Table of Contents

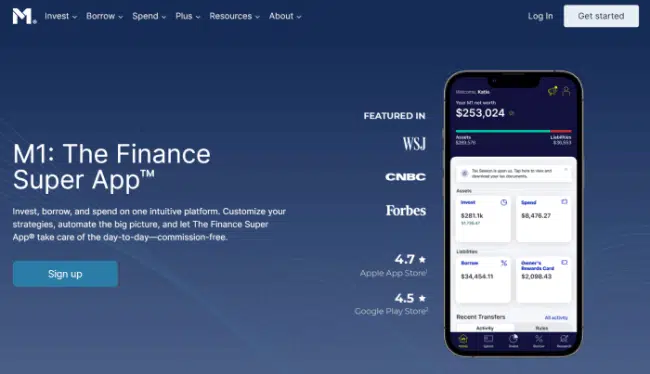

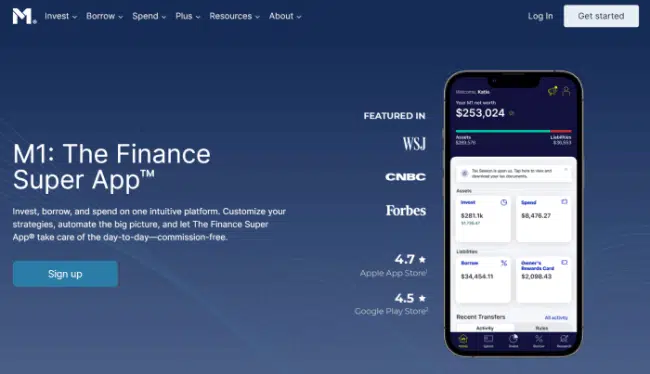

What is M1 Finance?

M1 Finance is an app that aggregates all your financial services in one place. It features an investment account, a bank account, loans and a debit card.

The company does not take any fees on the accounts or transactions you make through its platform – they are free to open and use for life.

The company offers taxable and tax-advantaged retirement accounts like Traditional, Roth and SEP IRAs.

If you’re thinking of managing your own investments but don’t know where to start, M1 Finance is a great app to consider.

In fact, a lot of free stock investing apps have captured investors’ attention recently because they’ve slashed trading commissions to nothing, leaving investors better off financially.

Apps like Robinhood, Webull and M1 Finance have led the vanguard in bringing down investing costs, allowing people to invest for the first time without meeting significant account minimums or having a need to start with a large upfront deposit.

Many of these investing apps work for beginners especially. Apps like M1 Finance offer the ability to invest in fractional shares, further eroding barriers to entry for anyone looking how to start investing with little money.

M1 Finance is an app that aggregates all your financial services in one place. It features an investment account, a bank account, loans and a debit card.

The company does not take any fees on the accounts or transactions you make through its platform – they are free to open and use for life.

The company offers taxable and tax-advantaged retirement accounts like Traditional, Roth and SEP IRAs.

If you’re thinking of managing your own investments but don’t know where to start, M1 Finance is a great app to consider.

In fact, a lot of free stock investing apps have captured investors’ attention recently because they’ve slashed trading commissions to nothing, leaving investors better off financially.

Apps like Robinhood, Webull and M1 Finance have led the vanguard in bringing down investing costs, allowing people to invest for the first time without meeting significant account minimums or having a need to start with a large upfront deposit.

Many of these investing apps work for beginners especially. Apps like M1 Finance offer the ability to invest in fractional shares, further eroding barriers to entry for anyone looking how to start investing with little money.

What is a Roth IRA?

A Roth IRA is a type of individual retirement account that allows you to save up to $7,000 per year by making after-tax contributions which never require you to pay tax again.

You can contribute the lesser of your earned income or $7,000 per year if under the age of 50, while you can contribute up to $8,000 if you’re 50 or older.

Practically anyone can open a traditional IRA and make contributions to the account. However, Roth IRAs come with account limitations based on your:

A Roth IRA is a type of individual retirement account that allows you to save up to $7,000 per year by making after-tax contributions which never require you to pay tax again.

