One of the most important decisions that parents make is creating custodial accounts for their children. Custodial accounts are a type of account where one person, usually a parent, has control over the funds while another party gains access to them as they become an adult.

The custodian controls all aspects of these types of accounts and can use them for almost any purpose at any time if they benefit the named beneficiary.

Though, when it comes to opening and managing a custodial account, there are custodial account rules you should know to keep from running afoul of any rules or regulations.

In this article we will go over custodial account rules for bank and brokerage (stock) custodial accounts and what they mean for your child’s future finances!

Table of Contents

What is a Custodial Account?

A child’s mind is like a sponge, absorbing everything they observe and hear from their parents. This is why it’s important to create a financial plan for educating them because if you don’t, they might not understand the concept of money as well as they could when they get older.

It starts with debit cards for kids, then banking apps for teens and finally an investment account!

These don’t necessarily need to happen in this order, but one of the most important needs early in life is developing a sense of comfort with money. These financial services help.

Custodial accounts allow a custodian, typically a parent or guardian, to have an account held with a financial institution that holds assets for the benefit of the named minor on the account.

When you open a custodial account, which is a financial account for kids, that means a custodial banking (savings) account and/or a custodial brokerage (stock) account.

Where you open the custodial account will determine what you can do with money the beneficiary holds in the account.

A standard custodial bank account only allows for simple interest earnings while a custodial brokerage account allows for this as well as the ability to invest in assets like stocks, bonds, mutual funds, exchange-traded funds (ETFs) and more.

How Does a Custodial Account Work?

Once you open a custodial account, they work like any other account held with a bank or brokerage firm. Two main roles exist for custodial brokerage accounts:

- The custodian

- The beneficiary

In the case of a custodial brokerage account, the custodian—who acts as a designated manager providing investment advice and decision-making—decides how to invest money for the minor, who owns the account.

The account manager—as well as other entities—can contribute to the fund an unlimited amount of money, though certain federal gift tax rules come into effect and may impact your tax return if you contribute more than federal limits allow to the minor child.

Learn about how to gift stock and get some ideas on financial gifts for babies, kids and grandkids.

As discussed above, you can use custodial accounts to invest in a wide variety of assets and investment vehicles, though the institution offering the account will likely curb some types of investment decisions.

These financial institutions offer custodial accounts to protect the best interests of minors who own the assets in the account.

Therefore, they likely won’t allow the custodian to use the account to trade on margin nor buy stock futures, derivatives, or other highly speculative and unsuitable investments for the minor.

Once the minor reaches the age of termination, usually the same age as entering adulthood, the custodian relinquishes control of the account. At this point, the assets transfer to the named beneficiary who can then claim full use of the funds held in the account.

Should the minor die before reaching the age of termination, the account becomes part of the child’s estate.

Custodial Account Rules for Adults and Account Owners (Minors)

Before opening a custodial account, make sure you consider the following custodial account rules and decide whether opening one of these accounts for your child makes sense.

- Considered the minor’s asset. The gifts made into the account become the property of the minor and cannot return to the contributor.

- Transferred to the minor at a certain age (between 18-25). These assets transfer to the minor at the age of termination, which is often the age of majority in their state of residence unless stated otherwise in the titling of the account.

- Made with after-tax money, though there are tax benefits. Not as tax-efficient as retirement accounts like Roth IRAs for kids or adults, but the money contributed does enjoy some tax buffer on unearned investment income subject to certain limits.

- A brokerage account for investing. These accounts allow you to invest on behalf of a minor, teaching how to do it, how to assess risk and ultimately how to build wealth to last a lifetime.

- Withdrawals must be made for the benefit of the minor. Custodians can’t withdraw funds for their own benefit. The funds in the account must be used by the custodian for the benefit of the account owner and not personal enrichment.

- Factored into financial aid eligibility. These assets technically belong to the minor. Therefore, they count toward financial assistance eligibility when applying to college and seeking financial help with paying for college.

- A way to directly transfer wealth. These accounts simplify the transfer of wealth from trust funds in the past. They offer little complexity and tremendous flexibility with respect to contribution limits, withdrawals and how you can invest inside the account.

The Role of the Custodian

Custodian is defined as “the person who manages assets for another” and typically refers to an adult who holds legal responsibility over the account on behalf of the child, usually a parent. Though, a custodian can be the child’s parent, guardian, spouse of their parent, grandparents or another relative.

