The Vanguard Total Stock Market ETF (VTI) and the Vanguard Total Stock Market Index Fund (VTSAX) are commonly confused for each other because they largely reflect similar underlying investment holdings.

In fact, these Vanguard funds are indeed very similar, though they aren’t exactly the same and can’t be spoken about interchangeably.

Both of these exchange-traded funds (ETFs) have gained prominence for their diverse holdings of U.S. stocks, low fees, respectable dividend yields, and dependability as the core to any investment portfolio.

Keep reading for a breakdown of each, their similarities, key differences, and how you can invest in them.

Table of Contents

What Is VTSAX?

The Vanguard Total Stock Market Index Fund (VTSAX) is a large-blend mutual fund centered around the U.S. market. It is passively managed; rather than being run by human fund managers, it tracks a rules-based index that determines what stocks the fund should hold. Specifically, VTSAX tracks the CRSP U.S. Total Market Index.

The fund represents almost 100% of the U.S. investable equity market and is the world’s largest index fund, showing consistent returns over long periods of time.

Despite VTSAX not having significant exposure to many international stocks, many of the companies represented in the index do have a large presence in international markets. For example, major tech companies like Facebook (FB), Apple (AAPL), and Google parent Alphabet (GOOGL) do a significant amount of business overseas and rely on these growing revenues for future growth.

Therefore, the broad holdings in companies based in the United States still provides some international exposure due to many American companies have significant operations abroad.

VTSAX’s top sectors include technology, consumer discretionary, industrials, health care, and financials.

The risk level of VTSAX is comparable with the S&P 500, though see my more thorough comparison of VTSAX vs. VFIAX (Vanguard S&P 500 index mutual fund) for how they differ further.

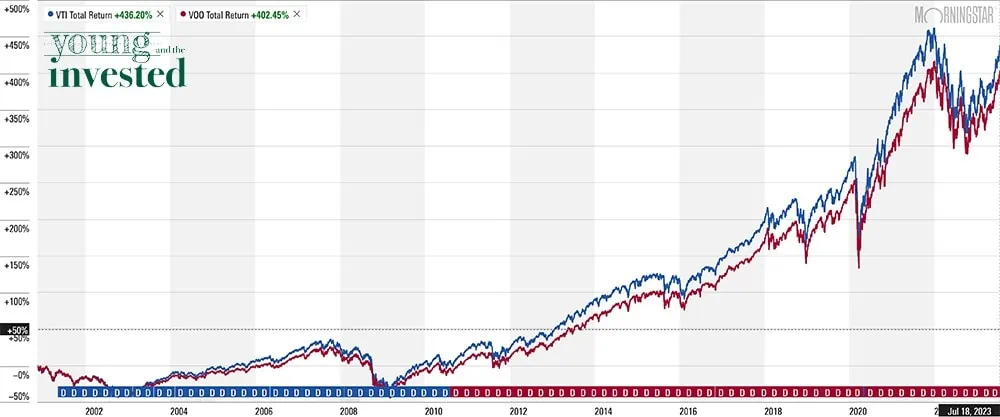

Below, you can see the total return (price plus dividends) performance of VTSAX since the fund’s inception in 2000, compared to the S&P 500, using the Vanguard S&P 500 ETF (VOO) as a proxy for the index.

→ VTSAX vs. S&P 500 Performance Since Inception

What Is VTI?

The Vanguard Total Stock Market ETF (VTI) is an extremely well-diversified, market capitalization-weighted index exchange-traded fund that measures the whole investible U.S. equity market. It was created in 2001.

VTI includes large-cap, mid-cap, and small-cap companies (with “cap” referring to a company’s market capitalization). To date, it remains one of the largest ETFs held by investors in today’s stock market.

VTI is a passive index fund with a very low expense ratio (its annual cost) and low turnover rate (the rate at which a mutual fund or ETF replaces its investment holdings on a yearly basis).

Because of these features, VTI represents one of the most beneficial investments in terms of diversification, expense ratio, and turnover for long-term investors.

VTI, much like VTSAX, tracks the CRSP U.S. Total Market Index.

Like all investments, VTI carries the inherent risk of loss associated with owning assets that follow the stock market during major market volatility. In other words, when the broader stock market turns negative due to a market event, economic downturn, or other adversely-impacting event, the assets underlying VTI (and therefore the ETF itself) can decline in value.

