Reaching financial independence requires sound decision-making, determination, and effort.

However, we can also use a little luck to work in our favor. In that case, learning to invest in stocks is paramount, but why not enlist some help to get us started by scoring some free stocks?

Believe it or not, several companies offer free stocks online through their services and apps. For those interested in getting some of the most popular stocks in their portfolio for free, consider reviewing the services listed below and see how you can earn free stocks with minimal effort.

This article looks at the best ways to get free stocks from investing and trading apps, which you can choose to hold for the long-term or sell for a quick profit. Some may even pay dividends which qualify for the passive income tax rates (long-term capital gains).

Best Apps Giving Away Free Stocks (or Deposit Bonuses)

How to Get Free Stocks for Signing Up

In today’s world, it might seem far-fetched to think anything comes to you for free. In the world of stock investing, you might have found an exception when it comes to finding ways to get free stocks.

Believe it or not, since many new discount brokerages have entered the trading scene, they’ve managed to lure millions of investors to sign up for the services with free trades and free stocks.

Further, some even go so far as to offer free stock charting, analytics, research and more. Their value proposition only continues to grow as they find new ways to monetize services and offer you free shares of stock.

If you want to receive free stock from different brokers, you will need to meet certain criteria. Some choose to give investors free shares by simply opening an account while others require you to take certain actions like making a minimum deposit and making a trade.

Make sure you read the fine print before proceeding but you may find that these free stock shares are only one part of what makes these investing platforms worthwhile.

Some even bypass the stock and give you a sign up bonus as an account credit to get you started investing sooner.

Have a look at this following list to see which brokers offer free stocks and sign up bonuses for opening accounts with their platforms.

| App | Apple App Store Rating + Best For | Fees | Promotions |

|---|---|---|---|

Robinhood Robinhood | ☆ 4.4 / 5 Basic stock and ETF investing, options | No-commission stock and ETF trades | Bonus stock with sign up ($5 - $200 in value) |

E*Trade E*Trade | ☆ 4.6 / 5 Options traders | No-commission stock and ETF trades | Get $50-$6,000 to open and fund a new account |

moomoo moomoo | ☆ 4.6 / 5 Intermediate stock traders | No-commission stock and ETF trades | 15 bonus stocks |

eToro eToro | ☆ 4.6 / 5 CopyTrading | No-commission stock and ETF trades | $10 when making deposit of $100+ |

Webull Webull | ☆ 4.7 / 5 Self-directed investors and intermediate traders | No-commission stock and ETF trades | 20 bonus stocks with $500 deposit, valued between $60 - $60,000 |

Groundfloor Groundfloor | ☆ 4.8 / 5 Real estate investors looking for flips | No fees to invest, No AUM fees | $50 toward first investment with $100 deposit |

SoFi Invest® SoFi Invest® | ☆ 4.8 / 5 Active trading and robo-investing | No-commission stock and ETF trades | Bonus stock worth up to $1,000 |

Acorns Acorns | ☆ 4.8 / 5 Investors in college looking for a complete personal finance solution | $3/mo. - $12/mo. | $20 bonus when you set up recurring investments and make your first successful recurring investment |

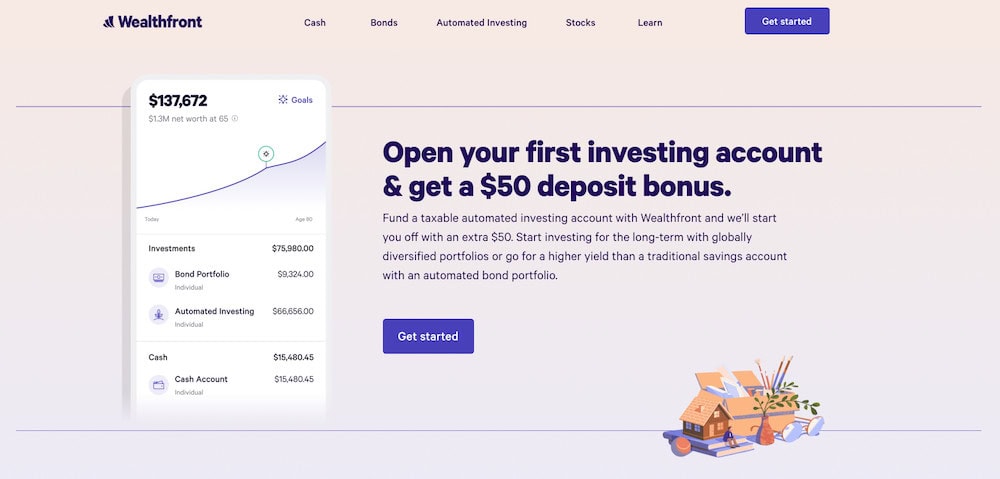

Wealthfront Wealthfront | ☆ 4.8 / 5 Investors seeking a robo-advisor with low minimum balances | 0.25% annual AUM fees | $50 deposit bonus |

