Robo-advisors offer a low-cost way to diversify your portfolio, rebalance it regularly and keep on track toward financial goals. Previously, accessing the stock market with tailored investment advice often came to you if you were prepared to shell out money for a professional or had the time and know-how to do it yourself. Further, you couldn’t start investing with little money like you can with most robo-advisors—you needed a decent sum to justify the management fee or maintain a minimum account balance.

Thanks to financial technology (fintech) advancements, this is no more. These automated investing services act as a free or low-cost investment advisor in your pocket. Even more, most of these services allow you the same ease of access as standard online brokers but add doses of automatic rebalancing of your portfolio and valuable financial planning help.

We cover the best robo-advisors for your needs below. Our ratings considered available portfolio customization, costs, account minimums, access to other services like a cash account or banking products, educational resources, sign-up bonuses, customer support, unique features and included tools. All of the robo-advisor options found on this list offer diversification, automatic rebalancing at a regular cadence and assist in planning your investment goals.

You can rest assured that these robo-advisors will help you build wealth for free or at a reasonable management fee compared to a traditional human advisor.

Best Robo-Advisors—Our Top Picks

|

4.4

|

4.0

|

4.0

|

3.7

|

|

No-commission equity trading. 0.25%/yr. AUM fee for robo-advisor.

|

0.25%/yr. AUM fee for robo-advisor.*

|

No commissions on stock and ETF trades.

|

$4/mo., or 0.25%/yr AUM fee*. Premium: Additional 0.15%/yr. AUM fee.**

|

Top Robo-Advisors

| App | Apple App Store Rating / Best For | Fees | Promotions |

|---|---|---|---|

SoFi Invest® SoFi Invest® | ☆ 4.8 / 5 Personal finance-focused investors | 0.25%/yr. AUM fee | Bonus stock with $50 deposit (up to $1,000 value) |

Robinhood Strategies Robinhood Strategies | ☆ 4.3 / 5 Investors who want to invest in individual stocks in their robo-advised account. | 0.25%/yr. AUM fee (capped at $250 for Robinhood Gold subscribers) | None |

Betterment Betterment | ☆ 4.7 / 5 Passive investors seeking tax-loss harvesting capabilities | $4/mo., but changes to 0.25%/yr. AUM fee if you set up recurring monthly deposits totaling $250, or reach a balance of at least $20,000 across all Betterment accounts. Premium: 0.65%/yr. AUM fees | None |

Vanguard Vanguard | ☆ 4.7 / 5 Vanguard fund investors | No-commission stock and ETF trades | None |

Acorns Acorns | ☆ 4.7 / 5 Passive investors | Acorns Personal: $3/mo. Personal Plus: $6/mo. Premium: $12/mo. | $20 bonus when you set up recurring investments and make your first successful recurring investment |

| ☆ 4.2 / 5 People wanting a robo-advisor with human financial planner services | 0.50%/yr. AUM fee | None | |

Schwab Schwab | ☆ 4.5 / 5 Investors and traders of all experience levels | No-commission stock and ETF trades | Account bonus commensurate with contributed funds |

M1 Finance M1 Finance | ☆ 4.7 / 5 Passive investors | No-commission stock and ETF trades | None |

| * Apple App Store Rating as of June 18, 2025. | |||

1. SoFi Invest®: Best for Robo- and Self-Directed Investing

- Available: (iOS), Android, Desktop

- Price: No stock or ETF commissions, 0.25%/yr. AUM fee for robo-advisory services

- Account minimum: $50

- Platforms: Desktop web app, Apple iOS and Android App

SoFi Invest is a versatile stock market app that allows you to use robo-investing services or make self-directed investment choices with stock and ETF trades. The well-known brand in the personal finance space recently entered into the investing world by offering no-commission trades on stocks, ETFs, and more. SoFi doesn’t offer mutual funds.

The service provides you the ability to trade under your investment strategy. Meaning, you can invest actively or stand back and let its robo-investing tools takeover as a robo-advisor. Therefore, this brokerage account might make an excellent place to hold your investment accounts because you’ll have options for investing money.

The company wants to serve all customers interested in improving their financial situation alongside participating in their other personal finance products like refinanced student loans, money management, credit cards and more.

If you’d like to start investing through SoFi’s brokerage services, they offer an added incentive for using a robo-advisor through their platform: bonus stocks to get you started.

Learn more about their taxable accounts (retirement accounts, too!) to get you started down the robo-investing path and build your diversified portfolio.

