Most parents want to set their children up for financial success. And opening a brokerage account for a child is one of the best ways to get started.

Not only can investment accounts for kids help their money grow, but if the child is contributing to the account or choosing some of the investments, it will also help them develop financial literacy skills. Hands-on investing and trading, monitored by parents, can help children learn about stocks, mutual funds and exchange-traded funds. It also will help them understand that while investing involves risk, it can also be rewarding.

It can also motivate children to save money, so they have more to invest. When children see their money growing in their investment account, that’s positive feedback promoting healthy money habits.

Clearly, there are many benefits to having your child invest. But it can be tricky to decide what type of investment account is best for kids.

Some choose a custodial account, while others open a joint brokerage account. Those with children who have earned income sometimes open an individual retirement account (IRA). Parents whose main concern is education funds opt to focus on a 529 account or prepaid tuition plan.

Let’s discuss how to open a brokerage account, including determining what type of account (or accounts!) is best for your child. We’ll also discuss topics such as what you’ll need, tax implications, even how these accounts might affect applications for financial aid.

Top Custodial Brokerage Account Picks

|

4.5

|

4.4

|

|

No-commissions on equity trading.

|

Acorns Gold: $12/mo. subscription required for custodial account.

|

Can a Minor Have a Brokerage Account?

Yes, a minor can have a brokerage account, in one of two forms:

- a custodial brokerage account

- a joint brokerage account

A joint brokerage account allows the minor to sit on the account title jointly with another owner—typically a parent or guardian—who is at least the age of majority.

In the U.S., custodial accounts take the form of a Uniform Gifts for Minors Act (UGMA) account or a Uniform Transfers to Minors Act (UTMA) account. These accounts are extremely similar, but not identical. (Check out the differences between a UGMA and UTMA account.)

The minor can’t open a joint brokerage or custodial account on their own. They need help from a parent, guardian, or other trusted adult.

The money and assets in the custodial brokerage account legally belong to the minor, but the adult custodian can conduct transactions for them. If an adult contributes any money, it’s considered a gift for tax purposes.

The adult can also withdraw money from custodial accounts, but only if it’s used in a way that will directly benefit the child, such as for educational costs or to buy equipment for a sport the child plays.

When the child reaches the age of majority, which varies by state, they can take full control of the account.

A child can open an IRA, which has federal income tax advantages, as soon as they have earned income as well. Just note that contributions are limited to the taxable income the child has earned that year and can’t exceed the yearly contribution limit, which is currently at $7,000 in 2024 ($7,000 in 2025 as well).

Related: 10 Best Teen Debit Cards

How to Open a Brokerage Account for Your Child

The good news is: Opening a brokerage account is typically a quick, painless process. You’ll typically end up spending more time on actually determining the type of investment account and which provider you’re go with than the actual opening of the account.

Here are the four steps you’ll go through:

1. Decide on the Type of Investment Account for Kids to Open

You’ll need to open an investment account to begin buying stocks, mutual funds or exchange-traded funds (ETFs). Two types of investment accounts will involve you co-owning it with your child, while the third is held in your child’s name and allows them to invest tax-free for retirement.

Custodial Accounts

A custodial account is a type of financial account that an adult maintains for another person, usually a child. Many parents use custodial accounts to invest for their teens.

Importantly, custodial accounts can hold a variety of assets—stocks and bonds, sure, but also CDs, insurance contracts, even antiques and collectibles.

The money in these accounts is controlled by a custodian, typically a parent. The teen or child doesn’t have access to the funds until he or she reaches that state’s age of majority. Depending on the state, that age might be 18, 21, or even 25.

Custodial accounts allow custodians to control assets for the benefit of the minor without the need for setting up a special trust fund, which has its own advantages but is a far more complicated process.