| *Apple App Store Rating as of Dec. 12, 2024. | |||

1. Robinhood (1 Free Stock)

- Free stock value: $5 – $200

- Platforms: Web, mobile app (Apple iOS, Android)

Robinhood is a pioneer of commission-free trading, jumping into the investing public’s consciousness in 2013 when they rolled out commission-free trading. They remain a standout option for cost-minded investors thanks to their continued $0 commissions on stocks, ETFs, and options, as well as for its fractional trading, which allows people to invest with as little as $1.

More importantly, though, Robinhood has evolved from a bare-bones app appealing to mostly beginner investors to a fuller-featured account suitable for a wider range of experience levels.

For instance, Robinhood now offers individual retirement accounts (IRAs) and Roth IRAs via Robinhood Retirement. Functionally, it comes up short compared to many other IRA providers because of its investment options. It offers just stocks and ETFs; like with its brokerage account, mutual funds aren’t available.

Sign up for a Robinhood brokerage account or Robinhood retirement account today.

→ How to Get Free Stock on Robinhood

Like Webull and other Robinhood alternatives listed in this article, Robinhood offers an incentive of earning a free stock valued between $5 and $200.

The service boasts your ability to get a free stock from companies like AAPL, AMZN, BRK.B, CVX, DE, DIS, F, GOOGL, HON, JNJ, JPM, KO, LLY, MCD, MSFT, NVDA, PG, TSLA, WMT, XOM.

To receive your Robinhood free stock, sign up with this link and open your account within 24 hours. Upon approval for your account, you will receive your free share of stock by playing their pick-a-card game of chance.

- Robinhood is a pioneer in the investing app world, offering commission-free trades on stocks, ETFs, options, and cryptocurrency, as well as one of the deepest libraries of investing educational content.

- Investing for retirement? Robinhood will match 1% of any IRA transfers or 401(k) rollovers, as well as any annual contributions*, made to your Robinhood Retirement account—and you can get a 3% match on any new contributions if you subscribe to Robinhood Gold.

- Want more advanced trading tools? Download Robinhoold Legend—a desktop trading platform with real-time data, customizable layouts, deeper asset analysis, and more—for free.

- Robinhood's robo-advisory service, Robinhood Strategies, will build you a custom portfolio of stock and bond ETFs (and individual stocks for accounts with at least $500), for a low 0.25% in AUM, which is capped at $250 annually for Robinhood Gold members.

- Robinhood Gold also includes Level II market data provided by Nasdaq, higher interest rates on uninvested brokerage cash, lower margin trading rates, bigger Instant Deposits, and access to the Robinhood Gold Card (a 3% cash-back Visa credit card).

- Special offer: Sign up for Robinhood, link a bank account, and fund your account with at least $10, and receive a randomly selected cash amount between $5 and $200 to put toward certain fractional shares.

- Very good selection of available investments in brokerage accounts

- 1% match on rollovers, IRA transfers, and new contributions to IRAs and Roth IRAs (3% new-contribution match with Robinhood Gold)

- Automated recommended portfolios

- Intuitive interface

- Robo-advisory service (Robinhood Strategies)

- Extensive educational library

- No mutual funds in brokerage or IRAs

- Match doesn't apply to Robinhood Strategies accounts

2. E*Trade ($50-$6,000 Deposit Bonus)

- Free stock value: $50-$6,000

E*Trade is a tried-and-true investing platform which has led the retail investing industry for many years.

Of note, E*Trade provides access to educational resources which can assist you with learning how to choose from your multiple investing options, conducting investment research software and analysis, trading stock futures and diversifying your portfolio.

They have additional trading options and data as a result of acquiring OptionsHouse. This can assist with making more-informed options investment decisions.

As another service, E*Trade also offers retirement planning to clients as well as in-person informational sessions annually in certain areas.

