As a parent, you want the best for your child. That means providing them with opportunities to succeed and get ahead in life.

One way to do that is by starting investments for them at an early age. A custodial account allows parents to start investing on behalf of their children while retaining full control over the account until they reach adulthood.

A child’s custodial account can teach them about investing—a laudable goal—but they also count toward the FAFSA and affect potential financial aid your child receives for college.

When opening a custodial account, you’ll want to plan ahead for the tax consequences of opening an account and whether better ways to save for college exist.

This article will discuss all types of custodial accounts, how they work, the tax rules for these accounts, how they affect college financial aid and what you need to know about each account type. We’ll also touch on joint brokerage accounts as an alternative option to consider.

Table of Contents

Best Custodial Accounts—Top Picks

|

4.5

|

4.4

|

|

No-commissions on equity trading.

|

Acorns Gold: $12/mo. subscription required for custodial account.

|

What is the Best Custodial Account (UGMA/UTMA) for Kids?

Now that we know a lot more about custodial accounts, it’s time to answer the question of where to open your custodial account. You’ll have no shortage of options available to you when deciding where to open an account, but you’ll likely want one with the ability to invest.

There is no black and white when it comes to “the best account,” but there are some considerations that can help you make a decision for what will work best for your individual financial situation.

- Fees. This is one of the most common considerations when choosing an account. Typically, custodial accounts have low or no fees if you are a customer with a brokerage firm. You may find some that charge trading commissions while others opt for a monthly fee and act as a free stock trading app within the account. Some even offer free stocks for signing up in the form of shares or a sign up bonus. Consider your preferred model.

- Account Minimums. Before opening an account, look into how much you’ll need to make as an initial deposit and the minimum account balance you’ll need to maintain.

- Investment Options. You’ll also want to think about the types of investment options you’ll have available. Some custodial accounts offer a wide range of investment choices while others provide guardrails with fewer choices but simplified offerings.

| App | App Store Rating + Best For | Fees | Promotions |

|---|---|---|---|

Acorns Early | ☆ 4.2 / 5 Automated investing in the background into diversified investments; Round-Ups | Acorns Gold: $12/mo. (required for Acorns Early Invest custodial account) | $20 bonus when you set up recurring investments and make your first successful recurring investment |

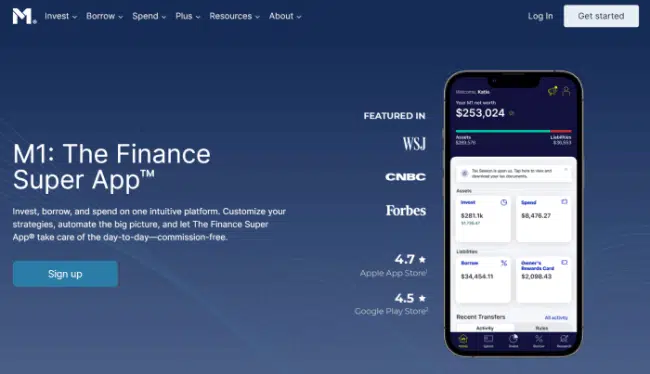

M1 Finance | ☆ 4.7 / 5 Fee-free active trading and automated investing | $0 trading or automated investing; $10/month or $95/year on M1 Plus subscription for custodial account | Three months of M1 Plus free |

Stash | ☆ 4.7 / 5 Everyday people looking to start managing their finances | $3/mo.-$9/mo. | $5 stock bonus for making a deposit of $5 or more |

UNest | ☆ 4.7 / 5 Age-based investments in custodial investment account | $4.99/mo. | New users get $30 free when they use promo code YOUNG30 and make their first deposit. |

Firstrade | ☆ 4.6 / 5 Mutual fund and target date fund investors | Free trades | Free account bonus commensurate with contributed funds |

| * Apple App Store Rating as of May 21, 2025 | |||

1. Acorns Early (1% Match, $20 Bonus)

- Available: Sign up here

- Price: Acorns Gold (required for Acorns Early Invest): $12/mo., includes Acorns Early for up to 4 children.

Acorns Early (formerly GoHenry) offers a custodial brokerage account for parents interested in opening an investment account, which is available by subscribing to Early through Acorns Gold.

An Acorns Gold subscription comes with a free Acorns Early account for up to four children. More importantly, it also allows you to open an Acorns Early Invest account—a custodial account that not allows you to invest for your kids’ future, but offers a 1% match on up to $7,000 in contributions. Acorns Early offers investment portfolios of various risk levels for kids, so you can feel confident in the account you’re opening up for your little one.

