Fractional shares are a great way to invest in the stock market without costing you an arm and a leg. Thanks to fintech applications, many fractional share investing brokerages have cropped up in recent years, creating a considerable amount of competition that has enormously benefited consumers like you.

People love online brokers that offer fractional share investing because they enable people with limited funds, or those who don’t want to risk too much of their capital on any investment, to buy partial stocks and ETFs at low prices. This demographic typically skews toward younger investors looking to buy stocks for the first time as they begin investing with small amounts of money.

These fractional share trading online brokers have empowered a new cohort of investors eager to begin investing without fronting an excessive amount of cash upfront nor pay costly commissions as they steadily add to their diversified portfolio of stocks and exchange-traded funds (ETFs).

These low barriers to entry place the best investments within reach of millions for the first time, whether they’re passive investors, self-directed investors, or some combination of both. The ability to buy fractional shares levels the playing field for building wealth through placing small stock trades on user-friendly investing apps.

This article will discuss the best fractional share brokerages that exist right now and which make the most sense for your unique situation. By the end of the article, you’ll have what you need to begin trading fractional shares and investing in the stock market—perhaps for the first time!

Let’s jump in!

Fractional Shares Brokerages—Top Picks

|

Primary Rating:

4.5

|

Primary Rating:

4.4

|

Primary Rating:

4.9

|

|

No commissions on stock, ETF, and options trades.

|

No commissions on stock and ETF trades. SoFi Plus: $10/mo.

|

No commissions on stock and ETF trades.

|

Best Fractional Share Brokerage Account Options for Buying Partial Stocks and ETFs

| App | App Store Rating + Best For | Fees | Promotions |

|---|---|---|---|

Robinhood Robinhood | ☆ 4.2 / 5 Basic stock, crypto and ETF investing | No-commission stock and ETF trades | Bonus stock with sign up |

Acorns Acorns | ☆ 4.7 / 5 Automated investing in the background into diversified investments | $3/mo.-$12/mo. | $20 bonus when you set up recurring investments and make your first successful recurring investment |

SoFi Invest® SoFi Invest® | ☆ 4.6 / 5 Active trading and robo-investing | No-commission stock and ETF trades | Bonus stock worth up to $1,000 |

Public.com Public.com | ☆ 4.7 / 5 Social theme-based investing interests | No-commission stock and ETF trades | None |

Webull Webull | ☆ 4.7 / 5 Self-directed investors and intermediate traders | No-commission stock and ETF trades | 20 bonus stocks with qualifying deposit, valued between $60-$60,000 |

Interactive Brokers Interactive Brokers | ☆ 3.8 / 5 Low margin rates | No-commission stock and ETF trades | None |

M1 Finance M1 Finance | ☆ 4.7 / 5 Fee-free active trading and automated investing | No-commission trades and automated investing; accounts with balances <$10k pay $3/mo. | None |

Greenlight Max Greenlight Max | ☆ 4.8 / 5 Teaching investing fundamentals with guidance from parents; allows individual and index fund investing | Max: $9.98/mo. Infinity: $14.98/mo. (Each plan supports up to 5 children.) | None |

Betterment Betterment | ☆ 4.7 / 5 Investors looking to build a globally-diversified portfolio | $4/mo., but changes to 0.25% annual AUM fee if you set up recurring monthly deposits totaling $250, or reach a balance of at least $20,000 across all Betterment accounts. Premium: 0.65% annual AUM fee | None |

| *Apple App Store Rating as of Feb. 14, 2025 | |||

1. Robinhood (Best Simple Stock Trading App for Beginners)

- Available: Sign up here

- Platforms: Web, mobile app (Apple iOS, Android)

Robinhood is a pioneer of commission-free trading, jumping into the investing public’s consciousness in 2013 when they rolled out commission-free trading. They remain a standout option for cost-minded investors thanks to their continued $0 commissions on stocks, ETFs, and options, as well as for its fractional trading, which allows people to invest with as little as $1.

More importantly, though, Robinhood has evolved from a bare-bones app appealing to mostly beginner investors to a fuller-featured account suitable for a wider range of experience levels.

For instance, Robinhood now offers individual retirement accounts (IRAs) and Roth IRAs via Robinhood Retirement. Functionally, it comes up short compared to many other IRA providers because of its investment options. It offers just stocks and ETFs; like with its brokerage account, mutual funds aren’t available.

However, Robinhood Retirement still stands out from the pack because it’s the only IRA provider that offers matching funds. If you open up an IRA with Robinhood Retirement, Robinhood will match 1% of any IRA transfers, 401(k) rollovers, and annual contributions to your account—and 3% if you pay for the Robinhood Gold service ($5 per month)—typically almost immediately after you make your contribution. Better still: Any matches made on annual contributions don’t count toward your contribution limit.

