An index fund consists of a mutual fund or an exchange-traded fund (ETF) and represents a diversified investment portfolio matching an underlying index. However, numerous types of index funds exist and can invest in any number of industries or sectors as well as use various investing strategies (e.g., using margin loans to leverage returns).

Moreover, index funds present a collection of assets created by a fund manager or by another company, such as a brokerage or investment fund.

They have gained in popularity in recent years because index funds diversify your portfolio affordably by investing in many assets simultaneously. By investing into multiple assets with one index fund, they minimize the risk of having exposure to only one underlying asset.

With the proliferation of free stock trading apps like Robinhood and Webull which enable free ETF trades and offer different types of investment accounts, as well as major firms like Vanguard and Fidelity offering free trades on their no-fee branded index funds, investing in index funds has only become more accessible and cost-effective for retail investors.

They’ve quickly become some of the best investments for young adults.

To keep markets honest, because index funds track an underlying index of stocks, bonds, commodities or other assets, they generally operate as an arbitrage mechanism.

They do this by design by trading close to their net asset values, or the market value of an index fund’s assets less its liabilities, divided by the number of issued shares.

Because the overall market, and popular indexes, such as the S&P 500 and NASDAQ, provide consistent performance in the long run, professionals tend to recommend having index funds serve as a significant store of your investment portfolio.

Even renowned investor Warren Buffett suggests buying a low-cost index fund and holding it for long periods of time to see how to build wealth. Buffett specifically recommends buying a S&P 500 index fund.

At this point, you might be asking yourself, “Should I invest in index funds?” or “How can I invest in index funds?” Keep reading to learn if index funds are the right choice for you as well as how to invest in index funds on Robinhood.

How to Know if You Should Invest in Index Funds

Some investors have a goal to “beat the market” and actively work to generate portfolio returns that outperform the stock market index of choice.

By investing in index funds, or securities which invest in a portfolio of underlying securities which comprise the same weightings used to calculate the index, you cannot beat your benchmark.

If you do the same thing as the market, how can you ever beat the market? Instead, for the investors who wish to outperform their market benchmark, they need more flexibility to react to price fluctuations to the securities in the index.

They can do so by investing in individual stocks as opposed to a market index.

Investors who prize this flexibility also likely do not care for the fees some index funds require. With services like Robinhood and Webull, you do not confront trading commissions and therefore no administrative expenses for the stocks in your portfolio.

If you want to be very active in your investing and want to try to beat the market, index funds might not be the best fit for you. In this investing preference, you might consider growth stocks, value stocks, or penny stocks on Robinhood and Webull.

If that sounds tedious and fraught with risk, the common motto of, “if you can’t beat them, join them” likely describes your investing philosophy.

Under this style of investing, often called passive investing, investors believe stock prices largely reflect accurate valuations and feel safer following the market.

By definition, index funds match the market index and show why passive investors like index funds. Further, these funds have less volatility than funds trying to beat the market because they experience far less portfolio turnover, all things equal.

In effect, index funds provide a powerful means for new investors to start investing money in stocks or for experienced investors to build their wealth.

Index funds take the question out of which assets your portfolio should hold. They can also pay dividends and be great income-generating assets.

Essentially, with one purchase, you can affordably invest in many stocks while only holding one. Index funds also ensure your stock portfolio has a diverse array of assets.

However, while diversification decreases risk, it does not eliminate it and you may still have a loss in a down market. In the case of downward market trading, you might consider inverse ETFs on Robinhood or shorting stocks on Webull, though both entail significant risk.

If you want a diverse stock portfolio at a low cost and do not have confidence in which stocks to purchase, an index fund might act as a good route for you.

If You Also Want to Own Individual Stocks

If you want to hold individual stocks alongside these index funds to add some alpha potential to your portfolio, consider the following services to surface stocks:

- Sign up here

- Price: Discounted rate for first year

My top pick of these subscriptions is Motley Fool’s Stock Advisor. The company highlights companies with consistent returns through steady performance over multiple years.

These so-called “Steady Eddies” serve as the foundation to your portfolio and have the ability to outpace the market. Consider signing up for your discounted rate on your first-year subscription.

If you aren’t satisfied with the service within 30 days, you can receive a full refund.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!