Custodial accounts are typically used to save and invest for a minor in hopes that they will be able to use their funds in a more productive way when they reach adulthood. Once you have opened a custodial brokerage account, you can use it for a variety of financial goals, including college savings, retirement or general investment purposes.

Making a custodial account for a child teaches them about investing their money and giving them a chance to learn about money management. You can use this opportunity to discuss investment options, review account statements, and give children a voice on major decisions affecting the funds in the account.

The rules for custodial accounts vary from state to state, but the responsibility of this account rests with the one designated by the account holder.

The custodian can withdraw money from the account if this benefits the child. Per the law, custodial account assets must only be used to benefit the minor child. The expectation is that the custodian does not spend any of the money on personal purposes. Deciding when and how to spend the money in the custodial account is a difficult task.

The question of which expenses are the responsibility of the child versus the custodian comes up often. Consider getting expert financial advice on the appropriate use of funds held in the account. The law may allow certain distributions but the account generally cannot have funds used to pay for daily expenses that the guardian or parent is legally obligated to cover.

Custodial accounts come in two flavors, a UGMA and UTMA account, discussed next.

What Types of Custodial Accounts Are There?

Both UGMA and UTMA accounts are custodial accounts, in which assets of the minor are held.

Where they differ are the types of assets that can be held within each.

→ UGMA (Uniform Gifts to Minors Act) Accounts

UGMA (Uniform Gifts to Minors Act) accounts are custodial accounts typically set up by parents, guardians, grandparents or other relatives, who then serve as custodian for the child’s account until reaching the age of termination or majority in their particular state.

In most places this is 18, but other places require the minor to be 21 or older.

When friends and family contribute money to a UGMA account opened through a bank or stock broker, they do not fall subject to annual contribution limits.

Though, when making these financial gifts, they become irrevocable, meaning they can’t be taken back from the minor once transferred.

For this reason, it may be important to consult a lawyer or other qualified professional before setting up an account.

UGMA accounts can hold purely financial assets like cash, stocks, bonds, mutual funds, life insurance policies, and other financial instruments.

→ UTMA (Uniform Transfer to Minors Act) Accounts

UTMA (Uniform Transfer to Minors Act) accounts are also custodial accounts set up by parents or other custodians and are not limited to a certain dollar amount each year.

Where UTMA accounts differ is that they can hold any type of property, meaning they can hold the above financial instruments but also real estate and real property.

For example, you could place a deed to a car or other property in the UTMA account and transfer ownership to the account beneficiary.

Another key difference between a UGMA and UTMA account relates to state adoption policies. All states have adopted UGMA accounts but Vermont and South Carolina have not allowed UTMA accounts.

If you live in either of these states, you’ll only have access to UGMA accounts.

How to Open a Custodial Account for Kids

You have many different options for custodial accounts, including investing with a brokerage or bank. In the case of wanting to explain investing to a child, you will want an investment account for your kids. A simple bank account that earns interest won’t meet the mark.

Opening an investment account allows you to invest funds for the minor’s benefit, which can offer much higher returns than a savings account. So how do you decide which type of custodial account to open for a child?

There is no black and white when it comes to “the best account,” but there are some considerations that can help you make a decision for what will work best for your individual financial situation.

- Fees. This is one of the most common considerations when choosing an account. Typically, custodial accounts have low or no fees if you are a customer with a brokerage firm. You may find some that charge trading commissions while others opt for a monthly or annual fee and act as a free stock trading app within the account. Some even offer free stocks for signing up in the form of shares or a sign up bonus. Consider your preferred model.

- Account minimums. Before opening an account, look into how much you’ll need to make as an initial deposit and the minimum account balance you’ll need to maintain.

- Investment options. You’ll also want to think about the types of investment options you’ll have available. Some custodial accounts offer a wide range of investment choices while others provide guardrails with fewer choices but simplified offerings.

- Investment support. You shouldn’t need to be an investment professional with a minimum of ten years on Wall Street to manage your investments. However, sometimes you want a little help beyond your own knowledge or a simplified menu of investment options suitable for most people’s goal of opening an investment account for kids: long-term capital appreciation. Some custodial accounts choose to shortlist what you can buy, others offer research and resources to make your own stock picks, while others provide you free personal advice and support. Choose the brokerage that meets your needs.

Now that you know what to look for in the best custodial accounts, below are some to consider for investing in stocks with your kids.

