Round-up apps are the modern-day coin jar.

For younger readers who aren’t as familiar: Tossing spare coins into a jar used to be one of the most popular forms of saving. It stopped your pockets from jingling, you didn’t miss the money, and once the jar was full, you could exchange all of the money at the bank or a coin machine.

Assuming you weren’t living paycheck to paycheck, this was “fun” money you could spend however you wanted—you might head out to a restaurant or pick up a new pair of shoes.

Paying with cash is becoming less common by the year, however, as people increasingly use more convenient methods: credit cards, debit cards, and money apps. Plastic and digital spending are in … and jingling pockets are out.

But that doesn’t mean “spare change” is gone completely—it, like spending, has simply evolved, becoming the “round-up.” Read on as we explain how these work, and then we’ll look at the best round-up apps you can use as your own digital coin jar.

What Are Round-Ups?

With round-ups, your purchase prices are rounded up to the nearest dollar.

If this sounds familiar, that’s because you see it all the time at grocery stores and other retailers. The cashier will ask you if you’d like to round up your total, say, to donate to a charity.

But this kind of roundup involves a financial app rounding up your purchase, with the “spare change” put into a savings account or invested for you.

How Do Round-Ups Work?

Let’s say you’re heading to work, and you decide to grab breakfast. You get a coffee and a sandwich, and it sets you back $9.69. You go to pay with a normal debit or credit card or money app, you pay the $9.69, and the transaction is over.

However, now let’s say you have a card or app with a round-up feature. Instead, your card is charged for $10, then the extra 31 cents is added to a spillover fund like a savings account or investing account. And this happens with every purchase you make with the card or app—a seamless process that makes saving automatic.

But which app does it the best?

Round-Up Apps—Our Top Picks

- Robinhood Cash Management ($5-$200 bonus)

- Acorns ($20 bonus)

- Greenlight

- SoFi Checking & Savings (Up to $300 bonus)

- Current

Best Round-Up Apps

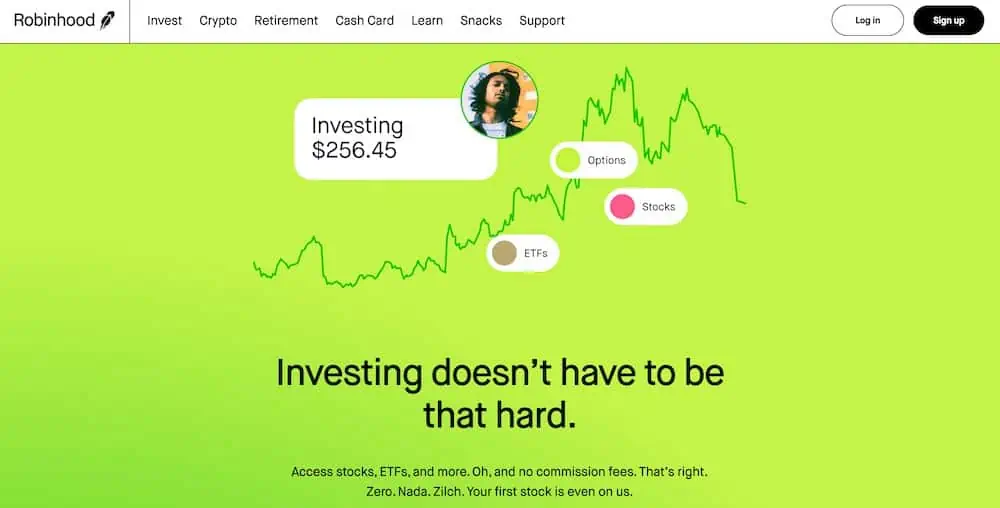

1. Robinhood Cash Management (Best for APY on Round-Ups)

- Available: Sign up here

- Price: No commission on equity trades; Robinhood Gold subscription: $5/mo.

- Platforms: Web, mobile app (iOS, Android)

Robinhood is best known for entering the market over a decade ago and changing the retail brokerage market by eliminating trading commissions on stocks and exchange-traded funds (ETFs). Lowering this hurdle brought down the cost of investing for small investors and by extension gave broader access to the stock market than any point in history.