E*Trade has three platforms. All are free and have no minimum investment limit.

- Power E*Trade offers investors real-time data and studies.

- E*Trade Web provides live market commentary and stock analysis.

- E*Trade Pro gives you strategy scanners and back-testing.

Each program gives you access to a dashboard where you keep track of your accounts, investments, and make your trades. E*Trade does have small fees for options contracts and some fees involved with retirement accounts.

→ How to Get E*Trade’s New Account Deposit Bonus

Getting a free bonus from E*Trade only requires you to open an account and deposit/transfer/rollover funds: click the “Open Account” button below to open and fund your new account. The E*Trade sign-up bonus ranges as follows:

Currently, the service offers a cash bonus in the following increments:

- $1,000-$4,999 earns $50.

- $5,000-$19,999 earns $150.

- $20,000-$49,999 earns $200.

- $50,000-$99,999 earns $300.

- $100,000-$199,999 earns $600.

- $200,000-$499,999 earns $800.

- $500,000-$999,999 earns $1,000.

- $1,000,000-$1,499,999 earns $3,000.

- $1,500,000-$1,999,999 earns $5,000.

- $2,000,000 or more earns $6,000.

Sign up by clicking “Open Account” below.

- E*Trade is one of the best online and mobile trading platforms among discount brokers, offering a full range of investments (including professionally managed accounts). It allows you to invest in stocks, ETFs, mutual funds, options, bonds, futures, micro futures, and futures options.

- $0 commission trading for online U.S.-listed stocks, ETFs, options, mutual funds, Treasuries, and new-issue bonds. (Options have a 65¢ contract fee, or 50¢ at certain volume thresholds.)

- Opening an account is easy and only takes a couple of minutes.

- Bonus: Get between $50 and $10,000* when you click the box below, then open and fund a new investment account using promo code "OFFER25."

- Excellent selection of available investments

- Commission-free mutual funds and Treasuries

- Automated portfolio builders and prebuilt mutual fund and ETF portfolios

- Separate apps for power users and casual users

- Limited availability of fractional shares (only in DRIP plans or robo-created portfolio)

- No direct cryptocurrency trading

3. Moomoo (15 Free Stocks)

- Free stock value: 15 free stocks, each valued $2 – $2,000

Moomoo is a commission-free professional trading app that enables active traders to trade like a pro with professional grade tools and interface. The free advanced trading app integrates AI-powered trading tools with free real-time Level 2, comprehensive data and an engaged trading community in one app.

Over 2 million clients worldwide have opened a brokerage account with FUTU, an SEC registered broker-dealer who backs the app with a fully digitized brokerage and wealth management app.

→ How to Get Free Stocks on Moomoo

You can receive up to 15 free shares (collectively worth $30 – $30,000) from Moomoo. Here’s how:

- If you open a new brokerage account with Moomoo and fund it with more than $100, you’ll earn five free stocks valued between $2 and $2,000 each.

- If you deposit more than $1,000, you’ll receive 15 total shares of stock worth between $30 – $30,000.

Enjoy these free bonus shares by opening an account with Moomoo through our link and making a qualifying deposit.

- Moomoo is an all-in-one investment app geared toward stock, ETF, and options traders who want to work with real-time market data at the ready.

- The service offers free Level 2 market data, offering more insight into the trading activity below the NBBO surface shown on many financial data sites.

- Use the service's powerful stock charting software capabilities to find trading opportunities.

- Get a great return on uninvested cash: Moomoo currently offers a 4.1% APY from its cash sweep program, though current promo offers 8.1% for a limited time.

- Special offer: New users get up to $1,000 in free NVDA stock when they sign up using our link and make a qualifying deposit,* as well as a three-month APY boost (to a total 8.1% APY on uninvested cash).

- Additional special offer for transfers: New customers who transfer assets into a Moomoo account can also receive a 3% match on their transfer up to $20,000 (for a reward cap of $600). New users who transfer in $50,000 or more and maintain for three days will also receive two suite tickets to a New York Mets game.