You can contribute the lesser of your earned income or $7,000 per year if under the age of 50, while you can contribute up to $8,000 if you’re 50 or older.

Practically anyone can open a traditional IRA and make contributions to the account. However, Roth IRAs come with account limitations based on your:

- age

- tax filing status

- modified adjusted gross income

What are the Rules for a Roth IRA?

Roth IRAs come with certain rules before you can contribute to one.

Roth IRAs come with certain rules before you can contribute to one.

- Earned income. You must have earned income, meaning the money you earn from working. This can come from a 9-5, freelance writing, or other source of income subject to employment taxes (Social Security and Medicare). Investment income doesn’t count as this is considered passive income.

- Age. To contribute to a Roth IRA, you need to be old enough to have earned income or continue earning it after 70. If you don’t have earned income, you can’t contribute to a Roth IRA.

- Tax Filing Status. If you file as a single taxpayer, you cannot earn more than $144,000 of modified adjusted gross income (MAGI) in tax year 2022 with phaseouts beginning at $129,000. If you’re married and file jointly, you can’t collectively earn more than $214,000 for the 2022 tax year with phaseouts beginning at $204,000. Phaseouts prorate over the income range, meaning if you earn $136,500 (midpoint of the phaseout) as a single filer, you can only contribute half, or $3,000 as an under 50 taxpayer.

What is the Downside of a Roth IRA?

Undoubtedly, Roth IRAs carry significant advantages for a lot of people.

Roth IRAs allow you to invest and earn tax-free portfolio growth, while making tax-free withdrawals in retirement and not experiencing required minimum distributions at age 72 or older.

This makes investing in appreciating assets through a Roth IRA valuable because you won’t pay taxes on those gains.

But not everything about a Roth IRA comes up roses for everyone.

One main disadvantage to contributing to a Roth IRA over a traditional IRA is the contribution of after-tax money.

That means you take a bigger hit to your income this year and realize the lowered taxable income hit in retirement. In other words, many years from now.

Because Roth contributions come from after-tax money that grows tax-free for life, you can’t deduct the contributions when you make them. Instead, you just don’t pay taxes on your withdrawals in retirement.

This is a great decision if you think your future income tax rate will be higher because you’ve built a good deal of wealth for retirement and your income then will be higher than it is now.

Another drawback from contributing to a Roth IRA comes from not having access to those funds for at least 5 years after you first contributed those funds.

For example, if you contributed to your Roth IRA in 2017 and need funds for buying a house, paying for an emergency or some other important need (I always advocate for not taking money out of your retirement funds unless absolutely necessary), you wouldn’t be able to touch those funds for at least five years, or 2022.

If you do remove money from the account, you can take out your after-tax contributions without penalty, though not the gains they may have realized in the years since contribution.

Undoubtedly, Roth IRAs carry significant advantages for a lot of people.

Roth IRAs allow you to invest and earn tax-free portfolio growth, while making tax-free withdrawals in retirement and not experiencing required minimum distributions at age 72 or older.

This makes investing in appreciating assets through a Roth IRA valuable because you won’t pay taxes on those gains.

But not everything about a Roth IRA comes up roses for everyone.

One main disadvantage to contributing to a Roth IRA over a traditional IRA is the contribution of after-tax money.

That means you take a bigger hit to your income this year and realize the lowered taxable income hit in retirement. In other words, many years from now.

Because Roth contributions come from after-tax money that grows tax-free for life, you can’t deduct the contributions when you make them. Instead, you just don’t pay taxes on your withdrawals in retirement.

This is a great decision if you think your future income tax rate will be higher because you’ve built a good deal of wealth for retirement and your income then will be higher than it is now.

Another drawback from contributing to a Roth IRA comes from not having access to those funds for at least 5 years after you first contributed those funds.

For example, if you contributed to your Roth IRA in 2017 and need funds for buying a house, paying for an emergency or some other important need (I always advocate for not taking money out of your retirement funds unless absolutely necessary), you wouldn’t be able to touch those funds for at least five years, or 2022.

