others offer as much as $50.

- Minimum cash-out: $10.

- Age restrictions: Must be at least 18 years old to participate.

- Pays you for easy tasks

- Offers cash back

- No complicated points system

- Not a lucrative side hustle

8. Rakuten Insight

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile app (Android)

Rakuten Insight is an online survey site that makes it easy to earn cash anytime, anywhere.

You earn points by completing surveys, and once you’ve earned at least $5 worth of points, you can redeem those points for PayPal cash or Amazon gift cards. Users can earn up to $5 on each survey, meaning in some situations, you can cash out right away.

Rakuten Insight’s surveys educate business organizations, universities, and other entities from around the globe, but primarily from the U.S., Europe, and Asia.

- Rakuten Insight is an online survey site where you complete surveys to earn points, which you can redeem for PayPal cash or Amazon gift cards.

- Users can earn up to $5 on each survey.

- Minimum cash-out: $5 (500 points).

- Age restrictions: Must be at least 16 years old to participate.

- Pays you for easy tasks

- Offers cash back

- Some teens can participate (ages 16+)

- Only gift card option is Amazon

- Not a lucrative side hustle

9. LifePoints

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile app (iOS, Android)

LifePoints is a popular survey app that paid more than $22 million to its members last year.

Users answer questions about various products and brands. In exchange, they receive LifePoints, which can be redeemed for e-gift cards/e-vouchers/store credit at a couple dozen leading merchants including Target and Best Buy; PayPal cash, experiences, even charitable donations to the Special Olympics.

To get started, you just need to sign up, verify your email, and complete your profile. Surveys, which cover a wide variety of topics, will arrive via email invitations and take between 10 and 20 minutes to complete. LifePoints also gives away bonus points each week, and it occasionally awards special prizes like smartphones and smart TVs to randomly chosen users. Worth noting is that LP’s points system doesn’t have an exact cash value—for instance, withdrawing $5 in PayPal cash might cost you more points than withdrawing $5 as an Amazon gift card.

- LifePoints is a popular survey app that pays you in points redeemable for e-gift cards, PayPal cash, and even charitable donations to the Special Olympics.

- Surveys take between 10 to 20 minutes to complete.

- LifePoints also conducts special giveaways with prizes including smartphones and smart TVs.

- Minimum cash-out: Roughly $5 (550 points).*

- Age restrictions: Must be at least 14 years old to participate.

- Pays you for easy tasks

- Offers cash back

- Offers wide array of rewards

- Most teens can participate (ages 14+)

- Not a lucrative side hustle

- Points' value fluctuates depending on how you cash out

Related: 60 Personal Finance Statistics You Might Not Know (But Should!)

Shopping Rewards Apps

| App Name | Cost | Available on |

|---|---|---|

Rakuten Rakuten | Free | Web, mobile (iOS, Android) |

Capital One Shopping Capital One Shopping | Free | Web, mobile (iOS, Android) |

Ibotta Ibotta | Free | Web, mobile (iOS, Android) |

Drop Drop | Free | Web, mobile (iOS, Android) |

10. Rakuten ($10 Bonus)

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile (iOS, Android, Galaxy Store)

Rakuten (formerly known as Ebates) has become one of the most popular apps among shoppers because of the rewards and savings it offers when you buy through the app. To date, it has paid members more than $2 billion via cash-back rewards.

To take advantage of the shopping savings, you can either shop through Rakuten’s online platform or install the Rakuten Chrome browser extension, which identifies potential shopping savings as you browse online retailers. Rakuten leverages its massive scale to extract affiliate revenue from more than 2,500 retailers—when you use Rakuten to get shopping savings, brands pay Rakuten a commission, which it then shares with you every three months (an admittedly infrequent payout schedule) via PayPal or check.

Currently, if you sign up with Rakuten, you’ll receive a $10 bonus.

- When you shop with Rakuten (formerly Ebates) activated, Rakuten automatically identifies potential shopping savings at thousands of retailers, and it pays you cash-back rewards for buying with those merchants.

- Offers available both online and in-store.

- Cash-back rewards add up as you complete offers. Payments are then sent out every three months, via PayPal or check.

- Minimum cash-out: $5.01.

- Age restrictions: Must be at least 18 years old to participate.

- Special offer: Sign up by using our link and receive a $30 bonus when you spend $30.*

- Easily earn savings for shopping

- Offers cash back

- Convenient Chrome extension

- Payments only sent out once per quarter

11. Capital One Shopping

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile app (iOS, Android)

Want help on saving real money within seconds? Install the Capital One Shopping app, log into the website or download the Chrome browser extension, and it will search for discounts and promo codes while you shop, and apply any of the deals it found to your cart.

Users can also put items on their watchlist so they’re notified when the price drops or it goes on sale. Additionally, whenever you see an item you want on Amazon, the app can let you know right away if there is a better deal available.

This app works with more than 100,000 stores, and you don’t need to be a Capital One credit card holder to use it.

- Capital One Shopping searches for discounts and promo codes while you shop, and it automatically applies any deals it finds to your cart.

- Want an item but it's too expensive right now? If you're searching on Amazon, Capital One Shopping will identify whether that item is cheaper elsewhere. And if it's not, you can put the item on a watchlist; the app will alert you when there's a price drop.

- In addition to immediate savings, you accumulate shopping rewards that you can spend on e-gift cards.

- Works with more than 100,000 stores.

- Does not require you to be a Capital One cardholder to use.

- Minimum cash-out: $5.

- Age restrictions: Must be at least 18 years old to participate.

- Easily earn savings for shopping

- Offers e-gift card rewards

- Convenient Chrome extension

- Limited gift card selection

- Long time (up to 60 days) for rewards to appear

Related: 23 Best Income-Generating Assets [Invest in Cash Flow]

12. Ibotta ($10 Bonus)

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile app (iOS, Android)

Ibotta gives users cash back whenever they buy from participating retailers, whether they’re shopping online or visiting a physical store. Whether you’re shopping in a brick-and-mortar location or online shopping on your phone, you can use the app, or you can add a browser extension to your desktop to earn exclusive cash-back offers at hundreds of retailers.

Earn up to 30% cash back at thousands of top retailers, such as Home Depot, Best Buy, Gap, and Kohl’s—and even on grocery pickup and delivery fees. Cash-back rewards can even apply to some gift card purchases! Better still? Ibotta also compares and tracks prices for you, helping you to get the best deals.

Users can withdraw their earnings through gift cards, PayPal, Venmo, or participating banks.

Currently, new users will get a $10 bonus when they spend $30 with Ibotta. (Offer excludes grocery purchases and purchases made on the Ibotta mobile app.)

- With iBotta, you can earn real cash back on everything from groceries to online shopping to restaurants to even gift cards.

- iBotta offers you different ways to save no matter where you're shopping, whether that's uploading receipts, linking loyalty accounts, shopping through the app, or even activating its Chrome extension.

- Cash out earnings to your bank account, PayPal, or Venmo.

- Minimum cash-out: $20.

- Age restrictions: Must be at least 18 years old to participate.

- Special offer: Earn $10 when you spend $30.*

- Easily earn savings for shopping

- Offers gift cards

- Offers cash back

- Convenient Chrome extension

- High minimum cash-out amount ($20).

