By skill or by luck, you have the good fortune of scouring the internet to determine how to invest $100k.

That’s a fantastic “problem” to have—and one we’re happy to help you solve.

How and when in your life you came across that $100,000 does matter, by the way. For example: Are you 40 and have slowly built up that nest egg? Are you 25 and just earned a massive bonus, or exercised some stock options, at your explosive startup? Are you 60 and received a sudden unexpected windfall (like, say, a deceased relative bequeathed it)?

If you said “yes” to one of these, how you should invest that $100,000 might be very different from people who came across that money through one of the other two scenarios.

Regardless of how you came across that six-figure sum, you probably aren’t doing yourself a favor by keeping it in a savings account. According to the FDIC, the national deposit rate for savings accounts sits at just 0.45%. That means your $100,000 would produce a mere $450 in income each year. Sure, a high-yield savings account would do a bit better, but even at an average 1.5% yield (compounded quarterly), your high-interest savings account would generate just $1,508 in annual wealth—a far cry from what you could get in other investments.

If you’re ready to move your money out of savings and into an investment that will work harder for you, here’s how to invest $100k. We’ll talk about some of the best investments worth considering—a few you’d expect, and a few that aren’t always on investors’ radar—the pros and cons of each, and even a few investing tips.

2 Money-Smart Actions to Take BEFORE You Invest $100,000

Before you work on trying to grow your sizable windfall, there are two points of business you might or might not have to tackle depending on your financial situation:

1. Start an Emergency Fund

An emergency fund is the simplest of financial backstops.

In short, an emergency fund is a store of money that will help you pay the most important of bills should “something” happen (like losing your job). Financial experts will tell you to save anywhere between three and six months’ worth of vital expenditures: rent, utilities, groceries, and so forth.

Emergency funds provide much-needed financial peace of mind. Just remember: It’s best to keep them in a liquid account, and where possible, try to earn a little from your rainy-day fund.

Brian Overby, Senior Markets Strategist at Ally, says you should “ensure that cash … is earning a solid yield,” but adds that “many checking accounts still show rates at basically zero.” So instead of a regular checking or savings account, you should instead hold your emergency fund in a high-yield savings account or money market account. That way, you can earn a higher annual percentage yield (APY) than the national average, but you’ll still have the benefit of being able to access your money easily if you need it.

Related: 11 Best Commission-Free Stock Trading Apps

2. Knock Out High-Cost Debt

The average interest rate on credit cards in July 2024 had jumped above 21%, so if you’ve been carrying a monthly balance, it can be a smart move to pay off your credit card debt with a portion of your $100k. The same holds true for other types of high-interest debt you might have. Interest charges can creep up quickly if you’re just paying the minimum balance each month.

The key term there is “high-interest debt.” The general wisdom is that if you’re trying to decide between paying off debt or investing, you should pay off debt with interest rates that are higher than the likely return of the stock market.

Paul Camhi, Vice President at investment firm The Wealth Alliance, says that when planning for retirement, he tends to err on the side of being conservative. So while the long-term return of the S&P 500 stock market index sits somewhere around 12% annually, “the software program my firm uses for retirement planning for our clients has a projected rate of return assumption of approximately 6.5% per year for a blend of large-cap U.S. stocks,” he says.

So if you want a rule of thumb, pay off at least some debt with a 6.5% interest rate or higher before investing that $100k, but don’t prioritize debt costing less than that.

Related: 15 Best High-Yield Investments

3 Vital Factors That Will Determine How You Invest

Once you’ve addressed your backstop and your debt, you can move on to investing!

Whether you’re planning to invest $100,000, $1,000, or just $10, you’ll want to start by taking a little time to consider three primary factors. These factors will largely educate what type(s) of investment is best for you, what kind of investment account you’ll use, and maybe even whether you’ll enlist the help of financial advisors.

Step 1: Determine Your Goals

Put bluntly: “What’s the point?” By and large, the most popular investment goal is retirement savings, but you can invest toward so much more: a down payment on a house (or paying for the whole enchilada!), a car, a dream wedding, a lavish vacation in Fiji. And not only will your goals help decide how you’ll invest that $100,000—they’ll likely determine whether you want to use a tax-advantaged account you can’t touch until retirement, or a brokerage account or trading app where you can withdraw the funds at any time.

Step 2: Establish Your Time Horizon(s)

Your goals will heavily influence your “time horizon”: basically, the period of time you’ll need before reaching your goal. You might save up for two to three years before a wedding, but several decades before you’re ready to retire. And your time horizon will have a lot of influence over how you invest that $100k.

For instance: If you won’t retire for another 40 years, you can afford to invest aggressively—sure, the market will have its ups and downs, but there’s a lot of time to recover from stock slumps and let your generational growth investments reach their full potential. On the other hand, if you only have, say, two to three years before you’ll need to tap your nest egg, you’ll probably focus on safer investments with more modest growth potential.

Step 3: Figure Out How Much Risk You Can Stomach

Your goals and time horizon will have some say in how much risk you can stand, otherwise known as risk tolerance. For instance, if you suddenly come across $100,000, but you know you’ll want to use that $100,000 on a down payment in just a year or two, chances are you’ll avoid risky investments that could suddenly cut your windfall in half.

But even your personality and life experiences will influence your risk tolerance. Some people can watch the stock market lurch higher and lower without a care, while others can’t stand the idea of losing money in the short term, even if it’s very likely they’ll gain it all back (and then some) in the long run.