- Discounted introductory price

- Strong outperformance above S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Benefits of Buying Index Funds on Robinhood

Two of the most significant benefits of getting your index funds on Robinhood include the simplicity and the lack of fees. Once you have downloaded the Robinhood app, verified your identity, and added funds, you can start investing in an index fund in a matter of minutes.

Full details on this can be found in the next section. Just make sure to do a bit of stock research with the best apps on the index funds you have interest in before you start the purchasing process.

Some index mutual funds have a minimum dollar amount required to invest, such as $2,000. You might also encounter trading commissions, administration fees, or annual fund maintenance fees.

Similarly, the best target date funds which use index funds can also require minimum initial investments.

However, you can avoid all of these costs with the Robinhood app and investing in index fund ETFs. Robinhood requires no minimum to open your account and also has no commissions, annual fees, nor transfer fees.

With this lack of cost, you might wonder “How does Robinhood make money?”

The only time you would pay a fee comes if you decide to upgrade to a Robinhood Gold account. This account has extra benefits, such as higher instant deposits, professional research from Morningstar, Level II Market Data from Nasdaq, and access to investing on margin.

Robinhood Gold acts as a premium option for more in-depth trading and research. You can always remain on the fee-free standard version to execute trades.

You Might Consider Index Funds on Webull Instead

Robinhood changed the retail investing game in 2013 but has since fallen behind of some of the other free stock trading apps for beginners for offering the most features and functionality.

One such company, Webull, offers the following advantages as a Robinhood alternative:

- Individual Retirement Accounts (IRAs) – including Traditional, Roth, and Rollover IRAs

- Shorting stocks with margin accounts for $0 commissions

- Paper trading simulator to model trades without putting money at-risk

- Free stocks by signing up and making an initial deposit

- Webull is a low-cost trading and investing app that allows you to invest in stocks, ETFs, options, futures, commodities, and crypto, and even participate in initial public offerings (IPOs).

- No-commission stock, ETF, and option trades (and many options have $0 contract fees).

- Trading features such as charting tools, technical indicators, customizable screeners, real-time stock alerts, and group orders.

- Let Webull manage your money for you with Webull Smart Advisor, which combines Webull's in-house investment expertise and artificial intelligence to build, manage, and rebalance an ETF portfolio for you.

- Sign up for Webull Cash Management to earn up to a 4.1% APY on uninvested cash.

- New users get one free month of Nasdaq TotalView's Level 2 Quotes service. (That subscription costs $2.99/mo. thereafter.)

- Subscribe to Webull Premium and receive a premium APY on uninvested cash in individual and joint cash accounts, premium margin rates, a 3% match when you transfer or roll over your IRA, and an extra 3.5% match on qualifying IRA contributions.

- Special offer: Make an initial deposit of at least $2,000 and receive 1.) a $100 cash bonus, 2.) a 2% match of your deposit (up to a maximum bonus of $20,000), 3.) a 30-day voucher for Webull Premium, 4.) a 30-day 4.0% APY booster on uninvested cash (for a total of 8.1%).**

- Good selection of available investments

- Fractional shares

- Powerful technical analysis tools

- Offers robo-advisory services

- Accessible to beginning and intermediate users

- Voice commands

- Offers highly competitive APY through Webull Cash Management

- Does not support mutual funds

How to Open and Fund Your Robinhood Account

Once you have downloaded the Robinhood app, you will need to verify your identity by submitting photographs of your passport or driver’s license. You will also need to connect to a bank account in order to fund your account.

The better choice likely comes from using a checking account as opposed to a savings account because this would avoid any potential transfer reversals or exceed your monthly allotted savings accounts withdrawals.

Specifically, when choosing a checking account to house your money, you will want to consider ones which have a free sign up and no minimum balance requirement.

Traditional banks tend not to qualify for these requirements because they often come loaded with fees. Online banks now act as the best manner for avoiding these problems.

When looking for an online bank, look for these features:

- Free to sign up and open an account.

- Free to manage (no deposit or balance minimum).

- Free and unlimited transfers and deposits.

- Free mobile deposits.

- Free ATM withdrawals at any machine.

- Allows at least one checking and one savings account that are linked.

- Can link to outside business tools and services through other financial companies like PayPal, Venmo or Mint.

- Is location-agnostic and entirely online, only requiring internet access.

