When teens invest, they don’t invest alone—parents legally need to be along for the ride. That’s why, whether you’re the teenager or the parent in this equation, you’ll want to be on the lookout for the best taxable brokerage accounts for parents and teens alike.

Teens crave many of the responsibilities (and rewards!) of adulthood. It’s common for teens to have jobs, many of them drive … and an astonishingly high number of them want to invest. While only 23% of teens currently invest, according to Fidelity’s 2023 Teens and Money Study, 91% of those who don’t invest say they want to start at some point, and 75% want to get going before they’ve graduated from college!

I highly encourage parents to indulge this interest—and they can do so by opening up a taxable brokerage account. Specifically, custodial or brokerage accounts can help teens accumulate wealth early while learning important investing and personal finance skills.

But which company should you open an account with?

Today, I’m going to talk to you about some of the best taxable brokerage accounts for teens and parents alike. (What makes them fitting for both parent and child? Well, in addition to typical investing capabilities, they have other useful features such as, say, educational resources or parental controls.) I’ll also spend some time answering common questions related to gift taxes, federal income taxes, contribution limits, and more.

How Can Minors Invest in the Stock Market Through a Taxable Brokerage Account?

Joint Brokerage Account

A joint brokerage account is a brokerage account that has two or more people on the account’s title. At least one of the account owners must be an adult—but a minor can be on the account as well, meaning a parent and child could share a joint brokerage account.

Both parent and child jointly own all of the assets in the account and are responsible for trading decisions. These accounts also boast the widest varieties of investment options, including stocks, bonds, mutual funds, ETFs, and more.

Custodial Brokerage Account

A custodial account is a financial account held in the name of a beneficiary (often a minor) by one or more custodians (often a minor’s parents).

The minor owns the account, but the custodian is legally responsible for the account and invests on behalf of the minor. That said, some custodians choose to involve the child in investment decisions to help them develop financial skills.

Assets in the account belong to the minor, and any withdrawals must directly benefit the child. Once the beneficiary reaches the age of majority, which varies by state, they gain legal control of the account.

Previously, different states used different types of custodial brokerage accounts. Some states offered Uniform Gifts to Minors Act (UGMA) accounts and others offered Uniform Transfers to Minors Act (UTMA) accounts. (If you’re curious, here’s the difference between UTMA and UGMA.) Now, anyone in one of the 50 U.S. states or the District of Columbia automatically uses UTMA accounts.

Parent Taxable Brokerage Accounts—Our Top Picks

|

Primary Rating:

4.8

|

Primary Rating:

4.4

|

|

Core: $5.99/mo. Max: $9.98/mo. Infinity: $14.98/mo. (Each account supports up to 5 children.)

|

30 days free. Copper: $4.95/mo. Copper + Invest: $7.95/mo.

|

Best Parent Taxable Brokerage Account Options to Help Kids Invest

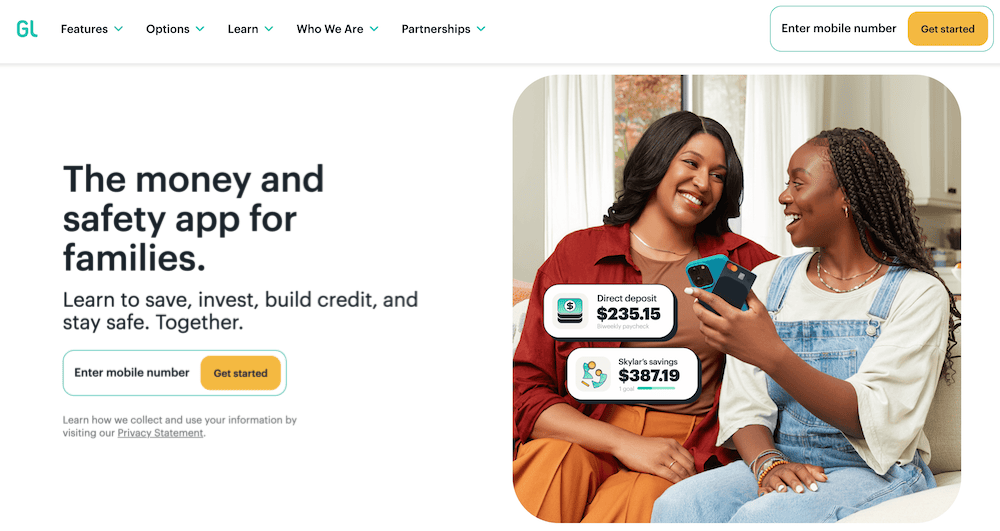

1. Greenlight Max or Infinity

- Available: Sign up here

- Price: Max: $9.98/mo. Infinity: $14.98/mo. (All plans include cards for up to 5 children)

Greenlight is a premier kids’ financial app that teaches minors the ins and outs of saving, spending, and financial responsibility—and with a Greenlight Max or Greenlight Infinity plan, they can start to invest, too!

