An index fund is an excellent way to diversify your investment portfolio instantly. With a single purchase, you can get exposure to nearly the entire U.S. stock market.

While it may seem as if all index funds are essentially the same, they have differences. For instance, index funds use different benchmarks, such as the S&P 500, Dow Jones Industrial Average, or the CRSP US Total Market Index.

Index funds can also refer to mutual funds or exchange-traded funds (ETFs). ETFs tend to be more affordable than mutual funds and have lower fees because they are passively managed.

In addition to being simple to buy and sell (these are very liquid investments), ETFs typically have very low expense ratios (far below those of mutual funds) and are tax-efficient investments.

VTI and SPY are two of the most popular index fund ETFs available today among expert and beginner investors. They are both are trusted funds that perform well and have many of the same top holdings.

However, these funds also have a few key differences. The funds are similar enough that you likely will want to choose one instead of both, so evaluating the differences is essential.

Let’s dig into the similarities and differences between VTI and SPY, their top holdings, expense ratios, dividend yields, and more. Finally, we’ll discuss which fund is likely the better one for you to buy.

Disclaimer: This article does not constitute individualized investment advice. These funds appear for your consideration and not as investment recommendations. Act at your own discretion.

Featured Financial Products

What Is VTI?

Track all markets on TradingView

VTI is the Vanguard Total Stock Market ETF. It’s passively managed and run by the Vanguard Equity Index Group. The ETF was incepted on May 24, 2001.

This total stock market ETF includes stocks regularly traded on the New York Stock Exchange. It is a market capitalization-weighted index fund, or “market-cap-weighted index fund.”

VTI consists mainly of large-cap stocks and includes smaller mid-, small-and micro-cap companies. These are U.S. stocks, with only 0.1% of the ETF consisting of foreign holdings.

It has around $478 billion of assets under management (AUM). AUM is the total market value of the investments managed, and the formulas to determine AUM can vary by company. Funds with larger assets are usually more easily traded.

Morningstar gives VTI a Gold medal rating (Morningstar’s forward-looking rating) and three out of five stars (a backward-looking performance rating). VTSAX is the mutual fund equivalent of VTI.

Related: VTSAX vs VFIAX

What Is SPY?

Track all markets on TradingView

The SPY ETF is also known as the SPDR S&P 500 ETF Trust. Being a Standard & Poor’s Depositary Receipt (SPDR) means it’s a specific type of ETF issued by the State Street Global Advisors.

SPDRs (sometimes also pronounced “spiders,”) are ETFs based on an index. It’s essentially a way to own an entire index through a single security. As a unit investment trust, SPY must try to completely replicate an index, in this case, the S&P 500.

SPY is the largest ETF globally and one of the most actively traded. Its inception date was Jan. 22, 1993, making it the first-ever index ETF.

SPY usually has the highest trading volume and greatest assets under management than other ETFs. Currently, it has around $630B in assets under management. Funds with high trading volume are more liquid, which helps if you’re an active investor.

SPY consists of 99.0% U.S. stocks and 1% foreign ones. It’s a large-cap ETF that is heavily weighted in technology companies.

Morningstar gives SPY a Silver medal rating, though it has four out of five stars currently.

What Benchmarks Do These Index Funds Use?

VTI uses the Center for Research in Security Prices (CRSP) U.S. Total Market Index as its benchmark.

This index represents nearly 100% of the investable U.S. stock market, which takes away the pressure to guess which stocks will rise the highest. Total stock market indexes usually track thousands of funds with varying market capitalizations.

To be added to the CRSP index, a stock must have a market value of at least $15 million, have at least 12.5% of its shares publicly traded (float shares), be for profit, and not have stretches of no trading that last over ten consecutive days.

The SPY fund seeks to track the Standard & Poor’s (S&P) 500 Index, containing 503 large-cap U.S.-listed stocks representing 500 companies. The S&P 500 is a standard benchmark and is known to indicate the overall financial health of the economy.

Although the S&P 500 contains far fewer stocks, its returns are similar to total stock market index funds. Since both indexes are heavily weighted towards large-cap stocks, the returns are correlated, and the total market fund is only a bit more diversified.

