College can be a stressful time for students, but investing your money shouldn’t add to the stress. College is typically when people start investing their money and it’s important to find an investing platform that grows with you as your financial needs change.

The best investing apps for college students offer this flexibility, making them powerful enough for long-term use while still simple enough to understand at first glance.

These platforms will also make transitioning from college life easier by providing all of the personal finance tools in one place. Investing doesn’t have to be complicated or scary—these are some of the best investing apps out there!

Best Investment Platforms and Apps for College Students—Top Picks

|

Primary Rating:

4.5

|

Primary Rating:

4.2

|

Primary Rating:

4.9

|

|

Free Stock w/Deposit ($5 - $200 value)

|

Free Stock w/Deposit ($3 - $300 value)

|

Commission-free trading.

|

What are the Best Investment Apps for College Students?

When looking for the best investment apps for beginners, you will want to consider apps that offer a variety of investment options and allow you to track your stocks as you wish, research and read stock news and grow with your needs.

Investing apps for beginners should also be easy-to-use, mobile-friendly and provide useful features such as automatic rebalancing or the ability to set up recurring investments with just one swipe.

The following list represents the best investing apps for college students starting to invest for the first time.

Related: Best Brokerage Account Bonuses, Promotions and Deals

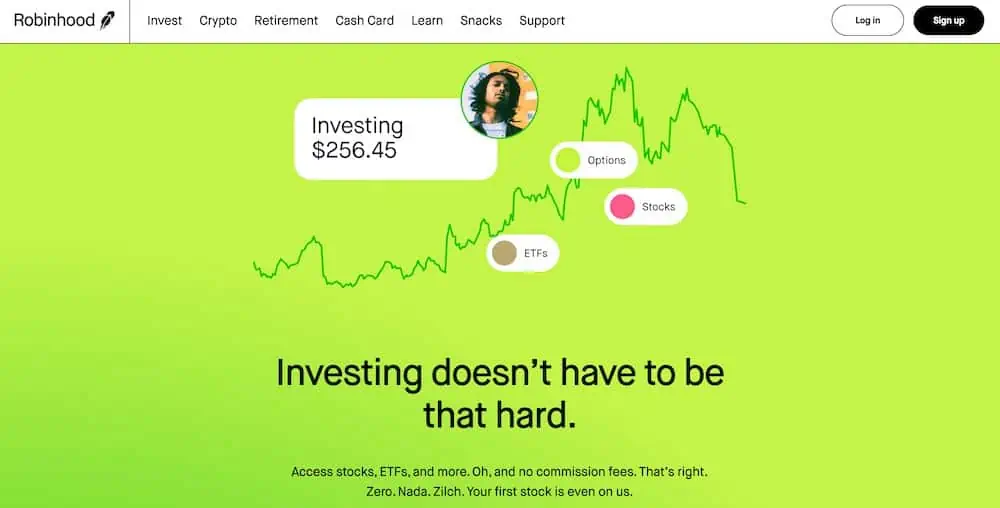

1. Robinhood (Best Simple Stock Trading App for Beginners)

- Available: Sign up here

- Platforms: Web, mobile app (Apple iOS, Android)

Robinhood is a pioneer of commission-free trading, jumping into the investing public’s consciousness in 2013 when they rolled out commission-free trading. They remain a standout option for cost-minded investors thanks to their continued $0 commissions on stocks, ETFs, and options, as well as for its fractional trading, which allows people to invest with as little as $1.

More importantly, though, Robinhood has evolved from a bare-bones app appealing to mostly beginner investors to a fuller-featured account suitable for a wider range of experience levels.

For instance, Robinhood now offers individual retirement accounts (IRAs) and Roth IRAs via Robinhood Retirement. Functionally, it comes up short compared to many other IRA providers because of its investment options. It offers just stocks and ETFs; like with its brokerage account, mutual funds aren’t available. Options aren’t currently available, though Robinhood has explicitly stated that options will be made available soon.