(Friendly message from your Young and the Invested tax expert: The reason the IRA match doesn’t count toward your annual IRA contribution limit is because Robinhood treats it as interest income in your IRA.)

Robinhood has long catered to younger investors with its gamified interface and growing library of educational content. But over the years, it has added a boatload of other features for new and experienced investors alike. Advanced Charts, for instance, provides simple and customizable charts with a variety of technical features. Robinhood’s Options Strategy Builder simplifies the options-trading process by helping you build a strategy based on what you expect your target stock or ETF will do in the future.

Sign up for a Robinhood brokerage account or Robinhood retirement account today.

- Robinhood is a pioneer in the investing app world, offering commission-free trades on stocks, ETFs, options, and cryptocurrency, as well as one of the deepest libraries of investing educational content.

- Investing for retirement? Robinhood will match 1% of any IRA transfers or 401(k) rollovers, as well as any annual contributions*, made to your Robinhood Retirement account—and you can get a 3% match on any new contributions if you subscribe to Robinhood Gold.

- Want more advanced trading tools? Download Robinhoold Legend—a desktop trading platform with real-time data, customizable layouts, deeper asset analysis, and more—for free.

- Robinhood's robo-advisory service, Robinhood Strategies, will build you a custom portfolio of stock and bond ETFs (and individual stocks for accounts with at least $500), for a low 0.25% in AUM, which is capped at $250 annually for Robinhood Gold members.

- Robinhood Gold also includes Level II market data provided by Nasdaq, higher interest rates on uninvested brokerage cash, lower margin trading rates, bigger Instant Deposits, and access to the Robinhood Gold Card (a 3% cash-back Visa credit card).

- Special offer: Sign up for Robinhood, link a bank account, and fund your account with at least $10, and receive a randomly selected cash amount between $5 and $200 to put toward certain fractional shares.

- Very good selection of available investments in brokerage accounts

- 1% match on rollovers, IRA transfers, and new contributions to IRAs and Roth IRAs (3% new-contribution match with Robinhood Gold)

- Automated recommended portfolios

- Intuitive interface

- Robo-advisory service (Robinhood Strategies)

- Extensive educational library

- No mutual funds in brokerage or IRAs

- Match doesn't apply to Robinhood Strategies accounts

Related: Best Free Investing Apps to Consider

2. Acorns: Best Micro-Investing App to Learn About Investing

- Available via Apple iOS and Google Android.

- Price: Personal: $3/mo. Personal Plus: $6/mo. Premium: $12/mo.

- Sign up here

Acorns is a micro-investing app for minors and young adults who wish to start with a small amount of money in their investments. You can choose to invest your spare change through a linked debit card and make regular deposits to contribute to your investment portfolio.

These recurring contributions and rounded-up deposits from your purchases could grow into an extensive portfolio over time. Hence the company’s name, Acorns: start small like an acorn but grow strong into a mighty oak tree.

The service charges a monthly fee for users. Though, it doesn’t charge trading commissions when your money gets invested on your behalf in fractional shares of ETFs. Instead, it charges an account fee depending on the subscription plan you select for your account. These subscriptions provide various product features that fit well for young adults’ goals, like investing young and managing your money prudently.

The service efficiently acts as one of the best money apps for kids with its all-in-one platform (Acorns Personal Plus).

Their plans are as follows:

- Acorns Personal ($3 per month): Includes an Acorns Invest investment account, as well as Acorns Later for tax-advantaged investment options such as Roth IRAs. Also includes Acorns Checking, a bank account that has no account fees, lets you withdraw fee-free from more than 55,000 ATMs nationwide, and Smart Deposit, which allows you to automatically invest a bit of each paycheck into your Acorns accounts.

- Acorns Personal Plus ($6 per month): Everything in Acorns Personal (Acorns Invest, Later, and Checking), plus Premium Education, which are live onboarding sessions covering account setup, Round-Ups, setting up recurring investments, and more; Emergency Fund; and a 25% bonus on Acorns Earn rewards (up to $200 per month).

- Acorns Premium ($12 per month): Everything in Personal Plus, plus Acorns Early, which allows you to open a custodial investment account for your child so you can begin investing for them while they’re a minor; custom portfolios that allow you to hold individual stocks; live Q&As with financial experts; a 50% match on Acorns Earn rewards (up to $200 per month); $10,000 in life insurance; even the ability to set up a will for free.