Regardless, VTI represents one of the safer ETF investments you can make for its broad market holdings, low costs and minimal asset turnover. Over the last 20 years, the VTI ETF has outperformed the S&P 500. (Chart uses VOO as a proxy for the S&P 500)

→ VTI vs. S&P 500 Performance Since Inception

Why Do Investors Choose VTI and VTSAX?

While it might seem advantageous to start investing money in individual stocks on your own, there are benefits to investing in index funds through ETFs and mutual funds.

Because VTI and VTSAX (and similar investments) come with built-in diversification, they involve less risk than individual stocks and bonds.

In the long run, index funds which follow the S&P 500 return around 10%, the historical annual market return since the 1920s.

While you can’t capture alpha (outperforming the market) like you might with individual stocks you find using the best stock research apps and software, you also won’t do worse than it.

In my own assessment, it’s hard to argue with the attractiveness of a 10% average annual return which costs you almost nothing to receive over long periods of time.

You could take the time to analyze countless individual stocks and morph them into your ideal portfolio with a service like M1 Finance, but buying VTI or VTSAX is both simpler and statistically more likely to perform well. Alternatively, you can invest in some stock picking services to attempt to beat the market.

While individual stocks can (and sometimes do) go down to zero, this hasn’t ever happened with index funds.

Instead, index funds represent the most straightforward, cheapest, and dependable way to see strong long-term returns in your investment portfolio.

Mutual funds and ETFs can often be actively managed by experts who pick and monitor the stocks or bonds to ensure the fund doesn’t stray too far from the target index. Despite some index funds being considered “actively managed,” they have a clear guide to follow for their investments: their underlying index fund benchmark.

If you want to supplement your portfolio with other stocks, you can do so in addition to holding VTI and/or VTSAX as majority allocations for your net worth.

In fact, both beginners and experienced traders often hold these funds in their portfolios because they know how powerful matching an index’s performance can be over long periods of time.

Other Top Investment Opportunities to Consider

Check out some of these other investment options for a complete listing of every fintech-enabled investment opportunity popping up. They might represent some of the best assets to buy for your portfolio.

|

4.5

|

4.4

|

4.0

|

|

Commission-free trading. Robinhood Gold: Free 30-day trial, then $5/mo.

|

Most funds: 0.85% annual fee. Fundrise Innovation Fund: 1.85% annual fee.

|

Minimum investment: $1,000

|

What Are the Similarities Between VTI and VTSAX?

In 1975, investor John “Jack” Bogle founded Vanguard, which ultimately created VTSAX in 2000, then its sister ETF, VTI, in 2001.

When you look at the commonalities between VTI and VTSAX, it becomes clear why people often mistake one for the other. They’re the same fund; one is just in mutual fund form, while the other one is in ETF form.

Bogle believed it’s better to follow the stock market than to fight it, hoping to capture some alpha from choosing individual securities. Hence, many of Vanguard’s best funds are index funds like VTSAX and VTI.

VTI and VTSAX both track the CRSP U.S. Total Market Index and cover nearly the entire U.S. stock market. As of 6/30/2023, VTSAX had $317 billion in total net assets, while VTI had $310 billion.

