By definition, generational wealth, also referred to as family wealth or legacy wealth, represents wealth passed down from one generation to the next. If you can leave behind a notable amount of money or assets, that constitutes generational wealth. These assets can include real estate, stock market investments, a business, or anything else which contains monetary value.

Stated simply, people who inherit generational wealth have a significant financial advantage over those who do not. These people likely have the ability to avoid student loans and other types of costly debt. Instead, their inheritance could go towards income-generating investments, assets which appreciate in value, or even towards purchasing their first home. However, it’s not easy to maintain generational wealth through several generations. Approximately 70% of families lose their capital in the second generation and 90% have lost it in the third.

Keep reading to learn the best ways to build generational wealth as well as how to ensure it lasts.

Table of Contents

How to Build Generational Wealth

To build generational wealth you can pass on, you need to acquire assets or save money you won’t need to spend in retirement. You then pass down the money and assets to children or other younger relatives.

While the concept is simple, unless you had wealth passed down to you, it can be slow to accumulate assets and extra money. Fortunately, it’s entirely possible if you are strategic with your finances.

→ Invest in Stocks

Stocks are arguably one of the best ways to build long-term wealth. Some people recommend starting by investing in index funds that carry low costs. An index fund is a type of mutual fund or exchange-traded fund (ETF) meant to match the components of a market index.

The advantages to investing in index funds comes with the instant diversification and not carrying the responsibility for picking out individual stocks.

You can make money from stocks through capital appreciation and income via dividends. For the former, you follow the tried and true investing advice of buying low and selling high.

However, in terms of generational wealth, it may serve as a more strategic decision to focus on obtaining dividend-paying stocks.

Investing in a dividend-paying stock means you purchase stock in a company which then distributes a proportional share of their profits in the form of a dividend. These distributions can carry tax-advantages for passive income.

The mechanics behind the income are simple: you own the stock over long periods of time and in exchange for holding your position, the company distributes dividends directly to your account.

Dividend-paying stocks act as a great source of passive income and, when passed down, can continue to make money without the owner having to take any actions.

Some people who invest wisely in these stocks early can live off the dividend payments without ever needing to sell the stock.

How to Start Investing Money

1. Webull – Self-Directed Investing

Stock market investing has built significant wealth for people and FinTech apps have made investing in the stock market more accessible than ever. Previously, only the savviest investors or groups engaged as a family business through Family Offices could make a buck in the market.

Now, some of the best stock trading apps for beginners have removed barriers tied to capital requirements, commissions and account minimums.

To begin investing, consider using Webull, a free stock app. The app offers commission-free trading in several types of assets which can build generational wealth over long periods of time.

Further, the app comes with useful analytical tools and the ability to simulate trading scenarios with their paper trading feature. For signing up and making an initial deposit, the company even rewards investors with free stocks.

- Webull is a low-cost trading and investing app that allows you to invest in stocks, ETFs, options, futures, commodities, and crypto, and even participate in initial public offerings (IPOs).

- No-commission stock, ETF, and option trades (and many options have $0 contract fees).

- Trading features such as charting tools, technical indicators, customizable screeners, real-time stock alerts, and group orders.

- Let Webull manage your money for you with Webull Smart Advisor, which combines Webull's in-house investment expertise and artificial intelligence to build, manage, and rebalance an ETF portfolio for you.

- Sign up for Webull Cash Management to earn up to a 4.1% APY on uninvested cash.

- New users get one free month of Nasdaq TotalView's Level 2 Quotes service. (That subscription costs $2.99/mo. thereafter.)

- Subscribe to Webull Premium and receive a premium APY on uninvested cash in individual and joint cash accounts, premium margin rates, a 3% match when you transfer or roll over your IRA, and an extra 3.5% match on qualifying IRA contributions.