Knowing your risk tolerance is important, because it can keep you from making panicked trading decisions that will ultimately weigh on your wealth. If you’re especially jumpy, you might want to consider bringing financial advisors or a wealth manager on board.

Empower, for instance, is one of our top-rated financial services firms for people of any income level thanks to the quality and breadth of its offerings: a suite of free-to-use tools that even the most financially experienced people can put to use, and fee-based investment, wealth management, and private client services available to people with as little as $100,000 in investible assets.

Use our exclusive link to sign up for the Empower Personal Dashboard, whether that’s for the free tools or the advisory services. If you have $100,000 or more in investible assets, you’ll also be able to schedule a free initial 30-minute financial consultation with an Empower professional.

- Empower offers both a free set of portfolio, net worth, and cash flow tracking tools, as well as paid asset management service.

- Link Empower to your bank and investing accounts, credit cards, and more to see a single view of useful information and data, including your net worth.

- Empower Advisory Group offers a comprehensive wealth management service known as Personal Strategy. This managed account solution provides clients with discretionary investment management, personalized portfolio construction, and access to financial planning support. Accounts investing $100k to $250k receive unlimited advice and retirement planning help from financial advisors, as well as a professionally managed ETF portfolio with reviews upon request. Higher asset tiers offer access to dedicated advisors, estate planning, and tax specialists, plus additional investment options like access to private equity.**

- Special offer: If you have $100k+ in investible assets, sign up with our link to schedule a free initial 30-minute financial consultation with an Empower professional.

- Free portfolio tracker (Dashboard)

- Free net worth, cash flow, and investment reporting tools (Dashboard)

- Tax-loss harvesting (Personal Strategy)

- Dividend reinvestment (Personal Strategy)

- Automatic rebalancing (Personal Strategy)

- Low investment expense ratios (Personal Strategy)

- High number of investment accounts supported (Personal Strategy)

- High $100k minimum for investment management (Personal Strategy)

- Moderately high investment management fee (0.89% AUM) compared to other online advisors (Personal Strategy)

Related: 8 Best Stock Portfolio Tracking Apps [Stock Portfolio Trackers]

How to Invest $100k: The 4 Best Investments

A quick note before we dig in: No matter what investment types you ultimately lean toward, we suggest that if you’re going to invest $100,000, you do so with “diversification” in mind.

Diversification, simply put, is holding different types of investments. For instance, you could hold stocks of small companies and large companies. You could hold stocks in each of the market’s 11 sectors. You could hold U.S. stocks and international stocks. And you could hold stocks, bonds, gold, even cryptocurrency. All those are examples of ways you can diversify.

Why do this? In a word: protection.

The old advice “don’t put your eggs in one basket” will serve you well when you invest. Let’s say you sink all $100,000 into one stock, and that stock collapses—well, there goes your $100,000. But if you spread your $100,000 across a few different holdings, your investment portfolio won’t face nearly as much risk from one stock falling apart.

With that out of the way, let’s look at our four top ways to invest $100,000 right now:

1. Stocks

One of the most common ways people start investing is through stocks. How common? Well, a Gallup poll shows that 58% of Americans are invested in the stock market—and the more money Americans have, the more likely they are to invest. A whopping 89% of households earning $100,000 annually or more have at least a little skin in the stock market.

You don’t need a lot of capital to invest in stocks—fractional shares allow people to invest for as little as $1—but having a big sum does make it easier to build a diversified portfolio.

Pros of investing in the stock market

Long-term growth potential

Like we mentioned above, The Wealth Alliance’s Paul Camhi says the average annual return of the S&P 500 is hovering around 12%—not too shabby if you’re looking to upgrade from a low-yield savings account. We’ll note that past performance doesn’t guarantee future returns, but the stock market historically does provide plenty of potential for growth.

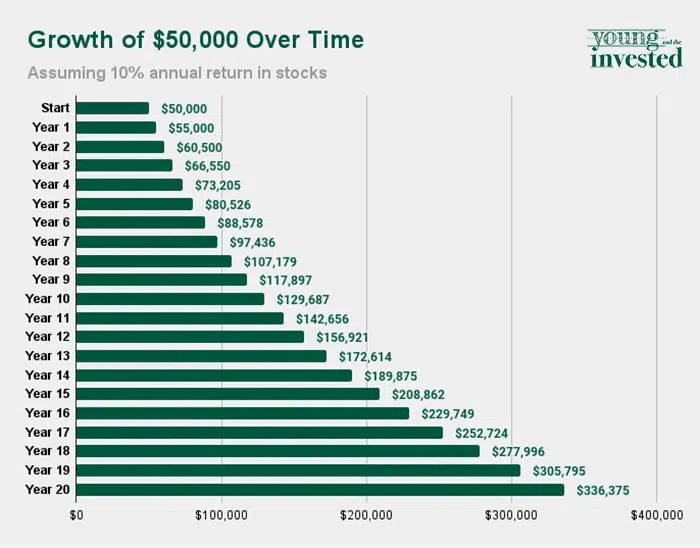

Let’s say you invest $50,000 of your $100,000 into stocks. If we assume even a 10% annual return, and you never drop another dime into your account, that investment will be worth $129,687 after a decade and $336,375 after 20 years.

Not bad at all.

