Money consistently ranks as one of the top reasons couples have disagreements. Individual finances can feel stressful enough and when your finances intertwine with another person, the stress amplifies. Fortunately, several ways exist to reduce money-related anxiety in relationships.

When done well, budgeting together can have a positive effect on communication and coordination. It’s essential to review your joint income to get a full picture of your expenses, including both fixed costs (such as housing, utilities and car payments) and variable, easily forgotten expenses (such as dining out and clothing).

Many couples use the apps featured below to get a comprehensive view of their joint finances as well as assistance in creating the best budgets for their financial situations.

Table of Contents

What are the Best Budgeting Apps for Couples?

As the economy has improved and wages have increased, Americans are spending more money than ever.

Couples need to find a way to manage their money together so they can enjoy life and make smart financial decisions.

Have a look at these best budgeting apps for couples to get a handle on your finances.

1. Empower: Best Free Budget Manager

- Available: Sign up here

- Price: Free, for accounts over $100,000 in investments, 0.89% annual fee for Wealth Management

Empower is one of our top-rated financial services firms for people of any income level thanks to its suite of free-to-use tools.

The free Personal Dashboard makes it easy for people to add all their financial accounts (including credit cards, savings, checking, loans, and tax-advantaged investment accounts) in one place.

Empower offers a number of investing and personal finance tools that you’d expect from a free service, such as the Savings Planner, Retirement Planner, and Financial Calculators—all intuitive and well-built.

But where I think Empower really shines is its free Investment Checkup tool. The tool assesses your portfolio risk, analyzes past performance, and even provides a target allocation for your portfolio. Many people don’t realize how much of their varying mutual funds and ETFs overlap with one another—but the tool can actually help you identify overweight and underweight sector investments (maybe you have too many assets in utilities and not enough in health care) and assess your true diversification.

You can even compare your portfolio to both the S&P 500 and Empower’s “Smart Weighting” Recommendation, which suggests that investors more equally weight their portfolios across size, style, and sector—unlike the S&P 500, where the biggest stocks have the most effect on the portfolio, and there are huge differences in how much each sector is weighted.

Another exceedingly useful tool is the education planner. This tool calculates the estimated cost for your child’s dream schools with a clear breakdown of how much to contribute to their tuition, and it can even model different scenarios such as enrolling out-of-state or the tax implication of different 529 plans.

Use our exclusive link to sign up for the Empower Personal Dashboard. If you have $100,000 or more in investible assets, you’ll also be able to schedule a free initial 30-minute financial consultation with an Empower professional.

- Empower offers both a free set of portfolio, net worth, and cash flow tracking tools, as well as paid asset management service.

- Link Empower to your bank and investing accounts, credit cards, and more to see a single view of useful information and data, including your net worth.

- Empower Advisory Group offers a comprehensive wealth management service known as Personal Strategy. This managed account solution provides clients with discretionary investment management, personalized portfolio construction, and access to financial planning support. Accounts investing $100k to $250k receive unlimited advice and retirement planning help from financial advisors, as well as a professionally managed ETF portfolio with reviews upon request. Higher asset tiers offer access to dedicated advisors, estate planning, and tax specialists, plus additional investment options like access to private equity.**

- Special offer: If you have $100k+ in investible assets, sign up with our link to schedule a free initial 30-minute financial consultation with an Empower professional.

- Free portfolio tracker (Dashboard)

- Free net worth, cash flow, and investment reporting tools (Dashboard)

- Tax-loss harvesting (Personal Strategy)

- Dividend reinvestment (Personal Strategy)

- Automatic rebalancing (Personal Strategy)

- Low investment expense ratios (Personal Strategy)

- High number of investment accounts supported (Personal Strategy)

- High $100k minimum for investment management (Personal Strategy)

- Moderately high investment management fee (0.89% AUM) compared to other online advisors (Personal Strategy)

2. Current: Best Family Finance App

- Available: Sign up here

- Price: Basic: Free; Current Premium: $4.99/mo

- App Store Rating: 4.7

Current is a banking app designed for all families and ages. The world of banking doesn’t have to be confusing or hard.

Current makes your banking better, simpler and no-hassle. When you sign up for direct deposit with Current Premium, your funds get into your account early – as much as 2 days!

Plus, hidden fees are a thing of the past too: there’s always an upfront pricing list in the app.