To be part of the S&P 500, a company must have a minimum market cap of $18.0 billion, have been publicly traded for at least one year, and have most of its shares be publicly traded.

Related: The 11 Best Vanguard Funds to Buy for the Everyday Investor

How Has VTI vs. SPY Performed?

Both funds have enjoyed steady returns over time. Yes, VTI clearly outperforms SPY over the long run, but SPY has had periods of outperformance compared to VTI, too.

My opinion? Rather than try to time the market, determine which index fund make the most sense for your goals, and hold that one for the long-term.

Remember: Past performance can be a good indicator of future performance, but it is no guarantee.

Featured Financial Products

Invest in Individual Stocks or Index Funds?

While it may seem advantageous to start investing money in individual stocks on your own, there are benefits to investing in index funds through ETFs and mutual funds.

Because VTI and SPY (and similar investments) come with built-in diversification, they involve less risk than individual stocks and bonds.

In the long run, index funds that follow the S&P 500 return around 10%, the historical annual market return since the 1920s.

While you can’t capture alpha (outperforming the market) like you might with individual stocks you find using the best stock research apps and software, you also won’t do worse than it.

In my own assessment, it’s hard to argue with the attractiveness of a 10% average annual return which costs you almost nothing to receive over long periods of time.

However, if you’d like to add some room for market outperformance to your portfolio, you can invest in some stock picking services to attempt to beat the market.

On the other hand, while individual stocks can (and sometimes do) go down to zero, this hasn’t ever happened with index funds.

Instead, index funds represent the most straightforward, cheapest, and dependable way to see strong long-term returns in your portfolio.

Related: 15 Best Stock Market Investing Research & Analysis Sites

VTI vs. SPY Similarities

VTI and SPY are both popular funds among long-term investors, and they have excellent performance histories.

The top holdings for VTI and SPY are the same (though with slightly different percentages for each). Technology is the heaviest weighted sector for both.

The most represented companies are Apple Inc., Microsoft Corp., Amazon Inc., Nvidia Corp., and Tesla.

VTI contains all the SPY stocks, so it essentially has SPY within it.

MSCI Inc. is the world’s biggest provider of Environmental, Social and Governance (ESG) Indexes. Their ratings tell investors how socially responsible an investment fund is so they can ensure their values and investments are aligned. MSCI ESG Research LLC’s ratings for both VTI and SPY are A—two steps below the top rating (AAA), but still above-average as it pertains to ESG ratings.

You can buy either fund through most major brokerage firms, such as Schwab or Fidelity.

Related: Best Commission-Free Stock Trading Apps & Platforms

VTI vs. SPY Differences

Different Tracking Indices

VTI has a different underlying index than SPY. VTI tracks the CRSP US Total Market Index, and SPY uses the S&P 500. As a result, the ETFs also differ in how much of them are comprised of small-cap stocks, mid-cap ones, and large caps.

VTI consists of 71.42% large-cap stocks, 19.56% mid-cap stocks and 8.60% small-cap stocks. It leans toward large companies, but it provides broad exposure to large, medium and small companies alike.

Meanwhile, SPY is 81.65% large caps, 17.59% in mid-cap stocks, with the tiny remainder in small-cap stocks.

Performance

While both ETFs have been performing well, SPY has performed better than VTI of late. SPY’s return over the past five years is +80.85% whereas VTI’s is +76.63%.

Turnover Rates

ETFs with higher turnover rates are more actively managed, leading to higher costs and taxes. SPY has a lower turnover rate, which is 2.00%, versus 3.00% for VTI. Both are low, but SPY’s is lower.

Expense Ratios

Expectedly, SPY’s expense ratio is higher than VTI’s. SPY’s is 0.0945%, while VTI’s is only 0.03%.

Dividend Yields

Also, VTI yields just slightly more than SPY, at 1.19% vs. 1.18%.