If you do remove money from the account, you can take out your after-tax contributions without penalty, though not the gains they may have realized in the years since contribution.

Does M1 Finance Offer Roth IRAs?

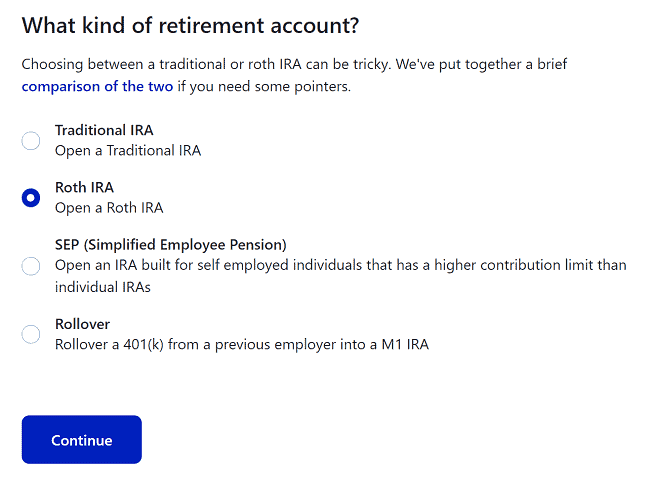

M1 Finance offers three types of IRAs:

- Traditional (pre-tax contributions, deductible in year of contribution)

- Roth (after-tax, non-deductible contributions that grow tax-free)

- Simplified Employee Pension, or SEP (either traditional or Roth and used by self-employed individuals or small business owners largely to replicate the 401(k) and 403(b) plans offered by employers)

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!

- Discounted introductory price

- Strong outperformance above S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Do M1 Finance Roth IRAs Have Fees?

Roth IRAs at M1 Finance do not have fees so long as you meet their account minimum: $500.

If you keep your average monthly balance at or above this level, M1 Finance will not charge you fees for using their account.

Of note, M1 Finance does not allow you to use their M1 Borrow product to add leverage to your retirement account assets.

That means you can’t take out a margin loan to enhance your buying power and give you leverage on your returns.

This is one method for M1 Finance to make money and would entail costs to you through the interest charge by the platform on these loans.

However, since you cannot use their M1 Borrow leverage, you don’t need to worry about paying fees on your Roth IRA if your balance remains at or above $500.

Roth IRAs at M1 Finance do not have fees so long as you meet their account minimum: $500.

If you keep your average monthly balance at or above this level, M1 Finance will not charge you fees for using their account.

Of note, M1 Finance does not allow you to use their M1 Borrow product to add leverage to your retirement account assets.

That means you can’t take out a margin loan to enhance your buying power and give you leverage on your returns.

This is one method for M1 Finance to make money and would entail costs to you through the interest charge by the platform on these loans.

However, since you cannot use their M1 Borrow leverage, you don’t need to worry about paying fees on your Roth IRA if your balance remains at or above $500.

Does a M1 Finance Roth IRA Have Account Minimums?

Yes. M1 Finance Roth IRAs require you to make a minimum $500 deposit when opening an account with the service.

Likewise, they require you to maintain this balance at $500 or higher to avoid any fees that come from having your balance below this level.

Yes. M1 Finance Roth IRAs require you to make a minimum $500 deposit when opening an account with the service.

Likewise, they require you to maintain this balance at $500 or higher to avoid any fees that come from having your balance below this level.

Is M1 Finance Good for Beginners?

M1 Finance is a great financial app for beginners because it automates all of your financial decisions regarding investments, saving and overall management through one platform.

This app allows you to make automated contributions to your Roth IRA, which is a great feature for beginners. You can also use it as a stock tracking app and portfolio management tool.

You can do this by looking at your portfolio monthly, quarterly or your preferred cadence without fear of your portfolio going too far astray from your intended portfolio allocation.

This is because as you make contributions over time, the service uses its Dynamic Rebalancing feature to right-size your positions to approach your preferred investment portfolio.