Some only allow the ability to invest in index funds as a means for placing guardrails on your kids’ investments while others allow individual stock investing.

| App | App Store Rating + Best For | Fees | Promotions |

|---|---|---|---|

Acorns Early | ☆ 4.2 / 5 Automated investing in the background into diversified investments; Round-Ups | Acorns Gold: $12/mo. (required for Acorns Early Invest custodial account) | $20 bonus when you set up recurring investments and make your first successful recurring investment |

M1 Finance | ☆ 4.7 / 5 Fee-free active trading and automated investing | $0 trading or automated investing; $10/month or $95/year on M1 Plus subscription for custodial account | Three months of M1 Plus free |

Stash | ☆ 4.7 / 5 Everyday people looking to start managing their finances | $3/mo.-$9/mo. | $5 stock bonus for making a deposit of $5 or more |

UNest | ☆ 4.7 / 5 Age-based investments in custodial investment account | $4.99/mo. | New users get $30 free when they use promo code YOUNG30 and make their first deposit. |

Firstrade | ☆ 4.6 / 5 Mutual fund and target date fund investors | Free trades | Free account bonus commensurate with contributed funds |

| * Apple App Store Rating as of May 21, 2025 | |||

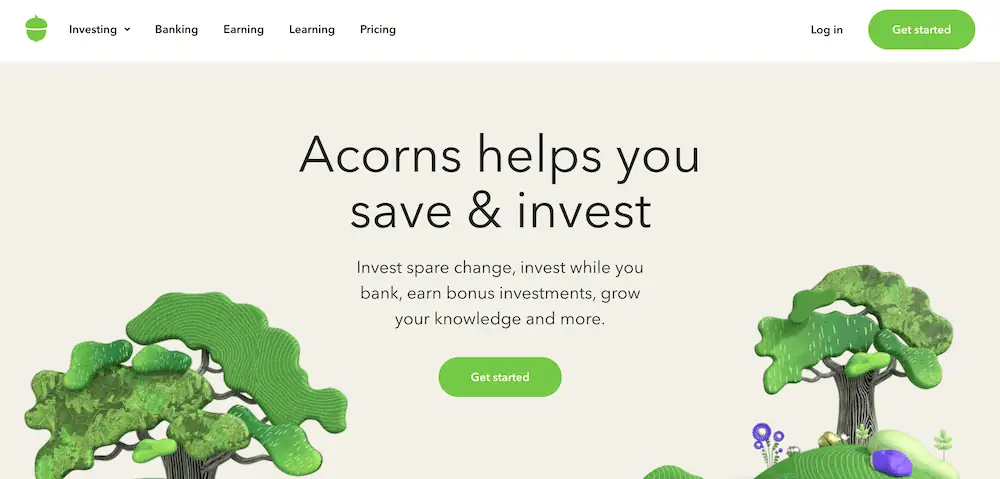

1. Acorns Early ($20 Bonus)

- Available: Sign up here

- Price: Acorns Premium: $12/mo.

Acorns offers a custodial brokerage account (Acorns Early) for parents interested in opening an investment account for their child.

Acorns Early offers investment portfolios of various risk levels for kids, so you can feel confident in the account you’re opening up for your little one. This app can be a great way to teach minors how to invest money.

The best part about Acorns is that it doesn’t require any minimum deposit to get started and allows you to contribute money on a regular basis.

One of the best ways to invest $1,000 for their child‘s future is in a custodial account like Acorns Early, which you can access by subscribing to Acorns Premium.

Learn more in our Acorns review.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Silver tier includes perks such as a 25% match on Acorns Earn rewards (up to $200/mo.), generous APYs on Checking and Emergency Fund, and live Q&As with investing experts.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts for children with 1% contribution matches.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions in your first year.*

- Special offer: Get a free $20 bonus investment when you sign up with our link and start making recurring investments.**

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Silver and Gold)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Gold for any self-directed investing options

Related: Best Debit Cards for Teens

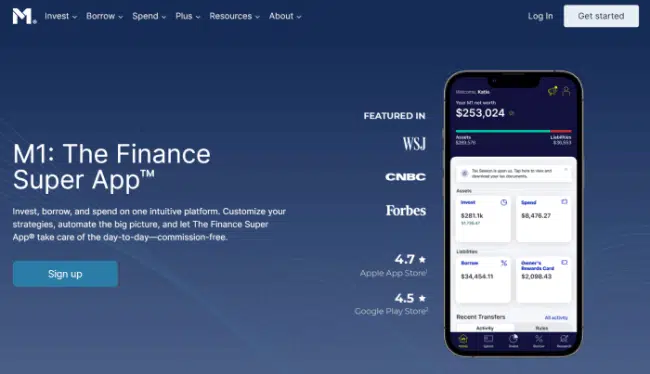

2. M1 Finance

- Available: Sign up here

- Price: Free trades, M1 Plus: $10/mo. or $95/yr.