- SoFi Invest allows you to trade or invest in stocks, ETFs, and options with no commissions and no account minimums. You can also participate in some initial public offerings (IPOs).

- Invest for as little as $5 with fractional shares.

- Robo-advisory services, including goal planning and auto-rebalancing, available for annual 0.25% AUM fee.

- Subscribe to SoFi Plus to unlock more than $1,000 per year in extra value, including a 1% match on recurring investment deposits, preferred IPO access, higher cash-back rewards on certain SoFi credit cards, a six-month APY boost, and more.

- Special offer: Get up to $1,000 in stock when you open and fund a new Active Invest account.*

- Good selection of available investments

- No options contract fees

- DIY and robo-investing options

- Fractional shares

- Doesn't support mutual funds

- Limited trading tools

- No tax-loss harvesting

- No socially responsible robo-advisor functionality

Related: 8 Best Stock Tracking Apps [Investment Portfolio Management]

2. Robinhood Strategies (A Robo-Advisory Done by People)

- Available: Sign up here

- Price: 0.25%/yr. AUM fee ($250 cap with Robinhood Gold subscription)

- Account minimum: $50

- Platforms: Desktop (PC), web, mobile app (Apple iOS, Android)

Robinhood’s M.O. over the years has always been putting a twist on traditional investment products. It offered brokerage accounts, but set itself apart by pioneering commission-free trading. It offered IRAs, but set itself apart by offering IRA matches. And it’s doing the same with Robinhood Strategies—a robo-advisory product that offers managed accounts … but light on the “robo.”

Robinhood Strategies works like many other robo-advisor products: You provide information about your risk tolerance, investment horizon, and financial goals, and Strategies whips up a portfolio tailored to those factors, then automatically rebalances regularly to ensure the portfolio is still aligned with those factors.

Where Robinhood Strategies primarily differs is that a team of human investment managers is making the decisions—not algorithms. Also, unlike many other robo-advisors that will build your portfolio with only funds, Robinhood Strategies will own not just stock and bond ETFs, but also individual stocks (as long as your account balance is at least $500).

They’re twists, but not a wholesale change.

Like most robo-advisors, you’ll have little input past the factors you list. This isn’t a true human-to-human advisory relationship, and you won’t have access to these managers or any other advisors. If you want changes to your portfolio, you’ll need to change your investor profile, though you can request certain stocks be excluded (and in time, Robinhood will let you use your dashboard to identify stocks you want to restrict). Portfolios are managed with tax-efficiency in mind; however, while the marketing alludes to tax-loss harvesting, Strategies does not manage tax-loss harvesting for you.

Robinhood Strategies is very financially accessible. You need just $50 to open an account. Annual management expenses are 0.25% of all assets under management, which is pretty much in line with most of its closest competitors. However, if you have a Robinhood Gold subscription ($5 per month), your fees are capped at $250 per year. You would reach that cap at a $100,000 balance—any balances higher than that reduce your AUM fee percentage. For instance, that $250 would represent a 0.25% fee on $100,000, but just 0.10% on $250,000 and 0.05% on $500,000. Strategies’ underlying investments are inexpensive, too; ETF-only portfolios average 0.10% in acquired fund fees, while ETF-and-stock portfolios average 0.06%.

Learn more or sign up for Robinhood Strategies through our link.

3. Betterment: Best for Tax-Loss Harvesting

- Available: Sign up by clicking the “Get Started” button below

- Price: Betterment: $4/mo. or 0.25%/yr. AUM fee*; Betterment Premium: 0.65%/yr. AUM fee**

- Account minimum: $10

- Platforms: Web, mobile app (Apple iOS, Android)

You can use the Betterment robo-advisor platform to buy fractional shares of low-cost ETFs in taxable accounts as well as individual retirement plans.

The portfolios buy fractional shares of ETF index funds tracking benchmarks like the S&P 500 to keep you invested in stocks and bonds. But there are no self-directed options; the service does not allow you to invest in individual stocks or bonds.

The app has also added crypto portfolios holding digital currencies such as Bitcoin and Ethereum, but again, you can’t buy them individually—only through pre-built portfolios held in separate crypto accounts.