Likewise, if you use a Prebuilt Portfolio Pie, it will automatically do this for you as you contribute money to your M1 Finance investment accounts.

The only downside of this app is that it’s not ideal for short-term traders who need more trade types and order windows.

The service only allows “Buy” and “Sell” Orders without any specific type like “Market”, “Limit” “Stop Loss”, etc.

This happens because they only have one trading window in the morning for M1 Basic customers and a second afternoon trading window for M1 Plus subscribers.

These limited trading windows avoid needing several order types to navigate, especially since you can purchase fractional shares on M1 Finance.

While good for long-term oriented investors uninterested with attempting to time their purchases, it can be limiting for short-term traders looking to be active in their Roth IRA account.

M1 Finance is a great financial app for beginners because it automates all of your financial decisions regarding investments, saving and overall management through one platform.

This app allows you to make automated contributions to your Roth IRA, which is a great feature for beginners. You can also use it as a stock tracking app and portfolio management tool.

You can do this by looking at your portfolio monthly, quarterly or your preferred cadence without fear of your portfolio going too far astray from your intended portfolio allocation.

This is because as you make contributions over time, the service uses its Dynamic Rebalancing feature to right-size your positions to approach your preferred investment portfolio.

Likewise, if you use a Prebuilt Portfolio Pie, it will automatically do this for you as you contribute money to your M1 Finance investment accounts.

The only downside of this app is that it’s not ideal for short-term traders who need more trade types and order windows.

The service only allows “Buy” and “Sell” Orders without any specific type like “Market”, “Limit” “Stop Loss”, etc.

This happens because they only have one trading window in the morning for M1 Basic customers and a second afternoon trading window for M1 Plus subscribers.

These limited trading windows avoid needing several order types to navigate, especially since you can purchase fractional shares on M1 Finance.

While good for long-term oriented investors uninterested with attempting to time their purchases, it can be limiting for short-term traders looking to be active in their Roth IRA account.

Can I Rollover Another Retirement Account into My M1 Finance Roth IRA?

You can rollover another retirement account into your M1 Finance Roth IRA. It works by transferring your 401k, 403b or IRA into a Roth IRA.

You may do this by transferring funds directly from one custodian to another (in the case of an employer sponsored retirement plan), and then rolling that over to a new M1 Finance Roth IRA.

If you have an existing Roth IRA with M1 Finance, you can also roll over funds from your current retirement account into your existing M1 Finance account as well.

This is the most efficient means for rolling over your funds and avoids any potential tax consequences that may arise from this decision.

Your previous custodian will not withhold any taxes on this type of transfer because the money will never enter your hands.

Instead, it remains in the ownership of the two custodians managing your retirement plans between your previous employer and now with M1 Finance.

If you prefer to have the funds sent directly to you first before transferring to your M1 Finance Roth IRA, you’ll need to be mindful of potential tax consequences if you can’t get the funds rolled over in enough time.

The IRS established a 60-day rule when the plan administrator at your previous employer-sponsored plans sends you a check for the funds and you deposit it into a new IRA within 60 days.

As long as you make this transfer within that time period, you will not have to pay early withdrawal penalties or taxes.

If you do not roll over the money in accordance with these rules, then you will need to pay a 10% penalty on the amount of money and you might be taxed on it as well.

Therefore, you’ll need to be very careful with taking temporary ownership of your retirement plan funds and will want to account for unforeseen administrative issues that can quickly eat up your 60-day window.

You can rollover another retirement account into your M1 Finance Roth IRA. It works by transferring your 401k, 403b or IRA into a Roth IRA.

You may do this by transferring funds directly from one custodian to another (in the case of an employer sponsored retirement plan), and then rolling that over to a new M1 Finance Roth IRA.

If you have an existing Roth IRA with M1 Finance, you can also roll over funds from your current retirement account into your existing M1 Finance account as well.

This is the most efficient means for rolling over your funds and avoids any potential tax consequences that may arise from this decision.

Your previous custodian will not withhold any taxes on this type of transfer because the money will never enter your hands.