13. Drop

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile app (iOS, Android)

Drop is a shopping app that helps you earn rewards for the shopping you were already going to do anyway!

It’s a simple process: Download the Drop app, sign up, connect your credit card or debit card, and pick five stores you want to earn rewards from automatically. Options include Uber, Starbucks, Target, and Walmart, among many others.

Typically, you earn 0.5 to 1.5% of your purchases back in the form of Drop points. The points can be redeemed for gift cards to stores, including popular ones such as Amazon and Starbucks; 1,000 Drop points are equivalent to $1 in gift card rewards

If you want to earn points more quickly, you can play Drop’s mini-games or complete surveys.

- With Drop, you can earn points rewards by spending with your favorite retailers. Earn more easily by linking your credit or debit card.

- Redeem your Drop points for gift cards to several different stores/restaurants.

- Minimum cash-out: $25.

- Age restrictions: Must be at least 18 years old to participate.

- Easily earn savings for shopping

- Offers gift cards

- Convenient Chrome extension

- High minimum cash-out amount ($25).

Related: 31 Millennial Spending Habits & Income Statistics to Know

Video Game and Gaming Apps

| App Name | Cost | Available on |

|---|---|---|

| Rewarded Play | Free | Mobile app (Android) |

| Mistplay | Free | Mobile app (Android) |

| Blackout Bingo | Free. Cash games require cash entry fees. | Mobile app (iOS, Android [Not in Google Play], Galaxy Store) |

| Bingo Cash | Free. Cash games require cash entry fees. | Mobile app (iOS, Android [Not in Google Play], Galaxy Store) |

| Bingo Tour | Free. Cash games require cash entry fees. | Mobile app (iOS, Android [Not in Google Play], Galaxy Store) |

| Bubble Cube 2 | Free. Cash games require cash entry fees. | Mobile app (iOS, Android [Not in Google Play], Galaxy Store) |

| Dominoes Gold | Free. Cash games require cash entry fees. | Mobile app (iOS, Android [Not in Google Play], Galaxy Store) |

| Pool Payday | Free. Cash games require cash entry fees. | Mobile app (iOS, Android [Not in Google Play], Galaxy Store) |

| 21 Blitz | Free. Cash games require cash entry fees. | Mobile app (iOS, Android [Not in Google Play], Galaxy Store) |

| Solitaire Cube | Free. Cash games require cash entry fees. | Mobile app (iOS, Android [Not in Google Play], Galaxy Store) |

| Solitaire Cash | Free. Cash games require cash entry fees. | Mobile app (iOS, Android [Not in Google Play], Galaxy Store) |

| Solitaire Clash | Free. Cash games require cash entry fees. | Mobile app (iOS, Galaxy Store) |

| Big Buck Hunter: Marksman | Free. Cash games require cash entry fees. | Mobile app (iOS, Android [Not in Google Play], Galaxy Store) |

| WorldWinner | Free. Cash games require cash entry fees. | Mobile app (iOS, Android [Not in Google Play]) |

14. Rewarded Play

- Available: Android

- Price: Free

- Platforms: Mobile app (Android)

Games apps help you earn money for doing something you might already do: playing games.

Rewarded Play, for instance, introduces you to new games to play—and the more you play, the more you earn.

Like many money-making apps, Rewarded Play is points-based. You earn points when you play games. If you earn at least 5,000 points in any given day, you’ll also earn a Daily Bonus that starts at 500 points. For each consecutive day you earn 5,000 points after that, your Daily Bonus grows by 500 points, up to five days—after that, you’ll earn 2,500 points every day you continue your earning streak. If you miss a day, the bonus starts over.

You can also earn points by making in-app purchases and watching ads.

You must accumulate at least 45,000 points (the equivalent of $5) to cash out. Points can be redeemed for gift cards to popular retailers such as Amazon, Walmart, and Macy’s. To date, Rewarded Play has paid out more than $15 million to users.

- Rewarded Play introduces you to the newest trending games—and pays you to play.

- The app runs on a points-based system that rewards you for playing games, buying in-game content, and watching ads. Redeem points for gift cards for retailers such as Amazon, Walmart, and Macy's.

- Currently, Rewarded Play is only available on Android devices.

- Minimum cash-out: $5.

- Age restrictions: Must be at least 18 years old to participate.

15. Mistplay

- Available: Android

- Price: Free

- Platforms: Mobile app (Android)

Mistplay is a loyalty program targeted to gamers that rewards you when you play video games and participate in contests.

To make money using the Mistplay app (only available as an Android app at the moment), you discover new games on the app’s mix list, select the ones that interest you, then generate points as you play.

You can redeem earned points toward prizes such as Amazon and Google Play gift cards, and PayPal cash. Mistplay also holds weekly contests and offers an “epic” grand prize in the last contest of each month.

Invite friends to the app to earn more or join competitions to improve your ranking on the Mistplay app.

- Mistplay is a loyalty program where you can earn points toward gift cards and PayPal cash by playing video games.

- Mistplay also holds weekly contests and offers an “epic” grand prize in the last contest of each month.

- Currently, Mistplay is only available on Android devices.

- Minimum cash-out: $5 for gift cards, $10 for PayPal cash.

- Age restrictions: You must be at least 18 years old to participate.

16. Blackout Bingo

- Available: iOS | Android | Galaxy Store

- Price: Free. Cash games require cash entry fees

- Platforms: Mobile app (iOS, Android [Not in Google Play], Galaxy Store)

Blackout Bingo is a fast-paced bingo game where you’re matched against opponents at similar skill levels. And unlike real bingo, which is completely about luck, skill plays a part in this money-making app.

Blackout Bingo is part of the Skillz umbrella of skill-based games. Because we cover several of them in this article, here’s what you need to know about the currencies they typically use:

- Ticketz: Players receive Ticketz for playing, win or lose. Ticketz can be redeemed for gift cards, Skillz swag, tech products, kitchen items, sports equipment, and more! (Naturally, high-priced items require a substantial number of Ticketz.)

- Z: This is an in-game currency that’s used to enter non-cash tournaments. You receive these by winning tournaments, earning trophies, receiving daily rewards, and through other actions.

- Bonus Cash: Bonus Cash is occasionally awarded in promotions and can be used to help pay for entry fees. For every $1 you spend on entry fees, 10 cents will be used for entry. So if you pay a $3 entry fee, 30 cents of that will come from Bonus Cash. While it is priced in U.S. dollars, it cannot be withdrawn; in fact, if you withdraw money, you forfeit your Bonus Cash.

- Cash: Cash is used to pay for entry fees, and you collect cash when you win cash games.

Players start Blackout Bingo in the Bronze Tier, where they only earn one ticket per game. To progress up the tiers, you must earn a certain amount of Ticketz each month. Once you reach the Black tier, you earn six Ticketz per game, meaning you’re earning much faster than someone who only plays infrequently.

Players have the option to spend money on the game so they progress faster, but it’s not required. But you do have to use Z, Bonus Cash, and/or cash to play against opponents and enter events. If you want to play for cash, you must deposit money with a credit card, prepaid gift card, Apple Pay, or PayPal account. Withdrawals up to the amount of your total deposits can be processed using the same form of payment as your deposit, but winnings will be sent by paper check if you’re a U.S.-based player, PayPal if you’re internationally based.