Betterment stands out from a lot of other brokerages for its tax-loss harvesting feature. If you invest in a taxable account, and you sell an investment for a gain, you’ll owe taxes on those gains. (What you owe differs depending on whether you’ve held that investment for more than a year.) However, if you sell an investment for a loss, you can use that to offset your capital gains, and thus the taxes you’d pay on them, or if your loss is more than your gains (or you don’t have any gains at all), you can even reduce taxes owed on your personal income, subject to a $3,000 annual cap.

It can be a complicated strategy, but Betterment’s Tax Loss Harvesting+ automates the process for you. It will regularly check your portfolio for tax-loss harvesting opportunities, then take the proceeds from selling those investments and reinvest them where it makes sense for you.

Just note that Betterment is different from many traditional brokers in that it’s a subscription-based product. Betterment charges $4 per month to start; however, if you set up recurring monthly deposits totaling $250, or reach a balance of at least $20,000 across all Betterment accounts, the fee changes to 0.25% of all assets under management. Betterment Premium provides unlimited financial guidance from a Certified Financial Planner™. Premium costs 0.65% annually, and upgrading requires having at least $100,000 in assets with Betterment.

- The Betterment app gives you the tools, inspiration, and support you need to become a better investor.

- Start with as little as $10 and use the top-rated mobile app to set up automatic investing into diversified ETF portfolios.

- You can also invest in diversified preset cryptocurrency portfolios.

- Customize your risk tolerance and investment goals with guidance available at any time.

- By upgrading to Premium, you can unlock unlimited financial guidance from a Certified Financial Planner™.

- Hands-off investment management

- Diversified portfolio that automatically rebalances

- Low-cost investment selection

- Limited investment selections

- Limited crypto diversification in cryptocurrency portfolios

4. Vanguard Digital Advisor: Best for Vanguard Funds

- Available: Sign up here

- Price: 0.15%-0.20%/yr. AUM fee

- Account minimum: $3,000

- Platforms: Web, mobile app (Apple iOS, Android)

Much like the Vanguard corporate ethos, the Vanguard Digital Advisor follows closely in those footsteps by offering a no-frills approach to investing. Though, don’t be fooled. With enough cash to invest, you can also upgrade your level of human involvement by gaining access to a certified financial planner and deeper customization through the company’s Vanguard Personal Advisor Services. The Vanguard Personal Advisor Services offering comes with a far higher account minimum ($50,000) and slightly higher management fees (0.30%) than the standard Vanguard Digital Advisor.

Vanguard Digital Advisor can stock your portfolio with dirt-cheap Vanguard ETFs for those interested in the entry-level product featured here. These tend to charge very competitive expense ratios compared to similar index funds from other providers like Fidelity ETFs and Charles Schwab ETFs.

The Vanguard Digital Advisor asks standard questions used by most any robo-advisor appearing on this list, questions about income, marital status, spending, investment goals and timelines. From here, it recommends a portfolio of index funds with low expense ratios and manages your money for competitive advisory fees as compared to other automated investing apps found here.

This robo-advisor doesn’t rank higher on the list due to its significant downside: a $3,000 minimum balance requirement (and Vanguard Personal Advisor requires a $50,000 minimum balance).

While trivial to some, it presents a significant barrier to entry for many. Overall, we think both the Vanguard Digital Advisor and Vanguard Personal Advisor services offer compelling value for investors interested in automation into low-cost Vanguard funds.

- Vanguard's low-cost mission continues through its commission-free brokerage and other investment accounts. Invest in stocks, ETFs, and Treasuries with zero commissions.

- Pay $0 to trade Vanguard mutual funds and no-transaction-fee mutual funds.

- Want to trade options? You can do that on Vanguard, too.

- Vanguard's mobile app is simple and easy to understand.

- Good selection of available investments

- Commission-free Treasuries

- Some commission-free mutual funds

- Can purchase fractional shares of mutual funds

- Can optimize your portfolio with Vanguard Portfolio Watch

- Limited investing and research tools

- Somewhat clunky web interface

- High options contract fees

- Limited features on mobile app

- No fractional shares of stocks or ETFs unless reinvesting through a DRIP plan

5. Charles Schwab: Best for Cash Account Management

- Available: Sign up here

- Price: Free trades

- Account minimum: $5,000

- Platforms: Desktop app, web, mobile app (Apple iOS, Android)

Charles Schwab offers similar products as all the other brokerages listed here, including Schwab’s Intelligent Portfolios robo-advisors. The service comes with a high minimum investment of $5,000. While powerful in practice, the high initial hurdle makes it challenging for beginning investors to start investing.