And if something goes wrong? You’re covered 24/7 through Current’s simplified customer service center that’s available around the clock in case they can help you fix an issue before it becomes a problem.

Current is here for you and position themselves as not just a bank—but better than one. That’s because they make banking easier with convenient features designed to save you time.

- Faster Direct Deposit

- No hidden/surprise fees (transparent pricing)

- Mobile banking

- Add cash through 60,000 stores nationwide

- Mobile deposits

- Automated savings in Savings Pods

- Fee-free overdraft

- Cash back

- Fee-free ATM withdrawals

- Gas hold removals

- Money management (for singles, couples and families)

- Instantly send and receive money through Current ~tags with other Current Users

- Security and privacy features (e.g., EMV chips, pause and resume transactions, fingerprint and Face ID lock)

- Free debit card for teens

Check out the Current app for your every day banking needs and budgeting goals. Work together to get ahead financially.

Read more in our Current review.

- Current is a financial technology platform that lets teens enjoy not just traditional banking basics, but numerous features meant to simplify spending, streamline saving, and set them on the path toward more organized finances.

- Teens can spend with the Current Visa debit card, which allows them to purchase in-store and online, as well as withdraw money fee-free from more than 40,000 in-network Allpoint ATMs.

- Current Teen Accounts also come with Savings Pods, which earn 0.25% APY and allow you to round up purchases (overages are funneled into your savings).

- Parents can monitor their kids' spending, adjust maximum ATM withdrawal and spending limits, and even toggle spending categories (and the Current debit card itself) on and off.

- Parents can also automate allowance payments, pay for chores, instantly transfer money to their teens, and more.

- Free account (no monthly maintenance fees)

- Good parental controls

- Fee-free ATMs

- Cash reloads

- Gas hold deposits

- 24/7 email and live-chat support

- No direct deposit

- No paired investment account

- No card customization

Related: Best Debit Cards for Teens

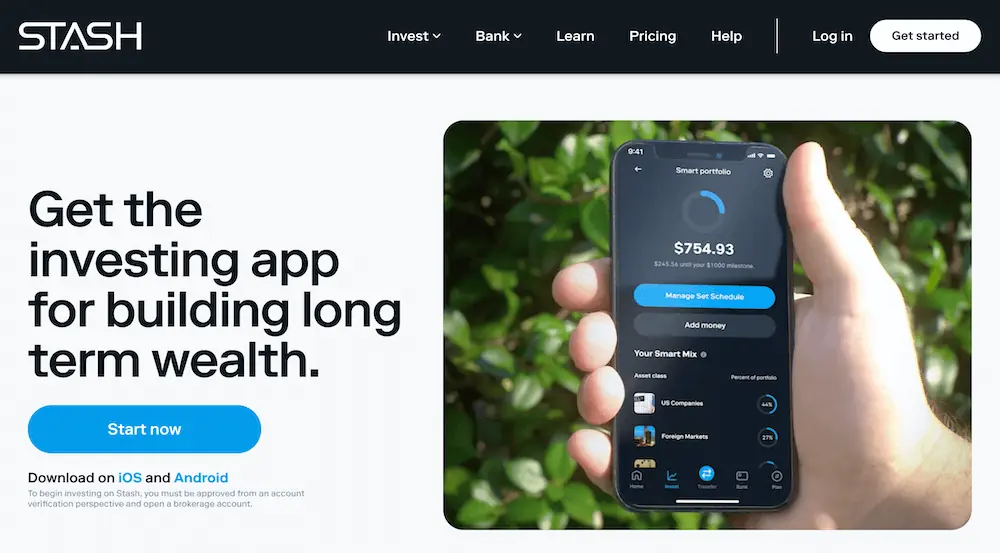

3. Stash: Best Approachable Personal Finance App

- Available: Sign up here

- Price: Growth: $3/mo, Stash+: $9/mo

Stash Online Banking is a mobile-friendly checking account from Stash, a leading low-cost all-in-one financial platform for hands-off investors.

With no hidden banking fees, no minimum deposit or ongoing balance requirements, and no in-network ATM fees, Stash Online Banking acts as a strong choice for consumers who prefer to do their banking and investing in the all through the same platform.

Plus, you’ll earn Stock-Back Rewards® at places like Walmart and Amazon when you make qualified purchases with your debit card.