- Free Level 2 market data

- Free powerful stock charting software

- Free paper trading

- Low margin rates

- Fewer features than peers

- No robo-advisor functionality

4. eToro (Get $10 free)

- Promotion: Get $10 when you deposit $100

- Platforms: Desktop app (Windows, macOS), web, mobile app (Apple iOS, Android)

Most trading apps keep you in one place: Your account. But eToro wants to change that.

eToro has made investing social by giving you the chance to engage with other traders, creating a social trading network designed to share ideas on the publicly traded markets. You can trade stocks, exchange-traded funds (ETFs), and options commission-free, and you can also get exposure to cryptocurrencies. (In non-U.S. markets, you can also trade currencies, as well as contracts-for-difference, or CFDs.)

eToro is known for its CopyTrader service—a novel product that allows you to copy the trades of experienced investors automatically. No more guesswork on making trades yourself; you simply follow the leader and let the app handle the legwork for you. While this might not interest advanced traders, it’s an appealing feature for beginners looking to replicate the performance of popular traders on the platform. (Editor’s Note: Even though this can make for a fun trading experience, you should still be fully aware of the risks entailed through this feature—namely, the potential for losses.)

Of course, you don’t have to copy anyone—you can trade on your own ideas. This intuitive investing app began with a strong crypto focus, but you can now make self-directed trades across a host of other assets.

Opening an account is quick and simple to do. Simply visit eToro’s website to open and fund an account. From there, you get access to their commission-free trading platform for stocks, ETFs, options, forex and crypto.

→ How to get $10 free with eToro

For a limited time, you can get $10 when you deposit $100* in your eToro account. To get your free $10 bonus, you’ll need to:

- Sign up for an eToro account

- Deposit $100

- Explore stocks, ETFs, and crypto

You’ll automatically receive $10 directly to your account balance. The deposited funds must remain in your account for a minimum of 90 days following the date of deposit in order to receive the one-time $10 reward deposited in your eToro account.

- The eToro trading platform allows you to buy and sell stocks, ETFs, and options with 0% commission, including no contract fees on options.

- Trade dozens of the most popular cryptocurrencies.

- Not sure what kind of trading strategy you want to employ? eToro allows you to replicate the trades of popular traders automatically, in real time.

- Test out your strategies with eToro's $100,000 practice account.

- $100 minimum deposit to get started.

- Special Offer: Get $10 when you deposit $100 or more.*

- Good selection of available investments

- No options contract fees

- Fractional shares

- Copy trading functionality

- Strong technical analysis tools available

- $100,000 virtual portfolio included for free

- Charges withdrawal fee ($5)

- Doesn't offer robust fundamental tools

- Unavailable in 4 U.S. states (NY, NV, HI, and MN)

Related: 15 Best Stock Research & Analysis Apps, Tools and Sites

5. Webull (20 Free Stocks)

- Free stock value: $60 to $60,000

- Platforms: Desktop, Apple iOS and Google Android.

Webull first hit the investing world in 2018 and made a splash by offering free stock trading, as well as commission-free trading of exchange-traded funds (ETFs) and options. And since then, it has become one of the best stock apps for intermediate traders and investors, though many of its features are helpful to beginners as well.

For one, Webull remains friendly to wallet-conscious traders today. It costs nothing to open a Webull account. Stocks, ETFs, and options still trade commission-free. Many options have $0 contract fees. And Webull has no deposit minimums. On top of that, it offers fractional shares, which allows investors to start buying for as little as $1. So beginners working with small dollar amounts can still easily diversify across numerous investments.

Newer investors can also learn trading skills through the courses in Webull’s education center, and even practice their skills via Webull’s paper trading service.

And Webull is available across just about every platform, allowing you to research, trade, and track your stocks on your smartphone, tablet, or desktop.

Why choose Webull to trade stocks?

Webull provides investors with several useful features and tools, including:

- Customizable screeners for both stocks and ETFs

- Preset lists—including Top Gainers, Top Losers, Most Active, and Best-Performing Industries—investors can use to identify opportunities

- Voice commands: Simply speak to buy, sell, or look up information about a ticker

- “Big Button Mode”: Populates giant buttons on your screen that allow you to quickly make trades with just a push

- Charting tools

- Free real-time stock quotes and stock alerts

We’ll point out that while Webull allows for many types of commission-free trades, other costs will still apply to a few transactions. For instance, a 55-cent contract fee applies to certain options trades. And Webull doesn’t directly charge fees for trading cryptocurrencies; however, it does build a 1-percentage-point markup into the price of cryptocurrency when you buy or sell crypto.