Blackout Bingo is one of several money-making game apps offered by Skillz, which has several noteworthy rules. There’s no minimum to withdraw, but you will be charged $1.50 for any withdrawal under $10. Cash tournaments aren’t available in Arkansas, Connecticut, Delaware, Louisiana, and South Dakota, according to Skillz. And you must be 18 or older to play for cash.

- Skillz's Blackout Bingo is a fast-paced bingo game where you can compete against other opponents and win both prizes and real cash.

- Win or lose, you'll earn Ticketz, which can be redeemed for gift cards, swag, and other prizes. You can also win in-game currency and Bonus Cash, and you can earn real money in cash games and tournaments.

- Deposit money with a credit card, prepaid gift card, Apple Pay, or PayPal account.

- Withdrawals up to the amount of your total deposits can be processed using the same form of payment as your deposit, but winnings will be sent by paper check if you’re a U.S.-based player, PayPal if you’re internationally based.

- Minimum deposit: $10.

- Minimum cash-out: None, but Skillz will charge a $2 check request processing fee for withdrawals of less than $2. You also forfeit any remaining Bonus Cash when you request a withdrawal.

- Age restrictions: You must be at least 18 years old to participate.

- State restrictions: Cash games/tournaments are not available in AR, CT, DE, LA, and SD.

Related: 75 Cryptocurrency Statistics Show Crypto’s Gone Mainstream

17. Bingo Cash ($5 Bonus)

- Available: iOS | Android | Galaxy Store

- Price: Free. Cash games require cash entry fees

- Platforms: Mobile app (iOS, Android [Not in Google Play], Galaxy Store)

Bingo Cash is another fun bingo game that doubles as a money-making app. You play against other users in tournaments; whoever has the highest score when the two-minute timer runs out wins. The faster you click your numbers, the more points you get. You can use “boosters” to increase your score as well.

You earn gems (the in-game currency) and bonus cash alike. You’ll also fill up an experience meter every time you play; as you level up, you’ll unlock new content and win prizes. You can collect daily rewards, too, and earn extra gems by watching ads. You also have the option to spend money to get gems, but it isn’t necessary. That said, some games do cost gems to play.

You can receive cash rewards through PayPal, Apple Pay, or a linked Visa or Mastercard. Just note that cash tournaments currently aren’t available in Arizona, Delaware, Iowa, Louisiana, and South Carolina. You must be 18 or older to play for cash.

- Compete against other players in Bingo Cash, a two-minute Bingo skill game where the faster you are, the more points you can rack up.

- Earn gems (in-game currency) and bonus cash, and win real money during cash games and tournaments. You can also collect daily rewards and earn extra gems by watching ads.

- Receive cash rewards through PayPal, Apple Pay, or a linked Visa or Mastercard.

- Minimum cash-out: $5. Bingo Cash charges a $1 withdrawal fee regardless of withdrawal size. You also forfeit any remaining bonus cash if you request a withdrawal.

- Age restrictions: You must be at least 18 years old to participate.

- State restrictions: Cash games/tournaments are not available in AZ, DE, IA, LA, and SC.

- Special offer: Earn $5 Bonus Cash when you make your first $10 deposit.

18. Bingo Tour

- Available: iOS | Android | Galaxy Store

- Price: Free. Cash games require cash entry fees

- Platforms: Mobile app (iOS, Android [Not in Google Play], Galaxy Store)

Bingo Tour is another skill-based bingo simulator that pits you against players around the world; they have similar skill levels and the same starting conditions. Various power-ups help you earn higher scores.

Players can use gems to play free matches, win real money in cash tournaments, and earn extra rewards and cash in minigames. Technically, it’s possible to play cash games with bonus cash awarded from free games, but it’s difficult—many users end up depositing money to play. When it’s time to cash out, you have three options: electronic check; PayPal; or Visa, Mastercard, or a debit card.

People in Arizona, Arkansas, Connecticut, Delaware, Louisiana, Montana, South Carolina, South Dakota, Tennessee, and Vermont are prohibited from playing cash matches, but they can still play free games.

- Bingo Tour is a skill-based bingo simulator that allows you to put your skills to the test against players around the world, both for free and in cash tournaments.

- Players can use gems to play free matches, win real money in cash tournaments, and earn extra rewards and cash in minigames.

- Receive cash awards via electronic check; PayPal; or Visa, Mastercard, or debit card.

- Minimum cash-out: $2, but Bingo Tour charges a $1 processing fee for any withdrawals under $10.

- Age restrictions: You must be at least 18 years old to participate.

- State restrictions: Cash games/tournaments are not available in AZ, AR, CT, DE, LA, MT, SC, SD, TN, and VT.

19. Bubble Cube 2

- Available: iOS | Android | Galaxy Store

- Price: Free. Cash games require cash entry fees

- Platforms: Mobile app (iOS, Android [Not in Google Play], Galaxy Store)

Bubble Cube 2 is a Puzzle Bobble clone where you shoot various colored bubbles onto a game board to create matches, which pop the bubbles and earn you points. Clearing all bubbles of the same color eliminates them for the rest of the round. If you run out of shooting bubbles before the meter fills, the board drops. If it drops too low, the game ends.

Bubble Cube 2 differentiates itself from most other bubble shooters in a couple of ways. For one, you play against another person. First off, you’re playing against another person. Both players have the same amount of time (three minutes) and the same bubbles in the same order; whoever earns the highest score wins.

It’s also different in that you can win prizes and cash. Bubble Cube 2, like Blackout Bingo, is under the Skillz umbrella of mobile games, so it uses the same currencies that you can redeem for gift cards, prizes, and real money.

Bubble Cube 2 also hosts cash prize tournaments, though they’re not available in Arkansas, Connecticut, Delaware, Louisiana, and South Dakota. Users younger than 18 can’t play for cash.

- Skillz's Bubble Cube 2 is a Puzzle Bobble clone where you shoot various colored bubbles onto a game board to create matches. In this version, however, you can compete against other players to win both prizes and real cash.

- Win or lose, you'll earn Ticketz, which can be redeemed for gift cards, swag, and other prizes. You can also win in-game currency and Bonus Cash, and you can earn real money in cash games and tournaments.

- Deposit money with a credit card, prepaid gift card, Apple Pay, or PayPal account.

- Withdrawals up to the amount of your total deposits can be processed using the same form of payment as your deposit, but winnings will be sent by paper check if you’re a U.S.-based player, PayPal if you’re internationally based.

- Minimum deposit: $10.

- Minimum cash-out: None, but Skillz will charge a $2 check request processing fee for withdrawals of less than $2. You also forfeit any remaining Bonus Cash when you request a withdrawal.

- Age restrictions: You must be at least 18 years old to participate.

- State restrictions: Cash games/tournaments are not available in AR, CT, DE, LA, and SD.

Related: 9 Best Credit Cards for Students with No Credit [Building Credit]

20. Dominoes Gold

- Available: iOS | Android | Galaxy Store

- Price: Free. Cash games require cash entry fees

- Platforms: Mobile app (iOS, Android [Not in Google Play], Galaxy Store)

Dominoes Gold, another Skillz game, is similar to the classic domino game All Fives. You and an opponent play identical games against the computer, and whoever gets the highest score before the time runs out wins.