The company continued to add features to its stock trading app that give their customers the power to earn on their money. One such product is the Robinhood Gold Cash Sweep account, a way to earn up to 4% on your idle cash and do so while enjoying up to $2.25m in FDIC-coverage on your money held there. That amounts to many multiples more than what the average savings account pays and they’re even sweetening the deal with a promotional unlimited 1% deposit boost bonus. (Editor’s Note: Getting this APY rate and deposit bonus requires enrolling in a Robinhood Gold subscription for $5 per month after a free 30-day trial.)

But what’s even better isn’t just earning this competitive APY, is pairing it with Robinhood’s Round-Ups. You can round up your Robinhood Cash card transactions to the next dollar, and set aside the spare change to invest in your choice of stock, ETF, crypto, or brokerage cash balance to earn interest. Your round-ups will deposit each week.

After you’ve turned on round-ups and selected an investment, Robinhood will automatically round up completed eligible transactions to the nearest dollar, and set aside the rounded-up change in your spending account. (If you’re not yet ready to invest in a stock, ETF, or crypto, you can select brokerage cash as your round-up option. Your weekly round-ups total will go into your brokerage cash balance and earn interest via the brokerage cash sweep program.)

So, if you’re looking for a place to stash your cash with a healthy yield with the added boost of Round-Ups and also with the flexibility to invest it in the market, consider opening a Robinhood account, funding it and earning interest on your automatic savings. On top of the competitive interest rate and deposit boost bonus, they also offer free stock for opening and funding an investment account.

- Robinhood is a pioneer in the investing app world, offering commission-free trades on stocks, ETFs, options, and cryptocurrency, as well as one of the deepest libraries of investing educational content.

- Investing for retirement? Robinhood will match 1% of any IRA transfers or 401(k) rollovers, as well as any annual contributions*, made to your Robinhood Retirement account—and you can get a 3% match on any new contributions if you subscribe to Robinhood Gold.

- Want more advanced trading tools? Download Robinhoold Legend—a desktop trading platform with real-time data, customizable layouts, deeper asset analysis, and more—for free.

- Robinhood's robo-advisory service, Robinhood Strategies, will build you a custom portfolio of stock and bond ETFs (and individual stocks for accounts with at least $500), for a low 0.25% in AUM, which is capped at $250 annually for Robinhood Gold members.

- Robinhood Gold also includes Level II market data provided by Nasdaq, higher interest rates on uninvested brokerage cash, lower margin trading rates, bigger Instant Deposits, and access to the Robinhood Gold Card (a 3% cash-back Visa credit card).

- Special offer: Sign up for Robinhood, link a bank account, and fund your account with at least $10, and receive a randomly selected cash amount between $5 and $200 to put toward certain fractional shares.

- Very good selection of available investments in brokerage accounts

- 1% match on rollovers, IRA transfers, and new contributions to IRAs and Roth IRAs (3% new-contribution match with Robinhood Gold)

- Automated recommended portfolios

- Intuitive interface

- Robo-advisory service (Robinhood Strategies)

- Extensive educational library

- No mutual funds in brokerage or IRAs

- Match doesn't apply to Robinhood Strategies accounts

2. Acorns (Best for Using Round-Ups to Invest)

- Function(s): Saving, spending, investing

- Available: Sign up here

Acorns is an investing app geared toward minors, young adults, and millennials, that pioneered round-up capabilities. Acorns’ Round-Ups feature rounds up purchases made on linked debit and credit cards to the nearest dollar, investing the difference on your behalf. On average, Acorns users invest over $30 each month from Round-Ups.

With Acorns, once your Round-Ups reach at least $5, they can be swept into your Acorns Invest account. You can choose to round up manually, deciding which transactions will be invested, or use Automatic Round-Ups to simplify the process. And if you have Automatic Round-Ups selected, these Real-Time Round-Ups will be invested as soon as your transaction clears.

Want to save faster? Take advantage of Round-Ups Multiplier, which lets you choose to multiply the amount that would normally be rounded up by 2x, 3x, or 10x. You can turn Multiplier on and off whenever you want.

Not sure what to do if the transaction is an even dollar amount? (Say, $1.00 or $2.00.) Whole-Dollar Round-Ups let you select how much to round up whenever this happens.