Greenlight’s investing app will help your kid learn the basics of investing, how stocks and exchange-traded funds (ETFs) work, and more with real money, real stocks, and real-life lessons—all with your direct involvement and supervision.

With Greenlight Investing, your child can:

- Start investing with as little as $1

- Buy fractional shares of companies they admire (say, kid-friendly stocks)

- Spread out their risk with ETFs

- Avoid trading commissions

Parents can enjoy peace of mind knowing that Greenlight’s popular guardrails extend to its investing offering, too. Teens can only invest in U.S.-listed stocks and ETFs that have either a market capitalization over $1 billion or a three-month average daily dollar volume of more than $500,000. And parents must approve every trade directly in the app.

And, of course, you get everything else that comes along with Greenlight. At the Max level, that includes a prepaid debit card with strong parental controls, mobile payments, ATM access, instant money transfers, and even 1% cash-back rewards. They can also save and get a 2% annual Greenlight Savings Reward—which is boosted to 5% at the Infinity level.

Read more in our Greenlight Card review, check out plan pricing below, or sign up for Greenlight Max or Infinity today.

- Greenlight is a financial solution for kids that allows them to spend with a debit card, earn money on savings, and even invest their money.

- Parents can use this app to teach kids how to invest with a brokerage account through Greenlight Max and Greenlight Infinity plans.

- Greenlight offers flexible parental controls for each child and real-time notifications of each transaction. And it's the only debit card that lets you choose the exact stores where kids can spend on the card.

- Families can earn 2% (Core), 3% (Max) or 5% (Infinity) per annum on their average daily savings balance of up to $5,000 per family. Also, Max and Infinity families can earn 1% cash back on their monthly expenditures.

- Unlike many apps that simply provide features and controls, Greenlight is also designed to spark discussions with children about spending, investing, and more, fostering a better educational experience.

- Best-in-class parental controls (can prohibit specific stores)

- Can add brokerage account to invest in stocks

- Intuitive Parent and Kid apps

- Competitive cash back and interest rates

- High price points

- No cash reload options

- No parent / child lending

Related: Best Greenlight Alternatives

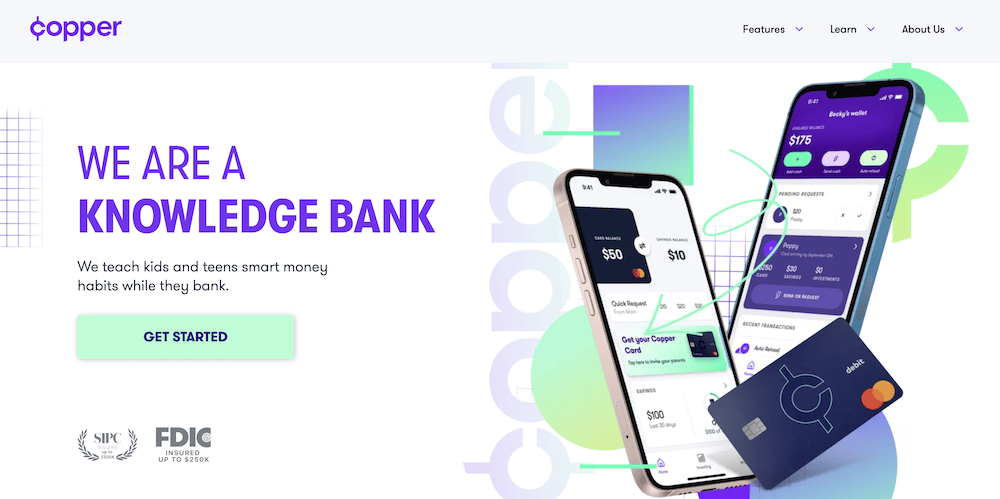

2. Copper Card

- Available: Sign up here

- Price: 30 days free. Copper: $4.95/mo. Copper + Invest: $7.95/mo.