Again, this is another Skillz game, and thus it shares a similar prize structure as Blackout Bingo and Bubble Cube 2. You earn Ticketz, win or lose, and can redeem Ticketz for a large range of prizes or cash. You can also earn Z, Bonus Cash, and real cash. Users can compete in daily domino tournaments for the opportunity to win prizes, too.

However, users in Arkansas, Connecticut, Delaware, New Jersey, Louisiana, and South Dakota can’t participate in Dominoes Gold cash prize tournaments.

- Compete in the classic domino game All Fives—for cash!—in Skillz's Dominoes Gold. You and an opponent play identical games against the computer, and whoever earns the best score before time runs out wins!

- Win or lose, you'll earn Ticketz, which can be redeemed for gift cards, swag, and other prizes. You can also win in-game currency and Bonus Cash, and you can earn real money in cash games and tournaments.

- Deposit money with a credit card, prepaid gift card, Apple Pay, or PayPal account.

- Withdrawals up to the amount of your total deposits can be processed using the same form of payment as your deposit, but winnings will be sent by paper check if you’re a U.S.-based player, PayPal if you’re internationally based.

- Minimum deposit: $10.

- Minimum cash-out: None, but Skillz will charge a $2 check request processing fee for withdrawals of less than $2. You also forfeit any remaining Bonus Cash when you request a withdrawal.

- Age restrictions: You must be at least 18 years old to participate.

- State restrictions: Cash games/tournaments are not available in AR, CT, DE, NJ, LA, and SD.

21. Pool Payday

- Available: iOS | Android | Galaxy Store

- Price: Free. Cash games require cash entry fees

- Platforms: Mobile app (iOS, Android [Not in Google Play], Galaxy Store)

Pool Payday, also by Skillz, is a pool/billiards game where you can play by yourself or get matched against other users at similar ability levels.

Pocket balls to score points. Extra points can be earned through multipliers and trick shots. Once you lose all your cue balls, the game is over. It can be tricky at first, but once you have the controls down, you can show off your geometry skills.

You must be 18 to compete in cash games. You also can’t participate in Pool Payday cash tournaments if you live in Arizona, Arkansas, Connecticut, Delaware, Illinois, Indiana, Louisiana, Maine, Montana, South Carolina, South Dakota, and Tennessee.

- Put your pool skills (or heck, your geometry skills) to the test against other 8-ball players with Skillz's Pool Payday.

- Win or lose, you'll earn Ticketz, which can be redeemed for gift cards, swag, and other prizes. You can also win in-game currency and Bonus Cash, and you can earn real money in cash games and tournaments.

- Deposit money with a credit card, prepaid gift card, Apple Pay, or PayPal account.

- Withdrawals up to the amount of your total deposits can be processed using the same form of payment as your deposit, but winnings will be sent by paper check if you’re a U.S.-based player, PayPal if you’re internationally based.

- Minimum deposit: $10.

- Minimum cash-out: None, but Skillz will charge a $2 check request processing fee for withdrawals of less than $2. You also forfeit any remaining Bonus Cash when you request a withdrawal.

- Age restrictions: You must be at least 18 years old to participate.

- State restrictions: Cash games/tournaments are not available in AZ, AR, CT, DE, IL, IN, LA, ME, MT, SC, SD, and TN.

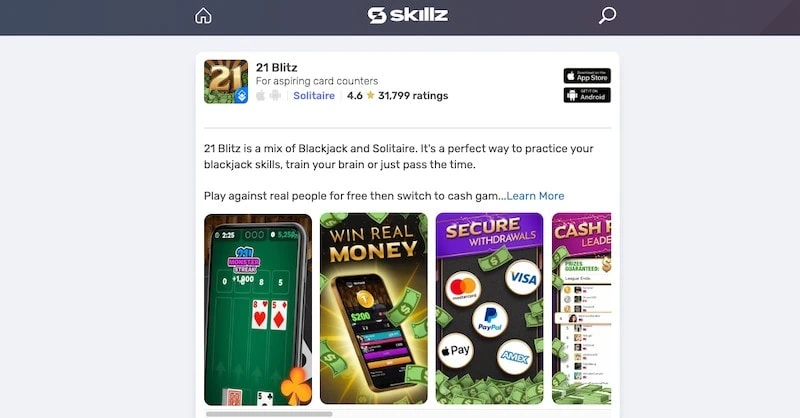

22. 21 Blitz

- Available: iOS | Android | Galaxy Store

- Price: Free. Cash games require cash entry fees

- Platforms: Mobile app (iOS, Android [Not in Google Play], Galaxy Store)

Another Skillz game, 21 Blitz, is a solitaire-blackjack hybrid that has paid out $50 million to players so far.

Like with other Skillz apps, 21 Blitz users compete against players at similar skill levels. No bots—only real human opponents. You can earn money by winning, and by reaching milestones such as scoring over a certain amount of points in a game.

Every time you play a game, your experience meter fills up. As you level up, you get rewards and new content, such as leagues with high cash rewards (say, $1,000).

Note that for competitions where you use some of your funds, you will need to share your location to ensure you’re in a state that allows you to participate. Arkansas, Connecticut, Delaware, Louisiana, and South Dakota currently prohibit cash tournaments like what Skillz offers, and Maine and Indiana prohibit cash games in card-based apps like 21 Blitz.

- Play cards mano a mano in Skillz's 21 Blitz—a fast-paced Solitaire-21 hybrid game—for in-game currencies, prizes, and real cash.

- Win or lose, you'll earn Ticketz, which can be redeemed for gift cards, swag, and other prizes. You can also win in-game currency and Bonus Cash, and you can earn real money in cash games and tournaments.

- Deposit money with a credit card, prepaid gift card, Apple Pay, or PayPal account.

- Withdrawals up to the amount of your total deposits can be processed using the same form of payment as your deposit, but winnings will be sent by paper check if you’re a U.S.-based player, PayPal if you’re internationally based.

- Minimum deposit: $10.

- Minimum cash-out: None, but Skillz will charge a $2 check request processing fee for withdrawals of less than $2. You also forfeit any remaining Bonus Cash when you request a withdrawal.

- Age restrictions: You must be at least 18 years old to participate.

- State restrictions: Cash games/tournaments are not available in AR, CT, DE, IN, LA, ME, and SD.

23. Solitaire Cube

- Available: iOS | Android | Galaxy Store

- Price: Free. Cash games require cash entry fees

- Platforms: Mobile app (iOS, Android [Not in Google Play], Galaxy Store)

Solitaire Cube is similar to classic Klondike solitaire, but with some twists. Players get points for every card and each card sent to the foundation pile. There is a time limit, so the faster you play, the better.

While the game might have the word “solitaire” in it, you actually compete against another person. Players must solve the same deck; whoever gets the most points wins.

This is another game by Skillz, which means all of the same rules above apply. You earn Ticketz that can be exchanged for gift cards and prizes. And if you live in a state that allows it, you can also play cash matches. That means you can’t play cash matches in Arkansas, Connecticut, Delaware, Indiana, Louisiana, Maine, and South Dakota.

- Skillz's Solitaire Cube is classic Klondike solitaire with a twist, where speed and smarts can win you cash and prizes.

- Win or lose, you'll earn Ticketz, which can be redeemed for gift cards, swag, and other prizes. You can also win in-game currency and Bonus Cash, and you can earn real money in cash games and tournaments.