If you are a couple, you may want to use Stash to invest money with regular automatic transfers or even “round up” purchases you make on a linked debit card like with Acorns.

This can make it easy to automate your finances and not have one person remain responsible for making manual transfers which can often go overlooked.

Stash also offers great financial education resources to improve your financial literacy. It covers numerous topics like investing, managing and planning money. It can be a great college investing app and for individuals entering adulthood together.

- Stash is a personal finance app that simplifies investing, making it easy and affordable for everyday Americans to build wealth and achieve their financial goals.

- Invest in stocks and exchange-traded funds (ETFs) for as little as 1¢ thanks to fractional shares.

- Earn Stock-Back® rewards on every eligible debit card purchase.

- Sign up for Stash+ and get access to custodial accounts, better Stock-Back® rewards, and access to $10,000 in life insurance.

- Special offer: Earn a $100 bonus when you sign up with Stash and make a $250 deposit.

- Robo-advisor with self-directed investing capability

- Fractional shares

- Custodial accounts available

- Offers values-based investment options

- Get paid up to two days early when you direct deposit pay into your Stash account

- FDIC/SIPC insurance

- Charges monthly fee

- Smart Portfolios don't offer tax-loss harvesting

Related: Best Kid Debit Cards

4. Quicken Simplifi: Best Expense Tracker App

- Available: Sign up here

- Price: $24/yr.*

Quicken Simplifi is a useful budgeting app that can help you progress toward your financial goals with confidence.

Simplifi allows you to build monthly budgets yourself, or it will create customized budgets generated automatically based on your income, expenses, and savings. It also provides budget suggestions, and it helps you track progress toward saving goals. The app provides a comprehensive view of your finances, too, syncing up with your bank accounts, credit cards, brokerage and retirement accounts, mortgages, even private investments.

If all of this makes Simplifi seem like a lighter version of Quicken … well that’s because it pretty much is. Quicken literally markets the service right alongside Classic Deluxe, Classic Premier, and Classic Business & Personal, and Simplifi is both cheaper and features fewer options than all three programs.

That said, Simplifi does have a few perks of its own that keep it from truly feeling like “Quicken Lite.” For one, it has a dedicated mobile app—one of my biggest gripes about Quicken is that it only has a “mobile companion app” that syncs up with the desktop versions. Simplifi can also automatically detect bills and identify subscriptions, and, unlike Quicken, it can separate those categories.

Try out Simplifi to see if it’s the budgeting app you need.

- Simplifi allows you to see all your finances in one place by connecting your bank accounts, credit cards, loans, 401(k), and other investments in a single dashboard.

- Save more money and plan better through goal setting.

- Know where your money goes through insight into spending across categories, tracking upcoming bills and building a projected cash flow.

- Get an automatically generated spending plan customizable to your needs.

- Wide range of compatible accounts

- Intuitive dashboard

- Robust budgeting tools

- Savings goals

- Comprehensive, easy-to-read reports

- No free version/free trial

- No credit score

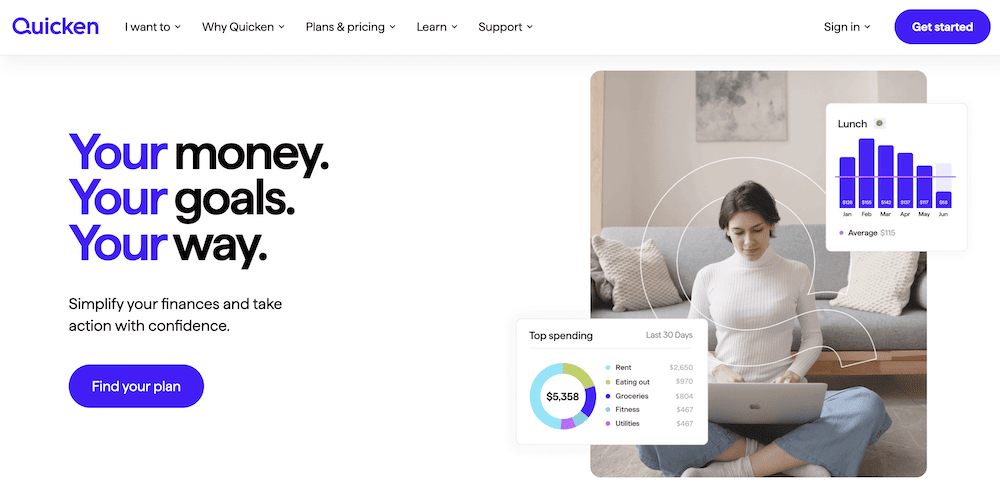

5. Quicken: Best Budget Planner App

- Available: Sign up here

- Price: Classic Deluxe: $30/yr. Classic Premier: $42/yr. Classic Business & Personal: $60/yr.*

Quicken has been around for several years and widely been used as a powerful personal finance solution.