Dividends

In addition to growth potential, some stocks also deliver cash payments, called dividends, to shareholders. Dividends are a type of passive income, which is basically income you earn from any activity that isn’t a job.

Stocks that pay dividends usually do so regularly—often every quarter, but sometimes less frequently (semiannually or annually) and occasionally more frequently (monthly). The “dividend yield” on a stock is the amount, as a percentage of a stock’s price, that you can expect to receive in dividends throughout the year. So, a $100 stock paying out $3 per share across the year provides a dividend yield of 3%.

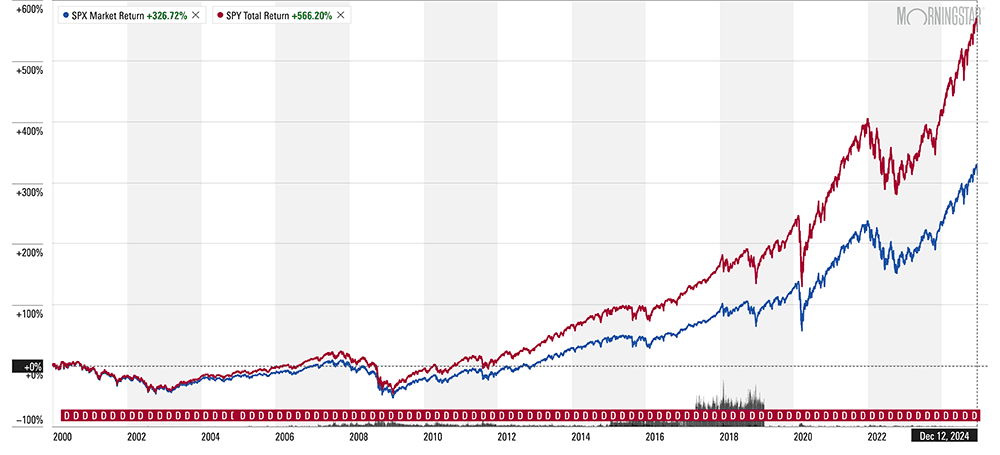

Dividends are a powerful source of returns. Here’s a look at the return someone could expect if they received just the price returns from the S&P 500 over the past 25 years:

Now look at how much better the return is when you factor in dividends (if you had reinvested the dividends back into the S&P 500):

Liquidity

Liquidity has to do with how easy it is to take your funds out of an investment. Some investments can tie your money up for decades (so they’re “illiquid”). When you invest in real estate, for instance, you’re in it for the long haul. But if you invest in the stock market, you can choose to take money out anytime (“liquid”), which gives you some much-needed flexibility if you think you’ll need funds in a few years’ time. (Note: This only applies for taxable brokerage accounts; tax-advantaged retirement accounts do have some withdrawal restrictions.)

Just remember: If you sell a stock or fund for more than you purchased it for in a taxable account, you’ll need to pay capital gains taxes.

Stay ahead of inflation

Let’s say inflation runs around 2% per year. That effectively means you need to earn at least 2% annually on your money for it to have the same purchasing power each year. Many checking and savings accounts can’t promise that. But investing in the stock market can typically keep your money well ahead of inflation.

Low barriers to entry

It’s pretty simple to open a taxable brokerage account, and you don’t need a lot of money to buy stocks. These low barriers to entry are (in part) what makes investing in stocks such a popular option.

How to invest in the stock market

While there are a number of ways to get your hands on stocks, these are the three most popular routes:

Individual stocks

Exactly what it sounds like: You buy the individual stocks of one or more companies. When those stocks improve in value, your portfolio does, too (and vice versa). The upside? You can make really concentrated bets in a few individual companies, and if your investments are smart, you can greatly outperform the market. The downside? It’s difficult to diversify—while you can buy as many stocks as you want, it’s difficult to manage too many stocks at one time.

Stock mutual funds

Mutual funds are a pool of money, gathered from a large group of investors, that is invested in a large group of assets—typically stocks, but they can invest in other assets. A mutual fund might have a portfolio of dozens or even hundreds of stocks, so by investing in the mutual fund, you’re investing in that wide portfolio of stocks. The downside: You’ll pay a fee for the privilege of joining this pooled investment.

Stock exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are similar to mutual funds in that they hold a diversified portfolio of stocks, bonds, and/or other investments. But they differ in a few ways.

For one, rather than settling just once a day like mutual funds, they trade on stock market exchanges, the same way stocks do. They also tend to be cheaper on average (primarily because many ETFs are index funds, which means they track an index, versus many mutual funds, which are actively run by one or more portfolio managers). You can also see what an ETF holds on any given day, whereas you only get a quarterly snapshot from mutual funds. And ETFs also boast certain tax advantages that also help their returns versus similar mutual funds.

Related: How to Invest for Retirement

Types of investment accounts

Taxable brokerage accounts

A taxable brokerage account is an investment account that offers flexibility, but no tax advantages. With this type of account, you’ll be able to buy, sell, and withdraw your cash freely, but you’ll pay taxes when you profit from the sale of an asset.

Tax-advantaged retirement accounts

There are several types of tax-advantaged retirement accounts out there. For instance, you might have an employer-sponsored 401(k) or 403(b) retirement account. A traditional IRA or a Roth IRA are also common, and specialized retirement accounts exist for small businesses, self-employed professionals, and more.