- Special offer: Make an initial deposit of at least $2,000 and receive 1.) a $100 cash bonus, 2.) a 2% match of your deposit (up to a maximum bonus of $20,000), 3.) a 30-day voucher for Webull Premium, 4.) a 30-day 4.0% APY booster on uninvested cash (for a total of 8.1%).**

- Good selection of available investments

- Fractional shares

- Powerful technical analysis tools

- Offers robo-advisory services

- Accessible to beginning and intermediate users

- Voice commands

- Offers highly competitive APY through Webull Cash Management

- Does not support mutual funds

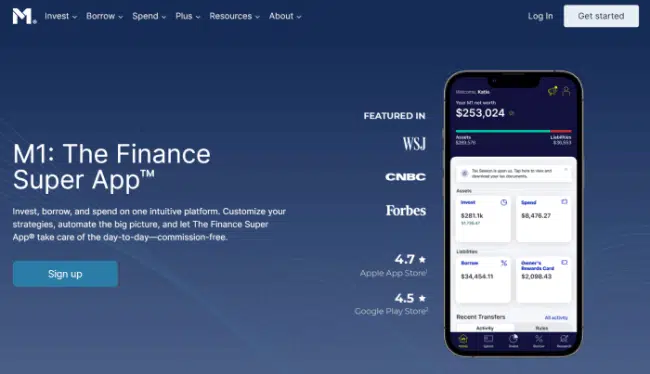

2. M1 Finance – Robo-Advisor

As an alternative to build generational wealth, if you only have small amounts of money to invest at one time and want a more sophisticated investing option, consider opening an account with M1 Finance.

This robo-advisor allows users to buy fractional shares of stocks and serve as a micro-investing app. In other words, instead of buying an entire share of stock, investors can buy just a portion of the stock.

The investing app also allows more sophisticated investors to build their own investment portfolios referred to as “Portfolio Pies”. Or, for those just learning how to start investing money, they can choose to invest in 80+ expert portfolios through M1 Finance’s platform.

The service also offers commission-free investing and charges no fees for simple investing choices made on the platform. Read more in our M1 Finance review.

- The M1 investing app is a basic robo-advisory system that acts almost like a 401(k). You build a "Pie" by choosing the stocks and ETFs you want to invest in, as well as the percentage of your portfolio that should be invested in each "Slice," and M1 uses that information to allocate your money each time you contribute.

- If you want help putting together a list of stocks and funds, you can use M1's model portfolios, which cover goals such as general investing, planning for retirement, income earners, and more.

- Enjoy a 4.00% APY on uninvested cash.

- Get a line of credit against your brokerage's account value at low fees (currently 6.40%) compared to other brokerage lines of credit.

- M1 lets you open individual, joint, and custodial brokerage accounts; traditional, Roth, and SEP IRAs; trusts; and cryptocurrency** accounts.

- Robo-advisor with self-directed investing elements

- Attractive APY on uninvested cash

- Borrow against your assets

- Limited selection of investible assets

- Doesn't allow trading throughout the trading day

- Monthly fees for account balances <$10,000

Pairing either service with some stock research apps and software can help you to select strong market performers and build generational wealth.

Likewise, you can use stock picking services, stock newsletters or stock investment websites to uncover individual stocks which might outperform the broader market.

Personally, I choose to invest in index funds like VTI, VTSAX or VFIAX to hold my wealth because these low-cost options have averaged more than 10% annualized returns over the last 10 years.

When combined with their ~2% average annual dividend distributions over this time period, these investments have performed very well in light of two major market downturns during that time (Great Recession and COVID-19).

Steady performance like this over several decades can build generational wealth.

→ Invest in Real Estate

Unlike stocks, real estate is tangible and can be an instant moneymaker for whoever inherits it.

If someone receives an apartment building where the costs for the mortgage, property fees and taxes amount to less than the money coming in from rent, the owner has immediate passive income and cash flow.

Further, passive income from real estate has several tax advantages, like having the ability to claim MACRS depreciation as a tax deduction among many other deductible expenses for maintaining the property.

While prices fluctuate, homes have consistently increased in value over long periods of time. This means that younger generations should be able to sell their homes for more than they spent on it—adding to generational wealth.

However, buying entire buildings isn’t the only way to build generational wealth from real estate. You might also choose to invest in a Real Estate Investment Trust (REIT). A REIT is a company that owns income-producing real estate.

When you invest in REITs, you receive dividends, similar to how you would for dividend-paying stocks.