Copper Banking was founded on the belief that kids and teens should have equal access to financial education and should be empowered to learn by doing. Now, the company is on a mission to help children gain real-world experience by giving them access to their money in a way that traditional banks can’t.

The Copper app and debit card teaches your child how to make smart financial decisions by creating a platform where parents and their kids can connect. With the Copper app, you get easy snapshots of your accounts. And with the Copper Debit Card, it’s easy to shop in-store or online, including with Apple Pay or Google Pay.

Plus, users get exclusive access to engaging advice curated by a team of financial literacy experts who provide tips on how to take control of their financial future.

Copper features

When I reviewed the Copper banking product, I found the following features to be most important:

- Send/Request: Kids and parents can easily send and receive money all at the touch of a button.

- Spend: Spend using Apple or Google Pay, or using the Copper Debit Card.

- Withdraw: Access your money from more than 55,000 fee-free ATMs.

- Monitor: Get a snapshot of all your child’s spending in an easy-to-read dashboard.

- Save: Gain quick snapshots of your kid’s savings and helpful tips on how to save even more. Set up savings buckets and save for the things that you want.

- Learn: With the help of Copper’s team of financial literacy experts, gain bite-sized tips on how you can maximize your money and prepare yourself for your financial future.

The basic Copper account includes the above banking features. With Copper + Invest, your child also gets access to automatically curated smart portfolios built with their preferences in mind. (We like the guardrails they provide to get your child started with investing.) Your child is given a questionnaire that helps Copper determine a portfolio based on their age, income, net worth, investment objective(s) and investment horizon. Copper then recommends one of three ETF portfolios—Moderately Aggressive, Aggressive, and Extra Aggressive—made up of thousands of stocks. Parents can review the portfolio to ensure it matches with not just your child’s preferences, but your family’s. (Portfolios can be changed later on by accessing the Support chat.)

Much like many other apps I’ve reviewed on WealthUp, your child doesn’t need much money to begin their investing journey with Copper. They can begin investing for as little as $1, then add more contributions down the road. Copper will automatically rebalance the portfolio as needed to make sure it always keeps up with your child’s investment preferences.

Copper is available to kids 6 years and older.

Read more in our Copper Banking review.

- Copper is the digital bank and debit card for teens built with the mission of creating a financially successful generation.

- Send/Request: Teens and parents can easily send and receive money all at the touch of a button.

- Spend: Pay with a digital wallet via Apple Pay or Google Pay or use the physical Copper Debit Card.

- Monitor: Get a snapshot of all your spending in an easy-to-read dashboard.

- Save: Gain quick snapshots of your savings and helpful tips on how you can save even more. Set up savings bucks and save for the things that you want.

- Learn: With the help of Copper's team of financial literacy experts, learn more about how to maximize your money and prepare yourself for your financial future.

- Allowance administration

- Financial education resources

- Network of 55,000-plus fee-free ATMs

- No chores tracking or assignment

- No parental controls beyond notifications

Related: 13 Best Money Apps for Teens [Invest, Spend, Budget + Pay]

3. Step

- Available: Sign up here

- Price: Free (no monthly fees)

Step is a free financial app that helps teens manage their money, build their credit, and even invest toward their futures.

Through Step, a parent or legal guardian can open a stock account, crypto account, or both for their minor—and those accounts will transfer to the teen once they’ve turned 18.

Within the Step stock account, teens get access to more than 1,000 “popular” stocks and ETFs. It’s not the whole world of offerings one could get through a traditional brokerage account, but it’s more than enough for beginner investors. Step also offers fractional shares, so teens can invest for as little as $1, and trades are commission-free. Step will even make recommendations based on how well users feel they can handle the market’s ups and downs.

The crypto account, meanwhile, allows teens to start investing in digital currencies by purchasing and holding Bitcoin.

Minors get all of the above while also enjoying the benefits of the Step Visa Card. Step’s unique “hybrid” secured credit card functions just like a Visa credit card, but offers the safety features of a debit card … all while building your teen’s credit history. Parents, who sponsor the card, can opt to have Step report the past two years’ worth of information—transactions, payment history, and more—to the credit bureaus when their child turns 18, which can result in a massive boost to their credit scores right from the get-go.