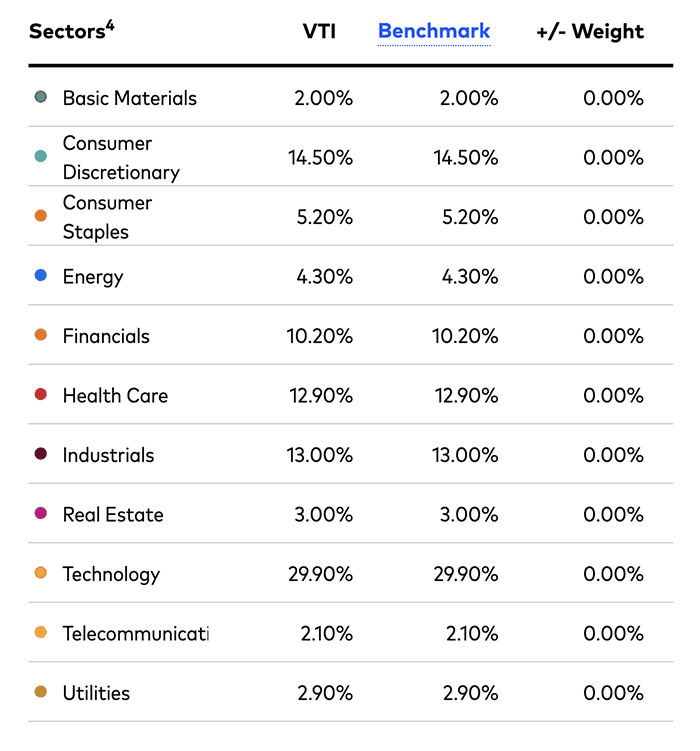

They both hold roughly 3,900 stocks. The technology sector accounts for 29.9% of each fund’s assets, followed by consumer discretionary at 14.50% and industrials at 13.00%. Th same stocks make up the highest percentage of each fund’s assets, too.

To get a sense for how their holdings vary by sector, have a look at the following chart for both VTSAX and VTI (updated as of 6/30/2023):

Meanwhile, here are the top 10 holdings for both VTSAX and VTI.

| Company | Ticker | Weight |

|---|---|---|

| Apple | AAPL | 6.09% |

| Microsoft | MSFT | 5.27% |

| Alphabet | GOOG / GOOGL | 2.81% |

| Amazon | AMZN | 2.21% |

| Nvidia | NVDA | 1.60% |

| Tesla | TSLA | 1.37% |

| Berkshire Hathaway | BRK.B | 1.32% |

| Meta Platforms | META | 1.16% |

| Exxon Mobil | XOM | 1.10% |

| UnitedHealth Group | UNH | 1.09% |

As for the specific similarities between VTI vs. VTSAX, consider the following items:

- Very similar expense ratios, with VTI at 0.03% and VTSAX at 0.04%.

- Extremely similar returns over equivalent periods of time.

- These income-generating investments have identical yields: 1.51% (as of 07/25/2023). You can choose to reinvest this passive income.

- Vanguard still assesses a $25 annual account service fee if your account with them has less than $10,000 in assets invested. However, you can avoid this fee simply by going paperless and opting for digital communications.

- These are solid options for investors who don’t want to pick out a bunch of individual stocks.

In almost all dimensions, the two funds are identical. However, as you’ll learn in the next section, while VTI and VTSAX have many similarities, there are a few key differentiators.

What Is the Difference Between VTI and VTSAX?

→ ETF vs. Mutual Fund

The clearest distinction between VTI and VTSAX is that VTI is an ETF while VTSAX is a mutual fund.

ETFs trade like stocks do with real-time pricing while the stock market is open. However, a mutual fund’s price settles at the end of market trading each day. Its net asset value (NAV) is calculated based on the buy and sell orders put in place since the last settlement date. This means on any particular day, you receive the same price as anybody else, regardless of what time of day you put in your order. It also means you won’t know the exact amount you pay until the trading day has finished.

Depending on your stock trading platform (consider some of these best Robinhood alternatives if you want a self-directed, zero commission broker), you might or might not have to pay a trading fee with an ETF.

If you want to trade equities quicker, an ETF represents the better option because it establishes better price certainty and timing on execution.

However, if you want to make a long-term investment without much dependence on market timing, the difference is negligible.

→ Automated Investing

Another factor to consider is that sometimes with mutual funds, enrollment in automated investing can be easier because mutual funds do not have a set price level for additional investment.

In other words, you do not need to set aside a specific amount of money per share like you might when buying a share of an ETF or stock because mutual funds trade on fractional shares.

For example, if you had $50 to purchase a share of a mutual fund but its price was $100/share, you could purchase half of a share with your $50. With an ETF, if it trades at $150 and you have $2,000 set aside for investing, you can’t put the full $2,000 in the ETF.

With most brokerages, you can invest $1,950 of that sum by purchasing 13 shares in the ETF, but you would either have to save the remaining $50 or invest it in a handful of penny stocks.

Now, some fintech investing services like M1 Finance allow you to purchase fractional shares in stocks and ETFs. It works when the service breaking shares into 1/100,000th of a share, thereby allowing you to trade specific dollar amounts which can better match your portfolio targets.