- Deposit money with a credit card, prepaid gift card, Apple Pay, or PayPal account.

- Withdrawals up to the amount of your total deposits can be processed using the same form of payment as your deposit, but winnings will be sent by paper check if you’re a U.S.-based player, PayPal if you’re internationally based.

- Minimum deposit: $10.

- Minimum cash-out: None, but Skillz will charge a $2 check request processing fee for withdrawals of less than $2. You also forfeit any remaining Bonus Cash when you request a withdrawal.

- Age restrictions: You must be at least 18 years old to participate.

- State restrictions: Cash games/tournaments are not available in AR, CT, DE, IN, LA, ME, and SD.

Related: 11 Best Compound Interest Investments [Where to Invest]

24. Solitaire Clash

- Available: iOS | Galaxy Store

- Price: Free. Cash games require cash entry fees

- Platforms: Mobile app (iOS, Galaxy Store)

It’d be easy to confuse Solitaire Clash with Solitaire Cash, given their nearly identical names. In Solitaire Clash, you play classic Klondike solitaire in timed multiplayer tournaments. With the timer ticking down, players try to get the highest score possible to beat their opponents.

Players can use gems to play free matches. Alternatively, they can participate in cash games to win real money if they live in an eligible state. Multiplayer tournaments usually include five to 10 other players, with the top three scorers winning prizes. You can earn extra rewards through mini-games as well.

Users can withdraw money via PayPal. Solitaire Clash also has a very low minimum withdrawal of $2.

You must be 18 or older to play Solitaire Clash. Cash games are not available in Arizona, Arkansas, Connecticut, Delaware, Louisiana, Montana, South Carolina, South Dakota, Tennessee, and Vermont.

- Solitaire Clash is a classic Klondike solitaire app where you compete for free, or for cash, in timed multiplayer tournaments against similarly skilled opponents.

- Earn extra money through mini-games.

- You can withdraw money via PayPal.

- Minimum cash-out: $2.

- Age restrictions: You must be at least 18 years old to participate.

- State restrictions: Cash games/tournaments are not available in AZ, AR, CT, DE, LA, MT, ME, IN, SC, SD, TN, and VT.

25. Big Buck Hunter: Marksman

- Available: iOS | Android | Galaxy Store

- Price: Free. Cash games require cash entry fees

- Platforms: Mobile app (iOS, Android [Not in Google Play], Galaxy Store)

If you enjoy the arcade game Big Buck Hunter but can only game on the go, you’ll likely also have fun playing Big Buck Hunter: Marksman.

Big Buck Hunter: Marksman works like the original. You visit a hunting location, look through your rifle scope, and take aim at deer. The better your shots, the likelier you are to take down the buck, and the more points you’ll earn.

But this is a multiplayer version that matches you with opponents at similar ability levels. It’s another Skillz game, so you win Ticketz no matter how you do. You can also earn coins, which you can cash in for upgrades at the in-game Big Buck Outfitters store.

Cash games are available in all states but Arkansas, Connecticut, Delaware, Louisiana, and South Dakota. Again, if you want to win cash, you’ll either need to deposit money (not required) or earn Bonus Cash. You can earn Bonus Cash through promo codes, referrals, or by winning enough games in free mode.

- Take aim at deer (with antlers!), critters, and other trophy animals—and cash prizes—in Skillz's Big Buck Hunter: Marksman.

- Win or lose, you'll earn Ticketz, which can be redeemed for gift cards, swag, and other prizes. You can also win in-game currency and Bonus Cash, and you can earn real money in cash games and tournaments.

- Deposit money with a credit card, prepaid gift card, Apple Pay, or PayPal account.

- Withdrawals up to the amount of your total deposits can be processed using the same form of payment as your deposit, but winnings will be sent by paper check if you’re a U.S.-based player, PayPal if you’re internationally based.

- Minimum deposit: $10.

- Minimum cash-out: None, but Skillz will charge a $2 check request processing fee for withdrawals of less than $2. You also forfeit any remaining Bonus Cash when you request a withdrawal.

- Age restrictions: You must be at least 18 years old to participate.

- State restrictions: Cash games/tournaments are not available in AR, CT, DE, LA, and SD.

26. WorldWinner (Free Bonus Bucks)

- Available: iOS | Android

- Price: Free. Cash games require cash entry fees.

- Platforms: Mobile app (iOS, Android [Not in Google Play])

WorldWinner offers nearly two dozen games you can play competitively against others, including Solitaire games, Trivial Pursuit, Bejeweled Champions, Wheel of Fortune, and more.

You can practice for free, but you must make a deposit to play in cash tournaments, with a starting entry fee of 25 cents. Simply pick a tournament, determine whether you want to play head-to-head or multiplayer, choose your level of difficulty, and play against opponents of similar skill levels.

Participants play separately and try to emerge with the top score. One the results are in, you’ll learn whether you’ve won some cash.

WorldWinner says it pays out around $250,000 in prizes every day. You can deposit and withdraw via debit card, credit card, Apple Pay, PayPal, and check. However, cash games may be limited or not available in Arkansas, Arizona, Connecticut, Delaware, Louisiana, Montana, South Carolina, South Dakota, Tennessee, and Vermont.

- WorldWinner lets you play nearly two dozen popular games, includingTrivial Pursuit, Bejeweled Champions, Wheel of Fortune, and more, against other players in cash tournaments!

- Choose your own difficulty and play against humans who have similar skills as you.

- Entry fees start at 25 cents.

- Securely withdraw and deposit money through Visa, Mastercard, PayPal, and Apple Pay.

- Minimum cash-out: None, but WorldWinner will charge $1.75 for a check request for any amount less than $10. Bonus Bucks are forfeited with any cash withdrawal.

- Age restrictions: You must be at least 18 years old to participate.

- State restrictions: Cash games/tournaments are limited or not available in AR, AZ, CT, DE, LA, MT, SC, SD, TN, and VT.

Related: 30 NFT Statistics to Understand [Market, Sales & Trends]

Cash-Back Apps

| App Name | Cost | Available on |

|---|---|---|

GoCashBack GoCashBack | Free | Web, mobile app (iOS) |

Upside Upside | Free | Mobile app (iOS, Android) |

Dosh Dosh | Free | Mobile app (iOS, Android) |

Samsung Wallet Samsung Wallet | Free | Mobile app (Android) |

27. GoCashBack ($8 Bonus)

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile app (iOS)

GoCashBack is a cash-back app trusted by more than 700,000 users who’ve collectively earned more than $8 million in rewards. The free platform allows users to shop online at retailers like eBay, Walmart, Home Depot, Macy’s, GNC, and more, and get up to 40% back on their purchases. (However, actual cash-back rates are more commonly in the low- to mid-single-digit range for most offers.)

You can shop through GoCashBack’s website or app, or use their Chrome browser extension to claim coupons and deals through various participating retailers. You can use their GoCashBack app to check your cash-back status from anywhere and click through while on the go to save when you shop on your phone. You can withdraw via PayPal, check, and gift cards.

Get an $8 sign-up bonus today for joining GoCashBack.

- GoCashBack has delivered more than $8 million in rewards to users who shop at major retailers including Walmart, Home Depot, Macy's, GNC, and more.

- Shop through GoCashBack's website or app, or shop like you normally would online while using its Chrome browser extension.

- Minimum cash-out: $10.