M1 Finance is an all-in-one personal finance solution that allows new investors to set up an account in seconds. If you want to use this as a kids investing app, you’ll need to apply for an M1 Plus subscription.

The service offers investors the ability to create Portfolio Pies, or a diversified portfolio that rebalances to help you achieve your money goals. You can even utilize M1 Finance’s fractional shares to invest in company’s with high share prices.

M1 Finance is a service designed for self-directed investors by offering flexible, customizable and automated financial solutions. The platform manages your money intelligently based on how you want.

Consider signing up for an M1 Finance custodial account.

Read more in this M1 Finance review.

- The M1 investing app is a basic robo-advisory system that acts almost like a 401(k). You build a "Pie" by choosing the stocks and ETFs you want to invest in, as well as the percentage of your portfolio that should be invested in each "Slice," and M1 uses that information to allocate your money each time you contribute.

- If you want help putting together a list of stocks and funds, you can use M1's model portfolios, which cover goals such as general investing, planning for retirement, income earners, and more.

- Enjoy a 4.00% APY on uninvested cash.

- Get a line of credit against your brokerage's account value at low fees (currently 6.40%) compared to other brokerage lines of credit.

- M1 lets you open individual, joint, and custodial brokerage accounts; traditional, Roth, and SEP IRAs; trusts; and cryptocurrency** accounts.

- Robo-advisor with self-directed investing elements

- Attractive APY on uninvested cash

- Borrow against your assets

- Limited selection of investible assets

- Doesn't allow trading throughout the trading day

- Monthly fees for account balances <$10,000

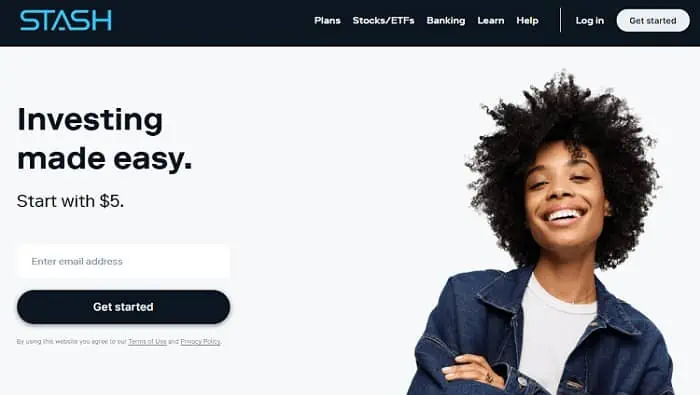

3. Stash Invest ($5 Bonus)

- Available: Sign up here

- Price: Beginner: $1/mo, Growth: $3/mo, Stash+: $9/mo

Stash is an all-in-one financial management platform, complete with investing, spending and banking functionality.

The app targets individuals just starting on their financial journey by making everything covered on the app accessible to all levels of financial literacy.

With time, the app aims to build up your financial skills and make you confident with your ability to manage and plan your money.

By signing up, you also can receive a $5 bonus for making your first deposit on the app.

- Stash is a personal finance app that simplifies investing, making it easy and affordable for everyday Americans to build wealth and achieve their financial goals.

- Invest in stocks and exchange-traded funds (ETFs) for as little as 1¢ thanks to fractional shares.

- Earn Stock-Back® rewards on every eligible debit card purchase.

- Sign up for Stash+ and get access to custodial accounts, better Stock-Back® rewards, and access to $10,000 in life insurance.

- Special offer: Earn a $100 bonus when you sign up with Stash and make a $250 deposit.

- Robo-advisor with self-directed investing capability

- Fractional shares

- Custodial accounts available

- Offers values-based investment options

- Get paid up to two days early when you direct deposit pay into your Stash account

- FDIC/SIPC insurance

- Charges monthly fee

- Smart Portfolios don't offer tax-loss harvesting

4. UNest ($30 bonus)

- Available: Sign up here

- Price: $4.99/mo.

UNest is a custodial account that allows parents to invest money for their kids for needs beyond just education but events like a new car, a wedding, vacation or anything else a minor might want some day.

UNest offers the UNest Investment Account for Kids through an app that makes it easy for families of all income levels and backgrounds to set up and manage savings and investment plans for their kids. UNest also has a gifting feature that allows friends and relatives to contribute to your kid’s account with just a few clicks. These gifts can be automated, too, so they never miss a birthday or holiday!