No monthly maintenance fees, zero minimum balance requirements and interest compounded daily. Gain access to over 80,000 ATMs nationwide, avoid overdraft or non-sufficient funds fees and earn up to 0.90% interest.

To fund your Robinhood account, follow these steps in this order:

- Robinhood will send two small deposits to your bank account to verify ownership before funding your Robinhood account.

- In the app, you will then verify the account by going to the Account Icon → Transfers → Linked Accounts → Verify.

- Enter and confirm the two deposit amounts shown in your bank account.

- You can then transfer money into your account to use when buying index funds or single stocks.

How to Buy Index Funds on Robinhood

Now that you have opened and funded your Robinhood account, you can begin purchasing index funds in only a few easy steps in a handful of moments. Follow the steps below to see how to buy the best index funds on Robinhood.

Step 1: Find the index fund you want.

Begin by going to the search bar at the top of the Robinhood app. If you already know the ticker symbol (an abbreviation that identifies publicly traded shares of a stock), you can type that into the bar.

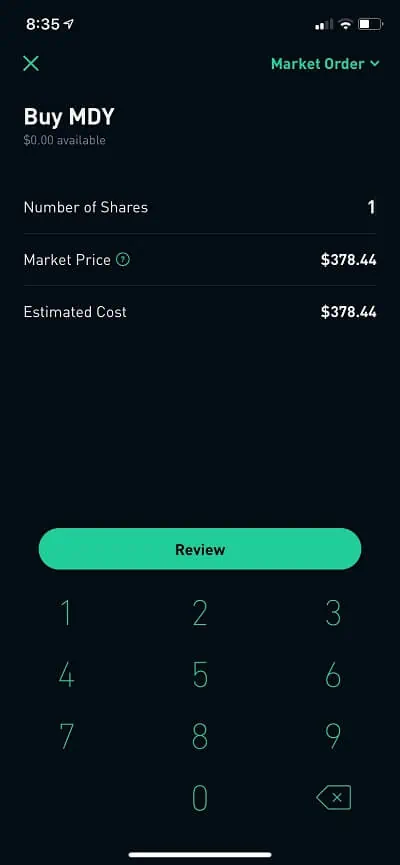

For example, you might enter “MDY.” Alternatively, you can type the words “index fund” to see a list of your options.

To learn more about each index fund, simply click the ones shown in your search results. Robinhood will provide more info about the selected index fund’s current market trends and statistics with data points like:

- Opening and closing prices

- Daily and average trading volume

- 52 week high and low prices

- P/E ratio (if applicable)

- Market capitalization

- Dividend / Yield

Additionally, below this information, you will also see a menu displaying what other Robinhood users tend to buy in addition to this index fund. For example, when examining the SPDR S&P 500 MidCap 400 Index Fund (MDY), you can see investors also purchased shares in:

- SPDR S&P 500 ETF (SPY),

- Vanguard S&P 500 ETF (VOO),

- Vanguard Total Stock Market ETF (VTI), and

- PowerShares (QQQ)

Step 2: Choose how many shares you want to purchase.

Start first by clicking the “Buy” button located in the bottom left of the screen. This will not instantly purchase the index fund, rather it will show you the market price and calculate your estimated cost based on the number of shares you will like to purchase.

Step 3: Buy an index fund using money in your account.

Once you have decided how many shares to buy, click “Review.” This triggers an estimated cost at the bottom of the order screen. Note the word “Estimated Cost.”

The trade may end up costing a slightly different amount depending on the actual ask prices available when you execute the trade.

Finally, before you select the check mark button to advance to the next screen, you will receive a pop-up window cautioning you of the variability in the market price displayed. It will say the price may vary due to a number of factors, including market activity.

If you have insufficient funds available in your account, the app will not let you make the purchase.

Because the app does not pull money directly from your bank account and only uses the money you have specifically deposited into your account, you will not have the risk of buying more than you can afford.

Without enough money, you will first have to deposit more into Robinhood. Do not worry, however, because if you add too much by accident, you can transfer it back to your bank in a few business days.

If you have enough funds, you can complete your order. Then, you wait or choose to add more money on a schedule that makes sense for you. But how long do you need to keep money in an index fund?

After investing in an index fund, do not plan to take that money out for weeks or months. Rather, it would be better to wait years to see the true effect of compounding returns.