- Age restrictions: Must be at least 18 years old to participate.

- Special offer: Sign up today and earn an $8 cash bonus.

- Easily earn cash back for everyday purchases

- Offers cash back

- Convenient Chrome extension

- No significant cons

28. Upside

Upside lets users earn cash back on purchases with minimal extra effort.

Upside can provide cash back at grocery stores, restaurants, gas stations, and more, and it can work alongside other discounts, coupons, and loyalty programs. And there’s no limit to how much you can earn.

Here’s how it works: You claim an offer through the app, then pay as you normally would with a credit card or debit card. From there, you either “Check In” your purchase (or upload a photo of the receipt), and cash back will be deposited into your Upside account. Finally, you can cash out as you wish via e-gift card, PayPal cash, or bank transfer.

- Upside lets users earn cash back on gas, restaurant, grocery, and other purchases with minimal extra effort.

- Check into the app to log your purchases, or upload a photo of your receipt, to earn cash-back rewards.

- Minimum cash-out: None, but must cash out at least $10 for gift cards or $15 for PayPal to avoid a $1 fee.

- Age restrictions: Must be at least 16 years old to participate. Teens age 16 and 17 must have parental consent.

- Easily earn cash back for everyday purchases

- Offers gift cards

- Offers cash back

- No minimum cash-out amount

- Some teens can participate (16+)

- Fees apply to small cash-out amounts

Related: 7 Best Teen Checking Accounts [Bank Accounts for Teenagers]

29. Dosh

- Available: Sign up here

- Price: Free

- Platforms: Mobile app (iOS, Android)

Dosh automatically generates cash-back rewards when you shop—not just retail brands, but restaurants, hotels, and more. Some of the well-known brands under its umbrella include Walgreens, Nike, Forever21, Hyatt, Marriott, Shake Shack, and Disney+.

Participating is easy. Simply download the app, link up any cards or eligible mobile wallets. Whenever you use your card with a partner featuring cash-back rewards, Dosh will automatically deposit the cash back into your wallet. You can also accumulate rewards faster by completing special offers.

When you’ve accumulated at least $15 in cash-back rewards, you can cash out to your bank, PayPal, or Venmo.

- Dosh automatically generates cash-back rewards when you shop—not just retail brands, but restaurants, hotels, gyms, and more.

- Not sure where to begin? The app can show you any offers that are available near you.

- Download the app, then link up any cards, eligible mobile wallets, or other payment platforms. When you spend, Dosh will automatically deposit the cash back into your Dosh wallet.

- Cash out via bank, PayPal, or Venmo.

- Minimum cash-out: $15.

- Age restrictions: Must be at least 18 years old to participate.

- Easily earn cash back for everyday purchases

- Offers cash back

- Wide variety of available merchants

- Limited linkable cards

- Must use debit card as credit to earn rewards

30. Samsung Wallet

- Available: Sign up here

- Price: Free

- Platforms: Mobile app (Android)

Samsung Wallet lets you avoid a bulging wallet filled with payment cards, membership cards, and gift cards. This mobile payment system lets you make purchases in-store, online, and through the app. All users need to do is register their cards on Samsung Wallet and the cards are always ready to use from their phones.

To make in-store purchases using Samsung Wallet, you simply swipe up from the home screen. Then, you choose a card, verify a fingerprint, and hover your phone over the card reader.

In addition to the convenience, users can get cash back when they make purchases within the app from select merchants during promotional periods. The cash-back percentage varies by retailer.

Note that users need at least $5 in rewards to redeem and the cash back isn’t received until the merchant’s return period is passed. Cash back can be used to make purchases through Samsung Wallet.

- Samsung Wallet is a mobile payment system that lets you make purchases in-store, online, and through the app. Simply register your cards on Samsung Wallet and use them wherever the app is accepted.

- Users can also earn cash back with Samsung Wallet when they make purchases within the app from select merchants during promotional periods. Cash back can be used to make purchases through Samsung Wallet.

- Minimum cash-out: $5.

- Age restrictions: Must be at least 13 years old to participate. Teens age 13 to 17 must have parental consent.

- Useful digital wallet

- Low minimum cash-out amount ($5)

- Teens can participate (13+)

- Has cash-back features but does not offer same range of opportunities as true cash-back apps

- Cash-back rewards can only be used through Samsung Wallet

Related: 9 Best Credit Cards for No Credit History: Starter Credit Cards

Banking and Investing Apps

| App Name | Cost | Available on |

|---|---|---|

Plynk™ Invest Plynk™ Invest | Commission-free trades** | Mobile app (iOS, Android) |

Fundrise Fundrise | Free | Web, mobile app (iOS, Android) |

Acorns Acorns | $3/mo. - $12/mo. | Web, mobile app (iOS, Android) |

Robinhood Robinhood | Free | Web, mobile app (iOS, Android) |

Webull Webull | Free | Web, mobile app (iOS, Android) |

CIT Bank CIT Bank | Free | Web, mobile app (iOS, Android) |

31. Plynk ($85 Bonus)

- Available via Apple iOS and Android App on Google Play.

- Price: Free, but certain features may require a fee in the future.

- Sign up here

Plynk™ is an app designed to help you start investing and learn along the way, and they’re currently offering a $10 account signup and $75 net deposit bonus ($85 combined).

The Plynk app helps investors put their money into an investment portfolio. You can invest with as little as $1, and trade stocks, funds, and crypto commission-free**—all in one app.

The platform uses straightforward, easy-to-understand language to explain investing concepts. No jargon. No complex charts and tables. Just simple-language tips and how-tos.

Navigate investment ideas with tools to help you explore and choose. With Plynk Explore, just answer a few questions, and the app will display stock, ETF, and mutual fund investments that mesh with your investment comfort zone.

To assist with building your financial literacy, Plynk offers complete lessons and courses on financial education, including tips, educational content and how-tos.

The Plynk app enables you to make use of a powerful investing technique called dollar-cost averaging through participating in recurring investments. By continuing to buy a fixed dollar amount of investments over time, whether the market is up or down, you can build a disciplined investing habit and lower the stress that can come from market movements.

One of Plynk’s most interesting features involves, of all things, gift cards. Specifically, you can redeem unused gift cards for money that you can use to buy stocks in your favorite companies.

If this sounds interesting to you, consider opening an account with Plynk. To make it more worth your while, they have a few special offers.

Simply open an account and link your bank account to get a $10 signup bonus. Plynk is also offering a special bonus promotion through Feb. 15, 2024. If you make a deposit, Plynk will double it up to $75. Customers must have a minimum of $25 in net deposits during the promotional period to receive a match. That means you may be eligible for up to $85 in signup bonuses from Plynk by taking qualifying actions.

Read more in our Plynk review.

- Start investing for as little as $1.

- Answer just a few questions, and find suitable investments for your needs.

- Invest in stocks, exchange-traded funds (ETFs), mutual funds and crypto commission-free**.

- Plynk™ lets you redeem unused gift cards for money that you can use to invest in your favorite companies.

- Signup bonus: Plynk offers two signup bonuses worth up to $85 combined: (1) Plynk will match up to $75 in net deposits made to your account through Feb. 15, 2024, subject to certain terms; (2) Plynk will pay a $10 sign-up bonus for downloading the Plynk app, opening an account and linking a bank account as a new customer (or existing customer who hasn't previously linked a bank account).