To begin, the service asks you to complete a short questionnaire as most robo-advisors would. The questions ask about your financial goals, risk tolerance and investing timeline. Based on your answers, the service builds a diversified portfolio of ETFs chosen by investing experts.

From there, the robo-advisor monitors your portfolio daily and automatically rebalances as needed.

Want to learn more? Check out the review here, and from there, click the “Visit Site” button to visit Schwab and sign up.

- Charles Schwab is one of the best online and mobile trading platforms among discount brokers, offering a full range of investments (including professionally managed accounts). It allows you to invest in stocks, ETFs, mutual funds, options, bonds, futures, micro futures, and futures options.

- $0 commission trading for online U.S.-listed stocks, ETFs, options, mutual funds, and Treasuries. (Options do have a 65¢ contract fee.)

- More experienced traders can find plenty of horsepower in the Thinkorswim platform, which provides advanced charting, screening, complex options trades, access to a trading community, and more.

- Learn with Schwab, too. Schwab offers a wide variety of educational resources and stock news. The accounts offer regular market commentary, tax planning and retirement advice, stock and fund screeners, Schwab courses ranging from “Income Investing” to “Directional Options: Single Options and Spreads," and even access to Onward—Schwab’s quarterly financial magazine.

- Opening a Schwab account is easy and only takes a couple of minutes.

- Excellent selection of available investments

- Commission-free mutual funds and Treasuries

- Schwab Intelligent Portfolios (robo-advisory)

- Thinkorswim platform (absorbed from TD)

- Fractional shares

- No direct cryptocurrency trading

6. Acorns: Best Robo-Advisor for Beginners

- Available: Sign up here

- Price: Acorns Bronze: $3/mo. Acorns Silver: $6/mo. Acorns Gold: $12/mo.

- Account minimum: $0

- Platforms: Web, mobile app (Apple iOS, Android)

Acorns is an investing app geared toward minors, young adults, and millennials by offering “Round-Ups”: The app rounds up purchases made on linked debit and credit cards to the nearest dollar, then invests the difference on your behalf.

For example, if you purchase a coffee for $2.60 on a linked credit card, Acorns automatically rounds this charge up to $3.00 and puts the 40-cent difference aside. Once those Round-Ups reach at least $5, they can be transferred to your Acorns account to be invested.

The Acorns investment offering itself is a simple, automated platform that uses pre-built portfolios of ETFs to keep investors exposed to stocks and bonds, which is similar to many robo-investing offerings. While it doesn’t have much to offer intermediate investors who want variety in their portfolios, Acorns’ basic approach makes it one of the best investment apps for beginners.

Here’s more about what you can expect from Acorns’ varying subscription options:

- Acorns Bronze ($3 per month): Includes an Acorns Invest investment account, as well as Acorns Later for tax-advantaged investment options such as Roth IRAs. Also includes Acorns Checking, a bank account that has no account fees, lets you withdraw fee-free from more than 55,000 ATMs nationwide, and Smart Deposit, which allows you to automatically invest a bit of each paycheck into your Acorns accounts.

- Acorns Silver ($6 per month): Everything in Bronze (Acorns Invest, Later, and Checking), plus Premium Education, which are live onboarding sessions covering account setup, Round-Ups, setting up recurring investments, and more; Emergency Fund; and a 25% bonus on Acorns Earn rewards (up to $200 per month).

- Acorns Gold ($12 per month): Everything in Silver plus Acorns Early, which allows you to open a custodial investment account for your child so you can begin investing for them while they’re a minor; custom portfolios that allow you to hold individual stocks; live Q&As with financial experts; a 50% match on Acorns Earn rewards (up to $200 per month); $10,000 in life insurance; even the ability to set up a will for free.

Silver and Gold subscribers also get access to a powerful way to accelerate their savings: Later Match. While most people are aware that employers will sometimes match funds you contribute to your 401(k), “matches” are virtually unheard of in retirement accounts like IRAs, where there’s no employer to kick in extra cash. However, Acorns itself will match 1% or 3% on new contributions to IRAs for Silver and Gold subscribers, respectively.

Learn more in our Acorns review, or use our link to sign up with Acorns today.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Silver tier includes perks such as a 25% match on Acorns Earn rewards (up to $200/mo.), generous APYs on Checking and Emergency Fund, and live Q&As with investing experts.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts for children with 1% contribution matches.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions in your first year.*

- Special offer: Get a free $20 bonus investment when you sign up with our link and start making recurring investments.**

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Silver and Gold)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Gold for any self-directed investing options

Related: Best Acorns Alternatives: Micro-Investing Apps to Use

7. Stash: Best for Approaching Investing for the First Time

- Available: Sign up here

- Price: Stash Growth: $3/mo. Stash+: $9/mo.

