Stock investing is one of the best ways to grow your money and earn financial freedom. But that doesn’t mean it’s easy to invest in stocks.

You want the highest capital appreciation possible, but unfortunately, risk and reward are intertwined. One of the most reliable ways to make money when you invest in stocks is to conduct ample investment research before purchasing and then to hold the most promising stocks long-term. Day trading may look appealing, but financial advisors agree it should be reserved for only the most experienced traders. But how do you know what stocks to buy as long-term investments?

Choosing individual stocks can be trickier than buying stock mutual funds or stock exchange traded funds (ETFs), which hold hundreds if not thousands of stocks for you, providing instant diversification. Trading individual stocks (and especially growth stocks) is a more aggressive approach; but one that gives you a chance at a more significant capital appreciation with individual stocks.

While a balanced portfolio will contain individual stocks, stock funds, and other investments, today, I just want to focus on which types of stocks are best to buy for the long-term, whether you buy them individually or as part of a larger fund.

Everyone’s stock research process looks a little different, so you’ll have to establish your own. Just make sure your process involves:

- Researching the company

- Calculating its standard valuation metrics

- Looking at its historical stock prices

Let’s get started.

Table of Contents

Long-Term Stock Recommendations to Consider—Top Picks

|

4.7

|

4.8

|

|

$99 for 1st year; $199 renewal

|

Premium: 7-day free trial, then $269/yr. ($30 discount)* Pro: $89 for 1 mo., then $2,149/yr. ($250 discount)**

|

How to Know What Stocks to Buy: What to Look for in a Stock

1. Establish a Process

If you don’t have an established process for vetting and buying stocks, it’s easy to make rash, emotional purchasing decisions. You might hear about someone else making money on a stock, get a sudden fear of missing out (FOMO), and buy it right before the price drops drastically.

Instead, create a logical plan for evaluating stocks and stick to it. Write down your investing goals, how much you can afford to invest, what industries you believe most in, how expert opinions will affect your decisions, and what metrics you want to check for each stock.

Consider how long you plan to hold stocks. You can constantly adjust your plan if there are unexpected developments with a company.

For most people, holding long-term stocks is taxed more leniently than when you hold them as a short-term investment. If you plan to hold a stock for decades, don’t worry about small dips.

Never buy a stock without first researching the company, evaluating commonly-used valuation metrics, and checking stock prices over time.

2. Research the Company Before Engaging in Stock Market Investing

Always research a company and the industry it is in before you invest in stocks. Don’t just trust a “hot tip,” but instead conduct due diligence. An excellent place to start is by reading the company’s most recent annual report.

You can also look at the following:

- SEC filings

- Quarterly earnings

- Conference call transcripts

- Financial statements

- Press releases

- Recent news articles showing public opinion

The brokerage firm you’ll use to buy stocks should also have additional information, such as ratings or “grades” from popular investment analysis companies.

Consider looking up the company’s competitors to see how it stacks up in comparison. See if a company pays investors dividend payments you can make use of immediately or reinvest. As you conduct your research, take note of the valuation metrics explained below.

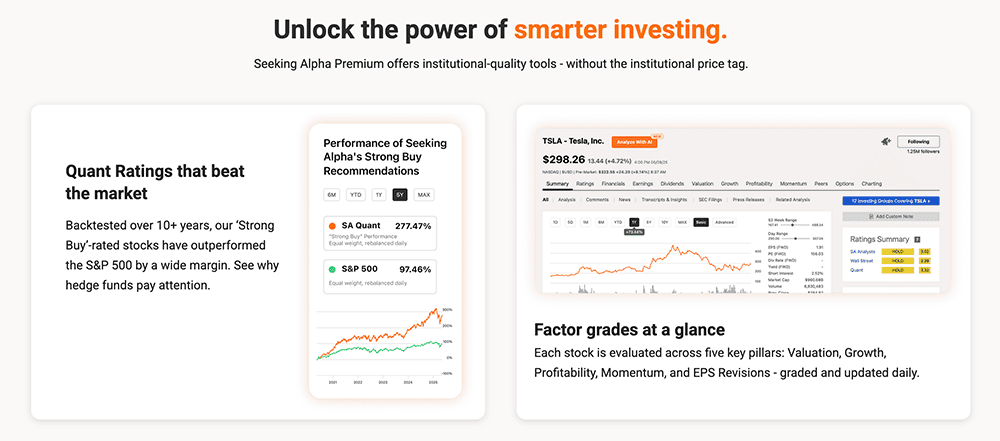

Seeking Alpha (Best for Investment Research + Stock Recommendations)

- Available: Sign up here

Seeking Alpha Premium is a great resource to do all of your research and due diligence with one service. The company provides access to company financials, valuation analysis, investor commentary and proprietary stock ratings and more.