However, some mutual funds still have minimum initial investment thresholds established by the fund companies and are not something a discount broker can overcome.

For example, the minimum investment to purchase VTSAX is $3,000, which may be intimidating to new investors. Once you’ve hit the minimum, you can invest any amount over it that you want.

VTI has no minimum initial investment beyond the cost of purchasing one share. You simply have to buy at least one share at the current market price.

At the time of this writing, VTI costs less than $250, which is much more accessible to start investing in early with some of the best financial apps for young adults.

→ Tax Efficiency

Generally speaking, ETFs have greater tax efficiency than mutual funds. In this case, VTI would count as a more tax-efficient investment than VTSAX.

The primary reason for this involves the nature of how the fund structures investor share balancing, specifically whether the fund counts as an open-ended or closed-end fund:

- Open-ended vs. closed-end fund. Mutual funds and ETFs are either: open-end—meaning the investment trades between an investor and the fund with a limitless number of shares available to the investing public; or closed-end—the fund issues a fixed number of shares for public investment, regardless of investor demand.

Typically, ETFs are closed-end investments while mutual funds are open-end funds. Because of the common closed-end nature of ETFs, they tend to have lower capital gains than mutual funds because of how they trade in the market.

Specifically, when an investor sells shares in a mutual fund, such as VTSAX, the investor sells the shares back to the fund (open-end), causing the fund to redeem the shares and sell the underlying assets to provide the investor with cash equivalent to the investment. Alternatively, mutual funds can keep cash on hand to avoid selling the underlying assets at an inopportune time.

Regardless, this sale counts as a taxable event to the investor and can trigger capital gains to other holders of the mutual fund when the fund realizes net capital gains from the sale of fund shares during the calendar year.

Additionally, the investor may have to pay taxes on a proportionate share of the fund’s capital gains realized during the year. In the event the mutual fund sells securities for a net profit (meaning the gains cannot be offset by losses), the law requires the mutual fund to distribute these capital gains to shareholders.

Typically, these capital gains distributions occur toward the end of the year as the fund may generate offsetting losses toward the end of the year, thereby avoiding distributing these capital gains to investors.

With ETFs, on the other hand, assets trade person-to-person as opposed to person-to-fund like with most mutual funds (closed-end). Therefore, when someone sells, the fund doesn’t need to sell the underlying assets and redeem the shares.

The best target-date funds also encounter this same tax efficiency dynamic depending on whether they are structured as ETFs or mutual funds.

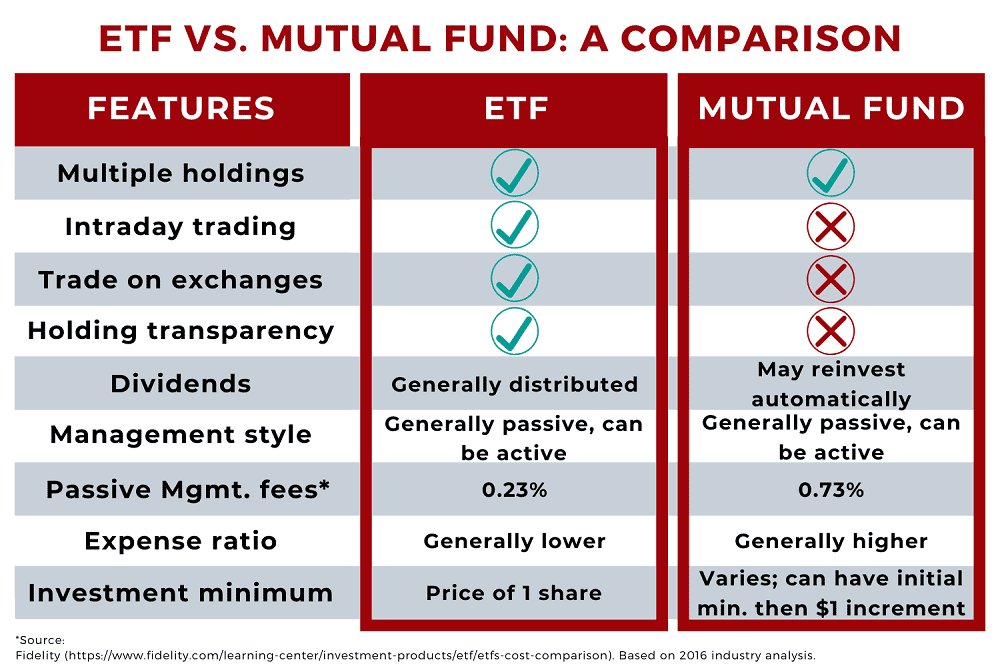

To get a better sense of how ETFs and mutual funds compare, have a look at the infographic I created below.