With a retirement savings account, you’ll generally get less flexibility than a taxable brokerage, but more tax benefits. For instance, withdrawing your account balance before age 59½ could result in tax penalties, but with certain accounts (such as Roth IRAs), withdrawals in retirement are tax-free.

Related: 15 Best Stock Market Investing Research & Analysis Sites

2. Bonds

When you invest in bonds, you’re investing in debt issued by some sort of entity—from a national government to a local municipality, to corporations big and small—that they use to finance projects, equipment, and more. When you hold a bond, that entity is promising to eventually pay back your initial investment with interest, with that interest usually paid out every six months.

Bonds tend to trade in a range around their “par value,” which is how much their issuer has promised to pay back. (Basically, the initial price of the investment.) So while people generally invest in stocks for growth, they tend to invest in bonds for their income and relative stability.

“For investors with shorter time horizons (two years or less), bonds are typically a good place to invest to earn a conservative yield and protect principal,” Canhi says. “For instance, if you are saving money to buy your first home, keeping your money invested in short-term, high-quality bonds is a safe way to earn income on your cash.”

Also, investors typically want to invest more in bonds the closer they are to retirement, as their focus shifts from growing their wealth to protecting it. “If you expect to retire in 30 years or more, you might target as little as 10% in bonds,” he says. “When you are 20 years out, you might increase that to 20%. At 10 years away from retirement, the allocation to bonds might be closer to 30%.”

Pros of investing in the bond market

Predictable income

When you invest in an individual bond, you’ll know when the bond matures and how much interest you’ll earn. (Because bond funds buy and sell debt over time, yields can vary, but they’re still heavily relied on for income.)

Diversification

Unlike the stock market, which can fluctuate daily (or even hourly), bonds are relatively stable. And throughout various periods in stock market history, bonds have moved in the opposite direction of stocks. Because of this stability and potential for positive performance when stocks are struggling, investors often diversify their portfolios by adding bonds.

Potential tax advantages

Certain types of bonds offer tax advantages. For instance, interest income on municipal bonds isn’t subject to federal taxes, and in some cases, it’s exempt from state and local taxes, too.

Related: 9 Best Fidelity Index Funds to Buy

How to invest in the bond market

Individual bonds

You can purchase several types of individual bonds, including Treasuries, municipal bonds (or “munis”), and corporate bonds. Each is structured slightly differently and might have different tax treatment, but all typically have a set interest rate and maturity date.

Individual treasuries can be purchased through TreasuryDirect.gov, brokerage firms, or banks. You can buy munis or corporate bonds through some brokerages.

Bond mutual funds

Unlike individual stocks, there aren’t many research resources for individual bonds. Plus, individual bonds can be difficult to access. Also, investors might want to diversify among hundreds or even thousands of bonds. For all those reasons, some investors prefer to invest in a bond mutual fund. Because bond funds invest in various bonds with different payout schedules, these funds often pay distributions more frequently than twice a year—in fact, they usually deliver monthly income. However, like stock mutual funds, you’ll have to pay a fee to participate.

Bond exchange-traded funds (ETFs)

Like bond mutual funds, bond exchange-traded funds (ETFs) represent a pool of numerous bonds, giving investors the benefit of diversification. And like with stocks, most bond ETFs also happen to be index funds, thus they tend to have lower fees than comparable bond mutual funds.

Related: 10 Best Fidelity Funds to Own

Types of bonds

Treasuries

Treasuries are bonds issued and backed by the U.S. government. They are considered some of the safest investments available.

Municipal bonds

Municipal bonds are bonds issued and backed by local governments. They’re used to fund projects such as building new roads or opening schools.

Corporate bonds

Companies issue corporate bonds to fund anything from new equipment to hiring to research.

Related: 10 Investments that Earn a Great Return [10% or More]

3. Real Estate

Real estate is a lesser-traveled but still fruitful place to put your money.

Starbucks. The local hospital. That apartment high-rise downtown. “These properties that you pass every single day on your commute to work are income-producing properties that pay you real cash in the form of dividends,” says David Auerbach, Managing Director at ETF provider Armada ETF Advisors.

Real estate sits at the crossroads of traditional investments (stocks, bonds, or cash) and alternative investments (essentially, anything that isn’t stocks, bonds, or cash). You can buy into real estate through a brokerage account or retirement account via publicly traded real estate investment trusts (REITs), which trade on stock exchanges. But you can also participate in real estate by investing in or actually owning property, such as a house or an office building.

Real estate investing has numerous benefits, but do understand that some real estate investments (specifically, private real estate) can be quite illiquid. So in some instances, you’ll need to have a firm grasp on how much of your money you’re willing to put out of arm’s reach for a couple years.

How much of your portfolio should be dedicated to real estate investing? “Most Wall Street models indicate that investors should allocate anywhere from 5% to 15% of their portfolio into real estate,” Auerbach says.

Related: 10 Monthly Dividend Stocks to Buy for Frequent Income

Pros of investing in real estate

Appreciation

Appreciation is essentially how the value of a property increases over time. According to the St. Louis Fed, the median price of a home in the U.S. in 2000 was $167,550. By the end of 2021, the median price of a home in the U.S. had appreciated to $396,800. Owners of rental property and other types of real estate have seen breakneck gains over that time period, too.