One particularly noteworthy shortcoming for investors is that you can’t buy mutual funds on Webull. Yes, ETFs offer a wide array of diversified strategies, but the mutual fund world offers some cheap index funds and many successful actively managed strategies.

Regardless, Webull remains one of the best, and most cost-friendly, trading platforms you can come across. And on top of all the free features mentioned above, Webull also runs frequent promotions. For instance, right now …

→ How to Get the Webull Free Stock Sign-Up Bonus

Currently, Webull is offering new users 20 free shares of stock worth between $3 and $3,000 each—so, the bonus is worth between $60 and $90,000—when they open an account and deposit at least $500.

To claim this potential bounty, you will first need to sign up through this link, open your account and make a deposit of at least $500. If you deposit $25,000 or more, you’d receive 70 free fractional shares worth between $3 and $3,000 each, good for $210 – $210,000.

Read more in our Webull review, or sign up at Webull today.

- Webull is a low-cost trading and investing app that allows you to invest in stocks, ETFs, options, futures, commodities, and crypto, and even participate in initial public offerings (IPOs).

- No-commission stock, ETF, and option trades (and many options have $0 contract fees).

- Trading features such as charting tools, technical indicators, customizable screeners, real-time stock alerts, and group orders.

- Let Webull manage your money for you with Webull Smart Advisor, which combines Webull's in-house investment expertise and artificial intelligence to build, manage, and rebalance an ETF portfolio for you.

- Sign up for Webull Cash Management to earn up to a 4.1% APY on uninvested cash.

- New users get one free month of Nasdaq TotalView's Level 2 Quotes service. (That subscription costs $2.99/mo. thereafter.)

- Subscribe to Webull Premium and receive a premium APY on uninvested cash in individual and joint cash accounts, premium margin rates, a 3% match when you transfer or roll over your IRA, and an extra 3.5% match on qualifying IRA contributions.

- Special offer: Make an initial deposit of at least $2,000 and receive 1.) a $100 cash bonus, 2.) a 2% match of your deposit (up to a maximum bonus of $20,000), 3.) a 30-day voucher for Webull Premium, 4.) a 30-day 4.0% APY booster on uninvested cash (for a total of 8.1%).**

- Good selection of available investments

- Fractional shares

- Powerful technical analysis tools

- Offers robo-advisory services

- Accessible to beginning and intermediate users

- Voice commands

- Offers highly competitive APY through Webull Cash Management

- Does not support mutual funds

6. Groundfloor ($50 bonus)

- Free stock value: $50

- Platform: Desktop

Groundfloor is a different type of investment platform from the others listed here. Groundfloor acts as a crowdsourced real estate investing platform which focuses on debt investments.

The platform focuses on purchasing fixer-uppers, performing the maintenance and upgrades, and then flipping it for a profit.

Groundfloor provides financing for short-term residential real estate loans and pays the platform’s investors interest for lending their funds. It reviews loan applications and offers investors the ability to fund one it believes will perform. In exchange, investors receive a set amount of interest from their loan as well as a return of principal. Most loans have a 6-12 month term, but can extend to 18 months.

→ How to Get Your Free Bonus from Groundfloor

As an incentive to open your account with Groundfloor and begin investing, they offer a $50 bonus if you deposit $100.

To receive your bonus, you will need to sign up through this link, connect your bank account to fund your account and deposit a minimum of $1,000.

You will receive your $50 investment credit bonus once your deposit settles in your Groundfloor account.

- Crowdsourced real estate investing platform which offers high-yield, short-term real estate debt investments

- Offers collateralized, secured real estate debt with 12-18 month terms

- Has delivered consistent 10%+ returns over past six years with repayments received in 6-9 months on average

- Offers after-tax and IRA investment options

- Sign Up Offer: Limited Time Offer: When you invest $1,000, you will receive a $100 credit to invest on Groundfloor*.

7. SoFi Invest® (1 Bonus Stock)

SoFi Invest is an app that allows you to track and trade your money. The service is the latest from the SoFi financial wellness platform and offers no-commission trades on stocks, ETFs, options and more.

The service allows you to be an active trader by picking stocks on a regular basis or passive through its robo-investing service.

The company wants to serve all customers who have an interest in improving their financial situation alongside participating in their other personal finance products like student loans, money management, credit cards and more.

→ How to Get Your Bonus Stock on SoFi Invest

By opening a Wealth account with SoFi Invest and depositing at least $10, you become eligible for a sign-up bonus worth $5 – $1,000.