Another option is real estate crowdfunding to build your real estate portfolio. To get started in online real estate investing, check out Fundrise. It’s considered the first company to successfully gather investments across several investors for the real estate market.

Entry requirements for Fundrise are low. You only need to be an adult U.S. resident and have at least $10 to invest.

- Regardless of your net worth, you can now benefit from real estate’s unique potential for generating consistent cash flow and long-term gains with Fundrise starting as low as $10.

- Enjoy set-it-and-forget-it managed portfolios with standard Fundrise accounts, or actively select the funds you want to invest in with Fundrise Pro.

- Diversify your portfolio with real estate, private tech investing, or private credit.

- Low minimum investment ($10)

- Accredited and non-accredited investors welcome

- IRA accounts available

- Highly illiquid investment

Related: 11 Best Fundrise Alternatives [Accredited & Non-Accredited Apps]

→ Save More Strategically

Generational wealth comes not just from making money, but from saving it as well. As you receive dividends from stocks or real estate and are making more by selling assets, make sure to put some of it aside in a place where it will continue to work for you.

If your day job provides a 401k match, make sure to “max out” your annual contributions, add funds to your individual retirement account (IRA) and generally make use of other tax-advantaged investment accounts.

Any money you choose not to reinvest, consider putting into a high-yield savings account.

Because cash needs are always present, holding your money in one of these accounts prove to be one of the best investments for young adults or anyone else wanting their cash to earn some interest.

In fact, holding your money in one of these accounts can really make a difference over time. Nationally, the average interest rate for savings accounts currently stands at 0.59% APY. Meanwhile, some high-yield savings accounts pay many multiples of that rate.

Right now, two of the best savings accounts I’ve found on the market come from Axos Bank and CIT Bank, both of which are online-only banks.

Because of their unique business model, they can afford to pay industry-leading rates on account of not needing to pay for a physical branch network, passing these cost savings along to depositors in the form of higher rates.

To give you a sense of how high-yield savings accounts can perform compared to the national average rates, imagine depositing $10,000 into an account paying 0.10%. This account will earn $10 of interest in the first year while an account paying 1.50% will pay 15x more, or $150.

Rates might be low right now, but when they do eventually rise, these high-yield savings accounts held at online-only banks will likely increase their rates to remain competitive for gaining deposits. That means rates will likely head north, providing you greater risk-free return on your cash.

- CIT Bank is an online bank that offers competitive interest rates on its multiple products.

- Earn up to 9 times more than the national average interest rate by keeping your cash and other savings in CIT Bank's Savings Connect high-yield savings account.

- Competitive interest rates

- Low minimum deposit ($100)

- Mobile banking features

Related: 15 Safe Investments with High Returns

→ Create a Business to Pass Down

There is a reason it’s popular for small businesses to have “& Sons” in the name. People like the idea of building a business to pass down to their children. The US Census Bureau states that 90% of all business enterprises in North America are family firms.

However, while almost 70% of family businesses state they want to pass the company to the next generation, only about 30% are successful in doing so.

Businesses can be very profitable long-term, but it’s crucial whoever takes over the business has interest in the industry and knows how to operate a business.

As with any generational wealth, you need to have a plan not just for how to build it, but for how to pass it to the next generation successfully.

How to Pass Down Generational Wealth

Don’t wait until you have a medical issue or are well into retirement to get everything in order to pass down your wealth. Life is uncertain. Some paperwork you’ll want to complete with a professional includes:

- Writing a will

- Buying life insurance

- Creating an estate plan

- Setting up custodial accounts (these are investment accounts children gain access to at age 18 or 21, depending on the state)

- Naming beneficiaries for your accounts

The above actions ensure a smooth transition of wealth and will minimize headaches for everyone later. But perhaps just as important as transferring wealth is passing on information on how to handle money.

Combine Term Life Insurance with Estate Planning

To combine some of these steps, consider purchasing a term life insurance policy through a company like Haven Life.

This couples a term life insurance policy with the act of drafting a will and can help toward creating an estate plan to ensure your wealth transfers in accordance with your wishes. This extra service comes in the form of an insurance rider called Haven Life Plus.

Haven Life comes highly recommended by its policyholders and has earned recognition for its industry best practices.