This micro-investing app can be a great way to teach minors how to invest money. Acorns Early also comes with a Mastercard debit card that can be used in stores and online; it allows you to give your children an allowance or pay them for chores; and it has myriad of security guardrails, including chip-and-PIN technology, Mastercard Zero-Liability Protection, and parental controls.

Get an Acorns Early Invest account by signing up for an Acorns Gold subscription today or learn more in our Acorns review.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Silver tier includes perks such as a 25% match on Acorns Earn rewards (up to $200/mo.), generous APYs on Checking and Emergency Fund, and live Q&As with investing experts.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts for children with 1% contribution matches.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions in your first year.*

- Special offer: Get a free $20 bonus investment when you sign up with our link and start making recurring investments.**

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Silver and Gold)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Gold for any self-directed investing options

Related: Best Acorns Alternatives: Micro-Investing Apps to Use

2. M1 Finance

- Available: Sign up here

- Price: Free trades, M1 Plus: $10/mo. or $95/yr.

M1 Finance is an all-in-one personal finance solution that allows new investors to set up an account in seconds. If you want to use this as a kids investing app, you’ll need to apply for an M1 Plus subscription.

The service offers investors the ability to create Portfolio Pies, or a diversified portfolio that rebalances to help you achieve your money goals.

M1 Finance is a service designed for self-directed investors by offering flexible, customizable and automated financial solutions. The platform manages your money intelligently based on how you want.

Consider signing up for an M1 Finance custodial account or custodial IRA today.

- The M1 investing app is a basic robo-advisory system that acts almost like a 401(k). You build a "Pie" by choosing the stocks and ETFs you want to invest in, as well as the percentage of your portfolio that should be invested in each "Slice," and M1 uses that information to allocate your money each time you contribute.

- If you want help putting together a list of stocks and funds, you can use M1's model portfolios, which cover goals such as general investing, planning for retirement, income earners, and more.

- Enjoy a 4.00% APY on uninvested cash.

- Get a line of credit against your brokerage's account value at low fees (currently 6.40%) compared to other brokerage lines of credit.

- M1 lets you open individual, joint, and custodial brokerage accounts; traditional, Roth, and SEP IRAs; trusts; and cryptocurrency** accounts.

- Robo-advisor with self-directed investing elements

- Attractive APY on uninvested cash

- Borrow against your assets

- Limited selection of investible assets

- Doesn't allow trading throughout the trading day

- Monthly fees for account balances <$10,000

Related: Best Greenlight Alternatives

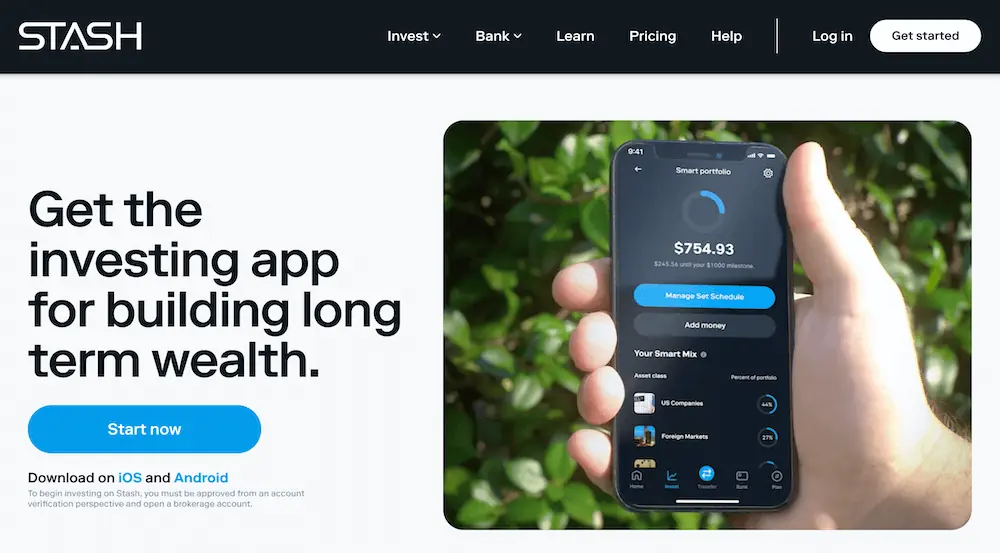

3. Stash Invest ($100 Bonus)

- Available: Sign up here

- Price: Growth: $3/mo, Stash+: $9/mo

Stash is an all-in-one financial management platform, complete with investing, spending and banking functionality.

The app targets individuals just starting on their financial journey by making everything covered on the app accessible to all levels of financial literacy. With time, the app aims to build up your financial skills and make you confident with your ability to manage and plan your money.