- Designed for beginning investors

- Redeem unused gift cards to invest

- Helpful educational resources

- Some features may require a fee in the future

32. Fundrise

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile app (iOS, Android)

Fundrise enables its investors to access several real estate funds, each of which holds a number of properties and is designed to provide varying levels of risk and income.

This popular real estate investment platform offers numerous ways to invest, including:

- Starter and Basic accounts: Investors can now access Fundrise for as little as $10. People who open a Starter account ($10-plus minimum investment) or Basic account ($1,000-plus) have their money automatically invested in the Flagship Real Estate Fund, which seeks a balanced objective of income and growth.

- Core, Advanced, and Premium accounts: Core ($5,000-plus), Advanced ($10,000-plus), and Premium ($100,000-plus) accounts all have access to more specialized strategies. The four primary funds, from low risk/income to high risk/income, are Fixed Income, Core Plus, Value Add and Opportunistic. These accounts also have varying amounts of access to Fundrise’s “eREITs,” as well as the tax-efficient Fundrise eFund.

- Fundrise iPO: This “internet public offering” allows investors to buy a stake in Fundrise’s parent company, Rise Companies Corp.

- Innovation Fund: This fund does not invest in properties, but rather private high-growth technology companies. While the fund expects to focus primarily on late-stage companies, it can hold early- and late-stage private companies, as well as some public equities.

You do not need to be an accredited investor to invest in Fundrise, but several of its funds are closed to non-accredited investors.

Learn more about Fundrise, including its various tiers, to determine what level of investing is best for you.

- Regardless of your net worth, you can now benefit from real estate’s unique potential for generating consistent cash flow and long-term gains with Fundrise starting as low as $10.

- Enjoy set-it-and-forget-it managed portfolios with standard Fundrise accounts, or actively select the funds you want to invest in with Fundrise Pro.

- Diversify your portfolio with real estate, private tech investing, or private credit.

- Low minimum investment ($10)

- Accredited and non-accredited investors welcome

- IRA accounts available

- Highly illiquid investment

Related: Which Type of Real Estate Investment is Right for You? 8 to Know

33. Acorns

- Available: Sign up here

- Price: Personal: $3/mo. Personal Plus: $6/mo. Premium: $12/mo.

- Platforms: Web, mobile app (iOS, Android)

Acorns is an investing app geared toward minors, young adults, and millennials by offering “Round-Ups”: The app rounds up purchases made on linked debit and credit cards to the nearest dollar, then invests the difference on your behalf.

For example, if you purchase a coffee for $2.60 on a linked credit card, Acorns automatically rounds this charge up to $3.00 and puts the 40-cent difference aside. Once those Round-Ups reach at least $5, they can be transferred to your Acorns account to be invested.

The Acorns investment offering itself is a simple, automated platform that uses pre-built portfolios of ETFs to keep investors exposed to stocks and bonds. While it doesn’t have much to offer intermediate investors who want variety in their portfolios, Acorns’ basic approach makes it one of the best investment apps for beginners.

It also features a powerful way to accelerate your savings: Later Match. While most people are aware that employers will sometimes match funds you contribute to your 401(k), “matches” are virtually unheard of in retirement accounts like IRAs, where there’s no employer to kick in extra cash. However, Acorns itself will match 1% or 3% on new contributions to IRAs for Personal Plus and Premium subscribers, respectively.

Here’s more about what you can expect from Acorns’ varying subscription options:

- Acorns Personal ($3 per month): Includes an Acorns Invest investment account, as well as Acorns Later for tax-advantaged investment options such as Roth IRAs. Also includes Acorns Checking, a bank account that has no account fees, lets you withdraw fee-free from more than 55,000 ATMs nationwide, and Smart Deposit, which allows you to automatically invest a bit of each paycheck into your Acorns accounts.

- Acorns Personal Plus ($6 per month): Everything in Acorns Personal (Acorns Invest, Later, and Checking), plus Premium Education, which are live onboarding sessions covering account setup, Round-Ups, setting up recurring investments, and more; Emergency Fund; and a 25% bonus on Acorns Earn rewards (up to $200 per month).

- Acorns Premium ($12 per month): Everything in Personal Plus, plus Acorns Early, which allows you to open a custodial investment account for your child so you can begin investing for them while they’re a minor; custom portfolios that allow you to hold individual stocks; live Q&As with financial experts; a 50% match on Acorns Earn rewards (up to $200 per month); $10,000 in life insurance; even the ability to set up a will for free.

Learn more in our Acorns review.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Silver tier includes perks such as a 25% match on Acorns Earn rewards (up to $200/mo.), generous APYs on Checking and Emergency Fund, and live Q&As with investing experts.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts for children with 1% contribution matches.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions in your first year.*

- Special offer: Get a free $20 bonus investment when you sign up with our link and start making recurring investments.**

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Silver and Gold)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Gold for any self-directed investing options

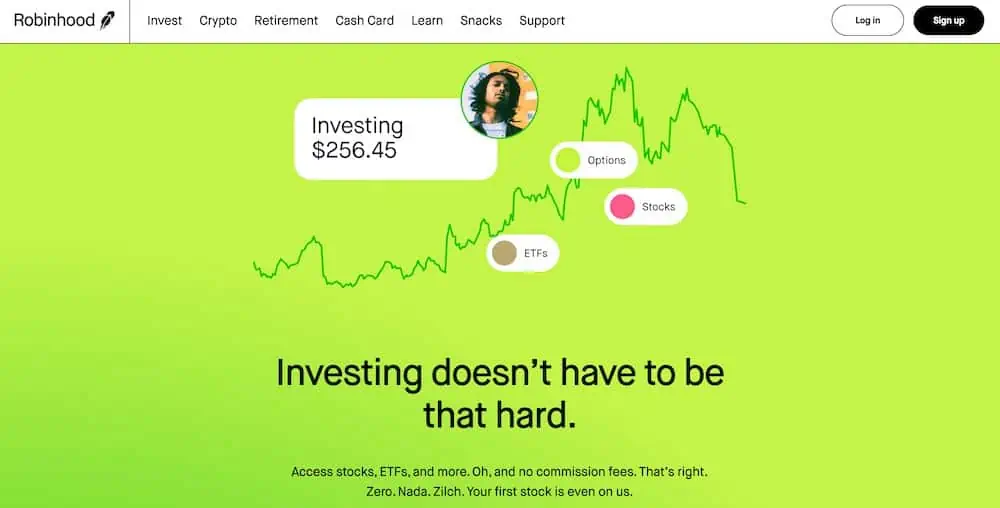

34. Robinhood ($5-$200 Bonus)

- Available: Sign up here

- Price: Free

- Platforms: Web, mobile app (iOS, Android)

Robinhood is a pioneer of commission-free trading, jumping into the investing public’s consciousness in 2013 when they rolled out commission-free trading. They remain a standout option for cost-minded investors thanks to their continued $0 commissions on stocks, ETFs, and options, as well as for its fractional trading, which allows people to invest with as little as $1.

Now, however, Robinhood now offers individual retirement accounts (IRAs) and Roth IRAs via Robinhood Retirement. Functionally, it comes up short compared to many other IRA providers because of its investment options. It offers just stocks and ETFs; like with its brokerage account, mutual funds aren’t available.