Personal Plus and Premium subscribers also get access to a powerful way to accelerate their savings: Later Match. While most people are aware that employers will sometimes match funds you contribute to your 401(k), “matches” are virtually unheard of in retirement accounts like IRAs, where there’s no employer to kick in extra cash. However, Acorns itself will match 1% or 3% on new contributions to IRAs for Personal Plus and Premium subscribers, respectively.

Learn more in our Acorns review.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Silver tier includes perks such as a 25% match on Acorns Earn rewards (up to $200/mo.), generous APYs on Checking and Emergency Fund, and live Q&As with investing experts.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts for children with 1% contribution matches.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions in your first year.*

- Special offer: Get a free $20 bonus investment when you sign up with our link and start making recurring investments.**

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Silver and Gold)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Gold for any self-directed investing options

Related: Best Acorns Alternatives: Micro-Investing Apps to Use

3. SoFi Invest®: Invest in Fractional Shares

- Available via desktop, Apple iOS and Android App on Google Play.

- Price: No-commission equity trades, annual 0.25% AUM fee for robo-advisor

- Sign up here: Web, iOS, Android

SoFi is a multi-faceted financial company that offers everything from credit cards and insurance to student loans and mortgages … and they also allow you to trade and invest through its SoFi Invest app.

With SoFi Invest, you can invest as actively or as passively as you’d like.

The SoFi Active Invest Brokerage Account has no required minimum balance, charges no commissions on stock, ETF, and options trades, and its options trading is free of contract fees, too. Want to put your portfolio on autopilot? SoFi’s robo-advisory services will create a portfolio for you for an annual 0.25% assets under management fee (that can be designed to address one or several goals) and auto-rebalance it for you as necessary over time.

SoFi Invest offers beginner-friendly features such as fractional trading, which means you can buy partial shares in more than 4,000 stocks and ETFs for as little as $5. The interface is very much geared toward younger, less experienced investors, too—everything is focused on simplicity and ease of use, rather than an expanse of sophisticated tools.

Unlike many brokerage companies that might have more limited offerings, SoFi’s app allows you to manage a much wider range of financial services and products, such as banking, student loans, insurance, and mortgages.

While SoFi Invest is free to use, you can also subscribe to SoFi Plus—a $10-per-month subscription tier that can unlock more than $1,000 per year in extra value. SoFi Plus perks include a match on recurring investment deposits, preferred access to initial public offerings, higher cash-back rewards on certain SoFi credit cards, home mortgage discounts, rate discounts on student loan refinancing and new personal loans, and a temporary boost on SoFi Savings APY, among others.

SoFi also occasionally has sign-up bonuses attached to its brokerage accounts, which you can read more about below. You can use our exclusive links to sign up with SoFi Invest, whether that’s on the web, the iOS app, or the Android app.

- SoFi Invest allows you to trade or invest in stocks, ETFs, and options with no commissions and no account minimums. You can also participate in some initial public offerings (IPOs).

- Invest for as little as $5 with fractional shares.

- Robo-advisory services, including goal planning and auto-rebalancing, available for annual 0.25% AUM fee.

- Subscribe to SoFi Plus to unlock more than $1,000 per year in extra value, including a 1% match on recurring investment deposits, preferred IPO access, higher cash-back rewards on certain SoFi credit cards, a six-month APY boost, and more.

- Special offer: Get up to $1,000 in stock when you open and fund a new Active Invest account.*

- Good selection of available investments

- No options contract fees

- DIY and robo-investing options

- Fractional shares

- Doesn't support mutual funds

- Limited trading tools

- No tax-loss harvesting

- No socially responsible robo-advisor functionality

Related: Best Credit Cards for Kids: Building Credit & Money Habits Early

4. Public.com: Best Free Investment App for Beginners

- Price: Free trades

- Sign up here

Public.com is a commission-free fractional share investing app targeting Millennials and Gen-Zers who have attuned their senses to social media.

While the company previously followed the lead of companies like Robinhood with monetizing Payment for Order Flow (PFOF) or receiving kickbacks from clearinghouses for routing trades to them, they’ve abandoned this practice.

Instead, they now rely on other income streams as well as a “tipping” system.

The decision not to route orders to specific clearinghouses places this beginner investment app firmly on the side of retail investors and not pledging allegiance to Wall Street firms.

Public.com is really about making investing like an investing social network, where members can own stock slices, or fractional shares of equities, follow popular creators, and share ideas within a community of investors.

What Public.com aims to do above all else is make the market an inclusive and educational place, with social features that make it easy to collaborate as you build your confidence as an investor—for free.

For younger investors who want to align their investing with their social preferences and keep good company to socialize and learn from others, Public.com might be the app for you.

If this sounds like an interesting fractional share trading app, open an account and make an initial deposit to see if the app meets your social and investing needs.