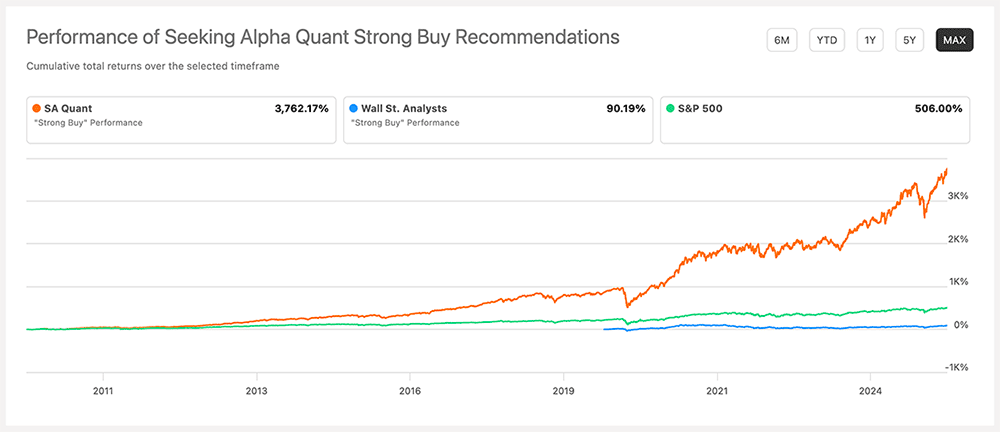

The service’s stock ratings have dramatically outperformed the S&P 500 since 2010, beating the S&P 500 by more than 3,250 percentage points.

This continued outperformance could build substantial wealth by following the service’s “Very Bullish” Top Quant Ratings recommendations.

Check out our Seeking Alpha review to learn more. And if you use our link, you’ll get a free 7-day trial (to see if SA’s Premium services make sense for your needs) and a discounted rate on your first year of subscription.

- Seeking Alpha Premium and Pro help you find profitable investing ideas, improve your portfolio, research stocks better and faster, track the news to find investing opportunities, and connects you to the world's largest investing community.

- A Premium subscription provides access to Seeking Alpha's stock and ETF ratings, including Seeking Alpha Quant Strong Buy recommendations, which have greatly outperformed the stock market over time.

- Premium also gives you access to Seeking Alpha's portfolio health check, which will analyze your portfolio's quality, risk level, and performance.

- Advanced and professional investors can sign up for Pro, where they'll get everything from Premium, as well as instant access to ideas from SA's top 15 analysts, the PRO Quant Portfolio (for active traders), short-selling ideas, and more.

- Special offer on Premium: New subscribers through our link receive a $30 discount off the price of Seeking Alpha Premium in their first year.*

- Special offer on Pro: New subscribers through our link receive one month of Pro for $89, then get $250 off their first full year's subscription.**

- Active community of engaged investors and analysts

- Stock screeners, quantitative tools for stock analysis

- Strong track record of market outperformance on stock ratings

- Minimal mutual fund coverage

Related: 6 Best Seeking Alpha Alternatives [Other Sites to Consider]

Evaluate Important Valuation Metrics

Valuation metrics are designed to provide investors with an idea of what a company might be worth. Don’t weigh any metric too heavily, but instead look at the big picture of what a stock’s metrics show.

Below are some of the most popular metrics investors measure.

Related: The 9 Best Dividend Stocks for Beginners

1. Price-to-Earnings (P/E) Ratio

The price-to-earnings (P/E) ratio is the ratio of the company’s share price to its earnings per share. You divide the stock price by the stock’s earnings per share.

This metric shows the current market’s willingness to pay for a stock based on past earnings or expected future earnings. For example, if a stock trades for $20 and the company’s earnings were $2 per share during the past year, it would have a P/E ratio of 10 or “10 times earnings.”

High P/E ratios might indicate a stock’s price is high for its earnings and is possibly overvalued. You don’t want to buy vastly overvalued stocks.