By signing up, you also can receive a $100 bonus for making your first deposit of at least $250 on the app. Learn how to get free stocks and other sign up bonuses to add a jumpstart to your investments.

- Stash is a personal finance app that simplifies investing, making it easy and affordable for everyday Americans to build wealth and achieve their financial goals.

- Invest in stocks and exchange-traded funds (ETFs) for as little as 1¢ thanks to fractional shares.

- Earn Stock-Back® rewards on every eligible debit card purchase.

- Sign up for Stash+ and get access to custodial accounts, better Stock-Back® rewards, and access to $10,000 in life insurance.

- Special offer: Earn a $100 bonus when you sign up with Stash and make a $250 deposit.

- Robo-advisor with self-directed investing capability

- Fractional shares

- Custodial accounts available

- Offers values-based investment options

- Get paid up to two days early when you direct deposit pay into your Stash account

- FDIC/SIPC insurance

- Charges monthly fee

- Smart Portfolios don't offer tax-loss harvesting

4. UNest

- Available: Sign up here

- Price: $4.99/mo.

UNest is a custodial account that allows parents to invest money for their kids for needs beyond just education but events like a new car, a wedding, vacation or anything else a minor might want some day.

UNest offers the UNest Investment Account for Kids through an app that makes it easy for families of all income levels and backgrounds to set up and manage savings and investment plans for their kids. UNest also has a gifting feature that allows friends and relatives to contribute to your kid’s account with just a few clicks. These gifts can be automated, too, so they never miss a birthday or holiday!

The app offers up to nine investment options for account owners:

- A conservative option investing in fixed income and bond ETFs

- Three age-based options with varying degrees of risk reflected in the investment mix (conservative, moderate, aggressive); these transition from more aggressive investments to conservative as the child gets owner and gains access to the funds

- Socially responsible age-based options also with varying degrees of risk (conservative, moderate, aggressive), likewise on the investment mix transition strategy from aggressive to conservative over time

- An aggressive option that invests 100% of the funds in Vanguard equity index ETFs, and a shortlist of popular cryptocurrencies.

Account holders can receive bonuses for their children’s UNest accounts via partner offers from companies such as Disney, AT&T, Uber, DoorDash, Levi’s, etc., through the UNest partner program.

- UNest is a tax-advantaged custodial investment account for kids. It allows them to save for an education, first car, house, wedding, or even for their financial security as an adult.

- Friends and relatives can gift to your child's account with just a few clicks, or even automate their gifts.

- UNest's investment options are portfolios of various low-cost ETFs that can achieve a variety of goals. They include a conservative portfolio made up of just fixed income and bond ETFs; three age-based options that hold bonds and stocks in conservative, moderate, or aggressive allocations; three similar options that are centered around socially responsible investments; and an aggressive portfolio made up of only stock ETFs.

- Accounts enjoy up to $2,500 in tax advantages: $1,250 is tax-free, and the other $1,250 is taxed at the child's tax rate.

- Special offer: New users get $30 free when they use promo code YOUNG30 and make their first deposit.

5. Firstrade

- Available: Sign up here

- Price: Free stock/ETF trades

Firstrade is a leading online brokerage firm offering a full line of investment products and tools designed to help investors improve their financial position through sound investing practices.

One unique feature of Firstrade is that it allows minors to invest (with a custodial account managed by their parents).

As a result, I feature this as one of the best investing apps for minors to buy stocks. It’s a great resource for kids to gain early exposure to the stock market through a custodial account and to start compounding their money from a young age.

- Firstrade is a low-cost leader in trading stocks, ETFs, mutual funds, and options. In addition to standard commission-free offerings of stocks, ETFs, and options, Firstrade charges no options contract fees, and offers free trading of mutual funds as well.

- Also trade cryptocurrency and bonds on Firstrade.

- Beginners can get up to speed with Firstrade's robust education center, which offers written and video lessons covering everything from the basics of stocks to advanced options concepts.

- Very good selection of available investments

- Commission-free mutual funds

- No options contract fees

- High margin rates

- Below-average customer support

What is a Custodial Account?

Custodial accounts are financial accounts held in the name of a minor by one or more custodians.

Custodian is defined as “the person who manages assets for another” and typically refers to an adult who holds legal responsibility over the account on behalf of the child, usually their parent.

Though, a custodian can be the child’s parent, guardian, spouse of their parent, grandparents or another relative.

Custodial accounts are typically used to save and invest for a minor in hopes that they will be able to use their funds in a more productive way when they reach adulthood.

Once you have opened a custodial account, you can use it for a variety of financial goals, including college savings, retirement or general investment purposes.