Read more in our Public.com investing app review.

- Public.com offers zero-commission trading on thousands of stocks and ETFs, available as fractional shares. The app also allows you to invest in cryptocurrency, options, and bonds as well, and it's one of the rare brokerages that allows its users to buy alternative assets.

- Lock in a 5.3% yield with Public.com's Bond Account, which allows you to invest in a diversified portfolio of investment-grade and high-yield bonds.

- Use a social feed where members can share why they believe in certain companies (or don't) and can post comments on others' trades.

- Invest in curated lists of stocks and ETFs for people to aggregate investments by interest area or values.

- Subscribe to Public Premium for features such as advanced company-level data, Morningstar insights, and exclusive audio content from Public.com's expert analysts.

- Special offer: Receive an uncapped 1% match on transfers into a Public IRA.

- Fractional shares

- Good selection of investible assets

- Allows you to trade alternative assets

- No payment for order flow (PFOF)

- Creative social investing features

- Doesn't support mutual funds

- Limited investment research and other tools

Related: 8 Best Stock Tracking Apps [Investment Portfolio Management]

5. Webull: Best Stock Trading App for Beginners

- Available via desktop, Apple iOS and Google Android.

- Price: Free trades

- Sign up here

Webull came into the stock trading world in 2018 when it started challenging Robinhood for market share. This stock trading app offers the ability to place equity trades commission-free and on ETFs, options and cryptocurrencies.

The company also recently added the ability to trade fractional shares, making this an excellent app for micro-investing.

Like most investment apps available, the company provides access to trade on your smartphone, tablet or desktop.

Further, it charges no commissions for the trades because Webull makes money on other actions you take, like Payment for Order Flow (PFOF), margin loans, interest on cash and service fees for their Nasdaq TotalView Level 2 Advances quotes subscription.

Webull also provides you access to several powerful tools you can use for in-depth trading analysis.

If these account features sound attractive, the best part might also come with knowing setting up a Webull account is free and comes with no account minimums you must meet or maintain.

Finally, to de-risk your signup, Webull also runs frequent promotions that give free stocks.

Read more in our Webull review.

- Webull is a low-cost trading and investing app that allows you to invest in stocks, ETFs, options, futures, commodities, and crypto, and even participate in initial public offerings (IPOs).

- No-commission stock, ETF, and option trades (and many options have $0 contract fees).

- Trading features such as charting tools, technical indicators, customizable screeners, real-time stock alerts, and group orders.

- Let Webull manage your money for you with Webull Smart Advisor, which combines Webull's in-house investment expertise and artificial intelligence to build, manage, and rebalance an ETF portfolio for you.

- Sign up for Webull Cash Management to earn up to a 4.1% APY on uninvested cash.

- New users get one free month of Nasdaq TotalView's Level 2 Quotes service. (That subscription costs $2.99/mo. thereafter.)

- Subscribe to Webull Premium and receive a premium APY on uninvested cash in individual and joint cash accounts, premium margin rates, a 3% match when you transfer or roll over your IRA, and an extra 3.5% match on qualifying IRA contributions.

- Special offer: Make an initial deposit of at least $2,000 and receive 1.) a $100 cash bonus, 2.) a 2% match of your deposit (up to a maximum bonus of $20,000), 3.) a 30-day voucher for Webull Premium, 4.) a 30-day 4.0% APY booster on uninvested cash (for a total of 8.1%).**

- Good selection of available investments

- Fractional shares

- Powerful technical analysis tools

- Offers robo-advisory services

- Accessible to beginning and intermediate users

- Voice commands

- Offers highly competitive APY through Webull Cash Management

- Does not support mutual funds

Related: Best Debit Cards for Kids

6. Interactive Brokers: Powerful Trading Platform With Fractional Stocks + ETFs

- Platforms: Desktop (PC, Mac), web, iOS, Android

- Best for: Intermediate and advanced investors

- Available: Sign up here

Interactive Brokers, founded in 1978, is the largest U.S. electronic trading platform, offering traders access to stocks, bonds, funds, options, cryptocurrencies, foreign exchange, and more. That also includes fractional shares of stocks and exchange-traded funds (ETFs).

IB’s Trader Workstation (TWS) is Interactive Brokers’ flagship desktop program—a trading platform with roots back to 1995. But since then, the company has launched a number of other access points for brokerage accounts, including:

- IBKR Desktop: This desktop trading platform combines the most popular tools from its flagship Trader Workstation (TWS) with new tools such as a powerful MultiSort screener and Options Lattice, as well as a growing suite of original features suggested by IBKR clients.