However, some companies that grow quickly, such as technology-focused companies, have high P/E ratios but aren’t overvalued. Don’t completely disregard a stock just because its P/E ratio is high, as this is common for growth stocks.

What’s more important is looking at a company’s P/E ratio and then assessing the relative P/E ratios of its peers. Does this company trade at a higher or lower P/E ratio compared to its direct competition?

Use this to judge whether the stock looks set to perform better or worse than similar companies or the market mispricing its underlying value.

A low ratio suggests the stock’s price is low in relation to the earnings. This might mean the market has mispriced the stock or that it has low growth prospects. An underpriced stock might be worth buying.

2. Price/Earnings-to-Growth (PEG) Ratio

The price/earnings-to-growth (PEG) ratio is a business’s P/E ratio (explained above) divided by its expected growth rate. You can sometimes estimate future growth based on past growth rates.

Since this is just an estimate, the calculation isn’t perfect. The PEG ratio can create a more complete image than just the price-to-earnings ratio for whether a stock is undervalued or overvalued.

Let’s say the P/E ratio is 14, and the expected growth rate is 10%. The PEG ratio would be 14/10 or 1.4. Usually, a PEG ratio of 1.0 or lower indicates a stock is fairly priced or undervalued. If it’s above 1.0, it suggests the stock could be overvalued.

3. Enterprise Value / Sales (EV/S)

A business’s enterprise value is approximately how much it would cost to buy the company. The enterprise value-to-sales (EV/S) ratio compares a company’s total value to its sales, and it shows how many dollars of EV are created through one dollar of yearly sales.

To calculate EV/S, you do the following:

- Add the company’s outstanding debt to its market cap

- Subtract its cash and cash equivalents

- Divide the result by the business’s annual sales (net sales, not gross sales)

In general, a low ratio is a cheaper company to invest in and could be undervalued.

EV/S is more accurate than just the price-to-sales ratio. However, it can also require a lot of searching through financial statements, and the calculation doesn’t include the company’s taxes or expenses, which leaves some room for error.

4. Beta Coefficient

A beta coefficient measures how much a stock moves compared to the overall stock market. In other words, it measures the stock’s volatility.

Covariance calculates the directional relationship between two assets’ returns. In a positive covariance, they move in the same direction, and they move opposite each other with a negative covariance.

Variance measures how far numbers are from each other in a data set. To calculate a stock’s beta coefficient, divide the covariance by the variance.

If the beta is 1.0, the volatility is similar to the market. The more volatile a stock, the riskier it is to buy. For example, penny stocks are known to be very volatile.

Volatile stocks can lead to high gains or high losses. Usually, day traders and other swing traders buy and sell stocks with high volatility frequently, and they aren’t as good of a fit for a long-term investment portfolio.

Related: 10 Best Investments for Roth IRA Accounts [Target High-Growth]

Look at a Company’s Stock Prices Over Time (Chart Evaluation)

While past stock performance makes no guarantees about future performance, looking at how a company has performed in the stock market over time can help show how investors’ perception of the company has evolved.

Technical analysts check historical prices to find stocks’ support and resistance levels. Fundamental analysts believe a company’s stock performance over time can aid in predicting future growth and determining value.

You’ve likely heard the investing advice of “Buy Low, Sell High.” Well, you won’t know what prices are considered low and high until you’ve looked at a stock’s prices over time.

Notice a stock’s trendlines, also called bounding lines. These are lines drawn on stock charts that connect two (or several) price points. Do the lines show a stock’s price has been on the rise or in decline?

If a stock has consistently been rising, it may be worth buying. The Motley Fool’s Stock Advisor and Rule Breakers (now part of Epic) use this as a screening criterion for finding the best stocks to buy.

The stock picking service reasons the best stocks continue to rise in a trend as they outperform peers in their specific industry. Strength begets strength in their investment screening methodology.

If the stock price has been on a downward trend for several years, you might want to sell stocks (unless you’re keeping it for a high dividend yield as a passive income idea).

You might also want to check a stock’s support lines, where trendlines connect price lows. When a stock’s price is near a previous low, some traders buy because they expect the trend to bounce back. If it doesn’t bounce back, it’s a sign of weakness for the stock.

Resistance lines occur when a trendline connects price highs. Short-term investors often sell stocks when it approaches a resistance line, while other investors buy stocks at this time as it can be a sign of strength.