However, Robinhood Retirement still stands out from the pack because it’s the only IRA provider that offers matching funds. If you open up an IRA with Robinhood Retirement, Robinhood will match 1% of any IRA transfers, 401(k) rollovers, and annual contributions to your account—and 3% if you pay for the Robinhood Gold service ($5 per month)—typically almost immediately after you make your contribution. Better still: Any matches made on annual contributions don’t count toward your contribution limit.

(Friendly message from your WealthUp tax expert: The reason the IRA match doesn’t count toward your annual IRA contribution limit is because Robinhood treats it as interest income in your IRA.)

You can choose your IRA investments yourself, but Robinhood’s Portfolio Builder can also provide you with a custom recommended portfolio made up of five to eight ETFs.

Sign up for a Robinhood brokerage account or Robinhood retirement account today.

- Robinhood is a pioneer in the investing app world, offering commission-free trades on stocks, ETFs, options, and cryptocurrency, as well as one of the deepest libraries of investing educational content.

- Investing for retirement? Robinhood will match 1% of any IRA transfers or 401(k) rollovers, as well as any annual contributions*, made to your Robinhood Retirement account—and you can get a 3% match on any new contributions if you subscribe to Robinhood Gold.

- Want more advanced trading tools? Download Robinhoold Legend—a desktop trading platform with real-time data, customizable layouts, deeper asset analysis, and more—for free.

- Robinhood's robo-advisory service, Robinhood Strategies, will build you a custom portfolio of stock and bond ETFs (and individual stocks for accounts with at least $500), for a low 0.25% in AUM, which is capped at $250 annually for Robinhood Gold members.

- Robinhood Gold also includes Level II market data provided by Nasdaq, higher interest rates on uninvested brokerage cash, lower margin trading rates, bigger Instant Deposits, and access to the Robinhood Gold Card (a 3% cash-back Visa credit card).

- Special offer: Sign up for Robinhood, link a bank account, and fund your account with at least $10, and receive a randomly selected cash amount between $5 and $200 to put toward certain fractional shares.

- Very good selection of available investments in brokerage accounts

- 1% match on rollovers, IRA transfers, and new contributions to IRAs and Roth IRAs (3% new-contribution match with Robinhood Gold)

- Automated recommended portfolios

- Intuitive interface

- Robo-advisory service (Robinhood Strategies)

- Extensive educational library

- No mutual funds in brokerage or IRAs

- Match doesn't apply to Robinhood Strategies accounts

Related: Best Free Investing Apps to Invest for Free

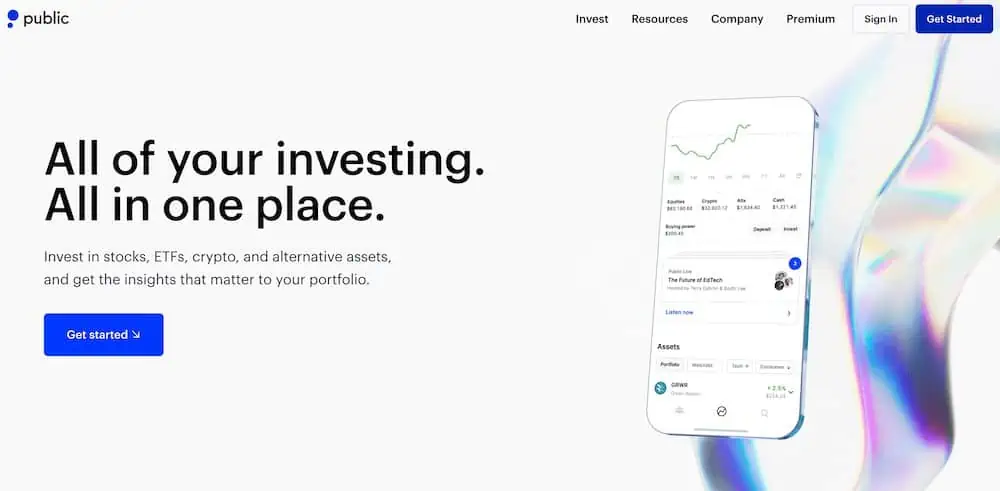

2. Public.com: Best Investment App for College Students Wanting a Social Media Experience

- Sign up here

- Price: Commission-free trades

Public.com is the social investing app meant to mimic younger generations’ affinity for social media. The app allows you to follow investor influencers and share and like their trades.

