Index funds make for great core holdings in your stock portfolio, and two of the best on offer are a pair of Vanguard mutual funds: The Vanguard Total Stock Market Index Fund (VTSAX), and the Vanguard 500 Index Fund Admiral Shares (VFIAX).

Index funds are typically better investments than individual stocks because, by and large, their diversification exposes average investors to less risk in the long-run. This buffers against firm-specific volatility and associated risks. Further, the best index funds also often have low fees.

Additionally, index funds are an easy “set it and forget it” investment opportunity, and they can even act as an effective way to generate tax-advantaged passive income.

Investors have the ability to select from thousands of index funds, providing ample opportunity to choose the ones best-aligned with your investment goals.

Some people see this positively while others become overwhelmed with the abundance of choices.

The Vanguard Total Stock Market Index Fund (VTSAX) and Vanguard 500 Index Fund Admiral Shares (VFIAX) are two of the top index mutual funds you can buy. They’re certainly worth adding to your watchlist to understand better.

Keep reading to learn their similarities and differences to find out which index fund performs better. Further, I will also share useful apps buying and selling these index funds as well as how to track their impact to your net worth over time.

But first, I’ll explain what to keep in mind when choosing between index funds in general.

Table of Contents

How to Choose an Index Fund

You need to consider several factors when picking an index fund to invest in. One critical factor is the level of risk you’re comfortable taking.

Market capitalization (aka market cap, if you’re into brevity) measures the size of a company by its stock-market value. To calculate this, you simply multiply the number of outstanding shares by the stock’s price. The smallest publicly-traded companies fall into the micro- or small-cap category and can sometimes trade as penny stocks, mid-size companies qualify as mid-cap, and investors refer to the biggest companies as large-cap or mega-cap stocks. Small-cap stocks tend to outperform their large-cap peers in the long-run though they do come with greater volatility since fewer investment decisions have disproportionate impacts on the small-cap companies’ stocks.

If you have a high level of risk aversion, you should choose a broad index of large-cap stocks, or a total stock market index (which might hold small- and mid-cap stocks, but is primarily made up of large-cap stocks), rather than, say, a small-cap index fund, or a fund with only a few, aggressive holdings.

Other factors you should consider when determining which type of index fund you should consider include:

- Business sector or industry. Some indexes focus mainly on technology, others on health-related businesses, etc.

- Company size and capitalization. Do you want an index fund that tracks small, medium, or large companies? Or do you want a combination?

- Ability to buy. Does your favorite discount broker offer the fund you’re considering or would you have to look elsewhere?

- Total cost. This includes expense ratios and other fees.