Many use the account to teach some basic financial lessons about investing to their children. You can use the opportunity to discuss investment choices and outcomes, review account statements and give them a vote on major decisions.

The custodian has the responsibility to manage and invest funds accordingly with trust that they act in their best interest at all times.

Custodial accounts come in two flavors, a UGMA and UTMA account.

What is the Difference Between an UGMA and UTMA Account?

Both UGMA and UTMA accounts are similar in that they are custodial accounts with assets held within them for the benefit of the minor. Where they differ are the types of assets that can be held within each.

UGMA (Uniform Gifts to Minors Act) accounts are custodial accounts typically set up by parents, guardians, grandparents or other relatives, who then serve as custodian for the child’s account until reaching the age of majority in their particular state. In most places this is 18, but other places require the minor to be 21 or older.

When friends and family contribute money to a UGMA account opened through a bank or stock broker, they do not fall subject to annual contribution limits. Though, when others make financial gifts, they become irrevocable, meaning they can’t be taken back from the minor once transferred. For this reason, it may be important to consult a lawyer or other qualified professional before setting up an account.

UGMA accounts can hold purely financial assets like cash, stocks, bonds, mutual funds, life insurance policies, and other financial instruments.

UTMA (Uniform Transfer to Minors Act) accounts are also custodial accounts set up by parents or other custodians and are not limited to a certain dollar amount each year.

Where UTMA accounts differ is that they can hold any type of property, meaning they can hold the above financial instruments but also real estate and real property. For example, you can place the deed to a home, car or other property into the UTMA account and transfer ownership to the minor.

How Does a Custodial Account Work?

A custodial account works by having a parent, guardian or other custodian establish an account with a bank or broker offering these accounts.

The custodian makes or accepts contributions into the account and manages the underlying assets the funds invest in for the beneficiary.

Custodial accounts allow custodians to invest the money into a variety of assets. Most commonly, parents establish these accounts for children to build assets they will eventually own in the future.

Due to this longer-term time horizon, stocks often make a suitable investment vehicles for these investment accounts.

Further, these investments can be carefully planned to provide the best chances for compounding returns by purchasing assets like index funds, individual stocks or mutual funds.

You can try a portfolio mixed with many different assets to teach your child how markets work and also with little money at risk to start.

Consider picking stocks in some of your child’s favorite companies like Disney, Netflix, McDonald’s or others. Several stock advice services can also point you toward stocks with significant long-term upside potential.

If you pick the right investments and hold them for a long time, this can maximize your child’s future financial prospects as well as your own if this makes your child financially independent.

After setting up an account, making contributions and choosing the investments to hold, you’ll need to be careful when managing the money in the account. This is especially true for any withdrawals that get made as you will want to remain mindful of the rules involved.

Custodial accounts require careful management because it is imperative that funds remain untouched until reaching age 18 or 21 depending on state law in order to ensure maximum benefits from compound interest over time.

Related: Best Stock Investment Newsletters to Capture Inbox Alpha

Another Investment Account Option for Minors: Joint Brokerage Accounts

The standard type of brokerage account is an individual brokerage, in which one person’s name is listed as the account owner.

A jointly owned brokerage account, however, allows two or more people to sit on the account’s title and act as owners of all assets within the account.

These accounts most commonly exist between spouses, but they can also be opened between multiple family members (say, a parent and child) or two or more individuals who share financial goals (say, unmarried partners or business partners).

When a parent and child have a jointly owned brokerage account, they can share in the decision-making of what to buy and sell. Many investing apps for kids allow you to open a brokerage account with joint ownership.

Do Custodial Accounts Get Taxed?

Custodial accounts need to factor for the kiddie tax rules. This works by having any investment income earned in the account, including dividend, interest or capital gains income generated from assets held in the account, fall under the child’s tax rate once reaching the age of majority.

If your child is younger than the age of majority, the first $1,300 goes untaxed while the next $1,300 gets taxed at the child’s rate. If the account has earnings above this amount ($2,600), this counts as investment income that becomes subject to your rate as a parent.

That means if your child has money invested in some great passive income ideas in their account, they might have to pay the taxman.

Finally, individuals can contribute up to $18,000 per individual per year in gifts to the account without tax consequence ($36,000 per couple) in 2024. Above this threshold, it triggers the federal gift tax limit.

Related: Federal Tax Brackets and Rates

Can I Invest with a Custodial Brokerage Account?

Absolutely. The primary point of opening a custodial account is to invest money in appreciating assets. Many parents and guardians use these accounts to invest for their kids and take advantage of compound interest.

Working with them at a young age can instill good money habits and be useful for building wealth in the long-run.