- SoFi Invest allows you to trade or invest in stocks, ETFs, and options with no commissions and no account minimums. You can also participate in some initial public offerings (IPOs).

- Invest for as little as $5 with fractional shares.

- Robo-advisory services, including goal planning and auto-rebalancing, available for annual 0.25% AUM fee.

- Subscribe to SoFi Plus to unlock more than $1,000 per year in extra value, including a 1% match on recurring investment deposits, preferred IPO access, higher cash-back rewards on certain SoFi credit cards, a six-month APY boost, and more.

- Special offer: Get up to $1,000 in stock when you open and fund a new Active Invest account.*

- Good selection of available investments

- No options contract fees

- DIY and robo-investing options

- Fractional shares

- No mutual funds

- Limited trading tools

- No tax-loss harvesting

- No socially responsible robo-advisor functionality

8. Acorns ($20 Bonus)

- Free value: $20

- Platforms: Apple iOS and Google Android.

Acorns is a investing app for minors and young adults wishing to start small and grow their portfolios into large amounts. Much as you would an acorn maturing into a mighty oak tree.

The micro investing app works by investing in tiny increments through rounding up your purchases on linked credit cards to the nearest dollar, making it one of the better money apps for kids and teens. For example: If you purchase a $4.25 latte from Starbucks, Acorns will round this amount up to $5 and invest the $0.75 on your behalf if you have automatic roundups enabled on your account.

The idea behind the app is simple: over time, you fit money into your investments through your regular purchases. The service automates your investing through small roundups, masking the decision to invest.

The service takes your contributions and invests them into professionally-created portfolios to ensure your investments align with your financial goals and remain diversified. This can be a smart way to learn how to invest as a teenager or younger because it builds good lifelong investing habits.

For a small monthly fee (as low as $3/mo.), you can use this service. Acorns also offers Acorns Later, a service meant to set aside money in an individual retirement account (IRA), one of the best investments for young adults. For that, you need to sign up for Acorns Personal Plus ($6 per month) or Premium ($12 per month).

Further, you can also sign up for an Acorns Spend debit card for kids and teens as well as a checking account that will allow you to earn and save more money.

→ How to Get Your Free Bonus from Acorns

To entice people to begin using their product, Acorns offers a $20 bonus when you sign up for a new account and setup a recurring deposit. After completing your signup, Acorns will deposit $20 into your account. From there, it can be invested according to your stated preferences.

Learn more in our Acorns review.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Silver tier includes perks such as a 25% match on Acorns Earn rewards (up to $200/mo.), generous APYs on Checking and Emergency Fund, and live Q&As with investing experts.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts for children with 1% contribution matches.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions in your first year.*

- Special offer: Get a free $20 bonus investment when you sign up with our link and start making recurring investments.**

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Silver and Gold)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Gold for any self-directed investing options

Related: Best Acorns Alternatives: Micro-Investing Apps to Use

9. Wealthfront ($50 Deposit Bonus)

- Free stock value: $50

- Platforms: Desktop web app, Apple iOS and Google Android.

Wealthfront is a popular robo-advisor that offers numerous account types, including individual, joint, and trust taxable brokerage accounts, Traditional, Roth, SEP, and Rollover IRAs and 529 plans.

While some of its robo-advisor competitors have a relatively high minimum balance requirement of a few thousand dollars or much more, Wealthfront requires a fairly small initial deposit of $500 to open an account. (Again, that’s high for an investment account, but low for a robo-advisory product.) So if you don’t have a huge sum invested already to move into the account or to rollover from an existing account like a 401(k) or other IRA, this account might be a good choice.

Wealthfront offers some valuable perks with its accounts, including automatic tax-loss harvesting, automatic rebalancing, automatic trading, and the option to customize your expert-built portfolio. This top robo-advisor also offers access to a 529 plan (or the ability to link an external one to your account) to help with saving for educational expenses. This is an uncommon feature for most standalone robo-advisors outside of a traditional brokerage, so it’s well worth noting.

If you’re considering putting this on your shortlist, just note that Wealthfront does charge a 0.25% annual management fee across the board. That’s more affordable than some robo-advisors, but it’s also not free. Learn more on Wealthfront’s website.