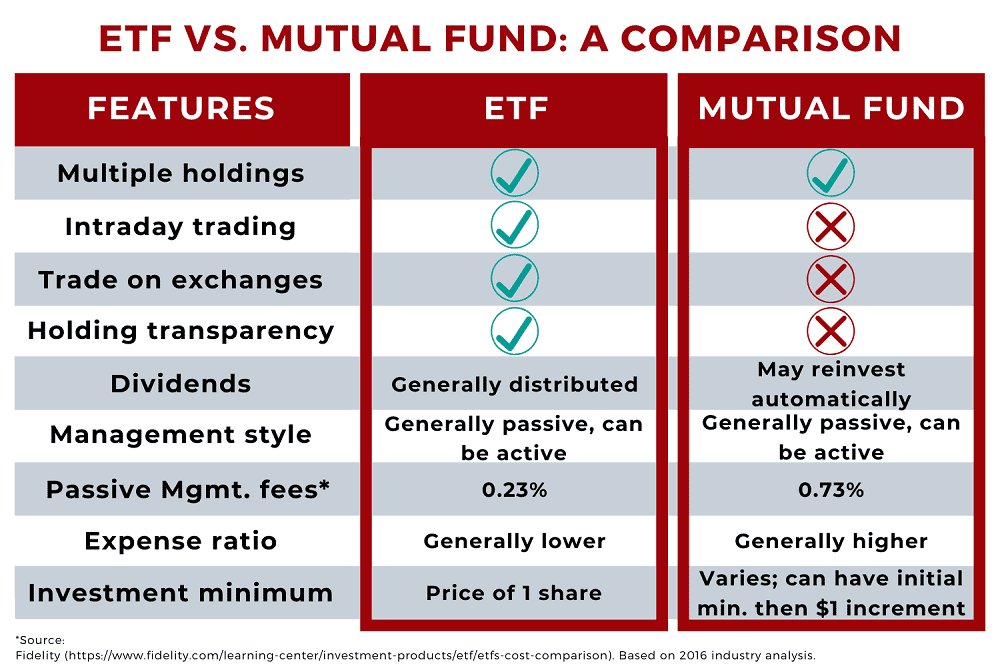

- Mutual funds vs. exchange-traded funds (ETFs). This is useful if you don’t have enough for the investment minimum yet and may be more tax efficient.

- Expected volatility. Volatility can lead to higher gains, but also more significant losses.

Our best index funds for beginners have a diverse portfolio of holdings, operate with low expense ratios, and have significant tax efficiency. But generally, in this space, two companies lead the pack: Vanguard and Fidelity. Out of the top 25 index funds (according to MarketWatch), 19 come from one of these two providers.

Vanguard’s VTSAX and VFIAX fit all three requirements of being diversified, low-cost, and tax efficient. In fact, Morningstar, a well-known global research and financial services firm, gives them Gold medal ratings (Morningstar’s forward-looking analytical rating system).

They arrived at this decision primarily through praise of their tax-efficiency. As an aside, these two index funds also make great tax-advantaged investments for their low-costs, diversification and impressive long-term returns.

Now that we have a sense for risk factors, elements you should consider when selecting a suitable lineup of index funds, and the industry leaders, let’s take a closer look at VTSAX and VFIAX to see why so many investors hold these index funds in their portfolios.

Overview of VTSAX

The Vanguard Total Stock Market Index Fund (VTSAX) is a large-blend mutual fund that provides investors with exposure to the complete United States equity market. The index fund tracks the CRSP U.S. Total Market Index and is one of the world’s largest in terms of assets under management.

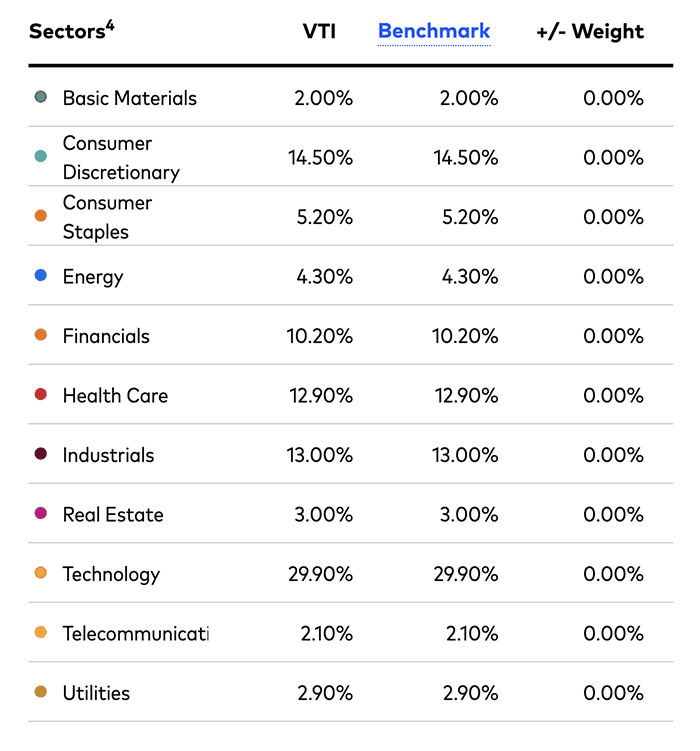

VTSAX includes small-, mid-, and large-cap stocks, and it holds growth and value stocks alike. The index fund’s top five sectors include (sector weightings as of 6/30/2023):

- Technology (29.90%)

- Consumer discretionary (14.50%)

- Industrials (13.00%)

- Health care (12.90%)

- Financials (12.20%)

For a more complete view into the VTSAX mutual fund’s sector weighting composition, have a look at the figure below (prepared as of 6/30/2023).