- Account minimum: $0

- Platforms: Web, mobile app (Apple iOS, Android)

Stash is a mobile-friendly personal finance app that comes paired with investing options and a checking account. Stash acts as a low-cost, all-in-one financial platform and gets included in this list as a result. While the app primarily caters to hands-off investors looking to automate their investing, you can also actively select stocks to trade. You can do all of this as you spend money and make recurring deposits into your account.

Stash offers custodial accounts for absolute beginners (young investors) or those under the age of 18. Getting started early on your investing journey can build real long-term wealth over time as your returns compound. Stash comes with a recurring monthly fee but justifies this with a full-service personal finance platform.

Of note, while it does charge a monthly account service fee for its full suite of products, it does not charge trading commissions for your investment holdings, nor does it have an account minimum.

- Stash is a personal finance app that simplifies investing, making it easy and affordable for everyday Americans to build wealth and achieve their financial goals.

- Invest in stocks and exchange-traded funds (ETFs) for as little as 1¢ thanks to fractional shares.

- Earn Stock-Back® rewards on every eligible debit card purchase.

- Sign up for Stash+ and get access to custodial accounts, better Stock-Back® rewards, and access to $10,000 in life insurance.

- Special offer: Earn a $100 bonus when you sign up with Stash and make a $250 deposit.

- Robo-advisor with self-directed investing capability

- Fractional shares

- Custodial accounts available

- Offers values-based investment options

- Get paid up to two days early when you direct deposit pay into your Stash account

- FDIC/SIPC insurance

- Charges monthly fee

- Smart Portfolios don't offer tax-loss harvesting

8. Wealthsimple: Best for Access to Human Financial Planner

- Available: Sign up here

- Price: 0.50%/yr. AUM fee

- Account minimum: $0

- Platforms: Web, mobile app (Apple iOS, Android)

Wealthsimple is another robo-advisor in what has become an increasingly-popular investing product: automating your investing decisions and investment selections. However, what makes Wealthsimple different is the unlimited access you can receive from a financial advisor for no additional cost.

The expert financial advice comes with any investment product as part of the Wealthsimple Invest management fee. Other services provide access to financial advisors, but this often comes with an added cost, be it one-time or a recurring set of fees. From my experience of screening investing platforms, financial advising is not something many other robo-advisors offer. Investors who want some help from people in the know might consider Wealthsimple.

Wealthsimple also offers the ability to invest according to your values, and that means you can choose specific investment strategies which reflect your priorities. Some of the current values-based investing options include portfolios for Halal Investing and Socially Responsible Investing.

Wealthsimple is available in Canada.

- Wealthsimple is a robo-advisor which offers investors included financial advice as part of their Wealthsimple Invest account.

- Wealthsimple investors can invest in alignment with their values by choosing from portfolios like Halal Investing and Socially Responsible Investing

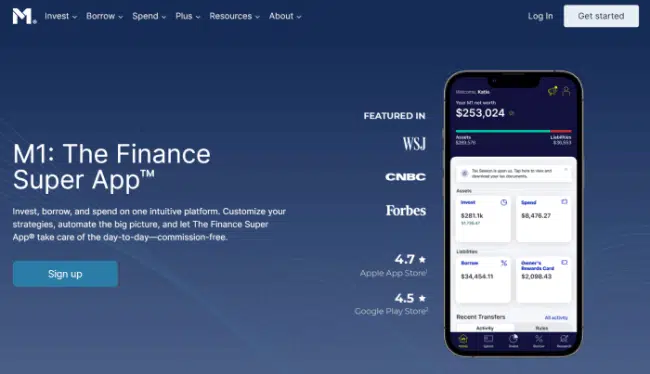

9. M1 Finance: Best Robo-Advisor for a Personalized Investment Portfolio

- Available: Sign up here

- Price: No stock or ETF commissions; $3/mo. platform fee on accounts under $10,000

- Account minimum: $0 (taxable accounts); $500 minimum deposit for IRAs

- Platforms: Web, mobile app (Apple iOS, Android)

M1 Finance offers commission-free stock and ETF trades and provides automated stock trading according to your predetermined investment decisions. What we like most about this app is your ability to make recurring deposits that automatically get invested into your portfolio.