→ How to Get Your $50 Deposit Bonus on Wealthfront

You can receive a $50 deposit bonus from Wealthfront. If you open a new taxable brokerage account with Wealthfront and fund it with $500 or more within 30 days of account opening and leave the funds there for at least 7 days, you’ll receive a $50 deposit bonus in your account.

Enjoy this deposit bonus by opening an account with Wealthfront through our link and making a qualifying deposit.

- Wealthfront provides the power of robo-investing for investors with a small starting deposit ($500 minimum).

- Answer just a few questions, and Wealthfront will build you a portfolio of low-cost index ETFs from up to 17 different asset classes, then manage rebalancing and trading as long as you have the account.

- Wealthfront allows you to link an outside 529 educational savings plan or open one through Wealthfront (plan is sponsored by the state of Nevada).

- Bonus: Get a $50 deposit bonus when you fund your first taxable investment account

- Low minimum investment for a *robo-investing product*

- Tax-loss harvesting

- Offers 529 plan management, investment account

- High minimum investment for an *investment account*

- Few investment choices

- No access to human financial advisors (CFPs)

Related Questions on Free Stocks

What are the Tax Consequences for Receiving Free Stock?

If you receive free stocks or sign-up bonuses from any of these brokerages, you should have awareness of the tax implications involved.

More broadly speaking, let’s discuss the tax impact of investing in stocks in general by reviewing some of the applicable rules affecting investing.

In particular, the most widely-known tax consequence associated with buying and selling stocks is the capital gains tax, which occurs when you sell a stock for a profit.

This tax breaks into two categories, depending on how long you held the stock before selling:

- Short Term Capital Gains: If you recognize a gain by selling an investment you held for under a year for a higher price than you originally paid, you will pay taxes on this in your usual marginal income tax bracket. This means if your top tax bracket was 22%, you will pay this amount of tax on your gain.

- Long Term Capital Gains: You face this tax when you sell an investment you held for over a year for a gain. These rates can be more advantageous than short-term capital gains because they vary from 0% to 20%.

When you receive a free stock from the brokerages listed above, this gain technically counts as taxable income and should be reported on your tax return. It will be taxed as if it were ordinary income (i.e., like your paycheck).

Another tax you may face comes from dividends you could receive from stocks which act as income-generating assets.

These typically count as taxable income but you will need to understand whether these dividends count as qualified or non-qualified dividends to understand how you claim them on your tax return.

Non-qualified or ordinary dividends have you pay the same tax rate as your regular income tax bracket, while qualified dividends are taxed at the same long-term capital gains rates above (0% to 20% depending on your income and situation).

If you want to pay as little tax as possible on these investments, you will need to think of investing as a long-term strategy.

Therefore, you should consider whether your investments can be held for over a year to avoid paying higher capital gains taxes.

Finally, not all investments result in gains when sold. If you incur a loss, you can use it to offset your capital gains or even have up to $3,000 of capital losses per year be used to lower your taxable income reported on your tax return.

Any unused amount can roll forward indefinitely to offset future capital gains or income (only up to $3,000 per year for income offsets).

Where Can I Get Stocks for Free?

Get your free stocks from the following companies:

Can You Buy Stocks for Free?

It is now common for many stock trading companies to offer free trades. Most of the companies above offer free stock trades (some even act as the best stock news apps or stock research websites) though some do charge commissions.

Many brokers have been forced to compete on price and must now follow the race to the bottom for offering free stock trades to remain in the consumer’s consideration.

What Companies Offer Free Stock Trading?

You can participate in free stock trading from the following companies both on and not on this list:

*Company offers free trading but charges monthly account subscription fees for bundled services offered through the all-in-one financial platforms.

How to Get Free Stocks: What App Gives You a Free Stock?

As described above, all of these companies offer free stock or a free bonus for signing up and possibly making some minimum deposit.

Of the companies listed, Robinhood offers free stocks for signing up.

The remaining companies all offer signup bonuses in the form of cash or fee rebates for transferring assets into your new investment account.

Does Robinhood Really Give Free Stock?

Robinhood does give free stock for opening an account and linking a bank account. No deposit is necessary as of when this was published. The stock will vary but can be worth as little as $5 or as much as $200.

What Free Stocks Can I Get?

The stocks awarded will vary because the companies target a specific dollar value when granting a stock. As stock prices rise and fall, the stocks eligible for being given as free stocks will change.