Instead, it remains in the ownership of the two custodians managing your retirement plans between your previous employer and now with M1 Finance.

If you prefer to have the funds sent directly to you first before transferring to your M1 Finance Roth IRA, you’ll need to be mindful of potential tax consequences if you can’t get the funds rolled over in enough time.

The IRS established a 60-day rule when the plan administrator at your previous employer-sponsored plans sends you a check for the funds and you deposit it into a new IRA within 60 days.

As long as you make this transfer within that time period, you will not have to pay early withdrawal penalties or taxes.

If you do not roll over the money in accordance with these rules, then you will need to pay a 10% penalty on the amount of money and you might be taxed on it as well.

Therefore, you’ll need to be very careful with taking temporary ownership of your retirement plan funds and will want to account for unforeseen administrative issues that can quickly eat up your 60-day window.

How Do Inherited IRAs Work at M1 Finance?

If you inherit an IRA, you can roll it into an IRA at M1 Finance. To do this, you’ll need to provide the following:

If you inherit an IRA, you can roll it into an IRA at M1 Finance. To do this, you’ll need to provide the following:

- The name of your inherited IRA’s custodian.

- Your account number with that company.

- A copy of either a death certificate or an obituary notarized by a public official. (This is likely to be necessary in order for M1 Finance’s compliance department to make the rollover as easy as possible).

- A copy of your driver’s license, passport or military ID.

- A signed letter from the executor or administrator providing a statement that you are authorized to make withdrawals or take control of the funds on behalf of the deceased owner and listing their contact information

- The name and address for both the beneficiary (you).

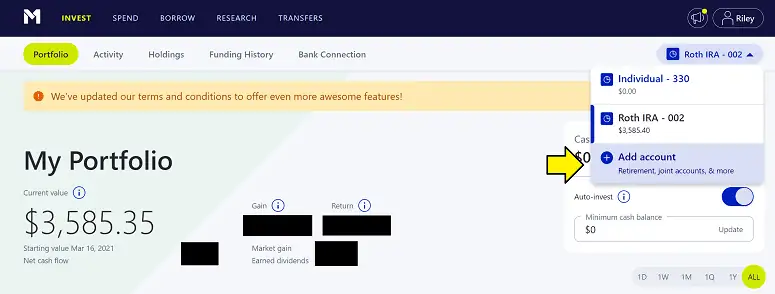

How to Open a Roth IRA on M1 Finance

Opening a Roth IRA account on M1 Finance is easy and only requires a handful of steps.

→ Step 1: Create M1 Finance Account

If you haven’t already, create an M1 Finance account by clicking this link and enrolling from the company’s homepage.→ Step 2: Add Retirement Account