The Acorns investment account itself is an automated platform that uses pre-built portfolios of exchange-traded funds (ETFs) to keep investors exposed to stocks and bonds—ideal for younger, less experienced investors, as well as people who just want to keep things simple. Learn more or sign up today.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Silver tier includes perks such as a 25% match on Acorns Earn rewards (up to $200/mo.), generous APYs on Checking and Emergency Fund, and live Q&As with investing experts.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts for children with 1% contribution matches.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions in your first year.*

- Special offer: Get a free $20 bonus investment when you sign up with our link and start making recurring investments.**

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Silver and Gold)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Gold for any self-directed investing options

Related: How to Invest as a Teenager [Start Investing as a Minor Under 18]

3. Greenlight (Best Investment Account With Parental Controls)

- Function(s): Saving, spending, investing

- Available: Sign up here

Greenlight, through its Max and Infinity plans, is an investment account for kids that comes paired with a debit card and bank account. It’s easy to use, it allows your child to spend and save, and it can teach your kid the basics of banking and investing.

Greenlight offers a number of Savings Boosts, such as savings rewards and cash back to savings. Another Savings Boost? Round Ups, which allows change from transactions to be funneled into your savings. You can have Round Ups set to always round up, never round up, or ask you before transferring.

A few features of the investing account:

- Start investing with as little as $1 in your account.

- Buy fractional shares of companies you admire (kid-friendly stocks).

- No trading commissions beyond the monthly subscription fee.

- Kids can only invest in stocks and ETFs with a market capitalization over $1 billion.

- Parents must approve every trade directly in the app.

Consider opening a Greenlight Max or Infinity account to start investing today.

- Greenlight is a financial solution for kids that allows them to spend with a debit card, earn money on savings, and even invest their money.

- Parents can use this app to teach kids how to invest with a brokerage account through Greenlight Max and Greenlight Infinity plans.

- Greenlight offers flexible parental controls for each child and real-time notifications of each transaction. And it's the only debit card that lets you choose the exact stores where kids can spend on the card.

- Families can earn 2% (Core), 3% (Max) or 5% (Infinity) per annum on their average daily savings balance of up to $5,000 per family. Also, Max and Infinity families can earn 1% cash back on their monthly expenditures.

- Unlike many apps that simply provide features and controls, Greenlight is also designed to spark discussions with children about spending, investing, and more, fostering a better educational experience.

- Best-in-class parental controls (can prohibit specific stores)

- Can add brokerage account to invest in stocks

- Intuitive Parent and Kid apps

- Competitive cash back and interest rates

- High price points

- No cash reload options

- No parent / child lending

Related: How to Invest Money: 5 Steps to Start Investing w/Little Money

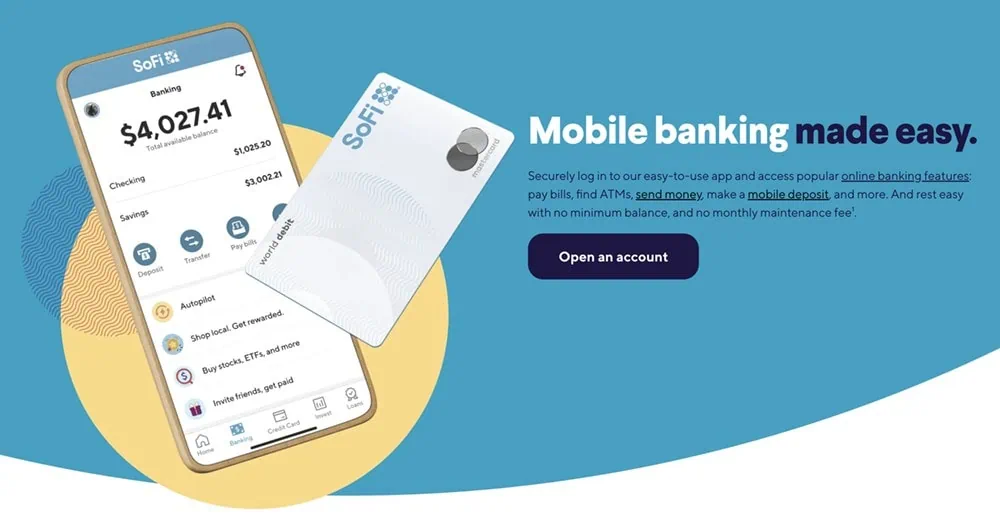

4. SoFi® Checking & Savings Account

- Function(s): Saving, spending, investing (through SoFi Invest®)