Related: Best Investments for Children

Top 10 Holdings for VTI

VTI has over 3,600 holdings, though some have more impact on the ETF than others. A look at its top 10 holdings as of 02/07/2025 (in order):

- Apple Inc. (AAPL) 7.59% (Technology Hardware, Storage & Peripherals)

- Nvidia Corp. (NVDA) 6.60% (Semiconductors)

- Microsoft Corp. (MSFT) 6.28% (System Software)

- Amazon Inc. (AMZN) 4.12% (Internet & Direct Marketing Retail)

- Alphabet Inc. (GOOG/GOOGL) 4.04% (Interactive Media & Services)*

- Meta Platforms Inc. (META) 2.56% (Interactive Media & Services)

- Tesla Inc. (TSLA) 2.26% (Automobile Manufacturers)

- Broadcom (AVGO) 2.17% (Semiconductors)

- Berkshire Hathaway Inc. (BRK.B) 1.67% (Multi-Sector Holdings)

*Note: This is split across two share classes.

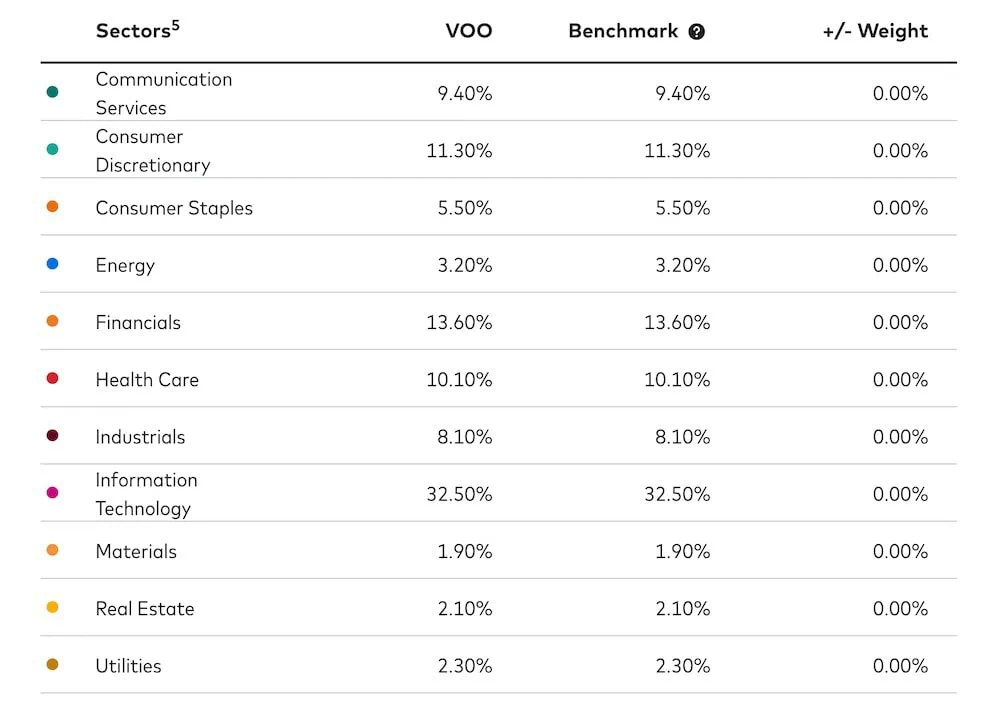

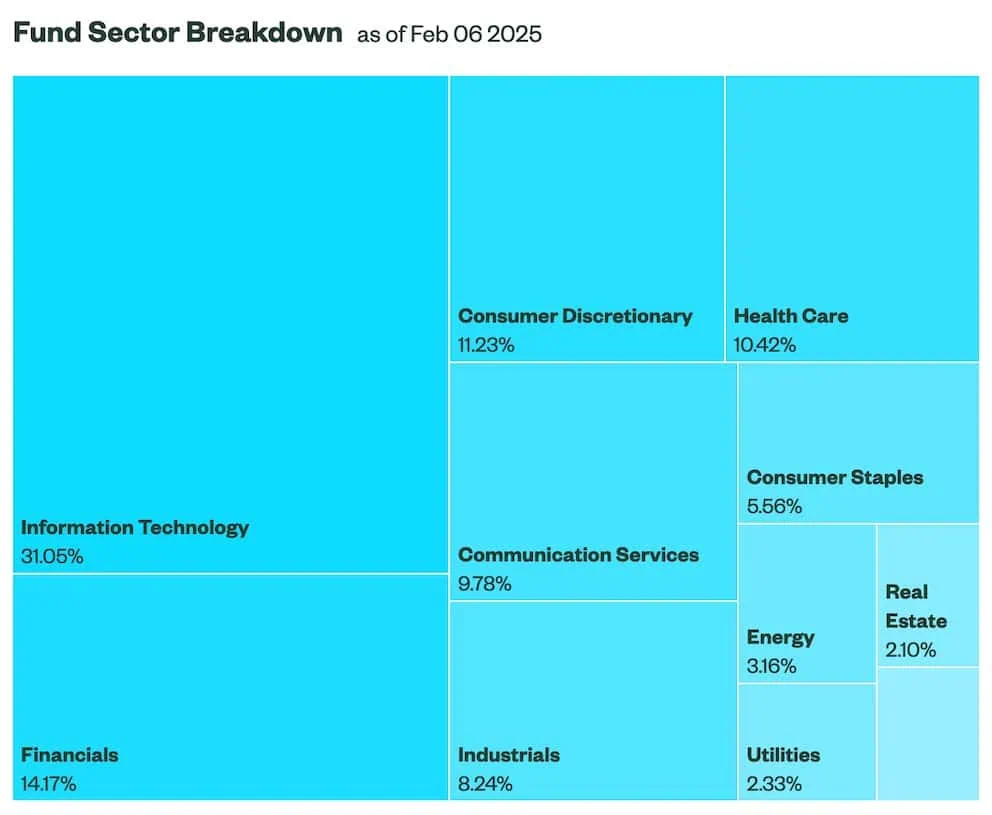

The top sectors are technology (32.50%), financials (13.60%), consumer discretionary (11.30%), industrials (8.10%), and health care (10.10%).

Featured Financial Products

Top 10 Holdings for SPY

SPY has 503 holdings. Its top 10 holdings, as of 02/07/25, include (in order):

- Apple Inc. (AAPL) 6.83% (Technology Hardware, Storage & Peripherals)

- Nvidia (NVDA) 6.12% (Semiconductors)

- Microsoft Corp. (MSFT) 5.99% (System Software)

- Amazon Inc. (AMZN) 4.33% (Internet & Direct Marketing Retail)

- Alphabet Inc. (GOOG/GOOGL) 3.95% (Interactive Media & Services)*

- Meta Platforms Inc. (FB) 3.01% (Interactive Media & Services)

- Broadcom (AVGO) 2.09% (Semiconductors)

- Tesla Inc. (TSLA) 2.03% (Automobile Manufacturers)

- Berkshire Hathaway Inc. (BRK.B) 1.70% (Multi-Sector Holdings)

*Note: This is split across two share classes.