The app offers up to nine investment options for account owners:

- A conservative option investing in fixed income and bond ETFs

- Three age-based options with varying degrees of risk reflected in the investment mix (conservative, moderate, aggressive); these transition from more aggressive investments to conservative as the child gets owner and gains access to the funds

- Socially responsible age-based options also with varying degrees of risk (conservative, moderate, aggressive), likewise on the investment mix transition strategy from aggressive to conservative over time

- An aggressive option that invests 100% of the funds in Vanguard equity index ETFs, and a shortlist of popular cryptocurrencies.

New users get $30 free when they use promo code YOUNG30 and make their first deposit. Account holders can also receive bonuses for their children’s UNest accounts via partner offers from companies such as Disney, AT&T, Uber, DoorDash, Levi’s, etc., through the UNest partner program.

- UNest is a tax-advantaged custodial investment account for kids. It allows them to save for an education, first car, house, wedding, or even for their financial security as an adult.

- Friends and relatives can gift to your child's account with just a few clicks, or even automate their gifts.

- UNest's investment options are portfolios of various low-cost ETFs that can achieve a variety of goals. They include a conservative portfolio made up of just fixed income and bond ETFs; three age-based options that hold bonds and stocks in conservative, moderate, or aggressive allocations; three similar options that are centered around socially responsible investments; and an aggressive portfolio made up of only stock ETFs.

- Accounts enjoy up to $2,500 in tax advantages: $1,250 is tax-free, and the other $1,250 is taxed at the child's tax rate.

- Special offer: New users get $30 free when they use promo code YOUNG30 and make their first deposit.

5. Firstrade

- Available: Sign up here

- Price: Free stock/ETF trades

Firstrade is a leading online brokerage firm offering a full line of investment products and tools designed to help investors improve their financial position through sound investing practices.

One unique feature of Firstrade is that it allows minors to invest (with a custodial account managed by their parents).

As a result, I feature this as one of the best investing apps for minors to buy stocks. It’s a great resource for kids to gain early exposure to the stock market through a custodial account and to start compounding their money from a young age.

- Firstrade is a low-cost leader in trading stocks, ETFs, mutual funds, and options. In addition to standard commission-free offerings of stocks, ETFs, and options, Firstrade charges no options contract fees, and offers free trading of mutual funds as well.

- Also trade cryptocurrency and bonds on Firstrade.

- Beginners can get up to speed with Firstrade's robust education center, which offers written and video lessons covering everything from the basics of stocks to advanced options concepts.

- Very good selection of available investments

- Commission-free mutual funds

- No options contract fees

- High margin rates

- Below-average customer support

Are Custodial Accounts a Good Idea?

A custodial brokerage account can serve as an excellent way to make a financial gift to a child. This can be for your own child but also a child of a relative or friend.

This type of account can go toward a child’s future benefit but you’ll also want to consider the legal and tax implications of opening one first.

From a tax perspective, these accounts provide some tax advantages by shielding a certain amount of unearned income from taxation each year while allowing another portion to remain subject to taxes only at the child’s tax rate.

Above this, the parent’s tax rate absorbs any income in excess of these limits.

While good in some respects, especially compared to a traditional taxable brokerage account, if the real goal for these funds is long-term appreciation for a safe and secure retirement, opening a custodial IRA might be more fitting.

This requires the minor to have earned income, but it also carries these tax advantages through retirement and not just an annual income level in the account. Plus, you’ll need to pay capital gains taxes on the assets held in the custodial account when you sell at some point in the future.

As a final point, these accounts may mean you’ll need to file annual tax returns for your child. While not a problem for some, this can be an added hurdle you don’t wish to cross.

As for the legal ramifications, the assets held in the account legally belong to the minor. This means they will count on the FAFSA as available financial resources and could potentially reduce available needs-based financial aid.

All of this said, these accounts still provide a powerful way to start investing as a minor and will certainly outperform funds held in a savings account or other banking apps for minors while also building potential investment income down the road.

Compared to doing nothing or investing in a standard brokerage account, these accounts can provide plenty of upside worth considering as well.

Paired with a bank account and useful investing books for kids, this account can serve as a solid financial foundation for teaching kids about financial literacy with skin in the game.

Can a Parent Withdraw Money from a Custodial Account?

Yes, if the funds go toward the benefit of the child. Funds cannot be used to enrich the custodian, and can only go toward expenses related to the child’s direct benefit.

Who is Responsible for Taxes on a Custodial Account?