- IBKR Mobile: A powerful app for iOS and Android that allows people to trade on the go

- IBKR GlobalTrader: A simplified app for iOS and Android that targets global traders, allowing deposits in up to 23 different currencies

- Client Portal: A lighter web-based platform allowing clients to manage their account, evaluate performance, and read market news

- IBKR EventTrader: A web-based platform allowing investors to trade “event” contracts (yes-or-no questions like “Will the S&P 500 Index close above 6,000 today?”)

- IBKR Impact: A mobile app that helps investors select holdings most in line with their values.

Importantly, investors can use these various platforms to trade fractional shares of eligible U.S. and European stocks and ETFs. Investors need a tiny minimum of $1.00 to trade fractional U.S. shares, and there’s no minimum for European shares.

IBKR also makes it easy to trade fractional shares thanks to its cash-quantity stock orders. Let’s say you want to buy $100 worth of a $75 stock—IBKR will automatically purchase a full share ($75) and one-third of a share ($25).

The company’s original platform, Trader Workstation, supports investments across 150 global markets, and offers a wide variety of features, including real-time monitoring and alerts, risk management tools, paper trading, and access to breaking news—all packaged under a heavily customizable layout.

While TWS users can still select the original view, they can build their own bespoke view through Mosaic. Functions such as stock monitoring, order entry, charts, and more appear as “tiles,” sized and arranged however you want them, and you can save custom layouts designed for one or more monitors.

Interactive Brokers offers two primary plans—IBKR Lite and IBKR Pro—and both have no account minimums and zero maintenance fees. The former offers commission-free U.S.-listed stock and ETF trading, and is most suitable for beginner and intermediate investors. The latter charges commissions, but it provides better execution for trades via IB SmartRouting, and offers a number of additional features not found on Lite.

You can visit Interactive Brokers to sign up or learn more.

- Trade stocks, bonds, ETFs, mutual funds, options, cryptocurrencies, foreign exchange, futures, micro futures, and futures options using the powerful legacy Trader Workstation desktop software or IBKR's web and mobile platforms.

- No account minimums, no maintenance fees with both IBKR Lite and IBKR Pro.

- Commission-free stock and ETF trading with IBKR Lite.

- Optimized trade execution and higher interest on cash balances with IBKR Pro.

- Earn interest rates of up to 4.08% on instantly available cash.

- Earn extra income on your lendable shares with IBKR's Stock Yield Enhancement program.

- Access features including watchlists, preset or customized stock scans, real-time trading alerts, advanced order types, and news and research from numerous leading providers.

- Excellent selection of available investments

- Extremely feature-rich desktop (Trader Workstation) and app (IBKR Mobile) platforms to satisfy even the most advanced traders

- Below-average options contract fees

- Trader Workstation Mosaic view is versatile and highly customizable

- Share lending program

- Robo-advisory services are available through Interactive Advisors

- Mobile app can be buggy, difficult to navigate, and sometimes has long load times

Related: Best Online Stock Broker Options for Beginners

7. M1: Build a Portfolio Pie of Fractional Shares of Stock

- Available via desktop, Apple iOS and Google Android.

- Price: Free trades

- Sign up here

The M1 app offers investors two options for investing on their platform.

The first option entails a traditional investing method: build your tailored portfolio with your picks of stocks and ETFs you think will meet your investment objectives.

Suppose that option sounds unappetizing or otherwise uncomfortable from an investment selection perspective. In that case, you can opt for the company’s pre-made “Expert Portfolio Pies” containing different stocks and ETFs for your money.

With either option, you can set predetermined percentage amounts for your M1 investment account (they offer several types of investment accounts, including a custodial Roth IRA and traditional individual retirement accounts) and then trade stocks to match those percentages.

This allows users of M1 to buy fractional shares of stock on their own without an extra charge or trading commissions.

As you earn dividends, you can choose to participate in automated dividend reinvestment plans following your portfolio preferences, making automated investing through M1 one of the best passive income investment ideas.

Read more about the app in our M1 review.

- The M1 investing app is a basic robo-advisory system that acts almost like a 401(k). You build a "Pie" by choosing the stocks and ETFs you want to invest in, as well as the percentage of your portfolio that should be invested in each "Slice," and M1 uses that information to allocate your money each time you contribute.

- If you want help putting together a list of stocks and funds, you can use M1's model portfolios, which cover goals such as general investing, planning for retirement, income earners, and more.

- Enjoy a 4.00% APY on uninvested cash.

- Get a line of credit against your brokerage's account value at low fees (currently 6.40%) compared to other brokerage lines of credit.

- M1 lets you open individual, joint, and custodial brokerage accounts; traditional, Roth, and SEP IRAs; trusts; and cryptocurrency** accounts.