Whereas assets in a joint brokerage account are co-owned by the child and the custodian, assets in custodial accounts irrevocably belong to the minor. However, the listed custodian can complete transactions on the minor’s behalf until they are of legal age to take over the account, and they can use money from the account for any purpose benefiting the child.

|

4.5

|

4.4

|

|

No-commissions on equity trading.

|

Acorns Gold: $12/mo. subscription required for custodial account.

|

Individual Retirement Account (IRA)

Does your child work a summer job? Done some babysitting? Tutored some classmates for pay? If so, they have what the IRS considers “earned income.”

That means they can contribute the lesser of their earned income or $7,000 per year toward their retirement and invest in a tax-advantaged manner in 2024 ($7,000 in 2025 as well).

Of course, they probably don’t have access to a workplace retirement account, so they can really only contribute to an individual retirement account (IRA).

An IRA is a tax-advantaged retirement account that allows you to save money for retirement. You set up an IRA at a financial institution and make contributions that you can invest in a variety of investment choices.

There are two primary types of IRA:

- Traditional IRA: These retirement accounts allow you to contribute “pre-tax” dollars today. You only pay taxes on the money once you withdraw it, which you are allowed to do without penalty once you reach age 59½.

- Roth IRA: These work in the opposite manner. You can only contribute to a Roth IRA with earnings that you have already paid taxes on. However, contributions are never taxed again—not while they’re in your account, nor once you withdraw them, which you can do at any time. (Earnings on those contributions are subject to taxes and penalties if you withdraw them before age 59½.)

Since your children are young (and likely don’t earn all that much), they probably pay very little to nothing in taxes. As a result, it makes sense for them to lock in their currently low tax rates by making after-tax retirement account contributions to a Roth IRA.

And the best part about contributing to a custodial Roth IRA as a teenager: years—no, decades—of compounding returns. And when they withdraw their money for retirement, they won’t pay any taxes on those gains.

| Initial Amount Saved @ 18 | Annual Contributions (Made @ Start of the Year) | Ending Balance @ Age 68 |

|---|---|---|

| $5,000 | $0 | $449,836 |

| $5,000 | $1,000 | $1,483,633 |

| $5,000 | $6,000 | $6,652,621 |

| $10,000 | $0 | $899,672 |

| $10,000 | $1,000 | $1,933,470 |

| $10,000 | $6,000 | $7,102,457 |

| $25,000 | $0 | $2,249,181 |

| $25,000 | $1,000 | $3,282,979 |

| $25,000 | $6,000 | $8,451,966 |

| *Assumes average annual return of 9% compounded daily, no dividends or tax implications | ||

One note about custodial Roth IRAs and how they compare to normal Roth IRAs: A parent or other adult must oversee the account as a custodian. Past that, they work exactly the same as any other Roth IRA.

Additionally, you can withdraw money from a Roth IRA to pay for qualified education expenses without paying a penalty on early withdrawal. While 529 plans are a better investment vehicle for saving toward education expenses, Roth IRAs tend to offer more freedom for investment options.

Related: 7 Best Teen Checking Accounts [Bank Accounts for Teenagers]

Joint Brokerage Accounts

The standard type of brokerage account is an individual brokerage, in which one person is listed as the account owner.

A jointly owned brokerage account, however, allows two or more people to sit on the account’s title and act as owners of all assets within the account.

These accounts most commonly exist between spouses. However, they can also be opened between two or more individuals who share financial goals (say, unmarried partners or business partners), or more to the point of investing for kids, multiple family members (say, a parent and child).

There are three types of joint brokerage accounts:

- Joint Tenants With Rights of Survivorship: All owners of a joint brokerage account share equal ownership of assets held in the account; if one owner dies, the survivor(s) receive the decedent’s share of the account.

- Tenants in Common: Similar to Joint Tenants, assets are shared equally but do not pass to the other owners should one owner pass away. Assets pass to their estate.

- Community Property: Only available in a limited number of states, this allows for spouses to share assets equally between one another. If a spouse dies, the assets go to their estate.

There is no “right” type of joint brokerage account—it ultimately comes down to your own personal preferences and financial situation.