M1 Finance acts as a singular personal finance app to assist with building wealth through automating your investments into diversified portfolios, having a bank account and linked debit card that provides market-beating interest rates and having access to valuable personal finance literature. Most importantly, investing with M1 Finance can be as simple as depositing money, setting your stock and index fund selections and having the platform automate your investments on your behalf.

I’ve said it before, but this truly automates your investments if you set up recurring deposits, allowing your wealth to build. From there, M1 Finance automatically rebalances your portfolio in line with your stated asset allocation targets. Doing this at regular intervals has been shown to improve overall portfolio performance. It moves outperforming funds into underperforming ones, capturing a value effect over time as returns revert to the mean.

Consider opening an investment account with M1 Finance. The app has no account minimum unless you choose to open an IRA, for which you’ll need to deposit at least $500. (It should be noted: if you maintain an account balance of less than $5,000, the service charges a $3/mo. fee.) You can even open up a custodial Roth IRA for your children if they have earned income through purchasing a subscription to M1 Plus.

Read more in our M1 Finance review.

- The M1 investing app is a basic robo-advisory system that acts almost like a 401(k). You build a "Pie" by choosing the stocks and ETFs you want to invest in, as well as the percentage of your portfolio that should be invested in each "Slice," and M1 uses that information to allocate your money each time you contribute.

- If you want help putting together a list of stocks and funds, you can use M1's model portfolios, which cover goals such as general investing, planning for retirement, income earners, and more.

- Enjoy a 4.00% APY on uninvested cash.

- Get a line of credit against your brokerage's account value at low fees (currently 6.40%) compared to other brokerage lines of credit.

- M1 lets you open individual, joint, and custodial brokerage accounts; traditional, Roth, and SEP IRAs; trusts; and cryptocurrency** accounts.

- Robo-advisor with self-directed investing elements

- Attractive APY on uninvested cash

- Borrow against your assets

- Limited selection of investible assets

- Doesn't allow trading throughout the trading day

- Monthly fees for account balances <$10,000

Features to Consider When Selecting the Best Robo-Advisors

Have a look at the features below to understand what you should consider when looking for a robo-advisor to manage your investments.

Fee Model

Robo-advisor offerings come with two primary methods for assessing management fees and account fees:

- Fixed monthly account fees – The service charges a fixed monthly fee regardless of your portfolio size

- Fixed fund management fees – Using an assets under management (AUM) approach, you might find small balances pay very little relative to fixed monthly account fees. In contrast, more significant balances pay far more. A standard fee ranges from a 0.20% management fee to a 0.25% management fee or even a 0.35% management fee. The level of service and features offered often drive this management fee.

Portfolio Options

Many start your assessment with a questionnaire to understand essential items like your age, income, investment goals, marital status and more. Based on these answers, you will have several portfolio options recommended to you. This can include diversified portfolios of index funds with low expense ratios offered through proven portfolio allocations.

It can also offer the ability for you to customize your portfolio and automatically rebalance it as you go.

Access to Human Financial Planners

Some robo-advisor options allow you to pay additional fees or management expenses to access a human financial planner. Likewise, you may need to make a minimum investment on the platform to unlock this access automatically.

Having a human financial advisor can help you with non-investment-related questions a traditional financial advisor might provide.

Ability to Trade Individual Stocks

Not all robo-advisor options allow you the ability to trade individual stocks. Some require you to purchase index funds only.

If individual stock buying serves as a requirement for your investing needs, make sure you choose services like M1 Finance, SoFi, Stash or Charles Schwab.

Account Minimum Requirements

The central sticking point for many people looking to start investing for the first time is the available money they have to put into the market. In the past, working with a traditional broker might require some hefty minimums, but this hurdle has largely gone the way of the dodo: extinct.

Many of the robo-advisor choices shown on this list require no account minimum to begin investing. For those that do, the threshold amounts to a few thousand dollars.

Tax-Loss Harvesting

Tax-loss harvesting gives you the chance to lower your tax bill but not necessarily your investment returns. This feature, when used in a taxable brokerage account, can lead to significant cost savings.

Banking Services

Some options in the market offer other services to complement your investing needs. This can mean offering you access to a savings account, credit card or debit card, personal loans, student loan refinancing and more.

Retirement Accounts

Many of these services offer multiple types of investment accounts, such as individual and joint taxable brokerage accounts, individual retirement accounts in multiple flavors (e.g., Traditional, Roth, SEP, SIMPLE).