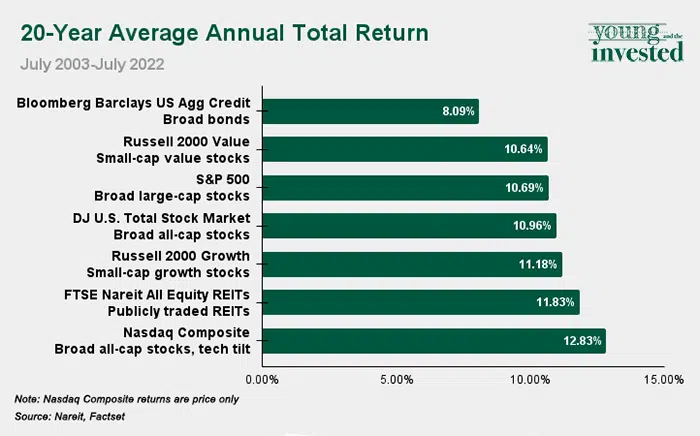

But you don’t need to physically own property to enjoy in real estate gains. Consider the annual average returns of several popular investments over the past 20 years. Publicly traded REITs’ 11.83% average annual return easily beats broad bond and stock benchmarks, and trails only the tech-heavy Nasdaq Composite stock index in that time.

Cash flow

Similar to traditional dividend stocks, many real estate investments (owning rental property, holding REITs), allow you to collect passive income in the form of either rent payments or dividends. This cash flow can be used to offset landlord costs (mortgage, maintenance, etc.), or you can reinvest it.

Tax advantages

If you own investment property, you’ll need to report your rental income on your tax return. But you’ll also get tax benefits, including deductions that reduce your taxable income.

“Mortgage interest on a primary residence can be deductible (up to certain limits), and investment real estate provides the opportunity for depreciation,” says The Wealth Alliance’s Paul Camhi. For investors in a high tax bracket, these tax benefits can be very meaningful.

Inflation hedge

Many investors tend to invest in tangible assets (assets with real physical properties, whether that’s gold, natural resources, or real estate) to hedge against inflation. While inflation can weigh on investments like stocks and bonds, property owners sometimes are able to partially or completely offset the effects of inflation by raising rents.

“Historically, higher inflation rates have not systematically affected real estate investment performance,” says asset manager Nuveen.

How to invest in real estate

As we said before, investors have a wide array of ways to invest in real estate across both the public and private markets:

Brokerage or retirement account

With a brokerage or retirement account, investors can purchase shares of a real estate investment trust, or company that owns, finances, and maintains commercial properties. You can also choose to invest in REIT mutual funds or exchange-traded funds (which, yes, include actively managed funds and index funds) instead of individual REITs.

“If you invest through a mutual fund or ETF (exchange traded fund), you can get a great deal of diversification while only investing a small amount of money,” Camhi says.

Related: 10 Best Vanguard Funds to Buy

Buying property (private real estate)

Traditional real estate investment involves purchasing property. Investors frequently buy single-family houses as rental property, but others buy multi-family housing (apartments), land, even commercial real estate.

The drawback of this type of investment is that it’s expensive, with even single-family homes costing in the hundreds of thousands of dollars.

Crowdfunding platforms

Crowdfunding platforms are a relatively new investment option. These platforms allow real estate investors to pool their money and purchase shares of a property or group of properties.

Private placements

Private placements are similar to crowdfunding in that a group of investors combine to invest in one or more properties. However, private placements typically are only open to accredited investors (investors who pass certain income, net worth, or education requirements), and deal sizes tend to be higher.

Related: 7 Best High-Yield Dividend Stocks to Buy for Income-Hungry Investors

Types of Real Estate Investments

Real estate investment trusts (REITs)

A real estate investment trust (REIT) is a special type of business that owns (and sometimes manages) properties. These can include apartments, office buildings, hotels, and other types of physical property, and in some cases, certain REITs own mortgages.

REITs were created by Congress in 1960 to spur real estate investment. These entities are required to pay at least 90% of their taxable income to shareholders in the form of dividends.

REITs are often publicly traded on a stock exchange, and most are priced below $100 per share. There are non-traded REITs as well, but if you’re considering a non-traded REIT, do your due diligence, because these assets can come with special risks. Also consider speaking with a financial advisor to determine whether this is the best investment strategy for you.

Directly owned private real estate

Directly owned real estate is exactly what it sounds like: You purchase a property directly, own it, and ensure it’s maintained.

Out of all types of real estate investing, direct ownership generally requires the most involvement. In addition to finding the right property and working with a bank to finance it, you’ll also need to interface with tenants and maintain the property—or hire a property manager to do so.

Indirectly owned private real estate

Methods of indirectly owned private real estate, whether that’s crowdfunding or private placements, involve pooling your money through another party to invest in one or more properties. The downside? You have less direct control over your investment, and the crowdfunding/private placement platform itself could encounter financial or operational difficulties. However, this means of investing often requires a smaller minimum investment than a direct purchase.

Commercial real estate (CRE)

Many crowdfunding platforms and private placements hone in on commercial real estate (CRE). CRE is generally considered to be any real estate you’re investing in for profit (rather than living in), so, say, offices, hotels, retail properties, industrial parks, etc. Multifamily homes, like apartment buildings, typically are considered commercial real estate. But single-family homes, even though you can rent those out, usually aren’t lumped in with CRE.