- Robo-advisor with self-directed investing elements

- Attractive APY on uninvested cash

- Borrow against your assets

- Limited selection of investible assets

- Doesn't allow trading throughout the trading day

- Monthly fees for account balances <$10,000

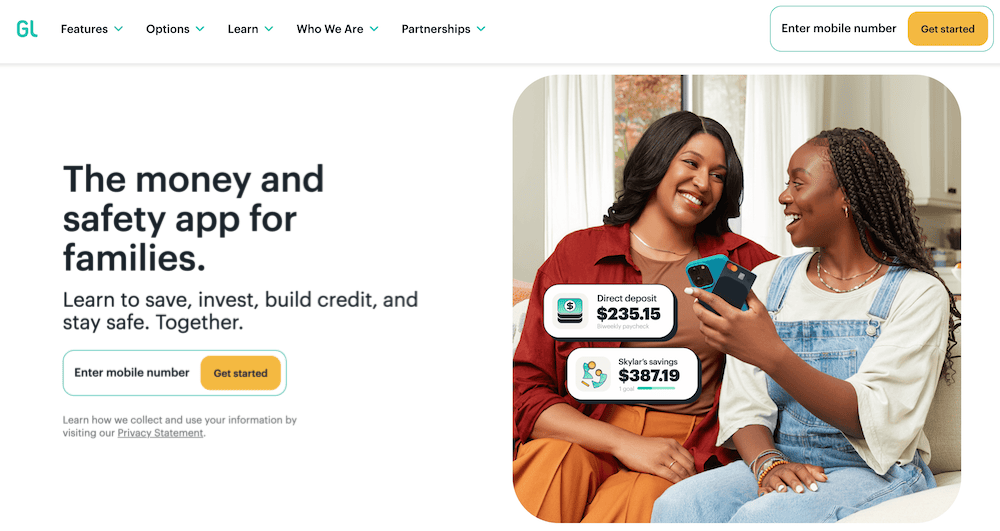

8. Greenlight: Fractional Share Investing for Minors

- Available: Sign up here

- Price: Greenlight Max: $9.98/mo. Greenlight Infinity: $14.98/mo.

Greenlight, through its Max and Infinity tiers, is an investment account for kids paired with a debit card and bank account. It’s easy to use and can double as a savings account and banking apps for teens. The app will teach the basics of investing, how to invest money in stocks and ETFs, etc. Parents and guardians will need to approve trades made in the investment account.

The all-in-one plan teaches them critical financial skills like money management and investing fundamentals — with real money, real stocks and real-life lessons.

You can use the investing feature to invest in stocks:

- Buy fractional shares of companies your kids admire (kid-friendly stocks) or in an exchange-traded fund

- Start investing with as little as $1 in your account (with fractional shares)

- No trading commissions beyond the monthly subscription fee

- Parents approve every trade directly in the app on individual stocks and ETFs with a market capitalization of $1 billion+

An app like Greenlight is one of the best investments for kids. Read more in our Greenlight Card review, or consider opening a Greenlight Max or Infinity account to get your kids investing today.

- Greenlight is a financial solution for kids that allows them to spend with a debit card, earn money on savings, and even invest their money.

- Parents can use this app to teach kids how to invest with a brokerage account through Greenlight Max and Greenlight Infinity plans.

- Greenlight offers flexible parental controls for each child and real-time notifications of each transaction. And it's the only debit card that lets you choose the exact stores where kids can spend on the card.

- Families can earn 2% (Core), 3% (Max) or 5% (Infinity) per annum on their average daily savings balance of up to $5,000 per family. Also, Max and Infinity families can earn 1% cash back on their monthly expenditures.

- Unlike many apps that simply provide features and controls, Greenlight is also designed to spark discussions with children about spending, investing, and more, fostering a better educational experience.

- Best-in-class parental controls (can prohibit specific stores)

- Can add brokerage account to invest in stocks

- Intuitive Parent and Kid apps

- Competitive cash back and interest rates

- High price points

- No cash reload options

- No parent / child lending

Related: GoHenry vs. Greenlight: Who Has the Best Debit Card for Teens?

9. Charles Schwab: Invest in Stock Slices

- Available via desktop, Apple iOS and Google Android.

- Price: Free trades

Charles Schwab offers similar products as all the other brokerages listed here, including Schwab Stock Slices, Schwab’s version of fractional shares.

Instead of paying the entire stock price on one share of stock, fractional share trading through Schwab Stock Slices allows you to buy fractional portions of stocks commission-free.

The fractional share investing product allows users to participate for as low as $5, with the ability to buy up to 10 Schwab Stock Slices at a time.