Automatic Rebalancing

These automated investment services should work to keep your portfolio balanced over time, meaning you answer questions at the start and maintain ongoing contributions to build your balance over time. SoFi robo-investing, Betterment, Marcus Invest, and more all offer such features.

Low-Cost Exchange Traded Funds

Make sure the index funds in your portfolio charge the lowest expense ratios possible if they have the same investment objective: to mimic the performance of a stock or bond index. If they all deliver the same intended result, why pay more for an index fund than you must?

Target the lowest expense ratios you can, typically from providers like Vanguard, Schwab, Goldman Sachs and Fidelity.

Smart Beta

Beta implies the performance of the overall stock market. The Beta of an individual stock shows the average correlation in movement in the stock’s price relative to the market. For example, a stock with a beta coefficient of 1.5 moves 1.5x more than the stock market does. If the market tends to move 10%, this stock historically moves 15%. Likewise, if the market declines 10%, this stock tends to decline by 15%.

Smart Beta offers a transparent, rules-based approach to investing in a stock portfolio with passive and active investing strategies. Services like Marcus Invest offer this investment portfolio in an attempt to outperform the market, delivering you alpha or outperformance or earning the same return for less risk. In either scenario, your risk-adjusted returns could come out ahead. This feature involves engaging in active investing, but when left to professionals like those at Goldman Sachs with Marcus Invest, it could result in better long-term risk-adjusted returns for your portfolio.

Though, of course, returns aren’t guaranteed, and past performance isn’t necessarily indicative of future results. This strategy involves added risk but would lead to greater performance.

Robo-Advisor FAQs

How does a robo-advisor work?

Robo-advisors work by first gathering necessary information from you related to your investment goals, age, risk tolerance and investment suitability, among other valuable questions. Based on your responses, it will create a portfolio tailored to your answers and provide two significant functions investing by yourself might not: diversification and making programmatic, emotionless decisions.

One of the best ways to outperform the stock market is not making mistakes when everyone else does. Often, emotion drives these mistakes (such as selling when the market bottoms and missing the upside when it resumes its ascent higher). Robo-advisors don’t fall prey to emotions, instead relying on programmatic investment selections and asset allocations.

How are the best robo-advisors different from human financial advisors?

The best robo-advisors can deliver better monitoring and performance than a human advisor, such as a traditional financial advisor. However, where the value differs between even the best robo-advisors and human financial planners comes with personalized advice extending beyond your investment portfolio.

Human financial planners can assist with portfolio management just like the best robo-advisors, but they cannot offer advice on other financial questions you might have. This can include insurance, savings rates, educational expense planning, helping with building an emergency fund and much more. Certified financial planners can offer value-added investment advice alongside a personalized retirement plan and financial plan.

Robo-advisors invest your money following your questionnaire responses and some have even sought to offer free financial planning (or for a one-time fee) to match the service offerings of a human financial advisor.

When would it make sense to consider consulting human advisors for your financial planning needs?

You may want to consider consulting a human advisor when you want more individualized recommendations and hand-holding. Robo-advisor options use artificial intelligence and rules to place your money in optimized portfolios for the masses. You might want something different than this generic advice.

Further, human advisors might offer you more value-added services beyond investment management like wealth management strategies from other financial products like life insurance, annuities and more.

Consulting with human financial planners might be more advisable if you seek a more comprehensive financial management arrangement. If you just need investment advice, a robo-advisor can handle most of your needs in all likelihood.

What is tax-loss harvesting?

Generally, you engage in tax-loss harvesting when selling some of your investments at a taxable loss and using this loss to offset capital gains earned elsewhere in your investment portfolio. Because of the wash sale rule from the IRS, you can’t sell a stock or other security for a loss and then immediately add it back to your portfolio.

Instead, you can employ a tax-loss harvesting strategy by yourself by selling the security at a loss and waiting at least 30 days to repurchase the same security or a substantially similar one. You can use the capital loss to offset other capital gains or up to $3,000 of your taxable income in a year. Any unused losses roll forward indefinitely to offset future capital gains or taxable income. You can have this work by selling your investment for a loss and then having the plan to repurchase it at least 30 days later or outside of the IRS’ 30-day wash sale rule window.

Many top robo-advisors offer this feature for you in taxable brokerage accounts, lowering the cost of client assets. This can offset the costs of advisory fees or the robo-advisor’s management fee on your robo-advisor account.