You can use the app to track expenses and make budgets as a couple, but also handle several other personal finance management needs.

Quicken provides a consolidated view of your finances in one customizable dashboard, leveraging information from your accounts and activity to understand and manage your spending better.

The functionality of Quicken extends beyond just personal finances, however, and also covers useful financial management needs of your small business and rental properties you may own and operate as a couple.

Consider using the comprehensive tools provided by Quicken and their ability to meet your unique financial planning needs.

- Use the Quicken family of personal finance and money management software to see your financial life in one place.

- Create a custom comprehensive budget, track your investments and plan for retirement.

- Stay on top of spending and track what's left to pay bills that you can easily view and manage.

- Review your investment portfolio and monitor performance.

- Multiple versions for differing needs

- Wide range of compatible accounts

- Bill pay reminders

- Real estate features

- Excellent customer support

- No free version or free trial

- Mobile app is only "companion" software

- Several features not available on Mac

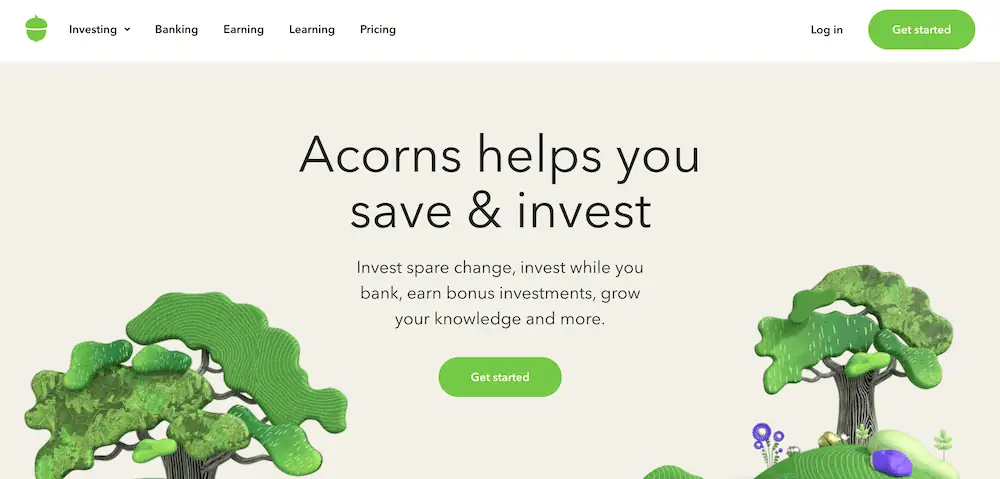

6. Acorns: Best Micro-Investing App

- Available: Sign up here

- Price: Acorns Bronze: $3/mo. Acorns Silver: $6/mo. Acorns Gold: $12/mo.

Acorns offers a solution that can meet a couple’s banking and investing needs at the same time.

Any Acorns account, which allows you to invest in a diversified portfolio of funds, also comes with Acorns Banking. This Acorns checking account and debit card saves, earns, and even invests for you via the company’s famous Round-Ups, which diverts spare change into your investment account.

The account includes no overdraft fees, access to more than 55,000 fee-free ATMs worldwide, and $250,000 of FDIC insurance coverage to protect your deposits against loss.

All Acorns subscription tiers come with Acorns Banking, though the Silver and Gold levels include additional perks, such as a limited-edition tungsten metal Visa card and the ability to earn on checking and emergency fund savings. Also, couples with children can open a custodial account and save for their kids’ future with Acorns Early Invest, which they can open via the Acorns Gold subscription tier.

Learn more in our Acorns review.

- Acorns Spend is a checking account with a debit card which invests money each time you swipe.

- The account has free bank-to bank transfers, no overdraft or minimum balance fees and free (or fee-reimbursed) ATMs nationwide.