When a parent and child have a jointly owned brokerage account, they can share in the decision-making of what to buy and sell. Many investing apps for kids allow you to open a brokerage account with joint ownership.

2. Do Your Due Diligence

Once you decide on the type of account you want, you’ll need to determine which provider offers the best version of that account.

To do that, you’ll want to focus on a few characteristics and features, some of which might be more important to you than others. Among them?

Costs

How much does it cost to put your money to work? Check to see what you’ll pay, and how often. Are there monthly or annual maintenance fees? Trading fees? Commissions? The good news is, high competition among brokers and stock trading apps has brought many costs down to zero, but some account providers still charge certain fees.

Of course, if those providers deliver a better overall experience, those fees might be worth it.

Platform/App Functionality

Always look to see what features the account provides, and whenever possible, try the free demos. Is everything in the app inherent, or would a kid have a difficult time finding what they need? Is the browser-based version clunky, or does everything load right away? Is it loaded with investing tools—and if so, is that even what you want, or would you prefer a pared-down experience to keep things simple for your child?

Remember: If the account is a pain to use, your child probably won’t use it very much.

Selection

Each type of account has a list of assets they can invest in. But what’s actually offered might differ from one account provider to the next. Some accounts might only allow your child to invest in stocks and ETFs, for instance. Maybe they’ll be allowed to invest in mutual funds, but only from a single fund family, such as Fidelity or Vanguard.

Again, just like features, you need to decide whether you want a wealth of investment options, or a narrow menu to make investing less complicated for your child early on.

Education Center

Who doesn’t want their child to learn about money? One of our strongest suggestions, if you’re opening a brokerage account for your child, is to make sure it has a robust education center that will grow not only your kid’s wealth, but their investing and financial knowledge, too.

Perks

Who doesn’t like to get a little something extra? While you should pick an account based on more important factors such as cost and features, if you’re trying to decide between two comparable accounts, go with the one that’s offering better freebies. Popular sweeteners include sign-up bonuses and free stocks—often earned once the account is funded.

Branch Locations

This factor’s importance dwindles each year as people increasingly handle their finances online. Still, if it’s important to be able to talk to a human in person, make sure your account provider has a branch near you.

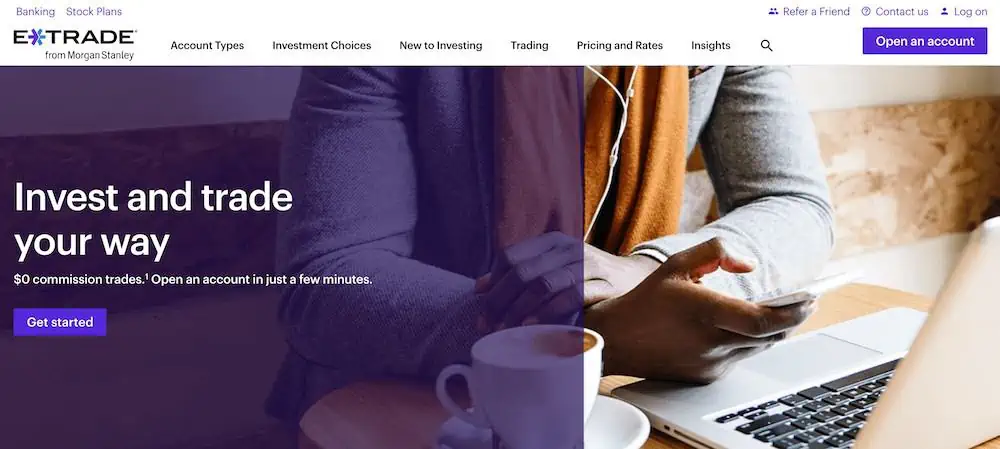

E*Trade (Our Top Pick for Custodial IRAs)

- Platforms: Web, mobile app (Apple iOS, Android)

- Price: No monthly fees or trading commissions on stocks and ETFs through E*Trade’s Custodial Account

Most people know E*Trade as one of the leading providers of individual brokerage accounts, but you can also put the powerful platform to work saving for your child’s future, through a custodial account (and even a custodial IRA).