The top sectors are technology (32.35%), health care (10.43%), financials (13.70%), consumer discretionary (11.40%), and industrials (7.29%).

What Are the Stock Market Cap Weightings for Mid Cap Stocks on VTI and SPY?

Mid-cap companies usually have a market value between $2 billion and $10 billion. They tend to be more volatile than large-cap stocks but have higher growth potential.

VTI consists of 19.56% mid-cap stocks, while SPY is just 17.59% in mid-cap stocks.

Related: The 10 Best Vanguard Index Funds to Buy

What Are the Stock Market Cap Weightings for Large Cap Stocks on VTI and SPY?

Large-cap companies typically have a market value of over $10 billion.

These tend to be well-established companies (often called blue-chip stocks) with an above-average chance of surviving economic downturns. There is less chance for extreme growth in exchange for the increased safety of purchasing these stocks.

The vast majority of stocks comprising both funds are large caps. VTI is 71.42% large-caps, while large-cap stocks make up 81.65% of SPY.

What Is the Expense Ratio for VTI?

ETF’s expense ratios are the fees investors are charged that cover portfolio management, marketing, administration, and more. The expense ratio for VTI is 0.03%, one of the lowest rates available.

What Is the Expense Ratio for SPY?

SPY’s expense ratio is 0.0945%. The fund’s expense ratio is considered a low ratio for an ETF and much lower than the average mutual fund. But it is more costly than VTI.

What Are the Dividend Yields for VTI and SPY?

A dividend yield is an amount a company pays out in dividends each year relative to its share price. The dividend yields for SPY and VTI are similar, but SPY’s is slightly higher.

VTI’s dividend yield is 1.18%. SPY’s dividend yield is about 1.19%.