- Acorns Spend comes paired with Acorns Invest (famous for "Round-Ups") and Acorns Later, the automated Acorns retirement IRA.

Related: Best Acorns Alternatives: Micro-Investing Apps to Use

7. You Need a Budget: Best Spending Tracker App

- Available: Sign up here

- Price: Free 34-day trial, then $14.99/mo on Monthly Plan or $98.99/year

YNAB determines how much money you have, what your expenses are, and when your expenses need to be paid. It can track regular payments as well as budget for less frequent costs. This knowledge can assist couples take control of their monthly budgeting needs.

YNAB makes managing a budget simple. In addition to keeping track of expenses, it can help you establish goals and plan savings. You can try YNAB for free for 34 days and then it costs $98.99 per year or $14.99 per month if paid monthly.

- You Need a Budget (YNAB) is an award-winning software platform which uses a proven method to teach you how to manage your money and get ahead.

- Budgets update automatically and in real time, and can be accessed on your computer, phone, or tablet.

- Customizable

- Allows for multiple budgets

- Difficult for beginners

- No bill tracking or bill pay

- No investment tracking features

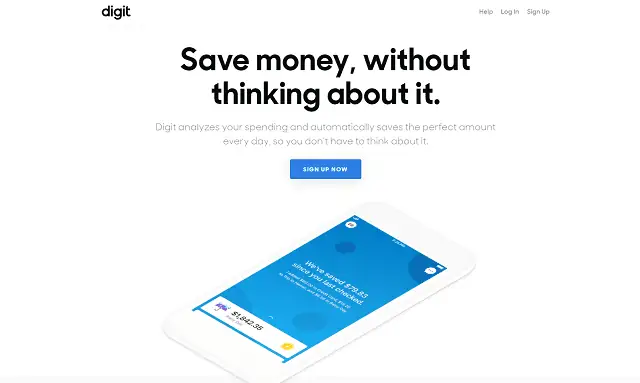

8. Digit

- Available: Sign up here

- Price: Free for 30 days; $5/mo thereafter

Digit can help you save more money with little effort on your end. The app considers your expected income, account balances, upcoming bills, recent spending, and personalized preferences as a couple to calculate how much money you can spare for savings.

Next, it automatically transfers that amount into your Digit savings account a few times a week or month, depending on your spending patterns.

This eliminates the guesswork for couples on how much they can safely save towards vacations, paying off debt, or anything else. Every three months you save with Digit, you receive a 0.5% saving bonus.

The app prevents overdrafts by automatically transferring money to your checking account, and in the event an overdraft still occurs, Digit will cover the fee.

There are no account minimums and you can withdraw money at any time. You can try Digit free for 30 days and then the cost is $5/month.

- Digit helps you save more money with little effort.

- The app evaluates your expected income, account balances, upcoming bills, recent spending and your stated preferences to calculate how much money you can set aside for your savings.

9. Buxfer

- Available: Play Store, iOS

- Price: Free; Paid plans range from $1.99/mo to $9.99/mo

Buxfer has many similar features to what Mint provides. It’s especially well suited for younger couples who are focusing on building long-term wealth together. Buxfer lets you view all your accounts in one place.

You can keep track of your transactions with customized tags to understand where your money goes. Together you can set up weekly, monthly, or annual spending limits for each tag and will receive alerts if your budget has been surpassed.

Based on your spending habits, you can forecast future expenses so there aren’t any overdraft fees or other financial surprises.

When you’re sharing an expense with your significant other, Buxfer will divide the payment and send a text message or email to each person as a reminder.

There is a free version of Buxfer as well as four additional types of plans, ranging from $1.99/month to $9.99/month for users who want more advanced features.

10. Wealthfront

- Available: Play Store, iOS

- Price: Free; 0.25% on assets under management

Wealthfront is an extremely comprehensive budgeting app. You can add your partner’s Wealthfront account to your plan to get a full view of your household investments.

It’s great for people who want to invest in a hands-off way because the software automatically rebalances portfolios when assets move away from their target allocations, rather than on a yearly or quarterly schedule.

Wealthfront is not one of the best free stock trading apps because it charges an ongoing management fee, but handles a lot of the portfolio management for you.

The app also has tools to help couples who are in the market for a new home. Wealthfront watches the housing market and updates you on home pricing trends as well as what prices are likely to look like in the future.

The app allows you to play around with housing scenarios to see how different down payments would affect your monthly payment.