- Available: Sign up here

The SoFi Checking & Savings Account sounds like your run-of-the-mill bank account, but it’s more: It’s also a high-yield savings account that earns far more than the national average percentage yield (APY)2 and more than the average high-yield account. Better still, it boosts your ability to save right off the bat by rewarding you with up to $300 upon sign-up.1

Sofi Checking & Savings covers all of the basics: An account with website and mobile app access with no monthly account fees, overdraft fees, and minimum balances3. Among its best perks:

- FDIC insurance of up to $250,000, and you can access additional insurance up to $3 million on deposits through a seamless network of participating banks.4

- Access to more than 55,000 fee-free ATMs within the Allpoint® Network.5

- Get your paycheck up to two days early when you set up direct deposit.6

- No-fee overdraft coverage up to $507

- Round-ups on debit card purchases, which are deposited into your savings.

You can get a head start on your savings with qualifying direct deposits. You’ll receive $50 in bonus cash if $1,000.00 to $4,999.99 is sent to your account within a 25-day period, starting from when you receive the first direct deposit. That number jumps to $300 when you receive $5,000 or more. The higher cash bonus requires you to hit an admittedly high threshold, but the $50 is a reasonable bonus for a much more manageable threshold.

Want to get started on your cash bonus? Use our exclusive link to sign up with SoFi today.

- SoFi's Checking & Savings Account is an account with no monthly fees and an above-average APY on the savings side that offers a number of perks, especially if you meet certain direct deposit monthly minimums.

- Receive up to 3.60% APY² with eligible direct deposit or $5,000 or more in qualifying deposits during the 30-day evaluation period. (Members without eligible direct deposit earn 1.00% APY on savings and 0.50% APY on checking.)

- Earn up to 4.30% APY on SoFi Savings with a 0.70% APY Boost (added to 3.60% base APY as of 11/12/25) for up to 6 months.⁸

- Your money is FDIC-insured up to $250,000. You can also access additional insurance up to $3 million on deposits through a seamless network of participating banks.⁴

- Round up debit card purchases, and the excess is automatically sent to your savings.

- Special Offer: If you set up a qualifying direct deposit within the promotion period, you can earn up to a $300 cash bonus.¹

- Above-average yield (3.80% APY) on its high-yield savings account²

- No monthly fees, no overdraft fees³

- Up to $3 million in FDIC insurance⁴

- Round-ups

- Offers up to $50 of overdraft coverage with direct deposit of at least $1,000 monthly⁷

- Many perks tied to direct deposits

- High direct deposit threshold for maximum cash bonus

5. Current Bank (High-Powered Banking App)

- Function(s): Saving, spending

- Available: Sign up here

Current provides a wide range of banking services, as well as financial tools and other perks that set it apart from traditional accounts.

Among Current’s most popular features are Savings Pods. Each Current account comes with three Savings Pods, which are like digital envelope savings plans, or like having multiple savings accounts. Most people have more than one savings goal—and Savings Pods allow you to choose how much you want to allocate toward each goal.

Current’s Round-Ups feature allows you to send digital “change” into the Savings Pod of your choice. But note that you can’t use Round-Ups for multiple Savings Pods—the feature can only be enabled for one Pod at a time.

Current offers a high APY on the first $2,000 in each of your three Savings Pods, though the APY on additional balances is close to the national average for all (not just high-yield) savings accounts. Other features include no fees for overdrafts under $200, faster paydays with direct deposit, and points that you can redeem for cash back in your account.

- Current is a financial technology platform that lets teens enjoy not just traditional banking basics, but numerous features meant to simplify spending, streamline saving, and set them on the path toward more organized finances.

- Teens can spend with the Current Visa debit card, which allows them to purchase in-store and online, as well as withdraw money fee-free from more than 40,000 in-network Allpoint ATMs.

- Current Teen Accounts also come with Savings Pods, which earn 0.25% APY and allow you to round up purchases (overages are funneled into your savings).

- Parents can monitor their kids' spending, adjust maximum ATM withdrawal and spending limits, and even toggle spending categories (and the Current debit card itself) on and off.