Parents simply add money to this FDIC-insured account, and then their teens can use their card anywhere Visa is accepted. They can also withdraw money from more than 30,000 ATMs for free.

Other features include Savings Goals, where any money saved can generate 5% in annual interest (compounded and paid monthly) with a qualifying direct deposit*; Savings Roundup, where purchases are rounded up to the nearest dollar and the overage is put toward a Savings Goal; and opt-in cash or Bitcoin rewards from companies including Hulu, Chick-Fil-A, CVS, and the New York Times.

The Step Card is protected by Visa’s Fraud Protection and Zero Liability guarantee. That means if your teen’s card gets lost or stolen, or misplaced and fraudulent charges crop up, you can dispute the charges within a certain time frame to avoid liability for paying.

Check out our Step review to learn more, or sign up today.

- Earn 5% annually on savings with Step, where you can save, spend, invest, and even build your credit history.

- Step offers a high yield on up to $250,000 stored in Savings Goals.* While the savings rate can change, Step will provide a 30-day notice before it does.

- Earn points that you can redeem for cash when you use your Step Visa Card at participating merchants.*

- Buy and sell fractional shares of stocks, ETFs, and Bitcoin for as low as $1.

- Send and receive money instantly, spend with Apple and Google Pay, and track your card's balance from the Step App.

- Banking services, provided by Evolve Bank & Trust, are FDIC-insured for up to $250,000.

- High yield on money held in Savings Goals

- Helps build credit

- Free investment account for stocks, ETFs, and Bitcoin

- Fractional investing for as low as $1

- FDIC insurance

- High-yield savings only available with qualifying monthly direct deposit*

- Can't directly deposit checks into a Step account

Related: 4 Best Ways to Save Money for Kids [Children’s Savings Plans]

4. Fidelity Youth™ Account (Top Investing App for Teens)

- Available: Sign up here

- Price: No account fees¹, no account minimum, no trading commissions*

- Platforms: Web, mobile app (Apple iOS, Android)

Is your teen interested in jumpstarting their financial future? Do you want them to build smart money habits along the way?

Of course you do! Learning early about saving, spending and investing can pay off big when you start on the right foot. And one tool that can help your teen get that jump is the Fidelity Youth™ Account—an account for teens 13 to 17 that’s designed to help them start their money journey. Teens own the account themselves and can start investing in most U.S. stocks, exchange-traded funds (ETFs), and Fidelity mutual funds for as little as $1!³

Your teen will also get a free debit card with no subscription fees, no account fees, no minimum balances, and no domestic ATM fees². And they can use this free debit card for teens to manage their cash and spend it whenever they need.

And as for building smart money habits? You and your teen can access the account through the Fidelity Youth™ app, which has a dedicated Learn tab packed with materials developed specifically to help teens develop good financial habits. Not only will Fidelity’s interactive lessons, videos, articles, tools, and calculators accelerate their learning—but for every level they complete, reward dollars will be deposited into their account to use however they want.

Controls parents want and need

A parent or guardian must have or open a brokerage account with Fidelity® to open a Fidelity Youth Account. For new Fidelity® customers, opening an account is easy, and there are no minimums and no account fees.

Having a Fidelity account gives parents and guardians access to plenty of tools they can use to monitor their teen’s activity: They have online account access, can follow monthly statements and trade confirmations, and can view debit card transactions made in the account.

To make it even easier, you can set up alerts to notify you of your teen’s trades, transactions, and cash management activity, keeping you firmly in the loop on actions your teen takes across the Fidelity Youth Account’s suite of products.

If your teen has an interest in learning about investing, becoming smarter about money, and taking their first steps toward building their financial journey, you should consider downloading the Fidelity Youth app and opening a Fidelity Youth Account. The account comes custom-built for their needs, which will help them become financially independent and start investing for their future.

Read more in our Fidelity Youth Account review.

- The Fidelity Youth™ Account is a free¹ account where teens can save, spend, and invest their own money.

- No monthly fees or account minimums to open.

- Your teen can learn to save and spend smarter with their own debit card, which features no domestic ATM fees.²

- Teens can invest in stocks for as little as $1 with fractional shares.³

- Parents can set up alerts and monitor their teen's account activity online, and through statements, trade confirmations, and debit card transactions.

- The Fidelity Youth™ app will have a dedicated Youth Learn tab to help jumpstart your teen's financial learning and build better money habits.