Based on your financial situation, home prices, and mortgage rates, it helps you calculate the approximate amount you can afford to spend on a home. You can adjust your savings time frame to see different results.

Another Wealthfront feature pulls your spending activity, evaluates data on people’s costs as they age, and adds inflation and Social Security assumptions to estimate what your spending will look like in retirement.

Additionally, the app can predict your future net worth, set up tax-advantaged investments (like an individual retirement account) and help couples with children manage 529 college savings plans.

Perhaps the best feature is the high-yield cash account that lets you earn interest on money that is still readily available when you need it.

Wealthfront’s planning tools are free. Cash accounts require a minimum of $1 and investment accounts need at least $500 to open.

- Wealthfront provides the power of robo-investing for investors with a small starting deposit ($500 minimum).

- Answer just a few questions, and Wealthfront will build you a portfolio of low-cost index ETFs from up to 17 different asset classes, then manage rebalancing and trading as long as you have the account.

- Wealthfront allows you to link an outside 529 educational savings plan or open one through Wealthfront (plan is sponsored by the state of Nevada).

- Bonus: Get a $50 deposit bonus when you fund your first taxable investment account

- Low minimum investment for a *robo-investing product*

- Tax-loss harvesting

- Offers 529 plan management, investment account

- High minimum investment for an *investment account*

- Few investment choices

- No access to human financial advisors (CFPs)

11. Mvelopes

- Available: Play Store, iOS

- Price: Free, offers in-app purchases

Mvelopes is one of the most straightforward budgeting apps available to couples. Reminiscent of when people set aside money in physical envelopes, Mvelopes lets you set up virtual envelopes to put aside money for short and long-term savings goals.

Rather than just placing all your extra money in a generic savings account, this app gives your money a purpose.

Couples might be saving for a large wedding or a down payment for a house. It’s easy to see the progression towards your money-saving goals.

You aren’t only required to use joint accounts and can choose to keep them separate while still seeing your money in a single place, if you so choose.

Mvelopes helps you plan better for unexpected costs, such as car repairs, rather than needing to put those charges on high-interest credit cards.

The beauty of this app lies in the simplicity and the motivation it instills. Mvelopes has a 60-day free trial before you choose between their Basic package for $6/month, Premiere account for $9.95/month or the Plus package for $19/month.

12. Billshark

- Available: Sign up here

- Price: Free; Billshark keeps 40% of savings

Billshark offers some useful cost-savings services to couples. The company’s goal is to save consumers and small businesses of $2.7 billion by 2025. Users send Billshark copies of their bills and the company’s team starts negotiating savings.

Unsuccessful negotiations cost you nothing. Couples can use these found savings to pad their monthly budget.

Following a successful negotiation, Billshark calls or emails you to tell how much you have saved, when the savings go into effect, and a detailed explanation of where you saved money.

Then you receive an invoice for 40% of the money saved during the associated contract period (meaning you won’t be charged indefinitely for the savings).

Billshark will also keep track of when your new savings expire so they can automatically restart negotiations to lower your payments again.

It’s possible to negotiate bills on your own, but most consider this an extremely unpleasant task. Rather than deciding which person in a couple has to make these calls, it can be easier to use a third party.

If you’re unsure whether or not Billshark is for you, consider trying their savings calculator to see how much you could save.

- Billshark aims to save customers almost $3 billion by 2025. The service offers to cut bills through aggressive negotiation, often an unpleasant task. In exchange for 40% of the savings, the app costs you nothing but a share of your savings.

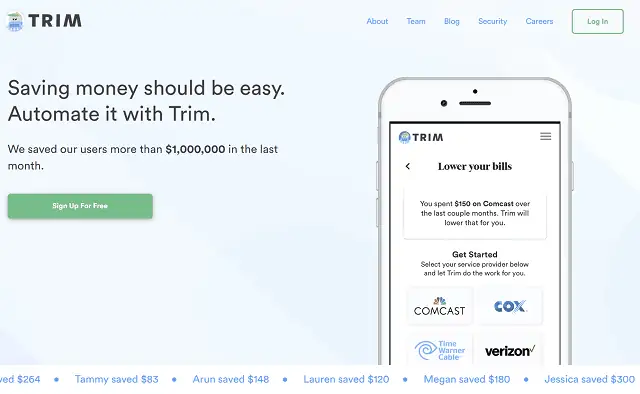

13. Trim

- Available: Sign up here

- Price: Free with 33% of savings kept; Premium subscription costs $9.99/mo

The Trim app has helped its users save more than $20 million and over $1 million in just the last month.