However, Robinhood Retirement still stands out from the pack because it’s the only IRA provider that offers matching funds. If you open up an IRA with Robinhood Retirement, Robinhood will match 1% of any IRA transfers, 401(k) rollovers, and annual contributions to your account—and 3% if you pay for the Robinhood Gold service ($5 per month)—typically almost immediately after you make your contribution. Better still: Any matches made on annual contributions don’t count toward your contribution limit.

Also, the Robinhood Cash Card can help turn purchases into investments. This debit card lets users earn a 10% to 100% bonus on weekly roundups (with bonuses capped at $10 per week), which is then invested into your choice of stocks or cryptocurrency.

Sign up for a Robinhood brokerage account or Robinhood retirement account today.

- Robinhood is a pioneer in the investing app world, offering commission-free trades on stocks, ETFs, options, and cryptocurrency, as well as one of the deepest libraries of investing educational content.

- Investing for retirement? Robinhood will match 1% of any IRA transfers or 401(k) rollovers, as well as any annual contributions*, made to your Robinhood Retirement account—and you can get a 3% match on any new contributions if you subscribe to Robinhood Gold.

- Want more advanced trading tools? Download Robinhoold Legend—a desktop trading platform with real-time data, customizable layouts, deeper asset analysis, and more—for free.

- Robinhood's robo-advisory service, Robinhood Strategies, will build you a custom portfolio of stock and bond ETFs (and individual stocks for accounts with at least $500), for a low 0.25% in AUM, which is capped at $250 annually for Robinhood Gold members.

- Robinhood Gold also includes Level II market data provided by Nasdaq, higher interest rates on uninvested brokerage cash, lower margin trading rates, bigger Instant Deposits, and access to the Robinhood Gold Card (a 3% cash-back Visa credit card).

- Special offer: Sign up for Robinhood, link a bank account, and fund your account with at least $10, and receive a randomly selected cash amount between $5 and $200 to put toward certain fractional shares.

- Very good selection of available investments in brokerage accounts

- 1% match on rollovers, IRA transfers, and new contributions to IRAs and Roth IRAs (3% new-contribution match with Robinhood Gold)

- Automated recommended portfolios

- Intuitive interface

- Robo-advisory service (Robinhood Strategies)

- Extensive educational library

- No mutual funds in brokerage or IRAs

- Match doesn't apply to Robinhood Strategies accounts

Related: 12 Best Robinhood Alternatives [US + Non-US Trading Apps]

35. Webull ($18-$36,000 Bonus)

- Available: Sign up here

- Price: Free

- Platforms: Desktop app (Windows, macOS, Linux), web, mobile app (Apple iOS, Android)

Webull first hit the investing world in 2018 and made a splash by offering free stock trading, as well as commission-free trading of exchange-traded funds (ETFs) and options. And since then, it has become one of the best stock apps for intermediate traders and investors, though many of its features are helpful to beginners as well.

For one, Webull remains friendly to wallet-conscious traders today. It costs nothing to open a Webull account. Stocks, ETFs, and options still trade commission-free. Many options have $0 contract fees. And Webull has no deposit minimums. On top of that, it offers fractional shares, which allows investors to start buying for as little as $1. So beginners working with small dollar amounts can still easily diversify across numerous investments.

Newer investors can also learn trading skills through the courses in Webull’s education center, and even practice their skills via Webull’s paper trading service. And Webull is available across just about every platform, allowing you to research, trade, and track your stocks on your smartphone, tablet, or desktop.

On top of all the free features mentioned above, Webull also runs frequent promotions that allow investors to collect free stocks.

Read more in our Webull review, or sign up at Webull today.

- Webull is a low-cost trading and investing app that allows you to invest in stocks, ETFs, options, futures, commodities, and crypto, and even participate in initial public offerings (IPOs).

- No-commission stock, ETF, and option trades (and many options have $0 contract fees).

- Trading features such as charting tools, technical indicators, customizable screeners, real-time stock alerts, and group orders.

- Let Webull manage your money for you with Webull Smart Advisor, which combines Webull's in-house investment expertise and artificial intelligence to build, manage, and rebalance an ETF portfolio for you.

- Sign up for Webull Cash Management to earn up to a 4.1% APY on uninvested cash.

- New users get one free month of Nasdaq TotalView's Level 2 Quotes service. (That subscription costs $2.99/mo. thereafter.)

- Subscribe to Webull Premium and receive a premium APY on uninvested cash in individual and joint cash accounts, premium margin rates, a 3% match when you transfer or roll over your IRA, and an extra 3.5% match on qualifying IRA contributions.

- Special offer: Make an initial deposit of at least $2,000 and receive 1.) a $100 cash bonus, 2.) a 2% match of your deposit (up to a maximum bonus of $20,000), 3.) a 30-day voucher for Webull Premium, 4.) a 30-day 4.0% APY booster on uninvested cash (for a total of 8.1%).**

- Good selection of available investments

- Fractional shares

- Powerful technical analysis tools

- Offers robo-advisory services

- Accessible to beginning and intermediate users

- Voice commands

- Offers highly competitive APY through Webull Cash Management

- Does not support mutual funds

36. CIT Bank

- Available: Sign up here

- Price: Free

- Platform: Web, mobile app (iOS, Android)

High-yield savings accounts are a type of federally insured savings account which aim to earn interest rates much higher than the national average. In recent years, they’ve not paid much to account holders. But, that’s starting to change.

Depending on where you look and the prevailing market interest rates overseen by the Federal Reserve, high-yield accounts can earn around 3.00% APY or more.

As a comparison, the national savings account average interest rate comes to 0.07% APY—a far cry from the most competitive offers in the market. All things equal, if you hold your money in an account which pays a higher interest rate, your balance will grow faster without any additional effort on your part.

To illustrate the effect of holding money in a high-yield savings account compared to one offering a far lower rate, consider the following comparison. After one year, a savings account balance of $10,000 would earn $10 in an account with a 0.10% APY. If this money had instead been placed in a high-yield savings account offering 3.00% APY, your money would have earned 30x more, or a total of $300.

Consider placing your money in one of the most competitive high-yield savings accounts available on the market through CIT Bank’s Savings Connect. The Savings Connect Account currently is offering much more than the national high-yield savings account average—with the convenience of mobile banking, and with no monthly service fees.

- CIT Bank is an online bank that offers competitive interest rates on its multiple products.

- Earn up to 9 times more than the national average interest rate by keeping your cash and other savings in CIT Bank's Savings Connect high-yield savings account.

- Competitive interest rates

- Low minimum deposit ($100)

- Mobile banking features

Related: 6 Best Investing Apps for College Students to Start Investing

Passive Income Apps

| App Name | Cost | Available on |

|---|---|---|

Public.com Public.com | Free | Web, mobile app (Apple iOS, Android) |

Honeygain Honeygain | Free | Desktop app (macOS, Windows, Linux), web, mobile app (iOS, Android [Not in Google Play]) |

37. Public.com

- Available: Sign up here

- Price: Basic: Free. Premium: $10/mo.

- Platforms: Web, mobile app (Apple iOS, Android)

Public.com, an investing platform that allows you to invest in stocks, ETFs, crypto, and alternatives, has launched a product that allows you to invest in Treasury bills and offers a high rate of passive income.