Additionally, the app enables users to share real-time investing activity with friends and family via public posts or private messages.

Public.com is a great way for new investors to learn how stocks work by following more experienced traders. Further, you don’t need to commit significant amounts of money to get started through this micro investing app.

The downside of Public is that it lacks some of the advanced features offered by other apps.

Read more in our Public.com investing app review.

- Public.com offers zero-commission trading on thousands of stocks and ETFs, available as fractional shares. The app also allows you to invest in cryptocurrency, options, and bonds as well, and it's one of the rare brokerages that allows its users to buy alternative assets.

- Lock in a 5.3% yield with Public.com's Bond Account, which allows you to invest in a diversified portfolio of investment-grade and high-yield bonds.

- Use a social feed where members can share why they believe in certain companies (or don't) and can post comments on others' trades.

- Invest in curated lists of stocks and ETFs for people to aggregate investments by interest area or values.

- Subscribe to Public Premium for features such as advanced company-level data, Morningstar insights, and exclusive audio content from Public.com's expert analysts.

- Special offer: Receive an uncapped 1% match on transfers into a Public IRA.

- Fractional shares

- Good selection of investible assets

- Allows you to trade alternative assets

- No payment for order flow (PFOF)

- Creative social investing features

- Doesn't support mutual funds

- Limited investment research and other tools

3. Webull: Best Stock Trading App for Intermediate Investors

- Available: Sign up here

- Price: Commission-free trades

Webull is a new free stock trading app, offering a better platform of investing tools than Robinhood.

The Webull investing app offers a variety of investing strategies including “Instant Orders.” This allows Webull users to make trades within seconds.

Further, the app also offers a high-quality trading platform that is easy to use and understand — even for beginners.

Consider signing up with Webull if you’re looking for an investing solution free from fees or overly complicated features.

For opening an account and making an initial deposit, the service also offers free stocks for signing up.

- Webull is a low-cost trading and investing app that allows you to invest in stocks, ETFs, options, futures, commodities, and crypto, and even participate in initial public offerings (IPOs).

- No-commission stock, ETF, and option trades (and many options have $0 contract fees).

- Trading features such as charting tools, technical indicators, customizable screeners, real-time stock alerts, and group orders.

- Let Webull manage your money for you with Webull Smart Advisor, which combines Webull's in-house investment expertise and artificial intelligence to build, manage, and rebalance an ETF portfolio for you.

- Sign up for Webull Cash Management to earn up to a 4.1% APY on uninvested cash.

- New users get one free month of Nasdaq TotalView's Level 2 Quotes service. (That subscription costs $2.99/mo. thereafter.)

- Subscribe to Webull Premium and receive a premium APY on uninvested cash in individual and joint cash accounts, premium margin rates, a 3% match when you transfer or roll over your IRA, and an extra 3.5% match on qualifying IRA contributions.

- Special offer: Make an initial deposit of at least $2,000 and receive 1.) a $100 cash bonus, 2.) a 2% match of your deposit (up to a maximum bonus of $20,000), 3.) a 30-day voucher for Webull Premium, 4.) a 30-day 4.0% APY booster on uninvested cash (for a total of 8.1%).**

- Good selection of available investments

- Fractional shares

- Powerful technical analysis tools

- Offers robo-advisory services

- Accessible to beginning and intermediate users

- Voice commands

- Offers highly competitive APY through Webull Cash Management

- Does not support mutual funds

4. Vanguard: Best Fund Company Offering an Investment App

- Available: Sign up here

- Price: Commission-free trades

I can’t create a list of the best investing apps without mentioning Vanguard. Their service has led the way in reducing investing fees and empowered the index fund movement.