E*Trade’s custodial account for teens (and generally any minor) allows you to open up a custodial account that offers the chance to build a personalized portfolio through thousands of stocks, bonds, ETFs, and mutual funds, or you can have E*Trade select your holdings for you through its Core Portfolio robo-advisory service (minimum account size of $500 is needed to use this product). Further, you can choose to open a traditional custodial IRA or a custodial Roth IRA for children under age 18 who have earned income.

To open a free E*Trade custodial account, click “Open Account” below.

- E*Trade is one of the best online and mobile trading platforms among discount brokers, offering a full range of investments (including professionally managed accounts). It allows you to invest in stocks, ETFs, mutual funds, options, bonds, futures, micro futures, and futures options.

- $0 commission trading for online U.S.-listed stocks, ETFs, options, mutual funds, Treasuries, and new-issue bonds. (Options have a 65¢ contract fee, or 50¢ at certain volume thresholds.)

- Help build your child’s future by managing their portfolio until they come of age without contribution or income limitations.

- Get easy access to your cash with a free debit card, checking, and Bill Pay

- Opening an account is easy and only takes a couple of minutes.

- Bonus: Get between $50 and $10,000* when you click the box below, then open and fund a new investment account using promo code "OFFER25."

- Excellent selection of available investments

- Commission-free mutual funds and Treasuries

- Automated portfolio builders and prebuilt mutual fund and ETF portfolios

- Separate apps for power users and casual users

- Limited availability of fractional shares (only in DRIP plans or robo-created portfolio)

- No direct cryptocurrency trading

Related: How to Invest as a Teenager or Minor [Start Investing Under 18]

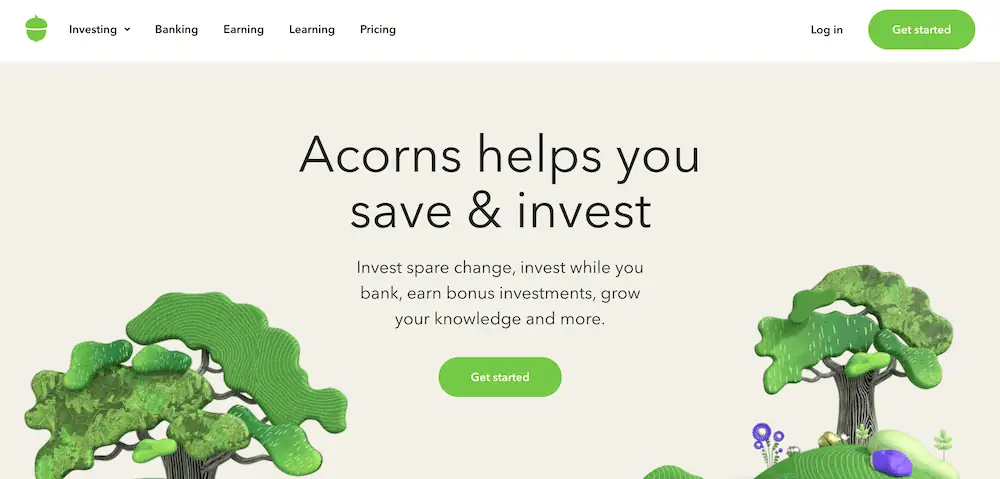

Best Custodial Brokerage Account for Kids

- Available: Sign up here

- Price: Premium: $12/mo. (Required to open a custodial account)

Acorns offers custodial brokerage accounts (Acorns Early) for parents and grandparents interested in opening an investment account for their family. Acorns Early offers investment portfolios of various risk levels for kids, so you can feel confident in the account you’re opening up for your little one. This app can be a great way to teach minors how to start investing money.