Charles Schwab differs from other investing brokerages on this list by only allowing you to make fractional share purchases for S&P 500 companies.

This compares to investing brokerages like those above and Fidelity and Interactive Brokers, except they don’t have such restrictions on their fractional share investing features.

While good choices exist in the S&P 500 index, extending the Schwab Stock Slices capability to medium and small business opportunities outside of the index can be helpful for anyone seeking opportunities beyond the widely-tracked index.

10. Betterment: Best for Automation and Tax-Loss Harvesting

- Available: Click the “Get Started” button below

- Price: Betterment: $4/mo. or 0.25%/yr. AUM fee*; Betterment Premium: 0.65%/yr. AUM fee**

- Platforms: Web, mobile app (Apple iOS, Android)

Betterment is a robo-advisor platform that allows you to invest in pre-built portfolios—with different themes and goals—in taxable accounts as well as individual retirement plans.

Betterment’s primary offering is ETF-only portfolios that provide varying types of exposure depending on your risks and interest. For instance, Core is a roughly 60% stock/40% bond portfolio that keeps you invested in most domestic and international securities. Social Impact buys stocks and bonds of companies with “a demonstrated focus on supporting social equity and minority empowerment.”

There are no self-directed options, however. The portfolios buy fractional shares of ETF index funds tracking benchmarks like the S&P 500 to keep you invested in stocks and bonds. But the service does not allow you to invest in individual stocks or bonds. The app has added crypto portfolios holding digital currencies such as Bitcoin and Ethereum, but again, you can’t buy them individually—only through pre-built portfolios.

That makes Betterment one of the best investment apps for beginners—especially those who don’t want to be particularly active in selecting what they hold.

One interesting perk that stands out: Betterment’s tax-loss harvesting feature.

If you invest in a taxable account, and you sell an investment for a gain, you’ll owe taxes on those gains. (What you owe differs depending on whether you’ve held that investment for more than a year.) However, if you sell an investment for a loss, you can use that to offset your capital gains, and thus the taxes you’d pay on them, or if your loss is more than your gains (or you don’t have any gains at all), you can even reduce taxes owed on your personal income, subject to a $3,000 annual cap.

It can be a complicated strategy, though, but Betterment’s Tax Loss Harvesting+ automates the process for you. It will regularly check your portfolio for tax-loss harvesting opportunities, then take the proceeds from selling those investments and reinvesting them where it makes sense for you.

Just note that Betterment is different from many traditional brokers in that it’s a subscription-based product. Betterment charges $4 per month to start; however, if you set up recurring monthly deposits totaling $250, or reach a balance of at least $20,000 across all Betterment accounts, the fee changes to 0.25% of all assets under management. Betterment Premium provides unlimited financial guidance from a Certified Financial Planner™. Premium costs 0.65% annually, and upgrading requires having at least $100,000 in assets with Betterment.

- The Betterment app gives you the tools, inspiration, and support you need to become a better investor.

- Start with as little as $10 and use the top-rated mobile app to set up automatic investing into diversified ETF portfolios.

- You can also invest in diversified preset cryptocurrency portfolios.

- Customize your risk tolerance and investment goals with guidance available at any time.

- By upgrading to Premium, you can unlock unlimited financial guidance from a Certified Financial Planner™.

- Hands-off investment management

- Diversified portfolio that automatically rebalances

- Low-cost investment selection

- Limited investment selections

- Limited crypto diversification in cryptocurrency portfolios

What Are Fractional Shares?

Fractional shares are a part of a share—not the whole.

A fractional share is a portion of stock in an individual company divided into many (hence fractional shares). These make investing more affordable and accessible for those who do not have large sums of money available upfront or beginning their careers.

Investing apps that allow you to buy fractional shares typically avoid account minimums or commissions, as these investment vehicles appeal toward individuals without much capital to invest at once.

An account minimum keeps people from starting, and commissions could eat up any amount of money you wish to use for your fractional investing.

The theory behind fractional shares is nothing more than allowing people to invest in a company with a high share price with smaller amounts of money.

For example, if fractional shares were available for Tesla, they could be bought at a fraction of the cost of a full-price share—even a few dollars worth. This would allow people with smaller budgets and those just starting to buy into this fast-growing company.

Before fractional shares investing, you could only do this through purchasing shares in mutual funds or exchange-traded funds (ETF) with the hope that the underlying stocks held by the fund would perform and increase your equity in several companies simultaneously.

Stock markets, like the New York Stock Exchange (NYSE) or the NASDAQ, require investors to buy whole shares in a publicly traded company.