It trims unnecessary expenses by canceling old subscriptions and adjusts overpayments by negotiating the price of your bills, such as phone, cable, internet, and even medical bills.

When couples start to live together and share more expenses, it’s easy to forget to cancel old, duplicate subscriptions and Trim is excellent at catching costs you may have missed.

Additionally, Trim will negotiate your interest rates with banks and credit cards, get bank fees refunded, and waive interest fees. A newer feature is Trim’s automated savings account.

For the first $2,000 you save in the account, you get a 4% annual reward. After the initial $2,000, the rate goes down to 1.1%. It’s possible to schedule automatic transfers into this account.

The basic version of the app is free, but 33% of the total yearly savings are taken out.

For example, if they save you $10/month for 12 months, they’ll take $40 (and you still save $80 more than you otherwise would have).

For $10/month, users can upgrade to the Premium plan that comes with unlimited email access with Trim’s expert financial planners.

- Trim has saved its more than 3 million customers some $86 million over time, with customers saving an average of $213 per year.

- Trim examines and analyzes your spending patterns to determine where it can save you money.

- Trim can also go to the negotiation table for you. In addition to potentially lowering some of your bills (like internet, cable, and phone), it can also talk to banks and credit cards to get better interest rates, have fees refunded, and have other fees waived.

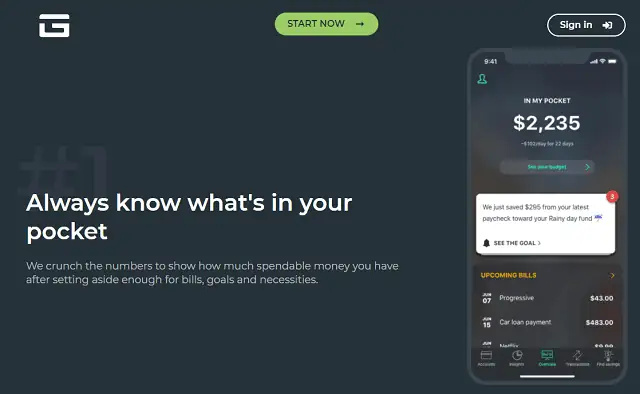

14. PocketGuard

- Available: Play Store, iOS

- Price: Free 7-day trial, then $74.99/yr. or $12.99/mo.

PocketGuard calculates how much spendable money you have (“in your pocket”) after you’ve put aside enough for necessities and goals. You link all of your bank accounts, credit cards, loans, and more.

Significant others can share the same PocketGuard profile on different devices as long as they use the same login and password or Google account.

You can add and customize your categories. Some couples like to differentiate spending such as “Alan dinner out” and “Anne dinner out,” while others use unified categories such as just “Dinner out.”

With categories in place, you’ll receive personalized reports with a pie graph showing how much of your overall budget various expenses take up.

PocketGuard can also help you save money by negotiating better rates for your bills. With the Autosave feature, you inform the app how much you want to save and it’ll allocate funds accordingly.

- PocketGuard provides a secure place to get a holistic view of all your financial accounts, making it easier to budget, track your cash flow, determine your net worth, and more.

- PocketGuard's free plan includes budgeting, spending reports, cash tracking, accounts and transactions aggregation, bills and income tracking, and anti-fraud technology.

- PocketGuard plus includes everything in the free plan, plus a debt payoff planner, unlimited budgets, unlimited savings goals, data transfer, storage, and more.

- Compatible with accounts from thousands of financial institutions

- Personalized spending results

- Savings goals

- Eliminated free plan

Best Budgeting Apps for Couples

Transparency and communication come as essential elements to relationships in general, but especially when couples start to share their finances. That being said, there isn’t a one-size-fits-all formula for coordinating finances with your significant other.

Some couples choose to split expenses 50/50, others based on income levels, and still others choose systems that work for them, but wouldn’t for different couples.

Whichever system works best for you, choose the right finance app(s) that best fits with your approach. Budgeting apps make it simple to involve partners and reduce the burden of financial planning.

Use budgeting as an opportunity to bond and look towards your (financial) future together.