- Parents can also automate allowance payments, pay for chores, instantly transfer money to their teens, and more.

- Free account (no monthly maintenance fees)

- Good parental controls

- Fee-free ATMs

- Cash reloads

- Gas hold deposits

- 24/7 email and live-chat support

- No direct deposit

- No paired investment account

- No card customization

Related: 15 Best Investing Research & Stock Analysis Websites

6. Chime Bank (Checking Account With Round-Ups)

- Function(s): Saving, checking, spending

- Available: Sign up here

Chime was created with the idea that basic banking services should be easy and free. Thus, users aren’t charged service fees, overdraft fees, foreign transaction fees, and other charges. Chime customers also have access to more than 60,000 fee-free ATMs nationwide, and they can get paid up to two days earlier if they set up direct deposit.

When you open a Chime checking account, you can choose to enroll in savings, too. Chime’s high-yield savings account boasts an average annual percentage yield (APY) that’s several times higher than the national savings account yield.

With Chime’s Save When You Spend feature, round-ups from your Chime Visa Debit Card are automatically transferred from your checking account into your savings account, helping you put that high yield to work more quickly.

- Chime banking is a financial technology platform that charges no monthly, transaction, or overdraft fees, requires no minimum balance, and offers access to more than 60,000 fee-free ATMs.

- Build your credit with Chime's no-fee Visa secured credit card.

- High-yield savings account currently offers 2.00% APY and provides automated saving services.

- Chime's Save When You Spend feature automatically rounds up transactions to the nearest dollar and funnels those round-ups into the Automatic Savings Account app.

- Age requirement: 18 or older

- Access to 60,000-plus fee-free ATMs

- Round-ups

- Get paid early on direct deposit paychecks

- FDIC insurance

- No physical branches

- Must sign up for direct deposit to use mobile check deposit service

- Savings APY lower than typical high-yield savings account

Related: Best Custodial Accounts: How to Start Investing for Kids

7. Qoins

- Function(s): Saving, spending, budgeting

- Available: Sign up here

Qoins is a financial app and prepaid debit card with features centered around getting its users out of debt faster.

Unlike other apps where your goal might be a car down payment or a vacation to Greece, Qoins helps its users meet goals like knocking out their credit card debt or student loans. (But once you’re debt-free, you can set fun savings goals, too!)

Qoins takes the money in your account and makes debt payments with it once every month. This can help you pay off debt faster, reduce the amount of interest you pay, and improve your credit score. According to Qoins, its program can shave anywhere from two to seven years off loan terms, and it has saved users an average of $3,200 in interest payments.

As you might expect, Qoins’ round-ups work with the same goal in mind. The app rounds up purchases that you make, but rather than putting the digital change toward savings, it goes to paying off your debt.

- The Qoins prepaid debit card helps you to pay off debt faster without thinking about it. The app automates extra payments towards your debt and helps you save money every month.

- Organize and track all of your debts and financial goals in one app.

- FDIC-insured

- Free financial tools and money tips

- High fees

- No investing functionality

- Few features

Related: 15 Best High-Yield Investments [Safe Options Right Now]

8. Qapital

- Function(s): Saving, spending, investing, budgeting

- Available: Sign up here

Qapital is a highly customizable savings app that pulls money from an existing checking account you connect with the app.

Qapital has one of the more flexible round-up programs. Like with most programs, when you make a purchase with an account that its “Round-Up Rule” is applied to, Qapital will deposit the spare change into one of your Goals (investment or savings).

However, unlike most programs, you don’t just have to round up to the nearest dollar—you can round up even higher. So, let’s say you selected $4 for your Round Up Rule amount: If you spent $5.50 on a coffee, the purchase wouldn’t be rounded up to $6—it would be rounded up to $9! And whole-dollar amounts are always rounded up to your Round Up Rule amount; if it’s set to $2 and you spend $1, you’ll be charged $3 and a full $2 will be saved toward your goal.

You can save in other ways, too. For instance, you can set Qapital to save a dollar every time you go for a jog, or five bucks every time you go to a baseball game.