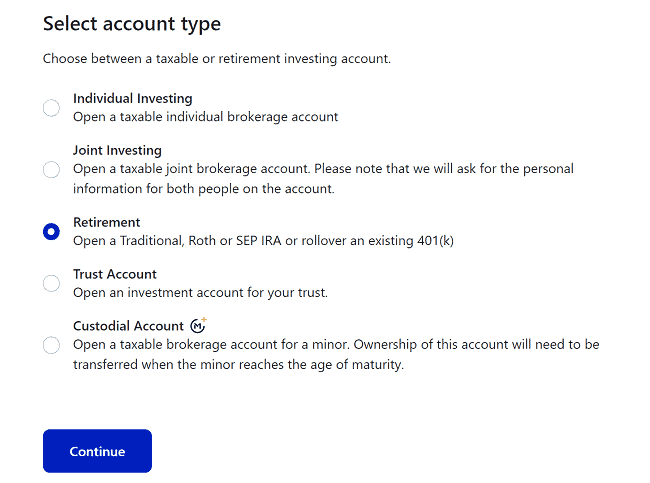

→ Step 3: Select M1 Finance Account Type

→ Step 4: Select The Type of M1 Finance Retirement Account

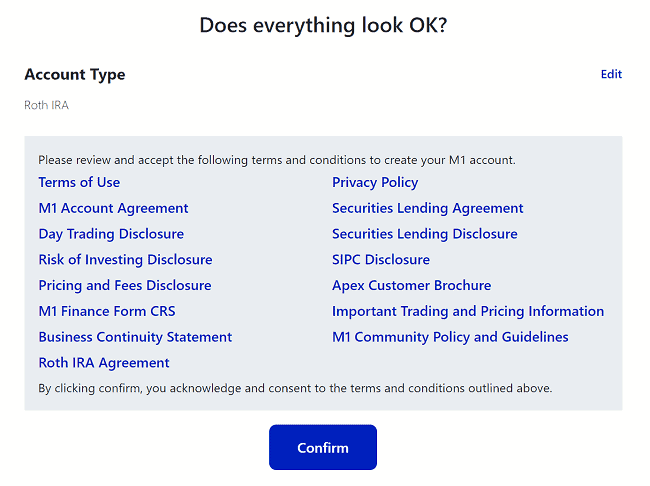

→ Step 5: Review Terms of Use and Relevant Account Details and Disclosures

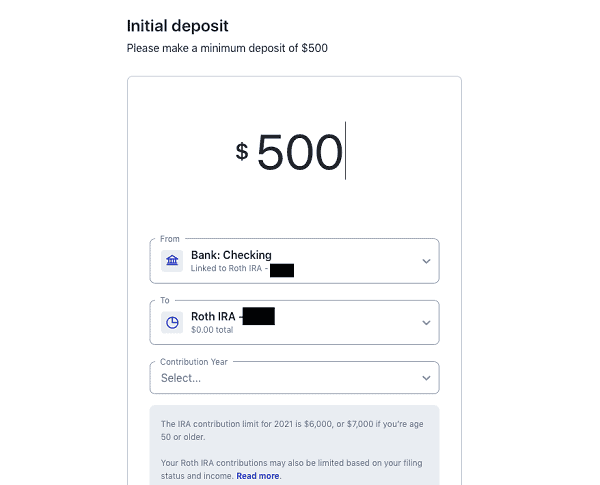

→ Step 6: Initiate Deposit to Fund Account

When you complete your account setup, you’ll need to initiate a minimum contributing deposit to fund the account. M1 Finance requires a minimum $500 contribution to open the account and then for you to maintain this on an ongoing basis to avoid account fees. Continue making contributions throughout the year to your selected portfolio and watch it Dynamically Rebalance as you contribute money.How to Fund a Roth IRA on M1 Finance

I expand Step 6 from above into more detail below with individual actions and screens you’ll expect to see at account funding.

→ Step 7: Initiate Deposit to Fund Account with Plaid

Plaid is a secure and private means for linking your bank account to M1 Finance to initiate a fund transfer into the account. Walk through the onscreen prompts to contribute to your account.

Plaid is a secure and private means for linking your bank account to M1 Finance to initiate a fund transfer into the account. Walk through the onscreen prompts to contribute to your account.