For Webull, the company has awarded shares from the following companies:

- The New York Times (NYT)

- International Paper (IP)

- Douglas Emmett, Inc. (DEI)

- Vonage Holdings (VG)

How Many Free Stocks Can You Get on Robinhood? Webull?

Robinhood allows up to $200 per year of free stocks as referral bonuses through their in-app referral program. Webull currently has no limit to the number of free stocks you can receive.

How Long Does It Take to Get My Free Stock?

For most of the companies listed here, the stock award can be nearly instant, while some can take a few business days for the free stock to settle in your account.

Robinhood awards them instantly and will notify you each morning if you have received your free stock.

You will need to read the fine print on how long you must hold the stock in your account before you can sell it for cash. Once you receive your free stock, you may need to hold onto it for a minimum time.

Nvstr, for example, requires you to hold the cash reward in your account for at least one year as well as make one trade within 30 days of account opening.

Is Robinhood Still Giving Free Stock?

Yes. As of this writing, Robinhood continues to give free stocks to individuals who open an account, link a bank account and fund the account.

Robinhood has used this lure to draw in millions of investors who first begin investing with the stock trading app.

What is the Cheapest Way to Buy Stock?

The cheapest way to buy stock is through a discount broker who charges no trading commissions nor monthly or annual account subscription fees.

Further, you want a discount broker who doesn’t enforce account minimums, making inactivity or low account balances not a problem.

One such broker to consider is Webull. The free stock trading app has no investment minimums, charges no trading commissions nor recurring subscription fees. Trading with Webull is completely free and easy to do.

Are Free Stocks Really Free?

The common adage, “There’s no such thing as a free lunch” also applies to the free stocks world.

Most apps require you to make some minimum initial deposit in order to unlock the free stocks or sign up bonus for joining the service.

However, many of them require a very low amount of capital to receive a free stock.

Therefore, free stocks are mostly really free. It doesn’t cost you money in the sense that you must spend it, but it does require you to commit money upfront in order to receive the free stocks or bonuses offered by the company.

This might also require a minimum time commitment to holding the money on the platform.

Therefore, it is a judgement call on your part about whether free stocks are really free if you must commit a certain amount for a certain period of time to keep your free stocks.

Can You Sell Your Free Stock on Robinhood?

Yes. Robinhood allows you to sell your free stock on the app after a few days. You cannot sell the stock as soon as you receive it. They require you to hold it in your account for at least 3 market days prior to selling.

Afterward, you may sell the stock to buy another share of stock or other investment offered on the app or withdraw the cash to your bank account.

How Do I Claim My Free Robinhood Stock?

Claiming your free Robinhood stock is easy. After you’ve completed your enrollment in the app and made the connection to your checking account, Robinhood will send you a push notification alerting you to having earned a free stock from Robinhood.

From there, you click through the on-screen prompts to navigate to your free stocks selection screen, allowing you to pick between 1 of 3 available options.

They make the free stocks giveaway into a game of chance, meaning you don’t know what is behind each option.

You need to play their game and you will immediately receive the free stock you picked in your account as soon as you return to your account homepage.

How Can I Get Free Apple Stock?

You can receive free Apple stock from Robinhood if you are lucky enough to receive one of their higher value free stock giveaways.

The odds are lower that you will receive a share of Apple stock as opposed to stocks like small pharmaceutical companies, mining operations or other tech companies. However, you can receive a free share of Apple stock, Facebook stock or other companies.

Webull occasionally does special promotions for giving away Apple, Facebook, Amazon, Alphabet (Google), Tesla and other major tech stocks.

Can You Get Free Stocks with No Deposit?

At least one app, Plynk, allows you to receive cash with no deposit made into your account.

Though, generally, companies require some level of financial commitment before giving free stocks. Usually, investing companies use this as a gating action, meaning you must commit some minimum level of financial capital to their app for a minimum period of time to ensure you are an active user and not a bot.

Investing apps could be scammed by millions of people opening false accounts for free stocks and no deposit made.

Requiring a minimum level of money to be deposited and held on the platform requires you to be real or at least willing enough to park your money there for a period.

The apps above have various minimum deposit levels. Robinhood has low (when not accounting for recurring subscription fees) minimum deposits while Webull has one of the highest.

![7 Best Micro-Investing Apps [Small Investment Apps] 58 best micro investing apps](https://youngandtheinvested.com/wp-content/uploads/best-micro-investing-apps.webp)