The best part about Acorns is that it doesn’t require any minimum deposit to get started and allows you to contribute money on a regular basis.

One of the best ways to start saving for your grandchild is through a savings and investing account product like Acorns Early, which you can access by subscribing to Acorns Gold.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Silver tier includes perks such as a 25% match on Acorns Earn rewards (up to $200/mo.), generous APYs on Checking and Emergency Fund, and live Q&As with investing experts.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts for children with 1% contribution matches.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions in your first year.*

- Special offer: Get a free $20 bonus investment when you sign up with our link and start making recurring investments.**

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Silver and Gold)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Gold for any self-directed investing options

Related: Our Acorns Review

3. Submit an Application

Most brokerages let you complete the entire application process online.

Usually, the application can be completed in 15 minutes or less, assuming you have your child’s Social Security number and other relevant information on hand.

You also might be asked for your employment information.

Related: 7 Best Investments for Kids [Investing for Children]

4. Fund the Account

Once you’ve been approved for the account, you’ll likely need to make an initial deposit. Most brokerages require some sort of minimum account balance; even if they don’t, you’ll still need to fund the account to begin investing.

Your options should include these typical methods:

- Electronic funds transfer (or EFT, where you electronically transfer funds from a bank account)

- Check

- Wire transfer

- Asset transfer (a 401(k) rollover, for instance)

After the initial funding, you can continue to add money to the account with cash the child receives as gifts from relatives, money the child has earned through a job, or anywhere else.

Multiple people can contribute to a custodial account, but only the account owner can invest the money.

Related: Should You Open a Child Bank Account with a Debit Card?

Frequently Asked Questions (FAQs)

What do I need to open a brokerage account?

To open a custodial account, you only need standard information about the child, such as their name, Social Security number, birthday, and address.

You might be asked for some of your employment information. You’ll also need a way to fund the account, whether by linking it to another investment account or electronically transferring money from a bank account.

If you already have your own brokerage account with the same provider, it can make this process faster. But even if you’re signing up with a new company, the process typically is fast and painless.

How old does my child have to be to buy stocks?

To buy stocks without your assistance, your child would need to open their own brokerage account, which they can do at age 18. With your assistance and supervision, your child can start buying stocks at any age through a joint brokerage account.

In a custodial account, you can involve your child in the process of choosing investments, but you, as the custodian, ultimately will be the person who must buy them.

Related: How Old Do You Have to Be to Buy Stocks?

Who pays taxes on a custodial account or joint brokerage account?

When parents contribute money to their child’s custodial account, it counts towards gift contribution limits. For 2024, the annual gift limit is $18,000 for individuals and $36,000 for married couples filing jointly ($19,000 and $38,000 in 2025, respectively).

If you contribute more than that amount, fill out an IRS form so they can deduct the excess money from your lifetime gift tax exemption limit, which is currently $13.61 million in 2024 ($13.99 million in 2025).

For joint brokerage accounts, half of the account value can count as a taxable gift. Again, this isn’t much of an issue unless you expect to surpass the lifetime gift tax exemption limit.

What is the Kiddie Tax?

The “kiddie tax“ on children’s investments includes dividends, interest, and other unearned income. Here’s how it works:

- If the beneficiary is under age 19 or younger than 24 and a full-time student, then the first $1,300 of unearned income they earn isn’t taxed in 2024 ($1,350 in 2025).

- The subsequent $1,300 is taxed at the child’s tax rate in 2024 ($1,350 in 2025). If all of the earnings are long-term gains and the beneficiary is in the lowest tax bracket, this might be 0% again. In other situations, it may be 10%.

- Any additional unearned income is taxed at the parents’ rate. For this reason, high-earning parents sometimes stop or reduce contributions after this amount.

Does a custodial account affect financial aid eligibility?

Yes, a custodial account can affect financial aid eligibility because the child owns the assets. Colleges usually consider about 20% of a dependent’s assets as available college funds.