Check if a stock price is behaving normally or abnormally. There are several reasons individual stocks may act abnormally. It could be in response to recent stock news, such as an upcoming merger, a scandal, or an unexpectedly high or low earnings report.

Sometimes, mean reversion occurs, which suggests the price will eventually revert to the long-term average state. However, this isn’t always true, and a lowering price might be a sign the company doesn’t have the same prospects it once did.

Related: 14 Best Stock & Investment Newsletters for Inbox Alpha

Categorize Stocks Into Market Capitalization to Understand Growth Potential

Market capitalization, often shortened to market cap, is the total dollar market value of a publicly-traded company’s outstanding shares. It provides investors an indicator of a company’s size compared to its competitors.

Firms are typically categorized as micro-caps, smalls-caps, mid-caps, and large-caps. You calculate a firm’s market cap by multiplying the outstanding shares by the current stock price.

A diversified portfolio might have a combination of small-cap, mid-cap, and large-cap stocks. Your risk tolerance and time horizon will essentially decide the division of different sized caps in your investment account.

1. Micro-Cap

Micro-cap companies have a market value between $50 million and $300 million. These companies usually have less publicly available information than larger companies.

Many are traded over-the-counter rather than through an exchange. Micro-cap stocks tend to carry a higher risk than more established companies, and investors should invest with caution with this type of stock investing.

2. Small-Cap

A company whose market value is between $300 million and $2 billion is considered a small-cap. Small-caps are typically newer companies, often those in emerging industries or niche markets.

These companies have aggressive growth potential but can very quickly sink in value. New competition or overall economic downturns can affect them quickly.

3. Mid-Cap

Mid-cap companies’ market value typically falls between $2 billion and $10 billion. Often, these companies are established and in industries with high growth potential.

They are usually less risky than small-caps and riskier than large-caps. Generally, their growth potential is lower than small-caps but higher than large-caps.

4. Large-Cap

Large-cap companies have a market value of at least $10 billion. These firms typically have a reputation for creating quality items or services, and they often have consistent dividend payments and growth.

The average consumer already knows of many large-cap companies, such as Apple and Google (Alphabet Inc.) It’s less risky to buy stocks in these companies, but they also tend to have less aggressive growth potential.

It’s the [Stock] Price You Pay, Not What You Buy

Investing money involves many components, but the chief among them is the concept of risk.

By introducing the idea that—in stark contrast to a bank account or banking app you may have—stocks act fundamentally different and involve variable levels of risk and return, you can begin to understand their benefits and drawbacks.

In short, stocks can classify as high-risk assets, but they can also serve as potential high-yield investments which provide appreciation potential.

Start first by understanding the value of a stock can go up and down, which depends on several factors. Most importantly, a stock’s performance depends on its growth prospects and its profitability.

But just having good marks in these areas doesn’t guarantee high returns because you can’t always predict risk in stocks.

For instance, many investors may find a company’s financial profile attractive enough to buy into the stock. This results in an overpriced stock and makes it difficult to justify future high returns.

As famous investor Howard Marks succinctly concludes, “It’s not what you buy—it’s what you pay.”

You should identify companies consistently performing well or making strides to improve.

I recommend starting by researching five companies you admire (preferably in different industries) and cultivating ideas about the strategies of each firm, their competitive advantages, and the core value they provide.

If you don’t believe any of these items to be durable over time, I suggest moving on. You should recognize:

- what sets these companies apart from their peers,

- the prospects for the markets in which they operate (e.g., growing market vs. declining market), and

- how the stock market values them

The last item remains vital as the asset doesn’t matter as much, but its price does.

You can buy the most dogged companies for a fantastic price and earn a positive return, while you can buy the most overpriced fantastic companies and lose money.

The point is you should pay considerable attention to the price companies trade for as this will be the most significant predictor of your potential returns.

Pay too much and risk losing money or pay too little and extract some value the stock market didn’t assign the stock.

Related: 11 Best Commission-Free Stock Trading Apps & Platforms

How to Find Individual Companies Worth Buying

The best stock picking services consider all of the variables discussed above when making their selections to subscribers. Have a look at two Motley Fool stock research services subscribed to by close to a million investors.

We think either subscription makes for a great short-listing system to find good stocks worth investigating yourself—and possibly even buying for your portfolio for the long-term. Both services recommend buying and holding for no less than three to five years, departing with some of the other swing trade alerts services people use to find short-term profit potential in the stock market.