- No monthly account fees

- Investing feature

- Fractional shares

- Parental controls

- Comprehensive financial suite for teens

- Parent must be a Fidelity account holder

- Account balance doesn't accumulate interest

- No chore or allowance system

Related: 15 Best Investing Research & Stock Analysis Websites

Best Custodial Accounts for Parents to Invest With Their Children

5. Acorns Early (Formerly GoHenry)

- Available: Sign up here

- Price: Acorns Gold: $12/mo., includes Acorns Early for up to 4 children.

- Promotion: Earn $20 when you sign up with our link.

Acorns Early (formerly GoHenry) offers a custodial brokerage account for parents interested in opening an investment account, which is available by subscribing to Early through Acorns Gold.

An Acorns Gold subscription comes with a free Acorns Early account for up to four children. More importantly, it also allows you to open an Acorns Early Invest account—a custodial account that not allows you to invest for your kids’ future, but offers a 1% match on up to $7,000 in contributions. Acorns Early offers investment portfolios of various risk levels for kids, so you can feel confident in the account you’re opening up for your little one.

This micro-investing app can be a great way to teach minors how to invest money. Acorns Early also comes with a Mastercard debit card that can be used in stores and online; it allows you to give your children an allowance or pay them for chores; and it has myriad of security guardrails, including chip-and-PIN technology, Mastercard Zero-Liability Protection, and parental controls.

One of the best ways to invest $1,000 for their child‘s future is in a custodial account like the one offered by Acorns Early. Sign up with an Acorns Gold subscription today or learn more in our Acorns review.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Silver tier includes perks such as a 25% match on Acorns Earn rewards (up to $200/mo.), generous APYs on Checking and Emergency Fund, and live Q&As with investing experts.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts for children with 1% contribution matches.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions in your first year.*

- Special offer: Get a free $20 bonus investment when you sign up with our link and start making recurring investments.**

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Silver and Gold)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Gold for any self-directed investing options

Related: Best Brokerage Account Sign-Up Bonuses, Promotions and Deals

Teen + Parent Taxable Brokerage Accounts: FAQs

How old do you have to be to invest in the stock market?

If you want to invest in the stock market without any assistance or supervision, you need to be at least 18 years old. However, minors can invest in the stock market through certain types of brokerage accounts and other investment accounts with the help from adult family members.

Can minors invest?

Yes, as mentioned above, minors can invest. But they need some help.

A minor can’t just stroll into their local Fidelity office or log on to Schwab and open up their own brokerage account. But they still have options as long as they have a parent or other trusted adult to help.

For instance, with an adult’s assistance, a minor can use a joint brokerage account alongside an adult. Or an adult can open a custodial brokerage account, custodial IRA, or custodial Roth IRA—accounts the child technically owns, but that the parent helps steer until their kid is old enough. Also, adults can open up educational accounts like 529 plans or Coverdell education savings accounts (ESAs) to invest on behalf of their minor, though again, the child doesn’t have final say in how those are run.

Still, these varying accounts allow minors (or parents on behalf of minors) to hold a wide range of investments, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more.

Who owns the assets inside a taxable joint brokerage account?

When a parent and a child have a taxable joint brokerage account together, they jointly own all of the assets in the account. Both people can make investment decisions, so this is a great way for a parent to teach their child about investments, which is a valuable knowledge for a child’s future.

Who owns the assets inside a custodial account?

The money in a custodial brokerage account belongs to the beneficiary, which is the minor. They own any other assets in the account, as well. However, while the beneficiary owns the assets, the parent manages the custodial account until the child reaches the age of majority for their state, which is usually 18 or 21.

Do custodial accounts affect financial aid eligibility?

Yes, money stored in a custodial account can affect federal student aid eligibility. Since the assets in the account belong to the student, they are weighed more heavily than parental assets.

Parents trying to save money specifically for a child’s future educational expenses should consider using a 529 plan or Coverdell ESA. The assets in these accounts are owned by the parents and therefore don’t affect financial aid eligibility as much.

Do parents pay a gift tax for giving money to their kids?

When parents contribute funds to a child’s custodial account, it counts towards gift contribution limits. For 2023, the annual federal gift tax exclusion is $17,000 for an individual or $34,000 per married couple. (These figures rise to $18,000 and $36,000 in 2024, respectively.)