The difference becomes fairly negligible if you plan to hold either as a long-term investment. The logical question you’re likely asking yourself right now is, “Which should I invest in?” Fortunately, because you’re likely to see very similar returns, this isn’t a question to stress yourself out about too much. To decide, ask yourself a few questions, including:

- Am I investing long-term or short-term? If long-term, either works. For short-term, VTI may be better, but both are ideally long-term to build wealth.

- Do I want to dedicate a specific sum to my investment or do I mind it being slightly higher or lower depending on share price? If you can adjust the amount you invest, either works. If there is a specific amount you set aside, VTSAX may be better because of the fractional share purchasing opportunity presented by mutual funds unless you invest with a service like M1 Finance which allows fractional share purchases on stocks and ETFs.

- Do I currently have at least $3,000 to invest? If yes, either works. If no, you can only invest in VTI.

Remember that, while both VTI and VTSAX are historically some of the safer investments over long periods of time, there is still a degree of risk always involved when investing in the stock market.

With that risk often comes gains much more significant than that of a high-yield savings account or even Certificates of Deposit (CD) (both recommended as some of the best short-term investments for young investors), but this money isn’t insured like money put into savings. Carefully weigh the risks and benefits.

If you already know you want to invest in VTI or VTSAX, your next step is deciding what platform to invest through. With this question, you quickly learn that another difference between VTI and VTSAX is that you’re able to invest in VTI through many more trading platforms than VTSAX.

Related: 10 Best Debit Cards for Teens to Become Money Savvy

Track Your Net Worth with Either Fund Type

Regardless of whether you choose to invest in VTI or VTSAX, you’ll be happy you made an excellent long-term investment for building wealth. Investing smartly for the future is a core tenet of personal finance.

Additionally, it’s always a smart idea to diversify your portfolio, whether that be with more standard investments (such as real estate) or more alternative investments.

Empower (Personal Capital is now Empower) is a wonderful way to track all of your investment accounts in one place and track the growth of your net worth.

It’s an online financial advisor with both robo-advisor algorithms and human financial advisors. For access to human advisors, a minimum balance of $100,000 is required, however, the app itself is free and valuable even without the human advisors.

Getting started takes four steps, including:

- Link all of your external financial accounts to get a comprehensive view of your finances.

- Speak with an advisor about your risk tolerance, investment goals, and future major expenses.

- Create a plan. Their advisors will help you build an investment plan that fits your needs.

- Start investing and work with Empower’s award-winning tools.

The more familiar you are with your expenses, the better you can manage them and start to make your money work for you.

However, if you want a go-it-alone strategy and have VTI or VTSAX represent a major investment pillar in your portfolio, you might not need the financial advising which comes paired with the app.

If this sounds like you, the free app provides useful content for tracking your net worth, expenses, cash flow and more across time. This app functionality alone represents a valuable free tool for progressing toward financial independence.

- Empower (formerly Personal Capital) offers both a free set of portfolio, net worth, and cash flow tracking tools, as well as paid asset management service.

- Link Empower to your bank and investing accounts, credit cards, and more to see a single view of useful information and data, including your net worth.

- Empower Wealth Management offers unlimited advice and retirement planning help, as well as managed ETF portfolios, for accounts with between $100,000 and $250,000 in assets. Higher asset tiers include access to dedicated financial advisors, retirement specialists, and more investment options (including stocks, options, real estate, and private equity).