VTSAX’s average annual rate of growth in earnings from the past five years for the portfolio’s stocks is 18.6%. As of 6/30/2023, Vanguard Total Stock Market contains $1.4 trillion in assets across all its share classes, including $317 billion in VTSAX, and it has an expense ratio of 0.04%. The dividend yield is at 1.51% currently, but it can go higher or lower depending on what its components pay out and where VTSAX’s price goes.

This index fund also has an ETF equivalent, called VTI. To learn more about how these compare, see my detailed review of VTSAX vs. VTI. As for how ETFs vs. mutual funds compare, see the following infographic:

Overview of VFIAX

The Vanguard 500 Index Fund Admiral Shares (VFIAX) offers exposure to 500 of the largest United States companies, which collectively account for around 75% of the U.S. equities market value. The index fund tracks the S&P 500, which also acts as its benchmark for comparing investment returns.

Because VFIAX holds a broadly diversified portfolio within the large-capitalization market segment, the index fund acts as a strong option for an investor to hold as a core equity holding in a portfolio.

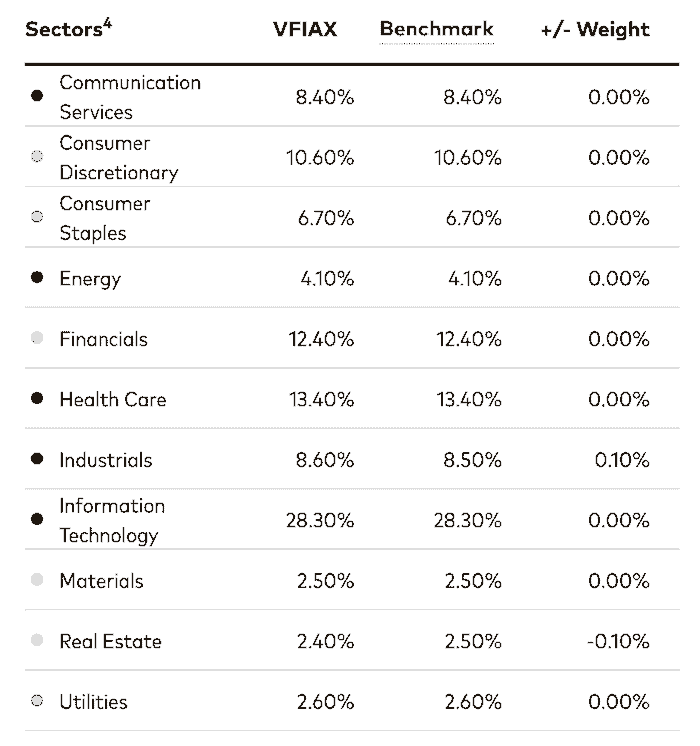

VFIAX’s top five sectors include (as of 6/30/2023):

- Technology (28.30%)

- Health care (13.40%)

- Financials (12.40%)

- Consumer discretionary (10.60%)

- Industrials (8.60%)

For a more complete listing of the fund’s major sector weightings, look at the chart below (prepared as of 6/30/2023):

Finally, Vanguard 500 Index Fund Admiral Shares has $887 billion in total net assets across all share classes, including $425 billion in VFIAX, and it has an expense ratio of 0.04% (as of 6/30/2023). The current dividend yield is 1.51%.

Related: 36 Best Passive Income Ideas [Income Investments to Consider]

Other Top Investment Opportunities to Consider

Check out some of these other investment options for a complete listing of every fintech-enabled investment opportunity popping up. They might represent some of the best assets to buy for your portfolio.

|

4.5

|

4.4

|

4.0

|

|

Commission-free trading. Robinhood Gold: Free 30-day trial, then $5/mo.

|

Most funds: 0.85% annual fee. Fundrise Innovation Fund: 1.85% annual fee.

|

Minimum investment: $1,000

|

Similarities Between VTSAX and VFIAX

→ Investment style.

Both VTSAX and VFIAX are large blend funds, meaning they hold a combination of growth and value stocks in their portfolio. Blended funds offer investors a diversification into both popular investment styles (growth vs. value) and do not specialize in either specific investing style.

→ Market-cap weighted indexes.