The dividends, interest and distributions from any investments are considered supplemental income for a child, which requires the custodian to remit the related taxes. Currently, any unearned income over $2,600 is subject to the “kiddie tax” when your child is under 18.

This rule also applies if the child is under 24 and a full-time student.

Here’s how it works. For the 2024 tax year,

- the child’s unearned income (investment income earned in the custodial account) under $1,300 does not get taxed

- the next $1,300 gets taxed at the child’s tax rate, which can be very low

- any unearned income in excess of $2,600 gets taxed at the parents’ tax rate.

Consider a number of the best passive income ideas for ways to earn investment income in custodial accounts.

What is a Custodial Brokerage Account vs. Custodial Savings Account?

These accounts are really one-in-the-same. Custodial savings accounts are able to invest in stocks, bonds, mutual funds and other investments or earn interest like a standard bank account.

When people refer to these accounts, they typically mean a custodial brokerage account that invests in stocks or other assets.

Custodial brokerage accounts are financial accounts held in the name of a minor by one or more custodians. In this type of brokerage account, a custodian manages the investments held for the benefit of the minor named on the account.

What Other Investment Accounts for Kids Should I Consider?

If you want to accomplish specific goals with these funds, you have other available options to consider.

- 529 plans. If you’d like to save money specifically meant for college or other qualified educational expenses, consider opening a 529 account with a company like Backer instead.

- Custodial Roth IRAs. If you’d like to get an early start on saving for your child’s retirement, consider a custodial Roth IRA for kids instead. This allows kids who have earned income to contribute at a presumably lower tax rate than when they’re adults and gain more years of compounding returns. Companies like E*Trade offer these accounts for kids.

- Trust Funds. If you’d like more flexibility with respect to the timing of when the money transfers, and not just the age of termination or majority, consider opening a trust fund.

Custodial Accounts vs 529 Plans

There are three options when it comes to saving for your child’s future: a custodial account, 529 Plan or an IRA.

When looking at custodial accounts vs 529 plans, these can have money go toward paying for schooling and don’t necessarily need to go toward retirement.

There are many ways to describe the differences between account types, but I always point out these basic points when someone asks me.

- The ownership of 529 plans is in the hands of the owner, which is usually a parent, even after their child turns 18. For many parents, this ability to remain in control is a huge factor when choosing between these accounts.

- In order to meet the requirements of a 529 plan, you can use the funds for: education related expenses (e.g., tuition and books), housing-related expenses through one’s institution board policy, or other qualified higher-education expenses such as lab fees associated with the student’s course load. Custodial accounts have no restriction on what the money can be used for beyond being to the benefit of the child.

- If the funds inside of a 529 plan are used for the aforementioned expenses, there will be no taxes on the withdrawal.

- Custodial account rules are more flexible with investment options (brokerage, high yield savings, etc.). 529 plans are typically mutual funds chosen by the state, which act as a portfolio for you.

The 529 plan may be a wiser choice for those who are saving specifically for K-12 and college education. If you want the money to go to more uses than just paying for schooling, then go with the custodial account.

What Happens to a Custodial Account When the Child Turns 21 (Becomes an Adult)?

Custodian accounts terminate when the child turns a specified age according to state law. In addition to the type of transfer, your account will terminate based on other factors.

A parent or legal guardian could designate an age that is different from state law, meaning a different age of termination.

For example, the account can terminate at 18 years of age in alignment with state law. However, the custodian may specify termination at age 21 in the account title. Once a custodial account expires, the child has full control of the assets.

One point to clarify is how accounts get handled if the child dies during the custodial account period. A custodian typically cannot distribute the assets in a custodial account.

A custodial account becomes part of the child’s estate and must be distributed according to estate laws.

Custodial Accounts for Grandchildren

A custodian can open a custodial account for grandchildren. This is different from some other account types like IRAs because it doesn’t require the child to have earned income in order to contribute to the account.

The custodian may be an individual or organization, such as a bank or brokerage firm. Grandparents can set up custodian accounts to invest in assets to benefit the grandchild.

This often acts as the best investments for grandchildren and best investments for kids. Have a look at the investing apps above to get a sense of where you can open custodial accounts.

![10 Financial Gifts for Babies, Kids & Grandkids [No More Toys] 48 best financial gifts children kids babies](https://youngandtheinvested.com/wp-content/uploads/best-financial-gifts-children-kids-babies-600x403.webp)

![7 Best Investments for Kids [Investing for Children] 49 best investments for kids 1](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-kids-1-600x403.webp)