- Free portfolio tracker

- Free net worth, cash flow, and investment reporting tools

- Dedicated investment advisor

- Free tax-loss harvesting

- Dividend reinvestment

- Automatic rebalancing

- 5-day-a-week live customer support, 24/7 email support

- High minimum for investment management ($100k)

- High investment management fee (0.89% AUM)

Related: Personal Capital Alternatives to Manage Your Portfolio

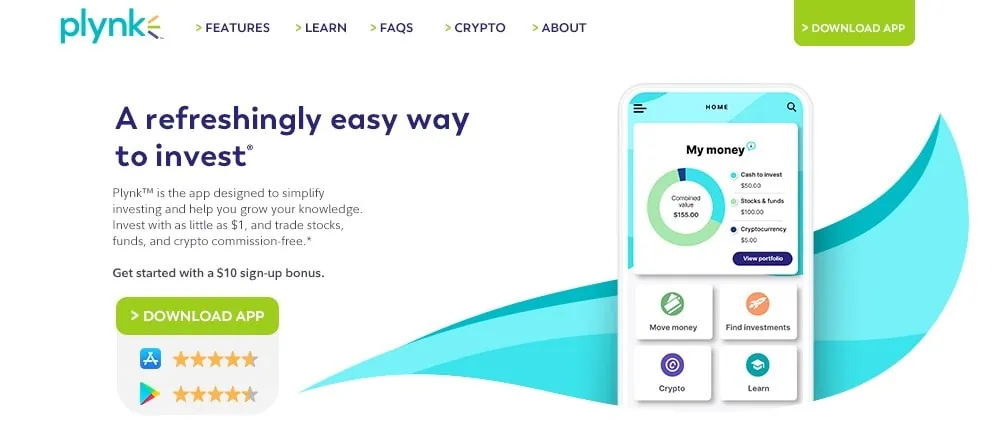

PlynkTM Invest

- Available via Apple iOS and Android App on Google Play.

- Price: Free, but certain features may require a fee in the future.

- Sign up here

Plynk™ is an app designed to help you start investing and learn along the way, and they’re currently offering a $10 account signup and $75 net deposit bonus ($85 combined).

The Plynk app helps investors put their money into an investment portfolio. You can invest with as little as $1, and trade stocks, funds, and crypto commission-free**—all in one app.

The platform uses straightforward, easy-to-understand language to explain investing concepts. No jargon. No complex charts and tables. Just simple-language tips and how-tos.

Navigate investment ideas with tools to help you explore and choose. With Plynk Explore, just answer a few questions, and the app will display stock, ETF, and mutual fund investments that mesh with your investment comfort zone.

To assist with building your financial literacy, Plynk offers complete lessons and courses on financial education, including tips, educational content and how-tos.

The Plynk app enables you to make use of a powerful investing technique called dollar-cost averaging through participating in recurring investments. By continuing to buy a fixed dollar amount of investments over time, whether the market is up or down, you can build a disciplined investing habit and lower the stress that can come from market movements.

One of Plynk’s most interesting features involves, of all things, gift cards. Specifically, you can redeem unused gift cards for money that you can use to buy stocks in your favorite companies.

If this sounds interesting to you, consider opening an account with Plynk. To make it more worth your while, they have a few special offers.

Simply open an account and link your bank account to get a $10 signup bonus. Plynk is also offering a special bonus promotion through Feb. 15, 2024. If you make a deposit, Plynk will double it up to $75. Customers must have a minimum of $25 in net deposits during the promotional period to receive a match. That means you may be eligible for up to $85 in signup bonuses from Plynk by taking qualifying actions.

- Start investing for as little as $1.

- Answer just a few questions, and find suitable investments for your needs.

- Invest in stocks, exchange-traded funds (ETFs), mutual funds and crypto commission-free**.

- Plynk™ lets you redeem unused gift cards for money that you can use to invest in your favorite companies.

- Signup bonus: Plynk offers two signup bonuses worth up to $85 combined: (1) Plynk will match up to $75 in net deposits made to your account through Feb. 15, 2024, subject to certain terms; (2) Plynk will pay a $10 sign-up bonus for downloading the Plynk app, opening an account and linking a bank account as a new customer (or existing customer who hasn't previously linked a bank account).

- Designed for beginning investors

- Redeem unused gift cards to invest

- Helpful educational resources

- Some features may require a fee in the future

Related: Best Debit Cards for Kids

Plynk Disclosures

![6 Best Seeking Alpha Alternatives [Competitors' Sites to Use] 28 best seeking alpha alternative](https://youngandtheinvested.com/wp-content/uploads/best-seeking-alpha-alternatives.webp)