To give an idea of how the two funds compare, VFIAX essentially acts as a subset of VTSAX. All of the 505 stocks VFIAX holds show up in VTSAX. However, VTSAX also holds a few thousand additional (large-, mid- and small-cap) stocks as well.

Further, both VTSAX and VFIAX are market cap-weighted. That means the largest the company, the larger a percentage of assets they make up in each fund. In VTSAX’s case, these few thousand smaller stocks only make up a small portion of the total fund.

→ Top ten holdings.

To compare these two benchmarks, around 75% of VTSAX’s value reflects stocks in the S&P 500. The top holdings for each are mostly the same, though with less weighting in those top stocks than in VFIAX.

VTSAX’s 10 largest holdings account for about 26% of total net assets while VFIAX’s 10 largest holdings account for 30% of total net assets.

VTSAX’s top 10 holdings (based on percentage of assets as of 6/30/2023) are:

| Company | Ticker | Weight |

|---|---|---|

| Apple | AAPL | 6.09% |

| Microsoft | MSFT | 5.27% |

| Alphabet | GOOG / GOOGL | 2.81% |

| Amazon | AMZN | 2.21% |

| Nvidia | NVDA | 1.60% |

| Tesla | TSLA | 1.37% |

| Berkshire Hathaway | BRK.B | 1.32% |

| Meta Platforms | META | 1.16% |

| Exxon Mobil | XOM | 1.10% |

| UnitedHealth Group | UNH | 1.09% |

VFIAX’s top 10 holdings (based on percentage of assets as of 6/30/2023) are:

| Company | Ticker | Weight |

|---|---|---|

| Apple | AAPL | 7.11% |

| Microsoft | MSFT | 6.22% |

| Alphabet | GOOG / GOOGL | 3.36% |

| Amazon | AMZN | 2.67% |

| Nvidia | NVDA | 1.98% |

| Tesla | TSLA | 1.62% |

| Berkshire Hathaway | BRK.B | 1.61% |

| Meta Platforms | META | 1.37% |

| Exxon Mobil | XOM | 1.31% |

| UnitedHealth Group | UNH | 1.28% |

→ Portfolio turnover rate.

The portfolio turnover rate, a measure of how fast securities in a fund are bought or sold by the fund’s managers, is low for both income funds, at 3.0% for VTSAX, and 2.0% for VFIAX.

When evaluating index funds (structured as either an ETF or mutual fund), portfolio turnover should enter into your consideration as it represents an important indicator of a fund’s investment strategy.

For those people who may ask “Who cares if my ETF or mutual fund has a high turnover rate?” know that this statistic can determine a significant amount of your fund’s performance.

To illustrate, a turnover ratio of 100% indicates the investment fund’s managers have purchased and sold all of its positions in the last year.

When an investment fund has a relatively low turnover ratio, something in the 0% to 30% range, this indicates the fund practices a buy-and-hold strategy. However, funds with high turnover ratios (say, anything above 50%) shows more of a trading strategy. You’ll often see higher turnover ratios in actively managed mutual funds.

→ Fees.

VTSAX and VFIAX are extremely low-cost index funds, charging a wee 0.04% in expenses, or $4 annually for every $10,000 invested. This is an extremely low expense ratio, typical of Vanguard’s Admiral shares. (Vanguard, like many mutual funds, has different type of share classes. Investor share funds, which are available to basic investors, are typically a little more expensive than larger-minimum share classes. However, for some funds, Vanguard only offers the super-inexpensive Admiral shares; in those cases, minimum initial investments are typically still low enough for most investors to buy in.)

→ Minimum initial investment.

Both index funds have a $3,000 minimum initial investment. If this acts as a barrier to entry, you might instead opt to invest in their ETF equivalents, discussed next.

→ ETF equivalents.

People who find the funds’ minimum initial investment unrealistic can turn to each fund’s ETF equivalent.

- VTSAX’s ETF equivalent is the Vanguard Total Stock Market ETF (VTI).

- VFIAX’s ETF equivalent is the Vanguard S&P 500 ETF (VOO).

Both VFIAX and VTSAX have over 20 years of history of returns and are popular options for retirement portfolios. Further, many of the best target-date funds use similar index funds to diversify investors’ holdings and provide market returns.