If the custodial account only holds a couple of thousand dollars, it’s unlikely to make much of a difference. But if the account contains a much more substantial amount of money, it will have a greater effect on aid.

If you specifically want to use the funds for college expenses, you may want to consider using a Coverdell education savings account (ESA), 529 plan, or prepaid tuition plan. A 529 plan and other types of education-specific accounts are given more favorable treatment for financial aid.

Note: You aren’t limited to just one type of account. A child can have both a 529 account and a custodial account, so you can open different accounts to achieve different goals.

How can you save money for qualified education expenses?

There are three popular types of accounts/plans for saving up to finance qualified education expenses in the future:

529 plans

A 529 plan was created specifically for higher-education expenses.

Money goes into these accounts after taxes have already been paid on it. The funds then grow on a tax-deferred basis, and the earnings are tax-free as long as the money is spent on qualified educational expenses. Qualifying expenses include tuition, books, computers, housing (if at least a half-time student), and more.

A downside to 529 accounts is that if money is spent on non-qualifying purposes, it’s taxed and subject to an additional 10% penalty.

Fortunately, the penalty can be waived under certain circumstances, like if the beneficiary earns a tax-free scholarship, attends a U.S. military academy, or develops a disability.

The account can also be transferred to another family member or moved into a 529 ABLE account.

Contribution limits are $90,000 for single filers or $180,000 for married couples filing jointly in 2024 ($95,000 and $190,000 in 2025). Some choose to donate a lump sum between $18,000 to $90,000 and set the contribution to be spread out over the next five years, making it less likely that they’ll surpass gift tax limits.

Related: Best 529 Plan Alternatives to Save for Education

Prepaid tuition plans

According to the Education Data Initiative, the average price of college tuition and fees for public four-year institutions has grown nearly 180% over the past two decades, or an average annual rise of 9%.

Translation: College prices have grown far more steeply than inflation.

Prepaid tuition plans, sometimes called guaranteed savings plans, let you freeze today’s tuition rates for when your child will attend college. It’s kind of like you’re getting the college rate on sale, because the price very likely will be higher once your child reaches college age.

Plans vary, with some offering contracts for community colleges, some for four to five-year undergraduate programs, a combination, or graduate school. It works for both qualifying public and private schools.

The tuition program pays your funds to any of the state’s eligible institutions for your beneficiary.

In the event your child goes to a non-participating college, you should still be able to use the value in the account, just not at the favorable tuition rate. If your child doesn’t attend college at all, most prepaid plans let you transfer to a younger sibling. However, if no children attend college and you have to cancel the plan, you usually only receive the amount you originally contributed, without any interest earned, and possibly a cancellation charge.

Note that these programs are just for tuition and don’t cover other expenses, such as housing. There are no investment options for these plans.

Coverdell education savings accounts (ESAs)

A Coverdell education savings account (ESA) can be a useful way to save for qualified education expenses.

Much like 529 plans above, Coverdell ESAs are among the most common education savings investment options due to their favorable federal income tax treatment. These accounts also allow you to put money toward qualified education expenses of K-12 schooling in addition to college costs.

Also like 529 plans, if you use funds from an ESA on nonqualified expenses, you will incur a 10% penalty. Plus, you’ll also be on the hook for capital gains tax on any gains recognized in the account at the time of sale.

You cannot deduct Coverdell contributions, and you must make them before your children reach the age of 18 (or later if they qualify as a special needs beneficiary by the Internal Revenue Service).

You can set up more than one ESA for a single beneficiary, but with these accounts the same maximum contribution applies across all of them (rather than an individual $2,000 limit).

This means you can have multiple ESAs, but you can only contribute up to $2,000 per year in aggregate across them.

Related:

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 42 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)

![How to Use Your HSA for Retirement [Tax-Efficient Investing Tool] 43 how to use your HSA in retirement](https://youngandtheinvested.com/wp-content/uploads/how-to-use-your-hsa-in-retirement-600x403.png.webp)