Custodial accounts allow you to invest in stocks, bonds and mutual fund investments, but not riskier assets like stock options or choosing to buy on margin.

As mentioned above, because the account assets technically belong to the child, a certain amount of the investment income earned will go untaxed, fall under the child’s tax rate and then have remainder add to income taxed under the parents’ rates.

What is a Custodial IRA?

If your child or the minor has earned income, using a custodial IRA might be a tax-smart way to save their earnings for retirement.

A custodial IRA is an account set up and controlled by a custodian, usually the parents, grandparents or guardian of the minor.

The IRA can be set up with a brokerage firm like M1 Finance and is an excellent way to start investing for your child while retaining control until they reach adulthood.

Like other custodial accounts, custodial IRAs revert to the minor once reaching the age of majority. Minors or their family members can contribute up to $6,000 per year or their earned income, whichever is greater.

You’d likely want to consider a custodial Roth IRA for your child when their income tax rate is likely the lowest they’ll ever encounter. That way, they pay tax on the income now and it comes to them tax-free in retirement.

That gives you multiple decades of tax-free, compounded returns. That’s every parents’ dream!

Consider opening a custodial IRA with a company like M1 Finance. Opening a custodial IRA at M1 Finance for your child or grandchild could be one of the best investments you make in their future.

Can You Withdraw Money from a Custodial Account?

Yes, but only when the funds withdrawn by the custodian use them for the benefit of the minor.

Money contributed to a custodial account becomes property of the account beneficiary and the withdrawal must serve a fiduciary purpose, meaning it will go toward the benefit of the minor.

In short, you shouldn’t withdraw the money for personal needs and instead it should only go toward the expenses of the custodial account beneficiary. Talk to a financial professional to learn more about the specific rules regarding distributions taken from custodial accounts.

What is the Difference Between a Trust and Custodial Account?

The differences between a trust and custodial account are twofold: the level of simplicity for establishing a custodial account as compared to a trust and the greater flexibility and control that comes with a trust.

To learn more about trusts and how they might benefit your situation, consider visiting Trust & Will. They assist with making estate plans and trusts easy as well as making sure everyone in your family is covered.

Related: What Happens if a Minor is a Beneficiary?

Can a Grandparent Open a Custodial Brokerage Account?

Yes, grandparents can open a custodial account for a grandchild.

It can be beneficial for grandparents to open custodial brokerage accounts if they want to start saving and investing early on in their grandchildren’s lives, especially with the intention of passing along the funds or assets at some point down the road.

Related: Best Investments for Kids

Do Custodial Accounts Affect Financial Aid?

Yes. Custodial accounts weigh more heavily on the scale of how much financial aid you are deemed to need for college.

If you want to save for college expenses, you’re probably better served by using a Section 529 plan like one offered by Backer or an Education Savings Account (ESA).

These accounts factor less into you or your child’s ability to pay for college than would a custodial account. Further, a custodial account doesn’t carry the same tax advantages as either of these account types.

The assets of a custodial UTMA account are reported as the student’s asset on the FAFSA. Assets belonging to students may reduce financial aid by 20%. The custodial account is an investment account held for a minor.

If it’s transferred to a 529 plan, the Student Aid Index (SAI) can be reduced by at least 14.36% (20% – 5.64% of the account value).

529 college savings plans get counted as a parent’s asset for dependent students. They get reported on the FAFSA and can reduce financial aid eligibility by 5.64%, less than the 20% of UTMA accounts.

In short, custodial accounts affect your eligibility for financial aid more so than other education-specific savings accounts.

Further, if you as a parent want more control over the account funds, including the ability to change the account’s beneficiary, these other accounts give you that ability.

Custodial accounts have irrevocable asset transfers, meaning the money placed into the account cannot return to you.

Are Custodial Accounts Reported on FAFSA?

UGMA and UTMA accounts count as assets of the applying student and must show on the filed FAFSA form. If you are the custodian of an account but not the owner, you do not report these assets on your portion of the FAFSA.

![13 Best Stock News Apps & Sites [Financial & Stock Market Info] 58 best stock and financial news apps](https://youngandtheinvested.com/wp-content/uploads/best-stock-and-financial-news-apps.webp)

![7 Best Motley Fool Alternatives [Competitors' Sites to Use] 59 best motley fool alternatives](https://youngandtheinvested.com/wp-content/uploads/best-motley-fool-alternatives-600x403.jpg.webp)

![How to Buy Fractional Shares [+ Brokers to Buy Partial Stocks] 60 how to buy fractional shares woman on smartphone](https://youngandtheinvested.com/wp-content/uploads/how-to-buy-fractional-shares-woman-in-cafe.webp)