VTSAX vs. VFIAX for Overall Performance

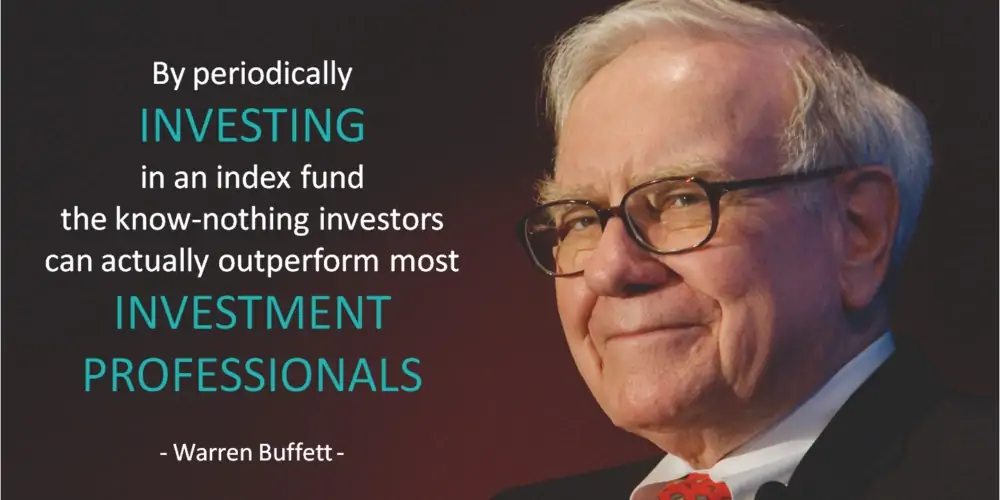

Acclaimed investor and billionaire Warren Buffett put in a 2014 letter to shareholders that for his wife’s inheritance he wanted 90% in a “very low-cost S&P 500 index fund.” He went on to write, “I believe the trust’s long-term results from this policy will be superior to those attained by most investors.”

Later, in 2017 during a CNBC interview, he reiterated his stance, stating, “Consistently buy an S&P 500 low-cost index fund.”

He encouraged people to “Keep buying it through thick and thin, and especially through thin…American business is going to do fine over time, so you know the investment universe is going to do very well.”

VFIAX would fit Buffett’s “low-cost S&P 500 index fund” qualification. The fund attempts to replicate the performance of the S&P 500 with a low expense ratio and tax efficiency with a low turnover rate.

If you trust Buffett, you may believe VFIAX will outperform VTSAX, which deviates slightly from the S&P 500, and instead follows the CRSP US Total Market Index.

I should note that an index fund’s return doesn’t always exactly match the index it tracks. That’s because the fund typically includes management expenses. This causes a slight deviation from the underlying benchmark performance and should be kept in mind when comparing these index funds’ performance against their relevant benchmark.

It might also be an advantage for VFIAX that the S&P 500 does not consist of a static list of publicly traded companies. In fact, over time, the companies which comprise the index change as they grow or shrink.

This causes the index’s exposure to change automatically and reallocate capital towards the top market-weighted performers.

VTSAX adjusts as well, but failing companies might stick in your portfolio longer because more companies qualify to be part of the CRSP US Total Market Index.

→ Sharpe ratio.

Both index funds’ Sharpe ratios (a common method for calculating risk-adjusted return) appear nearly identical over the long-term. This means investors in both of the funds had similar returns on a risk-adjusted basis.

As of 6/30/23, VFIAX’s Sharpe ratio is 0.75 while VTSAX’s is 0.71, making VFIAX’s ratio slightly better. To interpret this result, you need to understand what a Sharpe ratio means.

This measure compares an average investment return to the level of volatility (risk) of a security. To be specific, the Sharpe ratio represents the average return less the risk-free return (typically Treasury debt) divided by the standard deviation (a measurement of risk) of the return on an investment.

Therefore, higher average returns with lower risk result in a higher Sharpe ratio, whereas higher average returns with higher risk produce lower Sharpe ratios.

The statistic shows the additional average return an investor can expect for a commensurate increase in risk.

→ Standard deviation.