Buying and Holding Index Funds on Robinhood

If you have the ability to hold the money in index funds for long periods of time, you should consider leaving your money invested for the long-term. Said differently, this means you should not invest money you will need in the near future.

When you do withdraw your money (many years from now!), Robinhood allows you to do so for free.

And in case you are asking, “How long does it take to withdraw money from Robinhood?”, after you sell your investments, the customary time for the trades to settle is 2 business days.

This means the online discount broker does not need to receive the funds from the person who bought your sold investments until 2 business days after the transaction.

After the transaction proceeds settle and you then withdraw your money, it can take 4 more business days for the money to be transmitted to your bank account.

From there, your bank can take 1–2 days to approve the transaction. All told, from the moment you sell your investments in Robinhood to the time the funds become available, it can take approximately 7–8 business days.

As far as the amount you can withdraw per request, the app limits you to $50,000 per day. Also, as a consequence of selling your index funds, remember to set some of this money aside to cover taxes on your realized capital gains.

However, if you purchase index funds which pay qualified dividends and you have the correct amount of income, you might avoid paying taxes on this passive income.

When it comes to investing, index funds act as one of the safer investment options. They routinely come recommended as a top choice for passive investors who want an affordable and diverse stock portfolio.

Further, index funds also come as an excellent fit for people who remain unsure of which stocks might perform best.

If you choose to invest in index funds, Robinhood, one of the best financial apps for young adults, is a simple place to start. Getting started poses little challenge and setting up an account costs you nothing.

Better yet, the service charges no commissions, maintenance fees, nor transfer fees and offers you a free share of stock to get started.

It can be unnerving to invest in an index fund for the first time if you are not already an experienced investor. Just make sure only to invest money you can spare and have patience.

Also, make sure to do your stock research before making any purchases. When you put the initial work in upfront, your money will start to work for you down the road and grow your net worth, another important factor in reaching financial independence, which I discuss more below.

Why Tracking Your Net Worth is Important

Several benefits exist for calculating and keeping on top of your net worth. Knowing your net worth empowers you know whether you have made financial progress as well as your level of financial security in the event of exigent circumstances (like what we saw with Coronavirus-related stimulus checks).

Knowing your net worth can also help to motivate you toward creating an emergency fund, or money set aside for 3-12 months (depending on personal situation and risk tolerance) of expenses.

Before learning how to invest in index funds on Robinhood, you should already have at least a few months’ worth of living expenses in your savings account.

Knowing how much you have saved for emergencies and long-term financial needs is important for your personal finances. Fortunately, Empower offers a free stock tracking app and investment reporting through a free financial dashboard.

Simply connect all of your accounts, including your Robinhood investment account and see your complete financial picture in one place.

- Empower offers both a free set of portfolio, net worth, and cash flow tracking tools, as well as paid asset management service.

- Link Empower to your bank and investing accounts, credit cards, and more to see a single view of useful information and data, including your net worth.

- Empower Advisory Group offers a comprehensive wealth management service known as Personal Strategy. This managed account solution provides clients with discretionary investment management, personalized portfolio construction, and access to financial planning support. Accounts investing $100k to $250k receive unlimited advice and retirement planning help from financial advisors, as well as a professionally managed ETF portfolio with reviews upon request. Higher asset tiers offer access to dedicated advisors, estate planning, and tax specialists, plus additional investment options like access to private equity.**

- Special offer: If you have $100k+ in investible assets, sign up with our link to schedule a free initial 30-minute financial consultation with an Empower professional.

- Free portfolio tracker (Dashboard)

- Free net worth, cash flow, and investment reporting tools (Dashboard)

- Tax-loss harvesting (Personal Strategy)

- Dividend reinvestment (Personal Strategy)

- Automatic rebalancing (Personal Strategy)

- Low investment expense ratios (Personal Strategy)

- High number of investment accounts supported (Personal Strategy)

- High $100k minimum for investment management (Personal Strategy)

- Moderately high investment management fee (0.89% AUM) compared to other online advisors (Personal Strategy)

![9 Best Schwab ETFs to Buy [Build Your Core for Cheap] 26 best schwab etfs to buy](https://youngandtheinvested.com/wp-content/uploads/best-schwab-etfs-to-buy-600x403.webp)