For those curious about the value of term life insurance, know the following items should make the decision to purchase a policy worth it:

- It’s simple (no cash surrender value, underlying assets, policy dividends, etc.)

- It’s affordable (largely commoditized product with transparent pricing based on health, lifestyle and other risk factors)

- You pay for coverage during the years you have financial dependents

- It protects the most important people in your life against untimely death

- It gives you peace of mind

HAVEN LIFE AT A GLANCE

- Sells term life insurance online, with potential for medical exam (for the best rates)

- In some cases, no need for medical exam

- Coverage up to $3,000,000

- 10, 15, 20 and 30 year terms available

- Covers insurable age groups up to 64 years old

About half of all inherited money is spent or lost investing poorly, with the other half saved.

Furthermore, Chris Heilmann, the U.S. Trust’s chief fiduciary executive, states that “Looking at the numbers, 78% feel the next generation is not financially responsible enough to handle inheritance.”

It’s not enough to give people money, you need to ensure they are financially literate.

Fortunately, there are many ways for people to learn about finance if you don’t have time to teach them personally. You can encourage them to take college courses on finance or read top finance books.

To appeal to younger generations, you can also recommend investing apps geared toward teens and young adults or even debit cards for kids and possibly credit card for kids to begin building credit.

For example, the app Acorns has a library of resources meant to improve a user’s financial literacy. The app also has features that help the user create a budget and save money.

Related:

- Best Acorns Alternatives: Other Micro-Investing Apps to Use

- Best Greenlight Alternatives: Debit Cards for Kids & Teens

Start Building Generational Wealth to Secure Your Family’s Financial Future

With the birth of my son two years ago, I’ve spent a considerable amount of time reading into what actions I can take now to set him up for success later.

My first thought of course centers around providing him a good home, supportive environment to try, fail, improve and grow, caring for his health, and nurturing his emotional and social needs.

Laudable goals which take a lot of time, planning and effort to meet.

Another consideration centers on providing him with financial wherewithal—building generational wealth to pass down and securing my family’s financial future.

In school, I recall reading a famous passage written by America’s second president, John Adams (no relation to me) in a letter to his wife:

“I must study Politicks (sic) and War that my sons may have liberty to study Mathematicks (sic) and Philosophy. My sons ought to study mathematicks (sic) and philosophy, geography, natural history, naval architecture, navigation, commerce, and agriculture, in order to give their children a right to study painting, poetry, musick (sic), architecture, statuary, tapestry, and porcelaine.”

In other words, the current generation sacrifices so that the next can have an easier way of life.

Such is the goal of many in America: knowledge that your current work builds toward creating a better place for your descendants.

Sadly, when you review the statistics around this effort, the odds for sustainably passing along your wealth don’t look great.

Roughly 70% of second generations lose the wealth while the odds of losing it all jump to 90% by the third. Slim odds, to be sure.

Various elements factor into why this is: dividing this wealth across several children can dilute its single sum in the hands of wealth originator, poor financial habits of heirs, lack of appreciation and understanding of the value of money received, etc.

As a result, I’ve dispelled myself of the notion that generational wealth consists solely of transferring hard assets (house, investments, etc.).

In fact, what I’ve come to realize is that the accumulation and transmission of generational wealth comes not so much from these financial assets, but from placing a strong emphasis on developing good financial habits, supporting my child’s education, and eventually helping with making a down payment or other necessary purchase.

These are all hallmarks of a financially successful life and something I can work toward building with confidence.

However, this doesn’t excuse me from trying to build something substantial which I can pass to my son (and other children).

My new challenge involves teaching him everything he needs to know while also providing him financial assets he can understand and make good use of after my wife and I are gone.

Hopefully this article provides some actionable steps you can take toward building generational wealth and preparing to transfer it to your heirs.

![10 Financial Gifts for Babies, Kids & Grandkids [No More Toys] 28 best financial gifts children kids babies](https://youngandtheinvested.com/wp-content/uploads/best-financial-gifts-children-kids-babies-600x403.webp)

![7 Best Investments for Kids [Investing for Children] 29 best investments for kids 1](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-kids-1-600x403.webp)