Platforms like First National Realty Partners (FNRP) allow you to invest in both individual CRE deals and a portfolio of commercial properties. FNRP’s focus is grocery-anchored assets, which tend to be relatively stable, even in a volatile market. After all, everyone has to eat, no matter the economic climate.

All of FNRPs investments are thoroughly vetted by the platform and must meet specific criteria. For instance, holdings must be located in growing markets, and average household incomes within a 5-mile radius must meet or exceed $100,000.

If you choose to invest through FNRP, you might need to pay certain fees, such as acquisition or property management fees. Fees vary, so make sure to ask about them before you invest a portion of your $100K.

To learn more about investing in commercial real estate through FNRP, read our First National Realty Partners review.

- FNRP is the leading sponsor for grocery-anchored commercial real estate.

- FNRP has a nationwide focus and leverages relationships with the best national-brand tenants to bring accredited investors exclusive access to institutional-quality deals.

- FNRP provides partners with institutional-quality investments that achieve exceptional, risk-adjusted returns (12%-18% targeted average annual returns, of which, 8% is the targeted average annual cash distribution.)

- Uses the Dragnet Acquisitions Model - strong due diligence. FNRP looks at 1,000 deals and chooses just one. FNRP chooses only the best deals they believe offer the highest return for the absolute lowest risk.

- FNRP's entire investment cycle is 100% in-house and not outsourced like traditional private equity sponsors.

- Strong performance track record

- Unique investment niche (grocery-anchored CRE)

- High total shareholder return

- Only accessible to accredited investors

- High investment minimum ($50,000)

4. Other Alternative Assets

We mentioned before that some real estate is considered an alternative asset—an investment that doesn’t fit into conventional asset classes such as stocks, bonds, or real estate. But there are numerous other alternative assets, ranging from fine art and wine to private credit, and plenty more in between.

Alternative investments can provide both capital appreciation and income potential, just like stocks, but they often also have low correlation to stock performance (economic forces affect them differently and their prices don’t often move in relation to one another). That combination of traits is appealing to investors who want to diversify their portfolios.

However, alternative assets also come with several other risks you wouldn’t normally encounter in traditional investments. Alternatives sometimes have muddier legal structures than traditional investments. And they’re often not required to register with authorities like the U.S. Securities and Exchange Commission (SEC), though they typically do fall under some regulation, such as the Dodd-Frank Act.

That makes alternatives especially risky, so it’s even more vital to do your research prior to investing. In fact, many “alts” are available only to accredited investors. Only recently have some come within reach of retail investors through alternative funds and crowdfunding platforms.

Pros of investing in alternative assets

Potential for high returns

While investing in non-traditional assets comes with risks, there’s also the potential for explosive returns.

As an example: For the 25 years ended December 2020, contemporary art delivered an annual return of 14%, according to the Citi Global Art Market. The S&P 500, meanwhile, delivered “just” 9.5% over that time.

Portfolio diversification

Again, alternative investments often have a low correlation to the stock market, making them especially attractive for anyone seeking investments that might produce returns during periods when stocks are declining.

According to modern portfolio theory, investors should allocate between 10% to 20% of their portfolio to alternative investments. So if you’re investing $100k, you’re looking at about $10,000 to $20,000 allocated to alternatives. (But remember, non-publicly traded real estate would count toward that alternatives figure.)

Income potential

Beyond the potential for capital gains, some alternatives can provide regular income. The most common type, of course, is monthly rental income from one or several properties, but other alts such as private credit can also deliver consistent streams of cash.

Potential for short time horizons

While we typically advise people to invest for the long term, investors can find short-term opportunities in some alternative investments. As a for-instance, Percent allows you to access private credit investments; its deals mature in as little as nine months, and liquidity can sometimes be available as soon as one month in.

How to invest in alternative assets

While there are various methods for investing in alts, they vary widely by accessibility. You can purchase some alternatives as easily as making a few clicks on a website; others require you to belong to specific platforms; but still others require you to qualify as an accredited investor and put down large sums of capital.

Individual alternatives

In many cases, you can just buy one or more of the alternative investment itself: a gold bar, a painting, even a bottle of wine.

There are varying levels of difficulty purchasing individual alternatives—it’s easier to find a reputable outlet for, say, gold bullion than it is to find a broker of legitimate fine art or investment-worthy wine. In other cases, some alts have much easier-to-access research and data than others.

Private equity

As you might guess by the name, you can’t just open your brokerage account and access private equity. These investment funds pool money from pension funds, institutional investors, wealthy individuals, and other big-money investors to purchase (and often restructure) companies.

If you’re an accredited investor, you’ll likely need to work with a private equity firm to explore your investment options.

Hedge funds

Hedge funds are another type of private fund focused on providing high returns for investors as quickly as possible. These funds may invest in commodities, derivatives, or another type of asset that the fund manager deems valuable at a given time.

Like private equity funds, hedge funds tend to be reserved for high net worth or accredited investors.

Venture capital (VC)

Venture capital (VC) is a form of financing made available through private equity funds to startups or other small companies seen as having long-term growth potential. And venture funds provide access to several VC investments at once.

VCs typically invest much-needed capital in exchange for equity in these young companies. However, the relationships don’t always end there: Some VCs provide managerial or technical expertise as well. And whether it’s capital, expertise, or both, these contributions can help small businesses expand rapidly.