Motley Fool Stock Advisor: Best for Buy-and-Hold Investors

- Available: Sign up here

Motley Fool’s signature product, Stock Advisor, aims to provide investors with one thing: top picks for market-beating stocks from the site’s co-founders.

Stock Advisor is an online investment service that espouses my favorite, plain-vanilla trading style: buy-and-hold. Fool analysts provide recommendations for both “Steady Eddies” and potential high-flying stocks with sound fundamentals—an ideal combination of holdings if you want to generate strong performance without risking extremely high volatility.

Importantly, Stock Advisor doesn’t just give you a list of tickers and call it a day—it also provides investment rationales and research for each pick to help educate you before you buy.

And now, Stock Advisor membership provides access to Motley Fool GamePlan: a hub for retirement and financial planning content and tools to improve not just your portfolio, but your entire financial life. GamePlan outlines three portfolio strategies—Cautious, Moderate, and Aggressive—with picks for mutual funds, exchange-traded funds (ETFs), and stocks, including allocation recommendations. It also hosts a library of content about financial planning, including topics such as everyday finances, health and wellness, and estate planning. And it boasts tools including a variety of calculators, such as credit card interest and mortgage calculators.

How has Motley Fool Stock Advisor performed?

Stock Advisor stock picks have performed exceptionally well over the service’s 22-year existence. The service has made 190 stock recommendations that have historically delivered 100%+ returns.

Overall, the Motley Fool Stock Advisor stock subscription service has returned 740% through July 24, 2024, since its inception in February 2002. This number is calculated by averaging the return of all stock recommendations it has made over the past 22 years. Comparatively, the S&P 500 Index has returned 163% over that same time frame.

What to expect from Motley Fool Stock Advisor

The Motley Fool Stock Advisor service provides a lot of worthwhile resources to members:

- “Foundational Stocks”: 10 stocks that can serve as the foundation of your portfolio, whether you’re a new investor or experienced

- Two new stock picks each month

- Monthly analyst rankings of the service’s top 10 stocks based on their potential to beat the market over a five-year span

- A list of all the service’s active picks, “hold” recommendations, and closed positions

- Recommendations for stock and fixed-income exchange-traded funds (ETFs) you can use to build a diversified portfolio core

- Access to the GamePlan financial planning hub

- Access to Fool IQ, which provides essential financial data and news summaries about all U.S.-listed publicly traded stocks

- Access to a community of investors engaged in outperforming the market and talking shop

The service charges a discounted rate for the first year and has a 30-day membership-fee-back period. Read more in our Motley Fool Stock Advisor review, or sign up for Stock Advisor today.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!—by clicking our link.*

- Discounted introductory price

- Strong outperformance above S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Related: Best Brokerage Account Sign-Up Bonuses, Promotions and Deals

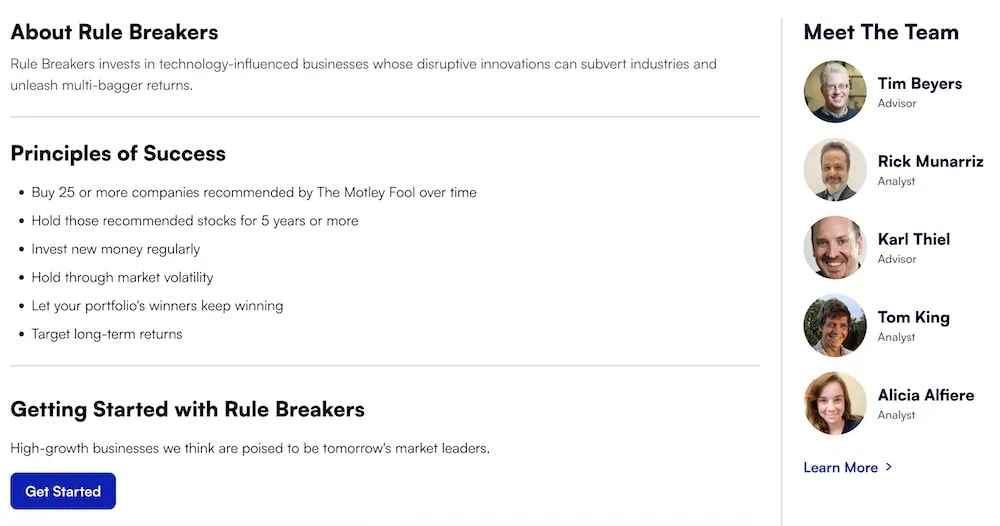

Motley Fool Rule Breakers (Now Part of Epic): Best for Long-Term Investors Looking for Growth Stocks

- Available: Sign up here (must subscribe to Motley Fool Epic to get Rule Breakers)

Motley Fool Rule Breakers, which is now an exclusive part of Motley Fool Epic, recommends stocks that the Rule Breakers team believes have massive growth potential. In some cases, these companies are at the forefront of emerging industries—in others, they’re disrupting the status quo in long-established industries.