Which robo-advisor has the best returns?

Overall, the investment performance varies based on the responses you make to your initial questionnaire. The underlying assets largely overlap between robo-advisors, meaning the ability to compare performance doesn’t necessarily make sense when stacking robo-advisor against robo-advisor.

Index funds attempt to mimic an underlying index. Therefore, the best robo-advisors offer tax-loss harvesting, low fees, and other features like Smart Beta investing, and Marcus Invest offers such an investing option.

Do robo-advisors beat the market?

Generally, no. They seek to replicate the market’s performance through purchasing low-cost index funds. Some offer the ability to invest in individual stocks alongside index funds or even use Smart Beta portfolios through a robo-advisor like Marcus Invest. Still, they by and large attempt to meet the market performance.

Is a robo-advisor good for beginners?

Because robo-advisors represent a way for beginning investors to add money to a diversified portfolio without much knowledge of the stock market or exposure to particular stocks, robo-advisors are suitable for beginners. Based on your responses to a questionnaire at account opening, your investment funds work for you on these online brokers without knowing how they work or manage your money.

If you answered the questions accurately and honestly, the robo-advisors would purchase a combination of exchange-traded funds or mutual funds in your brokerage account aligned with your risk tolerance.

Why are robo-advisors bad?

The answer to this depends on your investing style. If you prefer active stock picking to passive index fund investing, they present a challenge. For the vast majority of investors looking to add recurring contributions to a diversified portfolio over long periods, they make fantastic services.

Are robo-advisors a good investment?

Yes. If you’d like an automated investing service and investment advisor to manage your money on your behalf, robo-advisors present a remarkably good investment. They manage your money without emotion, and some even offer added financial planning tools to enable your secure financial future. Many come with valuable educational resources to teach you about investing and personal finance decisions you might encounter.

If you need extra help, some also offer access to human financial advisors for a fee. Combined, this can deliver you financial peace of mind, representing a good investment. You can even invest following your consumer preferences with some robo-advisors. Some offer access to socially responsible investing, meaning you invest in companies with environmental consciousness, strong corporate governance and socially-progressive positions.

Do robo-advisors make money?

Robo-advisors generally invest your money in index funds matching your risk tolerance and investment goals. While past performance doesn’t guarantee future results, when remaining invested in a widely-diversified portfolio matched to your risk tolerance over long periods, robo-advisors’ actions can make money for your bottom line.

These advisors overlook market downturns or market swells to maintain a diversified portfolio and transact without emotions. Remaining disciplined during critical moments can lead to the best returns when compared to other investors.

How much does a robo-advisor cost?

Most robo-advisors use either an assets under management fee model (e.g., 0.25% of AUM) or a fixed monthly fee approach. Depending on the intended size of your portfolio, one or the other may make sense. For example, if you plan to build an extensive portfolio quickly, choosing a low-fixed fee might save you more over time.

Likewise, if you won’t have serious money to invest for a while, a percentage of assets under management might have you come out ahead. Some robo-advisors also offer value-added services beyond simply picking suitable investments. This includes making a holistic financial plan complete with insurance, drafting a will, deciding how best to save for life goals like buying a house, sending your children to college, or even tax planning. These usually cost extra or amount to a higher fixed or variable (AUM) fee to include them.

While automating your investing approach can pay off handsomely, sometimes speaking directly with human advisors who can guide you toward making better financial decisions is a great idea. Typically, for traditional personalized investment accounts, robo-advisors compare favorably. Though, as with all things, it depends on your situation and the advisor you think makes the best fit for your needs.

Many financial advisors rely on a simple AUM model, whereby they charge anywhere from 0.50%-1.5% (or more) to manage your investments, create financial plans, and generally guide you toward making sound financial decisions. Likewise, many fee-only fiduciary advisors have come to serve customers by charging a fixed fee for performing multiple services or even a la carte pricing from a specific menu of services.

Depending on the services you choose, you will need to compare their cost to those of robo-advisors.

![The 12 Best Vanguard ETFs for 2026 [Build a Low-Cost Portfolio] 94 best Vanguard ETFs](https://youngandtheinvested.com/wp-content/uploads/best-vanguard-etfs-600x403.webp)

![15 Best Investing Research & Stock Analysis Websites [2026] 95 best stock investment research software and websites](https://youngandtheinvested.com/wp-content/uploads/investment-research-software-and-websites.webp)