People who want to incorporate Qapital further into their financial lives can sign up for the Qapital Visa Debit Card and spending account. The fee-free card provides no-fee access to more than 55,000 ATMs, and is compatible with Apple Pay, Google Pay, and Samsung Pay. It offers round-ups, too, as well as money management features such as Spending Sweet Spot and Money Missions.

When you’ve reached a certain savings goal, you can cash it out through the debit card, or through one of your bank accounts.

If you prefer to invest with your round-ups, you can pick from several pre-built portfolios—from very conservative (90% bonds, 10% stocks) to very aggressive (10% bonds, 90% stocks).

- Qapital is a personal finance app that automates many common decisions for individuals and couples, allowing you to focus elsewhere.

- The app provides tips rooted in behavioral psychology to supercharge your savings, reduce your debt and invest in your future.

- The service claims to help Premier users save an average of $5,000 per year.

- Automates personal finance decisions

- Can manage finances jointly with a significant other

- Offers free investment plans (no AUM fees)

- FDIC/SIPC insurance

- Can only invest with Complete or Premier

- Only receive a Visa debit card with Complete or Premier

- Low interest rate on Qapital Spending Account

Related: 10 Best Stock Trading Apps for Beginners [Free + Paid]

Frequently Asked Questions (FAQs)

Do Savings App Round-Up Plans Work?

Absolutely. A round-up app works in the background to set aside more money than you typically would. Every purchase you make suddenly becomes a new opportunity to save money.

But let’s be clear: If you have lofty savings goals—say, a child’s college fund or your retirement—you need to save and invest more substantial amounts than what a round-up program can provide. That said, some savings apps will also let you send over regular payments from a savings account or checking account, so you can augment your savings that way.

Are Round-Up Apps Safe?

Round-up apps aren’t inherently safe or unsafe. Features matter.

For one, you want to make sure that your savings are FDIC-insured. And all of the round-up apps listed above offer FDIC insurance up to $250,000 on savings. If your app has an investing component, you’ll also want to ensure there’s insurance on that—Stash Invest, for instance, offers $500,000 worth of insurance on investments through the Securities Investor Protection Corporation (DIPC). Just note that insurance only protects investments from an institutional failure—not from losses if your investments simply lose value.

Past that, you’ll want to make sure your round-up app has other types of security, such as account verification, identity protection, encryption, etc.

Are Round-Up Savings Apps Worth It?

If you want a way to incrementally save without having to think about it, round-up savings apps are excellent tools that are worth the time and energy. They automatically transfer money to your savings with each transaction, letting your savings slowly build up over time. They’re especially useful if they can double as standard banking and investment accounts.

Do be mindful of fees, however. If you’re paying a few dollars a month for an app and only end up saving a few dollars per month, you’re still where you started before. So make sure if you’re paying for a round-up savings account, that your savings progress—and the app’s other features—are worth the cost.

Is the Digit Account a Round-Up App?

Digit is a financial app that provides typical banking features such as saving and spending, allows you to invest, and also helps you budget your money. However, it is not a round-up app in the truest sense.

Some reviewers include the Digit account in their lists of round-up apps because it can help you save. Specifically, Digit uses artificial intelligence to study your finances, then it automatically saves money for you in incremental accounts, as your budget allows, to help you reach savings goals.

It sounds similar, and it has a similar goal of helping you save, but it’s not the same thing.

Why Should I Use Round-Up Apps?

We can think of several good reasons to use round-up apps, including (but not limited to):

- They’re easy to use. Setup is typically simple, and saving is even easier. Just make your regular purchase, and money will trickle into your savings account without you lifting another finger.

- Little amounts add up. Several of the round-up apps we’ve talked about claim that their users can save hundreds if not thousands of dollars each year. Yes, 30 cents here and 45 cents here doesn’t seem like much. But add those amounts up across dozens of transactions each month, and you’re generating real savings.

- They keep you focused on your goals. Round-up apps typically center around financial goals. That’s good! Vaguely saving can be difficult for people. But when you start to see real, tangible progress toward a stated goal, that can act as motivation to keep up what you’re doing and even find other ways to save.

Put simply: Round-up apps are easy to use and can help you reach savings goals more quickly than you’d think.

Related:

![Best Cash Alternatives [Get Yield on Short-Term Investments] 38 best cash alternatives](https://youngandtheinvested.com/wp-content/uploads/best-cash-alternatives-600x403.webp)