A stock’s standard deviation acts as a measure of its inherent volatility, or risk. All things being equal, higher standard deviation measures indicate a higher dispersion around the mean return, suggesting more volatile returns over the selected time period.

VFIAX currently has a better standard deviation. As of 6/30/2023, VFIAX’s 3-year standard deviation is 18.19%, while VTSAX’s is 18.46%. This shows VTSAX comes with a higher (albeit, only slight) level of risk than VFIAX.

→ Morningstar ratings.

Morningstar gives VFIAX a five-star rating and VTSAX a three-star rating.

Before you start buying all the VFIAX you can and disregard VTSAX, however, remember: Morningstar star ratings simply measure past performance. Also, let’s look at a couple of other reasons why VTSAX might be the better option. VFIAX is very popular for 401(k) plans, but some believe VTSAX to be superior.

→ Larger investing universe for VTSAX.

Small-cap companies typically experience less impact from evolving global trade conditions because their businesses focus more on domestic developments than do large caps.

Therefore, since VTSAX includes small-cap companies and VFIAX doesn’t, this might make VTSAX slightly more stable in the face of volatile global trade conditions.

→ Long-term time horizon favors exposure to small caps.

If you are a young investor with a long-term investment horizon, tracking the average annual returns since each fund’s inception shows VTSAX has done better.

Both funds’ Admiral shares were created and first offered to investors on 11/13/2000. The returns highlighted below are as of 6/30/2023 (23 years of return data since inception):

VFIAX’s total average annual returns since inception are +7.43%. It’s worth noting, however, that the 10-year average annual return rate is +12.82%.

VTSAX’s total average annual returns since inception are +7.69%, but the 10-year average annual return rate is +12.28%.

Therefore, over longer periods of time, VTSAX shows a slightly superior return, averaging over 30 basis points more per year (7.69% – 7.43%). However, VFIAX has been the better performer relatively recently.

→ Consider their ETF alternatives.

If you’re intimidated by the $3,000 minimum initial investment to open a position in either of the index funds, you might choose to first invest in their ETF counterparts and then transfer your earnings to the index fund once you’ve reached at least $3,000.

VTSAX’s ETF shares (VTI), at around $226 currently, have a much lower nominal fund price than VFIAX’s ETF (VOO) shares, which trade around $417. If the lower stock price allows you to buy VTI sooner, you might make more money overall than if you waited to invest in VOO.

Because their historical returns are very close to one another, the earlier you invest, the more money you could potentially make. Compounding returns help with building wealth over time.

Overall, these differences are slight and VTSAX and VFIAX tend to perform very similarly. Just remember: Past performance isn’t a guarantee of future results.

Why Do Investors Choose VTSAX and VFIAX?

While it might seem advantageous to start investing money in individual stocks on your own, there are benefits to investing in index funds.

Because VTSAX and VFIAX exist to promote the mission of diversified investing, they involve less risk than selecting individual stocks and bonds.

In the long run, index funds which follow the S&P 500 in some close proximity return around 10%, the historical average annual market return since the 1920s.

Following this investment strategy makes it impossible to capture alpha (outperform the market) like you might with individual stocks you find using the best stock research apps and software, you also won’t do worse than it.

In my own experience, I find it hard to argue with earning a 10% average annual return, especially when it costs you almost nothing over long periods of time.

If you want an alternative investing style, you might consider building a portfolio of individual stocks you expect to outperform the market.

Taking the time to analyze individual stocks and build them into a diversified portfolio with a service like M1 Finance could be an option to consider.

However, buying VTSAX and/or VFIAX is both simpler and statistically more likely to perform well. To be sure, buying the right individual stocks can lead to greater returns, but in some instances, individual stocks can (and sometimes do) go down to zero.

This has yet to happen with index funds.

Instead, index fund investing presents the most straightforward, cheapest, and dependable way to see strong long-term returns in your portfolio.

If you already know you want to invest in VTSAX or VFIAX, your next step comes with deciding which platform to invest with.

How to Invest in VTSAX or VFIAX and Track Your Investments

Many people choose to buy these index funds through Vanguard, but that isn’t your only choice. In fact, Vanguard primarily caters to those who only wish to invest in Vanguard funds and have little other trading or investing functionality options.