While apps like Robinhood have slashed trading commissions to $0, Vanguard has led index fund investors to virtually $0 fund expenses as well. When combined, you invest for almost nothing.

Talk about a great accomplishment for the small investor looking to invest steadily over time.

Vanguard excels as a stock trading platform for college students when you wish to buy and sell Vanguard securities like index fund ETFs. You pay no commissions on their products like VTI or VTSAX or VFIAX.

The app comes with a clunky interface compared to other newer apps, but it includes the ability to invest in their index funds automatically.

The app’s simplicity and lack of features can serve one goal: making you less interested to check in on your money.

Perhaps counterintuitive, but one of the biggest mistakes investors make comes from making adjustments to their diversified portfolios during market volatility.

Often, they end up selling at the market lows and and getting back in on the way up.

The Vanguard app is available to both iOS and Android users.

- Vanguard's low-cost mission continues through its commission-free brokerage and other investment accounts. Invest in stocks, ETFs, and Treasuries with zero commissions.

- Pay $0 to trade Vanguard mutual funds and no-transaction-fee mutual funds.

- Want to trade options? You can do that on Vanguard, too.

- Vanguard's mobile app is simple and easy to understand.

- Good selection of available investments

- Commission-free Treasuries

- Some commission-free mutual funds

- Can purchase fractional shares of mutual funds

- Can optimize your portfolio with Vanguard Portfolio Watch

- Limited investing and research tools

- Somewhat clunky web interface

- High options contract fees

- Limited features on mobile app

- No fractional shares of stocks or ETFs unless reinvesting through a DRIP plan

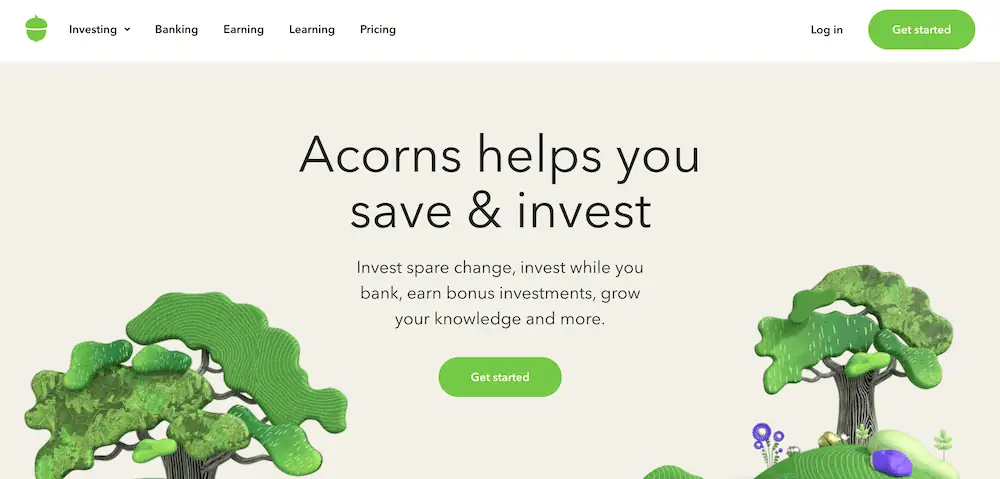

5. Acorns: Best Micro-Investing App for Beginners

- Available: Sign up here

- Price: Acorns Personal: $3/mo. Acorns Personal Plus: $6/mo. Acorns Premium: $12/mo.

Acorns is an investing app for minors and young adults specifically designed for beginners who want to start investing in stocks. While helpful to introduce investing for kids, it also works beyond childhood.

Acorns rounds up your everyday purchases on your debit card to the nearest dollar, invests that money for you and then charges a small fee each month depending on your plan.

Users can invest over time without having to think about it consciously or set aside any capital upfront while still making significant returns on their investments by using what they already spend each day.