Both funds pay out dividends quarterly.

Related: 17 Best Income-Generating Assets [Invest in Cash Flow]

Which Index Fund Should You Buy?

As VTI and SPY have many of the same top holdings, most successful investors choose to focus on just one or the other.

Too much overlap in your investments means your portfolio isn’t diversified, and a diversified portfolio lowers your risk.

But if you should only buy one of these index funds, which is better? The fund for you depends on your goals and investment style.

VTI is a Vanguard total stock market ETF and contains far more stocks than SPY (thousands compared to hundreds), so this is better if you want broad exposure to the equity market.

Since its asset allocation includes some smaller companies, it might be considered a bit riskier than SPY, which also means it has a higher reward potential.

VTI also has a lower expense ratio than SPY, which could save you money in the long run.

Vanguard is one of the most popular brokerage firms, and if you already use them for other investments, it may be convenient to choose VTI.

It’s also a more affordable ETF, so buying shares of VTI may mean you can have more of your money fully invested. However, this is irrelevant if you use an investment platform that lets you buy fractional shares of ETFs.

VTI and SPY are roughly the same for dividend investors seeking to create a solid passive income. While it has a slightly higher dividend yield percentage than SPY (1.19% vs. 1.18%), the difference is negligible. Also, the difference changes over time, with SPY sometimes yielding more than VTI.

Because SPY’s asset allocation contains virtually no small-cap stocks, it’s slightly less volatile than VTI, which more conservative investors appreciate. Additionally, SPY usually performs a bit better than VTI.

You may also choose to discuss your portfolio with a registered investment adviser. The Investment Advisers Act requires advisers to act primarily on behalf of the clients.

Always make sure to do your due diligence before making investment decisions.

These funds are a wise choice for your brokerage or retirement accounts, especially for long-term investors.

Both VTI and SPY instantly diversify portfolios, giving you broader exposure to the market than buying individual stocks alone. These are particularly wise options for long-term investors.

Related: Appreciating Assets: 10 Best Things that Appreciate in Value

Featured Financial Products

Track Your Net Worth with Either Exchange-Traded Fund

Regardless of whether you choose to invest in VTI or SPY, you’ll be happy you made an excellent long-term investment for building wealth.

Additionally, it’s always a smart idea to diversify your portfolio, whether that be with more standard investments (such as real estate) or more alternative investments.

Empower (Personal Capital is now Empower) is a wonderful way to track all of your investment accounts in one place and track the growth of your net worth.

It’s an online financial advisor with both robo-advisor algorithms and human financial advisors. For access to human advisors, a minimum balance of $100,000 is required, however, the app itself is free and valuable even without the human advisors.

Getting started takes four steps, including:

- Link all of your external financial accounts to get a comprehensive view of your finances.

- Speak with an advisor about your risk tolerance, investment goals, and future major expenses.

- Create a plan. Their advisors will help you build an investment plan that fits your needs.

- Start investing and work with Empower’s award-winning tools.

The more familiar you are with your expenses, the better you can manage them and start to make your money work for you.

However, if you want a go-it-alone strategy and have VTI or SPY represent a major investment pillar in your portfolio, you might not need the financial advising which comes paired with the app.

If this sounds like you, the free app provides useful content for tracking your net worth, expenses, cash flow and more across time. This app functionality alone represents a valuable free tool for progressing toward financial independence.

- Empower (formerly Personal Capital) offers both a free set of portfolio, net worth, and cash flow tracking tools, as well as paid asset management service.

- Link Empower to your bank and investing accounts, credit cards, and more to see a single view of useful information and data, including your net worth.

- Empower Wealth Management offers unlimited advice and retirement planning help, as well as managed ETF portfolios, for accounts with between $100,000 and $250,000 in assets. Higher asset tiers include access to dedicated financial advisors, retirement specialists, and more investment options (including stocks, options, real estate, and private equity).

- Free portfolio tracker

- Free net worth, cash flow, and investment reporting tools

- Dedicated investment advisor

- Free tax-loss harvesting

- Dividend reinvestment

- Automatic rebalancing

- 5-day-a-week live customer support, 24/7 email support

- High minimum for investment management ($100k)

- High investment management fee (0.89% AUM)