Anyone who exceeds that amount needs to fill out an IRS form so they can deduct the excess money from your lifetime gift tax exemption limit. Currently, the lifetime limit is $12.92 million in 2023 ($13.61 million in 2024). Unless you expect to surpass the lifetime limit, you shouldn’t face any issues.

In the case of joint brokerage accounts with a parent and child where the only contributions are from the parent, half of the account value can count as a taxable gift.

How are earnings from taxable brokerage accounts taxed for kids?

The earnings from a custodial account are subject to “kiddie tax” rules. There are three phases to the kiddie tax. Each year, there is a portion that is exempt from federal income tax, a portion taxed at the child’s tax rate, and the rest is taxed at the parents’ rate.

For 2023, the breakdown for custodial account taxes is as follows:

- The first $0 to $1,250 of unearned income is tax-free ($0 to $1,300 in 2024)

- The next $1,251 to $2,500 is taxed at the child’s rate ($1,300 to $2,600 in 2024)

- Over $2,500 is taxed at the parents’ rate (over $2,600 in 2024)

Remember, this only applies to unearned income in a custodial account –not the account balance.

What type of investments can you hold in a custodial account?

A custodial account lets you invest in popular stock market investments, such as stocks, bonds, cash, mutual funds, and exchange-traded funds. It can be fun for teens to research and choose their own individual stocks. Mutual funds are an easy way to automatically diversify a custodial account.

An UTMA custodial account can also hold real estate, fine art, life insurance policies, and more. This is a great way to pass family assets to a minor.

There are some regulations, though. A custodial account doesn’t let you trade on margin or buy derivatives, futures, or any other highly speculative investments.

Do custodial brokerage accounts have contribution limits?

A custodial account has no contribution limits, so people can invest as much as they want for a child’s future. Parental contributions count towards gift contribution limits, but this isn’t an issue unless you’re likely to surpass the lifetime federal gift tax exemption limit, which is currently $13.61 million in 2024.

Money can be withdrawn from a custodial account at any time as long as the funds are used in a way that directly benefits the minor.

An exception is custodial IRAs. Since a custodial IRA is a type of retirement account, this type of custodial account is subject to the same contribution limits as any other IRA.

Related:

- Best Credit Cards for Teens [Build Credit]

- 7 Best Teen Checking Accounts [Bank Accounts for Teenagers]

- How to Invest as a Teenager [Start Investing as a Minor Under 18]

Disclosures

Terms and Conditions for Fidelity Youth™ Account

The Fidelity Youth Account can only be opened by a parent/guardian. Account eligibility limited to teens aged 13-17.

* $0.00 commission applies to online U.S. equity trades and Exchange-Traded Funds (ETFs) in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients. Sell orders are subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). Other exclusions and conditions may apply. See Fidelity.com/commissions for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through Fidelity Clearing & Custody Solutions® are subject to different commission schedules.

¹ Zero account minimums and zero account fees apply to retail brokerage accounts only. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs) and commissions, interest charges, or other expenses for transactions may still apply. See Fidelity.com/commissions for further details.

² Your Youth Account will automatically be reimbursed for all ATM fees charged by other institutions while using the Fidelity® Debit Card at any ATM displaying the Visa®, Plus®, or Star® logos. The reimbursement will be credited to the account the same day the ATM fee is debited. Please note, for foreign transactions, there may be a 1% fee included in the amount charged to your account. The Fidelity® Debit Card is issued by PNC Bank, N.A, and the debit card program is administered by BNY Mellon Investment Servicing Trust Company. These entities are not affiliated with each other, and Fidelity is not affiliated with PNC Bank or BNY Mellon. Visa is a registered trademark of Visa International Service Association, and is used by PNC Bank pursuant to a license from Visa U.S.A. Inc.

³ Fractional shares quantities can be entered out to 3 decimal places (.001) as long as the value of the order is at least $0.01. Dollar-based trades can be entered out to 2 decimal places (e.g. $250.00)

Fidelity Brokerage Services LLC, Member NYSE, SIPC 900 Salem Street, Smithfield, RI 02917

Step Disclaimer

Disclaimer: Step is a trademark of Step Mobile, Inc.

![The 10 Best ETFs for Beginners [2026] 40 a hand taking a slice of a pie chart.](https://youngandtheinvested.com/wp-content/uploads/pie-chart-index-fund-etf-wooden-table-1200-600x403.webp)