The company offers a linked banking product that allows users to deposit their paycheck and then invest all or part of that money automatically into the Acorns portfolio, making it a truly hands-off investing solution.

Acorn’s recent partnership with CNBC allows investors access live market coverage during trading hours including breaking news alerts, stock charts and financial literacy resources.

Learn more in our Acorns review.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Silver tier includes perks such as a 25% match on Acorns Earn rewards (up to $200/mo.), generous APYs on Checking and Emergency Fund, and live Q&As with investing experts.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts for children with 1% contribution matches.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions in your first year.*

- Special offer: Get a free $20 bonus investment when you sign up with our link and start making recurring investments.**

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Silver and Gold)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Gold for any self-directed investing options

Related: Best Acorns Alternatives: Micro-Investing Apps to Use

6. M1 Finance: Best DIY Robo-Advisor

- Available: Sign up here

- Price: Commission-free trades

M1 Finance is an all-in-one personal finance solution that allows new investors to set up an account in seconds.

The service offers investors the ability to create Portfolio Pies, or a diversified portfolio that rebalances to help you achieve your money goals and make progress towards a list of things to save up for down the line.

M1 Finance is a service designed for self-directed investors by offering flexible, customizable and automated financial solutions. The platform manages your money intelligently based on how you want, for free.

Users can open a personal banking account with free instant transfers of cash between accounts based on your preferences.

You can even purchase stock in fractional shares, meaning you don’t need to save up $3,500 to buy one share of Amazon or some other high-priced stock.

The company offers both taxable and tax-advantaged accounts, making this one of the great options for those who qualify as a Roth IRA investor. They even have offer a Roth IRA for kids!

Consider signing up for an M1 Finance account today and earn a free sign up bonus.

Read more in our M1 Finance review.

- The M1 investing app is a basic robo-advisory system that acts almost like a 401(k). You build a "Pie" by choosing the stocks and ETFs you want to invest in, as well as the percentage of your portfolio that should be invested in each "Slice," and M1 uses that information to allocate your money each time you contribute.

- If you want help putting together a list of stocks and funds, you can use M1's model portfolios, which cover goals such as general investing, planning for retirement, income earners, and more.

- Enjoy a 4.00% APY on uninvested cash.

- Get a line of credit against your brokerage's account value at low fees (currently 6.40%) compared to other brokerage lines of credit.

- M1 lets you open individual, joint, and custodial brokerage accounts; traditional, Roth, and SEP IRAs; trusts; and cryptocurrency** accounts.

- Robo-advisor with self-directed investing elements

- Attractive APY on uninvested cash

- Borrow against your assets

- Limited selection of investible assets

- Doesn't allow trading throughout the trading day

- Monthly fees for account balances <$10,000

7. Stash: Best for Approaching Finances for the First Time

- Available: Sign up here

- Price: Growth: $3/mo. Stash+: $9/mo.

Stash is another all-in-one investing solution that offers users the ability to invest in individual stocks as well as ETFs.

Many parents love the investing app for kids because they can use a custodial account to begin investing even earlier than college. However, many teenagers and young adults like the app for the control it offers them over their money and investments.

Like Acorns, Stash offers a bank account and linked Stock-Back® Card1. Stash offers a considerable library of financial literacy articles meant to improve your financial knowledge.

Further, Stash offers their Stock-Back® rewards program2, which allows users to earn stock on qualifying purchases made on their linked Stock-Back® Card1. Over time, these additional stock contributions can build your portfolio.

Consider signing up for Stash if you’re looking for a simple investing and banking solution. Stash grows with the user and makes your money work for you.

- Stash is a personal finance app that simplifies investing, making it easy and affordable for everyday Americans to build wealth and achieve their financial goals.

- Invest in stocks and exchange-traded funds (ETFs) for as little as 1¢ thanks to fractional shares.

- Earn Stock-Back® rewards on every eligible debit card purchase.

- Sign up for Stash+ and get access to custodial accounts, better Stock-Back® rewards, and access to $10,000 in life insurance.