For example, the Vanguard app does not allow investors to buy and sell options, cryptocurrencies, or many other asset classes investors might wish to hold as part of a broader investment portfolio.

For a better investing platform which enables more investing choices, a great free stock app to consider is Firstrade. Firstrade is a leading online brokerage firm that lets you trade mutual funds, stocks, ETFs, options, fixed income products, and more for free.

This allows you to hold more investments in one account and not need to use multiple platforms for making investments outside of Vanguard index funds.

Further, much like the Vanguard app, it has free trades.

Where Firstrade differs from the Vanguard app, however, is that it does not assess the annual $20 fee for investment accounts under $10,000 in assets, has free research reports from recognized companies and it also offers a few more investment options.

Regarding fees, Firstrade highlights that it does not charge hidden fees.

You may also choose to invest in VTI or VOO, these mutual funds’ ETF counterparts, through Firstrade.

- Firstrade is a low-cost leader in trading stocks, ETFs, mutual funds, and options. In addition to standard commission-free offerings of stocks, ETFs, and options, Firstrade charges no options contract fees, and offers free trading of mutual funds as well.

- Also trade cryptocurrency and bonds on Firstrade.

- Beginners can get up to speed with Firstrade's robust education center, which offers written and video lessons covering everything from the basics of stocks to advanced options concepts.

- Very good selection of available investments

- Commission-free mutual funds

- No options contract fees

- High margin rates

- Below-average customer support

Related: 8 Best Stock Trading Apps, Software & Platforms for Beginners

While having a diversified portfolio and income-generating investments is a smart financial move, tracking everything can be frustrating for investors.

The net worth tracker app from Empower (Personal Capital is now Empower) is a wonderful way to keep a read on all of your financial assets in one place for free.

The service builds your complete financial picture by showing all of your accounts in one place. This shows a single view into your assets, whether in stocks, bonds, alternative investment options, bank accounts, real estate, and more, as well as any liabilities you may carry.

After placing all these into an easy-to-navigate dashboard, it builds your net worth calculation (assets – liabilities).

This complete view, paired with the app’s analytical tools, can help you to make smart decisions about how to manage your money.

Further, the Empower app can help you to organize all of your savings and spending based on different categories and make it easy to create a monthly spending target.

It’s a great stock tracking app for anyone looking to track their financial performance across time.

Some of their other top tools include a retirement planner, fee analyzer, and education planner.

As an additional option, it could be a worthwhile app to pursue if you are a high net worth investor who wants to access expert human financial advisors, though this is not a requirement for downloading the app and using its financial tools.

- Empower (formerly Personal Capital) offers both a free set of portfolio, net worth, and cash flow tracking tools, as well as paid asset management service.

- Link Empower to your bank and investing accounts, credit cards, and more to see a single view of useful information and data, including your net worth.

- Empower Wealth Management offers unlimited advice and retirement planning help, as well as managed ETF portfolios, for accounts with between $100,000 and $250,000 in assets. Higher asset tiers include access to dedicated financial advisors, retirement specialists, and more investment options (including stocks, options, real estate, and private equity).

- Free portfolio tracker

- Free net worth, cash flow, and investment reporting tools

- Dedicated investment advisor

- Free tax-loss harvesting

- Dividend reinvestment

- Automatic rebalancing

- 5-day-a-week live customer support, 24/7 email support

- High minimum for investment management ($100k)

- High investment management fee (0.89% AUM)

Related: Best Personal Capital Alternatives to Manage Your Portfolio

Final Thoughts

Overall, The Vanguard Total Stock Market Index Fund (VTSAX) and Vanguard 500 Index Fund Admiral Shares (VFIAX) are both solid options to consider as core holdings in your investment portfolio. Each largely comprises the same holdings and both have the same minimum investment requirement.

While they have slightly different Sharpe ratios, standard deviations, Morningstar ratings, and total overall average returns, the differences do not appear that significant.

Choosing either one is likely a strong investment option and something to consider when investing for the long-term. No matter what your investment decision, it’s typically a strategic move to invest earlier rather than later to maximize returns.

The fact that you’re analyzing the differences between VTSAX and VFIAX to determine which performs better is a sign that, as long as you have the funds, you’re ready to invest.