Meaning, people who wish to buy shares in Alphabet or Berkshire Hathaway could only do so if they had a lot of cash on hand or chose to purchase them as part of a larger basket of securities in a mutual fund or ETF.

To make shares in companies like these accessible to everyone, some apps like Robinhood, M1 Finance and others have chosen to offer fractional shares to their users.

This can be a great investment option for new investors looking to buy in some of the most innovative and successful companies on the market without breaking the bank.

How Does Fractional Share Investing Work?

Investors can purchase fractional shares in companies like Alphabet, Berkshire Hathaway and other high-priced stocks without having to buy a whole number of shares (in other words, full shares of stock).

This lowers barriers to entry for investors who may not be comfortable investing a large amount of money into one company’s stock or don’t have enough cash on hand at the time.

This allows small investors to transfer a consistent amount of money into their account and know it’ll get invested at transfer, not only when they’ve accumulated enough money to purchase a whole share.

Likewise, for younger investors who might not have a lot of money to spare, they can link a debit card for kids and teens (or young adults), which then employs a round-up system.

This rounds up your purchase to the nearest dollar, investing the difference automatically in fractional shares. Micro investing apps like this use fractional shares to build account holders’ balances slowly but consistently.

The dollar-cost averaging investment strategy allows for real-time purchasing and not delayed investments over lumpy periods.

Fractional shares allow you to diversify your portfolio with ease, which can help spread the risk of your investments and potentially increase your overall return.

Suppose you had to stash your money until you could afford one high-priced stock. In that case, it might mean your portfolio carries a lot of undesired exposure to a smaller basket of stocks while you wait to accumulate enough money to buy a whole share of a company you want.

Investors also have more control over fractional shares than they do with only buying and selling whole shares. You might not wish to liquidate an entire share of Tesla and instead only need a fourth of the share’s value for some purchase.

Fractional shares allow you to choose exactly how much money you need to pull from the market if you have a financial need.

For example, if Tesla stock is worth $750 and you currently hold $3,500 worth of the stock, you’d own 4.67 shares of the stock.

You might only need $300, lowering your ownership to 4.27 shares of stock. You don’t need to sell a whole share to get cash when you only need a fraction of a share’s worth.

Essentially, fractional share investing allows you to invest in the market on any budget.

Related:

- 15 Best Stock Investment Research Software & Websites

- 13 Best Stock & Investment Newsletters [Capture Inbox Alpha]

How to Buy Fractional Shares and ETFs

Many investing brokerages allow you to place stock and ETF trades for fractional shares, reducing the dollar amount you need to commit upfront when buying stocks by the slice.

These stockbrokers have enabled a new generation of investors to buy into the market without credence to share prices thanks to fractional trading capabilities.

When balancing student loans, living expenses and other competing money priorities, having the ability to invest through an institution that equips you with the tools that make any stock accessible is valuable.

The best options on the market that we’ve found are found above.

Fractional Share Brokerages FAQ

Can you buy stocks as whole shares?

Yes. You do not need to buy fractional shares only through these brokerages, and you can buy fractional shares and whole shares of stock.

Do you need to maintain an account minimum in these accounts?

Many of the accounts above do not require an account minimum. Specialty accounts, like the Roth IRA from M1 Finance, have account minimums—$500 in this case.

Do any fractional shares brokerages offer investment advice?

Many of these fractional share brokerages conduct a questionnaire when signing up to understand your investment goals, risk tolerance and investment time horizon.

After answering these questions, some robo-advisor options offer financial advice on how to invest your money.

What happens to fractional shares when stock splits occur?

Like whole shares of stocks, when stock splits occur, the amount of your position divides in the same way. For example, if you owned 100s of TSLA and a 3:1 stock split occurred, you’d have 300 shares of TSLA stock afterward.

The market cap remains the same, but the shares outstanding triples.

If you owned 33.3 fractional shares of TSLA stock, you’d have 99.9 fractional shares of TSLA following the stock split.

Do any of these fractional shares brokerages have custodial account options?

Yes. Many of the accounts above, like Acorns, M1 Finance and Greenlight, offer custodial accounts to underage investors. All make great picks as the best stock trading apps for beginners.

Do fractional shares affect capital gains and losses in taxable accounts?

There is no difference in capital gains and losses on fractional shares in taxable accounts compared to whole shares.

How do fractional shares affect dividend reinvestment opportunities?

Fractional shares allow for easier dividend reinvestment because you don’t need to receive enough dividends to wait for purchasing whole stock shares.

![8 Best Portfolio Analysis Tools [Portfolio Analyzer Options] 71 best portfolio analysis tools](https://youngandtheinvested.com/wp-content/uploads/best-portfolio-analysis-tools-600x403.jpg.webp)