- Special offer: Earn a $100 bonus when you sign up with Stash and make a $250 deposit.

- Robo-advisor with self-directed investing capability

- Fractional shares

- Custodial accounts available

- Offers values-based investment options

- Get paid up to two days early when you direct deposit pay into your Stash account

- FDIC/SIPC insurance

- Charges monthly fee

- Smart Portfolios don't offer tax-loss harvesting

How to Start Investing in College

When starting your college career, you’re likely more focused on your course load, making friends and getting adjusted to a new environment than investing.

However, it’s important not to neglect your financial future and start investing in college (even including building credit as a college student) so that you have an even stronger footing when starting the rest of your life!

Investing doesn’t need to be complicated or scary – here are some tips on how you can best get started as a student:

- Start with small amounts of money: Building up your investments with small amounts of money is a smart idea when you’re starting out. You can then build it up over time and turn investing into an automatic habit

- Pick a simple investing platform: There are lots of different platforms to choose from, but what’s important is that the one you pick should be simple enough for you – and have all the features you need to make investing an easy process.

- Have the platform grow with you: You can set up automatic investments, choose how much risk you’re comfortable taking on (and what percentage of your budget to put towards it), and even see where all of your money is invested – so that managing everything as a student becomes easier with time

What Should College Students Invest In?

When you just start investing with little amounts of money, you should consider investing in lower-risk investments. This will help you get used to the investing process without risking too much of your money if something goes wrong with it.

By this, I don’t mean certificates of deposit or short-term bonds, but rather investments that don’t carry risk tied to a specific company or sector.

Because traditional students begin college as teenagers and can start investing young, they should favor riskier asset types like stocks rather than bonds.

When you are investing at 18, these will have the greatest overall upside potential and take advantage of college students’ greatest asset: youth.

In general, college students should focus on what they are best at learning and enjoy before looking into investing in anything else. For example, the best investments for young adults is an investment in themselves by attending college.

As for how to invest their money in the stock market, they should likely start with investing in index funds. Index funds are investments that mimic the performance of a market index like the S&P 500 or Nasdaq and do not require any active trading on your part.

So, if you’re just beginning to invest, it’s a good place to start.

These low-cost, diversified investment options allow you to buy stocks but don’t require you to do any of the research into what those stocks are.

When selecting an investing platforms for beginners, they should grow with the user and make their money work for them.

For example, if a college student starts with index funds as an investment, when they graduate from college they’ll be able to invest in other more complex or riskier investments like individual companies.

For the more engaged investor, you can identify these individual stock opportunities with the best stock picking services, stock advisor services or through stock investment newsletters.

Likewise, you can conduct your own stock research and analysis with apps and find undervalued stocks before the market has caught on. At the same time, if you’re not sure what to invest in, index funds are a good place to start. They’re also a good place to invest for your entire life.

They require no active trading and provide diversification for even just $500 or less with very little effort involved from you. They do the heavy lifting for your portfolio automatically.

Best Investment Apps for College Students Beginning to Invest

These apps help college students begin to invest and grow their money.

The investing platforms grow with the user and make their money work for them, teaching students how to invest in stocks, bonds, ETFs – even how to start a Roth IRA account!

These apps are designed from the ground up to be easy-to-understand but still powerful enough to handle college students’ long term investing needs. Hopefully, college students choose to invest in appreciating assets over the long-term.

Consider opening an account with one of the above online discount brokers and see if it works for you.

Related: Best Stock Trading Apps for Beginners

Terms and Conditions for Stash

![7 Best Schwab Retirement Funds [High Quality, Low Costs] 42 a charles schwab sign against a glass building.](https://youngandtheinvested.com/wp-content/uploads/charles-schwab-glass-1200-600x403.webp)

![17 Best Income-Generating Assets [Invest in Cash Flow] 44 income generating assets cash flow](https://youngandtheinvested.com/wp-content/uploads/income-generating-assets.jpg)