Venture investments, of course, carry considerable risk compared to a publicly registered security trading on a regulated exchange. The companies usually are smaller than those found on public exchanges, and thus they’re rarely as financially or operationally stable. Indeed, depending on the study, anywhere between 65% to 75% of VC-backed businesses fail—a risk that many investors are happy to accept because of the potential for sky-high returns.

Types of alternative investments

While not a comprehensive list, here are just a few examples of alternative assets that investors can find access to.

Private stock

Privately held companies will sometimes issue stock to help raise funds. Typically, these offerings are limited to hedge funds and other institutional investors, but every now and then, an offering will be opened up to a much larger subset of people.

That’s currently the case with Pacaso, a real estate app that allows people to buy partial interests in vacation homes in more than 40 markets, including Italy, the U.S., Mexico, and the Caribbean. Unlike timeshares, in which buyers are effectively just purchasing the right to use the home during specific periods, Pacaso buyers are purchasing equity in the home and can benefit from any appreciation in its value.

But recently, the app has opened up a new investment opportunity: the company itself.

Pacaso is attempting to raise more than $56 million in new funding by offering up “Class D” common stock, which is available to both accredited and non-accredited investors alike, at a minimum investment of just over $1,000.

Like with most stock, Pacaso Class D shares allow owners to benefit from any growth in the company. Pacaso makes money by selling homes to co-owners, earning commissions when co-owners resell shares of property, property management fees, and financing services. The company doesn’t have the same reporting requirements as U.S.-listed companies, but a few selected stats from its 2024 financial report include:

- Gross real estate transacted and associated service fees: +16% YoY, to $164.5 million

- Adjusted gross profit excluding the impact of Whole Homes: +18% YoY, to $23.6 million

- Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) loss: -24% YoY, to -$20.4 million

The bull case, according to Pacaso? It currently only has less than 1% penetration in what it believes is a massive, $1.3 trillion total addressable market (TAM) for luxury vacation home ownership. While it was previously working on national brand awareness, the company says it’s refocusing on its core: “luxury homes in luxury markets for the [high-net-worth] customer.”

Just note that Pacaso is still a private company*, so if it does enjoy growth, you won’t be able to sell those shares as easily as you would publicly traded stock like what you invest in through a brokerage—instead, you’d likely have to wait for “liquidity events” such as an initial public offering (IPO) or acquisition.

Use our link to learn more about the offering (including SEC filings) or to start investing today.

* Pacaso publicizes that it has “reserved its Nasdaq stock ticker,” but that is no guarantee that the company will go public, nor is it a sign that the Nasdaq has or will approve its listing.

- Pacaso, a fractional-ownership real estate app that allows people to invest in luxury vacation homes, is now open to accredited and non-accredited investors alike through a limited-time offering of its Class D stock.

- Class D shares allow investors to enjoy any potential growth from Pacaso, which has a presence in more than 40 markets worldwide, is raising money to continue expansion in the $1.3 trillion luxury vacation home ownership market.

- The company is still privately held, which means investors will likely only be able to sell stock in "liquidity events" such as an initial public offering or an acquisition.

- Accessible stock offering (non-accredited investors may participate)

- Reasonable minimum required investment (~$1,000)

- Highly differentiated way to invest in real estate

- Illiquid investment (investors likely will only be able to sell alongside an IPO or acquisition)

- Relatively scarce information and analysis available for research compared to public companies

Art

Paintings and sculptures aren’t just pleasing to look at—in some cases, they can be lucrative investments.

Fine art can increase in value if it’s created by an already well-known artist, or if the artist grows in fame over time. Tragically, art can also appreciate when it’s created by an artist who has passed away and thus cannot release new pieces.

Buying famous artwork on your own can carry a high price tag, of course, and it’s fraught with risk, especially for those with little knowledge of the industry.

However, platforms such as Masterworks can help reduce both the price you pay and the risk you take.

Masterworks allows you to enjoy fractional shares of ownership in famous art, produced by the likes of Claude Monet, Yayoi Kusama, or Banksy. The company’s expert art collectors specifically choose artworks they believe will have the highest appreciation rates and lowest risk.

This is a wonderful option for people who want to invest in art but a.) don’t know how to find private buyers on their own, b.) don’t have the funds to wholly purchase these costly works of art, and/or c.) aren’t sure how to store these artworks properly.

Just note that art is an extremely illiquid asset that’s not easily bought or sold. Masterworks tends to hold paintings and other artworks for between three and 10 years.

You can start investing through Masterworks with a small minimum investment of $1,000.

- Masterworks allows investors to buy shares in art selected by the platform's team for both high quality and strong value.

- The service offers a secondary market where investors can sell shares if they want to exit their investment early.

- Provides an easy way to invest in art

- Access to dedicated support representative

- Investing requires a call screen consultation

- High fees

- High minimum investment per offering ($15,000), though it can be waived to as low as $500 on a case-by-case basis

Related: 7 Best High-Dividend ETFs to Buy for Serious Income

Wine

You don’t need to be a wine connoisseur to understand why fine wine can be a worthwhile investment.

Wine can increase in quality as it ages, for one. And with rare wines, supply and demand work in your favor: Only a finite amount of wine is produced in specific regions each year, and as people drink that wine, the supply diminishes. As demand increases for the dwindling supply, the price people are willing to pay for it rises.

Fine wines can deliver long-term, stable growth. It also does not correlate strongly with the economy, so it can act as a hedge against inflation and economic recessions.