→ Step 8: Select Deposit Amount

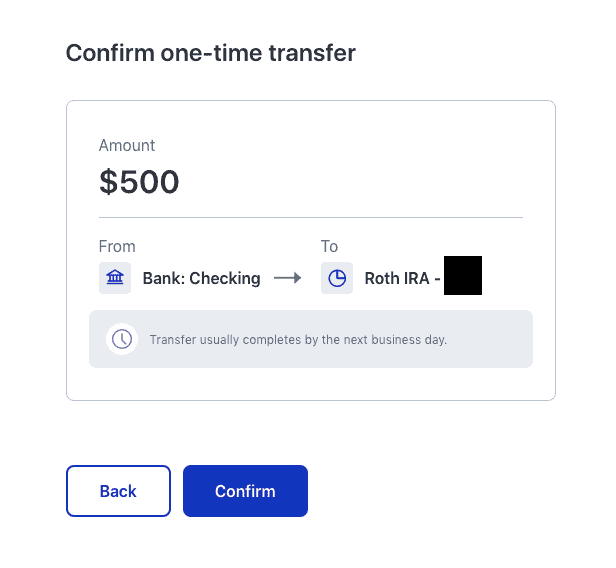

→ Step 9: Confirm One-Time Deposit / Set up Recurring Deposits

How to Build a Portfolio for Your M1 Finance Roth IRA

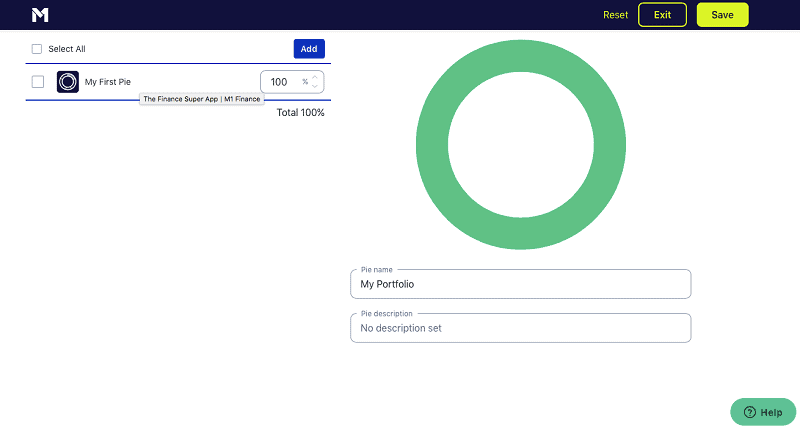

→ Step 10: Build a Portfolio with Portfolio Pies

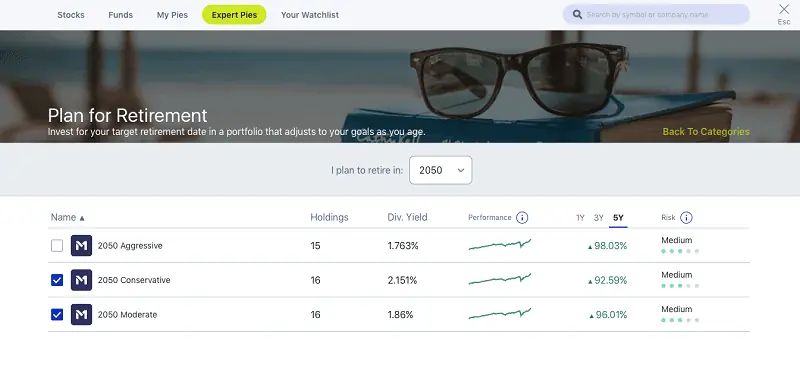

Likewise, you can explore the expert pies. Because this is a Roth IRA account, it might make sense to click on the “Plan for Retirement” Expert Pie selections to ensure these investments focus on long-term capital appreciation.

Likewise, you can explore the expert pies. Because this is a Roth IRA account, it might make sense to click on the “Plan for Retirement” Expert Pie selections to ensure these investments focus on long-term capital appreciation.

If, for example, you’d like to have an automated solution that adjusts your holdings as you near your intended retirement date, you might want to look at the proprietary target date funds created and managed by M1 Finance.

Because I’m in my early 30s with dreams of retiring around 60, I might opt for a target date fund setting me up for retirement in 2050.

If, for example, you’d like to have an automated solution that adjusts your holdings as you near your intended retirement date, you might want to look at the proprietary target date funds created and managed by M1 Finance.

Because I’m in my early 30s with dreams of retiring around 60, I might opt for a target date fund setting me up for retirement in 2050.

You can choose from three choices of target date funds, “Aggressive”, “Moderate” and “Conservative.” These align with allocations between more or less stock and bonds based on risk you prefer.

Because we’re young, it makes sense to stick with the Aggressive or Moderate target date funds, but you could just as easily feel more comfort in the Conservative and Moderate options.

Another approach to consider for this same investment goal is the 3-fund portfolio. This allows you to invest in U.S. stock index funds, global stock index funds and U.S. bond index funds.

The simple strategy has worked remarkably for people who choose this path and stick to it.