This technology-centric portfolio isn’t about picking what’s popular now—it’s about looking for stocks that will eventually become the next big thing. That means these Motley Fool picks have the potential to be nauseatingly volatile … but also to rocket higher exponentially.

Rule Breakers’ team has six rules it follows before making stock recommendations to subscribers:

- Only invest in “top dog” companies in an emerging industry. As Motley Fool puts it: “It doesn’t matter if you’re the big player in floppy drives—the industry is falling apart.”

- The company must have a sustainable advantage.

- The company must have strong past price appreciation.

- The company needs to have strong and competent management.

- There must be strong consumer appeal.

- Financial media must overvalue the company.

In other words, Rule Breakers’ team considers a number of factors before it ever recommends a stock to its users. If it’s not a well-run company with a sustainable advantage over its competitors, and it’s not in an emerging industry, it probably won’t get past Rule Breakers’ velvet ropes.

What to expect from Motley Fool’s Rule Breakers

In addition to getting access to the whole Motley Fool Rule Breakers portfolio, you’ll receive one new stock pick every month (complete with full analysis and risk profile) and a ranking of the team’s 10 favorite picks out of Rule Breakers’ hundreds of recommendations.

And because you must subscribe to Epic to get Rule Breakers, you’ll also unlock:

- Stock Advisor: Buy-and-hold stock picks designed to deliver consistent performance with less volatility. You can also subscribe to Stock Advisor individually.

- Hidden Gems: Stocks of medium-to-large businesses, selected by Fool CEO and co-founder Tom Gardner for their “all-in, visionary leadership teams.”

- Dividend Investor: Fool analysts target companies that deliver above-average yields and dividend growth, with the hope of producing both competitive total returns and an income stream that should carry you through retirement.

- Fool IQ+: An upgraded version of Stock Advisor’s Fool IQ. This tool provides detailed financial data, analysis, and news about all publicly traded, U.S.-listed stocks, as well as advanced charting options.

- GamePlan+: An upgraded version of Stock Advisor’s GamePlan. GamePlan is a hub of financial planning content and tools; GamePlan+ delivers a wider array of articles and tools, as well as more in-depth coverage.

- Epic Opportunities: A members-only podcast from Motley Fool.

You can get Epic at a discounted rate for your first year, and it has a 30-day membership-fee-back period. If you’re interested in Rule Breakers, you can learn more in our Epic review or sign up for Epic today.

- Motley Fool Rule Breakers, which is now an exclusive part of Motley Fool Epic, puts investors in the heart of innovation, focusing on growth recommendations centered around emerging industries.

- The Motley Fool has discontinued the standalone Rule Breakers service. Now, you can access Rule Breakers as part of Motley Fool's Epic subscription, which also includes Stock Advisor, Hidden Gems, Dividend Investor.

- Through Epic, you will also enjoy access to the Fool IQ+ research and data platform, the GamePlan+ financial planning platform, and the Epic Opportunities podcast.

- Limited-Time Offer: Get your first year with the Epic for $299 (vs. $499 usual value)—a 40% discount for new members!—by clicking our link and using the EPICSALE coupon code.*

- Discounted introductory price

- Strong outperformance compared to the S&P 500

- High overall average return for stock picks

- Diversified array of recommendations for investors targeting growth, income, or both

- Additional value from GamePlan+ financial planning content and tools

- High-growth stocks carry volatility

- High renewal price

- Not every stock has positive returns

Related:

![7 Best Value Stocks for 2026 [Smart Picks to Buy] 47 best value stocks for 2024](https://youngandtheinvested.com/wp-content/uploads/best-value-stocks-for-2024-600x403.webp)

![9 Best Non-Stock Investments [Alternatives to the Stock Market] 48 best non-stock investments](https://youngandtheinvested.com/wp-content/uploads/best-non-stock-investments.jpg.webp)