Unfortunately, you can’t simply buy a bargain wine from the grocery store, stick it in your basement for a few years, and expect to reap an eventual profit. If you want to make money from wine, it needs to be of high quality, ideally rare, and stored in optimal conditions.

Unless you already have vast wine knowledge and a professional storage setup, I recommend using Vinovest. Vinovest ensures wine authenticity, stores it for you, and ships it to buyers when they’re ready to sell. Users of the platform can fund an account with a mere minimum of $1,000, select an investment style, and wait patiently as their account balances (hopefully) grow. If you decide you’d actually like to taste some of that rare wine yourself, Vinovest will ship it to you.

And if you prefer a spirit with a little more bite, Vinovest now allows users to invest in whiskey. You can buy entire casks of American Whiskey from the likes of Whistle Pig and Breckenridge, or Scotch from Macallan, Highland Park, and more. You’ll receive a sample bottle from your cask every year, and if you decide it’s too good to sell, they’ll bottle the rest for you. You can start investing in whiskey via Vinovest for as little as $300; just note that Vinovest’s whiskey investing currently only offers managed accounts, with similar terms and fees as Vinovest’s wine-based managed accounts.

Vinovest’s managed portfolios charge annual fees between 1.90% and 2.50%, depending on which investment tier you fall in. You can learn more or sign up at Vinovest, or dive deeper into this platform by reading our Vinovest review.

- Vinovest allows you to invest in fine wine and whiskey—investments that aren't correlated with the stock or bond markets.

- Initial questionnaire helps Vinovest build and manage a wine portfolio based on your investment goals.

- Talk with a portfolio advisor to learn more about wine investing or improve your portfolio.

- Low investment minimums of $1,000 for wine and $300 for whiskey.

- Special offer #1: If you refer a friend to Vinovest, you and your friend will each enjoy three months of fee-free investing once your friend funds their account.

- Special offer #2: Receive 5% off all management fees if you enable auto-investing.

- Relatively low investment minimum

- Good liquidity

- Reasonable fees for high account balances

- Relatively high fees for low account balances

- Early liquidation fees might apply

- Prospective investors might miss some fee information; fee disclosures spread across multiple pages in FAQs

Debt-based assets/private credit

Percent is an investment platform designed for accredited investors who are interested in accessing private credit (non-bank lending).

You can diversify your portfolio with investments such as …

- small business lending in Latin America

- U.S. litigation finance

- Canadian residential mortgages

- merchant cash advances

Percent has built a way for retail accredited investors to access a wide range of private credit opportunities with a clear view into their performance through its innovative tools and comprehensive market data. That allows investors to make better-informed decisions, source and compare opportunities, and monitor performance with ease.

This platform also provides access to an alternative investment that’s a little more liquid than other alts, with some debt investments only lasting nine months, with liquidity available after the very first month in some cases.

The service targets annualized returns on unsecured notes between 12% to 18% on average and up to 20%. And while investment minimums vary, many Percent opportunities require only $500 to invest.

If you’re interested, visit Percent’s site to learn more or open an account.

- Access for accredited investors to private credit markets, which historically have been limited to institutional investors

- Shorter-term investments, with many durations between 9 months to several years, and liquidity available after the first month, if the borrower provides this option

- Lower minimums (most deals requiring only $500 to invest)

- Diversification, with access to small business lending in Latin America, U.S. litigation finance, Canadian residential mortgages, merchant cash advances, and more

- Uncorrelated returns with the stock market and a potential hedge on stock market volatility

- Greater liquidity than many alternative investments

- Low investment minimums

- Low stock market correlations

- Only accessible to accredited investors

Related: 10 Best Stock Trading Apps for Beginners

Other Smart Ways to Use $100,000

In addition to knocking out credit debt, building an emergency fund, or investing it in some of the options above, here are a few other productive ways to burn $100k:

- Pay off your home: It’s not the most exciting thing to do with $100,000, but you might start closer to home—literally. While many homeowners don’t have rates above the 6.5% guidance mentioned above, people who are suddenly flush with cash often try to put a big dent in their existing mortgage. And that’s OK. While the money might generate a better financial return invested in the market, paying down something as important and expensive as their own home can greatly improve a person’s mental well-being.

- Start a small business: Naturally, this number will vary from business to business. So in addition to investing in stocks, bonds, real estate, and alternatives, you might consider investing in your own entrepreneurial spirit.

- Spend a little on yourself: “Tomorrow isn’t promised.” If we’re being very real for a moment, no one lives forever, so it’s worth making yourself happy along the way. Take a vacation, buy a VR headset, adopt your first dog. Any of these things are sure to bring you a few smiles, and you’ll still have plenty of money left over to invest.

And if you’re still torn on what to do with that $100,000, talk to a financial advisor. They’re professionals that are tasked with putting your financial wellbeing first, and they should be able to help you plot out a responsible plan of action.

Related:

![8 Best Portfolio Analysis Tools [Portfolio Analyzer Options] 48 best portfolio analysis tools](https://youngandtheinvested.com/wp-content/uploads/best-portfolio-analysis-tools-600x403.jpg.webp)

![8 Best Stock Portfolio Management Software Tools + Apps [2026] 50 best stock portfolio management software tools apps](https://youngandtheinvested.com/wp-content/uploads/best-stock-portfolio-management-software-tools-apps-600x403.jpg.webp)