If you like Vanguard funds like myself, the three funds include:

You can choose from three choices of target date funds, “Aggressive”, “Moderate” and “Conservative.” These align with allocations between more or less stock and bonds based on risk you prefer.

Because we’re young, it makes sense to stick with the Aggressive or Moderate target date funds, but you could just as easily feel more comfort in the Conservative and Moderate options.

Another approach to consider for this same investment goal is the 3-fund portfolio. This allows you to invest in U.S. stock index funds, global stock index funds and U.S. bond index funds.

The simple strategy has worked remarkably for people who choose this path and stick to it.

If you like Vanguard funds like myself, the three funds include:

- Vanguard Total Stock Market Index Fund (VTI or VTSAX)

- Vanguard Total Bond Market Index Fund

- Vanguard International Stock Market Index Fund

Why You Should Open a Roth IRA at M1 Finance

You may be wondering what makes M1 Finance different from other investment firms offering Roth IRAs.

One great benefit of M1 Finance is that accounts allow you to take advantage of tax-free contributions at any time with commission-free trades in your account.

You can also have access to the best features of a traditional brokerage while also leveraging the digital automation capabilities of the M1 Finance platform.

Further, you can roll over all of your current IRAs and 401(k) accounts hassle-free at M1 Finance while possibly receiving a rollover bonus to get your balance upsized when you start investing with M1 Finance.

They handle a lot of the heavy lifting for you by dealing directly with your previous investment custodian, allowing you to forget about piles of paperwork.

By investing with M1 Finance’s Roth IRA, you can quit paying commissions and any account management fees you might find at other brokers.

That means you never need to worry about hidden fees eating into your returns again.

Consider signing up for a Roth IRA with M1 Finance and start investing for free by enjoying simple, secure and free investing. They’ll even give you a sign up bonus to get free stocks if you make a minimum qualifying deposit at opening.

You may be wondering what makes M1 Finance different from other investment firms offering Roth IRAs.

One great benefit of M1 Finance is that accounts allow you to take advantage of tax-free contributions at any time with commission-free trades in your account.

You can also have access to the best features of a traditional brokerage while also leveraging the digital automation capabilities of the M1 Finance platform.

Further, you can roll over all of your current IRAs and 401(k) accounts hassle-free at M1 Finance while possibly receiving a rollover bonus to get your balance upsized when you start investing with M1 Finance.

They handle a lot of the heavy lifting for you by dealing directly with your previous investment custodian, allowing you to forget about piles of paperwork.

By investing with M1 Finance’s Roth IRA, you can quit paying commissions and any account management fees you might find at other brokers.

That means you never need to worry about hidden fees eating into your returns again.

Consider signing up for a Roth IRA with M1 Finance and start investing for free by enjoying simple, secure and free investing. They’ll even give you a sign up bonus to get free stocks if you make a minimum qualifying deposit at opening.

- The M1 investing app is a basic robo-advisory system that acts almost like a 401(k). You build a "Pie" by choosing the stocks and ETFs you want to invest in, as well as the percentage of your portfolio that should be invested in each "Slice," and M1 uses that information to allocate your money each time you contribute.

- If you want help putting together a list of stocks and funds, you can use M1's model portfolios, which cover goals such as general investing, planning for retirement, income earners, and more.

- Enjoy a 4.00% APY on uninvested cash.

- M1 offers three individual retirement accounts (IRAs): traditional, Roth, and SEP. It also lets you open individual, joint, and custodial brokerage accounts; trusts; and cryptocurrency** accounts.

- No opening fees

- Robo-advisor with self-directed investing elements

- Attractive APY on uninvested cash

- High closing fee ($100)

- Required $500 minimum initial deposit for IRAs

- Doesn't support mutual funds

- Doesn't allow trading throughout the trading day

![9 Best Schwab ETFs to Buy [Build Your Core for Cheap] 50 best schwab etfs to buy](https://youngandtheinvested.com/wp-content/uploads/best-schwab-etfs-to-buy-600x403.webp)